Professional Documents

Culture Documents

Sales Acceleration

Sales Acceleration

Uploaded by

Lars Baker0 ratings0% found this document useful (0 votes)

32 views14 pagesThe document lists 58 companies with their order, symbol, name, IPO date, industry group rank and industry name. It also provides a rating, current price and volume information for each company. The companies span various industries including software, chips, energy, transportation, leisure and others.

Original Description:

Original Title

sales acceleration (3)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists 58 companies with their order, symbol, name, IPO date, industry group rank and industry name. It also provides a rating, current price and volume information for each company. The companies span various industries including software, chips, energy, transportation, leisure and others.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

32 views14 pagesSales Acceleration

Sales Acceleration

Uploaded by

Lars BakerThe document lists 58 companies with their order, symbol, name, IPO date, industry group rank and industry name. It also provides a rating, current price and volume information for each company. The companies span various industries including software, chips, energy, transportation, leisure and others.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 14

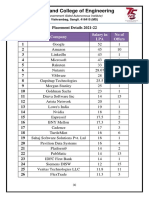

Order Symbol Name IPO Date Ind Group Rank Industry Name

1 AMBA Ambarella Inc 2012-10-10 45 Elec-Semicondcto

2 APPS Digital Turbine Inc 168 Computer Sftwr-E

3 ARWR Arrowhead Pharma 161 Medical-Biomed/

4 BILL Bill.com Holdings Inc 2019-12-12 156 Computer Sftwr-F

5 BRZE Braze Inc Cl A 2021-11-17 168 Computer Sftwr-E

6 CELH Celsius Holdings Inc 16 Beverages-Non-Al

7 CFLT Confluent Inc Class A 2021-06-24 118 Computer Sftwr-

8 COLD Americold Realty Trust 2018-01-19 51 Finance-Property

9 COP Conocophillips 4 Oil&Gas-Intl Exp

10 DAC Danaos Corporation 2006-10-06 7 Transportation-S

11 DCP D C P Midstream Lp 2005-12-02 19 Oil&Gas-Transprt

12 DDOG Datadog Inc Cl A 2019-09-19 168 Computer Sftwr-E

13 DOCN Digitalocean Holdings 2021-03-24 168 Computer Sftwr-E

14 DQ Daqo New Energy Corp Ads 2010-10-07 196 Energy-Solar

15 EPAM Epam Systems Inc 2012-02-08 89 Computer-Tech S

16 FLYW Flywire Corp 2021-05-26 188 Finance-CrdtCar

17 GDYN Grid Dynamics Hldgs Cl A 89 Computer-Tech S

18 GFL G F L Environmental Inc 2020-03-03 119 Pollution Control

19 GSL Global Ship Lease Inc 7 Transportation-S

20 HGV Hilton Grand Vacations 42 Leisure-Services

21 HLI Houlihan Lokey Inc Cl A 2015-08-13 48 Finance-Invest B

22 ICLR ICON plc 1998-05-18 171 Medical-Research

23 INTU Intuit Inc 1993-03-11 156 Computer Sftwr-F

24 KLAC K L A Corp 1980-10-08 80 Elec-Semiconduct

25 LNG Cheniere Energy Inc 19 Oil&Gas-Transprt

26 LYV Live Nation Entertmnt 42 Leisure-Services

27 MC Moelis & Company Cl A 2014-04-16 48 Finance-Invest B

28 MDB Mongodb Inc Cl A 2017-10-19 118 Computer Sftwr-

29 MNDY monday.com Ltd 2021-06-10 168 Computer Sftwr-E

30 MOS Mosaic Company 1988-01-27 10 Chemicals-Agricul

31 MRVL Marvell Technology Inc 2000-06-27 45 Elec-Semicondcto

32 OKE Oneok Inc 19 Oil&Gas-Transprt

33 OKTA Okta Inc Cl A 2017-04-07 92 Computer Sftwr-S

34 ONTO Onto Innovation Inc 1984-11-28 80 Elec-Semiconduct

35 OXY Occidental Petroleum 4 Oil&Gas-Intl Exp

36 PD Pagerduty Inc 2019-04-11 169 Computer Sftwr-

37 PFE Pfizer Inc 97 Medical-Ethical

38 PRTA Prothena Corp plc 161 Medical-Biomed/

39 RDFN Redfin Corporation 2017-07-28 58 Real Estate Dvlp

40 RNG RingCentral Inc Cl A 2013-09-27 168 Computer Sftwr-E

41 RVLV Revolve Group Inc Cl A 2019-06-07 152 Retail-Apparel/S

42 RYN Rayonier Inc Reit 51 Finance-Property

43 S Sentinelone Inc Cl A 2021-06-30 92 Computer Sftwr-S

44 SGH Smart Global Holdings 2017-05-24 39 Computer-Data S

45 SMAR Smartsheet Inc Cl A 2018-04-27 168 Computer Sftwr-E

46 SPT Sprout Social Inc Cl A 2019-12-13 168 Computer Sftwr-E

47 TASK Taskus Inc Class A 2021-06-11 89 Computer-Tech S

48 TEAM Atlassian Corp Plc Cl A 2015-12-10 157 Comp Sftwr-Spec

49 TECK Teck Resources Ltd 67 Mining-Metal Or

50 TREX Trex Company Inc 1999-04-08 72 Bldg-Constr Prds

51 UCTT Ultra Clean Holdings Inc 2004-03-25 80 Elec-Semiconduct

52 VIR Vir Biotechnology Inc 2019-10-11 161 Medical-Biomed/

53 WOLF Wolfspeed Inc 1993-02-08 60 Elec-Semiconduc

54 XM Qualtrics Intll Inc Cl A 2021-01-28 168 Computer Sftwr-E

55 Z Zillow Group Inc Cl C 136 Internet-Content

56 ZG Zillow Group Inc Cl A 2011-07-20 136 Internet-Content

57 ZI Zoominfo Techs Cl A 2020-06-04 168 Computer Sftwr-E

58 ZIM ZIM Integ Shipping Svcs 2021-01-28 7 Transportation-S

RS Rating Price % Chg % Off High Sector Vol % Chg vs 50-DayUp/Down Vol

85 1.3 -43.1 CHIPS -25.5 0.9

13 8 -60.97 SOFTWARE 14.3 0.6

22 3.9 -46.52 MEDICAL 3.7 0.8

34 7.7 -51.78 SOFTWARE 17.4 0.6

11 0.9 -50.4 SOFTWARE -64.2 1

17 11.3 -59.13 FOOD/BEV 56.8 0.6

95 7.8 -33.85 SOFTWARE -7.5 0.7

27 2.3 -32.26 REAL EST 53.6 0.8

98 -0.5 -0.58 ENERGY 44 1.1

99 6.5 2.29 TRANSPRT 168.1 1.5

88 4 -16.09 ENERGY -4.8 0.9

91 6.9 -31.41 SOFTWARE 19.7 0.8

43 6.4 -59.6 SOFTWARE -35.3 0.5

9 -0.6 -72.48 ENERGY -21.4 0.6

35 4.1 -37.81 BUSINS SVC -34.2 0.3

19 3.2 -54.45 FINANCE -25.6 0.9

97 2.3 -41.53 BUSINS SVC -36.8 0.7

39 1.5 -27.43 MACHINE 0.3 0.6

98 6.5 -1.85 TRANSPRT 139.8 1.1

90 2.6 -16.14 LEISURE -38.6 0.7

95 2.1 -14.92 FINANCE 3.8 1.1

85 2.5 -15.99 MEDICAL 38.7 1

87 3.4 -25.39 SOFTWARE -10.2 0.7

87 1.3 -19.79 CHIPS 47.1 0.8

97 2.5 -2.48 ENERGY 19 0.9

95 3.6 -17.6 LEISURE -13 0.6

56 2.7 -27.72 FINANCE -8.9 0.5

48 6.1 -36.77 SOFTWARE 10.9 0.7

25 1.9 -58.12 SOFTWARE -7.4 0.7

92 0.7 -9.74 AGRICULTRE -12.9 1.1

91 2.2 -29.33 CHIPS -1.9 0.9

89 -1.5 -11.22 ENERGY -5.3 1

22 4.9 -37.33 SOFTWARE -6.1 1

95 0.6 -20.19 CHIPS 100.3 0.7

98 0.8 -3.49 ENERGY 1.5 1.1

23 6.1 -44.91 SOFTWARE 22.1 1.1

97 1.8 -11.96 MEDICAL -34.9 1.2

93 3.9 -59.01 MEDICAL -5.1 0.8

8 4.3 -72.64 REAL EST -10.5 0.6

14 3.9 -63.79 SOFTWARE -33.7 0.5

27 4 -48.78 RETAIL 20.8 0.7

75 2.8 -11.73 REAL EST 66.1 1.1

25 5.5 -48.38 SOFTWARE -38.3 0.7

92 2.3 -26.31 COMPUTER 30.8 1

32 6.4 -32.27 SOFTWARE -20.1 1

21 10.4 -56.53 SOFTWARE 18.5 0.5

24 5.5 -65.9 BUSINS SVC -68.6 0.5

75 9.7 -33.94 SOFTWARE 199.3 0.8

97 -3.7 -13.18 MINING 121.1 1

32 2 -38.14 BUILDING 22.2 0.5

56 2.5 -29.04 CHIPS 40.7 0.8

26 8.7 -75.91 MEDICAL -41.5 1

29 -1.9 -38.35 CHIPS 70.6 0.7

16 5.3 -52.76 SOFTWARE 93.5 0.7

7 1.4 -77.21 INTERNET 4.3 0.8

6 1.7 -77.99 INTERNET -8.2 0.7

32 5.5 -38.31 SOFTWARE -29.8 0.6

99 6.2 0.72 TRANSPRT 6.1 1.1

A/D Rating EPS % Chg Last Qtr Current Price City 50-Day Avg Vol (1000s)

Price vs 50-Day

D- 533 129.5 Santa Clara 883 -27.8

C+ 193 40.03 Austin 3412 -24.8

D+ 50.09 Pasadena 703 -22.2

B- 168.06 San Jose 2133 -28.3

E 48.99 New York 543 -27.3

C -50 45.05 Boca Raton 1020 -28.2

D 62.82 Mountain View 2857 -9.1

D -10 27.67 Atlanta 2041 -11.6

C 89.22 Houston 8025 17.1

B+ 179 91.46 GREECE 395 25.5

D- -61 28.4 Denver 521 4.2

D+ 160 136.96 New york 4130 -15.5

D- 500 53.9 New York 2863 -32.4

C+ 1064 35.87 CHINA 1566 -20.6

E 47 451.1 Newtown 835 -24.7

C- 60 26.15 Boston 1237 -26.5

E 120 25.03 San Ramon 471 -28.9

B- 69 31.72 Vaughan 1384 -12.9

B 110 26.02 UNITED KINGDO 626 14.3

D- 47.24 Orlando 602 -5.7

C- 128 104.33 Los Angeles 407 -2.7

C- 33 262.95 IRELAND 524 -5.8

E 63 534.82 Mountain View 1959 -13.3

D- 73 366.65 Milpitas 1435 -10.6

B 112.86 Houston 1672 6.7

E 105.27 Beverly Hills 2371 -5.8

E 228 55.07 New York 456 -10

D+ 373.05 New York 1139 -21.1

D- 188.48 ISRAEL 539 -33.4

C 487 39.77 Tampa 4524 4.3

C 72 66.32 BERMUDA 11682 -17.8

C- 26 59.29 Tulsa 2583 -2.1

C 184.24 San francisco 2067 -14.3

C 145 84.67 Wilmington 361 -10.3

B+ 37.57 Houston 16408 19.4

B- 32.15 San Francisco 1518 -5.2

D+ 127 54.33 New York 43923 -1

C- 32.69 IRELAND 480 -27

E 26.93 Seattle 1176 -27.6

D- 38 162.58 Belmont 1290 -15

D- -19 45.89 Cerritos 1051 -23.6

C+ 483 36.27 Yulee 541 -6.4

D+ 40.54 Mountain View 4187 -18

C 177 54.9 CAYMAN ISLAND 606 -11.2

B- 58.01 Bellevue 1611 -13.9

D- 63.22 Chicago 615 -28.9

E 30 29.15 New Braunfels 1460 -34

B- 35 319.17 AUSTRALIA 1944 -9.5

C+ 683 30.71 Vancouver 4071 5.9

E 56 87.21 Winchester 923 -29.5

D- 47 46.36 Hayward 415 -15.1

B- 33.97 San Francisco 1996 -13.1

D 87.74 Durham 1663 -21.2

B 27.06 Provo 2298 -14.9

D 47.42 Seattle 5180 -17.7

C 46.75 Seattle 1029 -17.6

C 18 48.84 Vancouver 4856 -19

B- 794 65.41 ISRAEL 4343 18.6

ETF/Closed-End FundInd Group RS EPS Rating50-Day Avg $ Vol (1000s)

RS Line New HighVolume (1000s)

0 A- 64 114439 0 658

0D 99 136582 0 3900

0D 7 35238 0 729

0D 3 358572 0 2503

0D 13 26635 0 194

0 A+ 34 45991 0 1600

0C 2 179483 0 2641

0 B+ 10 56482 0 3135

0 A+ 69 716053 0 11561

0 A+ 74 36145 1 1059

0A 10 14804 0 496

0D 67 565768 0 4943

0D 47 154331 0 1853

0E 95 56193 0 1231

0 B- 96 376849 0 549

0E 44 32360 0 920

0 B- 97 11811 0 298

0C 67 43916 0 1389

0 A+ 72 16296 1 1501

0 A- 64 28443 0 369

0 A- 99 42504 0 423

0 D- 90 137996 0 727

0D 91 1047979 0 1760

0B 96 526399 0 2111

0A 2 188758 1 1990

0 A- 57 249605 0 2062

0 A- 88 25117 0 415

0C 33 425165 0 1263

0D 41 101685 0 499

0 A+ 76 179919 0 3942

0 A- 78 774803 0 11456

0A 90 153152 0 2445

0 B- 8 380971 0 1942

0B 95 30574 0 723

0 A+ 69 616471 0 16658

0 D- 15 48810 0 1853

0 C+ 81 2386369 0 28590

0D 69 15697 0 455

0 B+ 5 31672 0 1052

0D 94 209842 0 855

0 D+ 87 48253 0 1270

0 B+ 67 19647 0 899

0 B- 6 169757 0 2582

0 A- 97 33296 0 793

0D 42 93500 0 1287

0D 56 38880 0 728

0 B- 97 42579 0 459

0D 98 620753 0 5822

0B 76 125045 0 9001

0B 96 80547 0 1129

0B 91 19262 0 584

0D 69 67810 0 1167

0 B+ 36 145911 0 2837

0D 23 62189 0 4447

0 C- 30 245664 0 5405

0 C- 30 48105 0 944

0D 59 237181 0 3411

0 A+ 84 284075 1 4606

Shares (1000s)RS 3-Month Rating % Chg YTD % Chg Cur Week Avg True Range ETF

37003 12 -36.17 -4.04 11.05 0

96625 9 -34.37 0.86 3.72 0

104525 15 -24.45 -1.48 3.35 0

102553 9 -32.55 7.12 15.55 0

92109 7 -36.51 -7.6 6.31 0

74815 8 -39.59 2.57 4.61 0

264474 33 -17.6 4.89 5.6 0

266769 35 -15.62 -2.05 0.73 0

1318946 98 23.61 7.86 2.5 0

20596 99 22.52 17.08 3.5 0

208373 85 3.35 1.94 1.06 0

312016 24 -23.1 9.09 10.01 0

109166 7 -32.9 2.51 5.23 0

73714 11 -11.04 -11.5 2.66 0

56719 12 -32.52 -2.93 25.01 0

104681 9 -31.29 -4.46 2.12 0

65251 12 -34.08 -5.73 2.27 0

362058 25 -16.2 0.51 1.15 0

36216 97 13.57 13.33 1.02 0

119837 45 -9.35 1.85 1.97 0

68305 56 0.78 2.79 3.71 0

81397 50 -15.1 4.37 11.5 0

283166 29 -16.85 1.19 20.16 0

151622 34 -14.75 -1.71 19.26 0

253588 94 11.28 7.95 3.4 0

224659 52 -12.05 -4.07 4.45 0

65809 29 -11.9 1.98 2 0

66753 15 -29.53 -0.67 28.4 0

44267 6 -38.95 -5.05 18.94 0

378942 89 1.22 1.17 1.55 0

823600 23 -24.2 -8.59 4.08 0

445936 58 0.9 1.3 1.71 0

155543 21 -17.81 -2.14 11.49 0

49278 39 -16.36 -5.36 5.41 0

933980 98 29.6 11.32 1.61 0

85980 38 -7.48 6.74 2.16 0

5612866 91 -7.99 2.92 1.71 0

46593 10 -33.83 -7.21 3.04 0

105481 8 -29.85 -6.27 2.05 0

92161 18 -13.22 -2.84 9.86 0

72899 14 -18.11 11.82 3.65 0

143152 50 -10.13 0.25 1.03 0

266911 15 -19.71 1.07 3.59 0

24692 35 -22.66 -2.43 3.69 0

126752 26 -25.1 0.75 4.04 0

54005 9 -30.29 5.35 6.21 0

97290 5 -45.98 1.25 3.69 0

251917 31 -16.29 12.78 20.97 0

532500 93 6.56 -5.65 1.16 0

115117 11 -35.41 -6.58 5.11 0

44900 23 -19.18 -5.1 3.3 0

130880 39 -18.87 1.52 3.12 0

116217 14 -21.5 -2.3 6.22 0

539660 20 -23.56 6.66 1.86 0

254803 14 -25.73 -7.2 2.94 0

254798 14 -24.86 -6.95 2.89 0

397731 18 -23.93 6.2 3.37 0

115000 99 11.13 12.54 2.9 0

ADR Annual Sales (mil)

Sales % Chg Lst Qtr

Avg Sales % Chg 2QMarket Cap (mil)

Avg Sales % Chg 3Q

0 223 64 61.3 4791.9 50.3

0 313.6 338 299 3867.9 246.5

0 138.3 402 234.6 5235.7 169.6

0 238.3 152 118.9 17235.1 94.2

0 150.2 63 58.9 4512.4 55.8

0 130.7 158 137.1 3370.4 117.2

0 236.6 67 65.4 16614.3 60.7

0 1987.7 42 39.1 7381.5 36.4

0 19256 165 159.7 117676.4 146.3

0 461.6 65 45 1883.7 38.2

0 6302 78 70.9 5917.8 60.6

0 603.5 75 70.8 42733.7 64.3

0 318.4 37 36.1 5884 33.6

1 675.6 367 298.6 2644.1 216.3

0 2659.5 52 45.5 25585.9 36.9

0 131.8 61 58.3 2737.4 51.4

0 111.3 120 116.6 1633.2 84.6

0 4196.2 43 37.8 11484.5 34.4

0 282.8 96 56.3 942.3 38.5

0 894 346 258.8 5661.1 161.5

0 1525.5 95 85.7 7126.3 78.9

0 2797.3 166 103.2 21403.3 75.5

0 9633 52 46.4 151442.8 43.9

0 6918.7 43 39 55592.2 36.6

0 9358 119 72.4 28619.9 52.9

0 1861.2 1367 1022 23649.9 655.1

0 943.3 136 131 3624.1 111.2

0 590.4 50 47.1 24902.2 44.5

0 161.1 95 94.3 8343.4 91.1

0 8681.7 44 40.3 15070.5 36.1

0 2968.9 61 54.7 54621.2 43.1

0 8542.2 109 106.3 26439.5 87.4

0 835.4 61 59.4 28657.2 52

0 556.5 59 50.9 4172.4 41

0 16261 108 104.8 35089.6 64

0 213.6 33 33.3 2764.3 31.4

0 41908 134 113.4 304947 90.5

0 0.9 86881 58408.1 1523.1 38943.5

0 886.1 128 124.3 2840.6 96.3

0 1183.7 37 36.5 14983.5 34.9

0 580.6 62 60.8 3345.3 48.1

0 859.1 83 66.2 5192.1 35.4

0 93.1 128 124.7 10820.6 119.2

0 1501.1 61 59.3 1355.6 58.1

0 385.5 46 45.3 7352.9 42.5

0 132.9 46 44.1 3414.2 40.6

0 478 64 60.8 2836 56.9

0 2089.1 37 35.5 80404.3 33.6

0 8948 73 61 16353.1 43

0 880.8 45 43.1 10039.4 36.3

0 1398.6 52 50.9 2081.6 44

0 76.4 5269 2716.6 4446 1789.3

0 525.6 36 35.9 10196.9 35.5

0 1075.7 48 44.4 14603.2 42.2

0 3339.8 164 117.5 12082.8 81.1

0 3339.8 164 117.5 11911.8 81.1

0 476.2 60 58.5 19425.2 55.7

0 3991.7 210 204.6 7522.2 173.7

Avg Sales % Chg 4Q

Sales Accel 2 QtrsSales Accel 3 Qtrs

39.9 1 1

221.4 1 1

120.3 1 1

80.2 1 1

61.4 1 1

99.9 1 1

57.1 1 1

29.3 1 1

103.3 1 1

30.8 1 1

43.6 1 1

62.3 1 1

31.8 1 1

189.3 1 1

31.3 1 1

51.2 1 1

62 1 1

35.2 1 1

29.8 1 1

107.5 1 1

74.5 1 1

57.8 1 1

31.2 1 1

34.1 1 1

37.9 1 1

468.4 1 1

105.6 1 1

43 1 1

90.4 1 1

31.7 1 1

35.1 1 1

64.7 1 1

49.1 1 1

37.9 1 1

34.7 1 1

30.8 1 1

70.8 1 1

29217.2 1 1

73.5 1 1

34.2 1 1

34.9 1 1

30.3 1 1

113.5 1 1

46.5 1 1

41.9 1 1

38.6 1 1

52.3 1 1

34.8 1 1

31.4 1 1

36.8 1 1

40.3 1 1

1361.1 1 1

31.7 1 1

40.5 1 1

56.7 1 1

56.7 1 1

55.1 1 1

146.4 1 1

You might also like

- Tessent MemoryBIST RTL FlowDocument35 pagesTessent MemoryBIST RTL Flowpravallika vysyaraju100% (1)

- Automotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedFrom EverandAutomotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedRating: 4 out of 5 stars4/5 (3)

- Mac Address OUI - Vendor Find ListDocument371 pagesMac Address OUI - Vendor Find Listbinbert67% (12)

- LCD PanelsDocument85 pagesLCD PanelsJim Rich100% (1)

- Bucket ZeroDocument18 pagesBucket ZeroLars BakerNo ratings yet

- Order Symbol Name IPO Date Ind Group Rank Industry NameDocument12 pagesOrder Symbol Name IPO Date Ind Group Rank Industry NameLars BakerNo ratings yet

- 2021 Patent 300® IPO Top Patent Owners List FINALDocument10 pages2021 Patent 300® IPO Top Patent Owners List FINALhxjzoqaimeqlzgkfgoNo ratings yet

- 2024 Global 100 Full DatasetDocument30 pages2024 Global 100 Full DatasetSandeep ChatterjeeNo ratings yet

- He Watched Tech Stocks Scream Higher With Little InvolvementDocument37 pagesHe Watched Tech Stocks Scream Higher With Little InvolvementShankhadeep Mukherjee100% (1)

- How To Assign Cost To DCS Points - Automation & Control Engineering ForumDocument14 pagesHow To Assign Cost To DCS Points - Automation & Control Engineering ForumPravivVivpraNo ratings yet

- Free Weekly Newsletter June 18, 2010Document12 pagesFree Weekly Newsletter June 18, 2010ValuEngine.comNo ratings yet

- Institute Id: IR-E-U-0207 Institute Name: National Institute of Technology JamshedpurDocument24 pagesInstitute Id: IR-E-U-0207 Institute Name: National Institute of Technology JamshedpurNKS Å GAMÍNGNo ratings yet

- NQUS500LC ResearchDocument9 pagesNQUS500LC ResearchTshepo MichealNo ratings yet

- Nic Vendor TableDocument57 pagesNic Vendor Tablelaughinglizard100% (4)

- 2021 HIMSS Global Health Conference & Exhibition: Name BoothDocument24 pages2021 HIMSS Global Health Conference & Exhibition: Name BoothErica JonesNo ratings yet

- 2021 HIMSS Global Health Conference & Exhibition: Name BoothDocument24 pages2021 HIMSS Global Health Conference & Exhibition: Name Boothmahwish khanNo ratings yet

- Top Losers Mcap Greater Than 1000CrDocument11 pagesTop Losers Mcap Greater Than 1000Crnirav mehtaNo ratings yet

- 2010 Required CoeDocument4 pages2010 Required Coemj32loanNo ratings yet

- UntitledDocument24 pagesUntitledPrabhanshu TripathiNo ratings yet

- B.Tech Placement Report 2022 23Document2 pagesB.Tech Placement Report 2022 23himanshu mukaneNo ratings yet

- EDO MAN COE COR INT XXX 018 787 1088 Rev A MFZ - CP - SCADA - MANUALDocument16 pagesEDO MAN COE COR INT XXX 018 787 1088 Rev A MFZ - CP - SCADA - MANUALErol DAĞNo ratings yet

- 988611457NK448908 Configuration ReportDocument6 pages988611457NK448908 Configuration ReportVictor Daniel Piñeros ZubietaNo ratings yet

- Tycon Automation Pvt. LTD.: ProjectDocument76 pagesTycon Automation Pvt. LTD.: ProjectMesafint kassieNo ratings yet

- B. Tech M. Tech On Campus Placement Report 20 21Document12 pagesB. Tech M. Tech On Campus Placement Report 20 21virajsurana123No ratings yet

- The Economic Times Auto Yourstory Financial Express Outlook Express Computer VC CircleDocument6 pagesThe Economic Times Auto Yourstory Financial Express Outlook Express Computer VC CircleswathiNo ratings yet

- ETFs To Ride On An Electric Vehicle Boom - The Globe and MailDocument1 pageETFs To Ride On An Electric Vehicle Boom - The Globe and MailrobNo ratings yet

- Relative Valuation: Mro-Tek LTD S Mobility LTD Smartlink Network Systems LTDDocument3 pagesRelative Valuation: Mro-Tek LTD S Mobility LTD Smartlink Network Systems LTDAkshay MallNo ratings yet

- ValuEngine Weekly Newsletter July 2, 2010Document10 pagesValuEngine Weekly Newsletter July 2, 2010ValuEngine.comNo ratings yet

- November 2020Document10 pagesNovember 2020NileshNo ratings yet

- Intersec 2013 ExhibitorsDocument11 pagesIntersec 2013 Exhibitorsjonnyh85No ratings yet

- Placement Details of B.TECH 2017-2021 BatchDocument6 pagesPlacement Details of B.TECH 2017-2021 Batchsayan halderNo ratings yet

- Order Symbol Name Current Price Price $ CHG Price % CHGDocument8 pagesOrder Symbol Name Current Price Price $ CHG Price % CHGtrungNo ratings yet

- 2.-Recent-Placements-2021-22 VnitDocument8 pages2.-Recent-Placements-2021-22 VnitA 60 Prathamesh DabadeNo ratings yet

- Vanzari DistributieAUGUST2022Document23,602 pagesVanzari DistributieAUGUST2022VladNo ratings yet

- Goldman Sachs Hedge Industry VIP ETF - 9532 - IndexDocument4 pagesGoldman Sachs Hedge Industry VIP ETF - 9532 - IndexFaisal SaadNo ratings yet

- Motec Catalogue July 2010Document32 pagesMotec Catalogue July 2010mrtnnwmnNo ratings yet

- Ug - Placement Records - 2023-1Document6 pagesUg - Placement Records - 2023-1Anshu MeenaNo ratings yet

- Placement Report 2022Document7 pagesPlacement Report 2022Prabuddh ShakyaNo ratings yet

- Regulatory Data HandbookDocument116 pagesRegulatory Data HandbookKetul Sahu100% (1)

- 【S&P】标普全球 陈光远 - 全球自动驾驶和激光雷达市场趋势分析 20220920-atDocument27 pages【S&P】标普全球 陈光远 - 全球自动驾驶和激光雷达市场趋势分析 20220920-athaoyue yinNo ratings yet

- WCE Placements 2021-22Document5 pagesWCE Placements 2021-22Madhawi SharmaNo ratings yet

- WCE-PLACEMENT-2021-22 19th March 2022Document4 pagesWCE-PLACEMENT-2021-22 19th March 2022HahaHeheNo ratings yet

- 2016 Top-300-Patent-Owners IPO USPTODocument10 pages2016 Top-300-Patent-Owners IPO USPTOTeknova Innov&TechNo ratings yet

- Wacc Usa CompaniesDocument15 pagesWacc Usa CompaniesSergio OlarteNo ratings yet

- Exhibitor List: Company BoothDocument8 pagesExhibitor List: Company BoothMitsu BishiNo ratings yet

- ValuEngine Weekly Newsletter April 22, 2011Document11 pagesValuEngine Weekly Newsletter April 22, 2011ValuEngine.comNo ratings yet

- एन टी पी सी िलिमटेड (भारत सरकार का उद्यम) NTPC Limited (A Govt. of India Enterprise) (Formerly National Thermal Power Corporation Ltd.) (केंद्रीय कायार्लय नोएडा) Corporate Center NOIDADocument75 pagesएन टी पी सी िलिमटेड (भारत सरकार का उद्यम) NTPC Limited (A Govt. of India Enterprise) (Formerly National Thermal Power Corporation Ltd.) (केंद्रीय कायार्लय नोएडा) Corporate Center NOIDAsaini_sainiNo ratings yet

- List of Stations PS 1 Summer2023 Updated03042023Document40 pagesList of Stations PS 1 Summer2023 Updated03042023Aryan KhoranaNo ratings yet

- Silicon Valley CompaniesDocument1 pageSilicon Valley CompaniesRonn Falling Into BluesNo ratings yet

- 展商名录Document22 pages展商名录周雨頔No ratings yet

- Cause and Effect Matix(全厂跳闸矩阵)Document4 pagesCause and Effect Matix(全厂跳闸矩阵)کالرو تحریک اتحادNo ratings yet

- PA00X3MKDocument21 pagesPA00X3MKGSK MuhammadNo ratings yet

- Quant Mid Cap Fund Sep 2022Document9 pagesQuant Mid Cap Fund Sep 2022vnrNo ratings yet

- Berde PPA Pipe Line - ArnoldDocument38 pagesBerde PPA Pipe Line - Arnold2020dlb121685No ratings yet

- Valoracion Por Multiplos - EstudiantesDocument12 pagesValoracion Por Multiplos - EstudiantesJuLi Cañas HassellNo ratings yet

- Preliminary Acceptance Test: PAT For Business Switch ATN910C HuaweiDocument67 pagesPreliminary Acceptance Test: PAT For Business Switch ATN910C HuaweiNishanNo ratings yet

- VII Sem CSEDocument1 pageVII Sem CSEk03chandraNo ratings yet

- Walchand College of Engineering: SR No Company Salary in LPA No of OffersDocument4 pagesWalchand College of Engineering: SR No Company Salary in LPA No of OffersEliteNo ratings yet

- Topic 2 Sistem ScadaDocument13 pagesTopic 2 Sistem ScadaFebian TomyNo ratings yet

- 25 Dec 2023Document22 pages25 Dec 2023yunusyehya2No ratings yet

- About BlankDocument1 pageAbout Blankcollection58209No ratings yet

- Bucket ZeroDocument18 pagesBucket ZeroLars BakerNo ratings yet

- Order Symbol Name IPO Date Ind Group Rank Industry NameDocument12 pagesOrder Symbol Name IPO Date Ind Group Rank Industry NameLars BakerNo ratings yet

- Sales StarsDocument36 pagesSales StarsLars BakerNo ratings yet

- Order Symbol Name IPO Date Ind Group Rank Industry NameDocument6 pagesOrder Symbol Name IPO Date Ind Group Rank Industry NameLars BakerNo ratings yet

- Assembly Language Program - Part II: 1. BIOS InterruptDocument2 pagesAssembly Language Program - Part II: 1. BIOS InterruptLAI GUAN HONGNo ratings yet

- Holistic Seo: Yoast Seo For Wordpress Training - Lesson 1.1Document16 pagesHolistic Seo: Yoast Seo For Wordpress Training - Lesson 1.1Mohit RuhalNo ratings yet

- 1.1 Background of Study: Chapter OneDocument19 pages1.1 Background of Study: Chapter OneDamilola AdegbemileNo ratings yet

- BECIL MTS Recruitment 2021: For 55 MTS, House Keeping Staff, Supervisor PostsDocument2 pagesBECIL MTS Recruitment 2021: For 55 MTS, House Keeping Staff, Supervisor PostsRajesh K KumarNo ratings yet

- AFT Arrow 7 Data SheetDocument2 pagesAFT Arrow 7 Data SheetdelitesoftNo ratings yet

- Insurance Resume ExamplesDocument8 pagesInsurance Resume Examplesafayepezt100% (2)

- Computer Science AdvocacyDocument29 pagesComputer Science Advocacyapi-393859184No ratings yet

- WNL Ways Facebook Has Changed The World Adv PDFDocument5 pagesWNL Ways Facebook Has Changed The World Adv PDFAndrzejNo ratings yet

- Manual VOSviewer 1.6.5 PDFDocument33 pagesManual VOSviewer 1.6.5 PDFjibykNo ratings yet

- TTS ReaderDocument2 pagesTTS ReaderLúbñâ HâssåñNo ratings yet

- LUST Frequency InverterDocument346 pagesLUST Frequency InverterMuhammad Ahmad0% (1)

- Heathkit IT-28 Restoration - Thomas Bonomo K6ADDocument25 pagesHeathkit IT-28 Restoration - Thomas Bonomo K6ADMichel CormierNo ratings yet

- License Cerberus InfoDocument2 pagesLicense Cerberus InfopayNo ratings yet

- NFA - NFA - DFA EquivalenceDocument14 pagesNFA - NFA - DFA EquivalenceRahul SinghNo ratings yet

- Yak 42Document12 pagesYak 42AlexandraAndreeaNo ratings yet

- Hurakan User ManualDocument51 pagesHurakan User ManualMariel IzcurdiaNo ratings yet

- Intra Projects Tweets EditDocument3 pagesIntra Projects Tweets EditMohammad BousttaNo ratings yet

- World's Most Sophisticated AIS Transceiver World's Most Sophisticated AIS TransceiverDocument2 pagesWorld's Most Sophisticated AIS Transceiver World's Most Sophisticated AIS TransceiverZinmin BaboNo ratings yet

- Comms WiresDocument10 pagesComms WiresBDNo ratings yet

- Hormann Lineamatic Gate OperatorsDocument46 pagesHormann Lineamatic Gate Operatorsineskhiari2204No ratings yet

- Ahmed Ismail Mahdi: Work ExperienceDocument2 pagesAhmed Ismail Mahdi: Work ExperienceadasNo ratings yet

- Medical Health Care PowerPoint TemplatesDocument48 pagesMedical Health Care PowerPoint TemplatesRomanNo ratings yet

- Devops Enterprise+Continuous+DeliveryDocument14 pagesDevops Enterprise+Continuous+DeliverykasimNo ratings yet

- APPENDIX B Add-On Toolkits For Labview PDFDocument4 pagesAPPENDIX B Add-On Toolkits For Labview PDFrobertNo ratings yet

- Police Verification Form OriginalDocument2 pagesPolice Verification Form OriginalsandeepbodheNo ratings yet

- Brochure RomerDocument2 pagesBrochure RomerlaboratorioNo ratings yet

- Satellite Communications FinalsDocument32 pagesSatellite Communications FinalsJunel GenorgaNo ratings yet

- Cannibals MissionariesDocument8 pagesCannibals MissionariesElison José Gracite LusvardiNo ratings yet