Professional Documents

Culture Documents

w-2 2019 Form - LOUISA - BOKACHEVA

w-2 2019 Form - LOUISA - BOKACHEVA

Uploaded by

Keller Brown JnrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

w-2 2019 Form - LOUISA - BOKACHEVA

w-2 2019 Form - LOUISA - BOKACHEVA

Uploaded by

Keller Brown JnrCopyright:

Available Formats

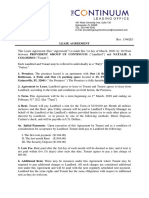

a Employee’s social security number Safe, accurate, Visit the IRS website at

22222 096-84-6406 OMB No. 1545-0008 FAST! Use www.irs.gov/efile

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

46-0558622 47,599.00 5,425.78

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

NEW YORK ACADEMY OF SCIENCES 48,000.00 2,976.00

250 Greenwich St, 40th Floor, 250 5 Medicare wages and tips 6 Medicare tax withheld

48,000.00 696.00

Greenwich St, NY 10007 7 Social security tips 8 Allocated tips

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

LOUISA BOKACHEVA

o

d

e

A 120.00

13 Statutory Retirement Third-party

employee plan sick pay

12b

C

1189 E 59th St

o

d

e

B 1,540.00

14 Other 12c

C

Brooklyn NY 11234 NYFLI - 129.60 o

d

e

C 20,000.00

NYSDI - 31.20 12d

C

o

d

e

D 401.00

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

NY 13-1773640 47,599.00 2,186.86

Wage and Tax Department of the Treasury—Internal Revenue Service

Form W-2 Statement 2020

Copy B—To Be Filed With Employee’s FEDERAL Tax Return.

This information is being furnished to the Internal Revenue Service.

You might also like

- DIY - CREDIT REPAIR EBOOK - Instructions - v1 PDFDocument69 pagesDIY - CREDIT REPAIR EBOOK - Instructions - v1 PDFYawNyarko93% (27)

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Elektronik Vizesi: Türkiye CumhuriyetiDocument1 pageElektronik Vizesi: Türkiye CumhuriyetiKeller Brown Jnr100% (1)

- OMB No. 1545-0008 OMB No. 1545-0008Document3 pagesOMB No. 1545-0008 OMB No. 1545-0008balackoNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- APN License IllinoisDocument19 pagesAPN License IllinoisEvangelist Michelle Leavy-BreunigNo ratings yet

- Affidavit of TruthDocument10 pagesAffidavit of TruthH J100% (3)

- 2020 W2 FormDocument7 pages2020 W2 FormMaria HowellNo ratings yet

- DD Form 2789, Waiver - Remission of Indebtedness Application, 20140917 DraftDocument6 pagesDD Form 2789, Waiver - Remission of Indebtedness Application, 20140917 DraftKeller Brown JnrNo ratings yet

- Lease For NatalieDocument6 pagesLease For NatalieKeller Brown JnrNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- Main Sept 01Document59 pagesMain Sept 01Lindsey RobbinsNo ratings yet

- Checklist For SSS Death Benefit ClaimDocument2 pagesChecklist For SSS Death Benefit ClaimAbbrielleAngelaBillones100% (1)

- Buck Act PDFDocument3 pagesBuck Act PDFJulian Williams©™100% (1)

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- 61 F 28319 Bcac 1Document1 page61 F 28319 Bcac 1MickeyNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Pyw219s Ee PDFDocument1 pagePyw219s Ee PDFBeyonceNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogbolo100% (1)

- Wage and Tax Statement: Employee's Social Security NumberDocument6 pagesWage and Tax Statement: Employee's Social Security NumberErma MonieNo ratings yet

- New Hire Paperwork 2021aDocument27 pagesNew Hire Paperwork 2021aTom BondalicNo ratings yet

- Johnnys w4 PDFDocument2 pagesJohnnys w4 PDFAnthony OrozcooNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Jose Jose Espinoza Espinoza: Employee's Address and ZIP CodeDocument1 pageJose Jose Espinoza Espinoza: Employee's Address and ZIP CodeJose EspinozaNo ratings yet

- 2023 Tax Return: Prepared ByDocument14 pages2023 Tax Return: Prepared BypatovoidNo ratings yet

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Document4 pagesKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonNo ratings yet

- 2021 w2Document1 page2021 w2Candy ValentineNo ratings yet

- FTF 2024-05-11 1715453284246Document4 pagesFTF 2024-05-11 1715453284246Brad Dorsey100% (1)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document3 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09gary hays100% (1)

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Reissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Document1 pageReissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Sadiki LuhandeNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (1)

- LG FFDocument1 pageLG FFfeem743No ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- Income Tax Return 2019Document6 pagesIncome Tax Return 2019Cindy WheelerNo ratings yet

- VA Attendant EnrollmentDocument2 pagesVA Attendant EnrollmentJeannie ArringtonNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 4blon majorsNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- FTF 2023-03-20 1679339077907Document15 pagesFTF 2023-03-20 1679339077907ayogbolo100% (1)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rose ownes100% (2)

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDocument3 pages05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Loan AppDocument9 pagesLoan Appanon-209253100% (1)

- Wage and Tax Statement Wage and Tax StatementDocument3 pagesWage and Tax Statement Wage and Tax StatementNathan VosNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationYut ChiaNo ratings yet

- 0LH47 0LH47 0429 20180101 W2Report W2Report 001Document2 pages0LH47 0LH47 0429 20180101 W2Report W2Report 001charly4877No ratings yet

- FTF 2022-04-19 1650352254304Document8 pagesFTF 2022-04-19 1650352254304Charles GoodwinNo ratings yet

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- 2020 Form 1099-MISCDocument1 page2020 Form 1099-MISCKeller Brown JnrNo ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- Irs Gov Forms-SignedDocument2 pagesIrs Gov Forms-SignedKeller Brown JnrNo ratings yet

- TSYS Bank Request Change Document-101Document1 pageTSYS Bank Request Change Document-101Keller Brown JnrNo ratings yet

- Pay Stub - ROY STEPHENDocument6 pagesPay Stub - ROY STEPHENKeller Brown JnrNo ratings yet

- Polisens Blanketter 442-4 EngelskaDocument3 pagesPolisens Blanketter 442-4 EngelskaKeller Brown JnrNo ratings yet

- Military Live Document THAILAND LANGUAGE - JUNG SUNGHODocument7 pagesMilitary Live Document THAILAND LANGUAGE - JUNG SUNGHOKeller Brown JnrNo ratings yet

- Dd2656-Data For Payment of Retired PersonnelDocument8 pagesDd2656-Data For Payment of Retired PersonnelKeller Brown JnrNo ratings yet

- DD Form 108, Application For Retired Pay Benefits, July 2002Document2 pagesDD Form 108, Application For Retired Pay Benefits, July 2002Keller Brown JnrNo ratings yet

- Irs Letter - Balance DueDocument1 pageIrs Letter - Balance DueKeller Brown JnrNo ratings yet

- 위임장 최종 지불 편지Document1 page위임장 최종 지불 편지Keller Brown JnrNo ratings yet

- Notice of ReviewDocument2 pagesNotice of ReviewKeller Brown JnrNo ratings yet

- 14 424 Malaysia Employment NotesDocument7 pages14 424 Malaysia Employment NotesKeller Brown JnrNo ratings yet

- 위탁 상자 위임장Document1 page위탁 상자 위임장Keller Brown JnrNo ratings yet

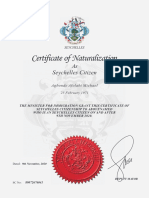

- SC No 89072676041 Agbonde Afolabi Michael 20-11-09 NaturalizationDocument1 pageSC No 89072676041 Agbonde Afolabi Michael 20-11-09 NaturalizationKeller Brown JnrNo ratings yet

- House Rental Agreement: Tenant Information Landlord InformationDocument3 pagesHouse Rental Agreement: Tenant Information Landlord InformationKeller Brown JnrNo ratings yet

- Moving-Goods Declaration FormDocument2 pagesMoving-Goods Declaration FormKeller Brown JnrNo ratings yet

- Taxpayer Identification Number - WikipediaDocument1 pageTaxpayer Identification Number - WikipediaBadhon Chandra SarkarNo ratings yet

- Dl-54b Photo ID Card ChangeDocument2 pagesDl-54b Photo ID Card ChangePA Work LicenseNo ratings yet

- DMV Statement On Data BreachDocument3 pagesDMV Statement On Data BreachKTLA 5 News100% (1)

- P 1formDocument1 pageP 1formbcwilesNo ratings yet

- Application Form For Institutional Grants: Educational and Research ProjectsDocument6 pagesApplication Form For Institutional Grants: Educational and Research ProjectsbarrackNo ratings yet

- Freedom Papers Section 2Document47 pagesFreedom Papers Section 2John Downs100% (5)

- Good Performance: His Majesty Meets President Nursultan Nazarbayev of The Republic of Kazaakhstan in March 2008Document6 pagesGood Performance: His Majesty Meets President Nursultan Nazarbayev of The Republic of Kazaakhstan in March 2008zeezonNo ratings yet

- Application For A Social Security Card: Free!Document5 pagesApplication For A Social Security Card: Free!Vhince GreenNo ratings yet

- Edgar Flores W-2 FormDocument1 pageEdgar Flores W-2 Formethannguyen939No ratings yet

- Sworn Statement - SecurityDocument2 pagesSworn Statement - SecurityRenz Marion Cortes CarasNo ratings yet

- Chapter 7 David N Hyman Eco PublicDocument32 pagesChapter 7 David N Hyman Eco PublicBendyNo ratings yet

- PAYTIPPERY209Document1 pagePAYTIPPERY209puppygirl.ash13yNo ratings yet

- Social Security GuideDocument20 pagesSocial Security Guiderickbmay100% (2)

- Identity NewDocument31 pagesIdentity NewZLand0178% (9)

- Engleski - Strucni Centralni TerminiDocument56 pagesEngleski - Strucni Centralni TerminivjakovljevicNo ratings yet

- Major Changes To Enhanced STAR and Senior Exemption RenewalsDocument1 pageMajor Changes To Enhanced STAR and Senior Exemption RenewalsNewzjunkyNo ratings yet

- SSSForms UMID ApplicationDocument2 pagesSSSForms UMID ApplicationhazelnutdesuNo ratings yet

- RSSB Bronchure FinalDocument32 pagesRSSB Bronchure FinalDrumaraNo ratings yet

- Department of Labor: scf161 IDocument3 pagesDepartment of Labor: scf161 IUSA_DepartmentOfLaborNo ratings yet

- Data Collection Survey JICA ReportDocument188 pagesData Collection Survey JICA ReportPurbaningsih Dini SashantiNo ratings yet

- Co-Signer AgreementDocument2 pagesCo-Signer AgreementRocketLawyerNo ratings yet

- Proof of Passing Mtle TestsDocument3 pagesProof of Passing Mtle Testsapi-455488731No ratings yet

- Identity and Employment Authorization Identity Employment AuthorizationDocument3 pagesIdentity and Employment Authorization Identity Employment AuthorizationAnonymous olIRceaUNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryChona Sollestre MurilloNo ratings yet