Professional Documents

Culture Documents

ACCT 1005 - Suggested Solutions - BBC Lecture Questions - Cash - Accounts Receivable

ACCT 1005 - Suggested Solutions - BBC Lecture Questions - Cash - Accounts Receivable

Uploaded by

Kenya LevyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 1005 - Suggested Solutions - BBC Lecture Questions - Cash - Accounts Receivable

ACCT 1005 - Suggested Solutions - BBC Lecture Questions - Cash - Accounts Receivable

Uploaded by

Kenya LevyCopyright:

Available Formats

ACCT 1005 _ Cash & Accounts Receivable

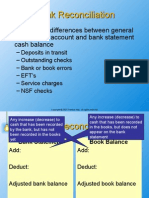

Preparation of the

Bank Reconciliation Statement

1. Identify items that are shown only in the books of the

business.

2. Identify items that appear only on the bank

statement of the business

3. Adjust the bank balance using the items that appear

only in the cash book

Deposits in Transit/Outstanding Deposits (+)

Outstanding/Unpresented Cheques (-)

& Bank Errors (+ or -) 1

4. Adjust the book balance using the items that

appear only on the bank statement

Bank Collections/Direct Credit (+)

EFTs (+ or -)

Difference in signature

Bank Charges/Fees (-) Missing signature/Missing date

Stale/Post dated

Interest Earned (+) Difference in words & figure

Insufficient funds (hot, bad, rubber, bounced)

Dishonoured Cheques (-)

& Book Errors (+ or -)

5. The adjusted bank balance should be equal

to the adjusted cash book balance.

Mona School of Business & Management 1

ACCT 1005 _ Cash & Accounts Receivable

After preparing the bank reconciliation statement:

Update the accounting records with the

transactions that are on the Company’s Book

side of the bank reconciliation statement

Correct all book errors & notify the bank of any

error(s) made.

Lecture Questions #1& 2

REMEDIAL MEDICAL COMPANY

Bank Reconciliation

April 30

Balance per bank, April 30 $23,775

Add: Deposit in Transit 3,580

Bank Error 2,970 6,550

30,325

Less: Outstanding Cheques (7,840)

Adjusted bank balance, April 30 $22,485

4

Mona School of Business & Management 2

ACCT 1005 _ Cash & Accounts Receivable

Bank Reconciliation Cont’d

Balance per books, April 30 $18,885

Add: Bank Collection - Note Receivable & Interest 3,780

22,665

Less: Book Error 70

Bank Service Charges 110 (180)

Adjusted book balance, April 30 $22,485

REMEDIAL MEDICAL COMPANY

General Journal Entries

Date Accounts & Explanation Dr $ Cr $

April 30 Cash 3,780

Notes Receivable 3,600

Interest Revenue 180

Collection of Note with Interest

April 30 Accounts Payable - Copelin Co. 70

Cash 70

Correction of Error

April 30 Miscellaneous Expenses 110

Cash 110

Bank Service Charges 6

Mona School of Business & Management 3

ACCT 1005 _ Cash & Accounts Receivable

BANNER Inc

Bank Reconciliation

July 31

Balance per bank, July 31 $114,828

Add: Outstanding Deposit 16,000

130,828

Less: Un-presented Cheques:

#811 314

#814 625

#823 175 (1,114)

Adjusted bank balance, July 31 $129,714

7

Bank Reconciliation Cont’d

Balance per Cash Book, July 31 $125,568

Add: Note Receivable – R. Mane 4,000

Error (Cheque #821) 396 4,396

129,964

Less: Service Charges 50

Dis. Cheque- H. Williams 200 ( 250)

Adjusted book balance, July 31 $ 129,714

Mona School of Business & Management 4

ACCT 1005 _ Cash & Accounts Receivable

BANNER Inc

General Journal Entries

Date Accounts & Explanation Dr $ Cr $

July 31 Cash 4,000

Notes Receivable – R. Mane 4,000

Note collected by bank

July 31 Cash 396

Office Equipment 396

Correction of error – Cheque #821

July 31 Miscellaneous Expenses 50

Cash 50

Bank service charges

July 31 A/Cs Receivable – H. Williams 200

Cash 200

NSF cheque returned by bank 9

Worksheet #3

Lecture Question 3

Texas Golf Carts

Prepared by Joan Thomas-Stone

Mona School of Business & Management 5

ACCT 1005 _ Cash & Accounts Receivable

TEXAS GOLF CARTS

General Journal

Date Accounts & Explanations Dr ($) Cr ($)

Aug.9 Allowance For Bad-Debts A/C 1,000

A/Cs Receivable: J. Aguilar 200

Seaton Co 100

T. Taylor 700

To write-off uncollectible accounts

Sept.30 Bad-Debt Expense A/C 2,100

Allowance For Bad-Debts A/C 2,100

To record bad debt expense

Oct. 18 Allowance For Bad-Debts A/C 900

A/Cs Receivable: Lantz Co 500

Navisor Corp 400

To write-off uncollectible accounts

Dec. 31 Bad-Debt Expense A/C 300

Allowance For Bad-Debts A/C 300

To record increase in allowance

Aging of Receivables

Age Interval Balance Est. Est.

Uncollectible Uncollectible

% Amount

1-30 days 100,000 0.1 100

31-60 days 40,000 0.5 200

61-90 days 14,000 5.0 700

Over 90 days 9,000 30 2,700

Total 163,000 3,700

Accounts Receivable Estimated Uncollectible AR

Mona School of Business & Management 6

ACCT 1005 _ Cash & Accounts Receivable

Allowance For Bad-Debts A/C

A/Cs Rec. - J. Aguilar 200 Bal. $3,200

- Seaton Co 100

- T. Taylor 700

Bal. $2,200

Bad-Debt Expense 2,100

A/Cs Rec. - Lantz Co 500 Bal. $4,300

- Navisor Corp 400

Bal. $3,400

Bad-Debt Expense 300

Bal. $3,700

Reporting Receivables on

Balance Sheet

Balance Sheet Extract

Current Assets

Cash & Cash Equivalents xxxxx

Accounts Receivable $163,000

Less: Allowance For Bad-Debts ( 3,700)

Net Receivables $159,300

OR

A/Cs Receivable, net of Allowance for BDS of $3,700 $159,300

Mona School of Business & Management 7

You might also like

- Quiz - Chapter 3 - Bank ReconciliationDocument6 pagesQuiz - Chapter 3 - Bank ReconciliationSHE82% (11)

- Audit of CashDocument4 pagesAudit of CashandreamrieNo ratings yet

- Bank Reconciliation Bank ReconciliationDocument9 pagesBank Reconciliation Bank Reconciliationmustafa_33No ratings yet

- CM 03 Bank ReconciliationDocument7 pagesCM 03 Bank ReconciliationDanicaEsponilla67% (3)

- Cash and Account Receivable: Tugas Pengantar Praktik Pengauditan Pertemuan VDocument18 pagesCash and Account Receivable: Tugas Pengantar Praktik Pengauditan Pertemuan VwillyNo ratings yet

- Customer Satisfaction Towards Life InsuranceDocument70 pagesCustomer Satisfaction Towards Life Insurancekkccommerceproject100% (1)

- Bank Reconciliation StatementsDocument25 pagesBank Reconciliation StatementsVernan ZivanaiNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Cash Book Bank ColumnBank StatementDocument6 pagesCash Book Bank ColumnBank StatementShaikh Ghassan AbidNo ratings yet

- Chapter 7 Practice SolutionsDocument5 pagesChapter 7 Practice Solutionslemanhan240103No ratings yet

- The Bank ReconciliationDocument3 pagesThe Bank ReconciliationAhmed SroorNo ratings yet

- Bank Reconciliation NotesDocument25 pagesBank Reconciliation NotesJohn Sue HanNo ratings yet

- College Accounting 12th Edition Slater Solutions Manual DownloadDocument35 pagesCollege Accounting 12th Edition Slater Solutions Manual DownloadRicardo Rivera100% (27)

- Principles of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashDocument12 pagesPrinciples of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashAli Zain Parhar100% (2)

- Accounting 7th Edition Horngren Solutions Manual Full Chapter PDFDocument46 pagesAccounting 7th Edition Horngren Solutions Manual Full Chapter PDFadelaideoanhnqr1v100% (18)

- Accounting 7th Edition Horngren Solutions ManualDocument25 pagesAccounting 7th Edition Horngren Solutions Manualnicholassmithyrmkajxiet100% (26)

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Tugas Latihan 4 PDFDocument2 pagesTugas Latihan 4 PDFRadit Ramdan NopriantoNo ratings yet

- ch08 PDFDocument4 pagesch08 PDFRabie HarounNo ratings yet

- Tugas Latihan 4Document2 pagesTugas Latihan 4Radit Ramdan NopriantoNo ratings yet

- Problem 1Document8 pagesProblem 1Mikaela JeanNo ratings yet

- CH 08Document4 pagesCH 08flrnciairnNo ratings yet

- Solution Aassignments CH 7Document5 pagesSolution Aassignments CH 7RuturajPatilNo ratings yet

- Activities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerDocument9 pagesActivities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerEfril Joy AlbitoNo ratings yet

- CHP 8 - in Class ExerciseDocument2 pagesCHP 8 - in Class ExerciseThomas TermoteNo ratings yet

- Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015Document12 pagesExercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015Doan Chan PhongNo ratings yet

- Example 2:: Adjustments To The Bank BalanceDocument8 pagesExample 2:: Adjustments To The Bank BalanceTERRIUS AceNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsShiela Mae SangidNo ratings yet

- Fabm1 q3 Mod8 PostingtransactionsintheledgerDocument8 pagesFabm1 q3 Mod8 PostingtransactionsintheledgerXedric JuantaNo ratings yet

- General Journal and LedgerDocument5 pagesGeneral Journal and Ledgersinta agnesNo ratings yet

- PT1&2Document2 pagesPT1&2nicolettecatamio015No ratings yet

- Chap 7_Bank ReconciliationDocument13 pagesChap 7_Bank ReconciliationamnaNo ratings yet

- Acc 3 Revision Questions 18Document6 pagesAcc 3 Revision Questions 18Danielle WatsonNo ratings yet

- Chapter 8Document26 pagesChapter 8ENG ZI QINGNo ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- Bank Reconcilation - ProblemDocument2 pagesBank Reconcilation - ProblemRayeed AliNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- Tut 6 Bank Recon AOPDocument12 pagesTut 6 Bank Recon AOPxa. vieNo ratings yet

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Document3 pagesA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaNo ratings yet

- ACTNG1Document2 pagesACTNG1Jake RyleNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- ACCOUNTING5Document9 pagesACCOUNTING5Natasha MugoniNo ratings yet

- Ar QDocument2 pagesAr QAyaNo ratings yet

- Welcome: Click To Edit Master Title StyleDocument29 pagesWelcome: Click To Edit Master Title StyleMingxNo ratings yet

- PRACTICE 6 ACCOUNTING 2 CorrectedDocument9 pagesPRACTICE 6 ACCOUNTING 2 CorrectedScribdTranslationsNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- Cash and Cash Equivalents & Bank ReconciliationDocument20 pagesCash and Cash Equivalents & Bank ReconciliationHesil Jane DAGONDON100% (1)

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Module 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPADocument24 pagesModule 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPALucas BantilingNo ratings yet

- Tutorial 1 and 2 Tutor Accy 112Document7 pagesTutorial 1 and 2 Tutor Accy 112mei100% (1)

- 5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0Document14 pages5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0ramosmikay0222No ratings yet

- Module 6 P2 Internal Control - BSA & BSMADocument14 pagesModule 6 P2 Internal Control - BSA & BSMAramosmikay0222No ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Journal To Trial BalanceDocument19 pagesJournal To Trial BalanceIrfan Ul HaqNo ratings yet

- Chapter 7 Exercises With SolutionDocument5 pagesChapter 7 Exercises With Solutionmohammad khataybehNo ratings yet

- Processing Accounting Information: QuestionsDocument57 pagesProcessing Accounting Information: QuestionsYousifNo ratings yet

- HomeWork#1 RealDocument3 pagesHomeWork#1 RealKenya LevyNo ratings yet

- Lecture 7Document10 pagesLecture 7Kenya LevyNo ratings yet

- Inferential Statistics - Introduction - Lecture - Part4 - RealDocument19 pagesInferential Statistics - Introduction - Lecture - Part4 - RealKenya LevyNo ratings yet

- Inferential Statistics - Introduction - Lecture - Part5 - RealDocument8 pagesInferential Statistics - Introduction - Lecture - Part5 - RealKenya LevyNo ratings yet

- Notes-2nd Order ODE pt1Document33 pagesNotes-2nd Order ODE pt1Kenya LevyNo ratings yet

- Lecture 8Document3 pagesLecture 8Kenya LevyNo ratings yet

- Lecture 15Document6 pagesLecture 15Kenya LevyNo ratings yet

- Inferential Statistics - Introduction - Lecture - Part3 - ActualDocument9 pagesInferential Statistics - Introduction - Lecture - Part3 - ActualKenya LevyNo ratings yet

- Lecture 12Document2 pagesLecture 12Kenya LevyNo ratings yet

- Lecture 1Document16 pagesLecture 1Kenya LevyNo ratings yet

- Lecture 9Document3 pagesLecture 9Kenya LevyNo ratings yet

- Prob Set#4-Risk - Return - ProblemsDocument4 pagesProb Set#4-Risk - Return - ProblemsKenya Levy0% (1)

- Lecture 4Document9 pagesLecture 4Kenya LevyNo ratings yet

- Lecture 2Document4 pagesLecture 2Kenya LevyNo ratings yet

- Lecture 5Document9 pagesLecture 5Kenya LevyNo ratings yet

- Force of InterestDocument24 pagesForce of InterestKenya LevyNo ratings yet

- Accumulated Values Present ValuesDocument20 pagesAccumulated Values Present ValuesKenya LevyNo ratings yet

- Corporation: Stockholders ShareholdersDocument6 pagesCorporation: Stockholders ShareholdersKenya LevyNo ratings yet

- Course Assessment: LECTURE SCHEDULE - Semester I 2021/2022Document14 pagesCourse Assessment: LECTURE SCHEDULE - Semester I 2021/2022Kenya LevyNo ratings yet

- Lecture Presentation - AdjustmentsDocument11 pagesLecture Presentation - AdjustmentsKenya LevyNo ratings yet

- Accounting For ReceivablesDocument4 pagesAccounting For ReceivablesKenya LevyNo ratings yet

- ACCT 1005 - Summary Notes 5 - Merchandising Businesses - 2015Document6 pagesACCT 1005 - Summary Notes 5 - Merchandising Businesses - 2015Kenya LevyNo ratings yet

- Does Bedload Change in Shape and Size Downstream in The Pagee River?Document2 pagesDoes Bedload Change in Shape and Size Downstream in The Pagee River?Kenya LevyNo ratings yet

- Diagram Showing Set Up of Apparatus Used in Pinhole Camera ExperimentDocument3 pagesDiagram Showing Set Up of Apparatus Used in Pinhole Camera ExperimentKenya LevyNo ratings yet

- 7 Cox Street, Port Maria P.O, ST Mary PHONE: +1 (876) 866-4444 Email: FAX: +1 (876) 416-2355Document1 page7 Cox Street, Port Maria P.O, ST Mary PHONE: +1 (876) 866-4444 Email: FAX: +1 (876) 416-2355Kenya LevyNo ratings yet

- Planning and Design #2 (IMPLEMENTED)Document4 pagesPlanning and Design #2 (IMPLEMENTED)Kenya LevyNo ratings yet

- Define VariableDocument5 pagesDefine VariableKenya LevyNo ratings yet

- Chapter 16 Matrices: Try These 16.1Document48 pagesChapter 16 Matrices: Try These 16.1Kenya LevyNo ratings yet

- 7 Cox Street, Port Maria P.O, ST Mary PHONE: +1 (876) 866-4444 Email: FAX: +1 (876) 416-2355Document1 page7 Cox Street, Port Maria P.O, ST Mary PHONE: +1 (876) 866-4444 Email: FAX: +1 (876) 416-2355Kenya LevyNo ratings yet

- Chapter 3 FinmarDocument21 pagesChapter 3 FinmarJohn SecretNo ratings yet

- TransUnion Credit ReportDocument34 pagesTransUnion Credit ReportMilan HarrisonNo ratings yet

- CMS Info SystemsDocument29 pagesCMS Info Systemskrishna_buntyNo ratings yet

- List of Banks EtcDocument3 pagesList of Banks EtcMehmood Ul HassanNo ratings yet

- Discharge For Death Claim Under Policy No.Document3 pagesDischarge For Death Claim Under Policy No.Jayabalaji RNo ratings yet

- Interest Rate Risk ManagementDocument8 pagesInterest Rate Risk ManagementEdga WariobaNo ratings yet

- SFM Formula BookDocument29 pagesSFM Formula BookAstikNo ratings yet

- Standard Setting BodiesDocument3 pagesStandard Setting Bodiesshe lacks wordsNo ratings yet

- Briefly Describe The Following Types of Financial Records A Business May UseDocument2 pagesBriefly Describe The Following Types of Financial Records A Business May Usesajana kunwarNo ratings yet

- REPORTING AND ANALYZING Cash FlowsDocument39 pagesREPORTING AND ANALYZING Cash FlowsmarieieiemNo ratings yet

- KGN Pub. Bill No. 16, Majencio Brand SolutionDocument1 pageKGN Pub. Bill No. 16, Majencio Brand Solutioncsingh081No ratings yet

- CRM of HSBCDocument112 pagesCRM of HSBCBabui OrccoNo ratings yet

- DLA 122 A1 - Project 2023: 1. Setup StepsDocument4 pagesDLA 122 A1 - Project 2023: 1. Setup StepsHitekani ImargineNo ratings yet

- Fundamentals of Accountancy Las 3 4Document10 pagesFundamentals of Accountancy Las 3 4Mayjustine DacilloNo ratings yet

- Topic 8 Lecture Example SolutionsDocument5 pagesTopic 8 Lecture Example SolutionsMitchell BylartNo ratings yet

- Acknowledgement Letter Templates #03Document2 pagesAcknowledgement Letter Templates #03Ericka Grace De CastroNo ratings yet

- Ict Group Assignment For Grade 12Document9 pagesIct Group Assignment For Grade 12KaddunNo ratings yet

- Null 20220614 231107Document4 pagesNull 20220614 231107FARMASI BEC BUBATNo ratings yet

- PPT On Raghunandan MoneyDocument17 pagesPPT On Raghunandan MoneyAmarkantNo ratings yet

- OpTransactionHistoryUX320 12 2023Document41 pagesOpTransactionHistoryUX320 12 2023Jamnas JamaludheenNo ratings yet

- Nationwide Junior ISA Ts and CsDocument4 pagesNationwide Junior ISA Ts and CsSpartacus UkinNo ratings yet

- Card ConfirmationDocument1 pageCard Confirmationkilo6954No ratings yet

- Practice Questions For Exam III (Time Value of Money and Valuation and Rates of Return)Document25 pagesPractice Questions For Exam III (Time Value of Money and Valuation and Rates of Return)Kim FloresNo ratings yet

- The Determinants of Intermediation Margins in Islamic and Conventional Banksmanagerial FinanceDocument18 pagesThe Determinants of Intermediation Margins in Islamic and Conventional Banksmanagerial FinanceHeriyanto UIRNo ratings yet

- Financial Market SummaryDocument21 pagesFinancial Market SummaryJorufel Tomo PapasinNo ratings yet

- Feasey V Sun Life AssuranceDocument64 pagesFeasey V Sun Life AssuranceAisha Miller100% (1)

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Murabaha AccountingDocument15 pagesMurabaha AccountingShakeel IqbalNo ratings yet

- Progress Monitoring Report: Basic Data Available Funds (US$) Total Cost and SourceDocument6 pagesProgress Monitoring Report: Basic Data Available Funds (US$) Total Cost and SourceFREDY RODRINo ratings yet