Professional Documents

Culture Documents

News Juice 28th Jan. 2022

News Juice 28th Jan. 2022

Uploaded by

Rahul BhaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

News Juice 28th Jan. 2022

News Juice 28th Jan. 2022

Uploaded by

Rahul BhaiCopyright:

Available Formats

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

1. This winter has been colder, wetter, and largely fogless. Here is why

Relevant for GS Prelims & Mains Paper I; Geography

For many people, especially in North India, the winter of 2021-22 is appearing to be

unusually cold and unusually long. The days, in particular, have felt colder and chillier than

normal. Is the popular impression borne out by data? Why is this happening?

Have the days indeed been colder?

Since December 2021, maximum temperatures across the North, Northwest and Central

India regions have persistently remained below normal, resulting in “cold day” conditions.

Technically, this means more than just a day that is cold.

The India Meteorological Department (IMD) defines a “cold day” as one in which the

maximum temperature falls below 16 degrees Celsius, a phenomenon that is commonly

seen during the winter months in the northern plains of India.

This winter, the national capital Delhi witnessed eight days in January (until January 25)

when the maximum temperature remained below 16 degrees, with the lowest maximum

temperature recorded at 12.2 degrees Celsius on Tuesday (January 25).

Similarly cold Januaries in recent years were felt in 2003, which saw 19 “cold days” in

January, 2015 (11 days), and 2010, 2013, and 2004 (9 days each). There are several days

still to go in January 2022.

It isn’t just Delhi either. Since late last week, many places in Maharashtra have experienced

“cold day” conditions as well. Maximum temperatures at several places in Madhya

Maharashtra and Konkan, including Mahabaleshwar, Pune, Mumbai, and Nashik have been

6 to 8 degrees Celsius below normal.

“Cold days” often mean warmer nights. “Persistent clouding blocks out the rays of the Sun

and heating during the day, but keeps the nights warmer than normal,” R K Jenamani,

senior scientist at the National Weather Forecasting Centre, Delhi, said.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

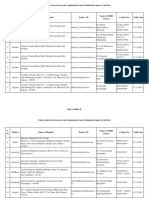

Delhi: Maximum and minimum temperature in January

What weather systems have been active over the country?

Winters over India are directly affected by the intensity and frequency of western

disturbances — eastward propagating wind streams as a cyclonic circulation or trough,

capable of inducing rain or snow-bearing weather systems along their path of movement.

Until January 25, seven western disturbances had passed over India — nearly all of them

strong enough to cause widespread rain, snowfall, and squally weather across large

geographical areas between Pakistan and Northeast India.

These systems caused hailstorms in northern Maharashtra, and heavy rainfall in Tamil

Nadu.

“Frequent and higher numbers of western disturbances are associated with La Niña,” D

Sivanand Pai, head, Climate Monitoring and Services at IMD, Pune said. At present,

moderate intensity La Niña conditions — which manifests itself as cooler than normal sea

surface temperatures in the equatorial Pacific Ocean — are prevailing.

After a western disturbance crosses India, cold winds from the far north of the country

penetrate to lower latitudes, and can reach up to even Telangana and Maharashtra, leading

to colder weather, and sometimes to cold wave conditions.

Back-to-back western disturbances separated by 10 days earlier this month caused a

prolonged cold spell in Jammu and Kashmir, Punjab, Haryana, Rajasthan, Himachal

Pradesh, Uttar Pradesh, Delhi, and Bihar between January 11 and 20.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

“The presence of low-lying clouds and the availability of moisture along the Indo-Gangetic

plains made it favourable for cold day conditions and the additional chill factor experienced

during the day time. This was the longest and most intense spell of the season so far,”

Jenamani said.

This has also been a rather wet winter.

Precipitation, mostly in the form of snow, is common during winter over Jammu and

Kashmir, Ladakh, Uttarakhand, and Himachal Pradesh. Light to moderate intensity rainfall

is also commonly seen during winters in neighbouring regions of North India.

This January, however, has seen widespread rain across the central, northwestern,

northern, eastern, and northeastearn regions of India.

As many as 24 states or Union Territories have recorded rainfall varying from excess to

large excess this month. The only exceptions have been Arunachal Pradesh (minus 26 per

cent), Mizoram (minus 43 per cent), Goa (minus 44 per cent), Karnataka (minus 80 per

cent), Kerala (minus 76 per cent) and Lakshadweep (minus 99 per cent).

January has been significantly wet over Delhi, Odisha, Madhya Pradesh, Uttar Pradesh,

Uttarakhand, Haryana, Punjab, Chhattisgarh, Himachal Pradesh, Jammu and Kashmir,

Ladakh, and Rajasthan, taking the all-India rainfall figure to 38.1 mm so far, which is 196

per cent above normal.

Delhi is witnessing the wettest January in 122 years. The national capital’s monthly rainfall

recorded at the Safdarjung (88.2 mm) and Palam (110 mm) stations are already 72 per

cent and 99 per cent above normal respectively.

Other states and Union Territories with large surpluses of rainfall during this month

include Uttarakhand (102.3 mm), Chandigarh (207.7 mm), Himachal Pradesh (170 mm),

Jammu and Kashmir (165.8 mm), and Punjab (104.6 mm).

The winter has been less foggy than normal.

Yes. December and January are known for the formation of dense fog across North India.

Delhi in December normally witnesses 278 hours of fog — during which visibility falls

below 1,000 metres — over 26 days, but December 2021 saw only 75 hours of fog spread

over 22 days. This was the lowest for December since 1982.

In January too, the national capital remained affected by fog for 252 hours against a normal

of 292 hours — the lowest since 2008.

IMD officials said the ongoing winter has recorded the lowest fog hours since 1991-92 over

Delhi. Conditions for the development of fog are not forecast for the rest of January.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

Strong northern and north-westerly winds have been dominant during the past six weeks.

This winter saw an unusual duststorm reaching parts of Gujarat, Maharashtra, and Delhi

over the last weekend. The strong winds associated with the duststorm originated above

Saudi Arabia, and picked up local dust along its course from the desert regions of

Afghanistan and Pakistan.

Source: The Indian Express

2. Everything we know about ISRO’s new SSLV programme

Relevant for GS Prelims & Mains Paper III; Science & Technology

The new chairman of the Indian Space Research Organisation Dr S Somanath indicated at a

meeting with the minister of state for space Jitendra Singh Tuesday that ISRO’s indigenous

new launch rockets, called the Small Satellite Launch Vehicle (SSLV), will have its much-

delayed, maiden development flight this April.

The ISRO chairman has mentioned the launch of an “SSLV-D1 Micro SAT in April 2022” the

Press Information Bureau said in an official statement on the meeting between the new

ISRO chairman and the Space Minister on Tuesday.

The SSLV is intended to cater to a market for the launch of small satellites into low earth

orbits which has emerged in recent years on account of the need for developing countries,

private corporations, and universities for small satellites.

The launch of small satellites has until now been dependent on ‘piggy-back’ rides with big

satellite launches on ISRO’s work-horse – the Polar Satellite Launch Vehicle which has had

over 50 successful launches so far. The launch of small satellites as a consequence has been

dependent on the finalising of launch contracts for the larger satellites by ISRO.

Somanath himself is credited with the design and development of the SSLV during his time

as director of the Vikram Sarabhai Space Centre in Thiruvananthapuram since 2018. The

launch of the maiden flight of the SSLV was scheduled for July 2019 but has been delayed

due to setbacks from the Covid 19 crisis and other issues.

The SSLV can carry satellites weighing up to 500 kg to a low earth orbit while the tried and

tested PSLV can launch satellites weighing in the range of 1000 kg.

“The SSLV is the smallest vehicle at 110-ton mass at ISRO. It will take only 72 hours to

integrate, unlike the 70 days taken now for a launch vehicle. Only six people will be

required to do the job, instead of 60 people. The entire job will be done in a very short time

and the cost will be only around Rs 30 crore. It will be an on-demand vehicle,” former ISRO

chairman K Sivan had stated in 2019 at the ISRO headquarters during an annual press

conference.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

The former chairman Sivan said in an industry meeting that year that about 15 to 20 SSLVs

would be required every year to meet the national demand alone.

The SSLV received a commercial booking in 2019 itself from the US space launch services

intermediary Spaceflight Inc. Spaceflight announced on August 8, 2019, that it has clinched

a deal with an ISRO commercial arm for using the second developmental flight of the SSLV

rocket to launch a spacecraft for an “undisclosed US-based satellite constellation”

customer.

“SSLV is perfectly suited for launching multiple microsatellites at a time and supports

multiple orbital drop-offs. We are excited to add SSLV to our launch portfolio and manage

many launches together — first to LEO (low earth orbit) mid-inclinations this year and SSO

missions starting in the fall of 2020,” Spaceflight CEO and president Curt Blake said in

2019.

The development and manufacture of the SSLV are expected to create greater synergy

between the space sector and private Indian industries – a key aim of the space ministry.

Indian industry has a consortium for the production of PSLV and should come together to

produce the SSLV as well once it is tested, ISRO has stated in the past.

One of the aims of the newly-created ISRO commercial arm, New Space India Limited

(NSIL), is to use research and development carried out by ISRO over the years for

commercial purposes through Indian industry partners.

“Manufacturing and production of Small Satellite Launch Vehicle (SSLV) and Polar Satellite

Launch Vehicle (PSLV) through technology transfer,” is one of the mandates of the new

firm.

There are more than 500 industries contributing to ISRO programs at present, and more

than half of the project budget outlay for space programs flows to these industries.

Source: The Indian Express

3. Why is Google getting sued for location-tracking?

Relevant for GS Prelims & Mains Paper III; Science & Technology

Google is being sued by the states of Texas, Indiana and Washington DC over the company’s

‘deceptive tactics’ around disclosing location data and how it is collected. The lawsuit is

based on a 2018 report by news agency The Associated Press (AP).

The report had highlighted how Google continued to collect user data, even if the user

turned off the option from the settings of their device. After the report, Google was forced

to update its policy on location tracking.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

What is the lawsuit? Has Google been sued before?

According to Bloomberg, a group of state attorneys general, including Texas, Indiana and

Washington District of Columbia (DC), announced Monday they were suing Google over the

deceptive practices related to location data collection. Google’s policy is likely in violation

of some state laws designed to protect consumers.

The crux is that Google continues to collect user location with the “Web & App Activity”

feature, even if the user specifically turns off location tracking on their phone. The lawsuit

is based on the 2018 AP report. Portions of the lawsuits were redacted, and the copy of the

Washington DC complaint said it was filed under seal, adds Bloomberg.

The report adds that the lawsuit by the District of Columbia also cited internal Google

discussions in which employees said its location history disclosures were “definitely

confusing,” and that account settings appeared designed to create the illusion of user

control.

The lawsuits also target Google’s user privacy settings, calling them confusing and

conflicting. This is not the first time Google is being sued for such claims. A similar case was

filed against the search and advertising giant by the state of Arizona in 2020 around

location tracking, arguing that the search giant made it impossible for users to not share

location.

A Google spokesperson said the lawsuits are “based on inaccurate claims and outdated

assertions about our settings”. Vowing to defend itself and set the record straight, Google

said it has “always built privacy features into our products and provided robust controls for

location data”.

What is the issue about Google collecting location data?

According to the DC lawsuit, location data is the most sensitive, and even a limited amount

collected over a time will expose a person’s identity and routines. The lawsuit states,

“Location can also be used to infer personal details such as political or religious affiliation,

sexual orientation, income, health status, or participation in support groups, as well as

major life events, such as marriage, divorce, and the birth of children.”

It further argues that such data in the hands of Google is powerful because the company

can then monitor consumers’ daily lives, especially since so many depend on the company

and its products on a daily basis. This data can be used to derive insights about consumers

and then also sell advertising ‘targeted’ to them, it adds.

It also states Google has financial motives at stake given the billions of dollars in

advertising and that is another reason why it wants to make it more difficult for users to

opt out of location tracking. The lawsuit adds that it has been filed “to correct the deceptive

and unfair practices that Google has used and uses to obtain consumers’ location data, and

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

to ensure that consumers are able to understand and control the extent to which their

location data is accessed, stored, used, and monetised by the Company.”

How does Google actually collect location data?

It is true that Google does provide the option to turn off collection of location data around a

device. But some location data is still collected.

On most Android or iOS phones, if you sign into your Google account, be it for Gmail or

Google Maps, location data is collected from the device. Remember, Google Maps will not

work if you do not allow it access to the location settings. A user’s Google account also has

some privacy settings, which can be accessed by going to the ‘Manage your account’ page.

In the ‘Data & Privacy’ segment, there is an option for History Settings. The options listed

here are Web & App Activity, Location History and YouTube History. Users have the option

of turning off each of these, and Google will technically not be able to collect that data and

store it for your account.

For instance, if you turn off YouTube History, it will not keep a tab of YouTube videos you

watch and the things you search for on YouTube to give you better recommendations, etc.

The same logic technically applies to Location History.

If you turn it off, Google says the “device’s locations will not be automatically saved to your

Location History.” It also adds that any “previous activity is not deleted from your Location

History.” A user has to manually delete this from the settings. Also keep in mind that

settings settings for other location services on your device, like Google Location Services,

Location Sharing, and Find My Device, are not changed.

But really the most important bit of information about these settings is posted at the end. It

notes, “Some location data may continue to be saved in other settings, like Web & App

Activity, as part of your use of other services, like Search and Maps, even after you turn off

Location History.”

So even if you turn off location history, Google will still collect some of this data. And this

the lawsuits argue is confusing users, and a deceptive tactic.

It should be noted that after AP had revealed this problem back in 2018, Google had

changed the help page for Location settings. The older version of the help would only

mention that users can turn off Location History at any time.

It used to say, “With Location History off, the places you go are no longer stored. When you

turn off Location History for your Google Account, it’s off for all devices associated with

that Google Account. You can also turn off Location History for a device.” It did not mention

that Google would collect this data via other services. That was later updated with the part

which we’ve mentioned above.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

How to turn off the Location History feature on your Google account from your

phone?

For those wondering how to turn off Google’s ‘Location History’ setting from the app on

your Android or iOS device, here are the steps. The settings are available in the Google app

for iOS as well, though you will need it installed on the device.

1. Go to the Settings app on your Android device and tap on “Google.” On iOS, go to the

Google app and tap on your profile picture

2. Select the ‘Manage your Google Account’ option, which shows up on both Android and

iOS.

3. Tap on ‘Data and Privacy’. In the Activity controls section, tap “Location History.”

4. Switch off Location History by swiping the button to the left.

Source: The Indian Express

4. How FCRA works, and why the government has been accused of

targeting NGOs

Relevant for GS Prelims & Mains Paper II; Polity & Governance

The Supreme Court on Tuesday asked 6,000-odd NGOs to go back to the government for

redressal of their grievances on non-renewal of their Foreign Contribution Regulation Act

(FCRA) registration. NGO Global Peace Initiative had petitioned the court that the NGOs

should be allowed to continue receiving and utilising foreign funds until the pandemic is

over.

The FCRA registrations of about 5,900 NGOs ceased to be active after December 31, 2021,

owing to either the NGOs not applying for renewal before the due date or the MHA refusing

their renewal for alleged violation of the Act.

On December 25 last year, the MHA refused to renew the FCRA registration of Mother

Teresa’s Missionaries of Charity, based on “adverse inputs”. The registration was, however,

restored on January 6, and Missionaries of Charity’s FCRA certificate has now been made

valid until the end of 2026.

What is the FCRA?

The FCRA was enacted during the Emergency in 1976 in an atmosphere of apprehension

that foreign powers were interfering in India’s affairs by pumping in funds through

independent organisations. These concerns had been expressed in Parliament as early as in

1969.

The law sought to regulate foreign donations to individuals and associations so that they

functioned “in a manner consistent with the values of a sovereign democratic republic”.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

An amended FCRA was enacted under the UPA government in 2010 to “consolidate the

law” on utilisation of foreign funds, and “to prohibit” their use for “any activities

detrimental to national interest”.

The law was amended again by the current government in 2020, giving the government

tighter control and scrutiny over the receipt and utilisation of foreign funds by NGOs.

Broadly, the FCRA requires every person or NGO wishing to receive foreign donations to be

registered under the Act, to open a bank account for the receipt of the foreign funds in State

Bank of India, Delhi, and to utilise those funds only for the purpose for which they have

been received and as stipulated in the Act.

They are also required to file annual returns, and they must not transfer the funds to

another NGO.

The Act prohibits receipt of foreign funds by candidates for elections, journalists or

newspaper and media broadcast companies, judges and government servants, members of

legislature and political parties or their office-bearers, and organisations of a political

nature.

How is FCRA registration granted?

NGOs that want to receive foreign funds must apply online in a prescribed format with the

required documentation. FCRA registrations are granted to individuals or associations that

have definite cultural, economic, educational, religious, and social programmes.

Following the application, the MHA makes inquiries through the Intelligence Bureau into

the antecedents of the applicant, and accordingly processes the application.

Under the FCRA, the applicant should not be fictitious or benami; and should not have been

prosecuted or convicted for indulging in activities aimed at conversion through inducement

or force, either directly or indirectly, from one religious faith to another.

The applicant should also not have been prosecuted for or convicted of creating communal

tension or disharmony; should not have been found guilty of diversion or misutilisation of

funds; and should not be engaged or likely to be engaged in the propagation of sedition.

The MHA is required to approve or reject the application within 90 days. In case of failure

to process the application in the given time, the MHA is expected to inform the NGO of the

reasons for the same.

For how long is approval granted?

Once granted, FCRA registration is valid for five years. NGOs are expected to apply for

renewal within six months of the date of expiry of registration. In case of failure to apply

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

for renewal, the registration is deemed to have expired, and the NGO is no longer entitled

to receive foreign funds or utilise its existing funds without permission from the ministry.

The FCRA registration of close to 5,900 NGOs, including Oxfam India Trust and Indian

Medical Association, lapsed on December 31 last year. According to sources, the

registration of as many as 5,789 NGOs had lapsed after they failed to apply for renewal

before the due date. The rest, who had applied for renewal, were refused as the MHA found

their operations or accounts to be in violation of the FCRA, sources said.

According to the MHA, NGOs failing to apply before the due date can petition the ministry

with cogent reasons within four months of the expiry of registration, following which their

applications can be reconsidered.

Many NGOs do not apply for renewal for a variety of reasons, which include either

completion of the project for which the FCRA registration had been taken or the NGO itself

folding up.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

On what basis is approval cancelled?

The government reserves the right to cancel the FCRA registration of any NGO if it finds it

to be in violation of the Act.

Registration can be cancelled if an inquiry finds a false statement in the application; if the

NGO is found to have violated any of the terms and conditions of the certificate or renewal;

if it has not been engaged in any reasonable activity in its chosen field for the benefit of

society for two consecutive years; or if it has become defunct.

It can also be cancelled if “in the opinion of the Central Government, it is necessary in the

public interest to cancel the certificate”, the FCRA says.

Registrations are also cancelled when an audit finds irregularities in the finances of an NGO

in terms of misutilisation of foreign funds.

According to FCRA, no order of cancellation of certificate can be made unless the person or

NGO concerned has been given a reasonable opportunity of being heard. Once the

registration of an NGO is cancelled, it is not eligible for re-registration for three years.

The ministry also has powers to suspend an NGO’s registration for 180 days pending

inquiry, and can freeze its funds.

All orders of the government can be challenged in the High Court.

Which NGOs have been accused of violating FCRA provisions?

Several international and well-known NGOs such as Compassion International, Greenpeace

India, Sabrang Trust, Lawyers’ Collective, Amnesty International, and Ford Foundation

have come under the government’s scanner for alleged violations of FCRA.

Most have been accused of financial irregularities or “political activity” for cancellation of

their registration. Amnesty was forced to shut its operation in India in 2020 following

investigations launched by the Enforcement Directorate in 2018 into its financial dealings.

Amnesty called the government action “witch-hunt of human-right activists…and a

crackdown on dissent”.

Greenpeace India has scaled down its operations after its FCRA registration was cancelled

in 2015 on grounds of opening multiple bank accounts, and movement of funds.

Lawyer Indira Jaising’s NGO Lawyers’ Collective is facing a CBI probe. In 2016, the MHA had

cancelled the FCRA licence of the NGO for allegedly using foreign contributions for

“political purposes”.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

Activist Teesta Setalvad’s NGO Sabrang Trust had its FCRA registration cancelled in 2016

for allegedly mixing foreign and domestic funds, and for spending funds on publishing the

Communalism Combat magazine.

In April 2015, the MHA put the Ford Foundation under the “prior approval category”,

which meant that all funds from the organisation to recipients in India would have to be

cleared by the government. The international NGO was also put on the Home Ministry’s

watch list for some time in the interest of “national security”.

In 2016, Compassion International was barred by the government from funding NGOs in

India over allegations of conversion.

Has the FCRA been used to target certain NGOs?

Until 2011, there were more than 40,000 NGOs registered under FCRA in India. That

number now stands at 16,000.

Over the past few years, the government has faced allegations of targeting NGOs. Over the

past seven years, the Narendra Modi government has cancelled the registration of more

than 16,700 NGOs. Over 10,000 of these cancellations were carried out in 2015.

The previous UPA government had cracked down on NGOs following protests against the

Kudankulam nuclear power project in Tamil Nadu. In 2012, the Manmohan Singh

government cancelled the registration of almost 4,000 NGOs — up from just four the

previous year.

It was under the UPA government that Greenpeace India first came under the scanner. Also,

Amnesty International, which was first granted FCRA registration in 2000, was not allowed

renewal of its registration by the UPA government.

Source: The Indian Express

5. India’s bilateral trade with China in 2021

Relevant for GS Prelims & Mains Paper II; Bilateral Relations

Despite India’s efforts to reduce dependence on Chinese imports amid an increased policy

emphasis on self-reliance and the continuing tension along the border, the country’s

bilateral trade with China has grown 44 per cent in 2021, according to Chinese government

data for the full calendar year. Imports grew over a record 46 per cent while exports were

up 35 per cent.

What are India’s imports from China?

India’s imports from China rose to $97.5 billion in calendar year 2021, up 46.1 per cent

from imports worth $66.7 billion in 2020, which was impacted by Covid-19 related

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

restrictions, as per data from the China General Administration of Customs. Imports were

up 30.3 per cent over 2019, which was not impacted by the pandemic. India’s total trade

with China was $125.7 billion in the 2021.

The sharp uptick in imports has pushed India’s trade deficit with China to $69.4 billion in

2021, up from $45.9 billion in 2020 and $56.8 billion in 2019. India’s official statistics on

bilateral trade with China are updated only till November 2021.

According to Commerce Ministry data, China was India’s second largest trading partner in

the April-November period, after the US. UAE, Saudi Arabia and Iraq and Hong Kong were

other top trading partners for India during the period.

Some of India’s key imports from China include smartphones, components for smartphones

and automobiles, telecom equipment, plastic and metallic goods, active pharmaceutical

ingredients (APIs), and other chemicals. Experts have noted that players in the Indian

electronic goods space are still largely focussed on the assembly of products and did not

have much discretion in sourcing of components.

Officials at the Commerce Ministry have, however, pointed out earlier in this fiscal that

growth in India’s trade with other key trading partners including the US, UAE and Australia

was even higher than the growth in trade with China. India is currently in the process of

negotiating Free Trade Agreements (FTAs) with the UAE, EU, UK and Australia.

What is the growth of Indian exports to China?

India’s exports to China grew to $28.1 billion in calendar year 2021, up 34.9 per cent from

exports worth $20.9 billion in 2020, which was impacted by Covid-19 related restrictions,

according to Chinese government data. India’s exports to China in 20201 were 56.5 per

cent higher than exports in 2019, which was not impacted by the pandemic. Raw material

exports constitute a significant portion of India’s outbound trade with China with iron ore,

organic chemicals and cotton figuring among key export items. Other key exports to China

include iron and steel, seafood and engineering goods.

Why is the government looking to curb imports from China?

In June 2020, Indian and Chinese militaries clashed in Ladakh’s Galwan Valley. Soon after,

the Power Ministry imposed a de facto ban on the import of power equipment from China

citing cybersecurity concerns. The government also asked state-owned telecommunication

companies, BSNL and MTNL, to exclude Chinese telecom equipment firms including

Huawei and ZTE from its network upgrading process.

The government also modified foreign direct investment (FDI) rules making the Centre’s

approval a must for any FDI in Indian firms from neighbouring countries — apparently

aimed at preventing opportunistic takeovers of domestic firms by Chinese companies

during the pandemic.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

India has also tightened a watch on dumping of goods from China in India. In December

2021 India imposed anti-dumping duties on five Chinese products, including certain

aluminium goods and chemicals, for five years to protect local manufacturers.

Source: The Indian Express

6. Understanding the Budget formulation

Relevant for GS Prelims & Mains Paper III; Economics

There are three major components of the Budget —expenditure, receipts and deficit

indicators. Depending on the manner in which they are defined, there can be many

classifications and indicators of expenditure, receipts and deficits. Total expenditure can be

further be divided into capital and revenue expenditure. Similarly, the receipts of the

Government also have three components —revenue receipts, non-debt capital receipts and

debt-creating capital receipts while fiscal deficit means the difference between total

expenditure and the sum of revenue receipts and non-debt receipts.

Since different components of expenditure and revenue can have different effects on

income of different classes and social groups, the Budget has implications for income

distribution as well.

In India the fiscal rule is guided by the recommendations of the N.K. Singh Committee

Report. Allowing for some deviations under exceptional times, it has three policy targets —

maintaining a specific level of debt-GDP ratio (stock target), fiscal deficit-GDP ratio (flow

target) and revenue deficit-GDP ratio (composition target).

The story so far: With the economy still hurting from the pandemic, the Budget on

February 1 is likely to address concerns around growth, inflation and spending. The

Budget, which will be tabled in Parliament by Finance Minister Nirmala Sitharaman, is the

Government’s blueprint on expenditure, taxes it plans to levy, and other transactions which

affect the economy and the lives of citizens.

What are the major components of the Budget?

There are three major components — expenditure, receipts and deficit indicators.

Depending on the manner in which they are defined, there can be many classifications and

indicators of expenditure, receipts and deficits.

Based on their impact on assets and liabilities, total expenditure can be divided into capital

and revenue expenditure. Capital expenditure is incurred with the purpose of increasing

assets of a durable nature or of reducing recurring liabilities. Consider the expenditure

incurred for constructing new schools or new hospitals. All these are classified as capital

expenditure as they lead to creation of new assets. Revenue expenditure involves any

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

expenditure that does not add to assets or reduce liabilities. Expenditure on the payment of

wages and salaries, subsidies or interest payments would be typically classified as revenue

expenditure.

Depending on the manner in which it affects different sectors, expenditure is also classified

into (i) general services (ii) economic services, (iii) social services and (iv) grants-in-aid

and contribution. The sum of expenditure on economic and social services together form

the development expenditure. Economic services include expenditure on transport,

communication, rural development, agricultural and allied sectors. Expenditure on the

social sector including education or health is categorised as social services. Again,

depending on its effect on asset creation or liability reduction, development expenditure

can be further classified as revenue and capital expenditure.

The receipts of the Government have three components — revenue receipts, non-debt

capital receipts and debt-creating capital receipts. Revenue receipts involve receipts that

are not associated with increase in liabilities and comprise revenue from taxes and non-tax

sources. Non-debt receipts are part of capital receipts that do not generate additional

liabilities. Recovery of loans and proceeds from disinvestments would be regarded as non-

debt receipts since generating revenue from these sources does not directly increase

liabilities, or future payment commitments. Debt-creating capital receipts are ones that

involve higher liabilities and future payment commitments of the Government.

Fiscal deficit by definition is the difference between total expenditure and the sum of

revenue receipts and non-debt receipts. It indicates how much the Government is spending

in net terms. Since positive fiscal deficits indicate the amount of expenditure over and

above revenue and non-debt receipts, it needs to be financed by a debt-creating capital

receipt. Primary deficit is the difference between fiscal deficit and interest payments.

Revenue deficit is derived by deducting capital expenditure from fiscal deficits.

What are the implications of the Budget on the economy?

The Budget has an implication for aggregate demand of an economy. All Government

expenditure generates aggregate demand in the economy since it involves purchase of

private goods and services by the Government sector. All tax and non-tax revenue reduces

net income of the private sector and thereby leads to reduction in private and aggregate

demand. But except for exceptional circumstances, the GDP, revenue receipt and

expenditure typically show a tendency to rise over time. Thus, the trend in absolute value

of expenditure and receipts in themselves has little use for meaningful analysis of the

Budget. The trend in expenditures and revenue is analysed either by the GDP or as growth

rates after accounting for the inflation rate.

Reduction in expenditure GDP ratio or increase in revenue receipt-GDP ratio indicates the

Government’s policy to reduce aggregate demand and vice-versa. For similar reasons,

reduction in fiscal deficit-GDP ratio and primary deficit-GDP ratios indicate Government

policy of reducing demand and vice versa.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

Since different components of expenditure and revenue can have different effects on

income of different classes and social groups, the Budget also has implications for income

distribution. For example, revenue expenditure such as employment guarantee schemes or

food subsidies can directly boost the income of the poor. Concession in corporate tax may

directly and positively affect corporate incomes. Though both a rise in expenditure for

employment guarantee schemes or reduction in the corporate tax would widen the fiscal

deficit, its implications for income distribution would be different.

What are fiscal rules and how do they affect policy?

Fiscal rules provide specific policy targets on the basis of which fiscal policy is formed.

Policy targets can be met by using different policy instruments. There exists no unique

fiscal rule that is applied to all countries. Rather, policy targets are sensitive to the nature of

economic theory and depend on the specificity of an economy.

In India’s case, its present fiscal rule is guided by the recommendations of the N.K. Singh

Committee Report. Allowing for some deviations under exceptional times, it has three

policy targets — maintaining a specific level of debt-GDP ratio (stock target), fiscal deficit-

GDP ratio (flow target) and revenue deficit-GDP ratio (composition target).

Though both expenditure and revenue receipts can potentially act as policy instruments to

meet a specific set of fiscal rules, tax rates within the existing policy framework happen to

be determined independent of the expenditure requirement of the economy. Accordingly,

in the present institutional framework in India, it is primarily the expenditure which is

adjusted to meet the fiscal rules at given tax-ratios. Such an adjustment mechanism has at

least two related, but analytically distinct, implications for fiscal policy. First, independent

of the extent of expenditure needed to stimulate the economy or boost labour income,

existing fiscal rules provide a cap on expenditure by imposing the three policy targets.

Second, under any situation when the debt-ratio or deficit ratio is greater than the targeted

level, expenditure is adjusted in order to meet the policy targets. By implication,

independent of the state of the economy and the need for expansionary fiscal policy,

existing policy targets may lead the Government to reduce expenditure. In the midst of the

inadequacies of fiscal policy to address the contemporary challenges of unemployment and

low output growth rate, the nature and objective of fiscal rules in India would have to be

re-examined.

Source: The Hindu

7. The stock markets’ recent downturn across the world

Relevant for GS Prelims & Mains Paper III; Economics

Stock markets across the world are witnessing a significant fall as the U.S. Federal Reserve

prepares to raise interest rates to contain rising prices.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

When central banks are willing to flood the credit market with plenty of money, this causes

the demand for credit instruments like bonds to rise as speculators bid up the price of

bonds in the expectation that central banks will lap up these bonds eventually. The rise in

the price of bonds causes their interest rates to fall.

When interest rates on safer investments like bonds fall, more investors would be willing

to dabble in stocks.

The story so far:

Stock markets across the world are witnessing a significant fall as it becomes increasingly

clear that the U.S. Federal Reserve will raise interest rates to contain rising prices. U.S.

Federal Reserve chairman Jay Powell on Wednesday struck a hawkish tone by stating that

the American central bank will begin raising interest rates as soon as March this year.

Stocks have been falling for a while now with the S&P 500 down almost 10% from its all-

time high hit earlier this month and India’s Nifty 50 index down about 7% from its most

recent high. Bond yields, on the other hand, have risen as speculators expect central banks

to reduce the liquidity support that they offer to bond markets.

What do rising interest rates mean?

Central banks such as the U.S. Federal Reserve, the European Central Bank, the Reserve

Bank of India and others constantly influence interest rates by regulating money supply.

When central banks are willing to flood the credit market with plenty of money, this causes

the overall demand for credit instruments like bonds (which represent a claim over future

cash flows) to rise as speculators bid up the price of bonds in the expectation that central

banks will lap up these bonds eventually. The rise in the price of bonds causes their yields

(or interest rates) to fall. In Europe, for instance, speculators were willing to pay more

money than the future cash flows that they were entitled to receive from bonds, thus

pushing yields into negative territory; these speculators expected the ECB to buy up these

bonds. The U.S. Federal Reserve has also been a major determinant of interest rates in the

American mortgage market through its bond purchase programme named quantitative

easing. When central banks, on the other hand, contract money supply or slow down the

pace at which they create fresh money, this can lead to a fall in liquidity in the credit

market and consequently lead to a drop in the speculative demand for bonds and other

credit products like short term loans. As a result, the prices of these instruments drop and

their yields (or interest rates) rise.

Why are stocks falling as interest rates rise?

Stock prices and bond yields are inversely related. As bond yields rise, stock prices fall; and

as bond yields fall, stock prices rise. This is because, when interest rates (or yields) on safer

investments like bonds fall for instance, more investors would be willing to dabble in

stocks. For example, if interest rates on bonds were to drop from 5% to 1%, this would

persuade investors requiring a minimum return on investment of anything between 1% to

5% to desert bonds and move into stocks in which they hope to make higher returns by

assuming greater risk. This process basically leads to future cash flows from stocks being

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

discounted at lower rates than before, thus causing stock prices to rise. Conversely, when

interest rates rise, this can cause future cash flows from stocks to be discounted at higher

rates, causing stock prices to fall as a result. So, it is possible that the recent fall in stocks is

due to speculators pricing in higher interest rates.

What lies ahead?

If central banks were to withdraw the support they have offered to credit markets and

allow interest rates to rise, this should mean that stock prices will fall. However, it should

be noted that markets can be overvalued or undervalued when compared to their

fundamentals for long stretches of time.

Further, there are other variables such as earnings expectations that influence stock prices.

Stocks may also consolidate at high prices for a long time until earnings catch up to justify

the high prices.

So, at the end of the day, the technical forces of demand and supply may determine trends

in stock prices in the short run. At the moment, it seems like the S&P 500 has found some

support at the 4,300 level while the Nifty could find further support at 16,600.

Rising interest rates can also wreak havoc on the economy as there could be the need for

widespread reallocation of goods and services across the economy to adjust to higher

interest rates. For example, business projects that seemed to make sense when interest

rates were low and liquidity was abundant may need to be abandoned in favour of other,

more viable projects.

Source: The Hindu

8. Central Asia meet forms Afghan group

Relevant for GS Prelims & Mains Paper II; International Issues

Overcoming the lack of land connectivity between India and Central Asia’s landlocked

countries was one of the “main issues of discussion” during the first India-Central Asia

Summit hosted by Prime Minister Narendra Modi with the Presidents of Kazakhstan,

Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, officials said on Thursday.

The leaders also spoke at length about concerns over Afghanistan, sharing the “same

concerns and same objectives” in broader terms and agreed to setting up a Joint Working

Group (JWG) of senior officials, said Reenat Sandhu, Secretary (West) in the Ministry of

External Affairs, listing those concerns as the need for immediate humanitarian assistance,

ensuring the formation of a truly representative and inclusive government, combating

terrorism and drug trafficking, and preserving the rights of women, children and

minorities.

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

For updates on WhatsApp, share your Name, City & Email ID on

WhatsApp No. 88986-30000

Mr. Modi tweeted that all countries at the summit were “concerned about the

developments in Afghanistan”. “In this context, our mutual cooperation has become even

more important for regional security and stability,” he said.

More meetings proposed

Mr. Modi also proposed a number of high-level exchanges between the two sides, including

biannual summits and annual meetings of the Foreign, Trade and Cultural Ministers and

Secretaries of Security (National Security Advisers) to “strengthen cooperation in the areas

of political and development, partnership, trade and connectivity, culture and tourism and

security”, the officials said, adding that these proposals were accepted, along with a plan to

build a “Central Asia Centre” in New Delhi. They also announced two “Joint Working

Groups” on Afghanistan and the Chabahar port project.

“Further development of mutual connectivity is essential for enhanced trade and

commerce between India and Central Asian countries in the context of their landlocked

nature and lack of overland connectivity with India,” said the “Delhi Declaration” joint

statement issued at the end of the 90-minute summit.

Source: The Hindu

Website: www.prepmate.in Telegram Channel: @upscprepmate

Prepmate Cengage Books Preview:https://prepmate.in/books/ Youtube channel: PrepMateEdutech

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Case Analysis - SCHIIT AUDIODocument4 pagesCase Analysis - SCHIIT AUDIORahul BhaiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Global Divides: The North and The SouthDocument24 pagesGlobal Divides: The North and The SouthCarissa Palomo86% (7)

- News Juice 18th April 2022Document14 pagesNews Juice 18th April 2022Rahul BhaiNo ratings yet

- Kemira Annual Report 2012Document247 pagesKemira Annual Report 2012Rahul BhaiNo ratings yet

- Homework Risk MGT PDFDocument2 pagesHomework Risk MGT PDFRahul BhaiNo ratings yet

- Visat Gandhinagar Junction: Reduced ServiceDocument8 pagesVisat Gandhinagar Junction: Reduced ServiceDhwani DoshiNo ratings yet

- Roof Truss QuoteDocument3 pagesRoof Truss QuoteMmamoraka Christopher MakhafolaNo ratings yet

- Cfas PrelimsDocument45 pagesCfas PrelimsRoshane Deil PascualNo ratings yet

- Railway LRT Metro References 2021Document16 pagesRailway LRT Metro References 2021Dinesh SahaiNo ratings yet

- Journal PDFDocument8 pagesJournal PDFEfaz AfnanNo ratings yet

- Payments BankDocument3 pagesPayments BankSwagata GhoshNo ratings yet

- Agriculture Has Always Been A Vital Part of The Philippine NationDocument2 pagesAgriculture Has Always Been A Vital Part of The Philippine NationLemuel Jefferson CastilloNo ratings yet

- NE Region KKHSOUDocument139 pagesNE Region KKHSOUProtinaz foodsNo ratings yet

- Postwar Problems and The RepublicDocument1 pagePostwar Problems and The RepublicRachel NicoleNo ratings yet

- The Economy of FranceDocument18 pagesThe Economy of Francejames killerNo ratings yet

- Canara BankDocument98 pagesCanara BankSuresh Babu Reddy67% (6)

- " A Study On " IDBI Bank's Performance" Submitted ToDocument40 pages" A Study On " IDBI Bank's Performance" Submitted TosalmaNo ratings yet

- The Case For Small and Medium Enterprises in Afghanistan PDFDocument34 pagesThe Case For Small and Medium Enterprises in Afghanistan PDFNomanNo ratings yet

- Reserve Bank of IndiaDocument3 pagesReserve Bank of IndiaCacptCoachingNo ratings yet

- Cautious Blasting: Muhammad Talha Reg #: 16PWMIN0779Document10 pagesCautious Blasting: Muhammad Talha Reg #: 16PWMIN0779Muhammad TalhaNo ratings yet

- O-H Äohh-H Hu+Hme+Hmh: PHFHHSH-H Huphv-HhDocument220 pagesO-H Äohh-H Hu+Hme+Hmh: PHFHHSH-H Huphv-HhSourabh PorwalNo ratings yet

- Introduction To Ancient Coin CollectingDocument21 pagesIntroduction To Ancient Coin CollectingchrysNo ratings yet

- Assignment 02Document4 pagesAssignment 02Do Thu Tra100% (1)

- Speaking 2.3 8A2.0Document4 pagesSpeaking 2.3 8A2.0Dana BautistaNo ratings yet

- Chapter 1 Story of PalampurDocument8 pagesChapter 1 Story of Palampurakanshi singhNo ratings yet

- HCG - Wilcon LaoagDocument1 pageHCG - Wilcon LaoagNeil San JuanNo ratings yet

- Topic 6 Business IncomeDocument37 pagesTopic 6 Business IncomeMuhamad Safwan ZulkifliNo ratings yet

- English Reading Comprehension - Comprensión de Lectura en InglésDocument2 pagesEnglish Reading Comprehension - Comprensión de Lectura en InglésJohana HerreraNo ratings yet

- Laporan Vts Tanjung Priok 14 - 15 November New 2022Document23 pagesLaporan Vts Tanjung Priok 14 - 15 November New 2022instalasi SBNPNo ratings yet

- Wizards Trading GuideDocument14 pagesWizards Trading Guidejunaidjabbar972No ratings yet

- (Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 106Document1 page(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 106JasmeetNo ratings yet

- List Od DoctorsDocument45 pagesList Od DoctorsShipra BansalNo ratings yet

- Corporate Social Responsibility Report 2023Document75 pagesCorporate Social Responsibility Report 2023syed asiqNo ratings yet

- Ch02 - FADocument220 pagesCh02 - FAduy794255No ratings yet