Professional Documents

Culture Documents

Auditors Report 2020-2021

Auditors Report 2020-2021

Uploaded by

Saurabh Chaudhary0 ratings0% found this document useful (0 votes)

7 views24 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

7 views24 pagesAuditors Report 2020-2021

Auditors Report 2020-2021

Uploaded by

Saurabh ChaudharyCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 24

‘To be printed on the letter head of the Company

To,

‘The members of the Company;

Board of Directors; and

Statutory Auditors,

nN’ Ui Ru

Irotng peerety sven that the Twentieth Annual General Meeting AGW’) of the members of Axis

ae oto vate Limited for the financial year 2020-21 will be held on Thursday, Nove noe 18, 2021,

Mover ius at the Registered Office of the Company situated at 19¢/16'8 ona Floor, Ramesh

Market, East of Kallash, New Delhi- 140065, India to trensact the following business

Statement for the financial year ended March the ‘ofthe

of Directors and Auditors thereon

pase wangert: the members of the Company are requested to consider end, if thought fit, to

pass with or without modification/s, if any, the following resolution as sm Ordinary

Resolution:

SRESOLVED THAT the audited financial statements of the Company including the Balance

Fence anon March 31, 2021, Statement of Profit and Loss and Cash Flow Statement for tre

Freres pal, 2020 to March 31, 2021 and the Directors’ Report and the auditer’s Rene

thereon, be and are hereby received and adopted by the members of the Company.

2, Any other business with the permission of Chairman,

By Order of the Board of Directors of

Axis Infoline PI

‘Sankalp 3ain

Di

DIN: 02634568

R/o House No.F-20,1* Floor, Sector-40,

Noida-201301, Gautam Buddha Nagar,

Uttar Pradesh, India

Date: October 23, 2021

Place: New Delhi, India

NOTES

Fate tae ittied to attend and vote at the meeting is enttied to appoint a proxy to attend and

rats instead of himself and the proxy need not be a member. The proxy torn duly completed

cppulited rer ceaistered office of the Company not later than forty-elght hours before me time

appointed for holding the meeting.

The Register of Directors and Key Managerial Personne! and their shareholding and Register of

Sontracts or arrangements in which the Directors are interested, maintained ace cea 170

Me ae? oF the Companies Act, 2013 respectively, will be avaliable for Wenecoes by the

Members at the ensuing AGM.

4 Ai documents referred to in the Notice shall be open for inspection at the registered office of the

Taanpany situated at 196/16-8 2nd Floor, Ramesh Market, East of Kallas, Wew Dein 110065,

{ndia, on all working days, between 11.00 AM to 01.00 P.M, upto the date of the Acer

5. Members desirous of obtaining any information or clarification concerning the Annual Accounts

er cperations of the Company are requested to address their questions to the Company's

(martered office, so as to reach at least 12 (Twelve) hours before the date of the meeting so

brat Sreuttormation/ documents (For inspection) may be made available at the mectiee eek

best of extent possible.

&fhe Members are requested to notify immediately change of address (including e-mail address),

if any, to Compeny’s registered office.

7 The route map of the venue for the annual general meeting forms part of this netice.

By Order of the Board of Directors of

Axis Infoline Private Limited,

or Axis Infoline Pye ad,

Director

Sankalp|

Director}

DIN: 02634568

R/o House No.F-20,1* Floor, Sector-40,

Noida-201301, Gautam Buddha Nagar,

Uttar Pradesh, India

Date: October 23, 2021

Place: New Delhi, India

ROUTE MAP TO THE VENUE OF THE TWENTIETH ANNUAL GENERAL MEETING

196/16-B 2nd Floor, Ramesh Market, East of Kallash New Darn 110065, India

"OF Axia Infoling Pvt, «0

pep TDR

or Axis Infoline Pvt, «10 bee

RRSA & CO.

CHARTERED ACCOUNTANTS

INDEPENDENT AUDITOR'S REPORT

fo the Members of M/s Axis Infoline Private Limited

Report on the Audit of the Financial Statements

1. Opinion

We have audited the financial statements of Axis Infoline Private Limited (“the

Company”), which comprise the Balance Sheet as at 31st March 2021, the Statement of

Profit and Loss, the Statement of Cash flows and notes to the financial statements,

incluclinga summary of Significant Aceounting, policies and other explanatory information.

{In our opinion and to the best of our information and according to the explanations given to

us, the aforesaid financial statements give the information required by the Companies Act,

2013 ("the Act”) in the manner so required and give a true and fair view in conformity with

the accounting principles generally accepted in India, of the state of affairs of the Company as

at March 31, 2021, and its PROFIT for the year oncled on that cate.

2. Basis for Opinion

We conducted our audit in accordance with the Standards on Auditing (5As) specitied under

section 143(10) of the Act. Our responsibilities under those Standards are further described in

the Auditor's Responsibilities for the Autit of the Financial Statements section of out report, We

are independent of the Company in accordance with the Cali of Ethics issued by the Institute

vf Chartered Accountants of India together with the ethical requirements that are relevant to

our audit of the finan auts under the provisions of the Companies Act, 2073 and the

Rules thereunder, and we have fulfilled our other ethical responsibilities in accordance with

these requirements and the Code of Ethics, We betieve that the audit ovi

staten

ence we have

obtained is sulficient and appropriate to provide a basis for our opinion,

5. Information other than the financial statements and Auditor's Report thereon:

The Company's Board of Directors is responsible for the preparation of the other information.

‘The other information comprises the information included in the Board’s Report inclucting its

Annexure, but cioes not include the financial statements and our auditor's report thereon.

Our Opinion on the financial statements docs not cover other information and we do not

express any form of assurance conchusion thereon.

In connection with our audit of the financial statement, our responsibility is to read the other

information and, in doing so, consider whether the other information is materially

inconsistent with the financial statements or our knowledge obtained in the audit or

otherwise appears to be materially misstated. If based on the work we have performed, we

conclude that there is the material misstatement of this other information; we are

roport that fact. We have nothing to report in this regard,

E-261, First Floor, Amar Colony, Lajpat Nagar IV, New Delhi-110024

Ph. 011-26215169, E-mail: rrco89@yahoo.com

4. Responsibility of Management for Financial Statements

The Company's Board of Directors is responsible for the matiers stated in Section 134(5) of

the Act with respect to the preparation of these financial statements that give a true and fair

view of the financial position and financial performance of the Company in accordance with

the accounting, principles generally accepted in India, including the accounting, Standards

specified uncer Section 133 of the Act, This responsibility also includes maintenance of

aclequate accounting records in accordance with the provisions of the Act for safeguarding of

the assets of the Company and for preven

selection and application oF appropriate implementation and maintenance of accounting,

policies; making judgments and estimates that are reasonable and prudent; and design,

implementation and maintenance of adequate internal financial controls, that were operating,

effectively for ensuring the accuracy and completeness of the accounting, records, relevant to

the preparation and presentation of the financial statement that give a true and fair view and

ing, ancl detecting frauds and other irregularities;

are free from material misstatement, whether due te fraud or error.

In preparing the financial statements, management is responsible for assessing. the

Company's ability to continue asa going concern, disclosing, as applicable, matters related to

going concern and using the going concern basis of accounting, unless management either

intends to liquidate the Company or to cease operations, or has ao realistic alternative but to

dose.

Those Koard of Directors are also responsible for averseeing the company’s financial

reporting process.

5. Auditor's Responsibilities for the Audit of the Financial Statements

‘Our objectives are to obtain reasonable assurance about whether the financial statements as a

whole are free from material misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is a high level of assurance,

but is not a guarantee that an audlit conducted in accordance with SAs will always detect a

material misstatement when it exists. Misstatements can arise from fraud or error and are

considered material if, individually or in the aggregate, they could reasonably be expected to

influence the economic decisions of users taken on the basis of these financial stasements,

AAs part of an audit in accordance with SAs, Wwe esereise professional judgment and maintain

professional skepticism throughout the audit. We also:

of material ynisstatement of the financial statements,

i, Identify and assess the i

whether due to fraud or error, design and perform audit procedures responsive to

those risks, and obtain audit evidence that is sufficient and appropriate to provide a

basis for our opinion. The risk of not detecting a material misstatement resulting froin

fraud is higher than for one resulting from error, as fraud may involve collusion,

forgery, intentional omissions, misrepresentations, or the override of internal control.

ii, Obtain an understanding of internal control relevant to the audit in order to design

procedures that are appropriate in the cireumstances, but not for the purpose of

au

‘expressing on the effectiveness of the company” internal financial control.

iii, Evaluate the appropriateness of accounting, policies used and the reasonableness of

accounting estimates and related disclosures made by managem

iv, Conclude on the appropriateness of management's use of the going concern basis of

accounting and, based on the audit evidence obtained, whether a material uncertainty

exists related to events or conditions that may cast signilicant doubt on the

Company's ability to continue as a going concern. If we conclude that a material

uncertainty exists, we are required to draw atiention in our auditor's report to the

related disclosures in the finaicial statements or, if such disclosures are inadequate, to

modify our opinion, Our conclusions are based on the audit evidence obtained up to

the date of our auditor's report, However, future events or conditions may cause the

Company to cease to contin ;

¥. Evaluate the overall presentation, structure and content of the financial statements,

including the disclosures, and whether the financial statements: represent U

1e awa going cones

underlying transactions and events in.a manner that achieves fair presentation,

Materiality is the magnitude of misstatements in the financial statement thal, individually or

in aggregate, makes it probable that the economic decisions of a reasonably knowledgeable

user of the financial statements may be influenced. We consider quantitative materiality and

qualitative factors in () planning the scope of our audit work and in evaluating the results of

our work; and (ii) to evaluate the effect of any identified misstatements in the financial

statement

We commu

icate with those charged with governance regarding, among other matters, the

Planned scope and timing of the audit and significant audit findings, including. any

ignificant deficiencies in internal control that we ilentily during, our audit,

We also provide those charged with govemance with a statement that we have complied

with relevant ethical requirements regarding independence, and to-communicate with them

all relationships and other matters that may reasonably be thought to bear on our

independence, and where applicable, related safeguards,

6. Report on Other Legal and Regulatory Requirements

1. As required by the Companies (Auditor's Report) Order, 2016 ("the Order") issued by

the Central Government of India in terms of sub-section (11) of section 143 of the Act, We

give in “Annexure A” a statement on the matters specified in paragraphs 3 and 4 of the

Order, to the extent applicable.

IL. As required hy Section 197(16) of the Act, we report that the company being a private

limited company, section 197 on payment of remuneration to its directors is not applicable

to the company,

Jil. As required by Section 143(3) of the Act, we report that:

a) We have sought and obtained all the information and explanations which to the best

ind belic# were necessary for the purposes of our audit

of our knowledge

b) In our opinion, proper books of account as required by law haye been kept by the

Company so far as it appears from our examination of those books.

©) The Balance Shect and the statement of Profit and Loss dealt with by this Report aee in

agreement with the books of account.

d) In our opinion, the aforesaid financial statements comply with the Accounting

Standards specified under Section 133 of the Act, read with Rule 7 of the Companies

(Accounts) Rules, 2014,

©) On the basis of the written representations received from the directors as on 1st

March, 2021 and taken on record by the Board of Directors, none of the directors is

disqualified as on 31st March, 2021 from being appointed as a director in terms of

Section 164 (2) of the Act.

1) The para relating to adequacy of the internal financial controls is not applicable to the

company as turnover/borrawings are loss than the limits specified in MCA

notification dated 13.06.2017.

&) With respect to the other matters to be included in the Auditor's Reportin accordance

with Rule 11 of the Companies (Audit and Auditors) Rules, 2014, in our opinion and

to the best of our information and according to the explanations given to us:

i, The Company does not have any pending litigations which would impact as at

31st March 2021 on its financial position as at 31 march 2021.

‘The Company did not have any long-term contracts including derivative

contracts for which there were any material foreseeable losses,

fii, There were no amounts which were required to be transferred to the Investor

Education and Protection Fund by the Company,

FOR RRSA & Co.

Chartered Accountants

Regd. No. 023539N

wah,

JK Aggarwal

Partner

UDIN-21091405AAAADX8454

Place of Signature: New Delhi

Date: 23.10.2021

4! TO THE INDEPENDENT AUDITOR'S REPORT

ent Auditors! Report to the members of the Company on the

gy March, 2021, we report that:

propet records showing full particulars, Inchidirg quanttetive

: fave been physical verified by the management

accordance i tion, which in our opinion is reasonable, considering

the size of nd tie of es esses. The equerey ‘of physical verification 5

reasonable and 10) is es were noticed nn such verification.

sions give to ox, none of the ltmaveble prepa

Accordingly provision ‘of clause 1c) of the order Is not

am pysicaly vii bythe management i Mg the year

ju ification is reasonable. The discrepancies noticed on

verification reat book records, whion were rot moteria, Nave

been properly deal

to's and on the besis of our examination of ie

fot granted any ‘ans, secured OF unsecured’ to the

sre reginter maintained under section 189 0 #Re A

5 3{ii)(a) to (c) of the Order are ‘not applicable to the Company

‘and hence not co

tn our opinion and according te the {information andi explanations Bien to us, the Company has

complied with the provisions of Sections. 185 nel 186 of the Cernpanies Act. 2013 in respect OF

Joans, investments, ‘guarantees and security

‘pccoeding to the information and-explanations 2° to us the Company has not accepted oy

deposits from the public within: the meaning ‘gf Section 73, 74, 75 and 76 of the Companies Act

2013, for the Company

The Central Goverment has ney prescribed the maintenance.nf cost records under sector 148(1)

of the Companies Act 2013, forthe.company:

{a} According to the information and explanations given to us and on the basis of our examination

of the records of the companys ‘amounts deducted /accrued in the books of account in respect of

‘undisputed statutory dues including provident fund, employees) state Wnsurpnrs ingame tax

arte tax, service tax, duty of customs, duty of ev

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Receipt Dated 15.03.2007 by Suman Chabbra To OBTPLDocument1 pageReceipt Dated 15.03.2007 by Suman Chabbra To OBTPLSaurabh ChaudharyNo ratings yet

- Narendrakumar J. Modi vs. CIT, Gujarat II, Ahmadabad (1976) 4SCC 456Document4 pagesNarendrakumar J. Modi vs. CIT, Gujarat II, Ahmadabad (1976) 4SCC 456Saurabh ChaudharyNo ratings yet

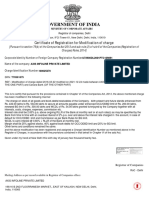

- Certificate of Registration For Modification of Charge 20220106Document1 pageCertificate of Registration For Modification of Charge 20220106Saurabh ChaudharyNo ratings yet

- PATIALA HOUSE All Courts Direct URL Links (New Links 16 October 2021)Document5 pagesPATIALA HOUSE All Courts Direct URL Links (New Links 16 October 2021)Saurabh ChaudharyNo ratings yet

- Lead Petition in Foreign Nationals Blacklisted CaseDocument75 pagesLead Petition in Foreign Nationals Blacklisted CaseSaurabh ChaudharyNo ratings yet