Professional Documents

Culture Documents

Req1 Annual Dosono p2

Req1 Annual Dosono p2

Uploaded by

Edzyl Cercado DosonoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Req1 Annual Dosono p2

Req1 Annual Dosono p2

Uploaded by

Edzyl Cercado DosonoCopyright:

Available Formats

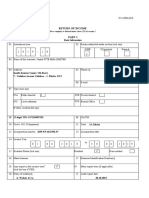

BIR Form No.

1702RTv2018 Page 1 of 1

BIR Form No.

Annual Income Tax Return

1702-RT

Corporation, Partnership and Other Non-Individual

January 2018(ENCS)

Taxpayer Subject Only to REGULAR Income Tax Rate

Page 2

1702-RT 01/18ENCS P2

Taxpayer Identification Number(TIN) Registered Name

987 654 321 00000 DOSONO CORPORATION

Part IV - Computation of Tax (DO NOT enter Centavos; 49 Centavos or Less drop down; 50 or more round up)

27 Sales/Revenues/Receipts/Fees 5,400,000

28 Less:Sales Returns, Allowances and Discounts 0

29 Net Sales/Revenues/Receipts/Fees (Item 27 Less Item 28) 5,400,000

30 Less: Cost of Sales/Services 900,000

31 Gross Income from Operation (Item 29 less Item 30) 4,500,000

32 Add: Other Taxable Income Not Subjected to Final tax 40,000

33 Total Taxable Income (Sum of Items 31 and 32) 4,540,000

Less: Deductions Allowable under Existing Law

34 Ordinary Allowable Itemized Deductions 1,260,000

35 Special Allowable Itemized Deductions 0

36 NOLCO (Only for those taxable under Sec. 27(A to C); Sec. 28(A)(1)(A)(6)(b) of Tax code, as amended) 0

37 Total Deductions (Sums of Items 34 to 36) 1,260,000

OR [in case taxable under Sec 27(A) & 28(A)(1)]

38 Optional Standard Deduction (OSD) (40% of Item 33) 0

39 Net Taxable Income/(Loss) If itemized: Item 33 Less Item 37; If OSD: Item 33 Less Item 38) 3,280,000

40 Applicable Income Tax Rate 30 %

41 Income Tax Due other than Mininum Corporate Income Tax(MCIT) (Item 39 x Item 40) 984,000

42 MCIT Due (2% of Item 33) 0

43 Tax Due (Normal Income Tax Due in Item 41 OR the MCIT Due in Item 42, whichever is higher) 984,000

Less: Tax Credits/Payments(attach proof)

44 Prior Year's Excess Credits Other Than MCIT 0

45 Income Tax Payment under MCIT from Previous Quarter/s 0

46 Income Tax Payment under Regular/Normal Rate from Previous Quarter/s 662,000

47 Excess MCIT Applied this Current Taxable Year 0

48 Creditable Tax Withheld from Previous Quarter/s per BIR Form No. 2307 52,000

49 Creditable Tax Withheld per BIR Form No. 2307 for the 4th Quarter 20,000

50 Foreign Tax Credits, if applicable 0

51 Tax Paid in Return Previously Filed, if this is an Amended Return 0

52 Special Tax Credits 0

Other Credits/Payments (Specify)

53 0

54 0

55 Total Tax Credits/Payments (Sum of Items 44 to 54) 734,000

56 Net Tax Payable (Overpayment) (Item 43 Less Item 55) 250,000

Part V - Tax Relief Availment

57 Special Allowable Itemized Deductions (Item 35 of Part IV x Applicable Income Tax Rate) 0

58 Add:Special Tax Credits 0

59 Total Tax Relief Availment (Sum of Items 57 & 58) 0

file:///C:/Users/user/AppData/Local/Temp/%7BC2BD166B-6F35-4A7D-867E-BF043F1... 19/12/2021

You might also like

- Bir 1701Document2 pagesBir 1701RAYNAN MARCELO100% (1)

- Withholding Compensation - 1601Cv2018 FormDocument1 pageWithholding Compensation - 1601Cv2018 FormReynaldo PogzNo ratings yet

- 1701Document6 pages1701Dolly BringasNo ratings yet

- Bir Annual Income Tax ReturnDocument5 pagesBir Annual Income Tax ReturnAldwin MamiitNo ratings yet

- 1702 Qjuly 2008Document2 pages1702 Qjuly 2008Chona MenorNo ratings yet

- EXIS INC - Financial Report 2022Document25 pagesEXIS INC - Financial Report 2022JohnfreNo ratings yet

- Astradigital Inc BIRForm 1702RT-page 2Document1 pageAstradigital Inc BIRForm 1702RT-page 2MARIA CRISTINA DE PAZNo ratings yet

- BIR Form 1702-RTDocument1 pageBIR Form 1702-RTGil DelenaNo ratings yet

- 1601C JanuaryDocument3 pages1601C JanuaryJoshua Honra0% (1)

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- eFPS Home - Efiling and Payment System PDFDocument2 pageseFPS Home - Efiling and Payment System PDFRegs AccountingTaxNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument2 pages1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationJa'maine ManguerraNo ratings yet

- 1601C Sept 2019Document2 pages1601C Sept 2019Virnadette Lopez0% (1)

- 1601C 082019 ItemsiDocument1 page1601C 082019 Itemsi___wenaNo ratings yet

- 01.dcreative 1601c Jan2019 FinalDocument2 pages01.dcreative 1601c Jan2019 FinalChristopher John CarmenNo ratings yet

- Quarterly Income Tax Return: Schedule 1Document3 pagesQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraNo ratings yet

- VL Yap 1601-c August 2019 FormDocument1 pageVL Yap 1601-c August 2019 FormAnimeMusicCollectionBacolod0% (1)

- 1701qjuly2008 (ENCS) q22019Document5 pages1701qjuly2008 (ENCS) q22019Andrew AndalNo ratings yet

- Itr 1Document1 pageItr 1olfuqc.3rdyearrep2324No ratings yet

- 1601-C July For ApprovalDocument1 page1601-C July For ApprovalJa'maine ManguerraNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationEljoe Vinluan0% (1)

- Form 340Document4 pagesForm 340ScribdTranslationsNo ratings yet

- Return of Income: Basic InformationDocument11 pagesReturn of Income: Basic InformationShuvro PaulNo ratings yet

- 1702Q SGC - 2nd QTR 2019 FOR EMAILDocument31 pages1702Q SGC - 2nd QTR 2019 FOR EMAILJaylou BobisNo ratings yet

- ZVI - ITR 2022 DraftDocument4 pagesZVI - ITR 2022 DraftMike SyNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationNards SVNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsAshly MateoNo ratings yet

- 1702 July 08Document7 pages1702 July 08Jchelle Lustre DeligeroNo ratings yet

- 1pg Itr SMIIDocument2 pages1pg Itr SMIIRic Dela CruzNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- 1701Q Page 2Document1 page1701Q Page 2John ApeladoNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument3 pages1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsLLYOD FRANCIS LAYLAYNo ratings yet

- War - Room 1701q 1st Quarter 2024 Pt2Document1 pageWar - Room 1701q 1st Quarter 2024 Pt2Edison Guevarra BaringNo ratings yet

- Bir Form 1701 (1) (Converted)Document43 pagesBir Form 1701 (1) (Converted)hazel ruayaNo ratings yet

- Annual Income Tax Return: (DonotentercentavosDocument2 pagesAnnual Income Tax Return: (DonotentercentavosKuhramaNo ratings yet

- 1701Q-2nd FINALDocument1 page1701Q-2nd FINALLoufelleJoiceCaseñasNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document4 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Rhomel HemorNo ratings yet

- BIR Form Page 2Document1 pageBIR Form Page 2Mark De JesusNo ratings yet

- Advanced Taxation FA2019Document133 pagesAdvanced Taxation FA2019Veronica Bailey100% (1)

- 1702 QDocument3 pages1702 Qappipinnim50% (2)

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemANTHONY CALDERONNo ratings yet

- 1701 Doc FabianDocument2 pages1701 Doc FabianCristopher NacinoNo ratings yet

- 1702-RT Annual Income Tax ReturnDocument1 page1702-RT Annual Income Tax ReturnTricia GBNo ratings yet

- 1701osd 2018 101224Document7 pages1701osd 2018 101224Janeth Tamayo NavalesNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- PLBC FY2022 AmendedDocument4 pagesPLBC FY2022 AmendedstillwinmsNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- ARAS AGRO Ltd.2022-2023Document9 pagesARAS AGRO Ltd.2022-2023Friends Law ChamberNo ratings yet

- Statement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020Document11 pagesStatement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020dineshkumar1234No ratings yet

- 1701A Annual Income Tax Return: (Add More... )Document1 page1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoNo ratings yet

- 1707 SunerDocument2 pages1707 SunerGSAFINNo ratings yet

- The Knot Wedding Planning SpreadsheetDocument46 pagesThe Knot Wedding Planning SpreadsheetRic Dela CruzNo ratings yet

- PayrollDocument553 pagesPayrollRic Dela CruzNo ratings yet

- Uid 10052022Document11 pagesUid 10052022Ric Dela CruzNo ratings yet

- Financial Requirements - V1 Ver.1Document3 pagesFinancial Requirements - V1 Ver.1Ric Dela CruzNo ratings yet

- Film Viewing IIDocument7 pagesFilm Viewing IIRic Dela CruzNo ratings yet

- Template SummaryDocument1 pageTemplate SummaryRic Dela CruzNo ratings yet

- Meralco Bill 470322010101 04142023Document2 pagesMeralco Bill 470322010101 04142023Ric Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Legal Ethic1Document12 pagesLegal Ethic1Ric Dela CruzNo ratings yet

- Memorandum For The AccusedDocument6 pagesMemorandum For The AccusedRic Dela CruzNo ratings yet

- Legal Writing TSN With Direct and CrossDocument12 pagesLegal Writing TSN With Direct and CrossRic Dela Cruz100% (1)

- Legal LogicDocument7 pagesLegal LogicRic Dela CruzNo ratings yet

- Bulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLDocument8 pagesBulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLRic Dela Cruz100% (1)

- Annual FactorDocument1 pageAnnual FactorRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Alex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Document11 pagesAlex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Ric Dela CruzNo ratings yet

- p1 p446 Legal Ethics PinedaDocument446 pagesp1 p446 Legal Ethics PinedaRic Dela CruzNo ratings yet

- Nature: Petition For Review On Certiorari of A Judgment of The CADocument10 pagesNature: Petition For Review On Certiorari of A Judgment of The CARic Dela CruzNo ratings yet

- Judicial Affidavit of Paul David C. ZaldivarDocument6 pagesJudicial Affidavit of Paul David C. ZaldivarRic Dela CruzNo ratings yet

- Ricardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityDocument2 pagesRicardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityRic Dela CruzNo ratings yet

- Alpha ListDocument8 pagesAlpha ListRic Dela CruzNo ratings yet

- College of Law: Bulacan State UniversityDocument2 pagesCollege of Law: Bulacan State UniversityRic Dela CruzNo ratings yet

- Alphalist Sched 1Document29 pagesAlphalist Sched 1Ric Dela CruzNo ratings yet

- ABM - AE12 - 001 - Revisiting Economics As A Social ScienceDocument33 pagesABM - AE12 - 001 - Revisiting Economics As A Social ScienceAries Gonzales Caragan82% (22)

- Extracted Pages From Walton Hi-Tech Industries Limited Red-Herring Prospectus Dt. 02.01.2020 - Updated - 2Document1 pageExtracted Pages From Walton Hi-Tech Industries Limited Red-Herring Prospectus Dt. 02.01.2020 - Updated - 2Aslam HossainNo ratings yet

- 4th PaperDocument4 pages4th PaperIshwor AcharyaNo ratings yet

- SC - XXXXX - Final - Bank and Cash Cycle (Including Cash Flows and Liquidity Issues) Internal Audit Report 202021Document17 pagesSC - XXXXX - Final - Bank and Cash Cycle (Including Cash Flows and Liquidity Issues) Internal Audit Report 202021christinahNo ratings yet

- Monthly Payslip 03Document1 pageMonthly Payslip 03dabu choudharyNo ratings yet

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- IN6198497Document1 pageIN6198497Shrishti VermaNo ratings yet

- Sample Bir Form - CorporationsDocument4 pagesSample Bir Form - CorporationsChristine Viernes100% (1)

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- CIR Vs Sony PhilippinesDocument1 pageCIR Vs Sony PhilippinesLouie SalladorNo ratings yet

- Comparison Between MAT and AMTDocument1 pageComparison Between MAT and AMTManoj Thakar100% (1)

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jaideep SinghNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- Us Tax OrganizerDocument3 pagesUs Tax Organizerscribd9710No ratings yet

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- Onumah, Simpson The Accounting Discipline and The Government Budgeting ConceptDocument18 pagesOnumah, Simpson The Accounting Discipline and The Government Budgeting ConceptInternational Consortium on Governmental Financial Management100% (1)

- IncomeTax IAS 12 Revised Edited GD 2020Document46 pagesIncomeTax IAS 12 Revised Edited GD 2020yonas alemuNo ratings yet

- Universal Access and Systems Solutions Phil., IncDocument1 pageUniversal Access and Systems Solutions Phil., Incmaykee01No ratings yet

- Ghana Revenue Authority: Company Self Assessment FormDocument2 pagesGhana Revenue Authority: Company Self Assessment Formokatakyie1990No ratings yet

- Anestar Schools Form 3 Maths Further Logarithms and Commercial ArithmeticDocument2 pagesAnestar Schools Form 3 Maths Further Logarithms and Commercial ArithmeticJOSEPH MWANGINo ratings yet

- CIR v. Bank of Commerce (2005) Case DigestDocument2 pagesCIR v. Bank of Commerce (2005) Case DigestShandrei GuevarraNo ratings yet

- Gsis Acquired Assets For DispositionDocument13 pagesGsis Acquired Assets For DispositionMary Grace BalmoresNo ratings yet

- Burgum July QuarterlyDocument767 pagesBurgum July QuarterlyRob PortNo ratings yet

- GMGF 2033-GST Di SingapuraDocument15 pagesGMGF 2033-GST Di SingapuraMuhd Yassier As Syafiq bin YaacubNo ratings yet

- International Tax Vietnam Highlights 2017Document4 pagesInternational Tax Vietnam Highlights 2017Thanh TrucNo ratings yet

- Bir Form 2306 and 2307 MchsDocument3 pagesBir Form 2306 and 2307 Mchschristopher labastidaNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- 32nd Parkview Plots Price List 08.01.2021Document1 page32nd Parkview Plots Price List 08.01.2021Zama KazmiNo ratings yet

- Financial Statement:: QuarterlyDocument2 pagesFinancial Statement:: QuarterlyJeraldine RamisoNo ratings yet