Professional Documents

Culture Documents

Life Insurance Premium Receipt: Personal Details

Life Insurance Premium Receipt: Personal Details

Uploaded by

chanam bedantaCopyright:

Available Formats

You might also like

- Airbnb Travel Receipt, Confirmation Code Y9WEFR PDFDocument2 pagesAirbnb Travel Receipt, Confirmation Code Y9WEFR PDFAnonymous oIhQKe2o8HNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancerellu prasadNo ratings yet

- 80D CertificateDocument2 pages80D CertificateYogy YNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- Renewal ReceiptDocument1 pageRenewal ReceiptAnkit SinghNo ratings yet

- 2866100498386100000Document4 pages2866100498386100000E-World Cyber ZoneNo ratings yet

- In - Gov.transport RVCER TN01BK9115Document1 pageIn - Gov.transport RVCER TN01BK9115Dr. Ezaykiyel PTNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- Income Tax Volume 1 With CorrectionsDocument554 pagesIncome Tax Volume 1 With CorrectionsSourabh NagurkarNo ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- CIR Vs Smart CommunicationsDocument1 pageCIR Vs Smart CommunicationsHoreb FelixNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Individual Premium Paid STMTDocument1 pageIndividual Premium Paid STMTGanesh SlvNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Premium CertificateDocument2 pagesPremium CertificateKamsiddha KhandekarNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedTESTERPERSONNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceGaurav SaxenaNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDocument2 pagesBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNo ratings yet

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- Krishna Sbi Life Policy Term InsuranceDocument36 pagesKrishna Sbi Life Policy Term Insurancekrishna_1238No ratings yet

- Lic Policy For Jeevan BeemaDocument14 pagesLic Policy For Jeevan BeemaPatel ZeelNo ratings yet

- ICICI COI IncomeProtect 445605Document5 pagesICICI COI IncomeProtect 445605sree koundinyaNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Consolidated Premium Paid STMT 2012-2013Document1 pageConsolidated Premium Paid STMT 2012-2013jahmeddNo ratings yet

- New VinothDocument3 pagesNew VinothRenga NathanNo ratings yet

- Tax Certificate - of Anjali Lalwani PDFDocument2 pagesTax Certificate - of Anjali Lalwani PDFBasant GakhrejaNo ratings yet

- Lic PreimumDocument1 pageLic PreimumAamir ShahNo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- TG1628 School Fees I PDFDocument1 pageTG1628 School Fees I PDFAnandKumarPNo ratings yet

- Health Policy SiddharthDocument9 pagesHealth Policy SiddharthSiddharth DasNo ratings yet

- Pawan S PDF CompletedDocument1 pagePawan S PDF CompletedAsifshaikh7566No ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- Acctstmt HDFC MFDocument1 pageAcctstmt HDFC MFthindmanmohanNo ratings yet

- Policy ParentsDocument6 pagesPolicy Parentsaniket goyalNo ratings yet

- Backup of Gopal InsurenceDocument5 pagesBackup of Gopal Insurencemkm969No ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Health Insurance Policy Certificate Section80DDocument1 pageHealth Insurance Policy Certificate Section80DDebosmita DasNo ratings yet

- WeeNNglHvNqn1597554384894 PDFDocument1 pageWeeNNglHvNqn1597554384894 PDFM VARAPRASADREDDYNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Prashant (1) CompletedDocument1 pagePrashant (1) CompletedAsifshaikh7566No ratings yet

- ADITYA Birla Elss 19-20Document2 pagesADITYA Birla Elss 19-20Rajgopal BalabhadruniNo ratings yet

- Renewal Receipt For 21882754Document1 pageRenewal Receipt For 21882754Raghu nNo ratings yet

- F D Bond GeneraterDocument1 pageF D Bond GeneraterJayprakash VermaNo ratings yet

- 10007104150chan PDFDocument4 pages10007104150chan PDFChandrasekhara kNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Estates and TrustsDocument4 pagesEstates and TrustsXiaoyu KensameNo ratings yet

- ABS Neuro Attapur Hyderabad: Acc/23-24/001 01-04-2023 36AABFI0048K1ZJ AABFI0048KDocument1 pageABS Neuro Attapur Hyderabad: Acc/23-24/001 01-04-2023 36AABFI0048K1ZJ AABFI0048Knoore rabbaniNo ratings yet

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorNo ratings yet

- VAT Tax CreditsDocument3 pagesVAT Tax Creditsdarlene floresNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Salary Slip: Gross Pay 25,600 Net Pay 14,710Document3 pagesSalary Slip: Gross Pay 25,600 Net Pay 14,710pratixa ranaNo ratings yet

- Taxation Lecture - 2: Income TaxDocument26 pagesTaxation Lecture - 2: Income TaxAl SukranNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- Taxation AssignmentDocument11 pagesTaxation AssignmentImran FarhanNo ratings yet

- Putri Gita Karmelita (25) Jurnal Penutup PT ZaliaDocument1 pagePutri Gita Karmelita (25) Jurnal Penutup PT ZaliaPutri gita KarmelitaNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument2 pagesIncome Statement - Annual - As Originally ReportedHoàng HuếNo ratings yet

- Bir - Train - It - WT - Tmap 04262018Document74 pagesBir - Train - It - WT - Tmap 04262018RonStephaneMaylonNo ratings yet

- Document 1514 9730Document67 pagesDocument 1514 9730rubyhien46tasNo ratings yet

- Adjusting EntriesDocument37 pagesAdjusting Entriesallijah100% (1)

- Daftar Akun UD Buana (Lisa Nabila)Document1 pageDaftar Akun UD Buana (Lisa Nabila)Lisa NabilaNo ratings yet

- TMBC Council Tax Charges Supplementary Information 2021 2022Document2 pagesTMBC Council Tax Charges Supplementary Information 2021 2022georgerouseNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018MaricrisNo ratings yet

- New Beneficiary Verification ReportDocument1 pageNew Beneficiary Verification ReportNatasha BAl-utNo ratings yet

- Tax SimulatorDocument10 pagesTax SimulatorAnil KesarkarNo ratings yet

- Association of Persons (AOP) / Body of Individuals (BOI) / Trust / Artificial Juridical Person (AJP) For AY 2021-22Document22 pagesAssociation of Persons (AOP) / Body of Individuals (BOI) / Trust / Artificial Juridical Person (AJP) For AY 2021-22RPNNo ratings yet

- Gatchalian, Et Al. v. Collector of Internal Revenue, G.R. No. 45425, April 29, 1939Document8 pagesGatchalian, Et Al. v. Collector of Internal Revenue, G.R. No. 45425, April 29, 1939Martin SNo ratings yet

- Theory and Basis of TaxationDocument1 pageTheory and Basis of TaxationLaica MontefalcoNo ratings yet

- Gain On Disposal of Asset and LiabilityDocument5 pagesGain On Disposal of Asset and LiabilitySujit KoiralaNo ratings yet

- 2020 2 aybQYldUEVfTZ0MAOB0$w PDFDocument1 page2020 2 aybQYldUEVfTZ0MAOB0$w PDFThapliyal Prakash100% (1)

- PAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)Document5 pagesPAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)sourabh6chakrabort-1No ratings yet

- PWC Divestitures Tax ReformDocument8 pagesPWC Divestitures Tax ReformliveitupliveNo ratings yet

Life Insurance Premium Receipt: Personal Details

Life Insurance Premium Receipt: Personal Details

Uploaded by

chanam bedantaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Insurance Premium Receipt: Personal Details

Life Insurance Premium Receipt: Personal Details

Uploaded by

chanam bedantaCopyright:

Available Formats

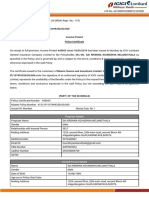

Date: 13-Dec-2021

Receipt No.: 139684310 DEC201701

Life Insurance Premium Receipt

Duration For Which the Premium is Received: 12-DEC-2020 to 11-DEC-2021

Personal Details

Policy Number: 139684310

Current residential state: Nepal

Policyholder Name: Mr. BOM BAHADUR CHH

Mobile No. 8986490886

Communication Address: POKHARA, PO/PS-

Landline no. Please inform us for regular updates

POKHARA, KASKI

Life Insured Name: Mr. BOM BAHADUR CHH

Pin- 284403

PAN Number: BEQPC5550J

Email ID: CSE.MANU@GMAIL.COM

Policy Details

Plan Name: Max Life Online Term Plan PlusMax Life Waiver Of Premium Plus Rider CO - 104N092V02

Policy Term 10 Years Premium Payment Frequency Yearly

Date of Commencement 12-DEC-2017 Date of Maturity 12-DEC-2027

Last Premium Due Date 12-DEC-2021 Next Due Date 12-DEC-2022

Reinstatement Interest (incl. GST) 0.00 Model Premium (incl. GST) 32960.60

Total Premium Received (incl. GST)* 32960.60 Total Sum Assured of base plan and term 9,00,000.00

rider (if any)

Agent's Name Coverfox Insurance Brokin Agent's Contact No.

18002005522

Head Office

GST Details

Coverage Type SAC Code GST (INR) GSTIN 27AACCM3201E1Z3

Base 997132 780.50 GST Regd. State Maharashtra

Rider 997132 102.90

Reinstatement Interest 0.00

Total 883.0

4

Affix

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premium paid would

be eligible for deduction as per the provision of Income Tax Act, 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due to changes in

legislation or government notification. *Applicable Taxes, Cesses and Levies, as per prevailing laws, shall be borne by you. *For GST purposes,this premium receipt is Tax

Invoice.Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%. In case of unit linked

product GST is applicable on charges.

Authorised signatory

PRM20

You might also like

- Airbnb Travel Receipt, Confirmation Code Y9WEFR PDFDocument2 pagesAirbnb Travel Receipt, Confirmation Code Y9WEFR PDFAnonymous oIhQKe2o8HNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancerellu prasadNo ratings yet

- 80D CertificateDocument2 pages80D CertificateYogy YNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- Renewal ReceiptDocument1 pageRenewal ReceiptAnkit SinghNo ratings yet

- 2866100498386100000Document4 pages2866100498386100000E-World Cyber ZoneNo ratings yet

- In - Gov.transport RVCER TN01BK9115Document1 pageIn - Gov.transport RVCER TN01BK9115Dr. Ezaykiyel PTNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- Income Tax Volume 1 With CorrectionsDocument554 pagesIncome Tax Volume 1 With CorrectionsSourabh NagurkarNo ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- CIR Vs Smart CommunicationsDocument1 pageCIR Vs Smart CommunicationsHoreb FelixNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Individual Premium Paid STMTDocument1 pageIndividual Premium Paid STMTGanesh SlvNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Premium CertificateDocument2 pagesPremium CertificateKamsiddha KhandekarNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedTESTERPERSONNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceGaurav SaxenaNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDocument2 pagesBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNo ratings yet

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDocument5 pagesReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNo ratings yet

- Krishna Sbi Life Policy Term InsuranceDocument36 pagesKrishna Sbi Life Policy Term Insurancekrishna_1238No ratings yet

- Lic Policy For Jeevan BeemaDocument14 pagesLic Policy For Jeevan BeemaPatel ZeelNo ratings yet

- ICICI COI IncomeProtect 445605Document5 pagesICICI COI IncomeProtect 445605sree koundinyaNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Consolidated Premium Paid STMT 2012-2013Document1 pageConsolidated Premium Paid STMT 2012-2013jahmeddNo ratings yet

- New VinothDocument3 pagesNew VinothRenga NathanNo ratings yet

- Tax Certificate - of Anjali Lalwani PDFDocument2 pagesTax Certificate - of Anjali Lalwani PDFBasant GakhrejaNo ratings yet

- Lic PreimumDocument1 pageLic PreimumAamir ShahNo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- TG1628 School Fees I PDFDocument1 pageTG1628 School Fees I PDFAnandKumarPNo ratings yet

- Health Policy SiddharthDocument9 pagesHealth Policy SiddharthSiddharth DasNo ratings yet

- Pawan S PDF CompletedDocument1 pagePawan S PDF CompletedAsifshaikh7566No ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- Acctstmt HDFC MFDocument1 pageAcctstmt HDFC MFthindmanmohanNo ratings yet

- Policy ParentsDocument6 pagesPolicy Parentsaniket goyalNo ratings yet

- Backup of Gopal InsurenceDocument5 pagesBackup of Gopal Insurencemkm969No ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Health Insurance Policy Certificate Section80DDocument1 pageHealth Insurance Policy Certificate Section80DDebosmita DasNo ratings yet

- WeeNNglHvNqn1597554384894 PDFDocument1 pageWeeNNglHvNqn1597554384894 PDFM VARAPRASADREDDYNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Prashant (1) CompletedDocument1 pagePrashant (1) CompletedAsifshaikh7566No ratings yet

- ADITYA Birla Elss 19-20Document2 pagesADITYA Birla Elss 19-20Rajgopal BalabhadruniNo ratings yet

- Renewal Receipt For 21882754Document1 pageRenewal Receipt For 21882754Raghu nNo ratings yet

- F D Bond GeneraterDocument1 pageF D Bond GeneraterJayprakash VermaNo ratings yet

- 10007104150chan PDFDocument4 pages10007104150chan PDFChandrasekhara kNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Estates and TrustsDocument4 pagesEstates and TrustsXiaoyu KensameNo ratings yet

- ABS Neuro Attapur Hyderabad: Acc/23-24/001 01-04-2023 36AABFI0048K1ZJ AABFI0048KDocument1 pageABS Neuro Attapur Hyderabad: Acc/23-24/001 01-04-2023 36AABFI0048K1ZJ AABFI0048Knoore rabbaniNo ratings yet

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorNo ratings yet

- VAT Tax CreditsDocument3 pagesVAT Tax Creditsdarlene floresNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Salary Slip: Gross Pay 25,600 Net Pay 14,710Document3 pagesSalary Slip: Gross Pay 25,600 Net Pay 14,710pratixa ranaNo ratings yet

- Taxation Lecture - 2: Income TaxDocument26 pagesTaxation Lecture - 2: Income TaxAl SukranNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- Taxation AssignmentDocument11 pagesTaxation AssignmentImran FarhanNo ratings yet

- Putri Gita Karmelita (25) Jurnal Penutup PT ZaliaDocument1 pagePutri Gita Karmelita (25) Jurnal Penutup PT ZaliaPutri gita KarmelitaNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument2 pagesIncome Statement - Annual - As Originally ReportedHoàng HuếNo ratings yet

- Bir - Train - It - WT - Tmap 04262018Document74 pagesBir - Train - It - WT - Tmap 04262018RonStephaneMaylonNo ratings yet

- Document 1514 9730Document67 pagesDocument 1514 9730rubyhien46tasNo ratings yet

- Adjusting EntriesDocument37 pagesAdjusting Entriesallijah100% (1)

- Daftar Akun UD Buana (Lisa Nabila)Document1 pageDaftar Akun UD Buana (Lisa Nabila)Lisa NabilaNo ratings yet

- TMBC Council Tax Charges Supplementary Information 2021 2022Document2 pagesTMBC Council Tax Charges Supplementary Information 2021 2022georgerouseNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018MaricrisNo ratings yet

- New Beneficiary Verification ReportDocument1 pageNew Beneficiary Verification ReportNatasha BAl-utNo ratings yet

- Tax SimulatorDocument10 pagesTax SimulatorAnil KesarkarNo ratings yet

- Association of Persons (AOP) / Body of Individuals (BOI) / Trust / Artificial Juridical Person (AJP) For AY 2021-22Document22 pagesAssociation of Persons (AOP) / Body of Individuals (BOI) / Trust / Artificial Juridical Person (AJP) For AY 2021-22RPNNo ratings yet

- Gatchalian, Et Al. v. Collector of Internal Revenue, G.R. No. 45425, April 29, 1939Document8 pagesGatchalian, Et Al. v. Collector of Internal Revenue, G.R. No. 45425, April 29, 1939Martin SNo ratings yet

- Theory and Basis of TaxationDocument1 pageTheory and Basis of TaxationLaica MontefalcoNo ratings yet

- Gain On Disposal of Asset and LiabilityDocument5 pagesGain On Disposal of Asset and LiabilitySujit KoiralaNo ratings yet

- 2020 2 aybQYldUEVfTZ0MAOB0$w PDFDocument1 page2020 2 aybQYldUEVfTZ0MAOB0$w PDFThapliyal Prakash100% (1)

- PAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)Document5 pagesPAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)sourabh6chakrabort-1No ratings yet

- PWC Divestitures Tax ReformDocument8 pagesPWC Divestitures Tax ReformliveitupliveNo ratings yet