Professional Documents

Culture Documents

DR N Massa - HANDOUTS - Enterprise Int 2019

DR N Massa - HANDOUTS - Enterprise Int 2019

Uploaded by

KlausOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DR N Massa - HANDOUTS - Enterprise Int 2019

DR N Massa - HANDOUTS - Enterprise Int 2019

Uploaded by

KlausCopyright:

Available Formats

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

Go Global Programme Programme objectives

SME Internationalisation & Export Management

Session 4: Wednesday 13 February 2019, 4:00-7:30 ► Context: globalisation overview & internationalisation dynamics

► Remind ourselves of key international business fundamentals

Enterprise Internationalisation and reflect on their relevance to your respective circumstances

► Contextual considerations & management imperatives

► Revisit basic motivations & potential barriers to internationalisation

Dr Nathaniel P Massa ► Reflect on & discuss realities, challenges & opportunities faced

Department of Management

► Consider strategic perspectives and their implications

Faculty of Economics, Management and Accountancy on SME resources and operationalisation

University of Malta

► Share lived experiences & apply through interaction & case work

Community for Internationalisation and Enterprise Research

Adam Smith Business School

University of Glasgow

Enterprise Internationalisation – Dr N P Massa

3 4

Programme outline Increasingly dynamic environments

● Context: Globalisation drivers, trends & enterprise dynamics “The world is shrinking” Competition is becoming more intense

● SME internationalisation demographics & rationale

● Motives & barriers for SME internationalisation Globalisation and internationalisation are fast redefining the

● Internationalisation modes: ‘Stage’ models & three pathways rules of the market and contextual parameters

within which enterprises must operate

● Managing Internationalisation

● Internationalisation: Key knowledge types & sources

► Some key drivers:

● Are you ready to export? Some considerations

● Advances in ICT and computer technologies

● Towards strategising: Select tools & fundamentals

● Advances in transportation - mobility and accessibility

● Entry modes: Quo vadis? Where? … and how?

● Deeper regional integration

● Performance & quality

● Managerial implications & factors contributing to SME success Firms seek to develop & exploit core competencies by internationalising

● The family business: Some considerations … yet international markets present both opportunities and threats

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 1

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

5 6

Defining ‘Globalisation’? Globalisation of Markets

National markets merging into a global marketplace

“The process by which the Increasing global connectivity,

● Falling barriers to trade make it easier to sell internationally

experience of everyday life ... is integration and interdependence in

becoming standardised around economic, social, technological, ● Tastes and preferences converge onto a global norm

the world” cultural, political, and ecological ● Firms offering standardised products worldwide creating a world market

Encyclopedia Britannica spheres … increasingly binding people

more tightly into one global system

Yet … Difficulties arise from the globalisation of markets:

Scholars stress:

► Significant differences still exist among national markets

Convergence of patterns of consumption and production

► Country-specific marketing strategies often necessary

and a resulting homogenisation of culture

► Varied product mix required due to local tastes

A shift toward more integrated and interdependent world economy

Most global markets are NOT consumer markets.

❷

Two key components: ● The globalisation of markets

● The globalisation of production Most global markets are for industrial goods and

materials serving a universal need the world over

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

7 8

Globalisation of Production Globalisation of Production: Considerations

Outsourcing productive activities to different suppliers

Sourcing goods and services from locations around the world

results in creation of products that are global in nature

to take advantage of differences in cost or quality

of factors of production: ► Barriers to globalisation of production include:

● Formal and informal barriers to trade

Labour; Land; Capital ● Barriers to foreign direct investment

● Transportation costs

Historically production outsourcing primarily ● Issues associated with economic risk

confined to manufacturing enterprises ● Issues associated with political risk

► The emergence of global organisations:

Increasingly companies (inc SMEs) taking advantage Globalisation created need for institutions to help

of ICT and Internet advances, to outsource service manage, regulate and police the global marketplace

activities to low-cost providers in other nations E.g.: GATT … WTO IMF World Bank UN

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 2

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

10

Drivers of Globalisation: (1) Declining Barriers WTO: World Trade Outlook Indicator

► General international trade tariffs imposed ● World Trade Outlook Indicator signals further loss of momentum in

In 1920s and 30s many nations 2017/18 trade growth into Q4 … and 2019

created significant barriers to 1913 1950 1990 2010 WTO

simple avg

final bound

International trade and FDI

France 21 % 18 % 5.9 % 3.9% 3.9%

Germany 20 % 26 % 5.9 % 3.9% 3.9%

Post-WW II West set about Italy 18 % 25 % 5.9 % 3.9% 3.9%

removing barriers to free flow of Japan 30 % -- 5.3 % 2.3% 2.5 %

Source: WTO 2019

goods, services and capital Holland 5% 11 % 5.9 % 3.9% 3.9%

enshrined in GATT … WTO Sweden 20 % 9% 4.4 % 3.9% 3.9%

UK -- 23 % 5.9 % 3.9% 3.9%

► Implications: USA 44 % 14 % 4.8 % 3.2% 3.2%

30.8%

1) Production processes dispersed in different international locations to

drive down costs and increase product quality 9.1%

34.6%

2) Economies of nations becoming intertwined and dependent

7.1%

3) Rising trade key determinant in world becoming wealthier since 1950

10.4%

4) Domestic markets increasingly ‘under attack’ from foreign competitors!

*Non-Agri. Simp Avg fin bound WTO. 26 November 2018

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

11 12

Drivers of Globalisation: (2) Technological Change Trade flow maps: Merchandise exports

● Computers and telecommunications

High-power, low-cost computing

Digital convergence, increasingly mobile devices

Global communication and ICT

● Internet and World Wide Web

Internet / WWW becoming info backbone for global economy

Web-based transactions and service delivery

Diminishes location and size / resource constraints

● Transportation technology

Containerisation greatly reduced costs & transportation times

Jet aircraft: fast cargo movement & Low-cost person mobility

Enterprise Internationalisation – Dr N P Massa Source: WTO 2019 (data est 2017 / 2018) Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 3

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

13 14

Trade flow maps: Commercial services exports & imports Changing Trends in Global Economy: Exports

World ex ports 2 008 es t.

Current world exports (est 2017)

Germany China Rank Country Exports

9% 9% US$ Million

USA 11% 1 China 2,157,000

8%

OTHE R

10% 2 EU* 1,929,000

49% Japan

5% 8% = 3 USA 1,576,000

7% = 4 Germany 1,401,000

Franc e

5% 4% = 5 Japan 683,300

Canada Italy

3%

UK Rus s ia Netherlands 3% 3% = 6 S. Korea 577,400

3% 3% 3% = 7 France 545,800

8 N’Lands 526,400

● Total world exports: c. 19.3 trillion US$ [WF 2019, data est 2017] 9 Italy 499,100

2009 Global crisis: Collapse in global demand = biggest contraction -24% since WWII 10 H’Kong* 499,100

● EU (ext. trade only): 1,929,000 US$m [≈10%] [WF 2019, data est 2017] = 11 UK 436,500

2009 Global crisis: EU ext trade contracts -21% = 12 Canada 433,400

● Exports as % of world GDP: 132 Malta 2,627

Source: WF 2019

1980: 21%; 2000: 25%; 2005: 29%; 2008: 33%; 2016: 29% [World Bank / OECD 2018]

2009 Global crisis: World exports fell faster than world GDP: Exp % GDP 2008: 33%; 2009: 23% (↓ 10%)

● China’s share of exports almost trebled in 5 yrs between 2000-2005, & doubled in 2005-2010

Source: WTO 2019 (data est 2017 / 2018) Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

15 16

Malta: Latest export data (FY 2017: € 3,207 m) (NSO Feb 2018) Changing Nature of Multinational Enterprises

Bev & Crude

Exports (€m) Materials, 13.3

5,000.0 Tobacco, 38.6

, 0% Misc Transact Multi-national enterprise (MNE): Any business having

Animal & Veg Oils & Fats , 1% &

4,500.0

4,000.0 Misc Transact & Commodities

Semi-Manuf

Goods, 151.3

Commodities, productive activities in two or more countries.

0.8 , 0%

Crude Materials , 5% Animal & Veg

3,500.0

Bev & Tobacco Food, 245.4 , Oils & Fats, 0.0

3,000.0

Semi-Manuf Goods

8% , 0% Trends since 1960s: 1. Rise of non-US multinationals

2,500.0

Machin &

2,000.0 Food Misc Manuf Transp Equip,

2. Growth of mini-multinationals

1,500.0 Misc Manuf Articles Articles, 379.9 1,009.8 , 31%

, 12%

1,000.0 Chemicals

by Product

500.0 Fuels & Lube etc 1973 share of world’s 260 largest multinationals:

Chemicals,

0.0 Machin & Transp Equip

2011 2012 2013 2014 2015 2016 2017

383.1 , 12% Fuels & Lube US = 48.5%; UK = 18.8%; Japan = 3.5%

etc, 985.2 ,

31%

Germany, Italy, 256.9, 8%

by Region Caribbean Is, by Country France, 231.3,

3.3, 0% EU 39% 398.0, 12%

7%

2002 share of world’s 100 largest multinationals:

S America, 8.4, USA, 128.6, 4% US = 28%; France = 14%; Germany = 13%; UK = 12%

0% Ships & Air

Japan, 106.5,

Store, 532.6,

Aust & Oceania, 17%

3% (… how have things shaped since 2002 ?)

7.8, 0% Europe , Other , 1284.6, UK, 77.8, 3%

40%

Africa, 556.7,

17%

1334.9, 42%

Tunisia, 62.2, ► Also, given facilitation by technology, transportation

2% and regional integration, SMEs are increasingly active

Ships & Air Spain, 47.6, 2%

Asia, 594.4, Stores, 532.6, in international business

N & Cent Am, 19% 17% S Korea, 43.8, € million

169.4, 5% China, 37.7, 1% 1%

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 4

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

17 18

Mapping world’s biggest* public companies Large global enterprises vis-à-vis National economies

Comparative ranking of world’s largest economic entities’ takings in US$ billions

Countries: Gross National Income (GNI); Companies: Revenue

Share of largest Cos

1. US 28.0% 1 United States 17,601 21 Norway 532 41 Samsung (S Korea) 305

2 China 10,097 22 Belgium 531 42 Singapore 302

2. China* 11.6%

3 Japan 5,339 23 Nigeria 526 43 Israel 290

3. Japan 11.4% 4 Germany 3,854 24 Poland 520 44 Egypt, Arab Rep. 273

4. UK 4.4% 5 France 2,844 25 Walmart (US) 485 45 Vitol (Hol / Switz) 270

5. S Korea 3.4% 6 United Kingdom 2,801 26 Sinopec* (China) 455 46 Chile 265

6. H Kong* 2.9% 7 Brazil 2,375 27 China Petrol Corp* 428 47 Finland 265

7. France 2.8% 8 Italy 2,102 28 Austria 424 48 Pakistan 258

8. Germany 2.7% 9 India 2,028 29 Royal D Shell (UK, NL) 421 49 Kuwait Petrol* 252

10 Russian Fed 1,931 30 United Arab Emirates 405 50 Volkswagen (Ger) 245

11 Canada 1,835 31 ExxonMobil (US) 394 51 Apple Inc. (US) 233

Top 10 Cos 12 Australia 1,516 32 Thailand 392 52 Toyota (Jap) 227

1. ICBC (Bank, China) 13 Spain 1,366 33 Colombia 381 53 Iraq 226

2. Construction Bank (Bank, China) 14 Korea, Rep. 1,366 34 Saudi Aramco* (Saud) 378 54 Portugal 222

3. JP Morgan Chase (Bank, US) 15 Mexico 1,238 35 South Africa 367 55 Glencore (Switz) 221

4. Berkshire Hatha (Finance, US) 16 Indonesia 924 36 BP (UK) 359 56 Ireland 215

5. Agri Bank China (Bank, China)

17 Netherlands 875 37 Philippines 347 57 Algeria 214

6. Bank of America (Bank, US)

18 Turkey 822 38 Denmark 346 58 Total (France) 212

7. Wells Fargo (Bank, US)

19 Sweden 597 39 State Grid* (China) 333 59 Kazakhstan 205

8. Apple (Tech, US)

20 Argentina 579 40 Malaysia 333 60 Qatar 200

9. Bank of China (Bank, China)

*’biggest’ measured via a composite of: 10. Ping An (Insure, China) Massa 2016. Compiled from various sources: World Bank 2016 (Country GNI data latest available, mostly FY 2014/15); Company revenue data

Source: Forbes 2019.

● revenues, ● profits, ● assets, ● market value (respective sites inc Statista 2016 and Wikipedia, mostly FY 2014/2015)

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

19 20

Whence the ‘Davids’? SMEs EU SME internationalisation: Broad snapshot

Internationally-active SMEs (import and / or export) tend to achieve higher

► c 24m SMEs (99.8%) Employ: 66.4% Value added: 56.8% turnover and employment growth (EC reports)

● At c.30%, imports most prevalent form of internationalisation

► c 29k SMEs (99.8%) Employ: 80.9% Value added: 81% (EC 2018)

● Often inward internationalisation leads to exports & new int’l opportunities

● “only 25% of EU-based SMEs export at all … much less outside EU” (c.7%)

“ Many SMEs in EU still struggle to internationalise – even with open, fair

trade frameworks in place” (EU SBA 2016)

− Internationalised SMEs engage more frequently in cooperation

− Small countries / domestic markets have more internationalised SMEs

− Size matters: Larger SMEs tend to be more internationalised (in- & out-)

Source: EC 2019 (SBA factsheet 2018)

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 5

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

21 22

EU SME internationalisation: Demographics EU SME Internationalisation: By sector (direct export / FDI)

− Export & import activities increase in intensity with enterprise age

− SMEs involved in e-commerce more internationally-active

− Awareness of agency support among SMEs is low

− Sectors most internationalised: ● Manufacturing, ● Wholesale trade

● Research (s), ● Comp & ICT (s)

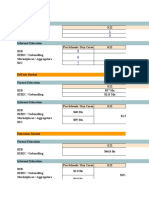

►Modes of internationalisation, % of SMEs ► % of SMEs with direct exports and / or imports

MT: 74%

MT: 30%

● SMEs with Tech. Coop /

Subcontracting / FDI % of SMEs with FDI, tech cooperation and/or

EU Avg: 17%. Malta: 24% % of SMEs with direct export by sector

foreign subcontractor relationships by sector

●

Source: EC 2014 data from EC 2010

Enterprise Internationalisation – Dr N P Massa Source: Latest EC data sourced from 2010 survey Enterprise Internationalisation – Dr N P Massa

23 24

EU SME internationalisation: Policy initiatives - sowing & reaping? Malta SMEs: Single market & Internationalisation

EU SBA Policy measures Internationalisation

for SME internationalisation

Enterprise Internationalisation – Dr N P Massa Source: EC 2019, latest available relevant* data from Malta SBA Factsheet (2018) Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 6

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

25 26

Time to Cost to Time to Cost to

Ease of Ease of Trade Trade

Doing Doing across across

Business Business Boarders Boarders

export: export: export: export:

Boarder Border Document Document Ease of Doing Business Globalisation & Internationalisation: Strategic considerations

compliance compliance compliance compliance

DB 2018 DB 2019 Score Rank

(Hrs) (US$) (Hrs) (US$)

Belgium 100 100 100.00 1 0 0 1 0

Denmark 100 100 100.00 1 0 0 1 0

France 100 100 100.00 1 0 0 1 0 Globalisation: In industrial sectors most SMEs face increasing competition

Italy 100 100 100.00 1 0 0 1 0

Netherlands

Romania

100

100

100 100.00

100 100.00

1

1

0

0

0

0

1

1

0

0

Strategic response required (whether SME is domestically focussed or committed to int’l)

Slovenia 100 100 100.00 1 0 0 1 0

Spain 100 100 100.00 1 0 0 1 0

Estonia 99.92 99.92 99.92 17 2 0 1 0 - Danger SMEs will increasingly have only limited competitive power

Lithuania 97.7 97.83 97.83 19 7 58 3 28

Latvia 95.26 95.26 95.26 26 24 150 2 35

Hong Kong* 95.04 95.04 95.04 27 1 0 1 12 - Forced into secondary roles rather than leading value chain positions

Source: World Bank (2018). Doing Business Project

United Kingdom 93.76 93.76 93.76 30 24 280 4 25

Greece 93.72 93.72 93.72 31 24 300 1 30

United States 92.01 92.01 92.01 36 1.5 175 1.5 60 - Trends risk eroding SMEs’ profit potential to minimum levels

Switzerland 91.79 91.79 91.79 39 1 201 2 75

Germany 91.77 91.77 91.77 40 36 345 1 45

Malta 91.01 91.01 91.01 41 24 325 3 25

Turkey

Georgia

86.73

90.03

90.27

90.03

90.27

90.03

42

43

16

6

358

112

4

2

55

0

To face these challenges SMEs must pay attention to:

Singapore 89.57 89.57 89.57 45 10 335 2 37

Cyprus 88.44 88.44 88.44 49 18 300 2 50 ► Global difference in production & cost conditions exploited more effectively

Canada 88.36 88.36 88.36 50 2 167 1 156

Ireland 87.25 87.25 87.25 52 24 305 1 75

Iceland 86.71 86.71 86.71 53 36 365 2 40 ► Innovative capability & ability to develop and absorb new technology

Japan 86.51 86.51 86.51 56 22.6 264.9 2.4 54

China 69.91 82.59 82.59 65 25.9 314 8.6 73.6

India 58.56 77.46 77.46 80 66.2 251.6 14.5 77.7 ► Knowledge of the market + networking & alliance resources

Russian Federation 70.2 71.06 71.06 99 66 580 25.4 92

Tunisia 70.5 70.5 70.50 101 50 469 3 200

Brazil 63 69.85 69.85 106 49 862 12 226.4 ► Access to capital

Barbados 61.88 61.88 61.88 132 41 350 54 109

South Africa 59.73 59.64 59.64 143 92 1257 68 55

Saudi Arabia 49.59 54.31 54.31 158 50 363 60 105

► Awareness of dominating statuses in corporate hierarchies

Afghanistan 30.63 30.63 30.63 177 48 453 228 344

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

27 28

Some typical SME characteristics (yet to different extents!) Why Export?

SMEs typically characterised by:

● Absence of standardisation, ● Lack of formality in working relationships,

● Flat organisational structure (staff development likely limited)

1 Achieve levels of growth not

possible domestically 6 Increase returns on

investments in R&D,

expansion, management

Organisation: Employees very close to entrepreneur / owner-manager.

Easily influenced. Owner’s aura. Intimacy & immediacy.

2 Increase resilience of

revenues and profits

7 Improve financial performance

Improve your productivity

3 Spread business risk

Risk taking: Can occur where enterprise survival threatened, or where major

competition undermining SME’s activities

4 Achieve economies of scale

not possible domestically

8 Gain knowledge, elevate your

product enhance opportunities

Risk compounded by limited experience or foreign market info in

decision making, also liabilities of ‘smallness’ in resources

5 Increase commercial lifespan

of your products & services

9 Elevate your profile &

international recognition

Flexibility: Direct communication & intimacy with customer / client & org.

helps SMEs react faster & more flexibly to customers’ needs

Leverage a skill or capability

10 Survive …

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 7

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

29 30

Should SMEs go international? Select broad EU indicators Why do SMEs internationalise?

Internationalisation can result in competitive gains for SMEs SME internationalisation (esp initially)

often … ultimately depends on the owner-manager,

From macro perspective this can contribute to

improved national socio-economic performance as well as … idiosyncratic circumstances (int / ext) … and … happenstance!

► Higher turnover growth

>50% SMEs with foreign investment or international SME objectives generally derive from managerial or firm-based perspectives

subcontracting reported increased turnover (other SMEs 33%)

► Higher employment growth ● Primary motivation: often to grow & survive, and improve competitiveness

10% for SMEs importing and exporting (other SMEs 3%)

Mainly based on market dynamics and costs in relation to firm capabilities

► Enhances innovation

26% of int’l-active SMEs launched new products in their country sector

(other SMEs 8%). Also more successful with new process innovations ● Others also argue that a firm’s objectives is to maximise profits

► Enhanced competitiveness

Int’l-active SMEs considered themselves more competitive as a result – increasing with Internationalisation can be a way to realise these objectives

commitment (Inward only: 53%, Export only: 56%, Subsidiary & multimode: 69%)

Source: EC 2004, 2010, 2014 Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

31 32

Why do SMEs internationalise? Some key motives SME Internationalisation: Internal & External perspectives

● Growth motives Some key internal stimuli: Some key external stimuli:

Possibilities for increased sales, revenues – profits and profitability

● Decision-maker’s characteristics ● Unsolicited orders

See also associated economies of scale (push / pull) & also domestic market size (push)

● Excess capacity ● A saturated domestic market

● Knowledge associated motives ● A unique product

Leveraging knowledge assets & expertise (push); Search for knowledge assets, ● Recession

know-how gaps, technology, keep lead in product / tech development ● Strategic advantage, e.g.. tech adv

● Better opportunities for rents

● Marketing advantage

● Network / social ties & supply chain links

Importance of soft assets: social / network capital … foreign suppliers, emigres Broadly 5 stimuli: All stimuli moderated by

1. Opportunity decision-maker’s perception

of risks, potential and costs

● Domestic market drivers 2. Environmental change

Stagnant domestic sales / market / small size, high production & labour costs, 3. Internal change Same factors may encourage /

discourage owner-manager

economic circumstance, local image & reputation, strict laws & regulations 4. Performance depending on situation & circumstance

5. Learning Source: Calof & Beamish

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 8

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

33 34

Internationalisation: Drivers & motives (EU perspectives) EU “SMEs” perception: Internal internationalisation barriers

Imp. of internal barrier

avg. score, by SME size

1 – not important

5 – very important

Source: EC 2004. Internationalisation of SMEs

Enterprise Internationalisation – Dr N P Massa Source: Latest EC data sourced from 2010 survey Enterprise Internationalisation – Dr N P Massa

35 36

EU “SMEs” perception: External internationalisation barriers Internal impediments to internationalisation

● Human resources constraints

- HR & managerial capacity

− Lack of managerial skills - Lack of entre’ / int’l orientation [?]

- Lack of strategic plans for internationalisation

− Staff qualifications & numbers - Experience & knowledge: Market / Int’l /

Prod & Tech / Network / Cultural / Entre’

− Time and knowledge

Costs of internationalisation:

- Doing market analysis

● Financial constraints - Buying legal consulting services

- Document translation

− Shortages in capital - Product adaptation

− Access to loans & finance - Compliance costs

- Travel expenses

% of SMEs identifying - Higher business / financial risk

barrier as ‘Important’ ● Limited / asymmetric information

- Market intelligence

− foreign markets - Tax regulations

− foreign rules and regulations - etc. …

Source: Latest EC data sourced from 2010 survey Enterprise Internationalisation – Dr N P Massa Source: Consolidated from EC (2014) Challenges & Opportunities for EU exporting SMEs Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 9

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

37 38

External domestic impediments Internationalisation Barriers ranked by Internationalisation Barriers ranked by

SMEs Member economies (policy makers)

1 Working capital shortage to finance exports Inadequate quantity of and / or untrained

● Domestic policies and admin practice & support

personnel for internationalisation

− Access to finance − Export insurance 2 Identifying foreign business opportunities Working capital shortage to finance exports

− Transparency & efficient admin to facilitate internationalisation 3 Limited info to locate / analyse markets Limited info to locate / analyse markets

4 Inability to contact potential overseas Identifying foreign business opportunities

customers

● Trade & investment-specific barriers 5 Obtaining reliable foreign representation Lack of managerial time to deal with

internationalisation

− Non-Tariff measures (NTMs) affect SMEs disproportionately

6 Lack of managerial time to deal with Inability to contact potential overseas

− Complex customs procedures internationalisation customers

7 Inadequate quantity of and / or untrained Developing new products for foreign markets

− Export controls

personnel for internationalisation

− Lack of IPR enforcement 8 Difficulty in matching competitors' prices Unfamiliar foreign business practices

− Lack of transparency re trade rules & other local / domestic regulations 9 Lack of home govt assistance / incentives Unfamiliar exporting procedures / paperwork

10 Excessive transportation costs Meeting export product quality / standards /

− Exchange rate fluctuations

specifications

Source: Consolidated from EC (2014) Challenges & Opportunities for EU exporting SMEs Source: OECD 2007. Top barriers and drivers to SME internationalisation. OECD & APEC survey

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

39 40

All ‘barriers’? How’s your ‘proverbial glass’ & stance? Globalisation & Internationalisation: SME modes & dynamics

Key stimuli motivating & assisting SMEs to overcome obstacles include: Traditionally, internationalisation = opportunity to increase sales (usually exports)

► Entrepreneurial vision / experience ► International strategy Globalisation intensified competition. SMEs realising internationalisation

► Firm / personal networks ► External assistance crucial for competitiveness … and in instances survival.

Hutchinson et al 2006

Export still very important traditional SME route for internationalisation …

Yet … increasingly, emphasis is on softer, hard-to-pin underlying … yet increasingly SMEs strategically engaging in other modes, e.g.:

factors critically influencing SME internationalisation behaviour: ● International partnerships, alliances & JVs

“it is important to note that the attitudes and motivations of decision ● Foreign investments

makers in SMEs determine the path and pace of internationalisation. ● Regional cross-border collaboration / clustering

… they need to be aware of the importance of issues such as their own

attitudes and motivations, timing, coherence, managed growth, ► Beyond financial transactions / physical product exchanges

keep in mind underlying social transactions & relational exchanges

business networks and learning in the internationalisation process.

In fact, managers need to be aware that the mental models they have ► Knowledge & technology transfer … enhance SMEs’

could be their main barriers to internationalisation.” Chetty and Campbell-Hunt 2003 competitiveness & international business strategies

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 10

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

41 42

Internationalisation process: Stage models Managing internationalisation

Based on managerial learning & I-Model (Innovation) Frequently mentioned problems:

accrued experience. Incremental I-Model (Innovation)

1. Domestic marketing

1. Domestic

Exclusive marketing

domestic focus. Not willing / ● Lack of explicit internationalisation strategy (esp initial phases)

Exclusive

capable todomestic focus. orders

Not willing / [0%]

U-Model (Uppsala) Commitment

handle export

capable to handle export orders [0%]

[EU 2004, 2010, Massa 2011]

U-Model (Uppsala)

Risk

1. ● Lack of know-how on: ► international activities

1. No

No regular

regular exports

exports Control

2. Pre-export

2. Pre-export

Interest.Seeks

Seeksinfo

info/ /feasibility

feasibility [0%]

2.

Interest. [0%] ► identification of partners / collaborators / contacts

2. Export

Export via

via independent

independent rep

rep Learning

Profit potential 3.

3. Experimental

Experimental involvement

involvement ► assessing market potential

3. Est foreign sales subsidiary Starts

Startslimited

limited exports,

exports,intermittent.

intermittent. Physical

Physical /

cultural distance

/ cultural distancelimited

limited [0-9%]

[0-9%]

4. Overseas

4. Overseas prod

prod // manufacture

manufacture

These are problems or critical limitations

4.

4. Active

Active involvement

involvement

Systematic effort exports / diff. countries. relating to management … or, specifically the CEO / MD

Systematic

Org structureeffort exports

to support / diff. countries.

exports [10-39%]

Various entry modes beyond ‘export’: Org structure to support exports [10-39%]

● Strategic alliances ● Joint ventures 5. Committed involvement SME managers’ focus often on: technology, structure, marketing …

5. Committed

High foreign market involvement

dependence. Decisions

● Franchising ● Licensing allocate resources & dependence.

direct invest. Decisions

[ >40%]

… but less on strategy and planning in relation to internationalisation !!

High foreign market

● Networking ● Subcontracting allocate resources & direct invest. [ >40%]

Source: Johansson & Vahlne 1977, 1990; Cavusgil 1980 Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

43 44

Managing internationalisation Internationalisation: Importance of internal competencies & barriers

► SME managers considered these planning activities ‘very important’: Various forms of knowledge required, e.g.: ► Foreign market conditions

– Analysis of foreign market potential is very important (73%) ► Laws & regulations,

– Analysis of the competitive environment (68%)

– Analysis of the legal environment (58%) ► Cultural differences etc…

► Yet, what actually happened in reality was markedly different!! Competency development

Learning-by-doing Employ / engage experts

However: CEO / Mgt international experience can be of major importance

Mindset and experience of managers

Small firm owners’ commitment, persistence & internationalisation orientation

crucial for firm’s growth internationally: volition (Jones et 2005, Pauwels et 2009, Massa 2011)

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 11

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

45 46

SME internationalisation: Key knowledge types & focus Dynamic competitive realities: Strategic imperative for SMEs

Knowledge type Key characteristics and focus SMEs attempting to internationalise business operations face a paradox!

Market Experiential tacit: Market - firm & country specific. Capability. Entry-modes

Non-experiential explicit: Gen. knowledge transferrable to other markets SMEs usually best when:

International- Know-how. Procedural & experiential. Tacit & transferrable to other markets.

► Serving small number of customers who buy quality

isation Firm-specific. Capabilities, resources. Entry-mode processes

Product & Internal processes & modus operandi. Tacit know-how. Can also be explicit. ► Customers demanding frequent changes, customisation

Technology Firm-specific unique / diff advantage. Tech /production / service advantages. to specialised product and willing to pay premium

Enhances ‘internationalisability’

Network Tacit, broad, non-specific, experiential. Informal / formal, social / business

SMEs typically characterised by:

networks. Ext. knowledge source. Contacts, suppliers, fairs. Opportunity

qualities of entrepreneurship,

Cultural* Predominantly experiential, tacit. Also foreign institutional knowledge.

flexibility and product development …

Country / region specific. Language, habits, norms, laws, behavioural modus

operandi. Also integrated in experiential market knowledge. … motivated by: need to generate

Entrepreneurial* Experiential / tacit. Knowledge on existing opportunities, potential &

growth (and perhaps survive), and

exploiting them. Low intensity at ‘novice’ stage. to challenge existing markets & players

Source: Massa 2011. Palimpsest from theory & empirical observation Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

47 48

Are you ready to export? Key considerations Market research: Can you afford it? (Can you afford not to?!)

Is there a market

What’s at stake? … What’s at stake? …

for what we do? ► If you do unnecessary research: ► If you don’t do research

What changes

Where? Scalability

do I need to make?

Research. Is there − Research cost − Target wrong market

demand?

− Target non-existent market

− Wrong offering

Can I service it now? Do we have the Motivation − Wrong route to market

… and in the future? necessary competencies &

How? within the business? Ambition − Sub-optimal execution

− Missed opportunities

− Damage to reputation

Strategic

Does my business Do I − Damage to core business

International

have the have the business − Time and money resources

capacity to cope? capacity to cope? development plan

Outlay and cost estimations: UK Department of Trade and Investment consulting

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 12

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

49 50

Quo Vadis? Where? Overall country attractiveness: Basics

► EU member states (regions)

► Peripheral emerging regions

Benefits Costs

● Market characteristics

► Brazil, Russia, India, China ● Corruption

● Size of economy

● Lack of infrastructure

► Columbia, Indonesia, Vietnam, Egypt, Turkey, South Africa ● Likely economic growth

● Operational costs

● Network / opportunity

► Australia, Canada, USA & Commonwealth ● Legal costs

access

World Bank: ‘Ease of Doing Business’ (2018) ranking: Overall

country

attractiveness

Risks

● Political: Social unrest / Anti-business trends

● Economic: Economic status / mismanagement

● Legal: Failure to safeguard IPR / regulation , …

Source: World Bank 2018 – Doing Business database Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

51 52

Country costs: Corruption & bribery Entry modes Advantages / Benefits

Entry Mode Disadvantages / Challenges

Exporting Relatively fast & easy. Low cost , low High transport costs; Tariff / non-tariff trade

commitment. Flexible. Ability to barriers; Issues w local marketing agents. Limited

Corruption Perceptions Index: EU comparison realise location & experience curve market / network knowledge

economies + scale

Rank RankInternational Bribe Turnkey Ability to earn returns from process Creating efficient competitors; Lack of long-term

Rank Rank Corruption CPI

EU2018

CPI

Country Chg. 2011

EU

Country

CPI Payers Index

CPI Chg.

contracts technology skills in countries where market presence.

Perceptions Index FDI is restricted.

12 36 Slovenia

1 1

Rank Denmark 88

Country Rank Country59

2 3 Finland 85 13 38 Cyprus 59 Licencing / Low entry / develop costs & risks. Lack of control over technology / quality.

2

13

Denmark

Sweden 85

least 13

1 Netherlands

38 Czech Republic 59

Franchising Possibility of rapid expansion. Strong (L) Inability to realise location & experience

4 28 New Zealand

Netherlands 82 13 1 Switzerland

38 Lithuania 57 =

presence in foreign market via brand. economies. Inability to engage in (int’l) strategic

5 39 Fin/S’pore/Swed/Switz

Luxembourg 81 = 14 3 Belgium

41 Latvia 58 = Licensee knows local conditions. coordination. Control costs & limited income.

6 711 Norway

Germany 80 14 4 41 Germany

Spain 58

Alliances & Access to local partner’s knowledge & Finding right JV partner critical. Structuring

6 811 Netherlands

United Kingdom 80 15 4 51 Japan

Malta 54

7 14 Austria 16 53 Italy 52 Joint ventures limited resources / distribution. Share effective partnerships tricky. Lack of control

76

development costs & risks. Access to over technology / aspects. Limited ability to

8 170

17 Belgium

Libya / Burundi =

75 23 United Arab Emirates=

17 57 Slovakia 50

market. Client familiarity & politically engage in global strategic coordination. Inability

9 172

18 Estonia 73 18 60 Croatia 48

Afg/Guinea/Sudan 25 Indonesia acceptable. to realise full location & experience economies.

9 18 Ireland 73 19 61 Romania 47

176 N Korea / Yemen 26 Mexico

10 21 France 72 20 64 Hungary 46 Wholly owned Full control . Protect tech IPR. Develop Complex registration & time-consuming.

178 Syria / South Sudan 21 27 China

67 Greece 45

11 30 Portugal 64 subsidiaries new knowledge / capability. Realise High costs / investments and risks.

12 180

36 Somalia

Poland most

60 = 22 28 Russia

75 Bulgaria 42most

location & experience curve econ. High commitment & comparatively least flexible.

© 2019 Transparency International © 2012 International

Transparency Transparency International

© 2019

(FDI)

Ability to engage in global strategic

coordination. Minimise transact risk.

© Transparency International 2019, CPI (data for FY 2018)

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 13

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

53 54

Whence the support and access to knowledge? Towards strategy formulation

► Yourself! (your drive, experiential knowledge, contacts and social access) Internationalisation … also involves complexity & risk

Also seek exposure at first hand! Travel, observe, meet, talk to potential clients

► Your employees & potential new recruits & engaged professionals Risks play important part in formulating your international business strategy

► Your (foreign) suppliers Strategy should be clear, based on realistic options

► Business networks & peers (informal & formal / local & international)

Focus: When, how and which markets to enter, & with what product?

► Internet – vast source of information

► Agencies & public bodies: First: Establish preliminary idea how to proceed:

● Malta Enterprise / TradeMalta

1. Establish your motives for internationalisation (Why?)

● Chambers & Industry associations (inc. foreign)

2. Clearly define your company’s current situation (SWOT analysis)

● Embassies

3. Establish product(s) / service(s) to be internationalised (What?)

► Specialists and consultants

4. Select the right market(s) to penetrate (Where?)

► Universities, training and research centres

5. Decide on your mode of entry (How?)

► Banks, investment agencies & sources of finance

6. Establish right timing and moment to enter (When?)

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

56

Determinants of Enterprise Value Value Creation

The way to increase profitability is to create more value

Reduce Costs ► Amount of value firm creates is measured by difference between its

costs of production and the value consumers perceive in its products.

Profitability

Porter: 2 basic strategies for creating value and

Add Value & attaining a competitive advantage in an industry:

Raise Prices

Enterprise 1. Low-cost strategy suggests a firm has high profits when it

Valuation creates more value for its customers and does so at a lower cost

Sell More in

Existing Markets 2. Differentiation strategy focuses primarily on

increasing attractiveness of a product

Profit Growth

Enter New Superior profitability goes to firms that create superior value.

Markets The way to create superior value is to drive down costs and / or

differentiate the product so that customers are willing to pay a premium

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 14

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

57 58

Strategic Capability General / Macro environment Industry / Competitor Analysis

Internal evaluation Analysis (PEST) (Five Forces, Porter)

Value Creation

● Resources: “what we have” Target country variables for Variables for entry mode & strategy choice

entry mode & int’l strategy choice

Tangible: Threat of

- Financial - Physical New Entrants

Politico-

- Technological - Organisational Economic

Legal forces

Intangible: forces

Bargain. Rivalry Bargain.

- Managerial - Knowledge & IP power of among exist power of

- Innovation - Reputation & trust Suppliers competitors Buyers

- Networks - Quality perception Socio- Techno-

Cultural logical Threat of

● Competencies: “what we do well” forces forces Substitute Prod

Generic Strategies Directional Growth Strategies Four Basic International Strategies

(Porter) (Ansoff) (Global / MNE perspectives)

BROAD HIGH

CURRENT

Pressure: cost reduction

Cost Differenti

Market Product Global

Competitive Scope

leader ation Standardisation Transnational

Penetration Development

Superior value creation relative to rivals does NOT necessarily Strategy Strategy strategy strategy

Markets

require a firm to have lowest costs in the industry, or to

create most valuable product in consumers’ eyes.

Focus Strategy Market Divers- Localisation /

International Multi-domestic

Cost Focussed Development ification strategy

strategy

However, it requires the gap between value (V) and focus differentiation

cost of production (C) be greater than competitors’ gap. NARROW NEW LOW

Competitive Advantage Products / Services Pressure: local responsiveness

LOW COST UNIQUE EXISTING NEW LOW HIGH

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

59 60

General / Macro Environment: PEST analysis Industry / Competitor Environment: Five Force analysis

Threat of / to new entrants

► Politico-Legal forces ► Economic forces

● Barriers to entry (permissions, patents, rights);

● Political stability; ● Policy stability; ● GDP growth rates; ● Domestic demand; ● Capital requirements, ● Costs, ● Switching

● Rules & regulations for business ops; ● Income / saving patterns; ● Inflation rates; costs; ● Brand equity; ● Customer loyalty

● Antitrust & cartel laws; ● Unemployment rates; ● Exchange rates;

● Competition & consumer protection; ● Tax levels; ● Trade & investment incentives Supplier bargain. power Competitor Rivalry Buyer bargaining power

● Labour laws; ● Environmental laws; ● Customs duties; ● Production costs; ● Number of suppliers; ● Competition intensity; ● No of ● B2B / B2C; ● Consumer

● Indigenous business ‘protection’. ● Labour costs; ● HR pool; ● Various indices ● Diversity of offers; ● Supply competitors; ● Prod capacity profiles; ● Volume / value of

costs; ● Access to raw ● Efficiency / productivity; purchases; ● Consumer habits;

materials; ● Importance of ● Market share; ● Concentration; ● Buyer profits; ● Distribution

industry for suppliers ● Segments; ● Market access & channels; ● Retailer networks;

PEST analysis of international General Environment

distribution; ● Industry life cycle ● Warehousing

Target country factors for entry mode and international strategy choice considerations

► Socio-Cultural forces ► Technological forces Threat of substitute products

● Product / service differentiation; ● Emerging

● Lifestyle, general fashion / taste trends; ● ICT investment levels & infrastructure; substitute threats; ● Brand strength & lock-in;

● Business & work ethic; ● Level of educ.; ● General level of digitalisation & IT society;

● Labour productivity; ● Social mobility; ● General R&D investment levels;

Trends & broad industry characteristics

● Consumer disposition; ● Environ. Aware; ● Innovation & competitiveness indices;

● Market size & growth rate; ● Industry profitability; ● Operating costs; ● Scale Economies; ● Production tech;

● Attitude towards foreign products & Cos; ● Logistics and transportation-related; ● Capital expenditure; ● Innovation & expenditure R&D; ● Quality standards; ● Certification; ● Computerisation

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 15

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

61 62

Generic and Directional growth strategies (Porter & Ansoff) Consolidating: Business level competitive strategies

BROAD

Cost Differenti ► Generic strategies (Porter) COST

Competitive Scope

leader ation

Strategy Strategy ● Cost Leadership Strategy: Competing in industry by providing

products at price as low as or lower that competitors’.

LOW MEDIUM HIGH

● Differentiation Strategy: Competing with all others in industry by STANDARD PREMIUM PRICE

Focus Strategy offering products perceived as different or unique.

LOW

PRICE FOR

NO FRILLS

/ LOW VALUE

DIFFERENTIATION

Cost Focussed

focus differentiation ● Focus Strategy: Competing in a niche serving unique needs of LOW VALUE GOODS

NARROW certain customers

Competitive Advantage

LOW COST UNIQUE

STANDARD

MEDIUM

PREMIUM PRICE

CURRENT PRODUCT

FOR

► Directional growth strategies (Ansoff) LOW PRICE AT

STANDARD

Market Product STANDARD

GOODS

● Market Penetration Strategy: Seek growth in current markets with Penetration Development PRICE

Markets

current products

● Market Development Strategy: Seek new markets for current products DIFFERENTIATED PREMIUM PRICE

HIGH

Market Divers- VALUE FOR PRODUCT FOR

● Product Development Strategy: Develop and improve goods or ification

Development MONEY WITHOUT DIFFERENTIATED

services for current markets

PREMIUM PRICE GOODS

● Diversification Strategy: Completely new products developed or NEW

acquired for new markets Products / Services

EXISTINGInternationalisation – Dr N P NEW

Enterprise Massa Enterprise Internationalisation – Dr N P Massa

63 64

The strategic management process: A basic take Managing internationalisation: Considerations for success

MOST PEST analysis Leadership Key to successful

analysis Stakeholder analysis Structure

5-Forces analysis HR / Networks

internationalisation project:

KSFs Info & Control Sys

Analyse & ID CEO /

EXTERNAL ► Strategy, planning and

Opportunities

Owner- communication with

Internationalisation:

& Threats Where? When? What? How? Which? Who? MD employees and other

Develop Reassess Evaluate stakeholders

SWOT analysis Formulate Implement

Mission Mission & Control

Strategies Strategies

& Goals & Goals Results

Analyse & ID ► Important: A clear strategy

INTERNAL Other and timely, comprehensive and

International Mgt /

Strengths & Business Stake- honest communication

Weaknesses Employ

Functional holders

► Main goal: Achieve most

Resource analysis widespread acceptance and

MOST

Functional analysis support for internationalisation

analysis

Core competencies project

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 16

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

65 66

Organisational aspects to consider Performance

Structure No consensus on measuring internationalisation performance

● Formal divisions / units

● Decision-making Firm growth important dimension of

responsibility

● Coordination mechanisms

firm performance, especially for SMEs

Important to understand internationalisation’s

influence of on both growth & profitability

Processes People Incentives &

● How are decisions made? Not only the employees! Control

● How is work performed? Recruitment strategy? ● Performance metrics

Strategy formulation? Retention. Compensation ● Rewards Growth: ● Annual growth rate of sales ● Annual growth rate of total assets

Resource allocation? Skills / Values / Orientation

Profitability: ● Return on sales (ROS) ● Return on assets (ROA)

International.: ● % exports (value / volume) ● Ratio of foreign to total assets (FDI)

Culture

Norms & value systems

shared among employees ► Competitive advantage sustainability dependent on knowledge / capability / resources

► Internationalisation is a process of adaptation – strategic, gradual and incremental

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

67 68

Entry mode & performance: Export Entry mode & performance: FDI

Firm growth via sales increase 1st order effect on growth: Similarly, broadens SME’s customer base

Broadens consumer base by selling in new markets (directly or via agents) via new markets enabling larger production volumes and growth

2nd order effect on growth: Knowledge & capability development (beyond how to sell /

Higher sales can provide higher production volume & production capacity market in countries), via local operations inc. scientific & technological skills &

expansion. Growth via broadening markets & creating room for expansion Knowledge – enhancing competitiveness and sustainable firm growth

Also: scale economies, asset utilisation, labour & management efficiency (experience ► Location advantages: ● Production costs , ● Talent access, ● Market proximity

curve) as result of increased sales volume ( rate of profit growth + profitability)

► Especially effective where SME’s competitive advantage based on proprietary assets

Diverse international markets lead to advantages in FDI can mitigate cases where:

market power & revenue diversification

● Product volume / value ratio result in excessive transport costs

● Import tariff & non-tariff regimes in host country are considerable

Indirectly: International market exposure contributes to profitability & growth:

● Greater control & market response mitigating distributor / agent opportunism

Opportunities to develop new knowledge and capabilities for

more international expansion & new opportunities (stepping stones) [Source: E.g. Lu & Beamish etc…] ● Offsets ‘liabilities of foreignness’ [Source: E.g. Lu & Beamish etc…]

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 17

Enterprise Internationalisation: Context & Management Imperatives (Dr N P Massa) 13 February 2019

69 70

Quality: Fundamental importance Managerial implications

Fundamentals: ► Actively & directly establish international networks. Leverage contacts for

knowledge acquisition, collaboration, opportunity recognition & access

● Poor Q is unacceptable

► Actively & strategically explore ICT / web / social media full potential

Lower costs ● Measure Q throughout production /

► Seek professional employment & experienced consultant involvement – integrate!

& service process (prevention less costly)

Positive

Higher ► Seek public agency support knowledge & support / chamber networks

company ● Rely on few Q suppliers (Right quality /

market

image share limit sampling. JIT) ► Go beyond ad hoc. Research. Articulate client value proposition, formulate

QUALITY exploratory strategy. Establish responsibility, structure & actively pursue

● Train employees for Q and empower

them to decide & report on Q ► Gradually explore / exploit overseas investment opportunities (alliances & JVs)

► Seek strategies helping quickly reach threshold levels for economies of scale

► The 10 dimensions of quality: (reaping benefits from bigger size / investments, higher marketing)

Decreased

product 1. Performance 6. Durability

► No matter size. Ensure quality in interaction & communication, relationships, physical

liability 2. Service / experience 7. Serviceability

8. Responsiveness

evidence, web presence, service … and … product! (core & augmented)

3. Features

4. Conformance 9. Aesthetics ► Relationships: trust, reliability & commitment. Professional yet forthcoming & flexible

5. Reliability 10. Reputation

► Prepared for possible ‘loss leaders’, to win future business and ‘lock-in’,

Enterprise Internationalisation – Dr N P Massa Enterprise Internationalisation – Dr N P Massa

71 72

Management: Key factors contributing to SMEs’ success Family businesses: Some considerations

Have a truly international outlook Adopt strategic approach (new market dev) ● Familiness presents a double edged sword!

● Seek world-wide opportunities ● Focus on few key markets at a time

● Resist temptation to wander ● Tacit knowledge and critical contacts reside with owner-manager / ‘boss’

● Strive to become an international business

● Build on success & review progress cont.

● Cultivate enthusiasm for exporting ● Ensure generational continuity along nurtured relationships

● Develop new prod/service w exports in mind

● Understand global picture for your industry ● Provide for local needs

● Balance boss’ seasoned experience with upcoming generations’

strategising (and trusted employed professionals that share family culture)

Show long-term commit to export markets Thoroughly research new markets

● Winning int’l orders takes time ● Gather information first hand ● Active involvement of upcoming generations & professional management

● Be prepared for a long haul ● Plan market visits well (maintain familiness) in good time. Think early and ease in over the years

● Budget sensible resources for each market ● Prepare for cultural & social differences

● Compare yourself with competitors ● As you professionalise – assume strategic stance yet do not sterilise

● Respond positively to obstacles entrepreneurial drive of incumbent owner-manager (fine balance)

● Participate in key trade exhibitions

● Expect to make mistakes ● Draw on other companies’ experiences

● Involve your whole team in exporting ● Follow-up your lucky breaks ● Ownership structure has important role in determining internationalisation

● Know your best sources of info & advice pathways (fragmented / concentrated)

● Encourage visitors to meet employees

Source: Lloyd-Reason et al. See also Department of Trade & Investment Enterprise Internationalisation – Dr N P Massa Source: Massa 2011. Enterprise Internationalisation – Dr N P Massa

© Dr Nathaniel P Massa 2019 18

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Field ListDocument140 pagesField ListSergio CostopulosNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CIBN SyllabusDocument170 pagesCIBN Syllabusdamola2real100% (1)

- Mamasab Bakery Rev 1Document3 pagesMamasab Bakery Rev 1Raja Noorlyana Raja HaronNo ratings yet

- The Nature of The Public SectorDocument14 pagesThe Nature of The Public Sectorhiwatari_sasuke100% (1)

- Introduction To Risk Management and MCQ L 1Document21 pagesIntroduction To Risk Management and MCQ L 1FarooqChaudhary92% (13)

- The Practice of Civil EngineeringDocument4 pagesThe Practice of Civil EngineeringMirabella Di Bastida71% (7)

- Corporate Expansion During Pro-Market Reforms in Emerging Markets The Contingent Value of Group Affiliation and DiversificationDocument10 pagesCorporate Expansion During Pro-Market Reforms in Emerging Markets The Contingent Value of Group Affiliation and DiversificationKlausNo ratings yet

- BOOK - Knowledge ManagementDocument730 pagesBOOK - Knowledge ManagementKlaus100% (1)

- 2 The Effects of Innovation Activities in Smes in The Republic of CroatiaDocument20 pages2 The Effects of Innovation Activities in Smes in The Republic of CroatiaKlausNo ratings yet

- KAPRO Industries IsraelDocument5 pagesKAPRO Industries IsraelKlausNo ratings yet

- Applications of Blockchain Technology in Banking FinanceDocument18 pagesApplications of Blockchain Technology in Banking FinancemonuNo ratings yet

- BY LawsDocument6 pagesBY LawsJig-jig AbanNo ratings yet

- How To Buy Bitcoin With Paypal?Document3 pagesHow To Buy Bitcoin With Paypal?Nayra JecobNo ratings yet

- Leverage Buyout and Junk KbondsDocument31 pagesLeverage Buyout and Junk KbondsChetan VenuNo ratings yet

- LC Procurement Agreement DraftDocument25 pagesLC Procurement Agreement DraftOndieki Obare JuniorNo ratings yet

- Revenue Models For Social-Networking SitesDocument40 pagesRevenue Models For Social-Networking Sitesmariyam_amreen100% (1)

- Y521 - Reflection Paper Alexx Dungey Final 6 9 14Document3 pagesY521 - Reflection Paper Alexx Dungey Final 6 9 14api-312697965No ratings yet

- Powerpoint Siomai PizzazzDocument10 pagesPowerpoint Siomai PizzazzKenneth SunicoNo ratings yet

- SW and ASSIGNMENT - TUGOTDocument9 pagesSW and ASSIGNMENT - TUGOTAndrea TugotNo ratings yet

- (External) Blume Ventures EdTech Market SizingDocument32 pages(External) Blume Ventures EdTech Market Sizingbhanu64No ratings yet

- Sma PDFDocument22 pagesSma PDFivanNo ratings yet

- MBCQ724D Project Management and Contract AdministrationDocument21 pagesMBCQ724D Project Management and Contract AdministrationShashi KanwalNo ratings yet

- Trends in Human Resource ManagementDocument4 pagesTrends in Human Resource ManagementPreethi SudhakaranNo ratings yet

- O'Mahoney and Markham: Edition: Management Consultancy, 2Document32 pagesO'Mahoney and Markham: Edition: Management Consultancy, 2sarasNo ratings yet

- Area Development Scheme ON: Goat Farming at Kishanganj DistrictDocument11 pagesArea Development Scheme ON: Goat Farming at Kishanganj DistrictKhistiz AgrotechNo ratings yet

- Sanjaya Raju Kunder: APAR Industries Limited Corporate Office: Regd. OfficeDocument181 pagesSanjaya Raju Kunder: APAR Industries Limited Corporate Office: Regd. Officeshreya.agrawalNo ratings yet

- New Thesis 2078.08.13Document41 pagesNew Thesis 2078.08.13MADHU KHANALNo ratings yet

- Chapter 3 & 4 Flexible Vs Standards FullDocument17 pagesChapter 3 & 4 Flexible Vs Standards FullkirosNo ratings yet

- Adobe Scan 11 Jul 2023Document1 pageAdobe Scan 11 Jul 2023Anandbabu YemulaNo ratings yet

- Internship Report On Sui GasDocument77 pagesInternship Report On Sui Gassiaapa84% (19)

- Trade BarriersDocument5 pagesTrade Barrierssobashaikh1104No ratings yet

- SaqibDocument2 pagesSaqibnidamahNo ratings yet

- Agency Compensation Hand Boo 7Document103 pagesAgency Compensation Hand Boo 7Big DaddyCoolNo ratings yet

- SAP S/$4 Hana Project: User CommunityDocument44 pagesSAP S/$4 Hana Project: User Communityroyjoy100% (1)