Professional Documents

Culture Documents

Exercise 5: To Record The Investment Property

Exercise 5: To Record The Investment Property

Uploaded by

Pearl Isabelle SudarioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 5: To Record The Investment Property

Exercise 5: To Record The Investment Property

Uploaded by

Pearl Isabelle SudarioCopyright:

Available Formats

EXERCISE 5

EXERCISE 1

BUILDING

Investment property 19, 379,500

Cash 19, 379,500

To record the investment property

Purchase price 18, 605, 000

Transaction cost 425, 500

305, 000

44, 000

Investment property P19, 379,500

Fair value 8, 855, 000

Acquisition Cost (P10, 405, 500)

Loss on change in fair value 2020 (1,550,500)

Investment property 1,550,500

Loss on change in fair value 1,550,500

To record the fair value change

Land, Fair value 8, 555, 000

Acquisition Cost (8, 974, 000)

Loss on change in fair value 2020 (₱419, 000)

Investment property 419, 000

Gain on change in fair value 419, 000

To record fair value change

Building, Fair value December 31, 2021 9,966, 000

Building, Fair value December 31, 2020 (8, 855, 000)

Gain on change in fair value ₱1, 111, 000

Land, fair value at Dec. 31, 2021 9, 900, 000

Land, fair value at Dec. 31, 2020 (8, 555, 000)

Gain on change in fair value ₱1, 345, 000

Investment property 1, 345, 000

Gain on change in fair value P1, 345, 000

To record fair value change.

EXERCISE 2

REQUIREMENT 1

SOLUTION:

Building fair value at dec 2022 8, 112, 000

building cost at jan. 2020 8, 888, 000

loss on change in fair value 176, 000

Journal entries in 2020

Investment property 8, 888, 000

cash 8, 888, 000

TO RECORD INVESTMENT PROPERTY AND EXPENSE

Loss on change in fair value 176, 000

investment property 176, 000

TO RECORD FAIR VALUE CHANGE

Journal entries for 2022

Investment property 8, 888, 000

cash 8, 888, 000

TO RECORD THE INVESTMENT PROPERTY AND EXPENSE

THE EXPENSE TO BE PRESENTED IN THE STATEMENT

IS ZER0.

Journal entries for 2020

Investment property 8, 888, 000

cash 8, 888,000

TO RECORD THE INVESTMENT PROPERTY REPAIRS

EXERCISE 3

Requirement 1:

14, 556, 000

Requirement 2:

22, 965, 000

Requirement 3:

Investment property 37, 521, 000

building 14, 556, 000

land 22, 965, 000

EXERCISE 4:

Cost 15, 650, 000

less: accumulated dep. 0

carrying amount 15, 650, 000

Fair value 9, 727, 000

less; change in fair value (5, 923, 000)

fair value 3, 804, 000

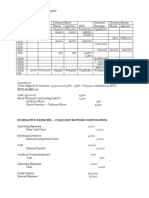

EXERCISE 5

Building fair value of December 31, 2021 127, 550, 000

building cosr of January 1, 2016 187, 000, 000

loss on change of fair value 57, 450, 000

EXERCISE 6

Cost 595, 000

Accumulated dep. (23, 800)

carrying amount 571, 200

less: fair value 707, 000

loss 135, 800

EXERCISE 7

Inventory 40, 485, 500

investment property 40, 485, 500

TO RECORD THE PROPERTY RECLASSIFICATION

Investment property 40, 485, 500

residual value 2, 485, 500

building 42, 970, 500

TO RECORD THE BUILDING RECLASSIFICATION

EXERCISE 8

Cost model

investment property

cash

Depreciation expense

accumulated dep.

TO RECORD DEPRECIATION

You might also like

- 5 Questioning Strategies - Sandler FoundationsDocument16 pages5 Questioning Strategies - Sandler FoundationsJose Ivan Miranda CamposNo ratings yet

- U3A5 - Transactions With HST - TemplateDocument2 pagesU3A5 - Transactions With HST - TemplateJay Patel0% (1)

- Clinical Chemistry Notes Without Blanks LegitDocument43 pagesClinical Chemistry Notes Without Blanks LegitPearl Isabelle SudarioNo ratings yet

- Problem For Practice: Accounting For Merchandise CompanyDocument1 pageProblem For Practice: Accounting For Merchandise CompanySiam FarhanNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Date: Mon, 28 Jul 2003 12:37:35 - 0400 From: "" 4fDocument4 pagesDate: Mon, 28 Jul 2003 12:37:35 - 0400 From: "" 4f9/11 Document ArchiveNo ratings yet

- Jean Keating S Prison Treatise PDFDocument36 pagesJean Keating S Prison Treatise PDFJOHN75% (4)

- Exercise 5 Intacc 2 Azarcon Juneil AndrewDocument12 pagesExercise 5 Intacc 2 Azarcon Juneil AndrewBARANGAY SIXTYNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- Investment PropertyDocument5 pagesInvestment PropertyKristine PerezNo ratings yet

- Local Media1556764160936285934Document5 pagesLocal Media1556764160936285934Prince PierreNo ratings yet

- Investment Property ProblemsDocument3 pagesInvestment Property ProblemsAbigail TalusanNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- ENG - Jawaban Mojakoe Akuntansi Keuangan 1 UAS Genap 2021 - 2022Document8 pagesENG - Jawaban Mojakoe Akuntansi Keuangan 1 UAS Genap 2021 - 2022Reta AzkaNo ratings yet

- Exercise 13 Statement of Cash Flows - 054924Document2 pagesExercise 13 Statement of Cash Flows - 054924Hoyo VerseNo ratings yet

- Kaya Mo Yan-Finac - Chap 22 Investment PropertyDocument8 pagesKaya Mo Yan-Finac - Chap 22 Investment PropertyTrixie JeramieNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- Kaya Mo Yan-Finac - Investment PropertyDocument8 pagesKaya Mo Yan-Finac - Investment PropertyTrixie JeramieNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Bs 320 - 30th AprilDocument2 pagesBs 320 - 30th AprilPrince Daniels TutorNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- AKL 2 - Tugas 3 Marselinus A H T (A31113316)Document3 pagesAKL 2 - Tugas 3 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Acctg 303 Midterm Quiz 1 With Solution at 2 Ma T1 Ma Addtnl TTHDocument4 pagesAcctg 303 Midterm Quiz 1 With Solution at 2 Ma T1 Ma Addtnl TTHOly VieenaNo ratings yet

- December 2010 TC1ADocument10 pagesDecember 2010 TC1AkalowekamoNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Buscom-Asset AcquisitionDocument7 pagesBuscom-Asset AcquisitionRenelyn DavidNo ratings yet

- Group 4 Problem 4Document9 pagesGroup 4 Problem 4Johanna Nina UyNo ratings yet

- Task 2 12024Document2 pagesTask 2 12024poeou sanNo ratings yet

- Problem 22-1, Page 610 Classic Company: GivenDocument3 pagesProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNo ratings yet

- Tutorial 10 Inventory SolutionsDocument6 pagesTutorial 10 Inventory SolutionsJen Hang WongNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Chapter 22: Intangible Assets: Problem 1Document5 pagesChapter 22: Intangible Assets: Problem 1Ivy MaximoNo ratings yet

- Gitman CH 8 Zutter CH 12 Solutions To Selected End of Chapter ProblemsDocument11 pagesGitman CH 8 Zutter CH 12 Solutions To Selected End of Chapter Problemsbobhamilton3489No ratings yet

- Simulated LECPA 1 - FAR - Answer KeyDocument9 pagesSimulated LECPA 1 - FAR - Answer KeyMitchel Dane CabilanNo ratings yet

- A221 MC 2 - StudentDocument7 pagesA221 MC 2 - StudentNajihah RazakNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Karakits ComapnyDocument5 pagesKarakits ComapnyAJNo ratings yet

- Gonzales, Ian Rogel L. - Assignment#3Document4 pagesGonzales, Ian Rogel L. - Assignment#3GONZALES, IAN ROGEL L.No ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- AFAR1 Chap 1Document7 pagesAFAR1 Chap 1CilNo ratings yet

- GA 04042022 - QuestionDocument3 pagesGA 04042022 - QuestionSakamoto HiyoriNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- FAR Week 7. Investment in Equity Securities and Investment in AssociateDocument3 pagesFAR Week 7. Investment in Equity Securities and Investment in AssociateMarianeNo ratings yet

- Accounting For Business Transaction Final ExamDocument7 pagesAccounting For Business Transaction Final ExamtiffNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- Journal Entries: To Record The Sale of Land and BuildingDocument2 pagesJournal Entries: To Record The Sale of Land and BuildingJoshua FrondaNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- FR222. IFA IL I Solution CMA January 2022 ExaminationDocument8 pagesFR222. IFA IL I Solution CMA January 2022 Examinationtdebnath_3No ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Activity Worksheet 001Document4 pagesActivity Worksheet 001Pearl Isabelle SudarioNo ratings yet

- Activity Worksheet 003Document4 pagesActivity Worksheet 003Pearl Isabelle SudarioNo ratings yet

- Leyte Financial Institution Cooperative: Articles of CooperationDocument8 pagesLeyte Financial Institution Cooperative: Articles of CooperationPearl Isabelle SudarioNo ratings yet

- Appendix B: XVI Ordinary General Assembly of The Synod of Bishops Archdiocese of PaloDocument3 pagesAppendix B: XVI Ordinary General Assembly of The Synod of Bishops Archdiocese of PaloPearl Isabelle SudarioNo ratings yet

- I. Short Essay QuestionsDocument2 pagesI. Short Essay QuestionsPearl Isabelle SudarioNo ratings yet

- Case1: Exercise Number 1Document8 pagesCase1: Exercise Number 1Pearl Isabelle SudarioNo ratings yet

- COD FRM 005MasterControlPlan 080813Document5 pagesCOD FRM 005MasterControlPlan 080813peeyaNo ratings yet

- Corporate Criminal LiabilityDocument12 pagesCorporate Criminal LiabilitydchaturNo ratings yet

- Axial - CEO Guide To Debt FinancingDocument29 pagesAxial - CEO Guide To Debt FinancingcubanninjaNo ratings yet

- Contemporary Financial Management Moyer 12th Edition Solutions ManualDocument16 pagesContemporary Financial Management Moyer 12th Edition Solutions ManualSteveJacobsafjg100% (40)

- 15DPM21F2026Document15 pages15DPM21F2026Jemi FosterNo ratings yet

- Misconduct Policy: UrposeDocument4 pagesMisconduct Policy: Urposeali rezaNo ratings yet

- Conflict of Laws - Quita vs. CADocument2 pagesConflict of Laws - Quita vs. CALotus KingNo ratings yet

- PDF Upload-381349 PDFDocument10 pagesPDF Upload-381349 PDFGunjeetNo ratings yet

- Parks Vs Province of TarlacDocument2 pagesParks Vs Province of TarlacTippy Dos Santos100% (2)

- Insurance Finals (Atty. Soleng)Document6 pagesInsurance Finals (Atty. Soleng)Bar GRazNo ratings yet

- IRR Revisions 2016 (25 Aug 2016)Document32 pagesIRR Revisions 2016 (25 Aug 2016)rina100% (1)

- Introduction To HTTP - Understanding HTTP BasicsDocument1 pageIntroduction To HTTP - Understanding HTTP BasicsGa ToneNo ratings yet

- Introduction To Mergers and AcquisitionDocument90 pagesIntroduction To Mergers and AcquisitionmpsrishaNo ratings yet

- Long Wharf Tour RiderDocument6 pagesLong Wharf Tour RiderOmar MackNo ratings yet

- My 12/17/14 Complaint About Sydnee McElroy MD To The WV Board of Medicine and The Board's Next-Day ReplyDocument3 pagesMy 12/17/14 Complaint About Sydnee McElroy MD To The WV Board of Medicine and The Board's Next-Day ReplyPeter M. Heimlich0% (13)

- Details About Craig Heaps Fraud Case - U.S. v. Brown, 147 F.3d 477 (6th Cir. 1998)Document11 pagesDetails About Craig Heaps Fraud Case - U.S. v. Brown, 147 F.3d 477 (6th Cir. 1998)Yucaipa ExposedNo ratings yet

- Vivekanand School Vivekanand School: Parents Copy BankDocument1 pageVivekanand School Vivekanand School: Parents Copy BankBhavik GargNo ratings yet

- Sisters in Arms Chapter 1Document9 pagesSisters in Arms Chapter 1Alexandre Mainaud0% (1)

- How To Appeal Decisions of ProsecutorDocument5 pagesHow To Appeal Decisions of Prosecutortere_aquinoluna828No ratings yet

- Chap 004Document132 pagesChap 004affy714No ratings yet

- Dell EMC™ ProDeploy Set Up A Production-Ready Environment in Less Time and Fewer StepsDocument14 pagesDell EMC™ ProDeploy Set Up A Production-Ready Environment in Less Time and Fewer StepsPrincipled TechnologiesNo ratings yet

- Business CreditDocument13 pagesBusiness CreditMenjetuNo ratings yet

- LABSTAN - Republic - Vs - Principalia ManagementDocument2 pagesLABSTAN - Republic - Vs - Principalia Managementmichelle zatarain100% (1)

- 1.3 Co V New Prosperity Plastic ProductsDocument6 pages1.3 Co V New Prosperity Plastic ProductsGloria Diana DulnuanNo ratings yet

- Muhammad Nafiz Ihsan Bin Muhammad: Lembaga Hasil Dalam Negeri Malaysia Borang Permohonan Nombor Pin E-Filing IndividuDocument1 pageMuhammad Nafiz Ihsan Bin Muhammad: Lembaga Hasil Dalam Negeri Malaysia Borang Permohonan Nombor Pin E-Filing IndividuLangit CerahNo ratings yet

- HCM Hcm-Wacs Setup GuideDocument43 pagesHCM Hcm-Wacs Setup Guideshubham kathaleNo ratings yet