Professional Documents

Culture Documents

Bureau of Local Government Finance Department of Finance

Bureau of Local Government Finance Department of Finance

Uploaded by

Ma. Zenia Detorio0 ratings0% found this document useful (0 votes)

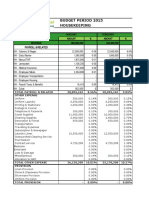

10 views5 pages1) The document is a statement of receipts for the 4th quarter of 2021 for the local government of San Rafael, Iloilo in the Philippines.

2) Actual tax and non-tax revenues were significantly below target amounts, with actual receipts representing only 10.08% of targeted income.

3) The largest shortfalls were in real property tax (-86.43% of target), business tax (-99.64%), and community tax (-90.53%).

Original Description:

Original Title

SRS_SAN RAFAEL_Q4_2021

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document is a statement of receipts for the 4th quarter of 2021 for the local government of San Rafael, Iloilo in the Philippines.

2) Actual tax and non-tax revenues were significantly below target amounts, with actual receipts representing only 10.08% of targeted income.

3) The largest shortfalls were in real property tax (-86.43% of target), business tax (-99.64%), and community tax (-90.53%).

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views5 pagesBureau of Local Government Finance Department of Finance

Bureau of Local Government Finance Department of Finance

Uploaded by

Ma. Zenia Detorio1) The document is a statement of receipts for the 4th quarter of 2021 for the local government of San Rafael, Iloilo in the Philippines.

2) Actual tax and non-tax revenues were significantly below target amounts, with actual receipts representing only 10.08% of targeted income.

3) The largest shortfalls were in real property tax (-86.43% of target), business tax (-99.64%), and community tax (-90.53%).

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 5

BUREAU OF LOCAL GOVERNMENT FINANCE

DEPARTMENT OF FINANCE

http://blgf.gov.ph/

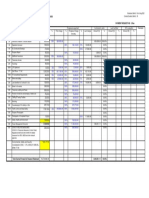

STATEMENT OF RECEIPTS SOURCES

LGU: SAN RAFAEL, ILOILO

Period Covered: Q4, 2021

Income Target Excess of Actual vs % of Over/ (Under)

Particulars Actual Receipts

( Approved Budget) Target to Target

LOCAL SOURCES

TAX REVENUES 1,509,000.00 152,081.83 -1,356,918.17 -89.92%

REAL PROPERTY TAX 1,000,000.00 135,726.83 -864,273.17 -86.43%

Real Property Tax -Basic 1,000,000.00 135,726.83 -864,273.17 -86.43%

Current Year 1,000,000.00 97,036.15 -902,963.85 -90.30%

Fines and Penalties-Current Year 0.00 3,756.78 3,756.78 0%

Prior Year/s 0.00 22,559.50 22,559.50 0%

Fines and Penalties-Prior Year/s 0.00 12,374.40 12,374.40 0%

TAX ON BUSINESS 336,000.00 1,200.00 -334,800.00 -99.64%

Amusement Tax 0.00 0.00 0.00 0%

Business Tax 330,000.00 1,200.00 -328,800.00 -99.64%

Manufacturers, Assemblers, etc. 0.00 0.00 0.00 0%

Wholesalers, Distributors, etc. 0.00 0.00 0.00 0%

Exporters, Manufacturers, Dealers, etc. 0.00 0.00 0.00 0%

Retailers 330,000.00 1,200.00 -328,800.00 -99.64%

Franchise Tax 0.00 0.00 0.00 0%

Tax on Delivery Trucks and Vans 6,000.00 0.00 -6,000.00 -100.00%

Tax on Sand, Gravel & Other Quarry

0.00 0.00 0.00 0%

Resources

Fines and Penalties-Business Taxes 0.00 0.00 0.00 0%

OTHER TAXES 173,000.00 15,155.00 -157,845.00 -91.24%

Community Tax-Corporation 0.00 0.00 0.00 0%

Community Tax-Individual 160,000.00 15,155.00 -144,845.00 -90.53%

Professional Tax 1,000.00 0.00 -1,000.00 -100.00%

Real Property Transfer Tax 0.00 0.00 0.00 0%

Other Taxes 12,000.00 0.00 -12,000.00 -100.00%

Fines and Penalties-Other Taxes 0.00 0.00 0.00 0%

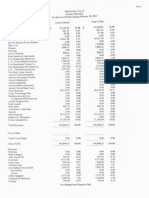

NON-TAX REVENUES 1,032,000.00 333,588.13 -698,411.87 -67.68%

REGULATORY FEES (Permits and Licenses) 381,000.00 148,698.25 -232,301.75 -60.97%

Permits and Licenses 191,000.00 130,703.25 -60,296.75 -31.57%

Fees on Weights and Measures 1,000.00 0.00 -1,000.00 -100.00%

Fishery Rental Fees and Privilege Fees 0.00 0.00 0.00 0%

Franchising and Licensing Fees 0.00 0.00 0.00 0%

Business Permit Fees 160,000.00 5,746.75 -154,253.25 -96.41%

Building Permit Fees 0.00 0.00 0.00 0%

Zonal/Location Permit Fees 0.00 0.00 0.00 0%

Tricycle Operators Permit Fees 0.00 0.00 0.00 0%

Occupational Fees 0.00 0.00 0.00 0%

Other Permits & Licenses 30,000.00 124,956.50 94,956.50 316.52%

Registration Fees 155,000.00 15,005.00 -139,995.00 -90.32%

Cattle/Animal Registration Fees 3,000.00 200.00 -2,800.00 -93.33%

Civil Registration Fees 152,000.00 14,805.00 -137,195.00 -90.26%

Inspection Fees 20,000.00 2,990.00 -17,010.00 -85.05%

Fines and Penalties-Permits and Licenses 15,000.00 0.00 -15,000.00 -100.00%

SERVICE/USER CHARGES (Service Income) 163,000.00 6,444.60 -156,555.40 -96.05%

Clearance and Certification Fees 23,000.00 6,344.60 -16,655.40 -72.41%

Police Clearance 13,000.00 5,520.00 -7,480.00 -57.54%

Secretary's Fees 0.00 824.60 824.60 0%

Health Certificate 10,000.00 0.00 -10,000.00 -100.00%

Other Clearance and Certification 0.00 0.00 0.00 0%

Other Fees 100,000.00 100.00 -99,900.00 -99.90%

Garbage Fees 0.00 0.00 0.00 0%

Wharfage Fees 0.00 0.00 0.00 0%

Toll Fees 0.00 0.00 0.00 0%

Other Service Income 100,000.00 100.00 -99,900.00 -99.90%

Fines and Penalties-Service Income 0.00 0.00 0.00 0%

Landing and Aeronautical Fees 0.00 0.00 0.00 0%

Parking and Terminal Fees 0.00 0.00 0.00 0%

Hospital Fees 0.00 0.00 0.00 0%

Medical, Dental and Laboratory Fees 40,000.00 0.00 -40,000.00 -100.00%

Market & Slaughterhouse Fees 0.00 0.00 0.00 0%

Printing and Publication Fees 0.00 0.00 0.00 0%

RECEIPTS FROM ECONOMIC ENTERPRISES

470,000.00 88,150.00 -381,850.00 -81.24%

(Business Income)

Receipts from Economic Enterprises

470,000.00 88,150.00 -381,850.00 -81.24%

(Business Income)

School Operations 0.00 0.00 0.00 0%

Power Generation/Distribution 0.00 0.00 0.00 0%

Hospital Operations 0.00 0.00 0.00 0%

Canteen/Restaurant Operations 0.00 0.00 0.00 0%

Cemetery Operations 120,000.00 59,550.00 -60,450.00 -50.38%

Communication Facilities & Equipment

0.00 0.00 0.00 0%

Operations

Dormitory Operations 0.00 0.00 0.00 0%

Market Operations 350,000.00 28,600.00 -321,400.00 -91.83%

Slaughterhouse Operations 0.00 0.00 0.00 0%

Transportation System Operations 0.00 0.00 0.00 0%

Waterworks System Operations 0.00 0.00 0.00 0%

Printing & Publication Operations 0.00 0.00 0.00 0%

Lease/Rental of Facilities 0.00 0.00 0.00 0%

Trading Business 0.00 0.00 0.00 0%

Other Economic Enterprises 0.00 0.00 0.00 0%

Fines and Penalties-Economic

0.00 0.00 0.00 0%

Enterprises

Prepaid Income (Prepaid Rent) 0.00 0.00 0.00 0%

OTHER INCOME/RECEIPTS (Other General

18,000.00 90,295.28 72,295.28 401.64%

Income)

Interest Income 0.00 0.00 0.00 0%

Dividend Income 0.00 0.00 0.00 0%

Other General Income (Miscellaneous) 18,000.00 90,295.28 72,295.28 401.64%

Rebates on MMDA Contribution 0.00 0.00 0.00 0%

Sales of

0.00 0.00 0.00 0%

Confiscated/Abandoned/Seized Goods & Properties

Miscellaneous - Others 18,000.00 90,295.28 72,295.28 401.64%

TOTAL INCOME-LOCAL SOURCES 2,541,000.00 485,669.96 -2,055,330.04 -80.89%

EXTERNAL SOURCES

SHARE FROM NATIONAL TAX COLLECTION 85,633,056.00 21,408,264.75 -64,224,791.25 -75.00%

INTERNAL REVENUE ALLOTMENT 85,633,056.00 21,408,264.75 -64,224,791.25 -75.00%

Current Year 85,633,056.00 21,408,264.75 -64,224,791.25 -75.00%

OTHER NON-INCOME RECEIPTS 0.00 107,015.96 107,015.96 0%

Collection Receivables 0.00 0.00 0.00 0%

Refund of Cash Advances 0.00 107,015.96 107,015.96 0%

TOTAL INCOME/RECEIPTS FROM EXTERNAL

85,633,056.00 21,515,280.71 -64,117,775.29 -74.88%

SOURCES

TOTAL GENERAL FUND 88,174,056.00 22,000,950.67 -66,173,105.33 -75.05%

SPECIAL EDUCATION FUND

SPECIAL EDUCATION TAX

Special Education Fund 500,000.00 169,658.55 -330,341.45 -66.07%

Current Year 500,000.00 121,295.20 -378,704.80 -75.74%

Fines and Penalties-Current Year 0.00 4,695.97 4,695.97 0%

Prior Year/s 0.00 28,199.38 28,199.38 0%

Fines and Penalties-Prior Year/s 0.00 15,468.00 15,468.00 0%

Other Receipts 0.00 0.00 0.00 0%

Grants and Donations - Foreign 0.00 0.00 0.00 0%

Loans - Foreign 0.00 0.00 0.00 0%

TOTAL SPECIAL EDUCATION FUND 500,000.00 169,658.55 -330,341.45 -66.07%

GRAND TOTAL (GF + SEF) 88,674,056.00 22,170,609.22 -66,503,446.78 -75.00%

ADVANCE PAYMENT FOR RPT

General Fund 0.00

Special Education Fund 0.00

TOTAL 0.00

Certified correct:

Municipal Treasurer

You might also like

- PM Schedule Interior Fit Out Works For DIB Baniyas Branch Abu Dhabi UAE PDFDocument5 pagesPM Schedule Interior Fit Out Works For DIB Baniyas Branch Abu Dhabi UAE PDFXozan100% (1)

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNo ratings yet

- Special Quadrilaterals: Honors GeometryDocument38 pagesSpecial Quadrilaterals: Honors GeometryMuhammad MirzaNo ratings yet

- Srs San Rafael q4 2021Document14 pagesSrs San Rafael q4 2021Ma. Zenia DetorioNo ratings yet

- Cierre 2021 Ambo Sa de CVDocument73 pagesCierre 2021 Ambo Sa de CVstefany2007.proveetubosNo ratings yet

- Cierre 2021 Ambo Sa de CVDocument73 pagesCierre 2021 Ambo Sa de CVstefany2007.proveetubosNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument2 pagesBureau of Local Government Finance Department of FinancetutoymolaNo ratings yet

- Fill Up Description Amount Previous This Billing To Date QTY Amount % QTY Amount % QTYDocument23 pagesFill Up Description Amount Previous This Billing To Date QTY Amount % QTY Amount % QTYConor McgregorNo ratings yet

- PrelimsDocument1 pagePrelimscard ttht tthtNo ratings yet

- REF Price Approval FEB 11 2024 - 25 March 2024Document1 pageREF Price Approval FEB 11 2024 - 25 March 2024mahmoodrasel228No ratings yet

- Income Statement Budget ComparisonDocument4 pagesIncome Statement Budget ComparisonRyan DizonNo ratings yet

- Analisi Horitzontal: Cash Flow Teòric Final 486.00 11% 338.00 8%Document4 pagesAnalisi Horitzontal: Cash Flow Teòric Final 486.00 11% 338.00 8%DeltaNo ratings yet

- IGA69636 SalSlipWithTaxDetailsMiscDocument1 pageIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshNo ratings yet

- Sre Malinao Q1 2023Document6 pagesSre Malinao Q1 2023Paolo IcangNo ratings yet

- Feb 2007Document38 pagesFeb 2007Larry LeachNo ratings yet

- Actual Vs BudgetDocument2 pagesActual Vs BudgetCarli MuzquizNo ratings yet

- 2022-06 Appropriation Status ReportDocument18 pages2022-06 Appropriation Status Reportkartik soniNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Balance General 2Document1 pageBalance General 2Esmeralda BernaNo ratings yet

- UntitledDocument4 pagesUntitledAnn LiNo ratings yet

- Quickbook Company Accounts.Document1 pageQuickbook Company Accounts.Talal KhanNo ratings yet

- Full Tesoreria 1 AnyDocument3 pagesFull Tesoreria 1 Anyah29130No ratings yet

- New Appraisal AnnextureDocument2 pagesNew Appraisal Annextureelangovan subashiniNo ratings yet

- Outlets To Be Open: M078. BIG MALL SAMARINDA Test Open Date: 25/9/2022Document8 pagesOutlets To Be Open: M078. BIG MALL SAMARINDA Test Open Date: 25/9/2022Auhah Mat ApesNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- The Gardens Budget Vs Actual March 2011Document1 pageThe Gardens Budget Vs Actual March 2011rls2orgNo ratings yet

- File Budget 2015 HKDocument10 pagesFile Budget 2015 HKAvip HidayatNo ratings yet

- 1 - Blank Financial AppendixDocument57 pages1 - Blank Financial AppendixMarcio Colen Barcellos JuniorNo ratings yet

- Standard - Income STMNT 2020-2021-2Document1 pageStandard - Income STMNT 2020-2021-2ssicaru salud velazquezNo ratings yet

- Profit Loss - 12month ComparisonDocument2 pagesProfit Loss - 12month ComparisonIbrahim SyedNo ratings yet

- Estados Financieros - Parte 1Document16 pagesEstados Financieros - Parte 1Laura CarolinaNo ratings yet

- Amit Agarwal BankingDocument6 pagesAmit Agarwal BankingPreetam JainNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument7 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill bylivefruitbazaar1122No ratings yet

- Property No: Bill Year:: Interest at 18% Is Charged On Remaining AmountDocument1 pageProperty No: Bill Year:: Interest at 18% Is Charged On Remaining AmountGOPAL DHUMADIYANo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Statement of Product ValueDocument2 pagesStatement of Product ValueveerendrareddyNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- A-Gastos Distribuidos % Venta MejoradoDocument6 pagesA-Gastos Distribuidos % Venta MejoradoArturo ValenciaNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- Laba Rugi Per SekolahDocument1 pageLaba Rugi Per SekolahPascal FelimNo ratings yet

- ABR-3Document22 pagesABR-3Wilfredo SinoyNo ratings yet

- Evi15 104951Document2 pagesEvi15 104951Al QadriNo ratings yet

- عرض سعر 3Document1 pageعرض سعر 3omar99366No ratings yet

- IGA74304 SalSlipWithTaxDetailsMiscDocument1 pageIGA74304 SalSlipWithTaxDetailsMiscSandeep SinghNo ratings yet

- Irma15 104936Document2 pagesIrma15 104936Al QadriNo ratings yet

- Bank Audit - Sahu Traders - CC 70 Lakh Renewal - 2024 (With Provisional)Document14 pagesBank Audit - Sahu Traders - CC 70 Lakh Renewal - 2024 (With Provisional)samir kumar 10th 'B' roll no- 33No ratings yet

- Profit and Loss of MankindDocument2 pagesProfit and Loss of MankindsarvodayaprintlinksNo ratings yet

- Evi16 104953Document2 pagesEvi16 104953Al QadriNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Trial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing BalanceDocument4 pagesTrial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing Balancesushilo_2No ratings yet

- Reconciling of AccountDocument72 pagesReconciling of AccountCarlo CariasoNo ratings yet

- Trial Balance: Margaria - Keziasulistio - 5150111005Document3 pagesTrial Balance: Margaria - Keziasulistio - 5150111005Kezia SulistioNo ratings yet

- Start-up-cost-08-21-22group3Document1 pageStart-up-cost-08-21-22group3Janel PeñaNo ratings yet

- Septya Ayu Neraca Saldo KlasikDocument1 pageSeptya Ayu Neraca Saldo KlasikwongtawengtawengNo ratings yet

- April 2023 To March 2023Document47 pagesApril 2023 To March 2023shivam.kr20081995No ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- Income StatementDocument2 pagesIncome StatementRyan DizonNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Evi12 104945Document1 pageEvi12 104945Al QadriNo ratings yet

- TCSDocument150 pagesTCSlaxmi joshiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Cartoon AbetmentDocument12 pagesCartoon AbetmentRabihaNo ratings yet

- Daksh Booklet - 26 PDF by Ankush LambaDocument35 pagesDaksh Booklet - 26 PDF by Ankush LambaSoham ChaudhuriNo ratings yet

- Wild Amazon Cradle of Life Film TestDocument2 pagesWild Amazon Cradle of Life Film TestQuratulain MustafaNo ratings yet

- Corrosion Prevention and ControlDocument19 pagesCorrosion Prevention and ControlJosa FatyNo ratings yet

- CIRFormDocument3 pagesCIRFormVina Mae AtaldeNo ratings yet

- 1b Reading Output 2Document1 page1b Reading Output 2Elisha Maurelle AncogNo ratings yet

- Full Papers: Modular Simulation of Fluidized Bed ReactorsDocument7 pagesFull Papers: Modular Simulation of Fluidized Bed Reactorsmohsen ranjbarNo ratings yet

- 04 What Is Easement Distinguish Easement From Usufruct 2 Can There Be A An - Course HeroDocument9 pages04 What Is Easement Distinguish Easement From Usufruct 2 Can There Be A An - Course HerojrstockholmNo ratings yet

- Aeotec DSD37-ZWUS by Aeon Labs - Installation ManualDocument2 pagesAeotec DSD37-ZWUS by Aeon Labs - Installation ManualAlarm Grid Home Security and Alarm MonitoringNo ratings yet

- Antiragging Committee - Jan-20Document1 pageAntiragging Committee - Jan-20TRH RECRUITMENTNo ratings yet

- Case Study of Railway Bridge Over Chakri River in PathankotDocument6 pagesCase Study of Railway Bridge Over Chakri River in Pathankotsaurav rajNo ratings yet

- Project Management A Systems Approach To Planning Scheduling and Controlling 10Th Edition Kerzner Test Bank Full Chapter PDFDocument24 pagesProject Management A Systems Approach To Planning Scheduling and Controlling 10Th Edition Kerzner Test Bank Full Chapter PDFGeorgeAndersonkqmr100% (13)

- ScribdDocument66 pagesScribdyeyeu5No ratings yet

- Syllabus Class 4 - 2019-20Document11 pagesSyllabus Class 4 - 2019-20Dominic SavioNo ratings yet

- Practical Class 2 Text Artificial IntelligenceDocument3 pagesPractical Class 2 Text Artificial IntelligenceAlex VaskoNo ratings yet

- Early Journal Content On JSTOR, Free To Anyone in The WorldDocument52 pagesEarly Journal Content On JSTOR, Free To Anyone in The Worldmarc millisNo ratings yet

- 06380492Document18 pages06380492Imam Adhita ViryaNo ratings yet

- Kahit Maputi Na Ang Buhok KoDocument13 pagesKahit Maputi Na Ang Buhok KoLouie Kem Anthony Babaran100% (1)

- Bulacan MTC: Notifiable Diseases Law Can't Be Used Against People Without Quarantine Pass, ButDocument7 pagesBulacan MTC: Notifiable Diseases Law Can't Be Used Against People Without Quarantine Pass, ButYNNA DERAYNo ratings yet

- Corporate QA-QC ManagerDocument7 pagesCorporate QA-QC ManagerDeo MNo ratings yet

- Tech-Voc Track Ict Strand Computer Programming (Software Development) Grade 11 - 1 Semester Core SubjectsDocument4 pagesTech-Voc Track Ict Strand Computer Programming (Software Development) Grade 11 - 1 Semester Core SubjectsWil-Ly de la CernaNo ratings yet

- Bungcaras Vs Bravo (Notice of Appeal)Document2 pagesBungcaras Vs Bravo (Notice of Appeal)Ramonbeulaneo RancesNo ratings yet

- Wilhoit, Summary PDFDocument5 pagesWilhoit, Summary PDFJake SimonsNo ratings yet

- Med Chem IV Sem Pre RuhsDocument1 pageMed Chem IV Sem Pre Ruhsabhay sharmaNo ratings yet

- b1 Speaking FashionDocument2 pagesb1 Speaking FashionIsaSánchezNo ratings yet

- Blog Profile: Activity A. " ". Complete El Perfil Con Su Información Personal en Los Espacios Indicados "Document5 pagesBlog Profile: Activity A. " ". Complete El Perfil Con Su Información Personal en Los Espacios Indicados "El dominadorNo ratings yet

- Physics Investigatory ProjectDocument18 pagesPhysics Investigatory ProjectMoghanNo ratings yet

- Edith Stein: Women, Social-Political Philosophy, Theology, Metaphysics and Public HistoryDocument281 pagesEdith Stein: Women, Social-Political Philosophy, Theology, Metaphysics and Public HistorySantiago GarciaNo ratings yet