Professional Documents

Culture Documents

Paystub 202109

Paystub 202109

Uploaded by

Ankush BarheCopyright:

Available Formats

You might also like

- Earnings Statement Only Non NegotiableDocument1 pageEarnings Statement Only Non NegotiableLiz MatzNo ratings yet

- 4:30:21 PaystubDocument1 page4:30:21 PaystubRhoderlande JosephNo ratings yet

- Payslip 1 PDFDocument1 pagePayslip 1 PDFkrishnaNo ratings yet

- Myob Payslip TemplateDocument1 pageMyob Payslip Templateapi-384163101No ratings yet

- PaystubDocument1 pagePaystubDorothy ShellNo ratings yet

- E-Statement 20131018 00027Document1 pageE-Statement 20131018 00027Renee0430100% (1)

- Document 2Document2 pagesDocument 2Trenika SwainNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadNo ratings yet

- Module 2 Lesson 2 Position PaperDocument4 pagesModule 2 Lesson 2 Position PaperMaicaNo ratings yet

- Paystub 02.28.2019 PDFDocument1 pagePaystub 02.28.2019 PDFAnonymous dDiu2yq2KNo ratings yet

- PellaUSOnlinePayslip PDFDocument2 pagesPellaUSOnlinePayslip PDFJoshuaM.ByrneNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- Payslip PDFDocument1 pagePayslip PDFTwilliams SavgeeNo ratings yet

- Paystub 04.30.2019 PDFDocument1 pagePaystub 04.30.2019 PDFGanesh RautNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

- Aeb SM CH11 1 PDFDocument16 pagesAeb SM CH11 1 PDFAdi SusiloNo ratings yet

- QSR OccupationalSafety PDFDocument440 pagesQSR OccupationalSafety PDFsreeNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Paystub, SeptemberDocument1 pagePaystub, SeptemberBhavani Prasad Sanapala100% (1)

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Payslip For The Month of Oct 2021: Rivigo Services PVT LTDDocument1 pagePayslip For The Month of Oct 2021: Rivigo Services PVT LTDDeeptimayee SahooNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Arshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeDocument1 pageArshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeSuhas AmbadeNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedArul Mhmmd10No ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- The Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PDocument1 pageThe Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PSangram JadhavNo ratings yet

- July 08Document1 pageJuly 08anon-99145No ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Paystub 202102Document1 pagePaystub 202102dsnreddyNo ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNo ratings yet

- Luis 4Document1 pageLuis 4dtk serviceNo ratings yet

- Etan Pay Slip NEWDocument12 pagesEtan Pay Slip NEWThana BalanNo ratings yet

- Earnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 29, 2021Document2 pagesEarnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 29, 2021Aditya AgrawalNo ratings yet

- Document 3Document1 pageDocument 3Chris AcostaNo ratings yet

- Nieves 1Document1 pageNieves 1carterNo ratings yet

- Pay003 2296Document1 pagePay003 2296selvam.kandasamy3297No ratings yet

- SSPUSADVDocument1 pageSSPUSADVJamesNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- Presto Mart SDN BHD (757250-V) : Pay Slip Month EndDocument1 pagePresto Mart SDN BHD (757250-V) : Pay Slip Month EndAwais IqbalNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Pay Details: Taxable Gross 248.22Document1 pagePay Details: Taxable Gross 248.22ArtemisNo ratings yet

- CCR 14-15 q4 Paystub ExampleDocument1 pageCCR 14-15 q4 Paystub Exampleapi-232724808No ratings yet

- Pay StatementDocument1 pagePay Statementjmatos_297262No ratings yet

- Navneet Pay SlipDocument1 pageNavneet Pay Slipdeepak_sharma9323No ratings yet

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDocument1 pageEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNo ratings yet

- Paystub 2022 04 17Document1 pagePaystub 2022 04 17Vivian TorresNo ratings yet

- PaycheckDocument2 pagesPaycheckapi-373194232No ratings yet

- 001 F 1 F 7441653639019Document1 page001 F 1 F 7441653639019Prateeksha MishraNo ratings yet

- 7258a013 9ad0 496f 8340 2b6368 PDFDocument1 page7258a013 9ad0 496f 8340 2b6368 PDFLadis andradeNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Rabade PayDocument1 pageRabade Paysarojdubey0107No ratings yet

- 1 Apr 17Document1 page1 Apr 17pravin_3781No ratings yet

- Information Needs of An Organization: "Need Is The Mother of Invention"Document15 pagesInformation Needs of An Organization: "Need Is The Mother of Invention"Suhas ParchureNo ratings yet

- Four Things - Travel VouchersDocument2 pagesFour Things - Travel Vouchershh021686No ratings yet

- 12 PpeDocument67 pages12 Ppesaufibs4966No ratings yet

- Presentation PPT On Fundamental RightsDocument13 pagesPresentation PPT On Fundamental RightsJappandeep KaurNo ratings yet

- Cambodia: Country Partnership StrategyDocument18 pagesCambodia: Country Partnership StrategyDara DoungNo ratings yet

- Hazard Psychosocial in Construction IndustryDocument9 pagesHazard Psychosocial in Construction IndustryYekti Arum NNo ratings yet

- District Operations Guide 2015-16 UpdatedDocument52 pagesDistrict Operations Guide 2015-16 Updatedapi-326164851No ratings yet

- Walmart CultureDocument7 pagesWalmart CulturekillersrinuNo ratings yet

- E&S TrainingDocument8 pagesE&S TrainingAyodeji Fasan SimeonNo ratings yet

- Supporter Reference Form V8.2 July16Document4 pagesSupporter Reference Form V8.2 July16DefterosNo ratings yet

- The Dual Training System in The PhilippinesDocument2 pagesThe Dual Training System in The PhilippinesCHARM BARCELONo ratings yet

- Work MeasurementDocument4 pagesWork MeasurementMiguel HernandezNo ratings yet

- Server Cover Letter ExamplesDocument7 pagesServer Cover Letter Exampleswtrnrgdkg100% (1)

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Offer of Employment - Haziq Syaqur Bin RazmanDocument2 pagesOffer of Employment - Haziq Syaqur Bin RazmanZu Eniera Abdul RazakNo ratings yet

- ISO14K and OHSAS 18K Readiness ChecklistDocument4 pagesISO14K and OHSAS 18K Readiness ChecklistIr Azil Awaludin MohsNo ratings yet

- LOB 2016 Trisem IDocument2 pagesLOB 2016 Trisem IEsha ChaudharyNo ratings yet

- 845 1 NLSC Sample 24 GuideDocument13 pages845 1 NLSC Sample 24 GuideangelNo ratings yet

- EsolDocument520 pagesEsolElena Beleska100% (7)

- Leave Policy Related To Staff of Future Generation School SystemDocument5 pagesLeave Policy Related To Staff of Future Generation School SystemhamzaNo ratings yet

- NFL Bathinda Quarter Lease AggreementDocument2 pagesNFL Bathinda Quarter Lease Aggreementsharma3066334No ratings yet

- Apprentice SystemDocument2 pagesApprentice SystemYanny WongNo ratings yet

- Apply Appropriate Safety Measures While Working inDocument28 pagesApply Appropriate Safety Measures While Working inNanette A. Marañon-Sansano100% (5)

- Sup Listening Unit 3Document4 pagesSup Listening Unit 3hoàng nguyễnNo ratings yet

- Industrial Safety Course PlanDocument11 pagesIndustrial Safety Course Planpradeep Y DNo ratings yet

- MCC Fire and Emergency Progress Report 2018Document38 pagesMCC Fire and Emergency Progress Report 2018Toby VueNo ratings yet

- CBSE Class 12 Syllabus For Economics 2014-2015Document4 pagesCBSE Class 12 Syllabus For Economics 2014-2015cbsesamplepaperNo ratings yet

Paystub 202109

Paystub 202109

Uploaded by

Ankush BarheOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paystub 202109

Paystub 202109

Uploaded by

Ankush BarheCopyright:

Available Formats

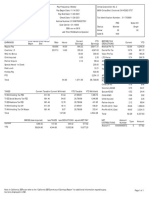

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Name : NITIN SHAMRAO SHIVANKAR DESG/ESG : Time Keeper

Empl ID : 6857 Birth Date :27.09.1979 PG/EG : Grade C Employee

CPF No./UAN: 02338939 / 100257833602 Retire Due :30.09.2037 LAP Avl/Bal: 0 / 35

PAN No. : DGDPS6429D Due Incr Dt :21.08.2022 SCL Avl/Bal: 0 / 2

Pay Period : 01.12.2021 - 31.12.2021 Basic Rate : 36,110.00 HAP Avl/Bal: 0 / 63

Bank Ac No : 3984633613 Emp.Status :Active Comm Avl : 0

Bank Name : CENTRAL BANK OF INDIA Seniority No: 2 TM KPR EOL Avl : 0

Pay Scale : MG05 - 30810-1060-36110-1160-47710-1265-88190 Absent(C/P): 0 / 0

PSA :HPS POPHALI

Earnings Deductions Loan Balances

Basic Salary 36,110.00 Ee PF contribution 5,547.00 Festival Advance 10,000.00

Dearness Allow 10,111.00 Ar. Emp. PF contribution 3,238.00 CPF Loan Principal 19,800.00

Special Compen Allow 280.00 Er Pension contribution 1,250.00 CPF Loan 2 66,660.00

Elec. Charges Allow 430.00 Prof Tax - split period 200.00

Factory Allowance 1,000.00 Ee LWF contribution 12.00

Fringe Benefit - Admin 270.00 Income Tax 4,210.00

Tech J A / Book Allow 230.00 Staff Welfare Fund 10.00

Sp. Allow (Koyana) 750.00 Revenue Stamp 1.00

Ar.Basic Salary 118,460.00 Mediclaim-Ee Contributio 700.00 Deductions not taken in the month

Ar.Dearness Allow 91,472.00- LIC 1,919.00

Ar.Special Compen Allow 810.00 Emp Dep Wel T Fund 30.00 NAVKSSPSM Eklahare 53,882.00

Ar.Elec. Charges Allow 1,290.00 Festival Advance 1,250.00

Ar.Edu. Assist. Allow 2,000.00 CPF Loan Principal 6,600.00

Ar.Tech J A / Book Allow 690.00 CPF Loan Principal 2 5,555.00

Ar.Transport Asst Allow 750.00 VKSPSL Shegaon Ahmednaga 3,263.00

Ar.FB Energy Allow 782.00- Yuvak Krida M Deepnagar 25.00

Ar.Fringe Benefit - Admi 1,563.00 Wachnalaya Deepnagar 20.00

NAVKSSPSM Eklahare 32,951.00

MVKSPSM Ratnagiri 4,613.00

Company Quarter Rent 81.00

Adjustments 0.00

Total 82,490.00 Total 70,225.00 Take Home Pay 12,265.00

Perks/Exemption Other Income/Deduction Form 16 summary Form 16 summary

Conveyance An 1,408.00 Ann Reg Incom 550,204.00 Balance 661,389.00

Other Exempti 3,450.00 Ann Irr Incom 72,589.40 Std Deduction 50,000.00

Prev Yr Incom 43,453.38 Empmnt tax (Prof Tax) 2,400.00

Gross Salary 666,246.78 Incm under Hd Salary 608,989.00

Exemption U/S 4,858.00 Gross Tot Income 608,989.00

Balance 661,389.00 Agg of Chapter VI 90,544.00

Total Income 518,450.00

Tax on total Income 16,190.00

Tax payable and surcharg 16,838.00

Tax payable by Ee. 16,838.00

Income Tax 4,210.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

All the Employees must complete their E-nomination at EPFO Member Portal on or before 31.12.2021. Failure to do so will result in

"STOP SALARY" w.e.f. January 2022

COVID-19: PLEASE FOLLOW THE INSTRUCTIONS OF GOVT & LOCAL AUTHORITY. STAY SAFE...STAY HEALTHY...

Date:27.01.2022

You might also like

- Earnings Statement Only Non NegotiableDocument1 pageEarnings Statement Only Non NegotiableLiz MatzNo ratings yet

- 4:30:21 PaystubDocument1 page4:30:21 PaystubRhoderlande JosephNo ratings yet

- Payslip 1 PDFDocument1 pagePayslip 1 PDFkrishnaNo ratings yet

- Myob Payslip TemplateDocument1 pageMyob Payslip Templateapi-384163101No ratings yet

- PaystubDocument1 pagePaystubDorothy ShellNo ratings yet

- E-Statement 20131018 00027Document1 pageE-Statement 20131018 00027Renee0430100% (1)

- Document 2Document2 pagesDocument 2Trenika SwainNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadNo ratings yet

- Module 2 Lesson 2 Position PaperDocument4 pagesModule 2 Lesson 2 Position PaperMaicaNo ratings yet

- Paystub 02.28.2019 PDFDocument1 pagePaystub 02.28.2019 PDFAnonymous dDiu2yq2KNo ratings yet

- PellaUSOnlinePayslip PDFDocument2 pagesPellaUSOnlinePayslip PDFJoshuaM.ByrneNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- Payslip PDFDocument1 pagePayslip PDFTwilliams SavgeeNo ratings yet

- Paystub 04.30.2019 PDFDocument1 pagePaystub 04.30.2019 PDFGanesh RautNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

- Aeb SM CH11 1 PDFDocument16 pagesAeb SM CH11 1 PDFAdi SusiloNo ratings yet

- QSR OccupationalSafety PDFDocument440 pagesQSR OccupationalSafety PDFsreeNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Paystub, SeptemberDocument1 pagePaystub, SeptemberBhavani Prasad Sanapala100% (1)

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Payslip For The Month of Oct 2021: Rivigo Services PVT LTDDocument1 pagePayslip For The Month of Oct 2021: Rivigo Services PVT LTDDeeptimayee SahooNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Arshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeDocument1 pageArshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeSuhas AmbadeNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedArul Mhmmd10No ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- The Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PDocument1 pageThe Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PSangram JadhavNo ratings yet

- July 08Document1 pageJuly 08anon-99145No ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Paystub 202102Document1 pagePaystub 202102dsnreddyNo ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNo ratings yet

- Luis 4Document1 pageLuis 4dtk serviceNo ratings yet

- Etan Pay Slip NEWDocument12 pagesEtan Pay Slip NEWThana BalanNo ratings yet

- Earnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 29, 2021Document2 pagesEarnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 29, 2021Aditya AgrawalNo ratings yet

- Document 3Document1 pageDocument 3Chris AcostaNo ratings yet

- Nieves 1Document1 pageNieves 1carterNo ratings yet

- Pay003 2296Document1 pagePay003 2296selvam.kandasamy3297No ratings yet

- SSPUSADVDocument1 pageSSPUSADVJamesNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- Presto Mart SDN BHD (757250-V) : Pay Slip Month EndDocument1 pagePresto Mart SDN BHD (757250-V) : Pay Slip Month EndAwais IqbalNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Pay Details: Taxable Gross 248.22Document1 pagePay Details: Taxable Gross 248.22ArtemisNo ratings yet

- CCR 14-15 q4 Paystub ExampleDocument1 pageCCR 14-15 q4 Paystub Exampleapi-232724808No ratings yet

- Pay StatementDocument1 pagePay Statementjmatos_297262No ratings yet

- Navneet Pay SlipDocument1 pageNavneet Pay Slipdeepak_sharma9323No ratings yet

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDocument1 pageEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNo ratings yet

- Paystub 2022 04 17Document1 pagePaystub 2022 04 17Vivian TorresNo ratings yet

- PaycheckDocument2 pagesPaycheckapi-373194232No ratings yet

- 001 F 1 F 7441653639019Document1 page001 F 1 F 7441653639019Prateeksha MishraNo ratings yet

- 7258a013 9ad0 496f 8340 2b6368 PDFDocument1 page7258a013 9ad0 496f 8340 2b6368 PDFLadis andradeNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Rabade PayDocument1 pageRabade Paysarojdubey0107No ratings yet

- 1 Apr 17Document1 page1 Apr 17pravin_3781No ratings yet

- Information Needs of An Organization: "Need Is The Mother of Invention"Document15 pagesInformation Needs of An Organization: "Need Is The Mother of Invention"Suhas ParchureNo ratings yet

- Four Things - Travel VouchersDocument2 pagesFour Things - Travel Vouchershh021686No ratings yet

- 12 PpeDocument67 pages12 Ppesaufibs4966No ratings yet

- Presentation PPT On Fundamental RightsDocument13 pagesPresentation PPT On Fundamental RightsJappandeep KaurNo ratings yet

- Cambodia: Country Partnership StrategyDocument18 pagesCambodia: Country Partnership StrategyDara DoungNo ratings yet

- Hazard Psychosocial in Construction IndustryDocument9 pagesHazard Psychosocial in Construction IndustryYekti Arum NNo ratings yet

- District Operations Guide 2015-16 UpdatedDocument52 pagesDistrict Operations Guide 2015-16 Updatedapi-326164851No ratings yet

- Walmart CultureDocument7 pagesWalmart CulturekillersrinuNo ratings yet

- E&S TrainingDocument8 pagesE&S TrainingAyodeji Fasan SimeonNo ratings yet

- Supporter Reference Form V8.2 July16Document4 pagesSupporter Reference Form V8.2 July16DefterosNo ratings yet

- The Dual Training System in The PhilippinesDocument2 pagesThe Dual Training System in The PhilippinesCHARM BARCELONo ratings yet

- Work MeasurementDocument4 pagesWork MeasurementMiguel HernandezNo ratings yet

- Server Cover Letter ExamplesDocument7 pagesServer Cover Letter Exampleswtrnrgdkg100% (1)

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Offer of Employment - Haziq Syaqur Bin RazmanDocument2 pagesOffer of Employment - Haziq Syaqur Bin RazmanZu Eniera Abdul RazakNo ratings yet

- ISO14K and OHSAS 18K Readiness ChecklistDocument4 pagesISO14K and OHSAS 18K Readiness ChecklistIr Azil Awaludin MohsNo ratings yet

- LOB 2016 Trisem IDocument2 pagesLOB 2016 Trisem IEsha ChaudharyNo ratings yet

- 845 1 NLSC Sample 24 GuideDocument13 pages845 1 NLSC Sample 24 GuideangelNo ratings yet

- EsolDocument520 pagesEsolElena Beleska100% (7)

- Leave Policy Related To Staff of Future Generation School SystemDocument5 pagesLeave Policy Related To Staff of Future Generation School SystemhamzaNo ratings yet

- NFL Bathinda Quarter Lease AggreementDocument2 pagesNFL Bathinda Quarter Lease Aggreementsharma3066334No ratings yet

- Apprentice SystemDocument2 pagesApprentice SystemYanny WongNo ratings yet

- Apply Appropriate Safety Measures While Working inDocument28 pagesApply Appropriate Safety Measures While Working inNanette A. Marañon-Sansano100% (5)

- Sup Listening Unit 3Document4 pagesSup Listening Unit 3hoàng nguyễnNo ratings yet

- Industrial Safety Course PlanDocument11 pagesIndustrial Safety Course Planpradeep Y DNo ratings yet

- MCC Fire and Emergency Progress Report 2018Document38 pagesMCC Fire and Emergency Progress Report 2018Toby VueNo ratings yet

- CBSE Class 12 Syllabus For Economics 2014-2015Document4 pagesCBSE Class 12 Syllabus For Economics 2014-2015cbsesamplepaperNo ratings yet