Professional Documents

Culture Documents

4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial Balance

4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial Balance

Uploaded by

Graciella Marie Sorreno0 ratings0% found this document useful (0 votes)

317 views3 pagesThe document provides the unadjusted and adjusted trial balances for DC Cruz Architectural Design for December 31, 2019. It lists assets, liabilities, equity, revenues and expenses. It also includes 6 adjustments to record prepaid insurance, supplies, depreciation of building and equipment, salaries expense, and interest expense. The adjusting entries section records these adjustments by debiting the related expenses and crediting the associated accounts.

Original Description:

Adjusting Entries

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides the unadjusted and adjusted trial balances for DC Cruz Architectural Design for December 31, 2019. It lists assets, liabilities, equity, revenues and expenses. It also includes 6 adjustments to record prepaid insurance, supplies, depreciation of building and equipment, salaries expense, and interest expense. The adjusting entries section records these adjustments by debiting the related expenses and crediting the associated accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

317 views3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial Balance

4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial Balance

Uploaded by

Graciella Marie SorrenoThe document provides the unadjusted and adjusted trial balances for DC Cruz Architectural Design for December 31, 2019. It lists assets, liabilities, equity, revenues and expenses. It also includes 6 adjustments to record prepaid insurance, supplies, depreciation of building and equipment, salaries expense, and interest expense. The adjusting entries section records these adjustments by debiting the related expenses and crediting the associated accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

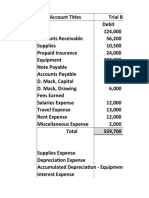

ACT. No. 4.3.2.

3 Elaborate – Preparing adjusting entries from unadjusted and adjusted trial balance

DC Cruz Architectural Design

Trial Balance

December 31, 2019

Unadjusted Trial Balance Adjustments

Dr Cr Dr Cr

Cash P72,000

Accounts Receivable 331,000

Prepaid Insurance 48,000 a) P12,000

Supplies 125,000 b) 53,000

Land 170,000

Building 850,000

Accumulated Depreciation- Building P230,000 c) 15,000

Computer Equipment 620,000

Accumulated Depreciation- Computer Equipment 106,000 d) 18,000

Notes Payable 550,000

Accounts Payable 143,000

Salaries Payable e) 34,000

Interest Payable f) 77,000

Mortgage Payable 470,000

Cruz, Capital 310,000

Cruz, Withdrawals 250,000

Architectural Design Service Revenues 1,470,000

Salaries Expense 813,000 e) P34,000

Insurance Expense a) 12,000

Supplies Expense b) 53,000

Depreciation Expense- Building c) 15,000

Depreciation Expense- Computer Equipment d) 18,000

Interest Expense f) 77,000

Totals P3,279,000 P3,279,000 P209,000 P209,000

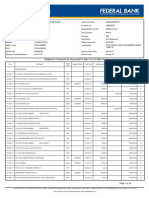

DC Cruz Architectural Design

Adjusting Entries

For the month ending December 31, 2019

Adjusted Trial Balance Date Account Name Dr

Dr Cr Dec. 31 Insurance Expense 12,000

P72,000 Prepaid Insurance

331,000

36,000 Dec. 31 Supplies Expense 53,000

72,000 Supplies

170,000

850,000 Dec. 31 Depreciation Expense- Building 15,000

P245,000 Accumulated Depreciation- Building

620,000

124,000 Dec. 31 Depreciation Expense- Computer Equipment 18,000

550,000 Accumulated Depreciation- Computer Equipment

143,000

34,000 Dec. 31 Salaries Expense 34,000

77,000 Salaries Payable

470,000

310,000 Dec. 31 Interest Expense 77,000

250,000 Interest Payable

1,470,000

847,000

12,000

53,000

15,000

18,000

77,000

P3,423,000 P3,423,000

Cr

12,000

53,000

15,000

18,000

34,000

77,000

You might also like

- Day Trading 4 Dummies PDFDocument47 pagesDay Trading 4 Dummies PDFPeterVUSA100% (1)

- Answer M4-Q1Document7 pagesAnswer M4-Q1kakaoNo ratings yet

- Customer Satisfaction in The Indian Banking SectorDocument70 pagesCustomer Satisfaction in The Indian Banking SectorAbhishek Singh83% (23)

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- WorksheetDocument3 pagesWorksheetRonnie Lloyd Javier100% (3)

- Group 6Document8 pagesGroup 6Parkiee JamsNo ratings yet

- Partnership FormationDocument13 pagesPartnership FormationPhilip Dan Jayson LarozaNo ratings yet

- Options Trader 0505Document43 pagesOptions Trader 0505mhosszu100% (2)

- Opm 530 - C1Document18 pagesOpm 530 - C1mamakayden100% (1)

- Chart of Accounts Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesChart of Accounts Assets Liabilities Owner'S Equity Income ExpensesErika Bucao100% (1)

- BA 1 Module 3 Trial Balance Errors DiscussionDocument4 pagesBA 1 Module 3 Trial Balance Errors DiscussionLovely Rose VillarNo ratings yet

- Short Case ActivitiesDocument2 pagesShort Case ActivitiesRaff LesiaaNo ratings yet

- Mr. Lindbergh Lendl S. Soriano Practice Set 2Document33 pagesMr. Lindbergh Lendl S. Soriano Practice Set 2Kevin MagdayNo ratings yet

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditJessie ForpublicuseNo ratings yet

- Trial Balance Wk17 GeneralizationDocument1 pageTrial Balance Wk17 GeneralizationYenique SalongaNo ratings yet

- Answer Problem 1Document9 pagesAnswer Problem 1MARY JUSTINE PAQUIBOTNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Learning Task 2 Financial Statements of Rosalina Besario SurveyorsDocument6 pagesLearning Task 2 Financial Statements of Rosalina Besario SurveyorsNeil Matundan100% (1)

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDocument5 pagesMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코No ratings yet

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Chapter 1 & 2Document13 pagesChapter 1 & 2Ali100% (1)

- Journalizing To Adjusting Entries QuizDocument3 pagesJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- ACCTG CYCLE Comprehensive ProblmDocument12 pagesACCTG CYCLE Comprehensive ProblmMaria Nicole OasinNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Document5 pagesPamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Mariane Manangan100% (2)

- Current Asset Current Asset Contra AssetDocument7 pagesCurrent Asset Current Asset Contra AssetAlexander QuemadaNo ratings yet

- ACC 1 Quiz No. 14 Answer KeyDocument9 pagesACC 1 Quiz No. 14 Answer Keynicole bancoroNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Perpetual System, Problem #17Document2 pagesPerpetual System, Problem #17Feiya LiuNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Cabutotan Jennifer 2ADocument12 pagesCabutotan Jennifer 2AJennifer Mamuyac CabutotanNo ratings yet

- Merchandising Problem AnswerDocument2 pagesMerchandising Problem AnswerBrian Gerome MercadoNo ratings yet

- Castro CompanyDocument41 pagesCastro CompanyMarinel Abril100% (1)

- CHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900Document3 pagesCHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900CacjungoyNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- Castro Company ZABALLADocument11 pagesCastro Company ZABALLAHelping Five (H5)No ratings yet

- Test Bank 4Document5 pagesTest Bank 4Jinx Cyrus RodilloNo ratings yet

- Inancial CCTG: Adjusting The AccountsDocument28 pagesInancial CCTG: Adjusting The AccountsLj BesaNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- Theories of AccountingDocument4 pagesTheories of AccountingShanine BaylonNo ratings yet

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- Sample Problem For Last MeetingDocument11 pagesSample Problem For Last MeetingLylanie Alcoran AnibNo ratings yet

- Ipil Grocery T AccountsDocument5 pagesIpil Grocery T AccountsJelaina Alimansa100% (1)

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Dasmarinas Duplicators VDocument29 pagesDasmarinas Duplicators VBlesh MacusiNo ratings yet

- Exercise#1 Earlmathew VisarraDocument2 pagesExercise#1 Earlmathew VisarraMathew VisarraNo ratings yet

- AccountingDocument5 pagesAccountingAbe Loran PelandianaNo ratings yet

- Worksheet 1Document8 pagesWorksheet 1Kevin Espiritu100% (1)

- City Laundry: Chart of Account Assets LiabilitiesDocument6 pagesCity Laundry: Chart of Account Assets LiabilitiesGina Calling DanaoNo ratings yet

- Business Transactions and Worksheet (Pio Baconga)Document1 pageBusiness Transactions and Worksheet (Pio Baconga)UnknownNo ratings yet

- Group Activity 1Document10 pagesGroup Activity 1Winshei Cagulada0% (1)

- Ex 7-AdjustingDocument15 pagesEx 7-AdjustingyeshaNo ratings yet

- Trial Balance - Daria TolentinoDocument1 pageTrial Balance - Daria TolentinoShaira Nicole VasquezNo ratings yet

- Recording Transactions in A Financial Transaction WorksheetDocument1 pageRecording Transactions in A Financial Transaction WorksheetSHENo ratings yet

- Problem 3 ACCA101Document3 pagesProblem 3 ACCA101Nicole FidelsonNo ratings yet

- Accounting Theory ReviewerDocument4 pagesAccounting Theory ReviewerAlbert Sean LocsinNo ratings yet

- DAGUPLO c2 p16 p17Document7 pagesDAGUPLO c2 p16 p17Jane Leona Almosa Daguplo100% (1)

- Dormitory Locators Journal Entries Date Accounts and Explanation Debit CreditDocument3 pagesDormitory Locators Journal Entries Date Accounts and Explanation Debit CreditEunice FulgencioNo ratings yet

- Worksheet AssignmentDocument2 pagesWorksheet AssignmentLyca MaeNo ratings yet

- Key To Correction Seatwork#5Document11 pagesKey To Correction Seatwork#5Shiela Mae CalangiNo ratings yet

- Abm 005 2Q Week 12 PDFDocument10 pagesAbm 005 2Q Week 12 PDFJoel Vasquez MalunesNo ratings yet

- Activity 25 - Journal Entry To Post-ClosingDocument23 pagesActivity 25 - Journal Entry To Post-ClosingAdam Cuenca100% (1)

- NA PE Compensation ReportDocument42 pagesNA PE Compensation Reportyjj856765No ratings yet

- Quality Management System Documents: Risk Based Audit Kyuc/Mr/Rba/09Document6 pagesQuality Management System Documents: Risk Based Audit Kyuc/Mr/Rba/09Harriet AliñabonNo ratings yet

- Baker Tilly International Corporate Identity Guidelines January 2013Document243 pagesBaker Tilly International Corporate Identity Guidelines January 2013zanNo ratings yet

- Business WritingDocument192 pagesBusiness WritingMZ100% (1)

- IAE - International BrochureDocument12 pagesIAE - International BrochurediemthanhvuNo ratings yet

- Epartment of Town and Country Planning, Govt. of Haryana: Applying For Change of Landuse (Clu)Document2 pagesEpartment of Town and Country Planning, Govt. of Haryana: Applying For Change of Landuse (Clu)AnilNo ratings yet

- Personal Information: Middleware & Java EngineerDocument5 pagesPersonal Information: Middleware & Java EngineerDonal GurningNo ratings yet

- TIEP Application TemplatesDocument6 pagesTIEP Application TemplatesactivatedcarbonsolutionsNo ratings yet

- Ashok Resume.Document3 pagesAshok Resume.Pritesh MistryNo ratings yet

- Asia Pacific Shopping Center Definition Standard Proposal PDFDocument18 pagesAsia Pacific Shopping Center Definition Standard Proposal PDFwitanti nur utamiNo ratings yet

- PT20 27Document7 pagesPT20 27Eric Duku100% (1)

- Econimic of DyeingDocument16 pagesEconimic of Dyeingawais123142541254125No ratings yet

- Ambal AutosDocument47 pagesAmbal AutosGokul Krishnan0% (1)

- George Robinson CVDocument4 pagesGeorge Robinson CVGeorge RobinsonNo ratings yet

- AR RemittanceDocument57 pagesAR RemittanceLavanya VemulaNo ratings yet

- Fashion StylingDocument1 pageFashion Stylingtarancharan123No ratings yet

- Public ExpenditureDocument15 pagesPublic ExpenditureVikas Singh100% (1)

- Account Closure Request FormDocument1 pageAccount Closure Request FormNiloy BiswasNo ratings yet

- Chapter 5-Dayag-TheorisDocument1 pageChapter 5-Dayag-TheorisMazikeen DeckerNo ratings yet

- Session 08 Mm2 - Barco Case - OverDocument19 pagesSession 08 Mm2 - Barco Case - OverAshwin KumarNo ratings yet

- Application of Game TheoryDocument65 pagesApplication of Game Theorymithunsraj@gmail.com100% (2)

- QAWithUL 60601-3rdeditionDocument18 pagesQAWithUL 60601-3rdeditionMonart PonNo ratings yet

- Decision Science Project Report On "Big Data"Document9 pagesDecision Science Project Report On "Big Data"Satyajit ChatterjeeNo ratings yet

- Attachment 1541334217746100001 Attach 1 1541334217746100001 Attachment 5818553000000582001 Attach 1 5818553000000582001 Attachment 5818553000000521001 Attach 1 5818553000000521001 Ca2373 PDFDocument26 pagesAttachment 1541334217746100001 Attach 1 1541334217746100001 Attachment 5818553000000582001 Attach 1 5818553000000582001 Attachment 5818553000000521001 Attach 1 5818553000000521001 Ca2373 PDFsyed tramexNo ratings yet

- Ridgid Tools - Catalog - Cosmo Petra - Safe Lifting Solutions - WWW - Cpworks-EgDocument182 pagesRidgid Tools - Catalog - Cosmo Petra - Safe Lifting Solutions - WWW - Cpworks-EgSafe Lifting Solutions100% (1)

- COOPDocument18 pagesCOOPEmanuel LacedaNo ratings yet