Professional Documents

Culture Documents

The Impact of Pandemic On Digital Payments in India: February 2021

The Impact of Pandemic On Digital Payments in India: February 2021

Uploaded by

ShameerCopyright:

Available Formats

You might also like

- Unity GDD TemplateDocument13 pagesUnity GDD TemplateIswandi AswarNo ratings yet

- I-240G-B ManualDocument256 pagesI-240G-B Manualqweneo100% (5)

- Digital Payments in IndiaDocument10 pagesDigital Payments in IndiaPrajwal KottawarNo ratings yet

- 062 Manual Traffic Sign and Gantries NorwayDocument141 pages062 Manual Traffic Sign and Gantries NorwayNat Thana AnanNo ratings yet

- APTK461Document1 pageAPTK461Eong Huat Corporation Sdn BhdNo ratings yet

- Study On Impact of Covid - 19 On Acceptance of Digital PaymentsDocument18 pagesStudy On Impact of Covid - 19 On Acceptance of Digital PaymentsPankaj GuravNo ratings yet

- 28-33 Digital PaymentsDocument6 pages28-33 Digital PaymentsSujata MansukhaniNo ratings yet

- General Management - DIGITAL PAYMENT REVOLUTION PDFDocument40 pagesGeneral Management - DIGITAL PAYMENT REVOLUTION PDFasitbhatiaNo ratings yet

- Literature Review: Digital Payment System in IndiaDocument8 pagesLiterature Review: Digital Payment System in IndiaAkshay Thampi0% (1)

- Impact of Covid 19 On Digital Transaction in IndiaDocument55 pagesImpact of Covid 19 On Digital Transaction in IndiapiyushNo ratings yet

- Role Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentDocument11 pagesRole Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentIAEME PublicationNo ratings yet

- BM - A-19bsphh01c0302Document11 pagesBM - A-19bsphh01c0302Chirag LaxmanNo ratings yet

- A Study On Digital Payments in India With Perspective of Consumer S AdoptionDocument10 pagesA Study On Digital Payments in India With Perspective of Consumer S AdoptionIron ManNo ratings yet

- 546 PDFDocument10 pages546 PDFIron ManNo ratings yet

- Iegs Cashless India Research PaperDocument12 pagesIegs Cashless India Research PaperKanikaNo ratings yet

- Digital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesDocument9 pagesDigital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesIJRASETPublicationsNo ratings yet

- Bm-Project (Chirag-0302)Document11 pagesBm-Project (Chirag-0302)Chirag LaxmanNo ratings yet

- REVIEW LITERATURE Digital PaymentsDocument7 pagesREVIEW LITERATURE Digital PaymentsMahimalluru Charan KumarNo ratings yet

- JASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedDocument10 pagesJASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedAnand SinghNo ratings yet

- An Analysis of How COVID-19 Revolutionized India's Payment InfrastructureDocument11 pagesAn Analysis of How COVID-19 Revolutionized India's Payment InfrastructureIJRASETPublicationsNo ratings yet

- Adoption of Digital Payment System by Consumer: A Review of LiteratureDocument8 pagesAdoption of Digital Payment System by Consumer: A Review of LiteratureRavi VermaNo ratings yet

- BRM Research PaperDocument5 pagesBRM Research PaperMonish PV PVNo ratings yet

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument11 pagesImpact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Vol2I1 Paper15Document15 pagesVol2I1 Paper15Piyush BhoyarNo ratings yet

- Chirag 19BSPHH01C0302Document11 pagesChirag 19BSPHH01C0302Chirag LaxmanNo ratings yet

- 1.1. Objective of The StudyDocument26 pages1.1. Objective of The StudyKruttika MohapatraNo ratings yet

- 1 Ed W6 X0 CFVXWL 4 Ubj OFeai SY3 XNKW TD0Document41 pages1 Ed W6 X0 CFVXWL 4 Ubj OFeai SY3 XNKW TD0Jitendra UdawantNo ratings yet

- Digital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz TajDocument6 pagesDigital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz Tajnilofer shallyNo ratings yet

- A Case Study On Perception Towards Online Payment Systems Among Urban and Rural CustomersDocument9 pagesA Case Study On Perception Towards Online Payment Systems Among Urban and Rural CustomersNicole MinNo ratings yet

- Jyoti Review Paper 20erwcs025Document10 pagesJyoti Review Paper 20erwcs025p.jyotii0008No ratings yet

- Cashless India - A Digital RevolutionDocument15 pagesCashless India - A Digital RevolutionHrishikesh PuranikNo ratings yet

- Digital Payment System 2018Document12 pagesDigital Payment System 2018wong wai hongNo ratings yet

- Impact and Importance of Digital Payment in IndiaDocument3 pagesImpact and Importance of Digital Payment in IndiaPrajwal KottawarNo ratings yet

- PSG 48 65Document19 pagesPSG 48 65ElsaNo ratings yet

- A Study On Digital Payments System & Consumer Perception: An Empirical SurveyDocument11 pagesA Study On Digital Payments System & Consumer Perception: An Empirical SurveyDeepa VishwakarmaNo ratings yet

- 455pm - 5.EPRA JOURNALS 12530Document4 pages455pm - 5.EPRA JOURNALS 12530tirthankarNo ratings yet

- Activity-2 - 1CD20CS126 - RAHUL TIWARI - CompressedDocument17 pagesActivity-2 - 1CD20CS126 - RAHUL TIWARI - CompressedRahul TiwariNo ratings yet

- Rahul 12007077Document16 pagesRahul 12007077Rahul TiwariNo ratings yet

- Digital Payments in IndiaDocument3 pagesDigital Payments in IndiaSona DuttaNo ratings yet

- 2024 Revolution of Digital Paymentin IndiaDocument10 pages2024 Revolution of Digital Paymentin Indiasneha.rs.imsarNo ratings yet

- Preeti PPT TybbiDocument30 pagesPreeti PPT Tybbipreeti magdumNo ratings yet

- Cashless Economy: Is Society Ready For TransformationDocument3 pagesCashless Economy: Is Society Ready For TransformationJazz AlexanderNo ratings yet

- Consumer Perception Towards Digital Payment ModeDocument8 pagesConsumer Perception Towards Digital Payment ModeSibiCk100% (1)

- Indian Economy - Cash To Cashless SystemDocument10 pagesIndian Economy - Cash To Cashless Systemb0gm3n0tNo ratings yet

- A Comparative Analysis of Paytm and BHIM App During PandemicDocument8 pagesA Comparative Analysis of Paytm and BHIM App During PandemicVampire KNo ratings yet

- ICT India Working Paper 1Document16 pagesICT India Working Paper 1Mohan SinghNo ratings yet

- A Study On Digital Payment Awareness Among Small Scale VendorsDocument4 pagesA Study On Digital Payment Awareness Among Small Scale VendorsEditor IJTSRDNo ratings yet

- Effect of Cashless IJSTRDocument5 pagesEffect of Cashless IJSTRRichard MerkNo ratings yet

- Consumer's Perception Towards Online Banking ServicesDocument7 pagesConsumer's Perception Towards Online Banking ServicesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Finance Ipr 2Document42 pagesFinance Ipr 2Navaneeth GsNo ratings yet

- JURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175Document21 pagesJURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175hahaha123No ratings yet

- Impact of Digital Wallets On Consumer Behavior in IndiaDocument17 pagesImpact of Digital Wallets On Consumer Behavior in IndiaIJAR JOURNALNo ratings yet

- A Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument16 pagesA Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaSimon ShresthaNo ratings yet

- Expansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West BengalDocument6 pagesExpansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West BengalInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Payment Dynamics Unveiling The Impacts On Sustainable Development, Environmental Protection, and Social InclusionDocument7 pagesDigital Payment Dynamics Unveiling The Impacts On Sustainable Development, Environmental Protection, and Social InclusionEditor IJTSRDNo ratings yet

- Digital Transformatioin FinanceDocument15 pagesDigital Transformatioin FinancesuhitaNo ratings yet

- SUPRIYA Final SYNOPSISDocument38 pagesSUPRIYA Final SYNOPSISpoonammadan0001No ratings yet

- Risk Reduction-An Individual Does Not Need To CarryDocument5 pagesRisk Reduction-An Individual Does Not Need To CarryRAJESH MECHNo ratings yet

- Preprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument10 pagesPreprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Impact of Covid-19 On Digital PaymentsDocument21 pagesImpact of Covid-19 On Digital PaymentsShubam SinghNo ratings yet

- A Study On Growth of Mobile Banking in India During Covid-19Document25 pagesA Study On Growth of Mobile Banking in India During Covid-19POOJA BHANUSHALINo ratings yet

- A Study On Changing Scenerio of Cashless Economy-1Document14 pagesA Study On Changing Scenerio of Cashless Economy-1Vainika Prasad V SNo ratings yet

- Door SensorDocument2 pagesDoor SensorShameerNo ratings yet

- Power SupplyDocument11 pagesPower SupplyShameerNo ratings yet

- 16f877a 1Document239 pages16f877a 1ShameerNo ratings yet

- BuzzerDocument1 pageBuzzerShameerNo ratings yet

- Flame Sensor 1Document2 pagesFlame Sensor 1ShameerNo ratings yet

- Micro ControllerDocument9 pagesMicro ControllerShameerNo ratings yet

- Flame Sensor2Document3 pagesFlame Sensor2ShameerNo ratings yet

- Preprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument10 pagesPreprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument11 pagesImpact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Survey ON Status of Coir Industry in Kerala: The ConsultantsDocument176 pagesSurvey ON Status of Coir Industry in Kerala: The ConsultantsShameerNo ratings yet

- The Impact of Covid - 19 On Digital Payment System With Reference To Chennai CityDocument13 pagesThe Impact of Covid - 19 On Digital Payment System With Reference To Chennai CityShameerNo ratings yet

- Verizon Usa Iphone Xsmax 256GBDocument1 pageVerizon Usa Iphone Xsmax 256GBClaudensky Succes2022No ratings yet

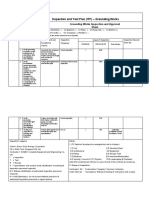

- Inspection and Test Plan (ITP) - Grounding WorksDocument2 pagesInspection and Test Plan (ITP) - Grounding WorksElisco Pher SalmasanNo ratings yet

- Microcontrollers Applications Note 4Document37 pagesMicrocontrollers Applications Note 4dhikacelvinNo ratings yet

- Project Report Hotel Management SystDocument63 pagesProject Report Hotel Management SystSubhash BajajNo ratings yet

- Module 4 Diesel CycleDocument11 pagesModule 4 Diesel CycleRalph Bernard Dela RosaNo ratings yet

- 2016-05 Brent Cross Cricklewood - OBJ-51 - M Axon PoEDocument31 pages2016-05 Brent Cross Cricklewood - OBJ-51 - M Axon PoEscribdstorageNo ratings yet

- Pro Mern Stack Full StackDocument1 pagePro Mern Stack Full StackJayadrata Middey0% (1)

- Consejos de Servicio de Transmisión Bescodyne SB 94-2Document4 pagesConsejos de Servicio de Transmisión Bescodyne SB 94-2Alfredo LopezNo ratings yet

- Switchgear ABBDocument240 pagesSwitchgear ABBd kurniawan0% (1)

- Stamford: Automatic Control System Alternatr Engine Alternator Alternatr AlternatorDocument3 pagesStamford: Automatic Control System Alternatr Engine Alternator Alternatr AlternatorRexelynNo ratings yet

- BV Requirement For UPS Back Up TimeDocument3 pagesBV Requirement For UPS Back Up TimeVishnu LalNo ratings yet

- Cloud Computing Assignment-2Document3 pagesCloud Computing Assignment-2Ahmad WaqarNo ratings yet

- CICS Concepts and FaclitiesDocument18 pagesCICS Concepts and FaclitiesIvan PetrucciNo ratings yet

- Structured Query LanguageDocument29 pagesStructured Query LanguageMukesh KumarNo ratings yet

- TEch File U8U8ADocument30 pagesTEch File U8U8AAilen LazarteNo ratings yet

- Fcto State of States 2014 1Document82 pagesFcto State of States 2014 1Pablo SanzNo ratings yet

- 4TH Semester Date Sheet of Academic Batch-2022-23Document2 pages4TH Semester Date Sheet of Academic Batch-2022-23Hariom SinghNo ratings yet

- DM 1Document5 pagesDM 1Rajeev SharmaNo ratings yet

- Capr-Iii 3012Document72 pagesCapr-Iii 3012You TubeNo ratings yet

- Familiarize With TCMS V3 and Its Simple Installation ProcessDocument99 pagesFamiliarize With TCMS V3 and Its Simple Installation ProcessSeki AoiNo ratings yet

- Srija Puppala ResumeDocument11 pagesSrija Puppala ResumeHARSHANo ratings yet

- Bpo2 PPT 3Document12 pagesBpo2 PPT 3Mary Lynn Dela PeñaNo ratings yet

- BMW X5 Xdrive30d E70Document54 pagesBMW X5 Xdrive30d E70vavasthiNo ratings yet

- Google Pay SO APIDocument36 pagesGoogle Pay SO APIRohitha Vaidyan100% (1)

- 4100ES With IDNAC Addressable Fire Detection and Control Basic Panel Modules and Accessories FeaturesDocument14 pages4100ES With IDNAC Addressable Fire Detection and Control Basic Panel Modules and Accessories FeaturesdennisflorianNo ratings yet

- Inspire 1 (DJI), Scout X4 (Walkera), Voyager 3 (Walkera)Document15 pagesInspire 1 (DJI), Scout X4 (Walkera), Voyager 3 (Walkera)Quads For FunNo ratings yet

The Impact of Pandemic On Digital Payments in India: February 2021

The Impact of Pandemic On Digital Payments in India: February 2021

Uploaded by

ShameerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Impact of Pandemic On Digital Payments in India: February 2021

The Impact of Pandemic On Digital Payments in India: February 2021

Uploaded by

ShameerCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/349599173

THE IMPACT OF PANDEMIC ON DIGITAL PAYMENTS IN INDIA

Article · February 2021

CITATIONS READS

0 4,900

2 authors, including:

Parvathi Subranami

maharani womens arts commerce and management college

2 PUBLICATIONS 0 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Women Entrepreneurship View project

All content following this page was uploaded by Parvathi Subranami on 25 February 2021.

The user has requested enhancement of the downloaded file.

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

THE IMPACT OF PANDEMIC ON DIGITAL PAYMENTS IN INDIA

Dr Nirmala M, Associate Professor, Canara Bank School of Management, Bangalore City

University, Bangalore

Parvathi S, Research scholar, Canara Bank School of Management, Bangalore City University,

Bangalore

ABSTRACT

In the current situation, Digital payments play a vital role and has many advantages over cash, such

as easy transaction, security and transparency. Banking sector play a key role in digital payment by

offering digital instruments such as debit cards, mobile banking, mobile wallets etc. in this pandemic

situation. The pandemic could drive the world faster towards digital payments. Circumstances fuelling

digital payment. Payment systems have proven that they are efficient and sustainable and continue to

command a high degree of trust in the general population. However, the closure of the companies and

the lock-down resulted in lower average transaction volumes. In order to aid the recovery and

contribute to the emerge of this new standard, it is imperative that the digital payments environment

evolves rapidly and help from the Post-COVID period.

This paper focus on the importance of Digital payments during pandemic, different modes of digital

payment systems, the growth of digital payment from last three years. And also, The road ahead in

the digital payment.

Key words: Pandemic, Digital payment, Mobile Banking, e-Banking, Cashless

INTRODUCTION

Digital payments play an important role in this pandemic. In view of the current situation in which

individuals are forced to maintain a physical distance, digital payment modes are actually being

adopted. Many businesses were shattered completely after the arrival of the coronavirus. Small

merchants, moreover, closed their shops. Many people across the globe have lost their sources of

income. All these things have made the economic situation very unfortunate. However, digital

payment modes play a very beneficial role in the face of this critical situation.

Digital payments in India have risen since the Pandemic. The Coronavirus epidemic will eventually

achieve what India's shock demonetization struggled to achieve four years ago by using digital

payment from the electricity bill to the cab fares.

"People who have never paid online bills are paying online for people who have never bought online

grocery stores to buy online." Said Nithyananda Sharma, Chief Executive Officer of Get Simple

Technology Pvt, Ltd., which helps people to order food and groceries online and pay online payment,

"What would have taken five years has happened in the last three months."

Initially, digital payments increased as people struggled to get bank notes, but shifted to cash as the

amount of notes in circulation rose again. Now the pandemic that made people afraid of near personal

connections is giving internet payments a fresh rise.

Volume-55, No.1 (I) 2021 216

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

The Digital India program is the Indian government's key outcome, whose vision is to transform India

into a digital society and an information economy. One of the positions Digital India professes is

"Faceless, paperless, cashless”. There are different digital payment methods available as part of

encouraging cashless transactions and transforming India to a business with no cash. It is likely that

demonetization would be characterized as a game changer for the Indian economy. Demonetization,

on the other hand, leads to booming cashless payments. All payments will be made in this futuristic

world using contactless cards, cell phone apps and other electronic means, while notes and coins will

be eliminated.

At present, the government is actively encouraging individuals to accept digital payments if it was for

convenience earlier, but now it has become compulsory with social distancing and the COVID-19

crisis because Novel Corona Virus (Covid-19) is rare and there are hundreds of different Corona

Viruses, most of which are found in animals such as pigs, camels, bats and cats. But they will transmit

from animals to humans sometimes. When they do, they cause chronic cold diseases that affect the

upper respiratory system. It is extremely unusual for the animal Corona virus to infect humans and

then transmit between individuals. It is extremely unusual for the animal Corona virus to infect

individuals and then transmit between individuals. However, over the past two decades, three of the

seven Corona Viruses believed to impact humans, which now includes SAR-COV-2, have originated

from animals and have caused serious, widespread disease and death as at present (01-01-2021) Global

reported cases 83,963,759, Global deaths (1,827,539), 2.18 percent, Global recovery (47,289,065)

56.32%.

Large-scale acceptance of digital payments was observed as the first big wave post demonetization.

During the pandemic and lock down, the second major wave arrived for Digital payments.

Central Government has long tried to drive digital payments to India, where three out of four customer

purchases are in cash. In November 2016, Central Government suddenly and unexpectedly invalidated

much of the country's high-value currency notes-more targeted at curbing inflation, which he also

noted later helped to promote a shift towards digital transactions.

Via our on-going 'UPI chalega' initiative, we have launched India pay safe in the current social

distancing climate to raise awareness of paying secure with digital payments. We hope that we will

inspire a lot of individuals who have been used to managing cash to turn to digital payments and make

a normal change. In terms of using UPI as a fast, stable and instant digital payment process, the

initiative pushes a wider public message. We have even attempted to use some celebrities to push the

cause that we have built UPIchalege.com Microsite where you can find all valuable details on how to

safely use UPI.

Obviously, technology has made our lives simpler. Electronic payments are one of the technological

developments in banking, finance and trade. Electronic Payments (e-payments) refers to the technical

advancement that helps us to electronically conduct financial transactions, eliminating long queues

and other problems. Electronic Payments gives people more flexibility to pay their taxes, permits,

penalties, fines and transactions at unconventional places and 365 days of the year at any time of the

day.

Volume-55, No.1 (I) 2021 217

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

Importance of Digital Payments

Cost Savings

Digital Payments will reduce a huge amount of cost that governments and companies used to invest.

Accessibility and Convenience

Using digital payment modes is very easy. You can make online payments within a second. In case of

a contactless transaction, you need to hover your card over the payment equipment. People can use it

using any mobile device.

Lower Risk

Online payment gateway will securely send the important transaction details. There is no specific time

for making an online transaction, you can do it whenever you want.

Trace Everything

The best part of using digital payment mode is that you can trace your transaction.

Future of Digital Payment

After the arrival of COVID-19, the online payment industry is booming. Various digital payment

companies are doing their hardest to encourage digital payment methods. There is no doubt that the

post pandemic era will be the era of digital payment mode. There are several enterprises that have

introduced advanced payment terminals as technology progresses. This payment terminals would

make it easier for retailers to take payments via credit card. Customers would now have the option to

make deposits in a comfortable manner. As a consequence, for small merchants, the digital payment

mode will be a blessing in disguise.

Various Modes of Digital payments

Formed in 2008, under the patronage of RBI and Indian Bank Association, NPCI has embarked on a

machine for touching every Indian across its diverse range of digital payment items like UPI (Unified

Payment Interface), BHIM (RuPay, NETC, AePS (Aadhaar enabled Payment System), BHIM

Aadhaar, Bharat Billpay, NFS (National Financial Switch), NACH (National Automated Clearing

House), CTS, IMPS (Immediate Payment Service) and to facilitate Safe and protected digital

payments.

These services are helpful in

Shift of money from person to person

Person to business, such as kirana stores, petrol stations, recharges, e-commerce,

Business to business, such as a retailer to supplier or distributor

Business to person as salaries, reimbursement, claims

REVIEW OF LITERATURE:

Sudha. G, Sornaganesh. V, Thangajesu Satish. M, Chellama. A.V, August 2020. This paper

discusses the different digital payment mechanisms used in the event of a pandemic based on primary

data by gathering data from 220 respondents and the Digital India initiative is an Indian government

flagship program whose vision is to turn India into a digital society and an information economy. In

this futuristic world, all purchases can be made by contactless cards, smart phone apps and other

electronic means. The Reserve Bank of India last year announced that it planned to raise digital

transactions to about 15% of gross domestic product by 2021. The government is looking for a billion

Volume-55, No.1 (I) 2021 218

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

digital transactions per day as the fastest-growing mobile industry in the world. The collected data are

analysed by applying Appropriate statistical tools like t-test, Chi-square test and ANOVA test.

A.Martina Franciska and Dr. S. Sahayaselvi May - June2015. Study focuses on secondary

information and resources have been collected from books, articles, journals and relevant pages

Review with a view to the review and progress of one of them. This article clarified the different forms

of digital payment transfers used by ordinary people in their day-to-day lives. A total of 4018 billion

mobile banking transactions were completed in 2015-16, compared to 60 billion in 2012-13. Digital

payments to rural regions are now extending the reach of mobile networks, the Internet and electricity.

During the time of demonetization, the Government of India compelled the people to do all trade

directly or indirectly. India has more than 100 crore active network connections and more than 22 core

smartphone users. The cashless change is not only better than the cash exchange, but less time

consuming. So, there is no question that the upcoming transaction method is a cashless transaction.

Arpita Pandey, Mr. Arjun Singh Rathore April 6-7 2018. This article focused on how digitalization

will aid the growth of the Indian economy and the adoption of the new technologies for globalization

and modernization of our region, which contributes to development. All the measures and policies put

in place by the Government of India enable the Indian Community to build information and

understanding, and also clarified how digital payment is becoming the powerful factor that it provides.

safety, security in day-to-day transaction. Knowledge obtained on the basis of secondary evidence

from various research journals, Government records.

Dr Rajeshwari M May-June 2019. This article explaining the operating cost of banks has been

significantly decreased by Digital Banking. This has made it easier for banks to charge lower service

fees and provide higher interest rates for depositors as well. The decrease in operational costs meant

more benefit for the banks. Digital transformation is moving from traditional banking to a digital

world. This paper covers the role of digitization in Indian banking, factors that affect the scope of

digital banking in India, and trends in digital banking in India. Data were derived from a number of

sources, such as journal journals, government publications from India, and various RBI databases. The

study also showed that the simple use of digital banking would drive the integration of the unbanked

economy into the mainstream.

Jayalakshmi. S and Parvathi. S, July 2019. This article showed that digital payment is an effective

means of doing business of all sectors to reach out to prospective clients and to examine the idea of

digital banking, digital payment and digital payment methods. Digital payments have many benefits

over cash, such as simplicity, security and clarity. Slow internet access and extra costs for digital

purchases are a big barrier to the introduction of this digital payment system in India. In the next few

years, there will be a whole new way of transferring capital in the Indian economy.

RESEARCH METHODOLOGY

The research is based on secondary data. The data has been extracted from various sources like

research article, Authenticated Websites, bulletins of RBI, and Daily’s.

OBJECTIVES

1. To Know the Importance of Digital Payment in Pandemic.

Volume-55, No.1 (I) 2021 219

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

2. To study modes of online payment.

3. To Compare and Analyse present with previous year data of Digital payment.

Outcome of the study

However, digital payments are on the rise in India. As in most other areas of the world, digital

purchases have hit a record high this year in the country with nearly 1.5 billion people. As stated for

the first time by the local outlet, all channels from the unified payment interface (UPI) to the Aadhar-

Enabled Payment System (AEPS) registered dramatic growth.

In comparison to the gloom created by the Covid-19 pandemic and the lockdown across the economy,

digital payments and fintech were one industry that saw record highs in 2020 when a vast number of

people opted to stay at home and retain social distances. With fears over catching new coronavirus

infections from visiting bank branches and using currency notes, many people—not only in metros but

even in smaller towns—began to use their smartphones to make purchases and even take loans for

smooth banking services.

As the COVID-19 lockdown and ensuing constraints pushed more and more people to opt for digital

transactions, Uttar Pradesh reported a huge 126 percent leap in digital transactions in 2020 compared

to the previous year.

In September, the Card spends between 60-70 percent of the January average at the point of sale of

terminals in shops. This means that people use digital payments in physical modes like shopping.

The value of transactions on the Unified Payment Interface, a portal built by India's Largest Banks in

2016, hit an all-time high last month as people worried, they would treat bank notes in the midst of the

pandemic. Transfers of electric funds from banks, which had declined in April as economic growth

slowed by almost half, have also recovered.

Digital payments reached a record high in 2020 with all platforms from the Unified Payments App to

the Aadhar-enabled Payment System (AePS) recording stellar progress.

Cumulative Payment Transactions in the last 12 months

No. of Growth

Transaction in %

(in Crore) (month

on

month)

Jan 2020 436.43

Feb 2020 847.44 94.17

March 2020 1,262.84 49.02

April 2020 1,566.22 24.02

May 2020 1890.23 20.69

June 2020 2,298.85 21.62

July 2020 2,699.06 17.41

August 3,132.43 16.06

2020

Volume-55, No.1 (I) 2021 220

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

Sept 2020 3,620.51 15.58

Oct 2020 4,108.29 13.47

Nov 2020 4,623.25 12.53

Dec 2020 4,764.28 03.05

(Sources: digipay.gov.in)

Cumulative Payment Transactions in the last 12

months

4,623.25 4,764.28

4,108.29

3,620.51

3,132.43

2,699.06

2,298.85

1890.23

1,566.22

1,262.84

847.44

436.43

94.17 49.02 24.02 20.69 21.62 17.41 16.06 15.58 13.47 12.53 3.05

JAN-20 FEB-20 MAR-20 APR-20 MAY-20 JUN-20 JUL-20 AUG-20 SEP-20 OCT-20 NOV-20 DEC-20

No. of Transaction ( in Crore) Growth in % (month on month)

After passing the 200-crore mark in October, UPI transactions hit a record high of 221 crore

transactions worth 3.9-lakh crore in November. The Centre has set a target of 4,630 crore for digital

payments for 2020-21, which—players are hopeful—is likely to be surpassed.

Though demonetization led to the initial launch of digital payments in India in 2016, the government's

acts have remained complex over time. The global pandemic fuelled the swift and widespread adoption

of digital payments and digital trade in India, said Manish Patel, Founder and CEO of Mswipe.

At Mswipe, contactless payments rose from 13% of total transactions in the month of January 2020 to

30% of total transactions in December 2020.

The government spokesperson said that the state has registered the highest digital payment this year

relative to all other States in the country. It is because of the continuous and intensive focus of Chief

Minister Yogi Adityanath on the assimilation of technology to the economy that people in the state

have made such large-scale digital transactions. UP, with a population of about 24crore, has seen an

online sale.

Digital payments reached a record high in 2020 with all platforms from the Unified Payment Interface

[UPI] to the Aadhar enable Payment System (AePS) recording Stellar growth.

Since exceeding the 200 Crore mark (approx. 27,1563 million) in October 2020. UPI transaction set

another record high at 221 Crore transactions (30 Million+) valued at Rs.3.9 lakh crore (approx. $53

Billion) in November 2020. Approximately $63 billion worth of digital payments is projected to be

accepted (or expected) between 2020-21.

Statewise Distribution of Digital Payment Transaction

Volume-55, No.1 (I) 2021 221

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

Payment Mode of BHIM *99#, Rupay Card on POS only

SL. STATES DIGITAL

NO. TRANSACTION

(BASED ON PER

CAPITA BASIS)

1 Andhra Pradesh 17.683

2 Arunachal Pradesh 1.041

3 Assam 1.764

4 Bihar 1.361

5 Chattisgarh 38.481

6 Goa 5.886

7 Gujarat 2.389

8 Haryana 12.42

9 Himachal Pradesh 2.834

10 Jarkhand 1.81

11 Karnataka 6.538

12 Kerala 2.909

13 Madhya Pradesh 2.184

14 Maharashtra 6.948

15 Manipur 0.8

16 Meghalaya 0.765

17 Mizoram 0.548

18 Nagaland 0.584

19 Odisha 5.275

20 Punjab 2.041

21 Rajasthan 2.377

22 Sikkim 2.139

23 Tamilnadu 3.437

24 Telangana 2.571

25 Tripura 1.114

26 Uttar Pradesh 7.731

27 Uttarakhand 3.911

28 West Bengal 3.162

(Sources : digipay.gov.in)

Volume-55, No.1 (I) 2021 222

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

DIGITAL TRANSACTION (BASED ON PER CAPITA BASIS)

45

40

35

30

25

20

15

10

5

0

Madhya Pradesh

Gujarat

Manipur

Tamilnadu

Andhra Pradesh

Chattisgarh

Haryana

Karnataka

Meghalaya

Tripura

Sikkim

Assam

Goa

Kerala

Mizoram

Maharashtra

Nagaland

Odisha

Rajasthan

Telangana

Punjab

Uttar Pradesh

Uttarakhand

Arunachal Pradesh

Himachal Pradesh

Jarkhand

Bihar

West Bengal

Union Territories

SL.NO. UNION TERRITORIES DIGITAL

TRANSACTION

(BASED ON PER

CAPITA)

1 Andaman and Nicobar 2.35

2 Chandigarh 0.419

3 Dadra & Nagar Haveli & Daman & 8.311

Diu

4 Delhi 9.313

5 Jammu & Kashmir 0.796

6 Ladakh -

7 Lakshadweep 1.272

8 Puducherry 4.991

(Sources : digipay.gov.in)

Volume-55, No.1 (I) 2021 223

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

0.419

2.35

4.991

1.272

0

0.796 8.311

9.313

Andaman and Nicobar Chandigarh

Dadra & Nagar Haveli & Daman & Diu Dehli

Jammu & Kashmir Ladakh

Lakshadweep Puducherry

BHIM – UPI Transactions, Monthly Growth (LAKHS)

2018-2019 2019-2020 2020-2021

April-18 1,899 April-19 7,817 April-20 9,995

May -18 1,893 May -19 7,334 May -20 12,344

June-18 2,462 June-19 7,544 June-20 13,368

July-18 2,355 July-19 8,222 July-20 14,973

August-18 3,119 August-19 9,183 August-20 16,187

September- 4,057 September-19 9,549 September-20 18,001

18

October-18 4,822 October-19 11,483 October-20 20,715

November- 5,248 November-19 12,187 November-20 22,101

18

December-18 6,200 December-19 13,083 December-20 22,341

January-19 6,726 January-20 13,049 January-21

February-19 6,741 February-20 13,256 February-21

March-19 7,994 March-20 12,468 March-21

(Sources: digipay.gov.in)

Volume-55, No.1 (I) 2021 224

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

BHIM – UPI Transactions, Monthly Growth (LAKHS)

25,000

20,000

15,000

10,000

5,000

0

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

2018-2019 2019-2020 2020-2021

As digital payments across India grew at a compound annual growth rate (CAGR) of 55.1 percent over

the past five years between the financial year (FY) 2015-16 and 2019-20, the government's move

toward a cashless economy bore fruit. The RBI disclosed the details. Its value has risen from INR-

920.38 lakh Cr to INR 1623.05 lakh Cr during this time. Clipping at a 15.2 percent compounded annual

rate.

Digital payments have risen at a compounded annual growth rate of 55.1 percent between 2015-16 and

2019-20 from 593.61 Cr in the year to March 2016 to 3,434.56 Cr in the year to March 2020 FY (2020)

saw a huge rise in volumes to 3,434.56 Cr over the previous year but in value slipped down to INR

1,623.05 lakh Cr.

In 2016-17, digital payments rose to INR 969.12 Cr from INR 593.61 Cr in the previous year,

compared to INR 1,120.99 Cr in the previous year. The volume increased to 1459,01 Cr in 2017-18

and the value jumped to INR 1,369,86 lakh Cr. While the numbers climbed at a faster pace in 2018-

19, with volume jumping to 2,343.40 Cr.

Conclusion

The Government is deliberately moving people to accept digital payments at present, if it has been

mandatory before, with social distancing and the COVID-19 crises. The offline-to-online transition in

payments has been around for a long time, but there has been an increased change in customer

behaviour in the latest lock-down scenario attributed to COVID-19. NPCI encouraged and urged

customers and all service providers of critical services to move to digital payment systems in order to

remain secure.

We're starting to see solutions coming up, and Merchants are heading further into the 'phygital world.'

And they don't have to go online entirely. People will be able to call any messaging mechanism in our

use to position orders or communicate by exchanging images, telling them what they want to purchase

and eventually digitally the payment will happen. Everyone goes out and picks up the items or delivers

them. After the lockdown, it's going to be a phase where we'll still have to be careful and take extra

precautions to stay safe until the world has really got rid of this situation. This period is all about

creating these solutions and innovating to meet these needs for the public, retailers and businesses.

Volume-55, No.1 (I) 2021 225

View publication stats

Journal of the Maharaja Sayajirao University of Baroda ISSN : 0025-0422

In the recent lockdown situation, along with RBI and the government, we are asking citizens to switch

to digital payment methods in order to remain protected. NPCI and other state governments are

ensuring that more providers of essential services are on the digital platform. The government has

taken action on social media to motivate the use of online payments and discourage the use of cash. In

their day-to-day transactions such as NEFT, IMPS, BBPS, which are available 24/7, the RBI and the

government continuously reiterate several digital payment options available to customers.

Through the use of smartphones, the digitization of the banking sector is bound to satisfy the increasing

expectations of the population. Indeed, it reduced human error and improved comfort. With the aid of

digital banking, most enterprises do not have to focus on the timing of banking operations.

Transactions will now be made even in odd hours.

References

Dr.V.Sornaganesh and Dr.M.Chelladurai (2016) “Demonetization of Indian currency and

its impact on business environment” International Journal of Informative and Futuristic

Research Vol-4, Issue-3 November2016, PP5654-5662

Aravind Kumar (2017) “Demonetisation and cashless banking transactions in India”

International Journal of new innovations in Engineering and Technology ISSN: 2321-6319,

Vol. No. 7, Issue No. 3, April 2017, Pp30-36

Anthony Rahul Golden S (2017) “An Overview of Digitalization in Indian Banking

Sector”, Indo - Iranian Journal of Scientific Research (IIJSR), October -December, 2017. [6].

https://www.crowdfundinsider.com

https://www.moneycontrol.com

https://www.thehindubusinesslin.com

https://www.researchdive.com

https://www.timesofindia.indiatimes.com

https://www.indiaexpress.com

https://www.expresscomputer.in

https://www.outlookindia.com

https://www.globaltrademay.com

https://www.digipay.gov.com

https://www.npci.org.in

https://www.cashlessindia.gov.in

Volume-55, No.1 (I) 2021 226

You might also like

- Unity GDD TemplateDocument13 pagesUnity GDD TemplateIswandi AswarNo ratings yet

- I-240G-B ManualDocument256 pagesI-240G-B Manualqweneo100% (5)

- Digital Payments in IndiaDocument10 pagesDigital Payments in IndiaPrajwal KottawarNo ratings yet

- 062 Manual Traffic Sign and Gantries NorwayDocument141 pages062 Manual Traffic Sign and Gantries NorwayNat Thana AnanNo ratings yet

- APTK461Document1 pageAPTK461Eong Huat Corporation Sdn BhdNo ratings yet

- Study On Impact of Covid - 19 On Acceptance of Digital PaymentsDocument18 pagesStudy On Impact of Covid - 19 On Acceptance of Digital PaymentsPankaj GuravNo ratings yet

- 28-33 Digital PaymentsDocument6 pages28-33 Digital PaymentsSujata MansukhaniNo ratings yet

- General Management - DIGITAL PAYMENT REVOLUTION PDFDocument40 pagesGeneral Management - DIGITAL PAYMENT REVOLUTION PDFasitbhatiaNo ratings yet

- Literature Review: Digital Payment System in IndiaDocument8 pagesLiterature Review: Digital Payment System in IndiaAkshay Thampi0% (1)

- Impact of Covid 19 On Digital Transaction in IndiaDocument55 pagesImpact of Covid 19 On Digital Transaction in IndiapiyushNo ratings yet

- Role Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentDocument11 pagesRole Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentIAEME PublicationNo ratings yet

- BM - A-19bsphh01c0302Document11 pagesBM - A-19bsphh01c0302Chirag LaxmanNo ratings yet

- A Study On Digital Payments in India With Perspective of Consumer S AdoptionDocument10 pagesA Study On Digital Payments in India With Perspective of Consumer S AdoptionIron ManNo ratings yet

- 546 PDFDocument10 pages546 PDFIron ManNo ratings yet

- Iegs Cashless India Research PaperDocument12 pagesIegs Cashless India Research PaperKanikaNo ratings yet

- Digital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesDocument9 pagesDigital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesIJRASETPublicationsNo ratings yet

- Bm-Project (Chirag-0302)Document11 pagesBm-Project (Chirag-0302)Chirag LaxmanNo ratings yet

- REVIEW LITERATURE Digital PaymentsDocument7 pagesREVIEW LITERATURE Digital PaymentsMahimalluru Charan KumarNo ratings yet

- JASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedDocument10 pagesJASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedAnand SinghNo ratings yet

- An Analysis of How COVID-19 Revolutionized India's Payment InfrastructureDocument11 pagesAn Analysis of How COVID-19 Revolutionized India's Payment InfrastructureIJRASETPublicationsNo ratings yet

- Adoption of Digital Payment System by Consumer: A Review of LiteratureDocument8 pagesAdoption of Digital Payment System by Consumer: A Review of LiteratureRavi VermaNo ratings yet

- BRM Research PaperDocument5 pagesBRM Research PaperMonish PV PVNo ratings yet

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument11 pagesImpact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Vol2I1 Paper15Document15 pagesVol2I1 Paper15Piyush BhoyarNo ratings yet

- Chirag 19BSPHH01C0302Document11 pagesChirag 19BSPHH01C0302Chirag LaxmanNo ratings yet

- 1.1. Objective of The StudyDocument26 pages1.1. Objective of The StudyKruttika MohapatraNo ratings yet

- 1 Ed W6 X0 CFVXWL 4 Ubj OFeai SY3 XNKW TD0Document41 pages1 Ed W6 X0 CFVXWL 4 Ubj OFeai SY3 XNKW TD0Jitendra UdawantNo ratings yet

- Digital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz TajDocument6 pagesDigital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz Tajnilofer shallyNo ratings yet

- A Case Study On Perception Towards Online Payment Systems Among Urban and Rural CustomersDocument9 pagesA Case Study On Perception Towards Online Payment Systems Among Urban and Rural CustomersNicole MinNo ratings yet

- Jyoti Review Paper 20erwcs025Document10 pagesJyoti Review Paper 20erwcs025p.jyotii0008No ratings yet

- Cashless India - A Digital RevolutionDocument15 pagesCashless India - A Digital RevolutionHrishikesh PuranikNo ratings yet

- Digital Payment System 2018Document12 pagesDigital Payment System 2018wong wai hongNo ratings yet

- Impact and Importance of Digital Payment in IndiaDocument3 pagesImpact and Importance of Digital Payment in IndiaPrajwal KottawarNo ratings yet

- PSG 48 65Document19 pagesPSG 48 65ElsaNo ratings yet

- A Study On Digital Payments System & Consumer Perception: An Empirical SurveyDocument11 pagesA Study On Digital Payments System & Consumer Perception: An Empirical SurveyDeepa VishwakarmaNo ratings yet

- 455pm - 5.EPRA JOURNALS 12530Document4 pages455pm - 5.EPRA JOURNALS 12530tirthankarNo ratings yet

- Activity-2 - 1CD20CS126 - RAHUL TIWARI - CompressedDocument17 pagesActivity-2 - 1CD20CS126 - RAHUL TIWARI - CompressedRahul TiwariNo ratings yet

- Rahul 12007077Document16 pagesRahul 12007077Rahul TiwariNo ratings yet

- Digital Payments in IndiaDocument3 pagesDigital Payments in IndiaSona DuttaNo ratings yet

- 2024 Revolution of Digital Paymentin IndiaDocument10 pages2024 Revolution of Digital Paymentin Indiasneha.rs.imsarNo ratings yet

- Preeti PPT TybbiDocument30 pagesPreeti PPT Tybbipreeti magdumNo ratings yet

- Cashless Economy: Is Society Ready For TransformationDocument3 pagesCashless Economy: Is Society Ready For TransformationJazz AlexanderNo ratings yet

- Consumer Perception Towards Digital Payment ModeDocument8 pagesConsumer Perception Towards Digital Payment ModeSibiCk100% (1)

- Indian Economy - Cash To Cashless SystemDocument10 pagesIndian Economy - Cash To Cashless Systemb0gm3n0tNo ratings yet

- A Comparative Analysis of Paytm and BHIM App During PandemicDocument8 pagesA Comparative Analysis of Paytm and BHIM App During PandemicVampire KNo ratings yet

- ICT India Working Paper 1Document16 pagesICT India Working Paper 1Mohan SinghNo ratings yet

- A Study On Digital Payment Awareness Among Small Scale VendorsDocument4 pagesA Study On Digital Payment Awareness Among Small Scale VendorsEditor IJTSRDNo ratings yet

- Effect of Cashless IJSTRDocument5 pagesEffect of Cashless IJSTRRichard MerkNo ratings yet

- Consumer's Perception Towards Online Banking ServicesDocument7 pagesConsumer's Perception Towards Online Banking ServicesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Finance Ipr 2Document42 pagesFinance Ipr 2Navaneeth GsNo ratings yet

- JURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175Document21 pagesJURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175hahaha123No ratings yet

- Impact of Digital Wallets On Consumer Behavior in IndiaDocument17 pagesImpact of Digital Wallets On Consumer Behavior in IndiaIJAR JOURNALNo ratings yet

- A Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument16 pagesA Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaSimon ShresthaNo ratings yet

- Expansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West BengalDocument6 pagesExpansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West BengalInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Payment Dynamics Unveiling The Impacts On Sustainable Development, Environmental Protection, and Social InclusionDocument7 pagesDigital Payment Dynamics Unveiling The Impacts On Sustainable Development, Environmental Protection, and Social InclusionEditor IJTSRDNo ratings yet

- Digital Transformatioin FinanceDocument15 pagesDigital Transformatioin FinancesuhitaNo ratings yet

- SUPRIYA Final SYNOPSISDocument38 pagesSUPRIYA Final SYNOPSISpoonammadan0001No ratings yet

- Risk Reduction-An Individual Does Not Need To CarryDocument5 pagesRisk Reduction-An Individual Does Not Need To CarryRAJESH MECHNo ratings yet

- Preprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument10 pagesPreprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Impact of Covid-19 On Digital PaymentsDocument21 pagesImpact of Covid-19 On Digital PaymentsShubam SinghNo ratings yet

- A Study On Growth of Mobile Banking in India During Covid-19Document25 pagesA Study On Growth of Mobile Banking in India During Covid-19POOJA BHANUSHALINo ratings yet

- A Study On Changing Scenerio of Cashless Economy-1Document14 pagesA Study On Changing Scenerio of Cashless Economy-1Vainika Prasad V SNo ratings yet

- Door SensorDocument2 pagesDoor SensorShameerNo ratings yet

- Power SupplyDocument11 pagesPower SupplyShameerNo ratings yet

- 16f877a 1Document239 pages16f877a 1ShameerNo ratings yet

- BuzzerDocument1 pageBuzzerShameerNo ratings yet

- Flame Sensor 1Document2 pagesFlame Sensor 1ShameerNo ratings yet

- Micro ControllerDocument9 pagesMicro ControllerShameerNo ratings yet

- Flame Sensor2Document3 pagesFlame Sensor2ShameerNo ratings yet

- Preprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument10 pagesPreprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument11 pagesImpact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Survey ON Status of Coir Industry in Kerala: The ConsultantsDocument176 pagesSurvey ON Status of Coir Industry in Kerala: The ConsultantsShameerNo ratings yet

- The Impact of Covid - 19 On Digital Payment System With Reference To Chennai CityDocument13 pagesThe Impact of Covid - 19 On Digital Payment System With Reference To Chennai CityShameerNo ratings yet

- Verizon Usa Iphone Xsmax 256GBDocument1 pageVerizon Usa Iphone Xsmax 256GBClaudensky Succes2022No ratings yet

- Inspection and Test Plan (ITP) - Grounding WorksDocument2 pagesInspection and Test Plan (ITP) - Grounding WorksElisco Pher SalmasanNo ratings yet

- Microcontrollers Applications Note 4Document37 pagesMicrocontrollers Applications Note 4dhikacelvinNo ratings yet

- Project Report Hotel Management SystDocument63 pagesProject Report Hotel Management SystSubhash BajajNo ratings yet

- Module 4 Diesel CycleDocument11 pagesModule 4 Diesel CycleRalph Bernard Dela RosaNo ratings yet

- 2016-05 Brent Cross Cricklewood - OBJ-51 - M Axon PoEDocument31 pages2016-05 Brent Cross Cricklewood - OBJ-51 - M Axon PoEscribdstorageNo ratings yet

- Pro Mern Stack Full StackDocument1 pagePro Mern Stack Full StackJayadrata Middey0% (1)

- Consejos de Servicio de Transmisión Bescodyne SB 94-2Document4 pagesConsejos de Servicio de Transmisión Bescodyne SB 94-2Alfredo LopezNo ratings yet

- Switchgear ABBDocument240 pagesSwitchgear ABBd kurniawan0% (1)

- Stamford: Automatic Control System Alternatr Engine Alternator Alternatr AlternatorDocument3 pagesStamford: Automatic Control System Alternatr Engine Alternator Alternatr AlternatorRexelynNo ratings yet

- BV Requirement For UPS Back Up TimeDocument3 pagesBV Requirement For UPS Back Up TimeVishnu LalNo ratings yet

- Cloud Computing Assignment-2Document3 pagesCloud Computing Assignment-2Ahmad WaqarNo ratings yet

- CICS Concepts and FaclitiesDocument18 pagesCICS Concepts and FaclitiesIvan PetrucciNo ratings yet

- Structured Query LanguageDocument29 pagesStructured Query LanguageMukesh KumarNo ratings yet

- TEch File U8U8ADocument30 pagesTEch File U8U8AAilen LazarteNo ratings yet

- Fcto State of States 2014 1Document82 pagesFcto State of States 2014 1Pablo SanzNo ratings yet

- 4TH Semester Date Sheet of Academic Batch-2022-23Document2 pages4TH Semester Date Sheet of Academic Batch-2022-23Hariom SinghNo ratings yet

- DM 1Document5 pagesDM 1Rajeev SharmaNo ratings yet

- Capr-Iii 3012Document72 pagesCapr-Iii 3012You TubeNo ratings yet

- Familiarize With TCMS V3 and Its Simple Installation ProcessDocument99 pagesFamiliarize With TCMS V3 and Its Simple Installation ProcessSeki AoiNo ratings yet

- Srija Puppala ResumeDocument11 pagesSrija Puppala ResumeHARSHANo ratings yet

- Bpo2 PPT 3Document12 pagesBpo2 PPT 3Mary Lynn Dela PeñaNo ratings yet

- BMW X5 Xdrive30d E70Document54 pagesBMW X5 Xdrive30d E70vavasthiNo ratings yet

- Google Pay SO APIDocument36 pagesGoogle Pay SO APIRohitha Vaidyan100% (1)

- 4100ES With IDNAC Addressable Fire Detection and Control Basic Panel Modules and Accessories FeaturesDocument14 pages4100ES With IDNAC Addressable Fire Detection and Control Basic Panel Modules and Accessories FeaturesdennisflorianNo ratings yet

- Inspire 1 (DJI), Scout X4 (Walkera), Voyager 3 (Walkera)Document15 pagesInspire 1 (DJI), Scout X4 (Walkera), Voyager 3 (Walkera)Quads For FunNo ratings yet