Professional Documents

Culture Documents

Question 1 (2010)

Question 1 (2010)

Uploaded by

Avinash SbscCopyright:

Available Formats

You might also like

- TRADING COURSE'sDocument51 pagesTRADING COURSE'sDHAVAL29% (7)

- Institute and Faculty of Actuaries: Subject CM2A - Financial Engineering and Loss Reserving Core PrinciplesDocument8 pagesInstitute and Faculty of Actuaries: Subject CM2A - Financial Engineering and Loss Reserving Core PrinciplesANo ratings yet

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadFrom EverandAdaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadRating: 5 out of 5 stars5/5 (2)

- CM2A September23 EXAM Clean ProofDocument7 pagesCM2A September23 EXAM Clean ProofVishva ThombareNo ratings yet

- CM2ADocument4 pagesCM2AMike KanyataNo ratings yet

- IandF CT8 201604 ExamDocument7 pagesIandF CT8 201604 ExamKa Wing HoNo ratings yet

- Ilovepdf Merged 6Document131 pagesIlovepdf Merged 6Dani ShaNo ratings yet

- FM423 - 2020 ExamDocument7 pagesFM423 - 2020 ExamSimon GalvizNo ratings yet

- IandF CT8 201109 Exam FINADocument7 pagesIandF CT8 201109 Exam FINAmuskan jainNo ratings yet

- SMM148 Theory of Finance Questions Jan 2020Document5 pagesSMM148 Theory of Finance Questions Jan 2020minh daoNo ratings yet

- Acf1002 1 2006 2Document6 pagesAcf1002 1 2006 2sandhyamohunNo ratings yet

- Ac.f215 Exam 2018-2019 PDFDocument6 pagesAc.f215 Exam 2018-2019 PDFWilliam NogueraNo ratings yet

- IandF CM2A 202009 ExamPaperDocument8 pagesIandF CM2A 202009 ExamPaperANo ratings yet

- PP Invt&sec 2018Document5 pagesPP Invt&sec 2018Revatee HurilNo ratings yet

- FIE400E 2018 SpringDocument9 pagesFIE400E 2018 SpringSander Von Porat BaugeNo ratings yet

- Training ExercisesDocument4 pagesTraining ExercisesnyNo ratings yet

- Institute and Faculty of Actuaries: Subject CT8 - Financial Economics Core TechnicalDocument7 pagesInstitute and Faculty of Actuaries: Subject CT8 - Financial Economics Core TechnicalRishabh AgarwalNo ratings yet

- CM2 A Question - 20021141Document6 pagesCM2 A Question - 20021141K DNo ratings yet

- Econf412 Finf313 Compre QDocument3 pagesEconf412 Finf313 Compre Qbits.goa2027No ratings yet

- IandF CT6 201709 ExamDocument7 pagesIandF CT6 201709 ExamUrvi purohitNo ratings yet

- Theory of Finance Questions Jan 2019Document5 pagesTheory of Finance Questions Jan 2019minh daoNo ratings yet

- CM21 Finance 2 Mock Final ExamDocument9 pagesCM21 Finance 2 Mock Final Examkoala.jacyNo ratings yet

- CFI5104201205 Investment AnalysisDocument7 pagesCFI5104201205 Investment AnalysisNelson MrewaNo ratings yet

- Problem Set 5 Financial Management - Financial AnalysisDocument4 pagesProblem Set 5 Financial Management - Financial AnalysisValentin IsNo ratings yet

- 2019 ZaDocument5 pages2019 ZaChandani FernandoNo ratings yet

- CT8 Iai QP 1009Document5 pagesCT8 Iai QP 1009Mike KanyataNo ratings yet

- FM413 Sample ExamDocument5 pagesFM413 Sample ExamTerry Jieyu ZhangNo ratings yet

- Sample Final UPF Financial Econ 22-23Document6 pagesSample Final UPF Financial Econ 22-23Cristina TortesNo ratings yet

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- Midterm ExamDocument7 pagesMidterm ExamkidhafNo ratings yet

- First Midterm Exam: Econ 435 - Financial EconomicsDocument14 pagesFirst Midterm Exam: Econ 435 - Financial EconomicsWill MillerNo ratings yet

- FM423 Practice Exam IIIDocument7 pagesFM423 Practice Exam IIIruonanNo ratings yet

- Chheev JJJDocument16 pagesChheev JJJrahulNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsdasNo ratings yet

- CT6 QP 0416Document6 pagesCT6 QP 0416Shubham JainNo ratings yet

- st62005-2009 0Document263 pagesst62005-2009 0chan chadoNo ratings yet

- Actuarial CT8 Financial Economics Sample Paper 2011 by ActuarialAnswersDocument8 pagesActuarial CT8 Financial Economics Sample Paper 2011 by ActuarialAnswersActuarialAnswersNo ratings yet

- Acts4130 14F A3qsDocument12 pagesActs4130 14F A3qsNurin FaqihahNo ratings yet

- Financial Mathematics 2018 ExamDocument5 pagesFinancial Mathematics 2018 ExamsamanNo ratings yet

- IandF CT6 201604 ExamDocument6 pagesIandF CT6 201604 ExamUrvi purohitNo ratings yet

- BCF 3202 - Financial Institutions and Markets - April 2021Document4 pagesBCF 3202 - Financial Institutions and Markets - April 2021dev hayaNo ratings yet

- Assignment FIN205 S2 - 2017Document4 pagesAssignment FIN205 S2 - 2017Japheth CapatiNo ratings yet

- CM2B - April23 - EXAM - Clean ProofDocument6 pagesCM2B - April23 - EXAM - Clean ProofmetineeklaNo ratings yet

- CM2ADocument5 pagesCM2ARahul IyerNo ratings yet

- ACTUARIES Statistical MethodsDocument21 pagesACTUARIES Statistical Methodsvg284No ratings yet

- CT 111Document6 pagesCT 111Urvi purohitNo ratings yet

- MSc- MA5121Document5 pagesMSc- MA5121Lahiru KariyawasamNo ratings yet

- ACCG329 Sample Exam PaperDocument25 pagesACCG329 Sample Exam PaperLinh Dieu NghiemNo ratings yet

- FE-Unit 1, 2 QuestionsDocument4 pagesFE-Unit 1, 2 Questionsarya.enactusdcacNo ratings yet

- BEE3032 2013 May ExamDocument5 pagesBEE3032 2013 May ExamMarius George CiubotariuNo ratings yet

- Add MathDocument20 pagesAdd MathSiti Nurfaizah Piei100% (1)

- ECON1095 Assignment 1 Sem 2 2018 1 82122208Document3 pagesECON1095 Assignment 1 Sem 2 2018 1 82122208iNeel0% (1)

- FandI CT6 200509 Exampaper PDFDocument6 pagesFandI CT6 200509 Exampaper PDFUrvi purohitNo ratings yet

- Progress Test QMDocument5 pagesProgress Test QMAzizNo ratings yet

- Examinations: Advanced Certificate in Derivatives: Further Mathematics, Principles and PracticeDocument5 pagesExaminations: Advanced Certificate in Derivatives: Further Mathematics, Principles and Practicedickson phiriNo ratings yet

- ISC Sample Question Paper Economics Class 12Document2 pagesISC Sample Question Paper Economics Class 12manojkv3146No ratings yet

- QF 2 PP 2015Document9 pagesQF 2 PP 2015Revatee HurilNo ratings yet

- Binomial Model and Arrow SecuritiesDocument8 pagesBinomial Model and Arrow SecuritiesAlbert WangNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument4 pagesInstitute of Actuaries of India: ExaminationsRochak JainNo ratings yet

- Strategic Risk Management: Designing Portfolios and Managing RiskFrom EverandStrategic Risk Management: Designing Portfolios and Managing RiskNo ratings yet

- Research ProposalDocument3 pagesResearch ProposalAvinash SbscNo ratings yet

- A Manufacturing Company Uses 25Document1 pageA Manufacturing Company Uses 25Avinash SbscNo ratings yet

- Chapter 1 TutorialsDocument1 pageChapter 1 TutorialsAvinash SbscNo ratings yet

- Interpretation of StatutesDocument7 pagesInterpretation of StatutesAvinash SbscNo ratings yet

- Classification of LawDocument3 pagesClassification of LawAvinash SbscNo ratings yet

- Swaps: Problem 7.1Document4 pagesSwaps: Problem 7.1Hana LeeNo ratings yet

- Stock Market Made EasyDocument16 pagesStock Market Made EasyChellapandiNo ratings yet

- Prospectus of A CompanyDocument31 pagesProspectus of A CompanyJaiminBarotNo ratings yet

- Financial Derivatives (Finance Specialization) (2019 Admission) 2022 MarchDocument6 pagesFinancial Derivatives (Finance Specialization) (2019 Admission) 2022 MarchkcashiquaNo ratings yet

- Chapter 1Document19 pagesChapter 1chaman_shresthaNo ratings yet

- (Exercise) WaccDocument3 pages(Exercise) Waccclary frayNo ratings yet

- Compound Financial InstrumentsDocument12 pagesCompound Financial InstrumentsLoro AdrianNo ratings yet

- Bonds: An Introduction To Bond BasicsDocument12 pagesBonds: An Introduction To Bond BasicsvinodNo ratings yet

- Explain How To Account For Cash Dividends, Stock Dividends, and Stock SplitsDocument16 pagesExplain How To Account For Cash Dividends, Stock Dividends, and Stock SplitsMohamed ZizoNo ratings yet

- MK Share Genius Back TestingDocument4 pagesMK Share Genius Back Testingyash MunotNo ratings yet

- 2 DDMDocument5 pages2 DDMSilvani Margaretha SimangunsongNo ratings yet

- Trading in SecuritiesDocument16 pagesTrading in SecuritiesUmar SulemanNo ratings yet

- JMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesDocument6 pagesJMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesSagar PatelNo ratings yet

- Kondratieff Comeback Modified Volume-Price Trend Bear Market Survival Kit Interview Product Review Traders' ResourceDocument100 pagesKondratieff Comeback Modified Volume-Price Trend Bear Market Survival Kit Interview Product Review Traders' Resourcepinokio504100% (1)

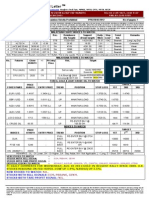

- FD Schedule & QBDocument6 pagesFD Schedule & QBDrDhananjhay GangineniNo ratings yet

- Red Herring ProspectusDocument414 pagesRed Herring ProspectusTejesh GoudNo ratings yet

- Merge (1) - Converted - by - AbcdpdfDocument105 pagesMerge (1) - Converted - by - AbcdpdfAnkita RanaNo ratings yet

- Sriram Insight Financial ProjectDocument99 pagesSriram Insight Financial ProjectVinay Bhandari100% (1)

- Financial EngineeringDocument18 pagesFinancial Engineeringtanay-mehta-3589100% (1)

- Reading 56 Option Replication Using Put-Call ParityDocument6 pagesReading 56 Option Replication Using Put-Call ParityNeerajNo ratings yet

- Auditing Problems: RequiredDocument2 pagesAuditing Problems: RequiredvhhhNo ratings yet

- 7 Introduction To Binomial TreesDocument25 pages7 Introduction To Binomial TreesDragosCavescuNo ratings yet

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongNo ratings yet

- Digitalization of IPOs Is The Best Possible Approach To Transparency in Indian Capital Market - An OverviewDocument9 pagesDigitalization of IPOs Is The Best Possible Approach To Transparency in Indian Capital Market - An OverviewMOHININo ratings yet

- National Stock ExchangeDocument18 pagesNational Stock Exchangeramesh_thorveNo ratings yet

- Module in Financial Management - 06Document11 pagesModule in Financial Management - 06Karla Mae GammadNo ratings yet

- Module 4-Capital MarketsDocument44 pagesModule 4-Capital MarketsDrNisa SNo ratings yet

- Ayala Corp: Terms and Conditions of Preferred Share OfferDocument17 pagesAyala Corp: Terms and Conditions of Preferred Share OfferBusinessWorldNo ratings yet

- (AXA Investment) Why The Implied Correlation of Dispersion Has To Be Higher Than The Correlation Swap StrikeDocument4 pages(AXA Investment) Why The Implied Correlation of Dispersion Has To Be Higher Than The Correlation Swap StrikeShikhar SharmaNo ratings yet

Question 1 (2010)

Question 1 (2010)

Uploaded by

Avinash SbscOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 1 (2010)

Question 1 (2010)

Uploaded by

Avinash SbscCopyright:

Available Formats

Question 1 (2010)

XYZ’s stock is a non-dividend paying stock trading at Rs100 on SEMDEX today. In one month’s time, XYZ’s stock price can either

increase of decrease and the market volatility of XYZ’s stock prices is known to be 15%. Furthermore, the interest rate on

savings account is quoted as 5% continuously compounded per annum.

(i) Show that the probability of an upward tick in XYZ’s stock price is 0.5374 under the risk neutral pricing of a Binomial model.

[6 marks]

(ii) Construct a Binomial tree to show the evolution of the XYZ’s stock prices over the next two months. [3 marks]

(iii) Calculate the option prices for a European put option on XYZ’s stock and an American put option on the same underlying

stock if both financial contracts have the same strike price of Rs100 and a maturity of two months.

[4 + 3 marks]

(iv)Explain the difference in the values of the above two options. [3 marks]

(v) What must be the value of an American call option on XYZ’s stock? The answer must be given without using the Binomial

model again to calculate the

American call option’s value and you should clearly outline the reasoning used. [4 marks]

(vi)Discuss what will happen to the Binomial option pricing model if the volatility of XYZ’s stock prices was zero. [2 marks]

[Total: 25 marks]

Question 2

A bond is available in financial markets, it offers an annual coupon of 5%, it possesses a maturity of two years and has a nominal

value of Rs100. It is assumed that the coupons are continuously compounded at a yield to maturity of 4%.

(i) Calculate the actual price and duration of the bond; without using the exponential touch available in your calculators. Specify

the answer to 3 decimal places. [7 marks]

(ii) If the yield to maturity increases by 0.01%, estimate the new price of the bond by using Taylor approximation of order 1.

[3 marks]

(iii) If the yield to maturity increases by 1%, estimate the new price of the bond by using Taylor approximation of order 1.

[2 marks]

(iv) Explain whether the estimates obtained in parts (ii) and (iii) are good estimations of the new bond price. Detail. [3 marks]

[Total: 15 marks]

Question 3

An individual wants to set up a portfolio with assets 1 and 2. The risk and return characteristics of the two assets are given in

the table below:

Asset Expected Return/% Standard Deviation/% Covariance of Asset 1 and Asset 2

1 10 10

2 13 30 -0.0150

(i) Determine the weights of the two assets (1 & 2) that will minimize the variance of the portfolio. Use matrix representation

and apply Cramer’s rule, to find the weights. [10 marks]

The individual decides to invest in a third asset (asset 3), which has an expected return of 11% and standard deviation of 15%.

The covariance between assets 1 and 3 is equal to 0.0075 and the covariance between assets 2 and 3 is equal to -0.0225.

(ii) Calculate the weights of assets 1, 2 and 3 in a minimum variance portfolio. [14 marks]

(iii) Draw the efficient frontier curve for the minimum variance portfolio in part (ii) above. [6 marks]

[Total marks 30]

You might also like

- TRADING COURSE'sDocument51 pagesTRADING COURSE'sDHAVAL29% (7)

- Institute and Faculty of Actuaries: Subject CM2A - Financial Engineering and Loss Reserving Core PrinciplesDocument8 pagesInstitute and Faculty of Actuaries: Subject CM2A - Financial Engineering and Loss Reserving Core PrinciplesANo ratings yet

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadFrom EverandAdaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadRating: 5 out of 5 stars5/5 (2)

- CM2A September23 EXAM Clean ProofDocument7 pagesCM2A September23 EXAM Clean ProofVishva ThombareNo ratings yet

- CM2ADocument4 pagesCM2AMike KanyataNo ratings yet

- IandF CT8 201604 ExamDocument7 pagesIandF CT8 201604 ExamKa Wing HoNo ratings yet

- Ilovepdf Merged 6Document131 pagesIlovepdf Merged 6Dani ShaNo ratings yet

- FM423 - 2020 ExamDocument7 pagesFM423 - 2020 ExamSimon GalvizNo ratings yet

- IandF CT8 201109 Exam FINADocument7 pagesIandF CT8 201109 Exam FINAmuskan jainNo ratings yet

- SMM148 Theory of Finance Questions Jan 2020Document5 pagesSMM148 Theory of Finance Questions Jan 2020minh daoNo ratings yet

- Acf1002 1 2006 2Document6 pagesAcf1002 1 2006 2sandhyamohunNo ratings yet

- Ac.f215 Exam 2018-2019 PDFDocument6 pagesAc.f215 Exam 2018-2019 PDFWilliam NogueraNo ratings yet

- IandF CM2A 202009 ExamPaperDocument8 pagesIandF CM2A 202009 ExamPaperANo ratings yet

- PP Invt&sec 2018Document5 pagesPP Invt&sec 2018Revatee HurilNo ratings yet

- FIE400E 2018 SpringDocument9 pagesFIE400E 2018 SpringSander Von Porat BaugeNo ratings yet

- Training ExercisesDocument4 pagesTraining ExercisesnyNo ratings yet

- Institute and Faculty of Actuaries: Subject CT8 - Financial Economics Core TechnicalDocument7 pagesInstitute and Faculty of Actuaries: Subject CT8 - Financial Economics Core TechnicalRishabh AgarwalNo ratings yet

- CM2 A Question - 20021141Document6 pagesCM2 A Question - 20021141K DNo ratings yet

- Econf412 Finf313 Compre QDocument3 pagesEconf412 Finf313 Compre Qbits.goa2027No ratings yet

- IandF CT6 201709 ExamDocument7 pagesIandF CT6 201709 ExamUrvi purohitNo ratings yet

- Theory of Finance Questions Jan 2019Document5 pagesTheory of Finance Questions Jan 2019minh daoNo ratings yet

- CM21 Finance 2 Mock Final ExamDocument9 pagesCM21 Finance 2 Mock Final Examkoala.jacyNo ratings yet

- CFI5104201205 Investment AnalysisDocument7 pagesCFI5104201205 Investment AnalysisNelson MrewaNo ratings yet

- Problem Set 5 Financial Management - Financial AnalysisDocument4 pagesProblem Set 5 Financial Management - Financial AnalysisValentin IsNo ratings yet

- 2019 ZaDocument5 pages2019 ZaChandani FernandoNo ratings yet

- CT8 Iai QP 1009Document5 pagesCT8 Iai QP 1009Mike KanyataNo ratings yet

- FM413 Sample ExamDocument5 pagesFM413 Sample ExamTerry Jieyu ZhangNo ratings yet

- Sample Final UPF Financial Econ 22-23Document6 pagesSample Final UPF Financial Econ 22-23Cristina TortesNo ratings yet

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- Midterm ExamDocument7 pagesMidterm ExamkidhafNo ratings yet

- First Midterm Exam: Econ 435 - Financial EconomicsDocument14 pagesFirst Midterm Exam: Econ 435 - Financial EconomicsWill MillerNo ratings yet

- FM423 Practice Exam IIIDocument7 pagesFM423 Practice Exam IIIruonanNo ratings yet

- Chheev JJJDocument16 pagesChheev JJJrahulNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsdasNo ratings yet

- CT6 QP 0416Document6 pagesCT6 QP 0416Shubham JainNo ratings yet

- st62005-2009 0Document263 pagesst62005-2009 0chan chadoNo ratings yet

- Actuarial CT8 Financial Economics Sample Paper 2011 by ActuarialAnswersDocument8 pagesActuarial CT8 Financial Economics Sample Paper 2011 by ActuarialAnswersActuarialAnswersNo ratings yet

- Acts4130 14F A3qsDocument12 pagesActs4130 14F A3qsNurin FaqihahNo ratings yet

- Financial Mathematics 2018 ExamDocument5 pagesFinancial Mathematics 2018 ExamsamanNo ratings yet

- IandF CT6 201604 ExamDocument6 pagesIandF CT6 201604 ExamUrvi purohitNo ratings yet

- BCF 3202 - Financial Institutions and Markets - April 2021Document4 pagesBCF 3202 - Financial Institutions and Markets - April 2021dev hayaNo ratings yet

- Assignment FIN205 S2 - 2017Document4 pagesAssignment FIN205 S2 - 2017Japheth CapatiNo ratings yet

- CM2B - April23 - EXAM - Clean ProofDocument6 pagesCM2B - April23 - EXAM - Clean ProofmetineeklaNo ratings yet

- CM2ADocument5 pagesCM2ARahul IyerNo ratings yet

- ACTUARIES Statistical MethodsDocument21 pagesACTUARIES Statistical Methodsvg284No ratings yet

- CT 111Document6 pagesCT 111Urvi purohitNo ratings yet

- MSc- MA5121Document5 pagesMSc- MA5121Lahiru KariyawasamNo ratings yet

- ACCG329 Sample Exam PaperDocument25 pagesACCG329 Sample Exam PaperLinh Dieu NghiemNo ratings yet

- FE-Unit 1, 2 QuestionsDocument4 pagesFE-Unit 1, 2 Questionsarya.enactusdcacNo ratings yet

- BEE3032 2013 May ExamDocument5 pagesBEE3032 2013 May ExamMarius George CiubotariuNo ratings yet

- Add MathDocument20 pagesAdd MathSiti Nurfaizah Piei100% (1)

- ECON1095 Assignment 1 Sem 2 2018 1 82122208Document3 pagesECON1095 Assignment 1 Sem 2 2018 1 82122208iNeel0% (1)

- FandI CT6 200509 Exampaper PDFDocument6 pagesFandI CT6 200509 Exampaper PDFUrvi purohitNo ratings yet

- Progress Test QMDocument5 pagesProgress Test QMAzizNo ratings yet

- Examinations: Advanced Certificate in Derivatives: Further Mathematics, Principles and PracticeDocument5 pagesExaminations: Advanced Certificate in Derivatives: Further Mathematics, Principles and Practicedickson phiriNo ratings yet

- ISC Sample Question Paper Economics Class 12Document2 pagesISC Sample Question Paper Economics Class 12manojkv3146No ratings yet

- QF 2 PP 2015Document9 pagesQF 2 PP 2015Revatee HurilNo ratings yet

- Binomial Model and Arrow SecuritiesDocument8 pagesBinomial Model and Arrow SecuritiesAlbert WangNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument4 pagesInstitute of Actuaries of India: ExaminationsRochak JainNo ratings yet

- Strategic Risk Management: Designing Portfolios and Managing RiskFrom EverandStrategic Risk Management: Designing Portfolios and Managing RiskNo ratings yet

- Research ProposalDocument3 pagesResearch ProposalAvinash SbscNo ratings yet

- A Manufacturing Company Uses 25Document1 pageA Manufacturing Company Uses 25Avinash SbscNo ratings yet

- Chapter 1 TutorialsDocument1 pageChapter 1 TutorialsAvinash SbscNo ratings yet

- Interpretation of StatutesDocument7 pagesInterpretation of StatutesAvinash SbscNo ratings yet

- Classification of LawDocument3 pagesClassification of LawAvinash SbscNo ratings yet

- Swaps: Problem 7.1Document4 pagesSwaps: Problem 7.1Hana LeeNo ratings yet

- Stock Market Made EasyDocument16 pagesStock Market Made EasyChellapandiNo ratings yet

- Prospectus of A CompanyDocument31 pagesProspectus of A CompanyJaiminBarotNo ratings yet

- Financial Derivatives (Finance Specialization) (2019 Admission) 2022 MarchDocument6 pagesFinancial Derivatives (Finance Specialization) (2019 Admission) 2022 MarchkcashiquaNo ratings yet

- Chapter 1Document19 pagesChapter 1chaman_shresthaNo ratings yet

- (Exercise) WaccDocument3 pages(Exercise) Waccclary frayNo ratings yet

- Compound Financial InstrumentsDocument12 pagesCompound Financial InstrumentsLoro AdrianNo ratings yet

- Bonds: An Introduction To Bond BasicsDocument12 pagesBonds: An Introduction To Bond BasicsvinodNo ratings yet

- Explain How To Account For Cash Dividends, Stock Dividends, and Stock SplitsDocument16 pagesExplain How To Account For Cash Dividends, Stock Dividends, and Stock SplitsMohamed ZizoNo ratings yet

- MK Share Genius Back TestingDocument4 pagesMK Share Genius Back Testingyash MunotNo ratings yet

- 2 DDMDocument5 pages2 DDMSilvani Margaretha SimangunsongNo ratings yet

- Trading in SecuritiesDocument16 pagesTrading in SecuritiesUmar SulemanNo ratings yet

- JMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesDocument6 pagesJMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesSagar PatelNo ratings yet

- Kondratieff Comeback Modified Volume-Price Trend Bear Market Survival Kit Interview Product Review Traders' ResourceDocument100 pagesKondratieff Comeback Modified Volume-Price Trend Bear Market Survival Kit Interview Product Review Traders' Resourcepinokio504100% (1)

- FD Schedule & QBDocument6 pagesFD Schedule & QBDrDhananjhay GangineniNo ratings yet

- Red Herring ProspectusDocument414 pagesRed Herring ProspectusTejesh GoudNo ratings yet

- Merge (1) - Converted - by - AbcdpdfDocument105 pagesMerge (1) - Converted - by - AbcdpdfAnkita RanaNo ratings yet

- Sriram Insight Financial ProjectDocument99 pagesSriram Insight Financial ProjectVinay Bhandari100% (1)

- Financial EngineeringDocument18 pagesFinancial Engineeringtanay-mehta-3589100% (1)

- Reading 56 Option Replication Using Put-Call ParityDocument6 pagesReading 56 Option Replication Using Put-Call ParityNeerajNo ratings yet

- Auditing Problems: RequiredDocument2 pagesAuditing Problems: RequiredvhhhNo ratings yet

- 7 Introduction To Binomial TreesDocument25 pages7 Introduction To Binomial TreesDragosCavescuNo ratings yet

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongNo ratings yet

- Digitalization of IPOs Is The Best Possible Approach To Transparency in Indian Capital Market - An OverviewDocument9 pagesDigitalization of IPOs Is The Best Possible Approach To Transparency in Indian Capital Market - An OverviewMOHININo ratings yet

- National Stock ExchangeDocument18 pagesNational Stock Exchangeramesh_thorveNo ratings yet

- Module in Financial Management - 06Document11 pagesModule in Financial Management - 06Karla Mae GammadNo ratings yet

- Module 4-Capital MarketsDocument44 pagesModule 4-Capital MarketsDrNisa SNo ratings yet

- Ayala Corp: Terms and Conditions of Preferred Share OfferDocument17 pagesAyala Corp: Terms and Conditions of Preferred Share OfferBusinessWorldNo ratings yet

- (AXA Investment) Why The Implied Correlation of Dispersion Has To Be Higher Than The Correlation Swap StrikeDocument4 pages(AXA Investment) Why The Implied Correlation of Dispersion Has To Be Higher Than The Correlation Swap StrikeShikhar SharmaNo ratings yet