Professional Documents

Culture Documents

Share Tips Experts Commodity Report As On 29042011

Share Tips Experts Commodity Report As On 29042011

Uploaded by

Hardeep YadavCopyright:

Available Formats

You might also like

- Lokotrack LT1213 S N 72964Document368 pagesLokotrack LT1213 S N 72964Carlos Israel Gomez67% (6)

- Strategic Marketing Plan For WalmartDocument22 pagesStrategic Marketing Plan For WalmartEsther Kakai100% (1)

- Architecture and Arts: Ielts Vocabulary Topic 3: ArchitectureDocument4 pagesArchitecture and Arts: Ielts Vocabulary Topic 3: ArchitectureLong NguyenNo ratings yet

- POWER BI TutorialDocument77 pagesPOWER BI TutorialAashirtha S100% (3)

- MA-4 Carb ManualDocument34 pagesMA-4 Carb Manualayazkhan797100% (1)

- Cardiff Council Planning Committee Agenda For Wednesday February 13, 2013.Document222 pagesCardiff Council Planning Committee Agenda For Wednesday February 13, 2013.jessica_best2820No ratings yet

- Hauptwerk Installation and User GuideDocument316 pagesHauptwerk Installation and User Guideanubis7770% (1)

- Share Tips Expert Commodity Report 27042011Document8 pagesShare Tips Expert Commodity Report 27042011Hardeep YadavNo ratings yet

- Commodity TipsDocument8 pagesCommodity TipsHardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 21042011Document8 pagesShare Tips Expert Commodity Report 21042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Call Report 15042011Document8 pagesShare Tips Expert Commodity Call Report 15042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 29032011Document8 pagesShare Tips Expert Commodity Report 29032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 28032011Document8 pagesShare Tips Expert Commodity Report 28032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 23032011Document8 pagesShare Tips Expert Commodity Report 23032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 01042011Document8 pagesShare Tips Expert Commodity Report 01042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 08042011Document8 pagesShare Tips Expert Commodity Report 08042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 06042011Document8 pagesShare Tips Expert Commodity Report 06042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 07042011Document8 pagesShare Tips Expert Commodity Report 07042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 13042011Document8 pagesShare Tips Expert Commodity Report 13042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 11042011Document8 pagesShare Tips Expert Commodity Report 11042011Hardeep YadavNo ratings yet

- Free Commodity Trading Tips 27-12-2010Document8 pagesFree Commodity Trading Tips 27-12-2010Hardeep Yadav100% (1)

- Share Tips Expert Commodity Report 31032011Document8 pagesShare Tips Expert Commodity Report 31032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 24032011Document8 pagesShare Tips Expert Commodity Report 24032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 30032011Document8 pagesShare Tips Expert Commodity Report 30032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 04042011Document8 pagesShare Tips Expert Commodity Report 04042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 18042011Document8 pagesShare Tips Expert Commodity Report 18042011Hardeep YadavNo ratings yet

- Lokotrack LT105 S/N 74184 Toc Lokotrack: Tue, 01 Nov 2011 1Document525 pagesLokotrack LT105 S/N 74184 Toc Lokotrack: Tue, 01 Nov 2011 1Jorge Yaipen100% (1)

- Name CYL SV TV: Sudam Rajput B Z High School Kalp Nath ChauhanDocument4 pagesName CYL SV TV: Sudam Rajput B Z High School Kalp Nath ChauhanDipak MahajanNo ratings yet

- Metals PDFDocument1 pageMetals PDFTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Metals - April 12 2018Document1 pageMetals - April 12 2018Tiso Blackstar GroupNo ratings yet

- Free MCX & NCDEX Market Report Via ExpertsDocument9 pagesFree MCX & NCDEX Market Report Via ExpertsRahul SolankiNo ratings yet

- Metals - April 25 2017Document1 pageMetals - April 25 2017Tiso Blackstar GroupNo ratings yet

- PF & Esi Challan ExcelDocument12 pagesPF & Esi Challan ExcelNitin KumarNo ratings yet

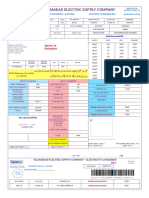

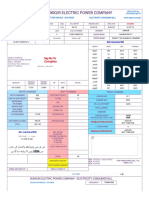

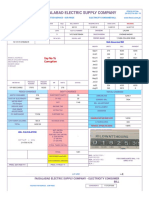

- Mepco Online BillDocument2 pagesMepco Online Billadnanbashir0610754No ratings yet

- Metals - August 3 2017Document1 pageMetals - August 3 2017Tiso Blackstar GroupNo ratings yet

- Commodity Report From AnuragDocument11 pagesCommodity Report From AnuragAnurag SinghaniaNo ratings yet

- Lokotrack LT105 S N 73412Document523 pagesLokotrack LT105 S N 73412orge menaNo ratings yet

- Long Term Commodity Trading TipsDocument9 pagesLong Term Commodity Trading TipsRahul SolankiNo ratings yet

- Metals - March 22 2017Document1 pageMetals - March 22 2017Tiso Blackstar GroupNo ratings yet

- Bill MasjidDocument1 pageBill MasjidNadeem ShahzadNo ratings yet

- Bill 1Document1 pageBill 1Usman MalikNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web BilltareeqdassanNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Permiso San MigelDocument1 pagePermiso San Migelnegocios 2022No ratings yet

- Metals - March 6 2017Document1 pageMetals - March 6 2017Tiso Blackstar GroupNo ratings yet

- Metals - September 12 2018Document1 pageMetals - September 12 2018Tiso Blackstar GroupNo ratings yet

- Panel Schedule (UDH)Document43 pagesPanel Schedule (UDH)Asif SajwaniNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Metals - February 28 2017Document1 pageMetals - February 28 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Mepco BillDocument2 pagesMepco BillRao M. YasirNo ratings yet

- Sepco Online BillDocument1 pageSepco Online BillGuru bhaiNo ratings yet

- Daily Morning Commodity Report - 20 Sept - 20-09-2023 - 10Document6 pagesDaily Morning Commodity Report - 20 Sept - 20-09-2023 - 10anuputaneNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SRounak ChowdhuryNo ratings yet

- Kia Parts OffersDocument6 pagesKia Parts Offershamdi galipNo ratings yet

- Metals - October 2 2018Document1 pageMetals - October 2 2018Tiso Blackstar GroupNo ratings yet

- Metals - January 16 2017Document1 pageMetals - January 16 2017Tiso Blackstar GroupNo ratings yet

- Faisalabad Electric Supply Company: Say No To CorruptionDocument2 pagesFaisalabad Electric Supply Company: Say No To Corruptionmubasherahmadbutt ButtNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Metals - March 23 2017Document1 pageMetals - March 23 2017Tiso Blackstar GroupNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SRounak ChowdhuryNo ratings yet

- Understanding Lightning and Lightning Protection: A Multimedia Teaching GuideFrom EverandUnderstanding Lightning and Lightning Protection: A Multimedia Teaching GuideNo ratings yet

- Share Tips Expert Calls Report 06052011Document3 pagesShare Tips Expert Calls Report 06052011Hardeep YadavNo ratings yet

- Commodity TipsDocument8 pagesCommodity TipsHardeep YadavNo ratings yet

- Share Tips Experts Commodity Calls Report As On 10052011Document3 pagesShare Tips Experts Commodity Calls Report As On 10052011Hardeep YadavNo ratings yet

- Share Tips Expert Calls Report 04052011Document3 pagesShare Tips Expert Calls Report 04052011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Call Report 15042011Document8 pagesShare Tips Expert Commodity Call Report 15042011Hardeep YadavNo ratings yet

- Sharetips Weekly Economical Data For 9-13 MayDocument6 pagesSharetips Weekly Economical Data For 9-13 MayHardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 21042011Document8 pagesShare Tips Expert Commodity Report 21042011Hardeep YadavNo ratings yet

- Share Tips Expert Calls Report 02052011Document3 pagesShare Tips Expert Calls Report 02052011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 27042011Document8 pagesShare Tips Expert Commodity Report 27042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 18042011Document8 pagesShare Tips Expert Commodity Report 18042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 08042011Document8 pagesShare Tips Expert Commodity Report 08042011Hardeep YadavNo ratings yet

- Share Tips Expert Calls Report 29042011Document3 pagesShare Tips Expert Calls Report 29042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 13042011Document8 pagesShare Tips Expert Commodity Report 13042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 11042011Document8 pagesShare Tips Expert Commodity Report 11042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 05042011Document3 pagesShare Tips Expert Commodity Calls Report 05042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 06042011Document3 pagesShare Tips Expert Commodity Calls Report 06042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 06042011Document8 pagesShare Tips Expert Commodity Report 06042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 07042011Document8 pagesShare Tips Expert Commodity Report 07042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 31032011Document3 pagesShare Tips Expert Commodity Calls Report 31032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 04042011Document8 pagesShare Tips Expert Commodity Report 04042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 30032011Document8 pagesShare Tips Expert Commodity Report 30032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 04042011Document3 pagesShare Tips Expert Commodity Calls Report 04042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 01042011Document8 pagesShare Tips Expert Commodity Report 01042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 24032011Document3 pagesShare Tips Expert Commodity Calls Report 24032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 29032011Document8 pagesShare Tips Expert Commodity Report 29032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 31032011Document8 pagesShare Tips Expert Commodity Report 31032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 28032011Document8 pagesShare Tips Expert Commodity Report 28032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 30032011Document3 pagesShare Tips Expert Commodity Calls Report 30032011Hardeep YadavNo ratings yet

- RPD QuestionsDocument77 pagesRPD QuestionsDontoNo ratings yet

- RabbitDocument11 pagesRabbitwinofvin9100% (1)

- Iit Jee (Links)Document5 pagesIit Jee (Links)Tarun MankadNo ratings yet

- Towards Being A HumanDocument53 pagesTowards Being A HumanlarenNo ratings yet

- Teachers Manual in Filipino 10 PDFDocument2 pagesTeachers Manual in Filipino 10 PDFIan Dagame0% (1)

- Class 8 Maths Algebra WorksheetDocument4 pagesClass 8 Maths Algebra WorksheetSanjay RawatNo ratings yet

- CHEM1 Chapter 2 - MeasurementDocument147 pagesCHEM1 Chapter 2 - MeasurementRomalyn GalinganNo ratings yet

- Passive Voice PPT 1Document30 pagesPassive Voice PPT 1Muhammad Rafif FadillahNo ratings yet

- BillDocument3 pagesBillTha OoNo ratings yet

- SafeBoda Data Intern JDDocument2 pagesSafeBoda Data Intern JDMusah100% (1)

- Scientific Management Scientific Management (Also Called Taylorism or The Taylor System) Is A Theory ofDocument2 pagesScientific Management Scientific Management (Also Called Taylorism or The Taylor System) Is A Theory ofDyan RetizaNo ratings yet

- Ppe Training Record: Department Occupation Type of Ppe Make/Model Name InitialsDocument3 pagesPpe Training Record: Department Occupation Type of Ppe Make/Model Name Initialsvlad100% (1)

- MAE4242 - Ch03 - Longitudinal Static Stability PDFDocument64 pagesMAE4242 - Ch03 - Longitudinal Static Stability PDFMatthew AustinNo ratings yet

- AND8331/D Quasi-Resonant Current-Mode Controller For High - Power Ac-Dc AdaptersDocument16 pagesAND8331/D Quasi-Resonant Current-Mode Controller For High - Power Ac-Dc AdaptersLucía MitchellNo ratings yet

- Facilities and Design Midterm Exam Part 2 2ND Sem 2023-24Document2 pagesFacilities and Design Midterm Exam Part 2 2ND Sem 2023-24bertjohnvillavert14No ratings yet

- Huawei HCIA-AI V3.0 Certification ExamDocument3 pagesHuawei HCIA-AI V3.0 Certification ExamAbraham MogosNo ratings yet

- A High-Throughput Method For Dereplication and Assessment Ofmetabolite Distribution Insalviaspecies Using LC-MS/MSDocument12 pagesA High-Throughput Method For Dereplication and Assessment Ofmetabolite Distribution Insalviaspecies Using LC-MS/MSkostNo ratings yet

- Advice On Effective Deposition Witness TechniquesDocument9 pagesAdvice On Effective Deposition Witness TechniquesKalbian Hagerty LLP100% (2)

- SIKA Marine 2016Document164 pagesSIKA Marine 2016pcatruongNo ratings yet

- Special EducationDocument13 pagesSpecial EducationJanelle CandidatoNo ratings yet

- Target Costing TutorialDocument2 pagesTarget Costing TutorialJosephat LisiasNo ratings yet

- Bonding QuizDocument7 pagesBonding Quiz卜一斐No ratings yet

- Int Org 2Document60 pagesInt Org 2Alara MelnichenkoNo ratings yet

- Maxim Hand OutDocument7 pagesMaxim Hand OutArlene Aurin-AlientoNo ratings yet

Share Tips Experts Commodity Report As On 29042011

Share Tips Experts Commodity Report As On 29042011

Uploaded by

Hardeep YadavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Share Tips Experts Commodity Report As On 29042011

Share Tips Experts Commodity Report As On 29042011

Uploaded by

Hardeep YadavCopyright:

Available Formats

Daily Commodity Market Update as on Friday, April 29, 2011

PRECIOUS METALS COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

GOLD 22175 22349 22143 22130 0.69

Bullion soared to an all-time high as the dollar fell and as

SILVER 69400 72849 68499 68820 3.18

signs that the Federal Reserve would maintain a loose

SPOT $

monetary policy stoked inflation worries.

GOLD 1535.65 1537.25 1532.3 1534.9 -0.13

SILVER 48.46 48.48 48.08 48.46 -0.25

PLATINUM 1831.99 1838.24 1832.75 1837 0.27

ENERGY COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

CRUDE 5046 5085 4988 5013 -0.68 Crude oil ended weak but recovered some of its losses as

a weak dollar attracts investors seeking alternative

N.GAS 198.3 206.1 197.1 198 3.7

assets. Natural gas ended higher after the U.S. Energy

Information Administration said natural gas inventories

SPOT $ rose less-than-expected last week.

CRUDE 113.13 113.97 111.69 112.86 -0.238663

BASEMETAL COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX Base metals yesterday ended mixed. Copper and lead

COPPER 424.7 427.4 419.75 423.85 -0.11 ended in red zone influenced by slowing economic

ZINC 101.45 102.3 100.1 100.85 0.4 conditions in the U.S. that underscored the bearish

NICKEL 1199.8 1209.3 1185.1 1197.6 0.57 sentiment surrounding demand prospects at the start of

114.4 115.3 112.05 114.15 -0.88 the year while other metals ended firm on short covering.

LEAD

ALUMINIUM 122.5 123 121.75 121.9 0.61

LME LME STOCK

COPPER 0 0 0 9385 0 COPPER 150 463650

ZINC 0 0 0 2245 0 ZINC 4675 821375

NICKEL 0 0 0 26760 0 NICKEL -588 117384

LEAD 0 0 0 2526.25 0 LEAD 1000 308375

ALUMINIUM 0 0 0 2740.5 0 ALUMINIUM 5950 4612050

GLOBAL MARKETS UPDATE

SENSEX NIFTY NASDAQ S&P NYSE DOW JON NIKKEI SHICOM KOREA HKFE $ INDEX

19309.11 5791.3 2409.9 1360.48 8639.73 12763.31 9849.74 2890.29 2186.56 23683.76 73.09

0.09 0.11 -0.15 0.36 0.35 0.57 0 0.11 -0.99 -0.48 -0.05

Strictly for private circulation www.sharetipsexpert.com Page No. 1

OPEN

22175

HIGH

22349

MCX GOLD FUTURE

LOW

22143

CLOSE

22130

% CNG

0.69

VOLUME

35506

OI

12507

RE CNG

153

INTRADAY LEVELS

Gold extended gains and settled at 22283 that is up by 0.69%, rallying to yet another all-time high

after official government data showed that the U.S. economy slowed significantly since the end of

P.P. 22258

2010 and initial jobless claims rose unexpectedly last week. The Commerce Department said gross

domestic product, the value of all the goods and services produced, rose at a seasonally adjusted SUP 1 RES 1

annual rate of 1.8% in the first quarter. The modest increase marked a significant slowdown from 22168 22374

the economy's pace in the fourth quarter, when GDP rose by 3.1%. The result was broadly in line SUP 2 RES 2

with economists' forecasts. The report said consumer spending, which accounts for about 70% of

22052 22464

demand in the U.S. economy, rose at a 2.7% rate in the first quarter, down from the 4.0% pace

registered in the fourth quarter. Now gold is getting support at 22168 and below could see a test of SUP 3 RES 3

22052 level, And resistance is now likely to be seen at 22374, a move above could see prices testing 21962 22580

OPEN

69400

MCX SILVER FUTURE

HIGH

72849

LOW

68499

CLOSE

68820

% CNG

3.18

VOLUME

135830

OI

8268

RE CNG

2261

INTRADAY LEVELS

Silver soared once again to an all-time high on Thursday as the dollar fell and as signs that the

Federal Reserve would maintain a loose monetary policy stoked inflation worries. Silver briefly

P.P. 70810

climbed to within a whisker of $50 an ounce, eclipsing the peak hit when Texan brothers William

Herbert and Nelson Bunker Hunt sought to corner the silver market three decades ago. The metal SUP 1 RES 1

later pulled back on technical selling. Spot silver , which has rocketed nearly 60 percent so far this 68770 73120

year, precious metals rose after data showed U.S. economic growth braked sharply in the first SUP 2 RES 2

quarter as higher food and gasoline prices dampened consumer spending, sending inflation rising at

66460 75160

its fastest pace in 2-1/2 years. Now silver is getting support at 68770 and below could see a test of

66460 level, And resistance is now likely to be seen at 73120, a move above could see prices testing SUP 3 RES 3

75160. 64420 77470

Strictly for private circulation www.sharetipsexpert.com Page No. 2

OPEN

5046

HIGH

MCX CRUDE FUTURE

5085

LOW

4988

CLOSE

5013

% CNG

-0.68

VOLUME

125790

OI

12881

RE CNG

-34

INTRADAY LEVELS

Crude bounced in the early trades to their highest in 2-1/2 years, as the dollar remained under

pressure after the Federal Reserve gave no sign it was about to tighten monetary policy. U.S.

P.P. 5029

gasoline futures surged for a sixth straight session, driving prices to the highest level since July 2008

as the world's top consumer gears up for driving season. A Bahraini military court ordered the death SUP 1 RES 1

penalty for four men Thursday over the killing of two policemen in recent protests, state media said, 4972 5069

a move that could increase sectarian strife in a close U.S. ally. U.S. crude oil imports in fell in SUP 2 RES 2

February, after increasing for three consecutive months, EIA said. Crude imports averaged 8.013

4932 5126

million barrels per day in February, down 1.056 million bpd from January. Now crude is getting

support at 4972 and below could see a test of 4932 level, And resistance is now likely to be seen at SUP 3 RES 3

5069, a move above could see prices testing 5126. 4875 5166

OPEN

424.7

MCX COPPER FUTURE

HIGH

427.4

LOW

419.75

CLOSE

423.85

% CNG

-0.11

VOLUME

33795

OI

16525

RE CNG

-0.45

INTRADAY LEVELS

Copper yesterday traded with the negative node and settled -0.12% down at 416.3 influenced by

slowing economic conditions in the US that underscored the bearish sentiment surrounding demand

P.P. 423.5

prospects at the start of the year. Copper's mildly negative tone came after US gross domestic

product for the first quarter slowed to a 1.8 percent annual pace. The negative close came a day SUP 1 RES 1

after the U.S. Federal Reserve said it would complete its $600 billion bond-buying program in June 419.6 427.3

and signaled it was in no rush to scale back its support for the world's largest economy. Volumes SUP 2 RES 2

slowed at the end of a holiday-shortened week in London, with the London Metal Exchange (LME) set

415.9 431.2

to close its doors Friday for a royal wedding and again on Monday for a bank holiday. For today's

session market is looking to take support at 412.4, a break below could see a test of 408.6 and SUP 3 RES 3

where as resistance is now likely to be seen at 420.3, a move above could see prices testing 424.4. 412.0 434.9

Strictly for private circulation www.sharetipsexpert.com Page No. 3

OPEN

101.45

HIGH

102.3

MCX ZINC FUTURE

LOW

100.1

CLOSE

100.85

% CNG

0.4

VOLUME

17387

OI

11522

RE CNG

0.4

INTRADAY LEVELS

Zinc yesterday traded with the negative node and settled -0.86% down at 98.5 tracking LME zinc

prices rose to USD 2,304/mt in the morning session during the Asian trading hours, but failed to P.P. 101.2

stabilize at USD 2,300/mt. The US 1Q GDP rose slower by 1.8%, weighing down LME zinc prices to SUP 1 RES 1

USD 2,226/mt, and with prices closing at USD 2,265/mt, down USD 20/mt. Trading volumes

100.1 102.3

decreased by 4,784 lots to 10,718 lots, and total positions increased by 1,591 lots to 236,913 lots.

The LME market is closed today due to the wedding of English prince. In yesterday's trading session SUP 2 RES 2

zinc has touched the low of 98.1 after opening at 99.9, and finally settled at 98.5. For today's 99.0 103.4

session market is looking to take support at 97.5, a break below could see a test of 96.4 and where SUP 3 RES 3

as resistance is now likely to be seen at 100.2, a move above could see prices testing 101.8.

97.9 104.5

OPEN

1200

MCX NICKEL FUTURE

HIGH

1209

LOW

1185

CLOSE

1197.6

% CNG

0.57

VOLUME

29811

OI

5540

RE CNG

6.9

INTRADAY LEVELS

Nickel yesterday traded with the negative node and settled -0.85% down at 1176.5 tracking LME

nickel for delivery in three months opened at USD 26,600/mt and closed at USD 26,760/mt, up by

P.P. 1200

USD 60/mt from a day earlier, with the highest price at USD 26,800/mt and the lowest price at USD

26,295/mt. LME nickel prices fluctuated wider and hit a high of USD 27,000/mt after opening at USD SUP 1 RES 1

26,800/mt during the Asian trading hours on Thursday, but were weighed by significant decline in 1190 1214

Asian equity market and met resistance at USD 27,000/mt. LME nickel inventories were down by SUP 2 RES 2

588 mt to 117,384 mt. In the Shanghai nickel spot market, traders lifted offers higher due to

1175 1224

support from firm LME nickel prices. Coupled with LME nickel price’s fluctuation at high level on

Thursday, spot prices were firm and were slightly higher from a day earlier. For today's session SUP 3 RES 3

market is looking to take support at 1168.9, a break below could see a test of 1161.2 and where as 1166 1238

Strictly for private circulation www.sharetipsexpert.com Page No. 4

MCX ALUMINIUM FUTURE

OPEN

122.5

HIGH

123

LOW

121.75

CLOSE

121.9

% CNG

0.61

VOLUME

3819

OI

3235

RE CNG

0.75

INTRADAY LEVELS

Aluminium yesterday traded with the positive node and settled 0.77% up at 122.85 after the US

Labor Department announced on Thursday that the initial claims for jobless benefits increased to

P.P. 122.5

429,000 in the week ending April 23rd, higher the expected level. The US Commerce Department

announced the US gross domestic product (GDP) in 1Q grew at an annual rate of 1.8%, lower than SUP 1 RES 1

the expected level of a 2.0% rise. The weak US economic data weighed down the US dollar index, 121.9 123.2

and the US dollar index opened at 73.32 and closed at 73.06 after dipping to a low of 72.87, down SUP 2 RES 2

0.34%. The weaker US dollar and tighter energy supply in China boosted LME aluminum prices, with

121.2 123.7

LME aluminum prices surging to USD 2,779/mt after opening at USD 2,746/mt, setting a new high

within two and a half years. Later, other base metals traded on the LME lacked upward momentum, SUP 3 RES 3

allowing LME aluminum prices to fall back. For today's session market is looking to take support at 120.7 124.4

OPEN

MCX NAT.GAS FUTURE

198.3

HIGH

206.1

LOW

197.1

CLOSE

198

% CNG

3.7

VOLUME

30282

OI

6794

RE CNG

7.6

INTRADAY LEVELS

Natural gas yesterday traded with the positive node and settled 3.7% up at 205.6 jumping to the

highest level in three months after the U.S. Energy Information Administration said natural gas

P.P. 202.9

inventories rose less-than-expected last week. The U.S. EIA said in its weekly report that natural gas

storage in the U.S. in the week ended April 22 rose by 31 billion cubic feet, after increasing by 47 SUP 1 RES 1

billion cubic feet in the preceding week. Market had expected U.S. natural gas storage to rise by 38 199.8 208.8

billion cubic feet. The five-year average withdrawal for the week is 65 billion cubic feet. Total U.S. SUP 2 RES 2

natural gas storage stood at 1.685 trillion cubic feet. Stocks were 215 billion cubic feet less than last

193.9 211.9

year at this time and 11 billion cubic feet below the five-year average of 1.696 trillion cubic feet for

this time of year. Stocks in the Producing Region were 119 billion cubic feet above the five-year SUP 3 RES 3

average of 674 billion cubic feet, after a net injection of 13 billion cubic feet. For today's session 190.8 217.8

Strictly for private circulation www.sharetipsexpert.com Page No. 5

ACTIVE SPREAD UPDATE

DAILY SPREAD IN GOLD - MCX DAILY SPREAD IN SILVER - MCX

MONTH RATE JUNE AUG OCT MONTH RATE MAY JULY SEPT

JUNE 22283 290 634 MAY 71081 570 1209

AUG 22573 344 JULY 71651 639

OCT 22917 SEPT 72290

Spread between Gold JUN & AUG contracts yesterday Spread between Silver MAY & JUL contracts yesterday

ended at 290, we have seen yesterday that the gold ended at 570, we have seen yesterday that the silver

market had traded with a positive node and settled 0.69% market had traded with a positive node and settled

up. Spread yesterday traded in the range of 290 - 510. 3.18% up. Spread yesterday traded in the range of 300 -

1201.

DAILY SPREAD IN CRUDE - MCX DAILY SPREAD IN COPPER - MCX

MONTH RATE MAY JUNE JULY MONTH RATE JUNE AUG

MAY 5013 52 117 JUNE 423.4 5.6

JUNE 5065 65 AUG 429

JULY 5130

Spread between crude APR & MAY contracts yesterday Spread between copper JUN & AUG contracts yesterday

SPREAD MARKET

ended at 52, we have seen yesterday that the crude ended at 5.6, we have seen yesterday that the copper

market had traded with a negative node and settled - market had traded with a negative node and settled -

0.68% down. Spread yesterday traded in the range of 49 -0.11% down. Spread yesterday traded in the range of

59. 5.45 - 7.15.

DAILY SPREAD IN ZINC - MCX DAILY SPREAD IN NICKEL - MCX

MONTH RATE MAY JUNE MONTH RATE MAY JUNE

MAY 101.25 1.35 MAY 1204.5 9.9

JUNE 102.6 JUNE 1214.4

Spread between zinc MAY & JUN contracts yesterday Spread between nickel MAY & JUN contracts yesterday

ended at 1.35, we have seen yesterday that the zinc ended at 9.90, we have seen yesterday that the nickel

market had traded with a positive node and settled 0.4% market had traded with a positive node and settled

up. Spread yesterday traded in the range of 1 - 1.55. 0.57% up. Spread yesterday traded in the range of 9.00 -

10.1.

DAILY SPREAD IN NAT. GAS - MCX DAILY SPREAD IN MENTHOL - MCX

MONTH RATE MAY JUNE MONTH RATE MAY JUNE

MAY 205.6 5.1 MAY 1035.7 -92.3

JUNE 210.7 JUNE 943.4

Spread between natural gas MAY & JUN contracts Spread between menthol oil MAY & JUN contracts

yesterday ended at 5.10, we have seen yesterday that the yesterday ended at -92.30, we have seen yesterday that

natural gas market had traded with a positive node and the menthol oil market had traded with a negative node

settled 3.7% up. Spread yesterday traded in the range of and settled -1.69% down. Spread yesterday traded in the

3.9 - 5.2. range of -108.5 to -88.6.

Strictly for private circulation www.sharetipsexpert.com Page No. 6

DAY TIME CURRENCY DATA Forecast Previous

ECONOMICAL

11:30am EUR German Retail Sales m/m 0.002 -0.004

1:30pm EUR M3 Money Supply y/y 0.022 0.02

1:30pm EUR Italian Monthly Unemployment Rate 0.084 0.084

DATA

1:30pm EUR Private Loans y/y 0.029 0.026

2:30pm EUR CPI Flash Estimate y/y 0.027 0.027

2:30pm EUR Unemployment Rate 0.099 0.099

Fri 2:30pm EUR Italian Prelim CPI m/m 0.003 0.004

6:00pm USD Core PCE Price Index m/m 0.001 0.002

6:00pm USD Employment Cost Index q/q 0.005 0.004

6:00pm USD Personal Spending m/m 0.006 0.007

6:00pm USD Personal Income m/m 0.003 0.003

7:15pm USD Chicago PMI 68.7 70.6

7:25pm USD Revised UoM Consumer Sentiment 70 69.6

India's natural rubber production has risen 3.7% in 2010-11 to 8,61,950 tons, according to Rubber Board. Revealing

the data at the 165th Annual meeting of the Board here, Sheela Thomas, Rubber Board Chairman said that domestic

production stood at 8,31,400 tons and anticipated production for 2010-11 was 9,02,000 tonnes. The anticipated

consumption in 2010-11 was 9,77,000 tons. Domestic consumption has increased by 2 per cent in 2010-11. During

2010-11, growth in tyre production in the automotive sector grew by 23 per cent. Export of tyres also increased by

20 per cent. However, truck and bus tyre exports declined by five per cent. During 2010-11 fiscal, exports stood at

28,424 tonnes compared with 25,090 tonnes in the previous fiscal. Imports accounted for 1,77,482 tonnes, 73 per

cent of which was through duty free channels. Rubber Board does not foresee any shortage for the commodity as the

opening stock of rubber in 2011-12 was relatively high at 2,77,095 tonnes against 2,11,290 tonnes in 2010-11.

Meanwhile, the Automotive Tyre Manufacturers Association (ATMA) has urged the rubber board to take steps to avoid

NEWS YOU CAN USE

delays in mandatory inspection of imported rubber which is affecting the raw material availability for manufacturers.

The onus of ensuring quality of imported rubber should lie with the manufacturers and not the government, ATMA

said.

The ministry of food and consumer affairs is not in favour of recommending a ban on forward trading of essential

commodities. The ministry is currently working on the final recommendations based on suggestions made by a

working group on consumer affairs headed by Narendra Modi and co-chaired by chief ministers of Maharashtra,

Andhra Pradesh and Tamil Nadu. These recommendations then will be sent to the Prime minister thereafter. The

working group had strongly recommended banning forward trading in essential commodities. The ministry, albeit is in

favour of many recommendations made by the working group, especially those on reforming the Agricultural Produce

Marketing Committees across states for bridging the gap between the wholesale and retail food prices and amending

the Essential Commodities Act to check hoarding.B C Khatua, chairman of FMC said: “Our presentation to the working

group was based on well founded facts and not mere sentiment. Today a farmer has multiple options for selling his

products- either in a mandi or a spot exchange . While we are continuing with our awareness programme, what is not

realised is that farmers need a sound price discovery system and thus, his interest is in futures market to plan and

execute pricing of his sale rather than just selling the products in the spot market.” However, we did not intervene

since higher margins would have affected the genuine domestic consumers who were anyway fighting higher prices

for procurement. Higher trade margins would have hurt genuine hedgers and traders.

Indian federal bond yields were little changed on Thursday as trader’s awaited weekly food and fuel inflation due

around 0630 GMT that could set the tone for the central bank's rate decision on Tuesday. The market has priced in

the possibility of a 25 basis points rate increase, but there is speculation the rise could be 50 basis points. The yield

on the 7.80 percent 2021 bond was steady at 8.09 percent after rising to 8.11 percent in early deals. A total of 75

basis points rate increase by the Reserve Bank of India in the remainder of 2011, or 25 bps more than they expected

in mid-March. Inflation concerns have been weighing on the market after March inflation came in at 9 percent, well

above an upwardly revised central bank target of 8 percent.

Strictly for private circulation www.sharetipsexpert.com Page No. 3

Contact us

CARROTINVESTMENT

Plot no 36, Sector 23, Gurgaon, Haryana (INDIA)

Work Tel#: Fax No:

Mobile Tel#:

E-Mail: carrotinvestment@gmail.com URL: http://www.sharetipsexpert.com

Disclaimer

The report and calls made herein are for general information purpose and report contains only the viewpoints. We make no

representation or warranty regarding the correctness, accuracy or completeness of any information, and are not responsible for

errors of any kind even though we have taken utmost care in obtaining the information from sources which are believed to be

reliable, which are publicly available. The information contained herein is strictly confidential and is meant for the intended

recipients. Any alteration, transmission, photocopied distribution in part or in whole or reproduction of any form of the

information without prior consent of SHARETIPSEXPERT GROUP is prohibited. The information and data are derived from the

source that are deemed & believed to be reliable and the calls are based on the theory of Technical Analysis. Neither the

company nor its employees are responsible for the trading Profit(es) & loss(es) arising due to the trader. The commodities and

derivatives discussed and opinions expressed in this report may not be suitable for all investors falling under different categories

and jurisdictions. All futures trading entail significant risk, which should be fully understood prior to trading.

Strictly for private circulation www.sharetipsexpert.com Page No. 4

You might also like

- Lokotrack LT1213 S N 72964Document368 pagesLokotrack LT1213 S N 72964Carlos Israel Gomez67% (6)

- Strategic Marketing Plan For WalmartDocument22 pagesStrategic Marketing Plan For WalmartEsther Kakai100% (1)

- Architecture and Arts: Ielts Vocabulary Topic 3: ArchitectureDocument4 pagesArchitecture and Arts: Ielts Vocabulary Topic 3: ArchitectureLong NguyenNo ratings yet

- POWER BI TutorialDocument77 pagesPOWER BI TutorialAashirtha S100% (3)

- MA-4 Carb ManualDocument34 pagesMA-4 Carb Manualayazkhan797100% (1)

- Cardiff Council Planning Committee Agenda For Wednesday February 13, 2013.Document222 pagesCardiff Council Planning Committee Agenda For Wednesday February 13, 2013.jessica_best2820No ratings yet

- Hauptwerk Installation and User GuideDocument316 pagesHauptwerk Installation and User Guideanubis7770% (1)

- Share Tips Expert Commodity Report 27042011Document8 pagesShare Tips Expert Commodity Report 27042011Hardeep YadavNo ratings yet

- Commodity TipsDocument8 pagesCommodity TipsHardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 21042011Document8 pagesShare Tips Expert Commodity Report 21042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Call Report 15042011Document8 pagesShare Tips Expert Commodity Call Report 15042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 29032011Document8 pagesShare Tips Expert Commodity Report 29032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 28032011Document8 pagesShare Tips Expert Commodity Report 28032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 23032011Document8 pagesShare Tips Expert Commodity Report 23032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 01042011Document8 pagesShare Tips Expert Commodity Report 01042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 08042011Document8 pagesShare Tips Expert Commodity Report 08042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 06042011Document8 pagesShare Tips Expert Commodity Report 06042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 07042011Document8 pagesShare Tips Expert Commodity Report 07042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 13042011Document8 pagesShare Tips Expert Commodity Report 13042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 11042011Document8 pagesShare Tips Expert Commodity Report 11042011Hardeep YadavNo ratings yet

- Free Commodity Trading Tips 27-12-2010Document8 pagesFree Commodity Trading Tips 27-12-2010Hardeep Yadav100% (1)

- Share Tips Expert Commodity Report 31032011Document8 pagesShare Tips Expert Commodity Report 31032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 24032011Document8 pagesShare Tips Expert Commodity Report 24032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 30032011Document8 pagesShare Tips Expert Commodity Report 30032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 04042011Document8 pagesShare Tips Expert Commodity Report 04042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 18042011Document8 pagesShare Tips Expert Commodity Report 18042011Hardeep YadavNo ratings yet

- Lokotrack LT105 S/N 74184 Toc Lokotrack: Tue, 01 Nov 2011 1Document525 pagesLokotrack LT105 S/N 74184 Toc Lokotrack: Tue, 01 Nov 2011 1Jorge Yaipen100% (1)

- Name CYL SV TV: Sudam Rajput B Z High School Kalp Nath ChauhanDocument4 pagesName CYL SV TV: Sudam Rajput B Z High School Kalp Nath ChauhanDipak MahajanNo ratings yet

- Metals PDFDocument1 pageMetals PDFTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Metals - April 12 2018Document1 pageMetals - April 12 2018Tiso Blackstar GroupNo ratings yet

- Free MCX & NCDEX Market Report Via ExpertsDocument9 pagesFree MCX & NCDEX Market Report Via ExpertsRahul SolankiNo ratings yet

- Metals - April 25 2017Document1 pageMetals - April 25 2017Tiso Blackstar GroupNo ratings yet

- PF & Esi Challan ExcelDocument12 pagesPF & Esi Challan ExcelNitin KumarNo ratings yet

- Mepco Online BillDocument2 pagesMepco Online Billadnanbashir0610754No ratings yet

- Metals - August 3 2017Document1 pageMetals - August 3 2017Tiso Blackstar GroupNo ratings yet

- Commodity Report From AnuragDocument11 pagesCommodity Report From AnuragAnurag SinghaniaNo ratings yet

- Lokotrack LT105 S N 73412Document523 pagesLokotrack LT105 S N 73412orge menaNo ratings yet

- Long Term Commodity Trading TipsDocument9 pagesLong Term Commodity Trading TipsRahul SolankiNo ratings yet

- Metals - March 22 2017Document1 pageMetals - March 22 2017Tiso Blackstar GroupNo ratings yet

- Bill MasjidDocument1 pageBill MasjidNadeem ShahzadNo ratings yet

- Bill 1Document1 pageBill 1Usman MalikNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web BilltareeqdassanNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Permiso San MigelDocument1 pagePermiso San Migelnegocios 2022No ratings yet

- Metals - March 6 2017Document1 pageMetals - March 6 2017Tiso Blackstar GroupNo ratings yet

- Metals - September 12 2018Document1 pageMetals - September 12 2018Tiso Blackstar GroupNo ratings yet

- Panel Schedule (UDH)Document43 pagesPanel Schedule (UDH)Asif SajwaniNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Metals - February 28 2017Document1 pageMetals - February 28 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Mepco BillDocument2 pagesMepco BillRao M. YasirNo ratings yet

- Sepco Online BillDocument1 pageSepco Online BillGuru bhaiNo ratings yet

- Daily Morning Commodity Report - 20 Sept - 20-09-2023 - 10Document6 pagesDaily Morning Commodity Report - 20 Sept - 20-09-2023 - 10anuputaneNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SRounak ChowdhuryNo ratings yet

- Kia Parts OffersDocument6 pagesKia Parts Offershamdi galipNo ratings yet

- Metals - October 2 2018Document1 pageMetals - October 2 2018Tiso Blackstar GroupNo ratings yet

- Metals - January 16 2017Document1 pageMetals - January 16 2017Tiso Blackstar GroupNo ratings yet

- Faisalabad Electric Supply Company: Say No To CorruptionDocument2 pagesFaisalabad Electric Supply Company: Say No To Corruptionmubasherahmadbutt ButtNo ratings yet

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupNo ratings yet

- Metals - March 23 2017Document1 pageMetals - March 23 2017Tiso Blackstar GroupNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SRounak ChowdhuryNo ratings yet

- Understanding Lightning and Lightning Protection: A Multimedia Teaching GuideFrom EverandUnderstanding Lightning and Lightning Protection: A Multimedia Teaching GuideNo ratings yet

- Share Tips Expert Calls Report 06052011Document3 pagesShare Tips Expert Calls Report 06052011Hardeep YadavNo ratings yet

- Commodity TipsDocument8 pagesCommodity TipsHardeep YadavNo ratings yet

- Share Tips Experts Commodity Calls Report As On 10052011Document3 pagesShare Tips Experts Commodity Calls Report As On 10052011Hardeep YadavNo ratings yet

- Share Tips Expert Calls Report 04052011Document3 pagesShare Tips Expert Calls Report 04052011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Call Report 15042011Document8 pagesShare Tips Expert Commodity Call Report 15042011Hardeep YadavNo ratings yet

- Sharetips Weekly Economical Data For 9-13 MayDocument6 pagesSharetips Weekly Economical Data For 9-13 MayHardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 21042011Document8 pagesShare Tips Expert Commodity Report 21042011Hardeep YadavNo ratings yet

- Share Tips Expert Calls Report 02052011Document3 pagesShare Tips Expert Calls Report 02052011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 27042011Document8 pagesShare Tips Expert Commodity Report 27042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 18042011Document8 pagesShare Tips Expert Commodity Report 18042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 08042011Document8 pagesShare Tips Expert Commodity Report 08042011Hardeep YadavNo ratings yet

- Share Tips Expert Calls Report 29042011Document3 pagesShare Tips Expert Calls Report 29042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 13042011Document8 pagesShare Tips Expert Commodity Report 13042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 11042011Document8 pagesShare Tips Expert Commodity Report 11042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 05042011Document3 pagesShare Tips Expert Commodity Calls Report 05042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 06042011Document3 pagesShare Tips Expert Commodity Calls Report 06042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 06042011Document8 pagesShare Tips Expert Commodity Report 06042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 07042011Document8 pagesShare Tips Expert Commodity Report 07042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 31032011Document3 pagesShare Tips Expert Commodity Calls Report 31032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 04042011Document8 pagesShare Tips Expert Commodity Report 04042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 30032011Document8 pagesShare Tips Expert Commodity Report 30032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 04042011Document3 pagesShare Tips Expert Commodity Calls Report 04042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 01042011Document8 pagesShare Tips Expert Commodity Report 01042011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 24032011Document3 pagesShare Tips Expert Commodity Calls Report 24032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 29032011Document8 pagesShare Tips Expert Commodity Report 29032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 31032011Document8 pagesShare Tips Expert Commodity Report 31032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Report 28032011Document8 pagesShare Tips Expert Commodity Report 28032011Hardeep YadavNo ratings yet

- Share Tips Expert Commodity Calls Report 30032011Document3 pagesShare Tips Expert Commodity Calls Report 30032011Hardeep YadavNo ratings yet

- RPD QuestionsDocument77 pagesRPD QuestionsDontoNo ratings yet

- RabbitDocument11 pagesRabbitwinofvin9100% (1)

- Iit Jee (Links)Document5 pagesIit Jee (Links)Tarun MankadNo ratings yet

- Towards Being A HumanDocument53 pagesTowards Being A HumanlarenNo ratings yet

- Teachers Manual in Filipino 10 PDFDocument2 pagesTeachers Manual in Filipino 10 PDFIan Dagame0% (1)

- Class 8 Maths Algebra WorksheetDocument4 pagesClass 8 Maths Algebra WorksheetSanjay RawatNo ratings yet

- CHEM1 Chapter 2 - MeasurementDocument147 pagesCHEM1 Chapter 2 - MeasurementRomalyn GalinganNo ratings yet

- Passive Voice PPT 1Document30 pagesPassive Voice PPT 1Muhammad Rafif FadillahNo ratings yet

- BillDocument3 pagesBillTha OoNo ratings yet

- SafeBoda Data Intern JDDocument2 pagesSafeBoda Data Intern JDMusah100% (1)

- Scientific Management Scientific Management (Also Called Taylorism or The Taylor System) Is A Theory ofDocument2 pagesScientific Management Scientific Management (Also Called Taylorism or The Taylor System) Is A Theory ofDyan RetizaNo ratings yet

- Ppe Training Record: Department Occupation Type of Ppe Make/Model Name InitialsDocument3 pagesPpe Training Record: Department Occupation Type of Ppe Make/Model Name Initialsvlad100% (1)

- MAE4242 - Ch03 - Longitudinal Static Stability PDFDocument64 pagesMAE4242 - Ch03 - Longitudinal Static Stability PDFMatthew AustinNo ratings yet

- AND8331/D Quasi-Resonant Current-Mode Controller For High - Power Ac-Dc AdaptersDocument16 pagesAND8331/D Quasi-Resonant Current-Mode Controller For High - Power Ac-Dc AdaptersLucía MitchellNo ratings yet

- Facilities and Design Midterm Exam Part 2 2ND Sem 2023-24Document2 pagesFacilities and Design Midterm Exam Part 2 2ND Sem 2023-24bertjohnvillavert14No ratings yet

- Huawei HCIA-AI V3.0 Certification ExamDocument3 pagesHuawei HCIA-AI V3.0 Certification ExamAbraham MogosNo ratings yet

- A High-Throughput Method For Dereplication and Assessment Ofmetabolite Distribution Insalviaspecies Using LC-MS/MSDocument12 pagesA High-Throughput Method For Dereplication and Assessment Ofmetabolite Distribution Insalviaspecies Using LC-MS/MSkostNo ratings yet

- Advice On Effective Deposition Witness TechniquesDocument9 pagesAdvice On Effective Deposition Witness TechniquesKalbian Hagerty LLP100% (2)

- SIKA Marine 2016Document164 pagesSIKA Marine 2016pcatruongNo ratings yet

- Special EducationDocument13 pagesSpecial EducationJanelle CandidatoNo ratings yet

- Target Costing TutorialDocument2 pagesTarget Costing TutorialJosephat LisiasNo ratings yet

- Bonding QuizDocument7 pagesBonding Quiz卜一斐No ratings yet

- Int Org 2Document60 pagesInt Org 2Alara MelnichenkoNo ratings yet

- Maxim Hand OutDocument7 pagesMaxim Hand OutArlene Aurin-AlientoNo ratings yet