Professional Documents

Culture Documents

Solution of Case Study: Option-1

Solution of Case Study: Option-1

Uploaded by

madnansajid8765Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution of Case Study: Option-1

Solution of Case Study: Option-1

Uploaded by

madnansajid8765Copyright:

Available Formats

Solution of Case Study

_________________________________________________________________

Probability of worker injury = 1/5

Losses from a Building & Plant:

Repair Expenses = 1,000,000

Lost accure due to damage Machinery & Equipment = 4,500,000

Total = 55, 00,000

Expected loss = 55, 00,000 x 1/5

= 11, 00,000

Option-1

Expected loss = 11, 00,000

Cost of residual uncertainty = 5, 00,000

Cost of loss control = 0

Cost of loss financing = 0

Cost of internal risk reduction = 0________

Total Cost of risk = 16, 00,000

Firm Value = 120,000,000 – 16, 00, 000

= 11, 84, 00,000

Option-II

Cost of Risk:

Expected Loss = 550,000

Cost of Residual Uncertainty = 250,000

Cost of loss control = 90,000

Cost of loss financing = 0

Cost of internal risk reduction = 0________

Total Cost of risk = 8,90,000

Firm Value = 120,000,000 – 8, 90,000

= 11, 91, 10,000

Option-III

Cost of Risk:

Expected Loss = 2,75,000

Cost of Residual Uncertainty = 1,25,000

Cost of loss control (80,000+90,000) = 1,70,000

Cost of loss financing = 0

Cost of internal risk reduction = 0______

Total Cost of risk = 5,70,000

Firm Value = 120,000,000 – 5, 70,000

= 11, 94, 30,000

Option-IV

Premium = 550,000

Loading = Premium - Expected Losses

= 550,000 - 1100,000

= (550,000)

Cost of Risk:

Expected Loss = 1100,000

Cost of Residual Uncertainty = 0

Cost of loss control = 0

Cost of loss financing = (550,000)

Cost of internal risk reduction = 0______

Total Cost of risk = 550,000

Firm Value = 120,000,000 –550,000

= 11, 94, 50,000

Assignment # 1

Financial Risk Management

Submitted To:

Tahseen Mohsin

Submitted By:

Adnan Sajid 100645-011

Aamir Saleem Rana 100645-007

Muhammad Rizwan Virk 100645-010

Muhammad Waqar Akram 100645-017

Programme:

M.com (3rd Semester)

(Batch-6)

Institute of Audit & Accountancy

University of Management & Technology.

You might also like

- Report Q6WR D58D 2RM3 CTNK HES2Document7 pagesReport Q6WR D58D 2RM3 CTNK HES2Arnav KumarNo ratings yet

- The Adrenal Reset Diet by Alan Christianson, NMD - ExcerptDocument39 pagesThe Adrenal Reset Diet by Alan Christianson, NMD - ExcerptCrown Publishing Group56% (9)

- Fin 320 - Individual AssignmentDocument14 pagesFin 320 - Individual AssignmentAnis Umaira Mohd LutpiNo ratings yet

- 601 13,14 SolutionsDocument37 pages601 13,14 SolutionsRudi SyafputraNo ratings yet

- Continue Operations or Shut DownDocument2 pagesContinue Operations or Shut DownDivina Secretario0% (1)

- Absorption CostingDocument29 pagesAbsorption CostingFarrukhsg0% (2)

- Strengths of Pakistan International TradeDocument4 pagesStrengths of Pakistan International Trademadnansajid8765No ratings yet

- Artwell Gosha - OPRDocument12 pagesArtwell Gosha - OPRArtwell GoshNo ratings yet

- Financial Management II Lecture 11: Modigliani-Miller (MM) PropositionsDocument3 pagesFinancial Management II Lecture 11: Modigliani-Miller (MM) PropositionsJannat JollyNo ratings yet

- PRTC - Final PREBOARD Solution Guide (2 of 2)Document37 pagesPRTC - Final PREBOARD Solution Guide (2 of 2)Anonymous Lih1laaxNo ratings yet

- FC Answer KeyDocument4 pagesFC Answer KeyMergierose DalgoNo ratings yet

- Module 4-AFDocument10 pagesModule 4-AFShayan KhanNo ratings yet

- Miranda Hotel Statement of Profit and Loss For The Year Ended XXXDocument4 pagesMiranda Hotel Statement of Profit and Loss For The Year Ended XXXMaria DellaportaNo ratings yet

- Paper 5-Financial Accounting: Answer To MTP - Intermediate - Syllabus 2012 - Dec2016 - Set 1Document20 pagesPaper 5-Financial Accounting: Answer To MTP - Intermediate - Syllabus 2012 - Dec2016 - Set 1pirates123No ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- MAS.07 Drill Balanced Scorecard and Responsibility AccountingDocument6 pagesMAS.07 Drill Balanced Scorecard and Responsibility Accountingace ender zeroNo ratings yet

- Transfer PricingDocument2 pagesTransfer PricingAva DasNo ratings yet

- p2 PointsDocument11 pagesp2 PointsKian TuckNo ratings yet

- Cost of CapitalDocument7 pagesCost of CapitalMohammad Shaniaz IslamNo ratings yet

- ADVANCED ACCOUNTING 1 - Chapter 9 and 10 James Cantorne Consignment Sales Problem 1Document4 pagesADVANCED ACCOUNTING 1 - Chapter 9 and 10 James Cantorne Consignment Sales Problem 1James CantorneNo ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- Decision Sci Project Wajeeha, Aqsa, SalmanDocument21 pagesDecision Sci Project Wajeeha, Aqsa, Salmanmuhammad.salmankhanofficial01No ratings yet

- The Pricing of Insurance PREMIUM CALCULATION INS 200Document12 pagesThe Pricing of Insurance PREMIUM CALCULATION INS 200Nur Syafatin Natasya100% (1)

- Provisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseDocument6 pagesProvisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseKim HanbinNo ratings yet

- FIN 410 CT AssignmentDocument3 pagesFIN 410 CT AssignmentIrfanul HoqueNo ratings yet

- Assignment No - 01 (Financial Management (FIN 501)Document9 pagesAssignment No - 01 (Financial Management (FIN 501)aajakirNo ratings yet

- Course Hero 2Document5 pagesCourse Hero 2Denis Deno Rotich100% (1)

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- A Simulation of The Return On InvestmentDocument2 pagesA Simulation of The Return On InvestmentAjith NairNo ratings yet

- 06 Challenger Series SolutionsDocument60 pages06 Challenger Series Solutionssujalpratapsingh71No ratings yet

- E Gazdism2ang 11maj Ut PDFDocument5 pagesE Gazdism2ang 11maj Ut PDFSzabó ÁgnesNo ratings yet

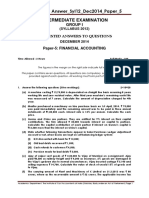

- Suggested Answer - Syl12 - Dec2014 - Paper - 5 Intermediate ExaminationDocument26 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 5 Intermediate ExaminationTRAILER HUBNo ratings yet

- Problem Solving AccountingDocument7 pagesProblem Solving AccountingKen Ken EsguerraNo ratings yet

- Assignment - Managerial FinanceDocument20 pagesAssignment - Managerial FinanceBoyNo ratings yet

- Working CapitalDocument1 pageWorking CapitalAva DasNo ratings yet

- Assignment 2: Name: Saif Ali Momin Erp Id: 08003 Course: Business Finance IIDocument39 pagesAssignment 2: Name: Saif Ali Momin Erp Id: 08003 Course: Business Finance IISaif Ali MominNo ratings yet

- DipIFR 2012 Dec AnswersDocument7 pagesDipIFR 2012 Dec AnswersRicardo Augusto Rodriguez MiñanoNo ratings yet

- Tug AsDocument5 pagesTug Asihalalis5202100% (2)

- Intermediate Examination Group Ii (SYLLABUS 2008) Suggested Answers To Questions JUNE 2013Document15 pagesIntermediate Examination Group Ii (SYLLABUS 2008) Suggested Answers To Questions JUNE 2013Tirupur KarthiNo ratings yet

- Solved Scanner CS Professional Model II, Paper-3 Financial, Treasury and Forex Management (I) AnsDocument13 pagesSolved Scanner CS Professional Model II, Paper-3 Financial, Treasury and Forex Management (I) AnskalbhorkNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Chapter 10 Financial Instruments: Answer 1 Extract From Financial Statements Statement of Comprehensive IncomeDocument24 pagesChapter 10 Financial Instruments: Answer 1 Extract From Financial Statements Statement of Comprehensive IncomeauliaNo ratings yet

- Income TaxationDocument3 pagesIncome TaxationRica AbellanosaNo ratings yet

- Principles of Managerial AccountingDocument4 pagesPrinciples of Managerial AccountingMohammed AwadNo ratings yet

- Decision Regarding Alternative ChoicesDocument29 pagesDecision Regarding Alternative ChoicesrhldxmNo ratings yet

- Assignement and Factoring: Problem 18-1Document15 pagesAssignement and Factoring: Problem 18-1Jaivy PeñafielNo ratings yet

- CostingDocument22 pagesCostingPrem SaudNo ratings yet

- Fire Insurance Claim - HomeworkDocument18 pagesFire Insurance Claim - Homeworknikhilcoke7No ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- Group-1-Chap-4 & 5Document10 pagesGroup-1-Chap-4 & 5Cherie Soriano AnanayoNo ratings yet

- MAS - First Pre-Board 2014-15 With SolutionsDocument6 pagesMAS - First Pre-Board 2014-15 With SolutionsAj de CastroNo ratings yet

- Study Unit 7 Self-Assessment SolutionsDocument9 pagesStudy Unit 7 Self-Assessment SolutionsM CNo ratings yet

- MIRANDA - Corporate Liquidation (12 Items)Document6 pagesMIRANDA - Corporate Liquidation (12 Items)SharmaineMirandaNo ratings yet

- Practice Exam Chapters 1-4 Solutions: Problem IDocument6 pagesPractice Exam Chapters 1-4 Solutions: Problem IJesse NgaliNo ratings yet

- SolDocument1 pageSolMuhammad Farhan AliNo ratings yet

- Sol ch13Document6 pagesSol ch13Kailash KumarNo ratings yet

- Solution 121Document21 pagesSolution 121Sony ThomasNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 21Document6 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 21Mr. JalilNo ratings yet

- Dnan Ajid: Address: Asad Colony Sheikhupura Road Gujranwala, Pakistan. Contact #: 0312-6150001 Email AddressDocument2 pagesDnan Ajid: Address: Asad Colony Sheikhupura Road Gujranwala, Pakistan. Contact #: 0312-6150001 Email Addressmadnansajid8765100% (1)

- The Impact of Mergers and Acquisitions On Acquirer PerformanceDocument10 pagesThe Impact of Mergers and Acquisitions On Acquirer Performancemadnansajid87650% (1)

- 3rd Quarter Report 2009-10Document22 pages3rd Quarter Report 2009-10madnansajid8765No ratings yet

- PIA Quantitative and Quality AnalysisDocument62 pagesPIA Quantitative and Quality Analysismadnansajid876525% (4)

- Liquidity Risk, Credit Risk, Market Risk and Bank CapitalDocument39 pagesLiquidity Risk, Credit Risk, Market Risk and Bank Capitalmadnansajid8765No ratings yet

- Fast Food Industry Complete AnalysisDocument32 pagesFast Food Industry Complete Analysismadnansajid8765100% (1)

- Kinnow Processing Plant (Sitrus Fruit)Document26 pagesKinnow Processing Plant (Sitrus Fruit)madnansajid8765No ratings yet

- Project On UBLDocument10 pagesProject On UBLmadnansajid8765No ratings yet

- Managerial Finance Basic TermsDocument11 pagesManagerial Finance Basic Termsmadnansajid8765No ratings yet

- Culture of An Organization ..... BOSS Moulded FurnitureDocument31 pagesCulture of An Organization ..... BOSS Moulded Furnituremadnansajid8765No ratings yet

- Telenor Human Resource ManagementDocument55 pagesTelenor Human Resource ManagementRaheela MuhammadNo ratings yet

- National Bank of PakistanDocument44 pagesNational Bank of Pakistanmadnansajid8765No ratings yet

- Mitchell's Ratio AnalysisDocument3 pagesMitchell's Ratio Analysismadnansajid8765No ratings yet

- Telenor Pakistan Training and DevelopmentDocument28 pagesTelenor Pakistan Training and Developmentmadnansajid8765100% (1)

- Report On Telenor (Human Resource Management)Document21 pagesReport On Telenor (Human Resource Management)madnansajid8765No ratings yet

- Project On Macro PakistanDocument8 pagesProject On Macro Pakistanmadnansajid8765No ratings yet

- Performance Management: Assignment # 4Document3 pagesPerformance Management: Assignment # 4madnansajid8765No ratings yet

- Project On NestleDocument7 pagesProject On Nestlemadnansajid8765No ratings yet

- Online Recruitment in Telenor PakistanDocument38 pagesOnline Recruitment in Telenor Pakistanmadnansajid8765No ratings yet

- IMF & Developing CountriesDocument6 pagesIMF & Developing Countriesmadnansajid8765No ratings yet

- Project On PESPIDocument13 pagesProject On PESPImadnansajid8765No ratings yet

- Project On 1122Document12 pagesProject On 1122madnansajid8765No ratings yet

- Case Study 2 (Saturn: An Image Makeover) : Institute of Audit & AccountancyDocument5 pagesCase Study 2 (Saturn: An Image Makeover) : Institute of Audit & Accountancymadnansajid8765No ratings yet

- Self Decipline AssignmentDocument3 pagesSelf Decipline Assignmentmadnansajid8765No ratings yet

- Participant & Imposed BudgetingDocument3 pagesParticipant & Imposed Budgetingmadnansajid8765No ratings yet

- Swot Analysis of Coca ColaDocument7 pagesSwot Analysis of Coca Colamadnansajid8765100% (8)

- Project On Coca ColaDocument26 pagesProject On Coca Colamadnansajid8765No ratings yet

- The Sharpe Corporation's ProjectedDocument3 pagesThe Sharpe Corporation's Projectedmadnansajid8765No ratings yet

- Test 5 R&UoE p1-4Document2 pagesTest 5 R&UoE p1-4Evil PetiNo ratings yet

- Do Animals Show GriefDocument1 pageDo Animals Show GriefMarcos Rogério LeitãoNo ratings yet

- Seminar PPT by Vinay RanaDocument24 pagesSeminar PPT by Vinay RanaHarshita RanaNo ratings yet

- CONCLUSION ZaraDocument2 pagesCONCLUSION ZaraThevhan MurallyNo ratings yet

- Remedial Strategies Class 12Document15 pagesRemedial Strategies Class 12Abhilash SahooNo ratings yet

- Summative-Test-In-English 5Document8 pagesSummative-Test-In-English 5Caroliza Gumera BanzonNo ratings yet

- Graded Assignment: Semester B Test, Part 2Document3 pagesGraded Assignment: Semester B Test, Part 2huda.guavaNo ratings yet

- Keprib SkinnerDocument10 pagesKeprib SkinnerAlya YasmineNo ratings yet

- FLOWSIC600 Product Presentation 2016Document62 pagesFLOWSIC600 Product Presentation 2016Osiros LunaNo ratings yet

- Contoh Soal Beggs and BrillDocument8 pagesContoh Soal Beggs and BrillClaviano LeiwakabessyNo ratings yet

- Build Link Hots Build Link Build Link: Last UpdatedDocument3 pagesBuild Link Hots Build Link Build Link: Last UpdatedHéctor CastilloNo ratings yet

- Low Quality Problems: Jeffrey Chen and Kevin ZhaoDocument2 pagesLow Quality Problems: Jeffrey Chen and Kevin ZhaoNadiaNo ratings yet

- Work Sheet in English 4 2 Summative Test: A. Text Structure PracticeDocument2 pagesWork Sheet in English 4 2 Summative Test: A. Text Structure PracticeLeizel Hernandez PelateroNo ratings yet

- Corner ModelDocument111 pagesCorner ModelmohamedNo ratings yet

- Coding Form BarangDocument7 pagesCoding Form Barangzalfa yourpackagingsolutionNo ratings yet

- Abney LevelDocument6 pagesAbney LevelAtish Kumar86% (7)

- Independent University BangladeshDocument17 pagesIndependent University BangladeshRobiul Alam RanaNo ratings yet

- Simulation and Design ToolsDocument63 pagesSimulation and Design ToolsJainamNo ratings yet

- Fast and Frugal HeuristicsDocument17 pagesFast and Frugal HeuristicsJanice YangNo ratings yet

- COT2 FinalDocument39 pagesCOT2 FinalLJ Caylan BareteNo ratings yet

- Pneumatics - Air CompressionDocument10 pagesPneumatics - Air CompressionNikolas FabryNo ratings yet

- GPS and Its ApplicationsDocument15 pagesGPS and Its ApplicationsSonal MevadaNo ratings yet

- Daftar Pustaka - 2 PDFDocument5 pagesDaftar Pustaka - 2 PDFReza AdrianNo ratings yet

- 2 50 1634896908 24ijasrdec202124Document8 pages2 50 1634896908 24ijasrdec202124TJPRC PublicationsNo ratings yet

- Methods of Engineering AnalysisDocument25 pagesMethods of Engineering AnalysisRajnish KumarNo ratings yet

- Guide On PE TopicsDocument3 pagesGuide On PE TopicsXyrell Jane MarquezNo ratings yet

- Eurocontract Epc Facility Management Model Contract en PDFDocument53 pagesEurocontract Epc Facility Management Model Contract en PDFIshtiaque AhmedNo ratings yet

- Vol1Document6 pagesVol1Nathan ScarpaNo ratings yet