Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

228 viewsAssemble 6-8

Assemble 6-8

Uploaded by

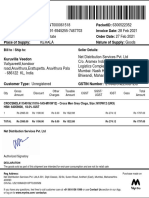

ok okThis tax invoice from AL-ATTAR TRADES & IMPORTS documents the sale of 19,500 mobile toys to ASSEMBLE ENTERPRISES. The total amount due is INR 99,370. The invoice provides details of the supplier and buyer, including their GSTIN numbers. It lists the item description, HSN code, quantity, rate, discounts, and taxes applied. The total CGST and SGST amounts are INR 5,323.50 each, for a total tax amount due of INR 10,647.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Pearce & StevensDocument1,062 pagesPearce & StevensNicoleNo ratings yet

- Cultural Genocide Yossef Ben JochannanDocument198 pagesCultural Genocide Yossef Ben JochannanDeyonne Chante Howard100% (31)

- Week2 - Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016)Document25 pagesWeek2 - Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016)Muhammet100% (1)

- Invoice PUMA-237293Document1 pageInvoice PUMA-237293Daksh Raj Singh008No ratings yet

- New Distributor Evaluation Form 2016Document3 pagesNew Distributor Evaluation Form 2016Ashish SrivastavaNo ratings yet

- Bill To / Ship To: Seller DetailsDocument1 pageBill To / Ship To: Seller DetailsErick MathewNo ratings yet

- Bill 110920S 940 PDFDocument1 pageBill 110920S 940 PDFRuler NanuNo ratings yet

- Invoice Samsung TabDocument2 pagesInvoice Samsung Tabanurag sahay100% (1)

- May 2021 Mobile BillDocument10 pagesMay 2021 Mobile BillRahatFatehIslamNo ratings yet

- Nike VIALE SLP Walking Shoes For Men: Grand Total 4146.00Document1 pageNike VIALE SLP Walking Shoes For Men: Grand Total 4146.00KeshavNo ratings yet

- BSNL BillDocument3 pagesBSNL BillthamizhanmaniNo ratings yet

- Mushak: 6.3: Tax Invoice Details of Registered PersonDocument2 pagesMushak: 6.3: Tax Invoice Details of Registered PersonAnonymous ZGcs7MwsLNo ratings yet

- CustomerInvoice PDFDocument1 pageCustomerInvoice PDFNamrata GundiahNo ratings yet

- InvoiceDocument1 pageInvoiceAbhijeet Kumar MeenaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoYash singh100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)vikash kumarNo ratings yet

- Tax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandDocument1 pageTax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandSANJAY PRAKASHNo ratings yet

- 6 Rent BillDocument1 page6 Rent BillBhavik DaveNo ratings yet

- Tax Invoice: G-One Enterprises 31-Mar-22Document2 pagesTax Invoice: G-One Enterprises 31-Mar-22LAKSHAY JAINNo ratings yet

- 46019396979737194-Invoice 6226609684Document1 page46019396979737194-Invoice 6226609684HsnsbsNo ratings yet

- Tax Invoice: MAHESHWARA INDANE (0000190023)Document2 pagesTax Invoice: MAHESHWARA INDANE (0000190023)Sathish DavulaNo ratings yet

- Od 116668082320669000Document1 pageOd 116668082320669000PrasantNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFagam sai sidarNo ratings yet

- Part Invoice N2521G202108378Document1 pagePart Invoice N2521G202108378Thakur B PNo ratings yet

- Payments/Adjustments/Discounts/Deposits/Refundsothercharges: Terms and ConditionsDocument1 pagePayments/Adjustments/Discounts/Deposits/Refundsothercharges: Terms and Conditionskrselvakumar8398No ratings yet

- Invoice TVDocument1 pageInvoice TVravinder85No ratings yet

- Bill No - 312 PDFDocument1 pageBill No - 312 PDFas constructionNo ratings yet

- InvoiceDocument2 pagesInvoicesourav acharyaNo ratings yet

- Tax Invoice: Mathru Indane Gas SERVICE (0000273708)Document2 pagesTax Invoice: Mathru Indane Gas SERVICE (0000273708)Shashi KiranNo ratings yet

- 1 PDFDocument2 pages1 PDFvilge rogesonNo ratings yet

- Invoice OD119090674113755000Document1 pageInvoice OD119090674113755000Parikshit ShomeNo ratings yet

- #INV 4723 ServiceDocument1 page#INV 4723 Serviceupkumar871No ratings yet

- Piperine 2Document1 pagePiperine 2vasavi reddyNo ratings yet

- Realme 2 Invoice PDFDocument1 pageRealme 2 Invoice PDFarjun bishtNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Praveen PujerNo ratings yet

- C243340 SalarySlipIncludeDocument1 pageC243340 SalarySlipIncludebenq78786No ratings yet

- Mahaveer Enterprises: Tax InvoiceDocument1 pageMahaveer Enterprises: Tax InvoiceAyush SrivastavNo ratings yet

- Purchase Summary Payment DetailsDocument2 pagesPurchase Summary Payment DetailsSai praneethNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pardeep JaatNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Amber SaxenaNo ratings yet

- UPS BillDocument2 pagesUPS Billmack100% (1)

- SOA009005567079Document2 pagesSOA009005567079Jeevan NJNo ratings yet

- Safari Bag Bill PDFDocument1 pageSafari Bag Bill PDFUjjwalPratapSinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Akash YadavNo ratings yet

- Invoice OD115233790567767000Document1 pageInvoice OD115233790567767000Vishnu wadhwaNo ratings yet

- Gj1rc2389 EstDocument4 pagesGj1rc2389 Estniren4u1567No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SHYAM GEORGENo ratings yet

- Invoice E1121112811033020474Document1 pageInvoice E1121112811033020474Pranav Shady AshishNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPadma GouteNo ratings yet

- Realme 8s 5G (Universe Blue, 128 GB) : Grand Total 18499.00Document1 pageRealme 8s 5G (Universe Blue, 128 GB) : Grand Total 18499.00ajithkuNo ratings yet

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDocument1 pageTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNo ratings yet

- Get Invoice PrintDocument2 pagesGet Invoice Printminturoberts2580No ratings yet

- WS Retail Services Pvt. LTD.,: Grand TotalDocument1 pageWS Retail Services Pvt. LTD.,: Grand TotalSakshiSharma100% (1)

- AadhaarDocument1 pageAadhaarVijayalakshmiNo ratings yet

- Lenovo Ideapad S340 Core I3 10th Gen - (8 GB/256 GB SSD/Windows 10 Home) S340-14IIL Thin and Light LaptopDocument2 pagesLenovo Ideapad S340 Core I3 10th Gen - (8 GB/256 GB SSD/Windows 10 Home) S340-14IIL Thin and Light LaptopAshish KumarNo ratings yet

- Invoice Sample RTR.19.05.16Document1 pageInvoice Sample RTR.19.05.16Samiul BariNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)JnaniSunkavalliNo ratings yet

- Invoice OD104053183032115000 PDFDocument1 pageInvoice OD104053183032115000 PDFVIKASH YADAVNo ratings yet

- Od 326965896423266100Document1 pageOd 326965896423266100khansana10344No ratings yet

- Retail Invoice / Bill: Your Total Savings: Rs.4.02Document2 pagesRetail Invoice / Bill: Your Total Savings: Rs.4.02nitin agrawalNo ratings yet

- InvoiceDocument1 pageInvoiceamal MNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesarifullah khanNo ratings yet

- When Does An Ombudsman Decision Become Final and eDocument4 pagesWhen Does An Ombudsman Decision Become Final and eFender BoyangNo ratings yet

- Jaworski Vs Pagcor DigestDocument1 pageJaworski Vs Pagcor Digestmegzycutes3871No ratings yet

- AQWFDocument2 pagesAQWFAlex Jr ValtierraNo ratings yet

- Sociology - G.H.mead - Self and IdentityDocument4 pagesSociology - G.H.mead - Self and IdentityhalleyworldNo ratings yet

- 2019 AFR Local Govt Volume IDocument406 pages2019 AFR Local Govt Volume IpierremartinreyesNo ratings yet

- FTC Investigation ProceduresDocument7 pagesFTC Investigation ProcedureskjkearlNo ratings yet

- Square Compass SymbolismDocument15 pagesSquare Compass SymbolismTejinder Singh RawalNo ratings yet

- Makalah Tentang Jual Beli Tanah Sengketa Dalam Perspektif Ekonomi IslamDocument18 pagesMakalah Tentang Jual Beli Tanah Sengketa Dalam Perspektif Ekonomi IslamYumiza ApriliaNo ratings yet

- Paris DevelopmentDocument40 pagesParis DevelopmentAnwan BurhaniNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetCracklings Gacuma100% (3)

- 2016 Economics H2 JC2 HWA Chong InstitutionDocument38 pages2016 Economics H2 JC2 HWA Chong InstitutionmaxximNo ratings yet

- IBO-02 (International Marketing)Document125 pagesIBO-02 (International Marketing)ram2joNo ratings yet

- The Information Approach To Decision UsefulnessDocument26 pagesThe Information Approach To Decision UsefulnessDiny Fariha ZakhirNo ratings yet

- Amortization of A 30-Year, $130,000 Loan at 8.5%Document10 pagesAmortization of A 30-Year, $130,000 Loan at 8.5%Ponleu MamNo ratings yet

- Acetic Acid (CH: B A B ADocument2 pagesAcetic Acid (CH: B A B APuwala ArdhanaNo ratings yet

- Example of Prior Period ErrorDocument2 pagesExample of Prior Period ErrorMjhayeNo ratings yet

- Go 2Document4 pagesGo 2farhahNo ratings yet

- Casa de Diseno Integrative Case 7Document7 pagesCasa de Diseno Integrative Case 7Efri DwiyantoNo ratings yet

- Bodycote Rules RevisedDocument2 pagesBodycote Rules RevisedNhinamanaNo ratings yet

- Qualities of A Good SpeakerDocument7 pagesQualities of A Good SpeakerKanshi BhoynaNo ratings yet

- A I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanyDocument102 pagesA I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanySajidNo ratings yet

- Santos V SantosDocument2 pagesSantos V Santosbai malyanah a salmanNo ratings yet

- English Practice Exercises Unit 2 P1 Ko KeyDocument4 pagesEnglish Practice Exercises Unit 2 P1 Ko KeyRS RSNo ratings yet

- AWWA Standards Presentation BrandedDocument22 pagesAWWA Standards Presentation BrandedDevohNo ratings yet

- wl2 T 16676 The Legend of King Arthur Reading Comprehension Activity - Ver - 3Document19 pageswl2 T 16676 The Legend of King Arthur Reading Comprehension Activity - Ver - 3TSMNo ratings yet

- What Factors Influence A Career Choice PDFDocument2 pagesWhat Factors Influence A Career Choice PDFmailk jklmnNo ratings yet

Assemble 6-8

Assemble 6-8

Uploaded by

ok ok0 ratings0% found this document useful (0 votes)

228 views1 pageThis tax invoice from AL-ATTAR TRADES & IMPORTS documents the sale of 19,500 mobile toys to ASSEMBLE ENTERPRISES. The total amount due is INR 99,370. The invoice provides details of the supplier and buyer, including their GSTIN numbers. It lists the item description, HSN code, quantity, rate, discounts, and taxes applied. The total CGST and SGST amounts are INR 5,323.50 each, for a total tax amount due of INR 10,647.

Original Description:

Original Title

ASSEMBLE 6-8 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis tax invoice from AL-ATTAR TRADES & IMPORTS documents the sale of 19,500 mobile toys to ASSEMBLE ENTERPRISES. The total amount due is INR 99,370. The invoice provides details of the supplier and buyer, including their GSTIN numbers. It lists the item description, HSN code, quantity, rate, discounts, and taxes applied. The total CGST and SGST amounts are INR 5,323.50 each, for a total tax amount due of INR 10,647.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

228 views1 pageAssemble 6-8

Assemble 6-8

Uploaded by

ok okThis tax invoice from AL-ATTAR TRADES & IMPORTS documents the sale of 19,500 mobile toys to ASSEMBLE ENTERPRISES. The total amount due is INR 99,370. The invoice provides details of the supplier and buyer, including their GSTIN numbers. It lists the item description, HSN code, quantity, rate, discounts, and taxes applied. The total CGST and SGST amounts are INR 5,323.50 each, for a total tax amount due of INR 10,647.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Tax Invoice

AL-ATTAR TRADES & IMPORTS Invoice No. Dated

Ground Floor, Room No.5, Chawl No. 5 AAT/133/21-22 6-Aug-2021

Municipal Transit Camp, Tank Oakhadi Road, Delivery Note Mode/Terms of Payment

Byculla, Mumbai-400011

GSTIN/UIN: 27BCGPS8142C1ZJ

Supplier’s Ref. Other Reference(s)

State Name : Maharashtra, Code : 27

E-Mail : shaikhmusaddique76@gmail.com

Buyer’s Order No. Dated

Buyer

ASSEMBLE ENTERPRISES Despatch Document No. Delivery Note Date

2ND FLOOR, FLAT NO.204 BUILDING NO.5,

PANVELKAR SANKUL, KARJAT ROAD, KHARWAI NAKA, Despatched through Destination

BADLAPUR EAST,

THANE, BADLAPUR

Terms of Delivery

GSTIN/UIN : 27DBFPK8240H1ZJ

PAN/IT No :

State Name : Maharashtra, Code : 27

Sl Description of Goods HSN/SAC GST Quantity Rate per Disc. % Amount

No. Rate

1 MOBILE TOY 9503 12 % 19,500.00 Pcs 4.55 Pcs 88,725.00

CGST @ 6% 6 % 5,323.50

SGST @ 6% 6 % 5,323.50

Less : R/off (-)2.00

Total 19,500.00 Pcs 99,370.00

Amount Chargeable (in words) E. & O.E

INR Ninety Nine Thousand Three Hundred Seventy Only

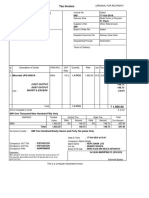

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

9503 88,725.00 6% 5,323.50 6% 5,323.50 10,647.00

Total 88,725.00 5,323.50 5,323.50 10,647.00

Tax Amount (in words) : INR Ten Thousand Six Hundred Forty Seven Only

Company’s Bank Details

Bank Name : ICICI BANK

A/c No. : 026105009512

Company’s PAN : BCGPS8142C Branch & IFS Code : Zaveri Bazaar & ICIC0000261

Declaration for AL-ATTAR TRADES & IMPORTS

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

This is a Computer Generated Invoice

You might also like

- Pearce & StevensDocument1,062 pagesPearce & StevensNicoleNo ratings yet

- Cultural Genocide Yossef Ben JochannanDocument198 pagesCultural Genocide Yossef Ben JochannanDeyonne Chante Howard100% (31)

- Week2 - Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016)Document25 pagesWeek2 - Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016)Muhammet100% (1)

- Invoice PUMA-237293Document1 pageInvoice PUMA-237293Daksh Raj Singh008No ratings yet

- New Distributor Evaluation Form 2016Document3 pagesNew Distributor Evaluation Form 2016Ashish SrivastavaNo ratings yet

- Bill To / Ship To: Seller DetailsDocument1 pageBill To / Ship To: Seller DetailsErick MathewNo ratings yet

- Bill 110920S 940 PDFDocument1 pageBill 110920S 940 PDFRuler NanuNo ratings yet

- Invoice Samsung TabDocument2 pagesInvoice Samsung Tabanurag sahay100% (1)

- May 2021 Mobile BillDocument10 pagesMay 2021 Mobile BillRahatFatehIslamNo ratings yet

- Nike VIALE SLP Walking Shoes For Men: Grand Total 4146.00Document1 pageNike VIALE SLP Walking Shoes For Men: Grand Total 4146.00KeshavNo ratings yet

- BSNL BillDocument3 pagesBSNL BillthamizhanmaniNo ratings yet

- Mushak: 6.3: Tax Invoice Details of Registered PersonDocument2 pagesMushak: 6.3: Tax Invoice Details of Registered PersonAnonymous ZGcs7MwsLNo ratings yet

- CustomerInvoice PDFDocument1 pageCustomerInvoice PDFNamrata GundiahNo ratings yet

- InvoiceDocument1 pageInvoiceAbhijeet Kumar MeenaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoYash singh100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)vikash kumarNo ratings yet

- Tax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandDocument1 pageTax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandSANJAY PRAKASHNo ratings yet

- 6 Rent BillDocument1 page6 Rent BillBhavik DaveNo ratings yet

- Tax Invoice: G-One Enterprises 31-Mar-22Document2 pagesTax Invoice: G-One Enterprises 31-Mar-22LAKSHAY JAINNo ratings yet

- 46019396979737194-Invoice 6226609684Document1 page46019396979737194-Invoice 6226609684HsnsbsNo ratings yet

- Tax Invoice: MAHESHWARA INDANE (0000190023)Document2 pagesTax Invoice: MAHESHWARA INDANE (0000190023)Sathish DavulaNo ratings yet

- Od 116668082320669000Document1 pageOd 116668082320669000PrasantNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFagam sai sidarNo ratings yet

- Part Invoice N2521G202108378Document1 pagePart Invoice N2521G202108378Thakur B PNo ratings yet

- Payments/Adjustments/Discounts/Deposits/Refundsothercharges: Terms and ConditionsDocument1 pagePayments/Adjustments/Discounts/Deposits/Refundsothercharges: Terms and Conditionskrselvakumar8398No ratings yet

- Invoice TVDocument1 pageInvoice TVravinder85No ratings yet

- Bill No - 312 PDFDocument1 pageBill No - 312 PDFas constructionNo ratings yet

- InvoiceDocument2 pagesInvoicesourav acharyaNo ratings yet

- Tax Invoice: Mathru Indane Gas SERVICE (0000273708)Document2 pagesTax Invoice: Mathru Indane Gas SERVICE (0000273708)Shashi KiranNo ratings yet

- 1 PDFDocument2 pages1 PDFvilge rogesonNo ratings yet

- Invoice OD119090674113755000Document1 pageInvoice OD119090674113755000Parikshit ShomeNo ratings yet

- #INV 4723 ServiceDocument1 page#INV 4723 Serviceupkumar871No ratings yet

- Piperine 2Document1 pagePiperine 2vasavi reddyNo ratings yet

- Realme 2 Invoice PDFDocument1 pageRealme 2 Invoice PDFarjun bishtNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Praveen PujerNo ratings yet

- C243340 SalarySlipIncludeDocument1 pageC243340 SalarySlipIncludebenq78786No ratings yet

- Mahaveer Enterprises: Tax InvoiceDocument1 pageMahaveer Enterprises: Tax InvoiceAyush SrivastavNo ratings yet

- Purchase Summary Payment DetailsDocument2 pagesPurchase Summary Payment DetailsSai praneethNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pardeep JaatNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Amber SaxenaNo ratings yet

- UPS BillDocument2 pagesUPS Billmack100% (1)

- SOA009005567079Document2 pagesSOA009005567079Jeevan NJNo ratings yet

- Safari Bag Bill PDFDocument1 pageSafari Bag Bill PDFUjjwalPratapSinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Akash YadavNo ratings yet

- Invoice OD115233790567767000Document1 pageInvoice OD115233790567767000Vishnu wadhwaNo ratings yet

- Gj1rc2389 EstDocument4 pagesGj1rc2389 Estniren4u1567No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SHYAM GEORGENo ratings yet

- Invoice E1121112811033020474Document1 pageInvoice E1121112811033020474Pranav Shady AshishNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPadma GouteNo ratings yet

- Realme 8s 5G (Universe Blue, 128 GB) : Grand Total 18499.00Document1 pageRealme 8s 5G (Universe Blue, 128 GB) : Grand Total 18499.00ajithkuNo ratings yet

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDocument1 pageTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNo ratings yet

- Get Invoice PrintDocument2 pagesGet Invoice Printminturoberts2580No ratings yet

- WS Retail Services Pvt. LTD.,: Grand TotalDocument1 pageWS Retail Services Pvt. LTD.,: Grand TotalSakshiSharma100% (1)

- AadhaarDocument1 pageAadhaarVijayalakshmiNo ratings yet

- Lenovo Ideapad S340 Core I3 10th Gen - (8 GB/256 GB SSD/Windows 10 Home) S340-14IIL Thin and Light LaptopDocument2 pagesLenovo Ideapad S340 Core I3 10th Gen - (8 GB/256 GB SSD/Windows 10 Home) S340-14IIL Thin and Light LaptopAshish KumarNo ratings yet

- Invoice Sample RTR.19.05.16Document1 pageInvoice Sample RTR.19.05.16Samiul BariNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)JnaniSunkavalliNo ratings yet

- Invoice OD104053183032115000 PDFDocument1 pageInvoice OD104053183032115000 PDFVIKASH YADAVNo ratings yet

- Od 326965896423266100Document1 pageOd 326965896423266100khansana10344No ratings yet

- Retail Invoice / Bill: Your Total Savings: Rs.4.02Document2 pagesRetail Invoice / Bill: Your Total Savings: Rs.4.02nitin agrawalNo ratings yet

- InvoiceDocument1 pageInvoiceamal MNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesarifullah khanNo ratings yet

- When Does An Ombudsman Decision Become Final and eDocument4 pagesWhen Does An Ombudsman Decision Become Final and eFender BoyangNo ratings yet

- Jaworski Vs Pagcor DigestDocument1 pageJaworski Vs Pagcor Digestmegzycutes3871No ratings yet

- AQWFDocument2 pagesAQWFAlex Jr ValtierraNo ratings yet

- Sociology - G.H.mead - Self and IdentityDocument4 pagesSociology - G.H.mead - Self and IdentityhalleyworldNo ratings yet

- 2019 AFR Local Govt Volume IDocument406 pages2019 AFR Local Govt Volume IpierremartinreyesNo ratings yet

- FTC Investigation ProceduresDocument7 pagesFTC Investigation ProcedureskjkearlNo ratings yet

- Square Compass SymbolismDocument15 pagesSquare Compass SymbolismTejinder Singh RawalNo ratings yet

- Makalah Tentang Jual Beli Tanah Sengketa Dalam Perspektif Ekonomi IslamDocument18 pagesMakalah Tentang Jual Beli Tanah Sengketa Dalam Perspektif Ekonomi IslamYumiza ApriliaNo ratings yet

- Paris DevelopmentDocument40 pagesParis DevelopmentAnwan BurhaniNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetCracklings Gacuma100% (3)

- 2016 Economics H2 JC2 HWA Chong InstitutionDocument38 pages2016 Economics H2 JC2 HWA Chong InstitutionmaxximNo ratings yet

- IBO-02 (International Marketing)Document125 pagesIBO-02 (International Marketing)ram2joNo ratings yet

- The Information Approach To Decision UsefulnessDocument26 pagesThe Information Approach To Decision UsefulnessDiny Fariha ZakhirNo ratings yet

- Amortization of A 30-Year, $130,000 Loan at 8.5%Document10 pagesAmortization of A 30-Year, $130,000 Loan at 8.5%Ponleu MamNo ratings yet

- Acetic Acid (CH: B A B ADocument2 pagesAcetic Acid (CH: B A B APuwala ArdhanaNo ratings yet

- Example of Prior Period ErrorDocument2 pagesExample of Prior Period ErrorMjhayeNo ratings yet

- Go 2Document4 pagesGo 2farhahNo ratings yet

- Casa de Diseno Integrative Case 7Document7 pagesCasa de Diseno Integrative Case 7Efri DwiyantoNo ratings yet

- Bodycote Rules RevisedDocument2 pagesBodycote Rules RevisedNhinamanaNo ratings yet

- Qualities of A Good SpeakerDocument7 pagesQualities of A Good SpeakerKanshi BhoynaNo ratings yet

- A I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanyDocument102 pagesA I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanySajidNo ratings yet

- Santos V SantosDocument2 pagesSantos V Santosbai malyanah a salmanNo ratings yet

- English Practice Exercises Unit 2 P1 Ko KeyDocument4 pagesEnglish Practice Exercises Unit 2 P1 Ko KeyRS RSNo ratings yet

- AWWA Standards Presentation BrandedDocument22 pagesAWWA Standards Presentation BrandedDevohNo ratings yet

- wl2 T 16676 The Legend of King Arthur Reading Comprehension Activity - Ver - 3Document19 pageswl2 T 16676 The Legend of King Arthur Reading Comprehension Activity - Ver - 3TSMNo ratings yet

- What Factors Influence A Career Choice PDFDocument2 pagesWhat Factors Influence A Career Choice PDFmailk jklmnNo ratings yet