Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsForm 12BB and POI Report

Form 12BB and POI Report

Uploaded by

Kabir's World dinolover1. This document is a statement showing details of tax deduction claims by an employee named Deepti Srivastava under section 192 of the Income Tax Act for the financial year 2021-22.

2. It provides details of Deepti Srivastava's claims for house rent allowance, leave travel concessions, deduction of interest on borrowing, and deductions under sections 80C, 80CCC, 80CCD of Chapter VI-A of the Income Tax Act.

3. Deepti Srivastava certifies that the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Ebook Corporate Financial Accounting 15Th Edition Warren Test Bank Full Chapter PDFDocument63 pagesEbook Corporate Financial Accounting 15Th Edition Warren Test Bank Full Chapter PDFdextrermachete4amgqg100% (11)

- Sample Heggstad Petition For CaliforniaDocument3 pagesSample Heggstad Petition For CaliforniaStan Burman40% (5)

- Business To Business MarketingDocument48 pagesBusiness To Business MarketingSatish Biradar80% (5)

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- Form-12BBDocument2 pagesForm-12BBarvindNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- 2022 2023 Form12bbDocument1 page2022 2023 Form12bbsriramdutta9No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form. 12BBDocument6 pagesForm. 12BBaruyl001No ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- F3CB PreviewDocument21 pagesF3CB PreviewTaranpreet KaurNo ratings yet

- 1 178161 SettlementApplicationDocument7 pages1 178161 SettlementApplicationkumar praweenNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- Img 0006Document3 pagesImg 0006Puneet GuptaNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form 12BB Qqa0345Document6 pagesForm 12BB Qqa0345Santosh UlpiNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Neha Enterprise DRC-03 Dated 03-04-2023 (131000)Document2 pagesNeha Enterprise DRC-03 Dated 03-04-2023 (131000)vikenveerNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Angela Simatupang - IIADocument18 pagesAngela Simatupang - IIAWelin KusumaNo ratings yet

- Day 5 - QuizizzDocument3 pagesDay 5 - QuizizzcassiopieabNo ratings yet

- UX Design StepsDocument17 pagesUX Design Stepsngoufor atemafacNo ratings yet

- Invitation For Pre Qualification at Michael Okpara University of Agriculture, Umudike SEPT2012Document4 pagesInvitation For Pre Qualification at Michael Okpara University of Agriculture, Umudike SEPT2012edmund44No ratings yet

- The Role of Strategic Leadership in Supporting Strategic Planning and Increasing Organizational CompetitivenessDocument6 pagesThe Role of Strategic Leadership in Supporting Strategic Planning and Increasing Organizational CompetitivenessEditor IJTSRDNo ratings yet

- Critical Success Factors of Lean Implementation in VietnamDocument6 pagesCritical Success Factors of Lean Implementation in VietnamTran Minh TriNo ratings yet

- GREENT Lesson 18 Examples of Sustainable BusinessesDocument9 pagesGREENT Lesson 18 Examples of Sustainable BusinessesJose HidalgoNo ratings yet

- Custom Search: Today Is Thursday, March 09, 2017Document9 pagesCustom Search: Today Is Thursday, March 09, 2017pinkblush717No ratings yet

- DoP 2021 Version-2.0Document81 pagesDoP 2021 Version-2.0Monali MendheNo ratings yet

- Recommendation System: Techniques, Evaluation and LimitationsDocument5 pagesRecommendation System: Techniques, Evaluation and LimitationsVijayalakshmi VengattaramaneNo ratings yet

- Notes On Internal ReconstructionDocument7 pagesNotes On Internal ReconstructionAli NadafNo ratings yet

- Qatar. Labour Act No. 3 of 1962Document1 pageQatar. Labour Act No. 3 of 1962LazarNo ratings yet

- InvitationFS FLarticlev16pre PubversionDocument18 pagesInvitationFS FLarticlev16pre PubversionjoaquincollaojulNo ratings yet

- MAS RefExamDocument7 pagesMAS RefExamjeralyn juditNo ratings yet

- Marketing Research Involves All of The Following RDocument7 pagesMarketing Research Involves All of The Following RSalem BawazirNo ratings yet

- Secretary's Certificate (ATOMTECH)Document1 pageSecretary's Certificate (ATOMTECH)Gelyn OconerNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Report: IKEA's Global Supply Chain Management: Prepared By: Group 11 MembersDocument21 pagesReport: IKEA's Global Supply Chain Management: Prepared By: Group 11 MembersMặc NhiênNo ratings yet

- Startup Ecosystem in VietnamDocument54 pagesStartup Ecosystem in VietnamKim AnhNo ratings yet

- NCM-119 Power Point PresentationDocument99 pagesNCM-119 Power Point PresentationEkoy TheRealNo ratings yet

- XIM University Mail - UG Student Activity Council Fee (2023-24)Document2 pagesXIM University Mail - UG Student Activity Council Fee (2023-24)Manas ChoudhuryNo ratings yet

- "Zero To One" Summary and Review - West Stringfellow - MediumDocument23 pages"Zero To One" Summary and Review - West Stringfellow - MediumGabriel Soares CostaNo ratings yet

- Technical Information Tankvision NXA820, NXA821, NXA822Document16 pagesTechnical Information Tankvision NXA820, NXA821, NXA822Jhon Anderson Arango Rodriguez100% (1)

- Laddering Is A Qualitative Marketing Research TechniqueDocument3 pagesLaddering Is A Qualitative Marketing Research TechniqueUsman AsifNo ratings yet

- Pakistan Water and Power Development Authority Application For Grant of G.P.Fund AdvanceDocument2 pagesPakistan Water and Power Development Authority Application For Grant of G.P.Fund AdvanceHammad Yousaf100% (1)

- Ipc 7093 (L)Document124 pagesIpc 7093 (L)Jessica MonroyNo ratings yet

- Planilha Glove PreenchidaDocument5 pagesPlanilha Glove PreenchidaMAYBEN PHARMACEUTICALNo ratings yet

Form 12BB and POI Report

Form 12BB and POI Report

Uploaded by

Kabir's World dinolover0 ratings0% found this document useful (0 votes)

8 views2 pages1. This document is a statement showing details of tax deduction claims by an employee named Deepti Srivastava under section 192 of the Income Tax Act for the financial year 2021-22.

2. It provides details of Deepti Srivastava's claims for house rent allowance, leave travel concessions, deduction of interest on borrowing, and deductions under sections 80C, 80CCC, 80CCD of Chapter VI-A of the Income Tax Act.

3. Deepti Srivastava certifies that the information provided is complete and correct.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document is a statement showing details of tax deduction claims by an employee named Deepti Srivastava under section 192 of the Income Tax Act for the financial year 2021-22.

2. It provides details of Deepti Srivastava's claims for house rent allowance, leave travel concessions, deduction of interest on borrowing, and deductions under sections 80C, 80CCC, 80CCD of Chapter VI-A of the Income Tax Act.

3. Deepti Srivastava certifies that the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesForm 12BB and POI Report

Form 12BB and POI Report

Uploaded by

Kabir's World dinolover1. This document is a statement showing details of tax deduction claims by an employee named Deepti Srivastava under section 192 of the Income Tax Act for the financial year 2021-22.

2. It provides details of Deepti Srivastava's claims for house rent allowance, leave travel concessions, deduction of interest on borrowing, and deductions under sections 80C, 80CCC, 80CCD of Chapter VI-A of the Income Tax Act.

3. Deepti Srivastava certifies that the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

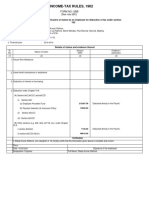

FORM NO.

12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1.Name and address of the employee : Deepti Srivastava

Flat no:2401, OrchidParamount SymphonyCrossing RepublikGhaziabad

2.Permanent Account Number of the employee : BXNPS8315P

3.Financial year : 2021-22

Details of claims and evidence thereof

Sl. Nature of claim Amount Evidence / particulars

No. (Rs.)

(1) (2) (3) (4)

1. House Rent Allowance:

Note: Permanent Account Number shall be furnished if the aggregate rent paid during the

previous year exceeds one lakh rupees

2. Leave travel concessions or assistance

3. Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii)Name of the lender

iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

4. Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C 337041

(ii) Section 80CCC

(iii) Section 80CCD -116271

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

5. Deduction under Section 24

Verification

I, Deepti Srivastava son/daughter of Uma Saran Srivastava do hereby certify that the information given above is complete and correct.

Place: Ghaziabad

Date: 05/01/2022 (Signature of the employee)

Designation: IND System Administrator I Full Name: Deepti Srivastava

Alight Services India Pvt Ltd

POI for the period of Apr 2021 To Mar 2022

Name : Deepti Srivastava Employee No : 1000169

Date Of Join : 08 Nov 2012 Permanent Account Number : BXNPS8315P

Sl.No Month Location Rent per month Approved Status Remarks

Indicator (Rs.) Amount

Sl.No Particulars Amount Approved Status No Proof Remarks

(Rs.) Amount of

Doc

Deduction Under Section 24

Note:

You might also like

- Ebook Corporate Financial Accounting 15Th Edition Warren Test Bank Full Chapter PDFDocument63 pagesEbook Corporate Financial Accounting 15Th Edition Warren Test Bank Full Chapter PDFdextrermachete4amgqg100% (11)

- Sample Heggstad Petition For CaliforniaDocument3 pagesSample Heggstad Petition For CaliforniaStan Burman40% (5)

- Business To Business MarketingDocument48 pagesBusiness To Business MarketingSatish Biradar80% (5)

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- Form-12BBDocument2 pagesForm-12BBarvindNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- 2022 2023 Form12bbDocument1 page2022 2023 Form12bbsriramdutta9No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form. 12BBDocument6 pagesForm. 12BBaruyl001No ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- F3CB PreviewDocument21 pagesF3CB PreviewTaranpreet KaurNo ratings yet

- 1 178161 SettlementApplicationDocument7 pages1 178161 SettlementApplicationkumar praweenNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- Img 0006Document3 pagesImg 0006Puneet GuptaNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form 12BB Qqa0345Document6 pagesForm 12BB Qqa0345Santosh UlpiNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Neha Enterprise DRC-03 Dated 03-04-2023 (131000)Document2 pagesNeha Enterprise DRC-03 Dated 03-04-2023 (131000)vikenveerNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Angela Simatupang - IIADocument18 pagesAngela Simatupang - IIAWelin KusumaNo ratings yet

- Day 5 - QuizizzDocument3 pagesDay 5 - QuizizzcassiopieabNo ratings yet

- UX Design StepsDocument17 pagesUX Design Stepsngoufor atemafacNo ratings yet

- Invitation For Pre Qualification at Michael Okpara University of Agriculture, Umudike SEPT2012Document4 pagesInvitation For Pre Qualification at Michael Okpara University of Agriculture, Umudike SEPT2012edmund44No ratings yet

- The Role of Strategic Leadership in Supporting Strategic Planning and Increasing Organizational CompetitivenessDocument6 pagesThe Role of Strategic Leadership in Supporting Strategic Planning and Increasing Organizational CompetitivenessEditor IJTSRDNo ratings yet

- Critical Success Factors of Lean Implementation in VietnamDocument6 pagesCritical Success Factors of Lean Implementation in VietnamTran Minh TriNo ratings yet

- GREENT Lesson 18 Examples of Sustainable BusinessesDocument9 pagesGREENT Lesson 18 Examples of Sustainable BusinessesJose HidalgoNo ratings yet

- Custom Search: Today Is Thursday, March 09, 2017Document9 pagesCustom Search: Today Is Thursday, March 09, 2017pinkblush717No ratings yet

- DoP 2021 Version-2.0Document81 pagesDoP 2021 Version-2.0Monali MendheNo ratings yet

- Recommendation System: Techniques, Evaluation and LimitationsDocument5 pagesRecommendation System: Techniques, Evaluation and LimitationsVijayalakshmi VengattaramaneNo ratings yet

- Notes On Internal ReconstructionDocument7 pagesNotes On Internal ReconstructionAli NadafNo ratings yet

- Qatar. Labour Act No. 3 of 1962Document1 pageQatar. Labour Act No. 3 of 1962LazarNo ratings yet

- InvitationFS FLarticlev16pre PubversionDocument18 pagesInvitationFS FLarticlev16pre PubversionjoaquincollaojulNo ratings yet

- MAS RefExamDocument7 pagesMAS RefExamjeralyn juditNo ratings yet

- Marketing Research Involves All of The Following RDocument7 pagesMarketing Research Involves All of The Following RSalem BawazirNo ratings yet

- Secretary's Certificate (ATOMTECH)Document1 pageSecretary's Certificate (ATOMTECH)Gelyn OconerNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Report: IKEA's Global Supply Chain Management: Prepared By: Group 11 MembersDocument21 pagesReport: IKEA's Global Supply Chain Management: Prepared By: Group 11 MembersMặc NhiênNo ratings yet

- Startup Ecosystem in VietnamDocument54 pagesStartup Ecosystem in VietnamKim AnhNo ratings yet

- NCM-119 Power Point PresentationDocument99 pagesNCM-119 Power Point PresentationEkoy TheRealNo ratings yet

- XIM University Mail - UG Student Activity Council Fee (2023-24)Document2 pagesXIM University Mail - UG Student Activity Council Fee (2023-24)Manas ChoudhuryNo ratings yet

- "Zero To One" Summary and Review - West Stringfellow - MediumDocument23 pages"Zero To One" Summary and Review - West Stringfellow - MediumGabriel Soares CostaNo ratings yet

- Technical Information Tankvision NXA820, NXA821, NXA822Document16 pagesTechnical Information Tankvision NXA820, NXA821, NXA822Jhon Anderson Arango Rodriguez100% (1)

- Laddering Is A Qualitative Marketing Research TechniqueDocument3 pagesLaddering Is A Qualitative Marketing Research TechniqueUsman AsifNo ratings yet

- Pakistan Water and Power Development Authority Application For Grant of G.P.Fund AdvanceDocument2 pagesPakistan Water and Power Development Authority Application For Grant of G.P.Fund AdvanceHammad Yousaf100% (1)

- Ipc 7093 (L)Document124 pagesIpc 7093 (L)Jessica MonroyNo ratings yet

- Planilha Glove PreenchidaDocument5 pagesPlanilha Glove PreenchidaMAYBEN PHARMACEUTICALNo ratings yet