Professional Documents

Culture Documents

Commissioner of Central Excise Vs Tiger Steel EngiQ100235COM736261

Commissioner of Central Excise Vs Tiger Steel EngiQ100235COM736261

Uploaded by

aditi rana0 ratings0% found this document useful (0 votes)

3 views9 pagesOriginal Title

Commissioner of Central Excise vs Tiger Steel EngiQ100235COM736261

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views9 pagesCommissioner of Central Excise Vs Tiger Steel EngiQ100235COM736261

Commissioner of Central Excise Vs Tiger Steel EngiQ100235COM736261

Uploaded by

aditi ranaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 9

MANU/CM/0255/2010

Equivalent Citation: 2011(183)EC R109(Tri.-Mumbai), [2010]29STT25

IN THE CUSTOMS, EXCISE AND SERVICE TAX APPELLATE TRIBUNAL

WEST ZONAL BENCH, MUMBAI

Order Nos. A/246 to 248/2010/EB/C-II and Appeal Nos. E/344 to 346/2009

Decided On: 08.07.2010

Appellants: Commissioner of Central Excise

Vs.

Respondent: Tiger Steel Engineering (India) (P.) Ltd.

Hon'ble Judges/Coram:

P.G. Chacko (J) and S.K. Gaule (T), Members

Counsels:

For Appellant/Petitioner/Plaintiff: K.M. Mondal, Adv.

For Respondents/Defendant: Naresh C. Thacker, Adv.

Case Note:

Service Tax - Refund - CENVAT credit - Rule 5 of the CENVAT Credit Rules,

2004 - Respondent filed refund claims on the premise that their clearances of

finished goods to the SEZ units were "exports" - Department contended that

for purposes of Rule 5 of the CENVAT Credit Rules, 2004 the meaning of

"export" has to be derived from the Central Excise Act, 1944 and the Customs

Act, 1962 and, accordingly, "exports" would not be anything other than

"taking goods out of India" - Whether the clearance of the finished goods

under Letter of Undertaking to the SEZ units amounted to "export"

Held, that the term "export" used in Rule 5 of the CENVAT Credit Rules, 2004

stands for "export" which is "physical export" out of the country as envisaged

under the Customs Act - Appeal allowed

ORDER

P.G. Chacko, Member (J)

1. These appeals filed by the revenue are directed against the common order passed by

the lower appellate authority in three appeals filed by the assessee. In three separate

orders passed by the original authority, in adjudication of equal number of show-cause

notices, six refund claims of the assessee, which were filed under Rule 5 of the CENVAT

Credit Rules, 2004 had come to be rejected. Aggrieved, the assessee preferred appeals

to the Commissioner (Appeals) and the same were allowed by the appellate authority.

Hence, the present appeals of the revenue.

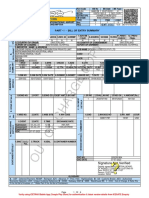

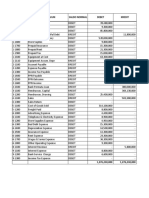

2 . The respondent was engaged, during the material period, in the manufacture of

excisable goods namely "Pre-fabricated Steel Buildings" falling under Chapter 94 of the

First Schedule to the Central Excise Tariff Act. They were also availing the benefit of

CENVAT Credit on inputs under the relevant provisions of the CENVAT Credit Rules,

2004. During the period of dispute, which comprises six quarters specified in the Table

given below, the respondent supplied their product viz., "Pre-fabricated Steel Buildings"

21-01-2022 (Page 1 of 9) www.manupatra.com Link Legal .

to Nokia India (P.) Ltd., a unit in Nokia Telecom Special Economic Zone ('SEZ' for

short) Chennai. These clearances were effected under Letter of Undertaking without

payment of duty in terms of Rule 19 of the Central Excise Rules, 2002:

Period Date of filing Amount of

refund claim refund claim (in

Rs. )

January 2007 10-6-2008 39,13,832

to March 2007

April 2007 to 2-6-2008 84,32,797

June 2007

July 2007 to 17-6-2008 60,52,189

September

2007

October 2007 23-6-2008 16,31,142

to December

2007

January 2008 21-7-2008 2,95,34,954

to March 2008

April 2008 to 20-10-2008 1,48,99,006

June 2008

Total 6,44,63,920

3 . The respondent filed the above refund claims under Rule 5 of the CENVAT Credit

Rules, 2004 on the premise that their clearances of finished goods to the SEZ units

were "exports" for the purpose of the said Rules. Show-cause notices were issued

proposing to reject these refund claims on the ground that the claimant had not fulfilled

the requirements of Rule 5 ibid. In these show-cause notices, it was alleged that the

goods cleared by the respondent to the SEZ units were capital goods and not inputs and

further that such clearances were not to be considered as physical exports. On this

basis, the refund claims were proposed to be rejected. The respondent denied the above

allegations and contested the above proposals. It was in adjudication of this dispute

that the original authority rejected the refund claims filed by the respondent. The

adjudicating authority rejected the reliance placed by the party on the Board's Circular

No. 29/06-Cus., dated 27-12-2006 by observing that there was no mention of Rule 5

ibid in the circular. It also relied on the Tribunal's decision in S.V. Business (P.) Ltd. v.

C C E 2006 (198) ELT 408 (Trib. - Mum.), as also on the decision in CCE v. Quality

Screens 2008 (226) ELT 608 (Trib. - Mum.), wherein it had been held to the effect that,

for a refund of unutilized Modvat/CENVAT Credit under Rule 5 to a 100 per cent EOU,

the claimant (EOU) must have physically exported goods out of the country. The

adjudicating authority also opined that the goods cleared by the respondent to the SEZ

units were more in the nature of capital goods rather than inputs and the same had not

been used in any manner in, or in relation to, the manufacture of the goods exported by

the SEZ units. The substantive view taken by the adjudicating authority was that Rule 5

was not applicable where the "exports" by the claimant were all deemed exports.

Setting aside the orders of the original authority, the learned Commissioner (Appeals)

heavily relied on certain provisions of the Special Economic Zones Act, 2005 and of the

Rules framed thereunder and arrived at the conclusion that any supply of goods to SEZ

unit by any unit in the Domestic Tariff Area (DTA), coming within the ambit of "export"

defined under Section 2(1)(ii) of the SEZ Act, 2005, would satisfy the purpose of Rule 5

of the CENVAT Credit Rules, 2004. The learned Commissioner (Appeals) took the view

that Circular No. 29/06-Cus. ibid is, mutatis mutandis, applicable to such supply of

21-01-2022 (Page 2 of 9) www.manupatra.com Link Legal .

goods by a DTA unit to SEZ unit. The learned Commissioner (Appeals) also found that

the proof of export by the respondent had been accepted by the department and further

that it was not in dispute that the respondent has "followed all the legal and procedural

requirements as per Rule 5 of CENVAT Credit Rules, 2004 read with Notification No.

5/06-CE, dated 14-3-2006." The appellate authority also relied on the Tribunal's

decision in CCE v. Self Knitting Works 2007 (220) ELT 926 (Trib. - Delhi), wherein a

learned Single Member of the Tribunal, following a Division Bench's decision viz.,

Amitex Silk Mills (P.) Ltd. v. CCE 2006 (194) ELT 344 (Trib. - Delhi) held that deemed

exports were to be treated as 'exports' for all purposes. Some of these findings of the

lower appellate authority are presently under challenge.

4. In these appeals, it is the submission of the department that, for purposes of Rule 5

of the CENVAT Credit Rules, 2004, the meaning of "export" has to be derived from the

Central Excise Act, 1944 and the Customs Act, 1962 and, accordingly, "exports" would

not be anything other than "taking goods out of India". In this context, the appellant

has relied on the Tribunal's decision in Quality Screens' case (supra). It is submitted by

the appellant that the learned Commissioner (Appeals) did not consider the Tribunal's

decision in Quality Screens's case (supra). The learned Consultant for the appellant has

amplified the grounds of these appeals by extensive reference to various provisions of

law as well as case law. His arguments have also been summarized in a synopsis filed

today and the same are as under:

(a) Though the term "export" has not been defined either in the Central Excise

Act or the Central Excise Rules, 2002, the term "export" used in Rule 5 of the

CENVAT Credit Rules, 2004 is to be understood in its ordinary and natural sense

i.e., 'taking goods physically out of India to a place outside India'. This legal

position is clear from the Explanation to Rule 18 of the Central Excise Rules,

2002, which reads:

'export' includes goods shipped as provision or stores for use on board

a ship proceeding to a foreign port or supplied to a foreign-going

aircraft.

(b) The relevant provisions of the SEZ Act and the SEZ Rules are meant for the

benefit of SEZ unit. The benefits available to a DTA unit supplying raw

materials or capital goods to SEZ units are limited to the extent specified under

para 7.9 of the Foreign Trade Policy;

(c) Neither SEZ Act or the Rules make any express provision for refund of

accumulated (unutilized) CENVAT Credit under Rule 5 of the CENVAT Credit

Rules, 2004 and therefore, the benefit of Rule 5 will not be available to a DTA

supplier supplying goods to a SEZ unit or developer;

(d) The Board's Circular No. 29/06-Cus., dated 27-12-2006 did not touch Rule

5 of the CENVAT Credit Rules, 2004 and hence, cannot be relied upon by the

respondent in the context of claiming a refund of unutilized CENVAT Credit

under Rule 5;

(e) The Tribunal's decision in Amitex Silk Milk (P.) Ltd. 's case (supra), which

was followed in the case of Self Knitting Works (supra) is not applicable to the

facts of the present case inasmuch as it did not pertain to any supply of goods

by a DTA unit to SEZ unit;

(f) In the case of Essar Steels Ltd. v. Union of India 2010 (249) ELT 3 (Guj.),

21-01-2022 (Page 3 of 9) www.manupatra.com Link Legal .

the Hon'ble High Court, after considering the various provisions of the SEZ Act

and the SEZ Rules, held that export duty could not be levied under the Customs

Act in respect of goods supplied by a DTA unit to SEZ unit. For purposes of levy

of such duty, the export should be physical export out of the country. In the

present case, the supply of goods by the respondent to SEZ units was only a

'deemed export' within the meaning of this expression as expounded by the

Hon'ble Madras High Court in the case of BAPL Industries Ltd. v. Union of India

2007 (211) ELT 23 (Mad.).

On the above grounds, the learned Consultant prays for setting aside the order of the

lower appellate authority and upholding the orders-in-original.

5. The learned Counsel for the respondent has contested the above submissions of the

learned Consultant. His arguments are summarized below:

(a) Rule 5 of the CENVAT Credit Rules, 2004 allows refund of CENVAT Credit in

respect of inputs and input services used in the manufacture of final product

which is cleared for export under Bond or Letter of Undertaking. The term

"export" used in this rule has not been defined under the Central Excise Act or

any Rules framed thereunder. Therefore, in respect of goods supplied to SEZ

unit, it should be understood as defined under the SEZ Act;

(b) According to the definition of "export" given under Section 2(1)(ii) of the

SEZ Act, supply of goods from the Domestic Tariff Area to a unit in SEZ is

'export'. This deeming fiction under Section 2(1)(ii) of the SEZ Act read with

Section 53 of the Act needs to be given full effect and, if so, its benefit would

be available to the DTA supplier. In the context of urging that full effect be

given to a deeming fiction, support is claimed from the Hon'ble Supreme

Court's judgments in Clariant International Ltd v. Securities and Exchange

Board of India MANU/SC/0694/2004 : (2004) 8 SCC 524 : 54 SCL 519 and

Commissioner of Commercial Taxes v. Swarn Rekha Cokes and Coals (P.) Ltd.

MANU/SC/0461/2004 : (2004) 6 SCC 689;

(c) Board's Circular No. 29/06-Cus., dated 27-12-2006 read with Instructions

No. 6/06, dated 3-8-2006 issued by the Ministry of Commerce and Industry to

the Chief Commissioners of Customs and Central Excise would strongly support

the respondent's contention that their supply of goods to SEZ units should be

considered to be in the nature of export for purposes of Rule 5 of the CENVAT

Credit Rules, 2004 and, for that matter, the respondent, as DTA supplier, would

be exporter for the present purpose. The Hon'ble High Court's decision in the

case of Essar Steel Ltd. (supra) will not be applicable to the present case

inasmuch as, in the said case, the question considered by the High Court

related to leviability of export duty under Section 12 of the Customs Act with

reference to the definition of "export" given under the SEZ Act;

(d) Circular No. 6/2010, dated 19-3-2010 issued by the CBEC to all Chief

Commissioners of Customs and Central Excise clarified that a DTA supplier

could claim rebate under Rule 18 of the Central Excise Rules, 2002 in respect of

supplies to SEZ unit in terms of the earlier Circular No. 29/06-Cus. If, for

purposes of Rules 18 and 19 of the Central Excise Rules, 2002, the supplies

from a DTA unit to SEZ unit can be deemed to be 'exports', they should be

considered likewise for purposes of Rule 5 of the CENVAT Credit Rules, 2004;

(e) The issue involved in the instant case is squarely covered by the Tribunal's

21-01-2022 (Page 4 of 9) www.manupatra.com Link Legal .

decision in Self Knitting Works' case (supra).

6 . We have given careful consideration to the submissions. The refund claims, in

question, were filed under Rule 5 of the CENVAT Credit Rules, 2004, which (without the

provisos thereto) reads as under:

5 . Refund of CENVAT credit.--Where any input or input service is used in the

manufacture of final product which is cleared for export under bond or letter of

undertaking, as the case may be, or used in the intermediate product cleared

for export, or used in providing output service which is exported, the CENVAT

credit in respect of the input or input service so used shall be allowed to be

utilized by the manufacturer or provider of output service towards payment of,

(i) duty of excise on any final product cleared for home consumption or

for export on payment of duty; or

(ii) service tax on output service, and where for any reason such

adjustment is not possible, the manufacturer or the provider of output

service shall be allowed refund of such amount subject to such

safeguards, conditions and limitations, as may be specified, by the

Central Government, by notification.

7. Admittedly, this claim was made in respect of the duty paid on the inputs used in the

finished goods (Pre-fabricated Buildings) cleared by the party to SEZ units. Whether the

finished goods so cleared to the SEZ units were to be used by them as capital goods or

inputs in their factory is not material. What matters is whether the clearance of the

finished goods under Letter of Undertaking to the SEZ units amounted to "export" by

the respondent for the purposes of Rule 5. We shall, therefore, address this question

first.

8 . The learned Counsel for the respondent has heavily relied on the provisions of the

SEZ Act and SEZ Rules in his bid to establish that the clearances made by them to the

SEZ units are to be considered to be 'export' for purposes of Rule 5 ibid. On the other

hand, it has been argued by the learned Consultant for the appellant that 'export' for

purposes of Rule 5 ibid should be understood in the sense the term has been defined

under the Customs Act. In this connection, he has relied on the Hon'ble High Court's

judgment in Essar Steel's case (supra). On a perusal of the provisions of the SEZ Act,

we have come across the following definition of 'export' under Section 2 of the Act:

(m) export" means--

(i) * * *

(ii) supplying goods, or providing services, from the Domestic Tariff Area to a

Unit or Developer; or;

(iii) * * *

No doubt, the supply of goods by a DTA unit to SEZ unit is 'export' for purposes of the

SEZ Act. This legal position is evident from the provisions of Rule 30 of the SEZ Rules,

which provides the procedure for procurements by a SEZ unit from the DTA. Sub-rule

(1) of Rule 30 provides that a DTA supplier supplying goods to a Unit or Developer

shall clear the goods, as in the case of exports, either under bond (apparently in terms

of Rule 19 of the Central Excise Rules, 2002) or as duty-paid goods under claim of

21-01-2022 (Page 5 of 9) www.manupatra.com Link Legal .

rebate (apparently in terms of Rule 18 of the Central Excise Rules, 2002). This sub-rule

also stipulates that such clearance of goods should be under the cover of ARE-1 referred

to in Notification No. 40/01-CE (NT), dated 26-6-2001. Sub-rule (2) allows admission

of such goods into SEZ unit on the basis of ARE-1 where exemption from payment of

Central Excise duty has been availed by the DTA supplier without availment of export

entitlements. Sub-rule (3) allows admission of such goods into a SEZ unit on the basis

of ARE-1 and Bill of Export filed by the supplier or, on his behalf, by the SEZ unit itself

where the procurements by the SEZ unit is under claim of export entitlements. This Bill

of Export has to be assessed by the authorized officer before arrival of the goods in the

normal course. The Sub-rules (4) to (8) deal with various aspects such as assessment

of Bill of Export, Grant of drawback or DEPB credit etc. Sub-rule (9) provides that a

copy of the Bill of Export and ARE-1 with an endorsement of the authorized officer that

the goods have been admitted in full in the SEZ shall be treated as proof of export. The

remaining sub-rules deal with various aspects which are not of relevance to the issue at

hand. The learned Counsel for the respondent has submitted that they followed the

above procedure in respect of the goods supplied to SEZ units and, therefore, such

goods should be deemed to have been exported for purposes of Rule 5 of the Central

Excise Rules, 2004. Yet another provision referred to by the learned Counsel is Section

51 of the SEZ Act which gives overriding effect to the provisions of the Act vis-a-vis any

other law for the time being in force. It has laid down that the provisions of this Act

shall have effect notwithstanding anything inconsistent therewith contained in any other

law for the time being in force or in any instrument having effect by virtue of any law

other than this Act. The learned Counsel has also referred to Section 53 of the SEZ Act,

which provides that a Special Economic Zone shall be deemed to be a "territory outside

the customs territory of India" for the purposes of undertaking the authorized

operations and that it shall also be deemed to be a port, airport, inland container depot,

land station and land customs stations, as the case may be, under Section 7 of the

Customs Act. On the strength of these provisions, the learned Counsel has argued that

the clearances, in question, were made to a place which was deemed to be a territory

outside the Customs territory of India and the same were covered by the definition of

'export' given under Section 2(m)(ii) of the said Act, and therefore, the respondent, as

the "exporter" of the goods, should get the benefit of Rule 5 of the CENVAT Credit

Rules, 2004. On the other hand, the learned Consultant has argued that the respondent

cannot claim any benefit on the strength of the provisions of the SEZ Act or the Rules

made thereunder in relation to any transaction covered by any of the provisions of the

said Act/Rules. He has pressed into service the definition of 'export' given under the

Customs Act.

9 . On a perusal of the provisions of the SEZ Act, we find that it is a special statute

enacted by Parliament to benefit manufacturing units in Special Economic Zones. It is a

special legislation which is intended to benefit such units only. The various provisions

of the SEZ Act are to be considered as vehicles which convey such benefits to SEZ

units. The definition of the term 'export' given under Section 2(m) of the SEZ Act and

the various related provisions of the Act have to be considered in this perspective.

Undisputedly, the definition 'export' given under Section 2(m)(ii) of the SEZ Act is a

deeming provision inasmuch as it purports to designate as 'export' a transaction which

is not recognized as export under the Customs Act. Section 2(18) of the Customs Act

defines 'export' thus:

'export' with its grammatical variations and cognate expressions, means taking

out of India to a place outside India;

The above provision of the Customs Act embodies the popular sense of the word

21-01-2022 (Page 6 of 9) www.manupatra.com Link Legal .

"export". On the other hand, Section 2(m)(ii) of the SEZ Act would consider as "export"

a transaction wherein SEZ unit, procures goods from the DTA. 'Export' as defined under

the SEZ Act must mean export by SEZ unit. The nitty-gritty of the procedure can be had

from Rule 30 of the SEZ Rules. According to this procedure, a Bill of Export will be filed

by a DTA supplier or, on his behalf, by the SEZ unit itself.

The provisions of Rule 30 also indicate that a copy of the Bill of Export and ARE-1 with

an endorsement of the authorized officer that the goods have been admitted in the SEZ

shall be treated as proof of export. Although, prima facie, it may appear that the DTA

unit is the exporter, it has to be discerned from the SEZ Scheme that it is only an

illusion created by the deeming provisions. We reiterate that any "export" as defined

under Section 2 of the SEZ Act purports to be an export by that unit just as an "import"

as defined under the Act purports to be an import by the same unit. One should not be

misled by the deeming provisions. It has to be borne in mind that if the supply of goods

by DTA unit to SEZ unit is considered to be an export by the DTA unit, then it should be

an import by the SEZ unit. But the definition of "import" under Section 2(o) of the SEZ

Act does not recognize the transaction to be an import for the SEZ unit. On the other

hand, the transaction squarely falls within the definition of "export" under Section 2(m).

It is an export for the SEZ unit. All the deeming provisions of the SEZ Act and the Rules

framed thereunder cumulatively aim at granting benefits to SEZ units. None of these

provisions can be construed as having been enacted to confer benefits on any DTA unit.

Looking at the issue from this angle, we are of the view that the respondent, as DTA

supplier, cannot claim any benefit under Rule 5 of the CENVAT Credit Rules, 2004 as

complementary to any benefit accruing to SEZ unit out of the same transaction.

10. The learned Counsel has cited two judgments of the Hon'ble Supreme Court in the

context of urging that the deeming provisions of the SEZ Act should be given full effect

to. We have perused the text of each of these judgments. In the case of Clariant

International Ltd. (supra), the Hon'ble Supreme Court held thus: "Purpose and object of

creating a legal fiction is well known. Once a fiction is created upon imagining a certain

state of affairs, the imagination cannot be permitted to be boggled when it comes to the

inevitable corollaries thereof." In the case of Swam Rekha Cokes and Coals (P.) Ltd.

(supra), Their Lordships held: thus "It is well-settled that in interpreting a provision

creating a legal fiction, the court must ascertain the purpose for which the fiction is

created and having done so, to assume all those facts and consequences which are

incidental or inevitable corollaries to the giving effect to the fiction." In the instant case,

by a legal fiction, procurements made by a SEZ unit from a DTA unit are 'exports' by the

SEZ unit. Again, by way of extension of this legal fiction, the SEZ Rules require the DTA

unit to file a Bill of Export. The legal fiction cannot be extended beyond its statutory

object. The object enshrined in the provisions of the SEZ Act and the Rules made

thereunder, insofar as a procurement of goods effected by SEZ unit from the DTA is

concerned, is that such procurement is an 'export' for the SEZ unit so that the unit can

claim all the export benefits available under the SEZ Scheme. In this context, useful

reference may be made to Rule 23, which provides that "supplies from the DTA to a Unit

or Developer for their authorized operations shall be eligible for export benefits as

admissible under the Foreign Trade Policy." The policy (vide Chapter-7 thereof) as

amended with effect from 1-4-2006, laid down thus: The policy relating to Special

Economic Zones is governed by SEZ Act, 2005 and the Rules framed thereunder. But

the SEZ Act or the SEZ Rules did not confer any export benefits on DTA suppliers. The

"export benefits" referred to under Rule 23 ibid are benefits available "to SEZ

Unit/Developer inasmuch as supplies from the DTA to SEZ Unit/Developer are deemed

to be exports made by the latter. We reject the contention of the learned Counsel that

the respondent as DTA supplier was exporting goods to the SEZ unit. The filing of Bill

21-01-2022 (Page 7 of 9) www.manupatra.com Link Legal .

of Exports by the DTA unit would not ipso facto make them exporter. Such filing of Bill

of Exports by the DTA supplier is only a convenient procedure and the same cannot

detract from the deeming provisions taking effect to the benefit of SEZ unit. Rules are

subsidiary to Sections of the parent Act and cannot be the basis of interpretation of the

latter. In none of the cases cited by the learned Counsel did the Supreme Court grant

the benefit of any deeming provision to a party other than the party for whose benefit

the provision was made. The deeming provisions under the SEZ Act and/or the SEZ

Rules are, as we have noted, exclusively for the benefit of SEZ units. The DTA unit, by

the mere activity of supplying goods to SEZ unit, cannot claim any complementary

benefit on the strength of the deeming provisions of the SEZ Act/Rules. It is also

pertinent to note that it was not the policy of the Government to grant benefits under

the Central Excise Act or any Rules thereunder to DTA unit supplying goods to SEZ unit.

Such benefits cannot be claimed by the DTA unit unless it is expressly provided for

under the Central Excise Act or any Rules thereunder.

11. In the present case, the respondent claimed refund of accumulated CENVAT Credit

under Rule 5 of the CENVAT Credit Rules, 2004. For this benefit, they had to satisfy

mainly two conditions viz., (i) the Cenvated inputs should have been used in or in

relation to the manufacture of the finished goods supplied to SEZ unit by way of export

under Bond/Letter of Undertaking and (ii) the CENVAT Credit taken on the inputs was

practically not capable of being utilized for payment of duty on any final product. The

finished goods, in this case, were admittedly supplied to SEZ units under Letter of

Undertaking. However, the question arises as to whether such supply of goods to SEZ

units was an 'export.' At no time was the term 'export' defined under the Central Excise

Act or any Rules framed thereunder. The definition of 'export' given under the Customs

Act has been traditionally adopted for purposes of the Central Excise Act and the Rules

thereunder. Therefore, in the absence of a definition of 'export' under the Central Excise

Act, the Central Excise Rules or the CENVAT Credit Rules, 2004, we hold that, for

purposes of the CENVAT Credit Rules, 2004, one should look for its definition given

under the Customs Act. The fictionalized definition of "export" under Section 2(m)(ii) of

the SEZ Act cannot be looked for as it purports only to make the SEZ unit an exporter.

In other words, the term 'export' used in Rule 5 of the CENVAT Credit Rules, 2004

stands for 'export', which is 'physical export' out of the country, envisaged under the

Customs Act. We take this view because, as we have already indicated, anybody other

than SEZ unit cannot be allowed to claim any benefit under the SEZ Act/Rules. Viewed

from this angle, the respondent cannot be held to be entitled to refund of accumulated

CENVAT Credit on the inputs used in or in relation to the manufacture of the 'pre-

fabricated buildings" supplied by them to the SEZ units.

12. We are of the considered view that the decision taken by the learned Single Member

in the case of Self Knitting Works (supra) is not in accordance with the purport of the

law. Noticeably, the learned Single Member chose to follow an earlier decision of the

Tribunal which pertained to 100 per cent EOU. With reference to the provisions of the

Exim Policy as applicable to 100 per cent EOU, the Tribunal had, in the earlier case,

held that clearances made by the EOU to DTA against payment in foreign currency were

also to be added to physical exports for the purpose of determining NFEP (Net Foreign

Exchange earning as a Percentage of exports). The SEZ Scheme, undisputedly, is an

entirely different self-contained scheme which is intended to benefit the SEZ units. The

policy provisions relating to 100 per cent EOU cannot be applied to SEZ units, for which

there is separate statute and a body of Rules framed thereunder. The Board's circular

relied on by the learned Counsel did not offer any clarification on whether a DTA

supplier who supplies goods to SEZ could be allowed to claim refund of accumulated

CENVAT Credit on inputs used in the manufacture of such goods. The Board's

21-01-2022 (Page 8 of 9) www.manupatra.com Link Legal .

clarification is in the context of applicability of Rules 18 and 19 of the Central Excise

Rules, 2002 to a DTA supplier who might claim duty-free clearance of goods under

Bond/Letter of Undertaking or rebate of duty paid on such goods or on raw materials

used therein. Such limited clarification offered by the Board cannot be applied to the

instant case where the issue under consideration is altogether different.

13. Both sides have referred to the Hon'ble High Court's decision in Essar Steel Ltd.

(supra) in support of their respective arguments. The Hon'ble High Court was dealing

with the question whether the goods supplied by the DTA unit to SEZ unit were

chargeable to export duty under the Customs Act. The revenue, in that case, argued

that, as such clearance of goods was covered by the definition of 'export' given under

the SEZ Act, export duty was leviable thereon. This contention was negatived by the

High Court which held that, for the levy of export duty on any goods, the goods should

be shown to have been physically exported out of the country as envisaged under the

provisions of the Customs Act. Their Lordships did not permit the provisions of the SEZ

Act to be applied to chargeability of export duty under the Customs Act. This approach

of the Hon'ble High Court is, in our view, working in favour of the revenue in the

present case, wherein, unlike in the case of Essar Steel Ltd. (supra), the revenue has

chosen to exclude the provisions of the SEZ Act/ Rules from the purview of the Central

Excise provision viz., Rule 5 of the CENVAT Credit Rules, 2004. Thus, the view which

was taken against the revenue in Essar Steel Ltd. 's case (supra) works in their favour

in the instant case.

1 4 . In this case, we also find that certain factual findings recorded by the lower

appellate authority do not stand the test of evidence. It was held that it was not in

dispute that the respondent had fulfilled all the legal requirements of Rule 5 read with

Notification No. 05/06-CE (NT). This finding would amount to holding that the

respondent established that they were not in a position to utilize the CENVAT Credit in

question. But we have not found any material in the impugned order to indicate that the

respondent could so establish. Be that as it may, the first and foremost point recorded

by the learned Commissioner (Appeals), which is to the effect that the clearance of

goods by the respondent to the SEZ Unit amounted to 'export' for the purpose of Rule 5,

has been negatived by us and, therefore, his order cannot be sustained in law.

15. In the result, the impugned order is set aside and all these appeals are allowed.

© Manupatra Information Solutions Pvt. Ltd.

21-01-2022 (Page 9 of 9) www.manupatra.com Link Legal .

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- FIN 6060 Module 3 Worksheet (Milestone 1)Document5 pagesFIN 6060 Module 3 Worksheet (Milestone 1)r.olanibi5560% (5)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Your Dojo Invoice: 06 Mar To 05 Apr 2023 (31 Days)Document3 pagesYour Dojo Invoice: 06 Mar To 05 Apr 2023 (31 Days)Helen KingNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Learn Forex With PAFXDocument67 pagesLearn Forex With PAFXShovo Mazumder Pial100% (1)

- Lalman Shukhla V Gauri Datt, Case ReviewDocument3 pagesLalman Shukhla V Gauri Datt, Case Reviewaditi ranaNo ratings yet

- Manual For ScanwellDocument64 pagesManual For ScanwellmirzaNo ratings yet

- PIL Legislative CommentDocument4 pagesPIL Legislative Commentaditi ranaNo ratings yet

- Scope of Inheritance (Gender and Sexuality)Document16 pagesScope of Inheritance (Gender and Sexuality)aditi ranaNo ratings yet

- TABLE 3A.2 (Ii) SLL Crimes Against Women (Crime Head-Wise & State/UT-wise) - 2019 (Continued)Document1 pageTABLE 3A.2 (Ii) SLL Crimes Against Women (Crime Head-Wise & State/UT-wise) - 2019 (Continued)aditi ranaNo ratings yet

- Case Review, Sarla Mudgal V UOIDocument2 pagesCase Review, Sarla Mudgal V UOIaditi ranaNo ratings yet

- Keynesian Economics: Growing Bigger and Bigger, and Finally PoppingDocument3 pagesKeynesian Economics: Growing Bigger and Bigger, and Finally Poppingaditi ranaNo ratings yet

- Criminology SynopsisDocument1 pageCriminology Synopsisaditi ranaNo ratings yet

- Cyber Crime Against Women: Right To Privacy and Other IssuesDocument14 pagesCyber Crime Against Women: Right To Privacy and Other Issuesaditi ranaNo ratings yet

- Jurisprudence Assignment Part-ADocument7 pagesJurisprudence Assignment Part-Aaditi ranaNo ratings yet

- 4 Stages of A Crime: 1. Mens Rea 2. Preparation - : Law of Crimes NotesDocument1 page4 Stages of A Crime: 1. Mens Rea 2. Preparation - : Law of Crimes Notesaditi ranaNo ratings yet

- Positivism: Book-The Province of Jurisprudence Determined - 1832Document11 pagesPositivism: Book-The Province of Jurisprudence Determined - 1832aditi ranaNo ratings yet

- HISTORYDocument6 pagesHISTORYaditi ranaNo ratings yet

- Continuous Evaluation 4Document2 pagesContinuous Evaluation 4aditi ranaNo ratings yet

- Response Paper III Joseph RazDocument2 pagesResponse Paper III Joseph Razaditi ranaNo ratings yet

- The Need For Coalition Politics in IndiaDocument5 pagesThe Need For Coalition Politics in Indiaaditi ranaNo ratings yet

- Family LawDocument4 pagesFamily Lawaditi ranaNo ratings yet

- Basic Financial Literacy CourseDocument30 pagesBasic Financial Literacy Coursejazzy mallari100% (1)

- STEEPLE AnalysisDocument10 pagesSTEEPLE AnalysisAhsan JavedNo ratings yet

- Unit 3Document52 pagesUnit 3Kingsman kuku100% (1)

- Declaration of Policy.: Republic Act No. 10668Document4 pagesDeclaration of Policy.: Republic Act No. 10668Jay GeeNo ratings yet

- Statement Date Y D. Y. D.: PaymentDocument2 pagesStatement Date Y D. Y. D.: PaymentSkander NoualiNo ratings yet

- Pambayang Kolehiyo NG Mauban: College of Education The Contemporary WorldDocument101 pagesPambayang Kolehiyo NG Mauban: College of Education The Contemporary WorldZyrene SardeaNo ratings yet

- Mushak-9.1 VAT Return On 17.DEC.2023Document6 pagesMushak-9.1 VAT Return On 17.DEC.2023Md. Abu NaserNo ratings yet

- Presentation On Financial InstrumentsDocument20 pagesPresentation On Financial InstrumentsMehak BhallaNo ratings yet

- 668815803072023INBLR4BE1070720231927Document6 pages668815803072023INBLR4BE1070720231927Ajay DarlingNo ratings yet

- Anexo 2 - C2 - Economista David RicardoDocument5 pagesAnexo 2 - C2 - Economista David RicardolinaNo ratings yet

- Chase Bank Account Statement 2021Document3 pagesChase Bank Account Statement 2021quannbui950% (1)

- 1 Energy Coils - Corner TradesDocument54 pages1 Energy Coils - Corner TradesMihaiNo ratings yet

- Mint Delhi 01-02-2023 PDFDocument18 pagesMint Delhi 01-02-2023 PDFubisoft playNo ratings yet

- Financial Management Module 6Document17 pagesFinancial Management Module 6Armand Robles100% (1)

- Statement 32049768Document1 pageStatement 32049768marychristeodoroNo ratings yet

- Business Research Methods ReportDocument5 pagesBusiness Research Methods Reportvijay choudhariNo ratings yet

- Evaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - PRACTICO - CULTURA Y ECONOMIA REGIONAL DE AMERICA - (GRUPO B01)Document12 pagesEvaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - PRACTICO - CULTURA Y ECONOMIA REGIONAL DE AMERICA - (GRUPO B01)Adrian Peñaloza100% (1)

- Business 10 PPT Chapter 4Document20 pagesBusiness 10 PPT Chapter 4cecilia capiliNo ratings yet

- Background Note 1 - Financial LeverageDocument12 pagesBackground Note 1 - Financial LeverageENS SunNo ratings yet

- ProvogueDocument14 pagesProvogueNS010519860% (1)

- International Trade Trade Barriers Trading BlocsDocument67 pagesInternational Trade Trade Barriers Trading BlocsArvind BhardwajNo ratings yet

- Ncert Sol Class 11 Business Studies Chapter 01Document10 pagesNcert Sol Class 11 Business Studies Chapter 01DHYAN PATELNo ratings yet

- Financial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFinancial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFClaudiaAdamsfowp100% (14)

- Unit 6 Banking Companies Final AccDocument79 pagesUnit 6 Banking Companies Final Acctimoni5707No ratings yet

- If I Were Finance Minister of Pakistan: Presented By: Bharat KumarDocument9 pagesIf I Were Finance Minister of Pakistan: Presented By: Bharat KumaraghafoormalaniNo ratings yet

- Kode Nama Akun Saldo Normal Debet KreditDocument21 pagesKode Nama Akun Saldo Normal Debet KreditNLson TsaragihNo ratings yet