Professional Documents

Culture Documents

Bank Treasury - Nuances For Statutory Audit

Bank Treasury - Nuances For Statutory Audit

Uploaded by

hitenalmightyCopyright:

Available Formats

You might also like

- BAFI3182-FINANCIAL MARKETS Assignment 3 Research PaperDocument16 pagesBAFI3182-FINANCIAL MARKETS Assignment 3 Research PaperChu Ngoc AnhNo ratings yet

- Case Study BDODocument2 pagesCase Study BDOSaumya GoelNo ratings yet

- Summary Pio - Too Hot To HandleDocument1 pageSummary Pio - Too Hot To HandleMuhammad Wildan FadlillahNo ratings yet

- HRMDocument35 pagesHRMdessaNo ratings yet

- V2 Exam 3 Morning PDFDocument82 pagesV2 Exam 3 Morning PDFCatalinNo ratings yet

- International Finance Question & AnswersDocument22 pagesInternational Finance Question & Answerspranjalipolekar100% (1)

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Ernst & Young Islamic Funds & Investments Report 2011Document50 pagesErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- Tata Mutual Fund 2Document14 pagesTata Mutual Fund 2mahesh2037100% (1)

- Why Implementation MattersDocument3 pagesWhy Implementation MattersBahidNo ratings yet

- The Father of Financial EngineerDocument5 pagesThe Father of Financial EngineerszbillNo ratings yet

- Management - Ch06 - Forecasting and PremisingDocument9 pagesManagement - Ch06 - Forecasting and PremisingRameshKumarMurali0% (1)

- (4-Volume Set) Rama Cont - Encyclopedia of Quantitative Finance-Wiley (2010)Document2,048 pages(4-Volume Set) Rama Cont - Encyclopedia of Quantitative Finance-Wiley (2010)tachyon007_mechNo ratings yet

- The Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFDocument5 pagesThe Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFEraNo ratings yet

- Ch. 11. Performance MeasurementDocument12 pagesCh. 11. Performance MeasurementHILDANo ratings yet

- T P C I R M: HE Romise and Hallenge of Ntegrated ISK AnagementDocument12 pagesT P C I R M: HE Romise and Hallenge of Ntegrated ISK AnagementRaza Muhammad waseemNo ratings yet

- Primary and Secondary Data SourcesDocument24 pagesPrimary and Secondary Data SourcesDEEP725No ratings yet

- BPR (Business Process Reengineering)Document7 pagesBPR (Business Process Reengineering)gunaakarthikNo ratings yet

- Aroob Zia-MMS151055Document63 pagesAroob Zia-MMS151055AZAHR ALINo ratings yet

- Slides CH 5 and 6Document87 pagesSlides CH 5 and 6beauty 4uNo ratings yet

- APC308 Financial Management April 2010 AssessmentDocument4 pagesAPC308 Financial Management April 2010 AssessmentmayatmanNo ratings yet

- Maf5102 Fa Cat 2 2018Document4 pagesMaf5102 Fa Cat 2 2018Muya KihumbaNo ratings yet

- Cross 1988Document11 pagesCross 1988deltanueveNo ratings yet

- Business Finance ManagementDocument14 pagesBusiness Finance ManagementMuhammad Sajid SaeedNo ratings yet

- Contemporary Management - NotesDocument6 pagesContemporary Management - NotesMahmoud NassefNo ratings yet

- Icici BankDocument13 pagesIcici BankdhwaniNo ratings yet

- Lorie Savage Capital JB 1949Document11 pagesLorie Savage Capital JB 1949akumar_45291100% (1)

- ARTICLE - 10 TimelessTests of StrategyDocument12 pagesARTICLE - 10 TimelessTests of Strategylinda29693No ratings yet

- Marketing Management: New Era University Graduate School of Business Master of Business Administration (Mba)Document13 pagesMarketing Management: New Era University Graduate School of Business Master of Business Administration (Mba)Saima Binte IkramNo ratings yet

- Goal OrientationDocument13 pagesGoal Orientationmadya sulisnoNo ratings yet

- Guidelines Case & Teaching Note WritingDocument8 pagesGuidelines Case & Teaching Note WritingSatyanarayana RentalaNo ratings yet

- Chap 1 - Goals & Governance of FirmDocument41 pagesChap 1 - Goals & Governance of FirmMuhammad ShaheerNo ratings yet

- Bond Portfolio Management StrategiesDocument32 pagesBond Portfolio Management StrategiesSwati VermaNo ratings yet

- Complexity ManagementDocument19 pagesComplexity Managementmtaimur1No ratings yet

- Influence of Job Satisfaction On Employee Retention - A Cross Dimensional Analysis With Reference To SBI Bank, BAJAJ ALLIANZ, HILL METALS, UTKAL AUTOMOBILDocument112 pagesInfluence of Job Satisfaction On Employee Retention - A Cross Dimensional Analysis With Reference To SBI Bank, BAJAJ ALLIANZ, HILL METALS, UTKAL AUTOMOBILSubhasis DasNo ratings yet

- Research Proposal - ThuLT PhD8 CFVG Hanoi Nov 18Document5 pagesResearch Proposal - ThuLT PhD8 CFVG Hanoi Nov 18Thu LeNo ratings yet

- Gowtham Project 2020Document62 pagesGowtham Project 2020Shanmugha SundarNo ratings yet

- Innovation Management Realizing Value 0913 1Document13 pagesInnovation Management Realizing Value 0913 1lsfnknNo ratings yet

- NMIMS International Finance - Assignment Answers (Sem-IV)Document7 pagesNMIMS International Finance - Assignment Answers (Sem-IV)Udit JoshiNo ratings yet

- APJ5Feb17 4247 1Document21 pagesAPJ5Feb17 4247 1Allan Angelo GarciaNo ratings yet

- "Leadership: Instructor: Sheena PitafiDocument46 pages"Leadership: Instructor: Sheena Pitafiami iNo ratings yet

- Assignment IB LeadershipDocument18 pagesAssignment IB Leadershipsasha100% (1)

- Objectives of The Dividend PolicyDocument2 pagesObjectives of The Dividend Policy2801 Dewan Foysal HaqueNo ratings yet

- Measuring Job SatisfactionDocument10 pagesMeasuring Job SatisfactionKeyza C. VicenteNo ratings yet

- Compensation MGMTDocument27 pagesCompensation MGMTUlpesh SolankiNo ratings yet

- Mba Semester 1: Mb0043 Human Resource Management 3 Credits (Book Id: B0909) Assignment Set - 1Document17 pagesMba Semester 1: Mb0043 Human Resource Management 3 Credits (Book Id: B0909) Assignment Set - 1Mohammed AliNo ratings yet

- AttritionDocument11 pagesAttritionSathya ShanmughamNo ratings yet

- Economics Outcome 3 Assessment TemplateDocument6 pagesEconomics Outcome 3 Assessment TemplateConnor ChivasNo ratings yet

- The Role of Chief Financial Officers in Managing InnovationDocument10 pagesThe Role of Chief Financial Officers in Managing InnovationNestaNo ratings yet

- Management Control System CH3Document28 pagesManagement Control System CH3Dinaol Teshome100% (1)

- Trust and Consequences: A Survey of Berkshire Hathaway Operating ManagersDocument5 pagesTrust and Consequences: A Survey of Berkshire Hathaway Operating ManagersHaridas HaldarNo ratings yet

- Ob Study CaseDocument1 pageOb Study CaseFarah HanisNo ratings yet

- Literature Review On Capital Budgeting TechniquesDocument6 pagesLiterature Review On Capital Budgeting Techniquesc5eyjfntNo ratings yet

- Cost of Capital, WACC and BetaDocument3 pagesCost of Capital, WACC and BetaSenith111No ratings yet

- Types of InterviewsDocument2 pagesTypes of InterviewsHamza MunawarNo ratings yet

- Report No. 10 - Dividend PolicyDocument45 pagesReport No. 10 - Dividend Policyhendrix obcianaNo ratings yet

- Measuring Service Quality in Higher Education: Hedperf Versus ServperfDocument17 pagesMeasuring Service Quality in Higher Education: Hedperf Versus ServperfSultan PasolleNo ratings yet

- Employee Engagement SHRM NotesDocument6 pagesEmployee Engagement SHRM NotesShahbaz Khan100% (1)

- Diversity in Organizational Behavior CH 2Document3 pagesDiversity in Organizational Behavior CH 2Chaqib SultanNo ratings yet

- Applying Lean Production To The Public SectorDocument7 pagesApplying Lean Production To The Public SectorAbdulrahman AlnasharNo ratings yet

- Abyssinia Bank 2019Document104 pagesAbyssinia Bank 2019abushaltaye9No ratings yet

- Inefficient Markets and The New FinanceDocument18 pagesInefficient Markets and The New FinanceMariam TayyaNo ratings yet

- Literature Review MotivationDocument4 pagesLiterature Review MotivationSwarnajeet GaekwadNo ratings yet

- Email Request For Advance Payment To VendorDocument1 pageEmail Request For Advance Payment To VendorhitenalmightyNo ratings yet

- JMK Reliance Script Facts in HDDocument18 pagesJMK Reliance Script Facts in HDhitenalmightyNo ratings yet

- Some Review: Lecture 9: Synthesis of Separation System - Heterogenous Mixture SeparationDocument13 pagesSome Review: Lecture 9: Synthesis of Separation System - Heterogenous Mixture SeparationhitenalmightyNo ratings yet

- Chemical Manufacturing Process & Product FormulationDocument8 pagesChemical Manufacturing Process & Product FormulationhitenalmightyNo ratings yet

- Glossary of TermsDocument8 pagesGlossary of TermshitenalmightyNo ratings yet

- BankingDocument66 pagesBankinghitenalmightyNo ratings yet

- Woman Achievers in IndiaDocument10 pagesWoman Achievers in IndiahitenalmightyNo ratings yet

- Lecture Notes: Introduction To Financial Derivatives: Jaeyoung SungDocument9 pagesLecture Notes: Introduction To Financial Derivatives: Jaeyoung SungRizki MaulanaNo ratings yet

- The Philippine Financial SystemDocument39 pagesThe Philippine Financial Systemathena100% (1)

- 2020 ECO Topic 1 International Economic Integration Notes HannahDocument23 pages2020 ECO Topic 1 International Economic Integration Notes HannahJimmyNo ratings yet

- Goldman Sachs Report That Asks, "Will The Kids Move Out of The Basement?"Document10 pagesGoldman Sachs Report That Asks, "Will The Kids Move Out of The Basement?"MarketplaceNo ratings yet

- 10 Myths About Financial DerivativesDocument6 pages10 Myths About Financial DerivativesArshad FahoumNo ratings yet

- Members' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDocument152 pagesMembers' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDuc-Anh NguyenNo ratings yet

- Reading 7 Economics of Regulation - AnswersDocument15 pagesReading 7 Economics of Regulation - Answerstristan.riolsNo ratings yet

- The Agricultural Futures MarketDocument10 pagesThe Agricultural Futures MarketBharath ChaitanyaNo ratings yet

- Valuations 20230707085302Document2 pagesValuations 20230707085302kshitijkumar2309No ratings yet

- Value at Risk - Theory and IllustrationsDocument67 pagesValue at Risk - Theory and Illustrationsczarina210No ratings yet

- AE14 PAS 32 and 39Document3 pagesAE14 PAS 32 and 39Stellar ArchaicNo ratings yet

- 06 19 2020 PSE 17-A Annual Report With Attachments PDFDocument324 pages06 19 2020 PSE 17-A Annual Report With Attachments PDFJC ReyesNo ratings yet

- Introducing The Adaptive Regime Compass: Measuring Equity Market Similarities With ML AlgorithmsDocument18 pagesIntroducing The Adaptive Regime Compass: Measuring Equity Market Similarities With ML AlgorithmsSak GANo ratings yet

- HDFC SecuritiesDocument6 pagesHDFC SecuritiesSuman GaneshNo ratings yet

- 2022 CFA Level 2 Curriculum Changes Summary (300hours)Document1 page2022 CFA Level 2 Curriculum Changes Summary (300hours)mawais263No ratings yet

- Security Exchange Board of India (Sebi) : Project RepoetDocument51 pagesSecurity Exchange Board of India (Sebi) : Project RepoetDishaNo ratings yet

- A Handbook On Derivatives PDFDocument35 pagesA Handbook On Derivatives PDFAccamumbai Acca Coaching50% (2)

- Instructions / Checklist For Filling KYC Form: Version 1.1 (July 2022)Document23 pagesInstructions / Checklist For Filling KYC Form: Version 1.1 (July 2022)Aditya KumarNo ratings yet

- Understanding Securitisation: In-Depth AnalysisDocument26 pagesUnderstanding Securitisation: In-Depth AnalysisAngelo BattagliaNo ratings yet

- SOA 30 Sample Problems On Derivatives MarketsDocument24 pagesSOA 30 Sample Problems On Derivatives MarketsSilvioMassaro100% (1)

- Goldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument3 pagesGoldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVIgnat FrangyanNo ratings yet

- Derivatives BasicDocument59 pagesDerivatives BasicHarleen KaurNo ratings yet

- PGDMSM 2022 Prospectus PDFDocument24 pagesPGDMSM 2022 Prospectus PDFAkash SherryNo ratings yet

- BBA 5th Sem Syllabus 2022-23Document11 pagesBBA 5th Sem Syllabus 2022-23GFGC BCANo ratings yet

- ITC January 2018 Paper 2 Question 1 Part II Solution PDFDocument4 pagesITC January 2018 Paper 2 Question 1 Part II Solution PDFTinotenda MuroveNo ratings yet

- Derivatives - Futures and ForwardsDocument56 pagesDerivatives - Futures and ForwardsSriram VasudevanNo ratings yet

- Swaps: Options, Futures, and Other Derivatives, 9th Edition, 1Document34 pagesSwaps: Options, Futures, and Other Derivatives, 9th Edition, 1胡丹阳No ratings yet

Bank Treasury - Nuances For Statutory Audit

Bank Treasury - Nuances For Statutory Audit

Uploaded by

hitenalmightyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Treasury - Nuances For Statutory Audit

Bank Treasury - Nuances For Statutory Audit

Uploaded by

hitenalmightyCopyright:

Available Formats

ACCOUNTING AND AUDITING

Bank Treasury – Nuances for Statutory Audit

It is imperative that an auditor obtains a complete overview of the treasury operations

of a bank before statutory audit. After conducting a risk assessment of the treasury

processes, the audit programme needs to be designed in a manner that it dovetails

into not just the control assessments of the treasury process but there is an assurance

that the figures appearing in the financial statements as well as the disclosures are

true and reflect fairly the affairs of the bank treasury. This article provides an over-

view of Bank Treasury in context of statutory audit.

A

s AS17 – Segment Reporting became ap- In addition to the above a bank can

plicable to banks, Reserve Bank of India execute certain transactions on behalf of its

(RBI) prescribed the segments as “Trea- constituents. These are also handled by the

sury Operations” and “Banking Operations”. Fi- treasury operations.

nancial Statements of Banks were then required It is imperative that an auditor obtains a

to disclose the data separately. Suddenly, the complete overview of the treasury operations.

focus came upon the profits of the Treasury Op- The following needs to be focused upon while

erations and their contribution to the overall conducting a risk assessment of the treasury

profitability of a bank. Amongst auditors too processes: -

the focus shifted to learning of these operations

as markets kept on evolving and newer treasury A. The bank’s overall management structure

products developed. This was also necessary as B. The bank’s treasury structure

computer systems developed and enterprise-

wide solutions were implemented in the trea- C. The deal execution process

suries with an interface into the main banking D. The deal settlement process

application.

E. The deal monitoring process

Essentially, the treasury operations can be

F. The flow of information and data to and

broadly divided into: -

from the treasury

l Fixed Income: It includes management of

G. The accounting and valuation systems and

investments in the domestic market in the

procedures

local currency and/or investment in the

foreign securities in the foreign currency. H. The computer system that helps in all the

above processes and the reliance that an

l Foreign Exchange: It involves manage-

auditor can place on the effective and

ment of foreign exchange assets, liabilities

efficient working of the same

and reserves.

Each of the above processes and systems

l Derivatives: These are undertaken to

coagulate to create the treasury operations of

hedge against various risks arising from

a bank. And each of them has its own role to

various facets of assets and liabilities such

play in the overall control systems of a bank

as interest rate risks, foreign exchange rate

functioning.

risks, credit risks, etc.

A. Bank’s Overall Management Structure

– CA. Ashutosh Pednekar

(The author is a member of the The Board of Directors of a bank has the over-

Institute. He can be reached at all responsibility of guiding the treasury opera-

ashu01@mpchitale.com)

tions. The Board specifies its thinking through

1412 The Chartered Accountant March 2007

ACCOUNTING AND AUDITING

the Investment Policy. This policy lays down the and processes followed by them while execut-

guiding principles of the treasury activity. RBI ing a deal and care taken by them in adhering to

requires that this policy be reviewed at least the overall framework of the investment policy.

once every year. This is on the premise that the

banking business as also the business of its con- D. Deal Settlement Process

stituents is dynamic and ever changing. Hence, The back office is responsible for settling the

there is a need to review this policy on an an- deal executed by the front office. Once a deal is

nual basis. All the internal procedures and sys- executed by the dealers, the back office of both

tems flow from this policy. An Investment Com- the counterparties confirms the transactions to

mittee of the senior management, including each other. On the settlement day the transaction

one or more whole time directors, is constituted is settled by exchange of funds or securities. In

to ensure that the investment policy is properly India the domestic fixed income segment is

implemented. An auditor needs to understand executed on various trading platforms, some are

the intentions of the management by perusing anonymous such as the NDS-OM, NEAT, BOLT;

and reviewing the investment policy. some are non-anonymous and includes deals

done telephonically (with or without brokers),

B. Bank’s Treasury Structure through the auctions of RBI etc. There are

International best practices have divided the different roles for the back office to play in each

treasury into three sections – the front office, of these trading platforms/mechanisms. The

the middle office (also the mid-office) and the auditor is required to understand the manner

back office. These three offices complement in which the back office executes its role in

each other in conduct of the treasury operations the bank; the control systems that they have

within the framework laid down by the bank implemented and the manner in which issues

management in the investment policy as well or disputes are resolved with counterparties.

as the control expectations of the management

and the regulator. The audit process should E. Deal Monitoring Process

review the treasury structure and be satisfied The mid-office can be considered to be the

that inherent controls exist in the treasury conscience keeper of the treasury. The mid-

structure such that there is no overlap of roles office is responsible for ensuring adherence to

and responsibilities as also the intentions of the various tolerance limits specified by the bank

the best practices of segregation of duties are management. These limits include NOP, AGL,

in place and working effectively. The auditor VaR, stop loss limits, currency limits, broker limits,

should discuss these matters with the head company/group/industry exposure limits etc.

of the treasury. These discussions should Normally, the mid-office is responsible for proper

document the treasurer’s own understanding of valuation of the entire portfolio. Performance

the structure and his expectations of the control monitoring of the treasury is also done by the

systems. mid-office. Concepts such as VaR (Value at Risk)

are used for this purpose. Considering its role, the

C. Deal Execution Process mid-office does not report to the treasurer but

The front office is responsible for the deal ex- to the chief of risk management. As our banks

ecution. There are different dealers for different move towards the regime of implementation of

desks of a treasury. There would be dealers for the recommendations of the Basel Committee,

each of the three components of the treasury— the mid-office will need to play a greater role

fixed income, forex and derivatives. And within in treasury operations. As the risk monitoring

each component there can be dealers for each torchbearers, this function needs to be closely

type of activity. The auditor could discuss with understood by the auditor. The more effective

these dealers and understand the mechanism the role of the mid-office the greater the reliance

March 2007 The Chartered Accountant 1413

ACCOUNTING AND AUDITING

an auditor can place on the internal checks and on Audit of Banks. The back-office is responsible

controls of the bank. The auditor should discuss for developing proper accounting procedures

with the mid-office their concerns of the bank’s and ensuring adherence to the applicable ac-

treasury operations and the strategies adopted counting standards as well as prescriptions of RBI.

by them to ensure that controls function within Similarly the valuation methodologies adopted

the risk tolerance levels. by the mid-office should be in complete sync

with the regulatory requirements and account-

F. Flow of Information from and to the ing principles. The classification and categorisa-

Treasury tion of investments should harmonise with the

All these functions can collapse unless there applicable requirements including income rec-

is a robust mechanism of flow of information ognition and asset classification and provisioning

within the bank. A bank’s investment committee norms. The auditor needs to evaluate whether all

needs data of its assets and liabilities and these are diligently followed in compiling the fi-

the maturity pattern too. This asset-liability nancial statements of the bank.

management is the first cornerstone while

determining the directions that the bank wants H. Computer Systems

a treasury to undertake. It is essential that the In applying all these various roles,

information is available to the front office in a responsibilities and requirements, the banks

clear, lucid and unambiguous manner so that depend on computer systems which may

the deals executed by them are in harmony range from stand-alone systems to multifarious

with the overall long and short-term business applications to core treasury systems. An auditor

objectives of the bank. Likewise, the information needs to get a complete overview of various

flow from the treasury is critical to ensure that computer systems. In today’s environment it is

banking operations move in an unhindered extremely difficult (or almost impossible) for a

manner. The auditor should acquaint himself treasury to function without a system support.

with this flow of information and the inherent From the complex calculations required for

checks and controls that the bank would have understanding a derivative transaction to simple

designed in it. This aid significantly in the risk interest accruals; from VaR computations to

assessment of the treasury operations and identification of non-performing investments;

audit procedures can be designed suitably. The from portfolio valuation to deal capturing and

MIS that is generated by the treasury needs to settlement—all these processes are computer-

be understood by the auditor to comprehend based system. The auditor has to be satisfied

the treasury’s performance and be satisfied that controls are adequately deployed such that

that there is an overall managerial performance the computer systems are performing as desired

review of the same within the bank. and the outputs generated are free from material

error. The auditor should also focus on the

G. Accounting and Valuation Systems and various interfaces from and to the application

Procedures systems. These interfaces are linkages into

As mentioned above, the accounting func- another application system. If the performance

tions of a treasury are handled by the back office is not satisfactory then the integrity of the data

and the function of valuation is handled by the available for audit becomes suspect. The critical

mid-office. The auditor should gain a complete interface between the treasury software and

understanding of these functions. Apart from the core accounting software is to be tested for

applying the Auditing and Assurance Standards efficient performance. If necessary, an auditor

(AASs) the auditor needs to use the techniques could take the help of a duly-qualified systems

and procedures mentioned in the Guidance Note auditor in this process.

1414 The Chartered Accountant March 2007

ACCOUNTING AND AUDITING

Statutory audit objectives require an auditor form audit report (LFAR) is another vital

to formulate an opinion on the truth and source of information. The LFAR question-

fairness of the financial statements. The above naire is designed in a manner that vital per-

understanding will enable an auditor to achieve formance parameters of treasury operations

the same. Apart from the above the following are commented upon by the auditor.

sources of information will help in these l Internal Reports: The auditor needs to

objectives: peruse various internal management

l Concurrent Audit Reports: Treasury reports. These provide an insight into the

operations are required to be audited treasury activities and performance. Some

concurrently. RBI has specified the areas that of these include the minutes of the meetings

need to be covered in the concurrent audit as well as the agenda papers of not just the

process. There are a number of assertions Board of Directors but also the Investment

that a concurrent auditor is required to Committee and the ALCO (Asset-Liability

make and also there is a responsibility of Management Committee) and the MIS

reporting the exceptions. The bank has to reports that are placed before them from

place its compliance with the concurrent time to time.

audit reports to the Audit Committee and The statutory auditor in his attest function

significant and persistent observations must remember to be continuously updated of

have to be discussed by them. the developments in the treasury arena. Prior to

l Internal Audit Reports: Banks are also commencing an audit, he should be aware of at

required to conduct an internal audit of the least the following:

treasury. As in the case of concurrent audit a. RBI Master Circular on Investments

the requirements of internal audit are well

laid down by RBI. The Audit Committee b. RBI Master Circular on Risk Management

is required to oversee the efficacy of this c. RBI’s Income Recognition and Asset

function. Classification Norms

l System Audit Reports: Due to the signifi- d. Accounting guidelines given by RBI

cant dependence on computer systems,

it is necessary for a bank to demonstrate e. Disclosure guidelines of RBI

good IT governance practices. One way of f. Applicable accounting standards of the

achieving it is through the conduct of regu- ICAI

lar system audits covering the entire gamut

g. New developments in the treasury market

of IT infrastructure, policies, procedures and

space, e.g. the recent permission to deal

practices. RBI has also mentioned about the

in “when issued” securities or conditions

need and frequency of system audit in its In-

under which “short sale” is permitted

ternal Control Guidelines for Dealing Room

Operations. h. An overall understanding of the various

derivative products available, the manner in

l RBI Inspection Report: These along with

which they are dealt with and the valuation

their compliance provide an insight into

aspects thereof including the mathematical

the manner in which the regulator has

principles applied

perceived the operations of the treasury. The

assurances given by the bank in closing out i. Newer settlement mechanisms such as the

an inspection issue needs to be reviewed RTGS, CCIL procedures etc

for implementation. j. Exposure drafts of the RBI on various

l LFAR: The previous reporting period’s long products e.g. the Draft Comprehensive

March 2007 The Chartered Accountant 1415

ACCOUNTING AND AUDITING

Guidelines on Derivatives mechanism.

k. Exposure drafts of the ICAI on the accounting ii. Having selected a sample, the auditor needs

treatment of financial instruments to verify the deal. Basic deal verification can

This literature keeps the auditor abreast of inter-alia be on the following lines

not only the latest developments but also the l Deal Ticket with internal supportings

path that the regulator and professional bodies and authorisations, term sheets, third

are intending to follow. If the auditor is well party evidence like Reuters’ Conversa-

aware of the above then the entire audit exercise tion, Term Sheets, Counterparty Con-

becomes seamless and the auditee develops a firmations, CCIL Confirmations, if appli-

healthy respect for the entire audit process. cable

Audit Programming and Procedures l Deal Register – applicable to manual as

well as systematised Treasuries

In framing the audit programme an auditor

will need to take into consideration his findings l Reconciliations of RBI A/cs, Nostro A/cs,

of the adequacy of controls within the above SGL and DP A/cs

processes. Based on the above-narrated process/ iii. Once this substantive testing is complete

flow of the treasury activities, the statutory audit the auditor needs to verify the closing

can be as under: statements. These include the valuation

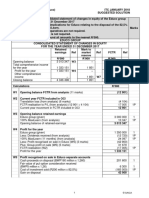

i. Selection of sample of transactions to statements as on the date of the financial

be verified. In India RBI prescriptions on statements. The following table indicates

concurrent audit require a 100% verification the areas to be covered in the valuation

of transactions by the concurrent auditors. process:

Type of Sub-category Evidence of valuation rate

Instrument

FI GOI Securities (CG, State, etc) FIMMDA declared rates

Non-SLR Bonds and Securities FIMMDA declared rates

Equities Exchange Price available on the Last day of the year

Debentures FIMMDA declared rates

Repos FIMMDA declared rates as well as there is RBI Guideline for

REPO securities valuation

Fx Open Positions FEDAI declared rates for each currency and maturity. If not

available, then the rates available on any Trading Platform,

like Reuters’, Bloomberg

Nostro Positions FEDAI – Spot rates of each currency

Derivatives Options Black Scholes’ Method

Swaps Discounted cash flows using the applicable Interest Curves

(ROI can be taken from FIMMDA / NSE / Reuters’ site based

on the nature and currency of the product)

Forward Rate Agreements Same as above

iv. The above valuations need to be matched

Hence, the selection of sample can be with the general ledger balances. This will

influenced by the quality of the concurrent make evident the completeness of the

audit function including the compliance

1416 The Chartered Accountant March 2007

ACCOUNTING AND AUDITING

valuation process vis-a-vis the financial outside India

books of account. l Net Value of Investmentsin India and outside

v. Many banks treat the treasury as a separate India

specialised branch subject to audit. Hence l Movement of provisions held towards

the treasury is required to prepare its own depreciation on investments giving the

balance sheet and profit and loss account opening balance, provisions made during

all the related schedules in the format the year, write-off/write-back of excess

prescribed by the Third Schedule to the provisions during the year and the closing

Banking Regulation Act, 1949 viz. Form A balance.

and B.

l The issuer composition of Non-SLR

vi. The following disclosures are required to Investment portfolio as given in the table

be made by a Bank in so far as its treasury on the next page.

operations are concerned. The auditor has to

verify the accuracy of the same and ensure l Movement of non-performing Non-SLR

that the data disclosed is in sync with the investments and the provision held for the

financial ledgers. The disclosures include: same at the year-end.

l Accounting policies w.r.t Investments l In respect of Derivatives the notional

recognition, classification and valuation. principal of agreements, losses which

would be incurred if counterparties

l Accounting policies w.r.t Foreign Exchange failed to fulfil their obligations under the

translations. agreements, collateral required by the bank

l Charge for the year in respect of deprecia- upon entering into these transactions,

tion in value of investments. concentration of credit risk arising from

l Maturity pattern of investments (as part of the transactions and the fair value of the

the ALM disclosures). derivative book. This disclosure is required

to be given separately for various types of

l Exposure to capital markets covering derivatives such as Currency swaps, FRAs,

inter-alia the Investments made in equity IRS etc.

shares, Investments in bonds/convertible

l In case of Exchange Traded Derivatives

debentures and Investments in units of

equity oriented mutual funds. instrument-wise the Notional principal

amount of exchange traded interest rate

l Details of repo and reverse repo deals derivatives undertaken during the year,

during the year in the following format:

Minimum Maximum Daily Average As on

outstanding outstanding outstanding March 31,

during the year during the year during the year 2007

Securities sold under Repo

Securities purchased under

reverse Repo

l Value of Investments giving break-up Notional principal amount of exchange

between Gross Value of Investments in India traded interest rate derivatives outstanding

and outside India as on 31st March 2007, Notional principal

amount of exchange traded interest rate

l Provisions for Depreciation in India and derivatives outstanding and not “highly

March 2007 The Chartered Accountant 1417

ACCOUNTING AND AUDITING

Issuer Amount Extent of Extent of ‘below Extent of Extent of

Private investment grade’ unrated ‘un-listed’

placement securities securities

Securities

PSUs

FIs

Banks

Private Corporates

Subsidiaries/

Joint Ventures

Others

Total

Less: Provisions held towards

Depreciation

NET

effective”, Mark-to-market value of exchange are generally done in the following pattern:

traded interest rate derivatives outstanding Please refer the guidelines contained in RBI

and not “highly effective”. circular DBOD No. BO.BC.72/21.04.018/2004-

l A bank is also required to give a write-up 05 dt. 3.3.2005 for the disclosures on

on the risk exposures in derivatives. The derivatives.

write-up has to mention the qualitative vii. As part of the statutory audit process

aspect wherein the bank’s policy, intention, the auditor needs to be aware of the

alignment with the risk management methodology adopted by a bank to compile

policies and procedures needs to be the above information. The data may flow

brought out. The quantitative disclosures

Particulars Currency Interest Rate

Derivatives Derivatives (INR)

Derivatives (Notional Principal Amount)

a) For Hedging

b) For Trading

Mark to Market Positions

a) Asset (+)

b) Liability (-)

Credit Exposure

Likely impact of one percentage change in interest rate (100*PV01)

a) On Hedging Derivatives

b) On Trading Derivatives

Maximum and Minimum of 100*PV01 observed during the year Max. Min. Max. Min.

a) On Hedging

b) On Trading

1418 The Chartered Accountant March 2007

ACCOUNTING AND AUDITING

from single or disparate software solutions.

There would be spreadsheet workarounds

adopted by a bank to calculate some of the FORM IV (See Rule 8)

figures to be disclosed. The auditor should

ensure that always this data matches

completely with the financial books of 1. Place of publication : New Delhi

account. He could also as part of mid-year

audit procedure review the procedure 2. Periodicity of : Monthly

its publication

adopted by the bank. This would give a

comfort when the year-end data is being 3. Printer’s Name : Vijay Kapur

tabulated. Nationality : Indian

Address : Journal Section,

All in all the audit programme needs to be Institute of Chartered

designed in a manner that it dovetails into not Accountants of India,

Indraprastha Marg.

just the control assessments of the treasury Post Box 7100,

process but there is an assurance that the New Delhi – 110002

figures appearing in the financial statements as

4. Publisher’s Name : Vijay Kapur

well as the disclosures are true and reflect fairly Nationality : Indian

the affairs of the bank treasury. Address : Journal Section,

Institute of Chartered

Treasury Dynamism – some examples Accountants of India,

Indraprastha Marg.

As mentioned above treasury operations are Post Box 7100,

New Delhi – 110002

dynamic. The marketplace is ever evolving

and newer techniques keep emerging. The 5. Editor’s Name : Sunil H. Talati

auditor has to be proactive in this entire Nationality : Indian

Address : Journal Section,

process. Institute of Chartered

One such example is in the method of Accountants of India,

Indraprastha Marg.

amortisation of the securities classified as Post Box 7100,

Held to Maturity (HTM). New Delhi - 110002

l The norms require that these securities 6. Names and addresses of Council of the Institute

have to be carried at acquisition cost with individuals who own the of Chartered Accountants

newspaper and partners of India, constituted

the premium paid being amortised over the or shareholders holding under the Chartered

residual period to maturity. Conventionally more than one per cent Accountants Act, 1949

banks used to amortise this on a straight-line of the total capital : (Act XXXVIII of 1949).

There is no share capital.

basis. For example, if a security maturing in

the year 2020 is purchased in the year 2006-

07 for Rs.114, then the premium of Rs.14

I, Vijay Kapur, hereby declare that the particulars given

would be amortised equally every year over

above are true to the best of my knowledge and be-

the next 14 years i.e. Re.1 every year. lief.

l Some banks felt that by adopting straight-

line method of amortisation, the yield on

the security amortised did not reflect the

correct yield at which the security was sd/-

Date: Vijay Kapur

purchased thereby distorting the yield

February 12, 2007 Signature of Publisher.

on the HTM portfolio when compared

periodically. These banks have changed

March 2007 The Chartered Accountant 1419

ACCOUNTING AND AUDITING

from the straight line to what is called the and no premium is paid. It is imperative for

“constant yield method”. the auditor to be satisfied that the sum

l In this method the yield of the security/ of the parts recognised in the software

portfolio remains constant even after systems should be equal to the whole of the

amortisation at every stage. The typical structured product.

effect is of a lower amortisation in the initial l In so far as the valuation of these structures

stages, which gets stepped up gradually. is concerned for want of system support

This is also called as a “pull to par” effect. In for advanced valuation techniques banks

this method this Rs.14 will be amortised in seek rates from counterparties. The

the proportion of the yield that is available auditor should understand the structure’s

on the balance sheet date by the bank. composition and then the valuation

Since the bank has intention of holding this methodology as narrated above for Swaps

security up to maturity (and that’s the reason (Interest as well as Currency), Options, FRA

for classifying it as HTM) the overall yield to are to be applied. One must also remember

that currently, banks are not allowed to run

a position for any structured products and

The auditor should ensure that so deals are entered on back-to-back basis.

always this data matches com- Hence for valuation purposes each of these

pletely with the financial books of deals are not valued per-se but the “Knock

account. He could also as part of Off” effect is considered i.e. the impact if

mid-year audit procedure review both the legs are knocked off on the balance

the procedure adopted by the

sheet date is determined and recognised in

bank.

the financial statements.

l The auditor would need to learn to

the bank up to 2020 is known. The premium comprehend and interpret the term-

of Rs.14 is compared with this yield and the sheet of these products as well as the

amortisation amount determined every mathematics involved in bifurcating these

year. deals for recognition in books of account as

also for period-end valuations. All this can

Another example would be of the audit

be achieved by doing a research on various

of Structured Derivative Products. The

developments in derivatives. A mid-year

following indicates the various nuances

audit of these transactions would enable

involved in their recognition and

the auditor to discuss and deliberate these

measurement principles: -

issues with the treasury officials. This would

l RBI requires that these structures which are make the year-end audit a far smoother and

generally at zero cost should not result into precise exercise.

an exposure to the counterparty/corporate

The above are just two examples of the

and no premium should be paid to them.

fascinating world of treasury with its ever-

Software solutions are still evolving to

changing facets. There can be and are many

capture these products. Hence banks are

required to break up these products and more such issues that require the auditor

recognise them as parts of a whole. In the and the auditee to do an in-depth analysis

deal verification process the auditor has of the situation and the recognition and

to develop his knowledge skills to assure measurement principles. It’s a challenge for

himself that these structures are indeed at all of us to hone our skill sets and achieve

zero cost, without resulting into an exposure the audit objectives. r

1420 The Chartered Accountant March 2007

You might also like

- BAFI3182-FINANCIAL MARKETS Assignment 3 Research PaperDocument16 pagesBAFI3182-FINANCIAL MARKETS Assignment 3 Research PaperChu Ngoc AnhNo ratings yet

- Case Study BDODocument2 pagesCase Study BDOSaumya GoelNo ratings yet

- Summary Pio - Too Hot To HandleDocument1 pageSummary Pio - Too Hot To HandleMuhammad Wildan FadlillahNo ratings yet

- HRMDocument35 pagesHRMdessaNo ratings yet

- V2 Exam 3 Morning PDFDocument82 pagesV2 Exam 3 Morning PDFCatalinNo ratings yet

- International Finance Question & AnswersDocument22 pagesInternational Finance Question & Answerspranjalipolekar100% (1)

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Ernst & Young Islamic Funds & Investments Report 2011Document50 pagesErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- Tata Mutual Fund 2Document14 pagesTata Mutual Fund 2mahesh2037100% (1)

- Why Implementation MattersDocument3 pagesWhy Implementation MattersBahidNo ratings yet

- The Father of Financial EngineerDocument5 pagesThe Father of Financial EngineerszbillNo ratings yet

- Management - Ch06 - Forecasting and PremisingDocument9 pagesManagement - Ch06 - Forecasting and PremisingRameshKumarMurali0% (1)

- (4-Volume Set) Rama Cont - Encyclopedia of Quantitative Finance-Wiley (2010)Document2,048 pages(4-Volume Set) Rama Cont - Encyclopedia of Quantitative Finance-Wiley (2010)tachyon007_mechNo ratings yet

- The Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFDocument5 pagesThe Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFEraNo ratings yet

- Ch. 11. Performance MeasurementDocument12 pagesCh. 11. Performance MeasurementHILDANo ratings yet

- T P C I R M: HE Romise and Hallenge of Ntegrated ISK AnagementDocument12 pagesT P C I R M: HE Romise and Hallenge of Ntegrated ISK AnagementRaza Muhammad waseemNo ratings yet

- Primary and Secondary Data SourcesDocument24 pagesPrimary and Secondary Data SourcesDEEP725No ratings yet

- BPR (Business Process Reengineering)Document7 pagesBPR (Business Process Reengineering)gunaakarthikNo ratings yet

- Aroob Zia-MMS151055Document63 pagesAroob Zia-MMS151055AZAHR ALINo ratings yet

- Slides CH 5 and 6Document87 pagesSlides CH 5 and 6beauty 4uNo ratings yet

- APC308 Financial Management April 2010 AssessmentDocument4 pagesAPC308 Financial Management April 2010 AssessmentmayatmanNo ratings yet

- Maf5102 Fa Cat 2 2018Document4 pagesMaf5102 Fa Cat 2 2018Muya KihumbaNo ratings yet

- Cross 1988Document11 pagesCross 1988deltanueveNo ratings yet

- Business Finance ManagementDocument14 pagesBusiness Finance ManagementMuhammad Sajid SaeedNo ratings yet

- Contemporary Management - NotesDocument6 pagesContemporary Management - NotesMahmoud NassefNo ratings yet

- Icici BankDocument13 pagesIcici BankdhwaniNo ratings yet

- Lorie Savage Capital JB 1949Document11 pagesLorie Savage Capital JB 1949akumar_45291100% (1)

- ARTICLE - 10 TimelessTests of StrategyDocument12 pagesARTICLE - 10 TimelessTests of Strategylinda29693No ratings yet

- Marketing Management: New Era University Graduate School of Business Master of Business Administration (Mba)Document13 pagesMarketing Management: New Era University Graduate School of Business Master of Business Administration (Mba)Saima Binte IkramNo ratings yet

- Goal OrientationDocument13 pagesGoal Orientationmadya sulisnoNo ratings yet

- Guidelines Case & Teaching Note WritingDocument8 pagesGuidelines Case & Teaching Note WritingSatyanarayana RentalaNo ratings yet

- Chap 1 - Goals & Governance of FirmDocument41 pagesChap 1 - Goals & Governance of FirmMuhammad ShaheerNo ratings yet

- Bond Portfolio Management StrategiesDocument32 pagesBond Portfolio Management StrategiesSwati VermaNo ratings yet

- Complexity ManagementDocument19 pagesComplexity Managementmtaimur1No ratings yet

- Influence of Job Satisfaction On Employee Retention - A Cross Dimensional Analysis With Reference To SBI Bank, BAJAJ ALLIANZ, HILL METALS, UTKAL AUTOMOBILDocument112 pagesInfluence of Job Satisfaction On Employee Retention - A Cross Dimensional Analysis With Reference To SBI Bank, BAJAJ ALLIANZ, HILL METALS, UTKAL AUTOMOBILSubhasis DasNo ratings yet

- Research Proposal - ThuLT PhD8 CFVG Hanoi Nov 18Document5 pagesResearch Proposal - ThuLT PhD8 CFVG Hanoi Nov 18Thu LeNo ratings yet

- Gowtham Project 2020Document62 pagesGowtham Project 2020Shanmugha SundarNo ratings yet

- Innovation Management Realizing Value 0913 1Document13 pagesInnovation Management Realizing Value 0913 1lsfnknNo ratings yet

- NMIMS International Finance - Assignment Answers (Sem-IV)Document7 pagesNMIMS International Finance - Assignment Answers (Sem-IV)Udit JoshiNo ratings yet

- APJ5Feb17 4247 1Document21 pagesAPJ5Feb17 4247 1Allan Angelo GarciaNo ratings yet

- "Leadership: Instructor: Sheena PitafiDocument46 pages"Leadership: Instructor: Sheena Pitafiami iNo ratings yet

- Assignment IB LeadershipDocument18 pagesAssignment IB Leadershipsasha100% (1)

- Objectives of The Dividend PolicyDocument2 pagesObjectives of The Dividend Policy2801 Dewan Foysal HaqueNo ratings yet

- Measuring Job SatisfactionDocument10 pagesMeasuring Job SatisfactionKeyza C. VicenteNo ratings yet

- Compensation MGMTDocument27 pagesCompensation MGMTUlpesh SolankiNo ratings yet

- Mba Semester 1: Mb0043 Human Resource Management 3 Credits (Book Id: B0909) Assignment Set - 1Document17 pagesMba Semester 1: Mb0043 Human Resource Management 3 Credits (Book Id: B0909) Assignment Set - 1Mohammed AliNo ratings yet

- AttritionDocument11 pagesAttritionSathya ShanmughamNo ratings yet

- Economics Outcome 3 Assessment TemplateDocument6 pagesEconomics Outcome 3 Assessment TemplateConnor ChivasNo ratings yet

- The Role of Chief Financial Officers in Managing InnovationDocument10 pagesThe Role of Chief Financial Officers in Managing InnovationNestaNo ratings yet

- Management Control System CH3Document28 pagesManagement Control System CH3Dinaol Teshome100% (1)

- Trust and Consequences: A Survey of Berkshire Hathaway Operating ManagersDocument5 pagesTrust and Consequences: A Survey of Berkshire Hathaway Operating ManagersHaridas HaldarNo ratings yet

- Ob Study CaseDocument1 pageOb Study CaseFarah HanisNo ratings yet

- Literature Review On Capital Budgeting TechniquesDocument6 pagesLiterature Review On Capital Budgeting Techniquesc5eyjfntNo ratings yet

- Cost of Capital, WACC and BetaDocument3 pagesCost of Capital, WACC and BetaSenith111No ratings yet

- Types of InterviewsDocument2 pagesTypes of InterviewsHamza MunawarNo ratings yet

- Report No. 10 - Dividend PolicyDocument45 pagesReport No. 10 - Dividend Policyhendrix obcianaNo ratings yet

- Measuring Service Quality in Higher Education: Hedperf Versus ServperfDocument17 pagesMeasuring Service Quality in Higher Education: Hedperf Versus ServperfSultan PasolleNo ratings yet

- Employee Engagement SHRM NotesDocument6 pagesEmployee Engagement SHRM NotesShahbaz Khan100% (1)

- Diversity in Organizational Behavior CH 2Document3 pagesDiversity in Organizational Behavior CH 2Chaqib SultanNo ratings yet

- Applying Lean Production To The Public SectorDocument7 pagesApplying Lean Production To The Public SectorAbdulrahman AlnasharNo ratings yet

- Abyssinia Bank 2019Document104 pagesAbyssinia Bank 2019abushaltaye9No ratings yet

- Inefficient Markets and The New FinanceDocument18 pagesInefficient Markets and The New FinanceMariam TayyaNo ratings yet

- Literature Review MotivationDocument4 pagesLiterature Review MotivationSwarnajeet GaekwadNo ratings yet

- Email Request For Advance Payment To VendorDocument1 pageEmail Request For Advance Payment To VendorhitenalmightyNo ratings yet

- JMK Reliance Script Facts in HDDocument18 pagesJMK Reliance Script Facts in HDhitenalmightyNo ratings yet

- Some Review: Lecture 9: Synthesis of Separation System - Heterogenous Mixture SeparationDocument13 pagesSome Review: Lecture 9: Synthesis of Separation System - Heterogenous Mixture SeparationhitenalmightyNo ratings yet

- Chemical Manufacturing Process & Product FormulationDocument8 pagesChemical Manufacturing Process & Product FormulationhitenalmightyNo ratings yet

- Glossary of TermsDocument8 pagesGlossary of TermshitenalmightyNo ratings yet

- BankingDocument66 pagesBankinghitenalmightyNo ratings yet

- Woman Achievers in IndiaDocument10 pagesWoman Achievers in IndiahitenalmightyNo ratings yet

- Lecture Notes: Introduction To Financial Derivatives: Jaeyoung SungDocument9 pagesLecture Notes: Introduction To Financial Derivatives: Jaeyoung SungRizki MaulanaNo ratings yet

- The Philippine Financial SystemDocument39 pagesThe Philippine Financial Systemathena100% (1)

- 2020 ECO Topic 1 International Economic Integration Notes HannahDocument23 pages2020 ECO Topic 1 International Economic Integration Notes HannahJimmyNo ratings yet

- Goldman Sachs Report That Asks, "Will The Kids Move Out of The Basement?"Document10 pagesGoldman Sachs Report That Asks, "Will The Kids Move Out of The Basement?"MarketplaceNo ratings yet

- 10 Myths About Financial DerivativesDocument6 pages10 Myths About Financial DerivativesArshad FahoumNo ratings yet

- Members' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDocument152 pagesMembers' Guide To 2023 Refresher Readings: in The Mainland of China, CFA Institute Accepts CFA® Charterholders OnlyDuc-Anh NguyenNo ratings yet

- Reading 7 Economics of Regulation - AnswersDocument15 pagesReading 7 Economics of Regulation - Answerstristan.riolsNo ratings yet

- The Agricultural Futures MarketDocument10 pagesThe Agricultural Futures MarketBharath ChaitanyaNo ratings yet

- Valuations 20230707085302Document2 pagesValuations 20230707085302kshitijkumar2309No ratings yet

- Value at Risk - Theory and IllustrationsDocument67 pagesValue at Risk - Theory and Illustrationsczarina210No ratings yet

- AE14 PAS 32 and 39Document3 pagesAE14 PAS 32 and 39Stellar ArchaicNo ratings yet

- 06 19 2020 PSE 17-A Annual Report With Attachments PDFDocument324 pages06 19 2020 PSE 17-A Annual Report With Attachments PDFJC ReyesNo ratings yet

- Introducing The Adaptive Regime Compass: Measuring Equity Market Similarities With ML AlgorithmsDocument18 pagesIntroducing The Adaptive Regime Compass: Measuring Equity Market Similarities With ML AlgorithmsSak GANo ratings yet

- HDFC SecuritiesDocument6 pagesHDFC SecuritiesSuman GaneshNo ratings yet

- 2022 CFA Level 2 Curriculum Changes Summary (300hours)Document1 page2022 CFA Level 2 Curriculum Changes Summary (300hours)mawais263No ratings yet

- Security Exchange Board of India (Sebi) : Project RepoetDocument51 pagesSecurity Exchange Board of India (Sebi) : Project RepoetDishaNo ratings yet

- A Handbook On Derivatives PDFDocument35 pagesA Handbook On Derivatives PDFAccamumbai Acca Coaching50% (2)

- Instructions / Checklist For Filling KYC Form: Version 1.1 (July 2022)Document23 pagesInstructions / Checklist For Filling KYC Form: Version 1.1 (July 2022)Aditya KumarNo ratings yet

- Understanding Securitisation: In-Depth AnalysisDocument26 pagesUnderstanding Securitisation: In-Depth AnalysisAngelo BattagliaNo ratings yet

- SOA 30 Sample Problems On Derivatives MarketsDocument24 pagesSOA 30 Sample Problems On Derivatives MarketsSilvioMassaro100% (1)

- Goldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument3 pagesGoldman Sachs Euro Short Duration Bond Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVIgnat FrangyanNo ratings yet

- Derivatives BasicDocument59 pagesDerivatives BasicHarleen KaurNo ratings yet

- PGDMSM 2022 Prospectus PDFDocument24 pagesPGDMSM 2022 Prospectus PDFAkash SherryNo ratings yet

- BBA 5th Sem Syllabus 2022-23Document11 pagesBBA 5th Sem Syllabus 2022-23GFGC BCANo ratings yet

- ITC January 2018 Paper 2 Question 1 Part II Solution PDFDocument4 pagesITC January 2018 Paper 2 Question 1 Part II Solution PDFTinotenda MuroveNo ratings yet

- Derivatives - Futures and ForwardsDocument56 pagesDerivatives - Futures and ForwardsSriram VasudevanNo ratings yet

- Swaps: Options, Futures, and Other Derivatives, 9th Edition, 1Document34 pagesSwaps: Options, Futures, and Other Derivatives, 9th Edition, 1胡丹阳No ratings yet