Professional Documents

Culture Documents

SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability Ratios

SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability Ratios

Uploaded by

AYYAZ TARIQCopyright:

Available Formats

You might also like

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- 21-Day Mind, Body and Spirit DetoxDocument6 pages21-Day Mind, Body and Spirit DetoxAjay TiwariNo ratings yet

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- Assem Mohamed Abdeltawab Case1Document24 pagesAssem Mohamed Abdeltawab Case1assem mohamedNo ratings yet

- Habib Bank Limited - Financial ModelDocument69 pagesHabib Bank Limited - Financial Modelmjibran_1No ratings yet

- Financial Analysis of Cherat Cement Company LimitedDocument18 pagesFinancial Analysis of Cherat Cement Company Limitedumarpal100% (1)

- Astro & Time FinancialsDocument4 pagesAstro & Time FinancialsDorcas YanoNo ratings yet

- DDM For A BankDocument5 pagesDDM For A BankSHIKHA CHAUHANNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Afs 26 JunDocument8 pagesAfs 26 JunSyed Fakhar AbbasNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- Ratio Case Study - Standfornd Yard Mon Sec Summer 2021Document8 pagesRatio Case Study - Standfornd Yard Mon Sec Summer 2021Muhammad Ali SamarNo ratings yet

- Black Gold - AnalysisDocument12 pagesBlack Gold - AnalysisAbdulrahman DhabaanNo ratings yet

- Liberty Medical Group Balance Sheet - Industry Comparison 621111 - Offices of Physicians (Except Mental Health Specialists)Document10 pagesLiberty Medical Group Balance Sheet - Industry Comparison 621111 - Offices of Physicians (Except Mental Health Specialists)throwawayyyNo ratings yet

- BDO Network Bank 2022 Annual Report Financial SupplementsDocument115 pagesBDO Network Bank 2022 Annual Report Financial Supplementsbenjamin.holhNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Case 4 For AnanlysisDocument2 pagesCase 4 For AnanlysisLaura HNo ratings yet

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADocument9 pagesCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNo ratings yet

- EDHEC-Risk Alternative Indexes - Overview February 2011Document1 pageEDHEC-Risk Alternative Indexes - Overview February 2011chris_clair9652No ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsKavitha prabhakaranNo ratings yet

- Ratios Formula 2017: Current Ratio 1.96 Quick Ratio 1.51Document5 pagesRatios Formula 2017: Current Ratio 1.96 Quick Ratio 1.51HAMMADHRNo ratings yet

- Pms With Evaluation Summary of SummaryDocument1 pagePms With Evaluation Summary of SummaryQuenn NavalNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Mergers and AcquisiotnsDocument1 pageMergers and AcquisiotnssudhirNo ratings yet

- Group 6 - Commercial BanksDocument3 pagesGroup 6 - Commercial Bankskanika patwariNo ratings yet

- Jawaban KOMPUTASI MDA PT SEMEN INDONESIADocument4 pagesJawaban KOMPUTASI MDA PT SEMEN INDONESIAAyu TriNo ratings yet

- PI Industries Limited BSE 523642 Financials RatiosDocument5 pagesPI Industries Limited BSE 523642 Financials RatiosRehan TyagiNo ratings yet

- Week 1 - Broadway ProformaDocument34 pagesWeek 1 - Broadway ProformashivangiNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Ratio Kalbe FarmaDocument7 pagesRatio Kalbe FarmaDiva Tertia AlmiraNo ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Valiant - 4q22 - Presentation For Analysts and Media RepresentativesDocument32 pagesValiant - 4q22 - Presentation For Analysts and Media RepresentativesMiguel RamosNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

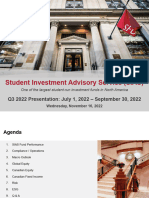

- Q3 2022-FinalDocument71 pagesQ3 2022-FinalcarunsbbhNo ratings yet

- 2022 Annual Financial Report - Printer FriendlyDocument304 pages2022 Annual Financial Report - Printer Friendlypcelica77No ratings yet

- Farrukh Maqsood Ratios (BWW)Document5 pagesFarrukh Maqsood Ratios (BWW)Afaq ZaimNo ratings yet

- AFS Ch-11Document26 pagesAFS Ch-11saqlain aliNo ratings yet

- 2016 Annual Financial ReportDocument247 pages2016 Annual Financial Reportpcelica77No ratings yet

- Example of PresentationDocument22 pagesExample of PresentationAygerim NurlybekNo ratings yet

- 16 - Manju - Infosys Technolgy Ltd.Document15 pages16 - Manju - Infosys Technolgy Ltd.rajat_singlaNo ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- Assignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Document9 pagesAssignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Maherban HaiderNo ratings yet

- Commercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Document10 pagesCommercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Pro BroNo ratings yet

- 2016 Annual ReportDocument187 pages2016 Annual Reportpcelica77No ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Aamc BS Va-1Document1 pageAamc BS Va-1Jomar CariagaNo ratings yet

- Risk Limit Guideline (Approved by Board On Apr. 1, 2017)Document10 pagesRisk Limit Guideline (Approved by Board On Apr. 1, 2017)nigussieabagazNo ratings yet

- Ratio Analysis of Eastern Bank LTDDocument19 pagesRatio Analysis of Eastern Bank LTDshadmanNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingBrendon McNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Scoops and Dips Ratio AnalysisDocument2 pagesScoops and Dips Ratio AnalysisjaseyNo ratings yet

- Stock Prediction-Fundamental AnalysisDocument9 pagesStock Prediction-Fundamental Analysischinmayaa reddyNo ratings yet

- Financial Spreadsheet KOSONGAN FinalDocument7 pagesFinancial Spreadsheet KOSONGAN FinalDwi PermanaNo ratings yet

- Ratio Analysis of SBI Bank LTDDocument4 pagesRatio Analysis of SBI Bank LTDvijay gaurNo ratings yet

- 2019 2018 2017 2016 2015 AssetsDocument1 page2019 2018 2017 2016 2015 AssetsFaisal RafiqueNo ratings yet

- Financial Statement Analysis FIN3111Document9 pagesFinancial Statement Analysis FIN3111Zile MoazzamNo ratings yet

- 2012 Annual ReportDocument156 pages2012 Annual Reportpcelica77No ratings yet

- Unit 1 GleimDocument19 pagesUnit 1 GleimAlina ZainabNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Quick Stress ReliefDocument2 pagesQuick Stress ReliefKannanNo ratings yet

- Philo ExamDocument2 pagesPhilo ExamJohn Albert100% (1)

- InglesDocument5 pagesInglesJessi mondragonNo ratings yet

- Brandi PPT For BrandingDocument27 pagesBrandi PPT For BrandingShah ParinNo ratings yet

- KS2 How Do We See ThingsDocument6 pagesKS2 How Do We See ThingsMekala WithanaNo ratings yet

- SY BSC IT SEM IV CORE JAVA UNIT 1Document56 pagesSY BSC IT SEM IV CORE JAVA UNIT 1stellaNo ratings yet

- FEU: Annual ReportDocument266 pagesFEU: Annual ReportBusinessWorldNo ratings yet

- Statistical Quality Control PPT 3 2Document18 pagesStatistical Quality Control PPT 3 2Baljeet Singh100% (1)

- Assignment 11 STM DavisDocument8 pagesAssignment 11 STM Davisrajesh laddhaNo ratings yet

- Module 2 UrineDocument17 pagesModule 2 UrineGiulia Nădășan-CozmaNo ratings yet

- MEDINA, Chandra Micole P. - Activity 6 Both A and BDocument2 pagesMEDINA, Chandra Micole P. - Activity 6 Both A and BChandra Micole MedinaNo ratings yet

- Full Download 2014 Psychiatric Mental Health Nursing Revised Reprint 5e Test Bank PDF Full ChapterDocument36 pagesFull Download 2014 Psychiatric Mental Health Nursing Revised Reprint 5e Test Bank PDF Full Chapterpassim.pluvialg5ty6100% (17)

- Brgy - OrdinanceDocument4 pagesBrgy - OrdinanceJulie Faith Aquimba Bulan100% (1)

- L4 02 Causative Verbs Teaching JobDocument4 pagesL4 02 Causative Verbs Teaching JobGeorge VieiraNo ratings yet

- MarkDocument8 pagesMarkPaul James BirchallNo ratings yet

- PM40 Risk Analysis andDocument101 pagesPM40 Risk Analysis andprincessmuneebashahNo ratings yet

- Deftones - Back To School (Pink Maggit Rap Version) : (Intro)Document2 pagesDeftones - Back To School (Pink Maggit Rap Version) : (Intro)zwartwerkerijNo ratings yet

- WorkshopPLUS-PowerShell For The IT Administrator Part 2 PDFDocument2 pagesWorkshopPLUS-PowerShell For The IT Administrator Part 2 PDFArif MohmmadNo ratings yet

- Authentic Assessment ToolsDocument24 pagesAuthentic Assessment ToolsJessica De QuintosNo ratings yet

- RMS Infosheet Classic Vehicle Scheme Mou 2016 12Document21 pagesRMS Infosheet Classic Vehicle Scheme Mou 2016 12www.toxiconlineNo ratings yet

- Cubicost Tas & TRB Elementary Quiz - AnswerDocument9 pagesCubicost Tas & TRB Elementary Quiz - AnswerChee HernNo ratings yet

- 01 Atomic Structures WSDocument34 pages01 Atomic Structures WSAreeba EjazNo ratings yet

- Hockey - Indian National Game-2compDocument21 pagesHockey - Indian National Game-2compRaj BadreNo ratings yet

- 2.preparation and Staining of Thick and Thin BloodDocument31 pages2.preparation and Staining of Thick and Thin Bloodbudi darmantaNo ratings yet

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet

- Lion of The North - Rules & ScenariosDocument56 pagesLion of The North - Rules & ScenariosBrant McClureNo ratings yet

- Contemporary World: Colt Ian U. Del CastilloDocument34 pagesContemporary World: Colt Ian U. Del CastilloNORBERT JAY DECLARONo ratings yet

- SWM Notes IIDocument8 pagesSWM Notes IIBeast gaming liveNo ratings yet

- Adebabay AbayDocument23 pagesAdebabay Abaymaheder wegayehuNo ratings yet

SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability Ratios

SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability Ratios

Uploaded by

AYYAZ TARIQOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability Ratios

SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability Ratios

Uploaded by

AYYAZ TARIQCopyright:

Available Formats

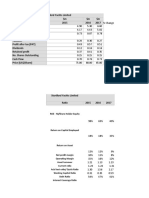

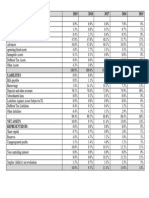

Sr.

No Financial Ratios Bank Alfalah (Commerial B

2020

1 Profitability Ratios %

Profit Margin Net Income/Operating Revenue 1.80

Return on Assets Net Income/Total assets 0.87

Return on Equity Net Income/Equity 11.55

2 Liquidity Ratios 1 Threshold

Current Ratio Current Assets/Current Liabilities 1.07

Quick Ratio Cash+Marketable Security+receivables/Current Liabilities 2.32

Cash Ratio Cash+Marketable Security/Current Liabilities 1.56

3 Assets Management Ratios %

Assets Turnover Revenue/Tatal assets 8.60%

Fixed Asset Turnover Revenue/Net Fixed assets 7.89%

Total Assets Turnover Net Sales Revenue/Net Fixed Assets 6.56%

4 Long Term Solvency Ratio %

Debt/Equity Tatal Liabilities/Equity 9.76%

Leverage Total Assets/Equity 9.02%

Long Term Debt/Equity Non-Current Liabilities/Equity 15.55%

Bank Alfalah (Commerial Bank) Bank Islami(Islamic Bank)

2019 2018 2020 2019 2018

% % % % %

1.85 1.71 0.32 0.23 3.56

1.26 1.11 0.55 0.44 0.10

15.65 15.33 0.11 0.08 0.10

1 Threshold 1 Threshold1 Threshold 1 Threshold 1 Threshold

1.09 1.08 1.31 1.12 1.79

2.21 2.12 1.06 1.07 1.07

1.02 1.43 0.97 0.99 0.99

% % % % %

9.93% 6.99% 3.34% 4.11% 3.00%

8.76% 5.67% 3.14% 3.83% 2.80%

6.89% 4.98% 2.25% 2.63% 1.41%

% % % % %

7.98% 10.41% 18.76 17.48 15.89

5.98% 7.89% 19.94 18.79 17.04

12.10% 13.30% 0.67 0.94 0.43

You might also like

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- 21-Day Mind, Body and Spirit DetoxDocument6 pages21-Day Mind, Body and Spirit DetoxAjay TiwariNo ratings yet

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- Assem Mohamed Abdeltawab Case1Document24 pagesAssem Mohamed Abdeltawab Case1assem mohamedNo ratings yet

- Habib Bank Limited - Financial ModelDocument69 pagesHabib Bank Limited - Financial Modelmjibran_1No ratings yet

- Financial Analysis of Cherat Cement Company LimitedDocument18 pagesFinancial Analysis of Cherat Cement Company Limitedumarpal100% (1)

- Astro & Time FinancialsDocument4 pagesAstro & Time FinancialsDorcas YanoNo ratings yet

- DDM For A BankDocument5 pagesDDM For A BankSHIKHA CHAUHANNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Afs 26 JunDocument8 pagesAfs 26 JunSyed Fakhar AbbasNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- Ratio Case Study - Standfornd Yard Mon Sec Summer 2021Document8 pagesRatio Case Study - Standfornd Yard Mon Sec Summer 2021Muhammad Ali SamarNo ratings yet

- Black Gold - AnalysisDocument12 pagesBlack Gold - AnalysisAbdulrahman DhabaanNo ratings yet

- Liberty Medical Group Balance Sheet - Industry Comparison 621111 - Offices of Physicians (Except Mental Health Specialists)Document10 pagesLiberty Medical Group Balance Sheet - Industry Comparison 621111 - Offices of Physicians (Except Mental Health Specialists)throwawayyyNo ratings yet

- BDO Network Bank 2022 Annual Report Financial SupplementsDocument115 pagesBDO Network Bank 2022 Annual Report Financial Supplementsbenjamin.holhNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Case 4 For AnanlysisDocument2 pagesCase 4 For AnanlysisLaura HNo ratings yet

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADocument9 pagesCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNo ratings yet

- EDHEC-Risk Alternative Indexes - Overview February 2011Document1 pageEDHEC-Risk Alternative Indexes - Overview February 2011chris_clair9652No ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsKavitha prabhakaranNo ratings yet

- Ratios Formula 2017: Current Ratio 1.96 Quick Ratio 1.51Document5 pagesRatios Formula 2017: Current Ratio 1.96 Quick Ratio 1.51HAMMADHRNo ratings yet

- Pms With Evaluation Summary of SummaryDocument1 pagePms With Evaluation Summary of SummaryQuenn NavalNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Mergers and AcquisiotnsDocument1 pageMergers and AcquisiotnssudhirNo ratings yet

- Group 6 - Commercial BanksDocument3 pagesGroup 6 - Commercial Bankskanika patwariNo ratings yet

- Jawaban KOMPUTASI MDA PT SEMEN INDONESIADocument4 pagesJawaban KOMPUTASI MDA PT SEMEN INDONESIAAyu TriNo ratings yet

- PI Industries Limited BSE 523642 Financials RatiosDocument5 pagesPI Industries Limited BSE 523642 Financials RatiosRehan TyagiNo ratings yet

- Week 1 - Broadway ProformaDocument34 pagesWeek 1 - Broadway ProformashivangiNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Ratio Kalbe FarmaDocument7 pagesRatio Kalbe FarmaDiva Tertia AlmiraNo ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Valiant - 4q22 - Presentation For Analysts and Media RepresentativesDocument32 pagesValiant - 4q22 - Presentation For Analysts and Media RepresentativesMiguel RamosNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Q3 2022-FinalDocument71 pagesQ3 2022-FinalcarunsbbhNo ratings yet

- 2022 Annual Financial Report - Printer FriendlyDocument304 pages2022 Annual Financial Report - Printer Friendlypcelica77No ratings yet

- Farrukh Maqsood Ratios (BWW)Document5 pagesFarrukh Maqsood Ratios (BWW)Afaq ZaimNo ratings yet

- AFS Ch-11Document26 pagesAFS Ch-11saqlain aliNo ratings yet

- 2016 Annual Financial ReportDocument247 pages2016 Annual Financial Reportpcelica77No ratings yet

- Example of PresentationDocument22 pagesExample of PresentationAygerim NurlybekNo ratings yet

- 16 - Manju - Infosys Technolgy Ltd.Document15 pages16 - Manju - Infosys Technolgy Ltd.rajat_singlaNo ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- Assignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Document9 pagesAssignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Maherban HaiderNo ratings yet

- Commercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Document10 pagesCommercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Pro BroNo ratings yet

- 2016 Annual ReportDocument187 pages2016 Annual Reportpcelica77No ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Aamc BS Va-1Document1 pageAamc BS Va-1Jomar CariagaNo ratings yet

- Risk Limit Guideline (Approved by Board On Apr. 1, 2017)Document10 pagesRisk Limit Guideline (Approved by Board On Apr. 1, 2017)nigussieabagazNo ratings yet

- Ratio Analysis of Eastern Bank LTDDocument19 pagesRatio Analysis of Eastern Bank LTDshadmanNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingBrendon McNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Scoops and Dips Ratio AnalysisDocument2 pagesScoops and Dips Ratio AnalysisjaseyNo ratings yet

- Stock Prediction-Fundamental AnalysisDocument9 pagesStock Prediction-Fundamental Analysischinmayaa reddyNo ratings yet

- Financial Spreadsheet KOSONGAN FinalDocument7 pagesFinancial Spreadsheet KOSONGAN FinalDwi PermanaNo ratings yet

- Ratio Analysis of SBI Bank LTDDocument4 pagesRatio Analysis of SBI Bank LTDvijay gaurNo ratings yet

- 2019 2018 2017 2016 2015 AssetsDocument1 page2019 2018 2017 2016 2015 AssetsFaisal RafiqueNo ratings yet

- Financial Statement Analysis FIN3111Document9 pagesFinancial Statement Analysis FIN3111Zile MoazzamNo ratings yet

- 2012 Annual ReportDocument156 pages2012 Annual Reportpcelica77No ratings yet

- Unit 1 GleimDocument19 pagesUnit 1 GleimAlina ZainabNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Quick Stress ReliefDocument2 pagesQuick Stress ReliefKannanNo ratings yet

- Philo ExamDocument2 pagesPhilo ExamJohn Albert100% (1)

- InglesDocument5 pagesInglesJessi mondragonNo ratings yet

- Brandi PPT For BrandingDocument27 pagesBrandi PPT For BrandingShah ParinNo ratings yet

- KS2 How Do We See ThingsDocument6 pagesKS2 How Do We See ThingsMekala WithanaNo ratings yet

- SY BSC IT SEM IV CORE JAVA UNIT 1Document56 pagesSY BSC IT SEM IV CORE JAVA UNIT 1stellaNo ratings yet

- FEU: Annual ReportDocument266 pagesFEU: Annual ReportBusinessWorldNo ratings yet

- Statistical Quality Control PPT 3 2Document18 pagesStatistical Quality Control PPT 3 2Baljeet Singh100% (1)

- Assignment 11 STM DavisDocument8 pagesAssignment 11 STM Davisrajesh laddhaNo ratings yet

- Module 2 UrineDocument17 pagesModule 2 UrineGiulia Nădășan-CozmaNo ratings yet

- MEDINA, Chandra Micole P. - Activity 6 Both A and BDocument2 pagesMEDINA, Chandra Micole P. - Activity 6 Both A and BChandra Micole MedinaNo ratings yet

- Full Download 2014 Psychiatric Mental Health Nursing Revised Reprint 5e Test Bank PDF Full ChapterDocument36 pagesFull Download 2014 Psychiatric Mental Health Nursing Revised Reprint 5e Test Bank PDF Full Chapterpassim.pluvialg5ty6100% (17)

- Brgy - OrdinanceDocument4 pagesBrgy - OrdinanceJulie Faith Aquimba Bulan100% (1)

- L4 02 Causative Verbs Teaching JobDocument4 pagesL4 02 Causative Verbs Teaching JobGeorge VieiraNo ratings yet

- MarkDocument8 pagesMarkPaul James BirchallNo ratings yet

- PM40 Risk Analysis andDocument101 pagesPM40 Risk Analysis andprincessmuneebashahNo ratings yet

- Deftones - Back To School (Pink Maggit Rap Version) : (Intro)Document2 pagesDeftones - Back To School (Pink Maggit Rap Version) : (Intro)zwartwerkerijNo ratings yet

- WorkshopPLUS-PowerShell For The IT Administrator Part 2 PDFDocument2 pagesWorkshopPLUS-PowerShell For The IT Administrator Part 2 PDFArif MohmmadNo ratings yet

- Authentic Assessment ToolsDocument24 pagesAuthentic Assessment ToolsJessica De QuintosNo ratings yet

- RMS Infosheet Classic Vehicle Scheme Mou 2016 12Document21 pagesRMS Infosheet Classic Vehicle Scheme Mou 2016 12www.toxiconlineNo ratings yet

- Cubicost Tas & TRB Elementary Quiz - AnswerDocument9 pagesCubicost Tas & TRB Elementary Quiz - AnswerChee HernNo ratings yet

- 01 Atomic Structures WSDocument34 pages01 Atomic Structures WSAreeba EjazNo ratings yet

- Hockey - Indian National Game-2compDocument21 pagesHockey - Indian National Game-2compRaj BadreNo ratings yet

- 2.preparation and Staining of Thick and Thin BloodDocument31 pages2.preparation and Staining of Thick and Thin Bloodbudi darmantaNo ratings yet

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet

- Lion of The North - Rules & ScenariosDocument56 pagesLion of The North - Rules & ScenariosBrant McClureNo ratings yet

- Contemporary World: Colt Ian U. Del CastilloDocument34 pagesContemporary World: Colt Ian U. Del CastilloNORBERT JAY DECLARONo ratings yet

- SWM Notes IIDocument8 pagesSWM Notes IIBeast gaming liveNo ratings yet

- Adebabay AbayDocument23 pagesAdebabay Abaymaheder wegayehuNo ratings yet