Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsLesson 4

Lesson 4

Uploaded by

EstherThe document discusses how capital, income, drawings, and expenses affect the accounting equation. It provides examples of how the accounting equation is impacted by:

1) A capital contribution which increases assets and owners' equity.

2) Receiving income for goods sold, which increases assets and owners' equity.

3) Paying expenses which decreases assets and owners' equity.

4) Withdrawals by the owner which decreases assets and owners' equity.

The accounting equation must always balance, with total assets equaling the sum of owners' equity and liabilities. Changes to one side of the equation require equal and opposite changes to the other side.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- EBOOK Ebook PDF Write Now 3Rd Edition by Karin Russell Download Full Chapter PDF Docx KindleDocument61 pagesEBOOK Ebook PDF Write Now 3Rd Edition by Karin Russell Download Full Chapter PDF Docx Kindleheather.bekis55398% (54)

- Stephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01Document29 pagesStephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01atul parad100% (2)

- Healing MantrasDocument29 pagesHealing Mantrasasingh18in100% (15)

- Mesoamerican Civilizations Lesson PlanDocument24 pagesMesoamerican Civilizations Lesson Planapi-279892935No ratings yet

- Accounting Equation Worksheet StudentDocument2 pagesAccounting Equation Worksheet StudentAlexis CarranzaNo ratings yet

- LJ Create: Analog and Digital Motor ControlDocument7 pagesLJ Create: Analog and Digital Motor ControlMahmud Hasan SumonNo ratings yet

- Mineral Water Report PDFDocument35 pagesMineral Water Report PDFSadi Mohammad Naved100% (1)

- Acc 111 Exam Review 1 Notes and SolutionDocument12 pagesAcc 111 Exam Review 1 Notes and SolutionGeorgeNo ratings yet

- Unit 1: Introduction of Business EquationDocument14 pagesUnit 1: Introduction of Business EquationAnees GillaniNo ratings yet

- Answer Key Chapter 3Document60 pagesAnswer Key Chapter 3HectorNo ratings yet

- The Accounting Equation: Business EducationDocument44 pagesThe Accounting Equation: Business EducationMarcus WongNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationAbubaker ShahzadNo ratings yet

- Midterm 1 Fall 19Document17 pagesMidterm 1 Fall 19shaimaaelgamalNo ratings yet

- Chapter 2Document15 pagesChapter 2emanmamdouh596No ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- 1-Accounting EquationDocument4 pages1-Accounting EquationNoraNo ratings yet

- The Accounting EquationDocument4 pagesThe Accounting Equationimandimahawatte2008No ratings yet

- Chapter 2Document49 pagesChapter 2haiderasim1212No ratings yet

- M3A Expanded Accounting EquationDocument20 pagesM3A Expanded Accounting EquationCharles Eli AlejandroNo ratings yet

- Principles of Accounting Second Year, Semester 1Document38 pagesPrinciples of Accounting Second Year, Semester 1Sara Abdelrahim MakkawiNo ratings yet

- Accounting EquationDocument24 pagesAccounting EquationApsara GunarathneNo ratings yet

- 02 - Book Keeping-QuestionDocument9 pages02 - Book Keeping-Questionvivian1642006No ratings yet

- Principles of Accounting Lecture 3Document21 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- SOAL AkuntansiDocument13 pagesSOAL AkuntansiArum MashitoNo ratings yet

- Accounting EquationfinalDocument40 pagesAccounting EquationfinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Principles of Accounting Lecture 3Document30 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

- Chapter 3 Lesson 1: Analyzing Changes in Financial PositionDocument22 pagesChapter 3 Lesson 1: Analyzing Changes in Financial PositionSneha DasNo ratings yet

- Principles of Accounting Second Year, Semester 1: Transactions AnalysisDocument38 pagesPrinciples of Accounting Second Year, Semester 1: Transactions AnalysisSara Abdelrahim MakkawiNo ratings yet

- Accounting Presentation COUNTPADocument118 pagesAccounting Presentation COUNTPADennis Esik MaligayaNo ratings yet

- Case Study 1Document5 pagesCase Study 18142301001No ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- Ch01. ReferrenceDocument38 pagesCh01. ReferrencerrNo ratings yet

- Group 1 Accounting 1Document14 pagesGroup 1 Accounting 1Mary Jessa Ubod TapiaNo ratings yet

- The Accounting EquationDocument8 pagesThe Accounting EquationcherinetNo ratings yet

- Accounting LedgerDocument5 pagesAccounting LedgerlekalonzoNo ratings yet

- Acc030 Accounting EquationDocument3 pagesAcc030 Accounting EquationAqilahNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingJunaid IslamNo ratings yet

- Accounting Principle1Document17 pagesAccounting Principle1DivyaNo ratings yet

- AfM 0 - Introduction, Transaction Recognition, AccountsDocument30 pagesAfM 0 - Introduction, Transaction Recognition, AccountsjaymursalieNo ratings yet

- Journal Entry and LedgerDocument23 pagesJournal Entry and LedgerValerie BognotNo ratings yet

- Question No 1: Cash Capital StockDocument6 pagesQuestion No 1: Cash Capital StockBushra NazNo ratings yet

- Chapter 2 - Accounting Equation and Double EntryDocument10 pagesChapter 2 - Accounting Equation and Double EntrykundiarshdeepNo ratings yet

- Chapter 2 - Assets Liablities and The Accounting EquationDocument51 pagesChapter 2 - Assets Liablities and The Accounting Equationshemida100% (7)

- 2.1b Double Entry (Expenses and Incomes)Document14 pages2.1b Double Entry (Expenses and Incomes)cccgNo ratings yet

- Chapter 6 Accounting Equations: Short Answer QuestionDocument16 pagesChapter 6 Accounting Equations: Short Answer QuestionSaransh BattaNo ratings yet

- Chap 1 - Acc Equation Exercises - STDocument17 pagesChap 1 - Acc Equation Exercises - STKim NganNo ratings yet

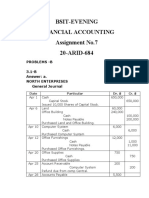

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- Chapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Document9 pagesChapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Lorence IbañezNo ratings yet

- Liabilities Are Classified Into Current and Non-Current.: SUBJECT Fundamental of AccountingDocument12 pagesLiabilities Are Classified Into Current and Non-Current.: SUBJECT Fundamental of Accounting1214 - MILLAN, CARLO, LNo ratings yet

- Chap 03 Double EntryDocument6 pagesChap 03 Double Entry465jgbgcvfNo ratings yet

- Double Entry BookkeepingDocument23 pagesDouble Entry BookkeepingAhrian BenaNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- L02 App of Acc Equation Wo ExerciseDocument7 pagesL02 App of Acc Equation Wo ExercisecalebNo ratings yet

- Chapter Accounting EquationDocument24 pagesChapter Accounting Equationpriyam.200409No ratings yet

- Accounting Chapter 3Document14 pagesAccounting Chapter 3Huy Nguyễn NgọcNo ratings yet

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- BKP 9 Accounting EquationDocument13 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Studies in Accounting 3Document19 pagesStudies in Accounting 3amirrashad141No ratings yet

- Accounting Period and Accounting EquationDocument19 pagesAccounting Period and Accounting EquationsptaraNo ratings yet

- Recording of TransactionDocument20 pagesRecording of TransactionNikita SharmaNo ratings yet

- Double Entry Illustrative ProblemDocument7 pagesDouble Entry Illustrative ProblemYana JaureguiNo ratings yet

- Engleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFDocument384 pagesEngleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFHarini SreedharanNo ratings yet

- Item, TM, and Move Tutor Locations v4.0 - Radical RedDocument19 pagesItem, TM, and Move Tutor Locations v4.0 - Radical Redsantiagopalomino268No ratings yet

- BR Quickie Freestyle Flyer v2 m56577569830549148Document2 pagesBR Quickie Freestyle Flyer v2 m56577569830549148beedoesNo ratings yet

- RUF Briquetting Systems For Wood and Biomass: PrechargerDocument12 pagesRUF Briquetting Systems For Wood and Biomass: PrechargerBartNo ratings yet

- Ratios-Solvency RatiosDocument18 pagesRatios-Solvency RatiosHari chandanaNo ratings yet

- BladderDocument66 pagesBladderPatel Alapkumar Kanubhai100% (1)

- Ai Mental HealthDocument11 pagesAi Mental HealthRajaNo ratings yet

- Best FPGA Development Practices 2014-02-20Document16 pagesBest FPGA Development Practices 2014-02-20Aaron RobbinsNo ratings yet

- Financial Accounting: Volume 3 Summary ValixDocument10 pagesFinancial Accounting: Volume 3 Summary ValixPrincess KayNo ratings yet

- Latin LiteratureDocument7 pagesLatin LiteraturePepe CuestaNo ratings yet

- Synfocity : Chawhma Inkhawm Chawhma InkhawmDocument4 pagesSynfocity : Chawhma Inkhawm Chawhma InkhawmMizoram Presbyterian Church SynodNo ratings yet

- INEVTARIODocument3 pagesINEVTARIOjorge chirinosNo ratings yet

- Lamb Historical ReenactmentDocument13 pagesLamb Historical ReenactmentlikmdogNo ratings yet

- Shell Omala s4 GXV 460 TdsDocument2 pagesShell Omala s4 GXV 460 TdsEdgar Leonel CortésNo ratings yet

- Afroze Textile Industries (PVT) LTDDocument42 pagesAfroze Textile Industries (PVT) LTDAslamNo ratings yet

- The Information AGE: Diong, Angelica, CDocument23 pagesThe Information AGE: Diong, Angelica, CManongdo AllanNo ratings yet

- Ae112 NotesDocument3 pagesAe112 NotesJillian Shaindy BuyaganNo ratings yet

- 7 - Regional Ecumenical Christian Councils in IndiaDocument11 pages7 - Regional Ecumenical Christian Councils in IndiaAjo Alex100% (1)

- Annual Procurement Program Calendar Year 2017: 1 Quarter 2 Quarter 3 Quarter 4 QuarterDocument2 pagesAnnual Procurement Program Calendar Year 2017: 1 Quarter 2 Quarter 3 Quarter 4 Quarterjacquelyn samsonNo ratings yet

- Defence Brochure 06Document12 pagesDefence Brochure 06pnsanat100% (1)

- The Diasporic Imaginary: Brian Keith AxelDocument18 pagesThe Diasporic Imaginary: Brian Keith AxelAM HERNANDONo ratings yet

- 1 Clock Domain CrossingDocument25 pages1 Clock Domain CrossingrajapbrNo ratings yet

- The Making of The Kosher PhoneDocument90 pagesThe Making of The Kosher Phonejames wrightNo ratings yet

- Sample Evidentiary Objections For CaliforniaDocument2 pagesSample Evidentiary Objections For CaliforniaStan Burman100% (1)

- Lesson Plan Social Studies East IndiansDocument8 pagesLesson Plan Social Studies East Indiansapi-317157861No ratings yet

Lesson 4

Lesson 4

Uploaded by

Esther0 ratings0% found this document useful (0 votes)

8 views3 pagesThe document discusses how capital, income, drawings, and expenses affect the accounting equation. It provides examples of how the accounting equation is impacted by:

1) A capital contribution which increases assets and owners' equity.

2) Receiving income for goods sold, which increases assets and owners' equity.

3) Paying expenses which decreases assets and owners' equity.

4) Withdrawals by the owner which decreases assets and owners' equity.

The accounting equation must always balance, with total assets equaling the sum of owners' equity and liabilities. Changes to one side of the equation require equal and opposite changes to the other side.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses how capital, income, drawings, and expenses affect the accounting equation. It provides examples of how the accounting equation is impacted by:

1) A capital contribution which increases assets and owners' equity.

2) Receiving income for goods sold, which increases assets and owners' equity.

3) Paying expenses which decreases assets and owners' equity.

4) Withdrawals by the owner which decreases assets and owners' equity.

The accounting equation must always balance, with total assets equaling the sum of owners' equity and liabilities. Changes to one side of the equation require equal and opposite changes to the other side.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesLesson 4

Lesson 4

Uploaded by

EstherThe document discusses how capital, income, drawings, and expenses affect the accounting equation. It provides examples of how the accounting equation is impacted by:

1) A capital contribution which increases assets and owners' equity.

2) Receiving income for goods sold, which increases assets and owners' equity.

3) Paying expenses which decreases assets and owners' equity.

4) Withdrawals by the owner which decreases assets and owners' equity.

The accounting equation must always balance, with total assets equaling the sum of owners' equity and liabilities. Changes to one side of the equation require equal and opposite changes to the other side.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

28/01/22

The effects of capital, income, drawings and expenses on the accounting equation

o Capital and drawings are the main accounts for owners’ equity.

o When the owner adds money/assets into the business as capital, the owner gets more

interest (increase in money), but when the owners withdraws money/assets out of the

business, the interest on the owners’ capital decreases.(money decreases)

o Income and expenses affect owners’ equity through profit or loss.

o Profit is income, and an increase in profit increases the owners’ equity.

o Expenses and drawings reduce income and the owners’ equity.

Examples

A. Capital contribution by the owner

1) The owner transferred $ 180 000 into the business’ bank account as his capital.

Effect; Money was deposited into the bank, bank increases. Capital introduction

increases monetary interest in the business, owners’ equity increases. No effect on

liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

1) +180 000 Bank increased +180 000 Capital 0 -

B. Receiving money for income

2) Sold goods for cash, $ 12 500.

Effect; cash was received when good were sold, cash increases. Sales is income,

income increases profit, owners’ equity increases. No effect on liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

2) + 12 500 Cash increased +12 500 Sales (income) 0 -

C. Paying for expenses

3) Paid cash for stationery, $ 300.

Effect; Cash in the business decreases when stationery is bought. Stationery is an

expense, which decreases profits and owners’ equity. No effect on liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

3) - 300 Cash decreased - 300 Stationery (expense) 0 -

D. Withdrawals/drawings by the owner

4) The owner took $ 5 000 cash for personal use.

Effect; Cash in business decreases. Drawings decrease owners’ equity. No effect on

liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

4) - 5 000 Cash decreased - 5 000 Drawings 0 -

E. Buying other assets

5) Bought equipment and paid by debit card $ 30 000.

Effect; Bank decreases, equipment in the business increases. No effect on owners’

equity and liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

5) - 30 000 Bank decreased 0 - 0 -

+30 000 Equipment increased

F. Depositing cash into the bank

6) Deposited $ 1 500 cash into the bank

Effect; Cash account decreases, bank account increases. No effect on owners’

equity and liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

6) - 1 500 Cash decreased 0 - 0 -

+1 500 Bank increased

G. Withdrawing money for cash float

7) Withdrew $ 400 by debit card for cash float.

Effect; Bank account decreases, Cash float increases. No effect on owners’ equity

and liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

7) - 400 Bank decreased 0 - 0 -

+400 Cash float increased

H. Withdrawing money for business use.

8) Withdrew $ 6 000 by debit card for business use.

Effect; Bank account decreases, cash account increases. No effect on owners’

equity and liabilities.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

8) - 6 000 Bank decreased 0 - 0 -

+6 000 Cash increased

I. Borrowing a loan (liabilities)

9) Borrowed a loan of $ 50 000 from Bank ABC, received the money by EFT.

Effect; Bank account increases when loan is received. Liabilities increase since it’s a

borrowed loan. No effect on owners’ equity.

Assets = Owners’ Equity + Liabilities

Effect Reason Effect Reason Effect Reason

9) +50 000 Bank increased 0 - +50 000 Liabilities

increase (Loan,

Bank ABC)

You might also like

- EBOOK Ebook PDF Write Now 3Rd Edition by Karin Russell Download Full Chapter PDF Docx KindleDocument61 pagesEBOOK Ebook PDF Write Now 3Rd Edition by Karin Russell Download Full Chapter PDF Docx Kindleheather.bekis55398% (54)

- Stephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01Document29 pagesStephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01atul parad100% (2)

- Healing MantrasDocument29 pagesHealing Mantrasasingh18in100% (15)

- Mesoamerican Civilizations Lesson PlanDocument24 pagesMesoamerican Civilizations Lesson Planapi-279892935No ratings yet

- Accounting Equation Worksheet StudentDocument2 pagesAccounting Equation Worksheet StudentAlexis CarranzaNo ratings yet

- LJ Create: Analog and Digital Motor ControlDocument7 pagesLJ Create: Analog and Digital Motor ControlMahmud Hasan SumonNo ratings yet

- Mineral Water Report PDFDocument35 pagesMineral Water Report PDFSadi Mohammad Naved100% (1)

- Acc 111 Exam Review 1 Notes and SolutionDocument12 pagesAcc 111 Exam Review 1 Notes and SolutionGeorgeNo ratings yet

- Unit 1: Introduction of Business EquationDocument14 pagesUnit 1: Introduction of Business EquationAnees GillaniNo ratings yet

- Answer Key Chapter 3Document60 pagesAnswer Key Chapter 3HectorNo ratings yet

- The Accounting Equation: Business EducationDocument44 pagesThe Accounting Equation: Business EducationMarcus WongNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationAbubaker ShahzadNo ratings yet

- Midterm 1 Fall 19Document17 pagesMidterm 1 Fall 19shaimaaelgamalNo ratings yet

- Chapter 2Document15 pagesChapter 2emanmamdouh596No ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- 1-Accounting EquationDocument4 pages1-Accounting EquationNoraNo ratings yet

- The Accounting EquationDocument4 pagesThe Accounting Equationimandimahawatte2008No ratings yet

- Chapter 2Document49 pagesChapter 2haiderasim1212No ratings yet

- M3A Expanded Accounting EquationDocument20 pagesM3A Expanded Accounting EquationCharles Eli AlejandroNo ratings yet

- Principles of Accounting Second Year, Semester 1Document38 pagesPrinciples of Accounting Second Year, Semester 1Sara Abdelrahim MakkawiNo ratings yet

- Accounting EquationDocument24 pagesAccounting EquationApsara GunarathneNo ratings yet

- 02 - Book Keeping-QuestionDocument9 pages02 - Book Keeping-Questionvivian1642006No ratings yet

- Principles of Accounting Lecture 3Document21 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- SOAL AkuntansiDocument13 pagesSOAL AkuntansiArum MashitoNo ratings yet

- Accounting EquationfinalDocument40 pagesAccounting EquationfinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Principles of Accounting Lecture 3Document30 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

- Chapter 3 Lesson 1: Analyzing Changes in Financial PositionDocument22 pagesChapter 3 Lesson 1: Analyzing Changes in Financial PositionSneha DasNo ratings yet

- Principles of Accounting Second Year, Semester 1: Transactions AnalysisDocument38 pagesPrinciples of Accounting Second Year, Semester 1: Transactions AnalysisSara Abdelrahim MakkawiNo ratings yet

- Accounting Presentation COUNTPADocument118 pagesAccounting Presentation COUNTPADennis Esik MaligayaNo ratings yet

- Case Study 1Document5 pagesCase Study 18142301001No ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- Ch01. ReferrenceDocument38 pagesCh01. ReferrencerrNo ratings yet

- Group 1 Accounting 1Document14 pagesGroup 1 Accounting 1Mary Jessa Ubod TapiaNo ratings yet

- The Accounting EquationDocument8 pagesThe Accounting EquationcherinetNo ratings yet

- Accounting LedgerDocument5 pagesAccounting LedgerlekalonzoNo ratings yet

- Acc030 Accounting EquationDocument3 pagesAcc030 Accounting EquationAqilahNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingJunaid IslamNo ratings yet

- Accounting Principle1Document17 pagesAccounting Principle1DivyaNo ratings yet

- AfM 0 - Introduction, Transaction Recognition, AccountsDocument30 pagesAfM 0 - Introduction, Transaction Recognition, AccountsjaymursalieNo ratings yet

- Journal Entry and LedgerDocument23 pagesJournal Entry and LedgerValerie BognotNo ratings yet

- Question No 1: Cash Capital StockDocument6 pagesQuestion No 1: Cash Capital StockBushra NazNo ratings yet

- Chapter 2 - Accounting Equation and Double EntryDocument10 pagesChapter 2 - Accounting Equation and Double EntrykundiarshdeepNo ratings yet

- Chapter 2 - Assets Liablities and The Accounting EquationDocument51 pagesChapter 2 - Assets Liablities and The Accounting Equationshemida100% (7)

- 2.1b Double Entry (Expenses and Incomes)Document14 pages2.1b Double Entry (Expenses and Incomes)cccgNo ratings yet

- Chapter 6 Accounting Equations: Short Answer QuestionDocument16 pagesChapter 6 Accounting Equations: Short Answer QuestionSaransh BattaNo ratings yet

- Chap 1 - Acc Equation Exercises - STDocument17 pagesChap 1 - Acc Equation Exercises - STKim NganNo ratings yet

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- Chapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Document9 pagesChapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Lorence IbañezNo ratings yet

- Liabilities Are Classified Into Current and Non-Current.: SUBJECT Fundamental of AccountingDocument12 pagesLiabilities Are Classified Into Current and Non-Current.: SUBJECT Fundamental of Accounting1214 - MILLAN, CARLO, LNo ratings yet

- Chap 03 Double EntryDocument6 pagesChap 03 Double Entry465jgbgcvfNo ratings yet

- Double Entry BookkeepingDocument23 pagesDouble Entry BookkeepingAhrian BenaNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- L02 App of Acc Equation Wo ExerciseDocument7 pagesL02 App of Acc Equation Wo ExercisecalebNo ratings yet

- Chapter Accounting EquationDocument24 pagesChapter Accounting Equationpriyam.200409No ratings yet

- Accounting Chapter 3Document14 pagesAccounting Chapter 3Huy Nguyễn NgọcNo ratings yet

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- BKP 9 Accounting EquationDocument13 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Studies in Accounting 3Document19 pagesStudies in Accounting 3amirrashad141No ratings yet

- Accounting Period and Accounting EquationDocument19 pagesAccounting Period and Accounting EquationsptaraNo ratings yet

- Recording of TransactionDocument20 pagesRecording of TransactionNikita SharmaNo ratings yet

- Double Entry Illustrative ProblemDocument7 pagesDouble Entry Illustrative ProblemYana JaureguiNo ratings yet

- Engleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFDocument384 pagesEngleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFHarini SreedharanNo ratings yet

- Item, TM, and Move Tutor Locations v4.0 - Radical RedDocument19 pagesItem, TM, and Move Tutor Locations v4.0 - Radical Redsantiagopalomino268No ratings yet

- BR Quickie Freestyle Flyer v2 m56577569830549148Document2 pagesBR Quickie Freestyle Flyer v2 m56577569830549148beedoesNo ratings yet

- RUF Briquetting Systems For Wood and Biomass: PrechargerDocument12 pagesRUF Briquetting Systems For Wood and Biomass: PrechargerBartNo ratings yet

- Ratios-Solvency RatiosDocument18 pagesRatios-Solvency RatiosHari chandanaNo ratings yet

- BladderDocument66 pagesBladderPatel Alapkumar Kanubhai100% (1)

- Ai Mental HealthDocument11 pagesAi Mental HealthRajaNo ratings yet

- Best FPGA Development Practices 2014-02-20Document16 pagesBest FPGA Development Practices 2014-02-20Aaron RobbinsNo ratings yet

- Financial Accounting: Volume 3 Summary ValixDocument10 pagesFinancial Accounting: Volume 3 Summary ValixPrincess KayNo ratings yet

- Latin LiteratureDocument7 pagesLatin LiteraturePepe CuestaNo ratings yet

- Synfocity : Chawhma Inkhawm Chawhma InkhawmDocument4 pagesSynfocity : Chawhma Inkhawm Chawhma InkhawmMizoram Presbyterian Church SynodNo ratings yet

- INEVTARIODocument3 pagesINEVTARIOjorge chirinosNo ratings yet

- Lamb Historical ReenactmentDocument13 pagesLamb Historical ReenactmentlikmdogNo ratings yet

- Shell Omala s4 GXV 460 TdsDocument2 pagesShell Omala s4 GXV 460 TdsEdgar Leonel CortésNo ratings yet

- Afroze Textile Industries (PVT) LTDDocument42 pagesAfroze Textile Industries (PVT) LTDAslamNo ratings yet

- The Information AGE: Diong, Angelica, CDocument23 pagesThe Information AGE: Diong, Angelica, CManongdo AllanNo ratings yet

- Ae112 NotesDocument3 pagesAe112 NotesJillian Shaindy BuyaganNo ratings yet

- 7 - Regional Ecumenical Christian Councils in IndiaDocument11 pages7 - Regional Ecumenical Christian Councils in IndiaAjo Alex100% (1)

- Annual Procurement Program Calendar Year 2017: 1 Quarter 2 Quarter 3 Quarter 4 QuarterDocument2 pagesAnnual Procurement Program Calendar Year 2017: 1 Quarter 2 Quarter 3 Quarter 4 Quarterjacquelyn samsonNo ratings yet

- Defence Brochure 06Document12 pagesDefence Brochure 06pnsanat100% (1)

- The Diasporic Imaginary: Brian Keith AxelDocument18 pagesThe Diasporic Imaginary: Brian Keith AxelAM HERNANDONo ratings yet

- 1 Clock Domain CrossingDocument25 pages1 Clock Domain CrossingrajapbrNo ratings yet

- The Making of The Kosher PhoneDocument90 pagesThe Making of The Kosher Phonejames wrightNo ratings yet

- Sample Evidentiary Objections For CaliforniaDocument2 pagesSample Evidentiary Objections For CaliforniaStan Burman100% (1)

- Lesson Plan Social Studies East IndiansDocument8 pagesLesson Plan Social Studies East Indiansapi-317157861No ratings yet