Professional Documents

Culture Documents

Final Acc Test Q

Final Acc Test Q

Uploaded by

Sachin 1257Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Acc Test Q

Final Acc Test Q

Uploaded by

Sachin 1257Copyright:

Available Formats

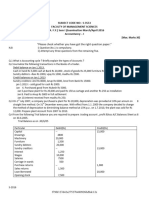

Time : 1.

5

1.5 hrs Topic : Final Accounts MM: 25

Q-1) Mr. Shyamal runs a factory, which produces detergents. Following details were available in

respect of his manufacturing activities for the year ended 31-03-2019. ·

Opening work-in-progress (9000 units) 26,000

Closing work-in-progress (14,000 units) 48,000

Opening inventory of Raw Materials 2,60,000

Closing inventory of Raw Materials 3,20,000

Purchases 8,20,000

Hire charges of Machinery @ ₹ 0.70 per unit manufactured

Hire charges of factory 2,60,000

Direct wages-contracted@ ₹ 0.80 per unit manufactured

and @ ₹ 0.40 per unit of closing W.I.P.

Repairs and maintenance 1,80,000

Units produced - 5,00,000 units

You are required to prepare a Manufacturing Account of Mr. Shyamal for the year ended 31-03-

2019.

(5 Marks)

Q-2) Mr. Birla is a proprietor engaged in business of trading electronics. An excerpt from his Trading &

P&L account is as follows:

Trading and P&L A/c for the year ended 31st March, 2017

Particulars ₹ Particulars ₹

To Cost of Goods Sold 45,00,000 By Sales C

To Gross Profit c/d D

E E

To Rent A/c 26,00,000 By Gross Profit b/d D

To Office Expenses 13,00,000 By Miscellaneous Income E

To Selling Expenses B

To Commission to Manager (on Net Profit 2,00,000

before charging such commission)

To Net Profit A

G 60,00,000

Commission is charged at the rate of 10%.

(5 marks)

-CA. DEEPAK KAPOOR CA-

CA- FOUNDATION TEST

Q-3) The following is the Trial Balance of Mr Smart Mind as at 31st March, 2018:

Particulars Dr.(

Dr.( ₹ ) Particulars Cr.(

Cr.( ₹ )

Plant & Machinery Creditors 1,00,000

(Purchased on 1.7.2017) 1,90,000 Bills Payables 5,600

Furniture & Fixtures 10% Loan From Bank

(Purchased on 1.7.2017) 1,00,000 (taken on 1.7.2017) 50,000

Opening Stock 75,000 Capital Account 5,19,000

Debtors 2,07,000 Sales 6,30,000

Bills Receivables 10,000 Purchases Returns 5,000

12% Investments Discount Earned 1,000

(purchased on 1.7.2017) 50,000 Bad Debts Recovered 2,500

Cash in Hand 5,000 Interest 3,000

Cash at Bank 10,000 Commission 3,750

Drawings 10,650

Purchases 5,25,000

Sales Returns 10,000

Wages 18,500

Carriage Inwards 500

Carriage Outwards 350

Rent 3,000

Insurance 3,600

Salaries 11,200

Discount Allowed 2,000

Bad Debts 5,000

Interest 2,500

Selling & Distribution Expenses 15,800

Income Tax paid 1,000

Loose Tools 3,750

Buildings 60,000

13,19,850 13,19,850

-CA. DEEPAK KAPOOR CA-

CA- FOUNDATION TEST

Additional Information:

(a) Closing Stock as on 31st March 2018 was ₹ 93,600. Loose Tools are valued at ₹ 1,250.

(b) Rent is payable at the rate of ₹ 300 per month. Insurance Premium was paid for the year

ending on 30th June, 2018. ₹ 1,250 is due for interest on Bank Loan.

(c) Accrued Interest on investments amounted to ₹ 1,500. One-third of the commission

received is in respect of work to be done next year.

(d) Provide for depreciation on Plant & Machinery @ 10% p.a. Write 10% off the Furniture &

Fixtures. Depreciate Buildings by 5%.

(e) Write off further ₹ 5,000 as bad. Create Provision for discount on Debtors @ 2%.Create a

Provision for Doubtful debts @ 10%.

(f) A fire occurred on 25th March 2018 in the godown and stock of ₹ 1,000 was destroyed, it

was fully insured but the insurance company admitted the claim to the extent of 60% only.

(g) Goods costing ₹ 2,000 were taken by the proprietor for his personal use but no entry has

been made in the books of accounts.

(h) Goods costing ₹ 3,000 were distributed as free samples but no entry has been made in the

books of accounts.

(i) Manager is entitled to a commission of 5% on Net Profit after charging his commission.

0) Wages include a sum of ₹ 4,000 spent on the erection of a cycle shed for employees and

customers. Wages ₹ 10,000 paid for erection of machinery have been debited to Wages Account.

(k) Remuneration of ₹ 2,000 paid to Sh. B. Barua, a temporary employee, stands debited to

his personal account.

Required: Prepare Trading and Profit and loss Account for the year ending on 31st March, 2018

and a Balance Sheet as at 31st March, 2018.

(15 Marks)

All the Best

‘’ Work hard silently, lets success make the noise”

-CA. DEEPAK KAPOOR CA-

CA- FOUNDATION TEST

You might also like

- Solution Manual For Effective Writing A Handbook For Accountants 11th Edition Claire B May Gordon S MayDocument8 pagesSolution Manual For Effective Writing A Handbook For Accountants 11th Edition Claire B May Gordon S MayPhillipMitchellpxog100% (42)

- Brand Logo and Its ImportanceDocument64 pagesBrand Logo and Its ImportanceDeepak SinghNo ratings yet

- Week 7 Workshop Solutions - Long-Term Debt MarketsDocument3 pagesWeek 7 Workshop Solutions - Long-Term Debt MarketsMengdi ZhangNo ratings yet

- Topper'S Classes: Ca-Foundation (U-86)Document4 pagesTopper'S Classes: Ca-Foundation (U-86)RishabhNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Final AccountsDocument15 pagesFinal AccountsVaishnavi VyapariNo ratings yet

- CorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DADocument3 pagesCorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DAMubin Shaikh NooruNo ratings yet

- Abd Question Paper BankDocument96 pagesAbd Question Paper BankRahul Ghosale100% (1)

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- C.A. Foundation Final Accounts For Sole Proprietorship QuestionsDocument2 pagesC.A. Foundation Final Accounts For Sole Proprietorship Questionsgpgaming1693No ratings yet

- Solution Example 3Document2 pagesSolution Example 3ashish panwarNo ratings yet

- 11 - Final Accounts Assessment 4 PDFDocument7 pages11 - Final Accounts Assessment 4 PDFShreyas ParekhNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- CorporateAccounting Costing October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A F96AA255Document3 pagesCorporateAccounting Costing October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A F96AA255Mubin Shaikh NooruNo ratings yet

- Suggested Answer CAP I Dec 2011Document90 pagesSuggested Answer CAP I Dec 2011Meghraj AryalNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- Mock Test 1 Accounts QuestionsDocument4 pagesMock Test 1 Accounts Questionsbhawanar3950No ratings yet

- Goodwill 2004 - 3,43,700 (Printing Mistake)Document9 pagesGoodwill 2004 - 3,43,700 (Printing Mistake)vasanthgurusamynsNo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- Revision Sheet - 2023 - 2024Document27 pagesRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Pune Uni M.B.A. (2016 Pattern)Document118 pagesPune Uni M.B.A. (2016 Pattern)yogeshNo ratings yet

- June 2016Document27 pagesJune 2016subham8555No ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet

- ADL 03 - Accounting For Managers AssignmentsDocument12 pagesADL 03 - Accounting For Managers AssignmentsAishwarya Latha Gangadhar50% (4)

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Revision Sheet - 2022-23Document27 pagesRevision Sheet - 2022-23addityawritesNo ratings yet

- M.B.A (2013 Pattern)Document110 pagesM.B.A (2013 Pattern)Niharika MehtreNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Trading & Profit & Loss Sheet 3Document2 pagesTrading & Profit & Loss Sheet 3Anshul JainNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Bba Iii CfaDocument3 pagesBba Iii Cfasaksham sikhwalNo ratings yet

- Mid SemDocument4 pagesMid Semf20220077No ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Company Final Accounts: Debit Rs. Credit RsDocument5 pagesCompany Final Accounts: Debit Rs. Credit RsDebaditya SenguptaNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- Homework 2Document2 pagesHomework 2Sudeep0% (1)

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Company Financial StatementsDocument6 pagesCompany Financial StatementsHasnain MahmoodNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- B.B.A. F.Y. Sem I March April 2016 Accountancy - IDocument2 pagesB.B.A. F.Y. Sem I March April 2016 Accountancy - Itusharvip2005No ratings yet

- Sole Prop SumsDocument6 pagesSole Prop SumsSidhant KothriwalNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- NCFM Model Test PaperDocument36 pagesNCFM Model Test PaperSpl FriendsNo ratings yet

- EFD Regulation PDFDocument36 pagesEFD Regulation PDFDeo CluxNo ratings yet

- Epc DraftDocument75 pagesEpc DraftDipak PatelNo ratings yet

- Meaning of Stock ExchangeDocument4 pagesMeaning of Stock ExchangeShruti BhatiaNo ratings yet

- Oblicon Memory AidDocument25 pagesOblicon Memory Aidcmv mendozaNo ratings yet

- Business Portfolio: The Growth-Share MatrixDocument2 pagesBusiness Portfolio: The Growth-Share MatrixUsama KhanNo ratings yet

- IBMSB-BL-Contract Act-Case Studies 1Document2 pagesIBMSB-BL-Contract Act-Case Studies 1ankita guptaNo ratings yet

- Del Mundo Landscape SpecialistDocument4 pagesDel Mundo Landscape SpecialistKendall JennerNo ratings yet

- Export Packing CreditDocument4 pagesExport Packing CreditkarthicfinconNo ratings yet

- Aa13 Eba (Tam)Document7 pagesAa13 Eba (Tam)Maiylvaganam ThishanthanNo ratings yet

- Axioma RiskDocument2 pagesAxioma RiskCheah Chee MunNo ratings yet

- Airport Privatization in India: Lessons From The Bidding Process in Delhi and MumbaiDocument54 pagesAirport Privatization in India: Lessons From The Bidding Process in Delhi and MumbaiRahul ShastriNo ratings yet

- ECO 372 Final Exam GuideDocument16 pagesECO 372 Final Exam GuideECO 372 Week 5 Final ExaminationNo ratings yet

- Short NotesDocument3 pagesShort NotesGautamPariharNo ratings yet

- Rupali Life Insurance Company: A Report OnDocument19 pagesRupali Life Insurance Company: A Report OnHk RockyNo ratings yet

- The Gazette: of IndiaDocument4 pagesThe Gazette: of Indiaravi_bhateja_2No ratings yet

- G) KFN /fi6 A) +S DLGR) H/: Ljlgodfjnl, @) &Document21 pagesG) KFN /fi6 A) +S DLGR) H/: Ljlgodfjnl, @) &Dhurba KarkiNo ratings yet

- Construction Cost Control Assignment 1: The End of The Project)Document2 pagesConstruction Cost Control Assignment 1: The End of The Project)Suresh SubramaniamNo ratings yet

- Ebtax SrilankaDocument166 pagesEbtax Srilankaramanvp60No ratings yet

- Zoomlion Annual ReportDocument192 pagesZoomlion Annual ReportHung Wen GoNo ratings yet

- Sample TestDocument15 pagesSample TestSoofeng LokNo ratings yet

- Constancio Joaquin VS. MadridDocument6 pagesConstancio Joaquin VS. MadridGIDEON, JR. INESNo ratings yet

- 2307 Jan 2018 ENCS v3Document1 page2307 Jan 2018 ENCS v3JAQUIELINE ANUENGONo ratings yet

- AISFDocument2 pagesAISFamitaquariusNo ratings yet

- CH 7 PresentationDocument32 pagesCH 7 PresentationJes KnehansNo ratings yet

- Lokanath MarketingDocument70 pagesLokanath MarketingPrabiNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet