Professional Documents

Culture Documents

Case Studv 3: Required: For The Purposes of The Cash Flow Statement Under The Direct Method, You Are Required To

Case Studv 3: Required: For The Purposes of The Cash Flow Statement Under The Direct Method, You Are Required To

Uploaded by

Tanya PribylevaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Studv 3: Required: For The Purposes of The Cash Flow Statement Under The Direct Method, You Are Required To

Case Studv 3: Required: For The Purposes of The Cash Flow Statement Under The Direct Method, You Are Required To

Uploaded by

Tanya PribylevaCopyright:

Available Formats

Case Studv 3

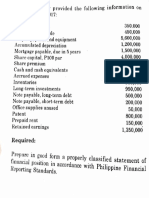

XYZ Inc. is preparing its cash flow statement under the direct method and has provided this information:

Net credit sale $5,000,000

Accounts receivable, end of the year 1,500,000

Accounts receivable, beginning of the year 2,500,000

Purchases (on account) 4,000,000

Trade payable, end of the year 1,900.000

Trade payable, beginning of the year 2,000,000

Operating expenses 3,000,000

Accrued expenses, beginning of the year 500,000

Accrued expenses, end of the year 400,000

Depreciation on property, plant, and equipment. 600,000

Required: For the purposes of the cash flow statement under the direct method, you are required to

compute cash collections from customers, payments to suppliers, and cash paid for operating expenses.

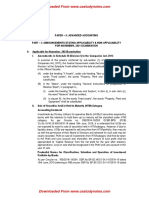

Case study #4

Client Inc. has provided the following information and requests you to prepare the operating

activities of the cash flow statement under the indirect method

Net income before taxes $400,000

Depreciation on property, plant, and equipment 200,000

Loss on sale of building 100,000

Interest expense 150.000

Interest payable, beginning of the year 100,000

Interest payable, end of the year 50,000

income taxes paid 100,000

Accounts receivable, beginning of the year 500,000

Accounts receivable, end of the year 850,000

Inventory, beginning of the year 500,000

Inventory, end of the year 400,000

Accounts payable, beginning of the year 200,000

Accounts payable, end of the year 500,000

Required:

Required: Prepare the operating activities section of the Statement of cash flows

Case study #4

Net income before taxes $400,000

Adjustments

Depreciation on property, plant, and equipment +200,000

Loss on sale of building +100,000

Accounts receivable -350, 000

Accounts payable +300,000

Inventory +100,000

Interest payable -50,000

Total adj. 200,000

Income taxes paid -100,000

Total net cash flow from operating activity 500,000

You might also like

- Chapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Document20 pagesChapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Asi Cas Jav100% (2)

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- Reading and Use of English CAEDocument12 pagesReading and Use of English CAETanya Pribyleva67% (3)

- Practice Test Reading and Use of EnglishDocument5 pagesPractice Test Reading and Use of EnglishTanya Pribyleva60% (5)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- Case Study No 3. Fin MGTDocument1 pageCase Study No 3. Fin MGTJoynen Baldevarona100% (1)

- Lili Reinhart's Revealing Speech About Body ImageDocument6 pagesLili Reinhart's Revealing Speech About Body ImageTanya PribylevaNo ratings yet

- C2 Speaking Useful PhrasesDocument1 pageC2 Speaking Useful PhrasesMyrto Papadaki75% (4)

- Clarkson Lumber Co Calculations1560944145Document9 pagesClarkson Lumber Co Calculations1560944145lauraNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Aac M 2 Cash Flow Prob Answer 1 5Document11 pagesAac M 2 Cash Flow Prob Answer 1 5Micah Danielle S. TORMON0% (1)

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Drill 4 AK FSUU AccountingDocument10 pagesDrill 4 AK FSUU AccountingRobert CastilloNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Seatwork Far3Document3 pagesSeatwork Far3Mansour HamjaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- Accounting 2Document18 pagesAccounting 2cherryannNo ratings yet

- Merchandising Comprrehensive ProblemDocument3 pagesMerchandising Comprrehensive ProblemJalod Hadji AmerNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Exercise 9 Statement of Cash Flows - 054915Document2 pagesExercise 9 Statement of Cash Flows - 054915Hoyo VerseNo ratings yet

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Cfas ActivitiesDocument10 pagesCfas ActivitiesAntonNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- 7062 - Deferred Income Tax SolvingDocument9 pages7062 - Deferred Income Tax SolvingstrmsantiagoNo ratings yet

- 6938 - Operating, Investisng and Financing ActivitiesDocument2 pages6938 - Operating, Investisng and Financing ActivitiesAljur SalamedaNo ratings yet

- Problem 4: AnswerDocument2 pagesProblem 4: AnswerYukidoNo ratings yet

- PRACTICAL FINANCIAL ACCOUNTING - Volume 1Document33 pagesPRACTICAL FINANCIAL ACCOUNTING - Volume 1KingChryshAnneNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Proof of Cash - DrillDocument3 pagesProof of Cash - DrillMark Domingo Mendoza100% (1)

- Exercise - FinmarDocument8 pagesExercise - FinmarRed VelvetNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- IA 3 AssignmentDocument2 pagesIA 3 AssignmentToni Rose Hernandez LualhatiNo ratings yet

- Cash Flow QuizDocument1 pageCash Flow QuizDan David FLoresNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- ACCTGREV1 - 009.1 Statement of Cash Flows Part 1Document1 pageACCTGREV1 - 009.1 Statement of Cash Flows Part 1Jeremiah David0% (1)

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixieNo ratings yet

- Worksheet 1 DR CRDocument5 pagesWorksheet 1 DR CRMc Clent CervantesNo ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Cuenco, Julie Ann (Bsa 1-1) Activity #7 CfasDocument2 pagesCuenco, Julie Ann (Bsa 1-1) Activity #7 CfasJulie Ann CuencoNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- Corporation LiquidationDocument1 pageCorporation LiquidationMelisa DomingoNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Trends in M&A, Investmet BanksDocument19 pagesTrends in M&A, Investmet BanksTanya PribylevaNo ratings yet

- Principles of Managerial Finance: Fifteenth EditionDocument62 pagesPrinciples of Managerial Finance: Fifteenth EditionTanya PribylevaNo ratings yet

- инструкция мультиваркаDocument93 pagesинструкция мультиваркаTanya PribylevaNo ratings yet

- Case 1 SWOT Analysis RobinhoddDocument1 pageCase 1 SWOT Analysis RobinhoddTanya PribylevaNo ratings yet

- Chapter 2 FinanceDocument1 pageChapter 2 FinanceTanya PribylevaNo ratings yet

- Homework REVIEWDocument1 pageHomework REVIEWTanya PribylevaNo ratings yet

- Would Rather Would SoonerDocument2 pagesWould Rather Would SoonerTanya PribylevaNo ratings yet

- Roadmap To Cae Speaking Success: Peter TravisDocument34 pagesRoadmap To Cae Speaking Success: Peter TravisTanya PribylevaNo ratings yet

- Speaking Test Mark SheetDocument1 pageSpeaking Test Mark SheetTanya PribylevaNo ratings yet

- Founders: Alex Faliushin Max SapelovDocument2 pagesFounders: Alex Faliushin Max SapelovTanya PribylevaNo ratings yet

- Practical Task 3 PROBLEM SOLUTIONDocument7 pagesPractical Task 3 PROBLEM SOLUTIONTanya PribylevaNo ratings yet

- Market StructuresDocument12 pagesMarket StructuresTanya PribylevaNo ratings yet

- Founders: Alex Faliushin Max SapelovDocument2 pagesFounders: Alex Faliushin Max SapelovTanya PribylevaNo ratings yet

- FC-202: Shults Liudmula Kuzmenko Liliya Pisarchuk Liliya Pribyleva Tetyana Kobesova Albina Skotz VeraDocument16 pagesFC-202: Shults Liudmula Kuzmenko Liliya Pisarchuk Liliya Pribyleva Tetyana Kobesova Albina Skotz VeraTanya PribylevaNo ratings yet

- Manual: NegotiatingDocument74 pagesManual: NegotiatingTanya PribylevaNo ratings yet

- Extra Homework - CountrysideDocument3 pagesExtra Homework - CountrysideTanya Pribyleva100% (1)

- Holiday PlansDocument3 pagesHoliday PlansTanya Pribyleva100% (1)

- Hotel VocabDocument6 pagesHotel VocabTanya PribylevaNo ratings yet

- Holiday Conversation Questions WorksheetDocument3 pagesHoliday Conversation Questions WorksheetTanya PribylevaNo ratings yet

- Exam (3) ASDocument6 pagesExam (3) ASUsama AslamNo ratings yet

- Actg 26A - Strategic Cost Management Take Home Quiz: RequirementsDocument2 pagesActg 26A - Strategic Cost Management Take Home Quiz: RequirementsseviNo ratings yet

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocument6 pagesCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNo ratings yet

- AFAR-01 (Partnership Formation and Operations)Document6 pagesAFAR-01 (Partnership Formation and Operations)Ruth RodriguezNo ratings yet

- ROE Disaggregation Exercise - P&GDocument3 pagesROE Disaggregation Exercise - P&GPepe GeoNo ratings yet

- Principles of Accounting Code 8401 Assignments of Spring 2023Document13 pagesPrinciples of Accounting Code 8401 Assignments of Spring 2023zainabjutt0303No ratings yet

- Pakistan State Oil:: WebsiteDocument5 pagesPakistan State Oil:: WebsiteAreeba FatimaNo ratings yet

- Solution Final Advanced Acc. First09 10Document6 pagesSolution Final Advanced Acc. First09 10RodNo ratings yet

- Ap Receivables Quizzer507Document20 pagesAp Receivables Quizzer507Jean Tan100% (1)

- Factsheet ANTM 2023 01Document4 pagesFactsheet ANTM 2023 01arsyil1453No ratings yet

- FA BOOK Final REVIEWDocument31 pagesFA BOOK Final REVIEWSayandeep ShillNo ratings yet

- Alliance Bank: ResearchDocument4 pagesAlliance Bank: ResearchZhi_Ming_Cheah_8136No ratings yet

- Jawaban ModulDocument12 pagesJawaban ModulAmelia Fauziyah rahmahNo ratings yet

- CHP 9 JeterDocument12 pagesCHP 9 JeterTri Ayu AstariNo ratings yet

- ABM FABM 2 Q1 Course Guide PDFDocument58 pagesABM FABM 2 Q1 Course Guide PDFEarl Christian BonaobraNo ratings yet

- Plant Assets Natural Resources and Intangible AsDocument59 pagesPlant Assets Natural Resources and Intangible AsxunaidNo ratings yet

- Answer 1 Joyce TilyenjiDocument4 pagesAnswer 1 Joyce TilyenjiANDREW MAZIMBANo ratings yet

- Second Term Exam-2070 Particulars Debit (RS.) Credit (RS.)Document8 pagesSecond Term Exam-2070 Particulars Debit (RS.) Credit (RS.)ragedskullNo ratings yet

- Basic AccountingDocument58 pagesBasic AccountingEnatCollege EthiopiaNo ratings yet

- 5 6120800679993803735Document39 pages5 6120800679993803735Harmony Clement-ebereNo ratings yet

- Solutions - MidtermDocument21 pagesSolutions - MidtermAndrew WatsonNo ratings yet

- SECO 03-2022-24 UpdateDocument13 pagesSECO 03-2022-24 UpdateJoachim HagegeNo ratings yet

- Chapter 3 - Section 1 Financial Statements Analysis: Prufrock CorporationDocument3 pagesChapter 3 - Section 1 Financial Statements Analysis: Prufrock CorporationCynthia CarranzaNo ratings yet

- Business MathDocument4 pagesBusiness MathPamela MarieNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- Annual Report PDFDocument15 pagesAnnual Report PDFAnusha CNo ratings yet

- Uniform Format of Accounts - SummaryDocument8 pagesUniform Format of Accounts - SummaryGotta Patti House100% (1)

- 221 PrintDocument23 pages221 PrintChara etangNo ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet