Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

51 viewsSalary Sleep October

Salary Sleep October

Uploaded by

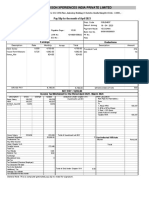

mayank dubeyThis payslip summarizes an employee's earnings and deductions for October 2021. It shows the employee's basic salary, HRA, and other bonuses amounting to a gross pay of Rs. 24,892. Deductions include a PF contribution of Rs. 2,315 resulting in a net pay of Rs. 22,577. An annual income tax worksheet provides projections of the employee's total gross salary of Rs. 299,965 for the financial year and estimates tax deductions of Rs. 0 after claiming deductions under Section 80C of Rs. 27,781.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- PayslipDocument1 pagePayslipKathy DagunoNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Salary Slip AprilDocument1 pageSalary Slip AprilDaya Shankar100% (2)

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- The International Tax HandbookDocument962 pagesThe International Tax HandbookDiego Serrano Dotte100% (2)

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- HTMLReports 1Document1 pageHTMLReports 1kuldeeptawar250No ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Salary For Sep - 2022Document1 pageSalary For Sep - 2022narottam.ojhaNo ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- HTMLReports 12Document1 pageHTMLReports 12Umesh SainiNo ratings yet

- HTML ReportsDocument1 pageHTML ReportsRahul SharmaNo ratings yet

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Document1 pageGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- Slip PDFDocument1 pageSlip PDFPratikDuttaNo ratings yet

- SlipDocument1 pageSlipPratikDuttaNo ratings yet

- Payslip For The Month of May 2020: Earnings DeductionsDocument1 pagePayslip For The Month of May 2020: Earnings DeductionsRNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- May'24 Salary SlipDocument1 pageMay'24 Salary Slipayanbhargav3No ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- March PDFDocument1 pageMarch PDFRNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Payslip For The Month of January 2022: Earnings DeductionsDocument1 pagePayslip For The Month of January 2022: Earnings Deductionssunanda singhNo ratings yet

- HTML ReportsDocument8 pagesHTML Reportsdpkch4141No ratings yet

- April'24 Salary SilpDocument1 pageApril'24 Salary Silpayanbhargav3No ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Payslip For The Month of March 2022: Earnings DeductionsDocument1 pagePayslip For The Month of March 2022: Earnings Deductionssunanda singhNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsuresh1.somisettyNo ratings yet

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Pay Slip OctDocument1 pagePay Slip Octchahalnikita7No ratings yet

- ReportDocument1 pageReportPriyanka DodkeNo ratings yet

- PS Mar 2023Document1 pagePS Mar 2023kannesravan80No ratings yet

- CG JUL 2023 46237545 PayslipDocument1 pageCG JUL 2023 46237545 Payslipsubalsahoo2018No ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsps5927510No ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Nirima Sahu ComputationDocument2 pagesNirima Sahu Computationbrs consultancyNo ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- CG AUG 2023 46237545 PayslipDocument1 pageCG AUG 2023 46237545 Payslipsubalsahoo2018No ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- Tax Returns Father 2 YearsDocument6 pagesTax Returns Father 2 YearsPARAMJEETSINGHNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MaynikitachaudharyworldNo ratings yet

- Payslip For The Month of FEBRUARY 2022: Capgemini Technology Services India LimitedDocument1 pagePayslip For The Month of FEBRUARY 2022: Capgemini Technology Services India LimitedAadityaNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - July 2022Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - July 2022goal.iit09No ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument2 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoSatyasheel ChandaneNo ratings yet

- computionDocument6 pagescomputionchiragdeora8No ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- HTML ReportsDocument2 pagesHTML Reportsdpkch4141No ratings yet

- PayslipDocument1 pagePayslipwala meronNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- PavanDocument1 pagePavanPavan KumarNo ratings yet

- Dimension Data India PVT LTD: Pay Slip For The Month of August 2019Document1 pageDimension Data India PVT LTD: Pay Slip For The Month of August 2019Ashok ChauhanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TX 101Document7 pagesTX 101Pau SantosNo ratings yet

- Philippine School of Business AdministrationDocument39 pagesPhilippine School of Business Administrationnorhana lucmanNo ratings yet

- Lecture 2Document24 pagesLecture 2Bình MinhNo ratings yet

- Income Tax Provisions Related To Charitable Trust in Brief: Income From Business Which Is Not IncidentalDocument5 pagesIncome Tax Provisions Related To Charitable Trust in Brief: Income From Business Which Is Not IncidentalAnkur MittalNo ratings yet

- DECIMP0101237942670Document2 pagesDECIMP0101237942670Yusuf ElkahkyNo ratings yet

- Shah G 4Document1 pageShah G 4Mehar ZamaanNo ratings yet

- Which Is Subject To FINAL TAXDocument1 pageWhich Is Subject To FINAL TAXbutterfly kisses0217No ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- Spesifikasi Kaedah Pengiraan Berkomputer PCB 2023Document48 pagesSpesifikasi Kaedah Pengiraan Berkomputer PCB 2023Annie LimNo ratings yet

- Order No. - 35058238Document2 pagesOrder No. - 35058238Xyz XyzNo ratings yet

- Myanmar Tax Booklet - 2019 2020Document60 pagesMyanmar Tax Booklet - 2019 2020Sai PhyoNo ratings yet

- 38 Tan vs. Municipality of PagbilaoDocument4 pages38 Tan vs. Municipality of PagbilaoSara Andrea SantiagoNo ratings yet

- Income Tax and Benefit ReturnDocument8 pagesIncome Tax and Benefit Returnapi-457375876No ratings yet

- Fabm2 12 Q2 1002 SGDocument27 pagesFabm2 12 Q2 1002 SGTin CabosNo ratings yet

- Commissioner of Internal Revenue Vs CTADocument2 pagesCommissioner of Internal Revenue Vs CTACarl IlaganNo ratings yet

- Statement Redesign OnlineDocument2 pagesStatement Redesign OnlineJoshua LaporteNo ratings yet

- Ranchi Municipal Corporation Pay.Document2 pagesRanchi Municipal Corporation Pay.Adarsh JhaNo ratings yet

- Express Scripts Surety Bond ApplicationDocument2 pagesExpress Scripts Surety Bond ApplicationPaul SteveNo ratings yet

- Finance Act 2020:: Key Changes and ImplicationsDocument5 pagesFinance Act 2020:: Key Changes and ImplicationsAdebayo Yusuff AdesholaNo ratings yet

- 21 - Continental Micronesia v. CIRDocument10 pages21 - Continental Micronesia v. CIRkaira marie carlosNo ratings yet

- 3 Income Taxation Final PDFDocument109 pages3 Income Taxation Final PDFwilliam0910900% (1)

- Philippine Bank of Communications v.CIR By: PJ Doronila FactsDocument3 pagesPhilippine Bank of Communications v.CIR By: PJ Doronila FactsBarry BrananaNo ratings yet

- Flytxt - ECB Interest - Form 15CB - 21 Nov 22Document4 pagesFlytxt - ECB Interest - Form 15CB - 21 Nov 22RahulNo ratings yet

- Tax Reform Cash Transfer Unconditional Cash TransferDocument16 pagesTax Reform Cash Transfer Unconditional Cash TransferChristian ErrylNo ratings yet

- SR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDocument2 pagesSR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDesikanNo ratings yet

- Corporate Taxation in BangladeshDocument8 pagesCorporate Taxation in Bangladeshskn092No ratings yet

- RwservletDocument1 pageRwservletstkmdbillalNo ratings yet

- 2007 Foreign National Checklist FINALDocument5 pages2007 Foreign National Checklist FINALcglaskoNo ratings yet

- Jagannath Kishore College, Purulia Pay Slip Government of West BengalDocument1 pageJagannath Kishore College, Purulia Pay Slip Government of West BengaldebabratamathNo ratings yet

Salary Sleep October

Salary Sleep October

Uploaded by

mayank dubey0 ratings0% found this document useful (0 votes)

51 views1 pageThis payslip summarizes an employee's earnings and deductions for October 2021. It shows the employee's basic salary, HRA, and other bonuses amounting to a gross pay of Rs. 24,892. Deductions include a PF contribution of Rs. 2,315 resulting in a net pay of Rs. 22,577. An annual income tax worksheet provides projections of the employee's total gross salary of Rs. 299,965 for the financial year and estimates tax deductions of Rs. 0 after claiming deductions under Section 80C of Rs. 27,781.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis payslip summarizes an employee's earnings and deductions for October 2021. It shows the employee's basic salary, HRA, and other bonuses amounting to a gross pay of Rs. 24,892. Deductions include a PF contribution of Rs. 2,315 resulting in a net pay of Rs. 22,577. An annual income tax worksheet provides projections of the employee's total gross salary of Rs. 299,965 for the financial year and estimates tax deductions of Rs. 0 after claiming deductions under Section 80C of Rs. 27,781.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

51 views1 pageSalary Sleep October

Salary Sleep October

Uploaded by

mayank dubeyThis payslip summarizes an employee's earnings and deductions for October 2021. It shows the employee's basic salary, HRA, and other bonuses amounting to a gross pay of Rs. 24,892. Deductions include a PF contribution of Rs. 2,315 resulting in a net pay of Rs. 22,577. An annual income tax worksheet provides projections of the employee's total gross salary of Rs. 299,965 for the financial year and estimates tax deductions of Rs. 0 after claiming deductions under Section 80C of Rs. 27,781.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

AAPT OUTSOURCING SOLUTIONS PVT. LTD.

7B, MATHURA ROAD, JANG PURA, NEW DELHI - 110014

Payslip for the month of October 2021 Print Date : 29/10/2021 02:20:32PM

Emp. Code 06521 Region : Location : NEW DELHI

:Name : MAYANK MAULI DUBEY Division : Dun & Bradstreet Information Services India

Department Cost Centre :

:Designation Field Audit Executive MOP : SBI-36534965910

Grade : PF No. : DS/SHD/22008/19793

DOB 11/10/1991 Arrear Days : ESI No. : 2214257581 PAN :BIRPD6265N

DOJ 01/04/2019 Payable Days : 31.00 PF UAN 101068953918

Earnings Deductions Reimbursements

Description Rate Monthly Arrear Total Description Amount Description Claimed Reimbursed

BASIC 19,291.00 19,291.00 19,291.00 P F. 2,315.00

HRA 3,993.00 3,993.00 3,993.00

SBONUS 1,608.00 1,608.00 1,608.00

GROSS PAY 24,892.00 24,892.00 GROSS DED 2,315.00 TOTAL

Net Pay : 22577.00 (RUPEES TWENTY-TWO THOUSAND FIVE HUNDRED SEVENTY-SEVEN)

Income Tax Worksheet for the Period April 2021 - March 2022

Description Gross Exempt Taxable Deduction Under Chapter VI-A HRA Calculation

BASIC 231,492 231,492 Investments u/s 80C Rent Paid

HRA 49,177 49,177 PROV. FUND 27,781 From

SBONUS 19,296 19,296 To

PRV EMP SAL 1. Actual HRA 49,177

2. 40% or 50% of Basic

3. Rent > 10% Basic

Least of above is exempt

Taxable HRA 49,177

Gross Salary 299,965 299,965 Total of Investment u/s 80C 27,781

Deduction

Standard Deduction 50,000.00 U/S 80C 27,781 Reimbursement Balances

Previous Employer Professional Tax

Professional Tax

Under Chapter VI-A 27,781

Any Other Income

Taxable Income 222,184

Total Tax

Tax Rebate Loan Balances

Surcharge

Tax Due

Educational Cess 0

Net Tax 0

Tax Deducted (Previous Employer) Leave Balances

Tax Deducted Till Date

Tax to be Deducted

Tax / Month Total of Ded Under Chapter VI-A 27,781

Tax on Non-Recurring Earnings

Tax Deduction for this month Interest on Housing Loan

Personal Note :

EMail ID:DubeyM@DNB.comPWD:

You might also like

- PayslipDocument1 pagePayslipKathy DagunoNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Salary Slip AprilDocument1 pageSalary Slip AprilDaya Shankar100% (2)

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- The International Tax HandbookDocument962 pagesThe International Tax HandbookDiego Serrano Dotte100% (2)

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- HTMLReports 1Document1 pageHTMLReports 1kuldeeptawar250No ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Salary For Sep - 2022Document1 pageSalary For Sep - 2022narottam.ojhaNo ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- HTMLReports 12Document1 pageHTMLReports 12Umesh SainiNo ratings yet

- HTML ReportsDocument1 pageHTML ReportsRahul SharmaNo ratings yet

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Document1 pageGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- Slip PDFDocument1 pageSlip PDFPratikDuttaNo ratings yet

- SlipDocument1 pageSlipPratikDuttaNo ratings yet

- Payslip For The Month of May 2020: Earnings DeductionsDocument1 pagePayslip For The Month of May 2020: Earnings DeductionsRNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- May'24 Salary SlipDocument1 pageMay'24 Salary Slipayanbhargav3No ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- March PDFDocument1 pageMarch PDFRNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Payslip For The Month of January 2022: Earnings DeductionsDocument1 pagePayslip For The Month of January 2022: Earnings Deductionssunanda singhNo ratings yet

- HTML ReportsDocument8 pagesHTML Reportsdpkch4141No ratings yet

- April'24 Salary SilpDocument1 pageApril'24 Salary Silpayanbhargav3No ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Payslip For The Month of March 2022: Earnings DeductionsDocument1 pagePayslip For The Month of March 2022: Earnings Deductionssunanda singhNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsuresh1.somisettyNo ratings yet

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Pay Slip OctDocument1 pagePay Slip Octchahalnikita7No ratings yet

- ReportDocument1 pageReportPriyanka DodkeNo ratings yet

- PS Mar 2023Document1 pagePS Mar 2023kannesravan80No ratings yet

- CG JUL 2023 46237545 PayslipDocument1 pageCG JUL 2023 46237545 Payslipsubalsahoo2018No ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsps5927510No ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Nirima Sahu ComputationDocument2 pagesNirima Sahu Computationbrs consultancyNo ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- CG AUG 2023 46237545 PayslipDocument1 pageCG AUG 2023 46237545 Payslipsubalsahoo2018No ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- Tax Returns Father 2 YearsDocument6 pagesTax Returns Father 2 YearsPARAMJEETSINGHNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MaynikitachaudharyworldNo ratings yet

- Payslip For The Month of FEBRUARY 2022: Capgemini Technology Services India LimitedDocument1 pagePayslip For The Month of FEBRUARY 2022: Capgemini Technology Services India LimitedAadityaNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - July 2022Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - July 2022goal.iit09No ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument2 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoSatyasheel ChandaneNo ratings yet

- computionDocument6 pagescomputionchiragdeora8No ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- HTML ReportsDocument2 pagesHTML Reportsdpkch4141No ratings yet

- PayslipDocument1 pagePayslipwala meronNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- PavanDocument1 pagePavanPavan KumarNo ratings yet

- Dimension Data India PVT LTD: Pay Slip For The Month of August 2019Document1 pageDimension Data India PVT LTD: Pay Slip For The Month of August 2019Ashok ChauhanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TX 101Document7 pagesTX 101Pau SantosNo ratings yet

- Philippine School of Business AdministrationDocument39 pagesPhilippine School of Business Administrationnorhana lucmanNo ratings yet

- Lecture 2Document24 pagesLecture 2Bình MinhNo ratings yet

- Income Tax Provisions Related To Charitable Trust in Brief: Income From Business Which Is Not IncidentalDocument5 pagesIncome Tax Provisions Related To Charitable Trust in Brief: Income From Business Which Is Not IncidentalAnkur MittalNo ratings yet

- DECIMP0101237942670Document2 pagesDECIMP0101237942670Yusuf ElkahkyNo ratings yet

- Shah G 4Document1 pageShah G 4Mehar ZamaanNo ratings yet

- Which Is Subject To FINAL TAXDocument1 pageWhich Is Subject To FINAL TAXbutterfly kisses0217No ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- Spesifikasi Kaedah Pengiraan Berkomputer PCB 2023Document48 pagesSpesifikasi Kaedah Pengiraan Berkomputer PCB 2023Annie LimNo ratings yet

- Order No. - 35058238Document2 pagesOrder No. - 35058238Xyz XyzNo ratings yet

- Myanmar Tax Booklet - 2019 2020Document60 pagesMyanmar Tax Booklet - 2019 2020Sai PhyoNo ratings yet

- 38 Tan vs. Municipality of PagbilaoDocument4 pages38 Tan vs. Municipality of PagbilaoSara Andrea SantiagoNo ratings yet

- Income Tax and Benefit ReturnDocument8 pagesIncome Tax and Benefit Returnapi-457375876No ratings yet

- Fabm2 12 Q2 1002 SGDocument27 pagesFabm2 12 Q2 1002 SGTin CabosNo ratings yet

- Commissioner of Internal Revenue Vs CTADocument2 pagesCommissioner of Internal Revenue Vs CTACarl IlaganNo ratings yet

- Statement Redesign OnlineDocument2 pagesStatement Redesign OnlineJoshua LaporteNo ratings yet

- Ranchi Municipal Corporation Pay.Document2 pagesRanchi Municipal Corporation Pay.Adarsh JhaNo ratings yet

- Express Scripts Surety Bond ApplicationDocument2 pagesExpress Scripts Surety Bond ApplicationPaul SteveNo ratings yet

- Finance Act 2020:: Key Changes and ImplicationsDocument5 pagesFinance Act 2020:: Key Changes and ImplicationsAdebayo Yusuff AdesholaNo ratings yet

- 21 - Continental Micronesia v. CIRDocument10 pages21 - Continental Micronesia v. CIRkaira marie carlosNo ratings yet

- 3 Income Taxation Final PDFDocument109 pages3 Income Taxation Final PDFwilliam0910900% (1)

- Philippine Bank of Communications v.CIR By: PJ Doronila FactsDocument3 pagesPhilippine Bank of Communications v.CIR By: PJ Doronila FactsBarry BrananaNo ratings yet

- Flytxt - ECB Interest - Form 15CB - 21 Nov 22Document4 pagesFlytxt - ECB Interest - Form 15CB - 21 Nov 22RahulNo ratings yet

- Tax Reform Cash Transfer Unconditional Cash TransferDocument16 pagesTax Reform Cash Transfer Unconditional Cash TransferChristian ErrylNo ratings yet

- SR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDocument2 pagesSR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDesikanNo ratings yet

- Corporate Taxation in BangladeshDocument8 pagesCorporate Taxation in Bangladeshskn092No ratings yet

- RwservletDocument1 pageRwservletstkmdbillalNo ratings yet

- 2007 Foreign National Checklist FINALDocument5 pages2007 Foreign National Checklist FINALcglaskoNo ratings yet

- Jagannath Kishore College, Purulia Pay Slip Government of West BengalDocument1 pageJagannath Kishore College, Purulia Pay Slip Government of West BengaldebabratamathNo ratings yet