Professional Documents

Culture Documents

7-3 PT Pandu Dan PT Sadewa

7-3 PT Pandu Dan PT Sadewa

Uploaded by

Team 1Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7-3 PT Pandu Dan PT Sadewa

7-3 PT Pandu Dan PT Sadewa

Uploaded by

Team 1Copyright:

Available Formats

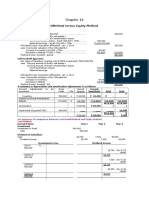

JAWABAN SOAL 7-3

(1). Perhitungan:

Fair value 500,000,000

Nilai buku kepemilikan yg diperoleh 500,000,000

Excess cost over book value -

Laba antar perusahaan - transaksi obligasi (downstream)

Investasi obligasi 95% x 100.000.000 95,000,000

Hutang obligasi 50% x 200.000.000 (jual ke PT Sadewa) 100,000,000

Laba konstruktif 30, 1 Jan'19 5,000,000

Amortisasi keuntungan 5.000.000/5 th (1,000,000)

Laba konstruktif 31 Des 2019 4,000,000

Laba antar perusahaan - penjualan tanah (Upstream):

Laba antar perusahaan 1 Oktober 2017 (20 jt x 75%) 15,000,000

Pembuktian nilai Investasi pd PT Sadewa menurut metode ekuitas sdh tepat:

Saldo investasi pada PT Sadewa, 1/1/18 (75% x 500 juta) 375,000,000

Penyesuaian Periode lalu (Retained Earnings)

+/+ Mutasi laba tahun lalu (300 jt - 200 jt) x 75% 75,000,000

Saldo investasi pada PT Sadewa, 31/12/18 450,000,000

-/- Penyesuaian periode lalu (R/E) atas laba penjualan tanah 2018 (15,000,000)

+/+ Income from PT Sadewa (Rp 100 jt x 75%) 75,000,000

-/- Dividen received (75% x 50.000.000) (37,500,000)

+/+ Laba kontruktif 5,000,000

-/- Amortisasi laba kontruktif (1,000,000)

26,500,000

(2). Investasi pada PT Sadewa 31/12/19 (sudah terbukti) 476,500,000

(3). Jurnal eliminasi per 31 Desember 2019:

a. Interest income 13,000,000

Contructive gain 1,000,000

Interest expenses 12,000,000

b Bonds payable 100,000,000

Contructive gain 4,000,000

Investment in PT Pandu - Bonds 96,000,000

c. Investasi in PT Sadewa - Stock 15,000,000

Noncontrolling interest 5,000,000

Land 20,000,000

d. Income from PT Sadewa 79,000,000

Dividend 37,500,000

Investasi in PT Sadewa - Stock 41,500,000

e. Noncontrolling interest 25,000,000

Dividend 12,500,000

Noncontrolling interest 12,500,000

f. Common stock 300,000,000

Retained earnings 300,000,000

Investasi in PT Sadewa - Stock 450,000,000

Noncontrolling interest 150,000,000

g. Dividend payable 18,750,000

Dividend receivable 18,750,000

h. Interest payable 6,000,000

Interest receivable 6,000,000

(4).

PT PANDU AND SUBSIDIARY

WORKSHEET - CONSOLIDATED FINANCIAL STATEMENTS

For The Year Ended December 31, 2019

75% Eliminations Consolidated

Descriptions PT PANDU PT SADEWA # Dr Cr # F/S

Income Statement

Sales 1,000,000,000 420,000,000 1,420,000,000

Income from PT Sadewa 79,000,000 - d 79,000,000 -

Cost of Sales (555,000,000) (274,000,000) (829,000,000)

Depreciation expenses (6,000,000) - (6,000,000)

Other Operating Expenses (164,000,000) (59,000,000) (223,000,000)

Constructive gain - bonds redemption - - 1,000,000 a 5,000,000

4,000,000 b

Interest income - 13,000,000 a 13,000,000 -

Interest expense (24,000,000) - 12,000,000 a (12,000,000)

Noncontrolling interest - - e 25,000,000 (25,000,000)

Net Income 330,000,000 100,000,000 330,000,000

Retained Earnings Statement

Retained Earnings 1/1/19 300,000,000 300,000,000 f 300,000,000 300,000,000

Net Income 330,000,000 100,000,000 330,000,000

Dividends (100,000,000) (50,000,000) 37,500,000 d (100,000,000)

12,500,000 e

Retained Earnings 31/12/19 530,000,000 350,000,000 530,000,000

Balance Sheet

Assets

Interest receivable - 6,000,000 6,000,000 h -

Dividend receivable 18,750,000 - 18,750,000 g -

Investment in PT Pandu - bonds - 96,000,000 96,000,000 b -

Investment in PT Sadewa - stock 476,500,000 - c 15,000,000 41,500,000 d -

450,000,000 f

Land 400,000,000 250,000,000 20,000,000 c 630,000,000

Other assets 546,750,000 373,000,000 919,750,000

Total Assets 1,442,000,000 725,000,000 1,549,750,000

Liabilities & Equity

Liabilities

Interest payable 12,000,000 - h 6,000,000 6,000,000

Dividen payable 50,000,000 25,000,000 g 18,750,000 56,250,000

Bonds payable 200,000,000 - b 100,000,000 100,000,000

Other liabilities 150,000,000 50,000,000 200,000,000

Total Liabilities 412,000,000 75,000,000 362,250,000

Equity

Common Stock 500,000,000 300,000,000 f 300,000,000 500,000,000

Retained Earnings 31/12/19 530,000,000 350,000,000 530,000,000

Noncontrolling interest, 1/1/19 c 5,000,000 150,000,000 f

Noncontrolling interest, 31/12/19 12,500,000 e 157,500,000

Total Liabilities and Equity 1,442,000,000 725,000,000 1,549,750,000

You might also like

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document89 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16Mckenzie100% (1)

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-16Document82 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-16Kate Alvarez75% (4)

- Noncurrent Asset Held For Sale: Problem 6-1 (IFRS)Document10 pagesNoncurrent Asset Held For Sale: Problem 6-1 (IFRS)Kimberly Claire Atienza71% (7)

- 7-3 PT Pandu Dan PT SadewaDocument2 pages7-3 PT Pandu Dan PT SadewaTeam 1No ratings yet

- Jawaban 9-1a (Struktur Induk-Anak-Cucu)Document2 pagesJawaban 9-1a (Struktur Induk-Anak-Cucu)felicia sunartaNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Assignment#2Document5 pagesAssignment#2Kristine Esplana ToraldeNo ratings yet

- ASSIGNMENT#2Document5 pagesASSIGNMENT#2Kristine Esplana ToraldeNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 3 (2022)Document76 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 3 (2022)Mazikeen DeckerNo ratings yet

- 7-4 PT Pandu Dan PT SadewaDocument5 pages7-4 PT Pandu Dan PT SadewaTeam 1No ratings yet

- Consolidation Q76Document4 pagesConsolidation Q76johny SahaNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Cost and Equity MethodDocument11 pagesCost and Equity MethoddmangiginNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- Joint VentureDocument24 pagesJoint VentureRoma Dela CruzNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- Accountancy 12 - DS2 - Set - 1Document15 pagesAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Topic 2 - Example 4A - Upstream DownstreamDocument6 pagesTopic 2 - Example 4A - Upstream DownstreamFuchoin ReikoNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Bahas Latihan TM11-1Document7 pagesBahas Latihan TM11-1Julia Pratiwi ParhusipNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Solution Chapter 16Document90 pagesSolution Chapter 16Frances Chariz YbioNo ratings yet

- PARTNERSHIP AND CORPORATION Answers For pp.226-227 Exercises 1,2, 3 and 8Document5 pagesPARTNERSHIP AND CORPORATION Answers For pp.226-227 Exercises 1,2, 3 and 8MALICDEM, CharizNo ratings yet

- Solution Far410 Jun 2019Document9 pagesSolution Far410 Jun 2019Nabilah NorddinNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- AKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085Document4 pagesAKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085mahendra ihzaNo ratings yet

- Audit of Receivables and Sales SolutionsDocument16 pagesAudit of Receivables and Sales SolutionsNICELLE TAGLENo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1CJ alandyNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1Jan ryanNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet

- Ans June 2018 Far410Document8 pagesAns June 2018 Far4102022478048No ratings yet

- Bahas Latihan TM11-1 2Document7 pagesBahas Latihan TM11-1 2Shely NaNo ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet

- Far570 Group ProjectDocument4 pagesFar570 Group ProjectN FrzanahNo ratings yet

- Fa Far Sesi 2Document28 pagesFa Far Sesi 2hdyhNo ratings yet

- QUIZ ArinaNurfitriFJ C10170054 AKL (D)Document5 pagesQUIZ ArinaNurfitriFJ C10170054 AKL (D)Arina Nurfitri Fauzi JamilNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000Document26 pagesMultiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000ALEXANDRANICOLE OCTAVIANONo ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument119 pagesChapter 16 Advanced Accounting Solution ManualAsuncion BarquerosNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Installlment AnsDocument21 pagesInstalllment AnsJHONALYN MARAONNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Consolidated Net Income P 370,000 P 460,000: Illustrative ProblemsDocument11 pagesConsolidated Net Income P 370,000 P 460,000: Illustrative ProblemsKeir GaspanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Csec Poa January 2012 p2Document9 pagesCsec Poa January 2012 p2Renelle RampersadNo ratings yet

- CMA Part 2 Financial Decision Making: Study Unit 8 - CVP Analysis and Marginal AnalysisDocument85 pagesCMA Part 2 Financial Decision Making: Study Unit 8 - CVP Analysis and Marginal AnalysisNEERAJ GUPTANo ratings yet

- Hero Motoco Elara ReportDocument7 pagesHero Motoco Elara ReportBhagyashree Lotlikar100% (1)

- FIN300 Homework 1Document7 pagesFIN300 Homework 1JohnNo ratings yet

- Fraud in AccountingDocument10 pagesFraud in AccountingDwi Putra Rachmad AbdillahNo ratings yet

- Learning Journal Unit 2 BUS 4404Document2 pagesLearning Journal Unit 2 BUS 4404Martina MakotaNo ratings yet

- Accounts From Incomplete RecordsDocument38 pagesAccounts From Incomplete Recordsdebashis1008100% (4)

- Merchandising - Adjusting To Reversing Entries - UpdatedDocument36 pagesMerchandising - Adjusting To Reversing Entries - Updatedhello hayaNo ratings yet

- Fluxo 02Document2 pagesFluxo 02GAME CRAFT vitorNo ratings yet

- (TR DR) (TR CR)Document33 pages(TR DR) (TR CR)sanddyhs2uNo ratings yet

- Midterm Mas 1-QuestionsDocument20 pagesMidterm Mas 1-QuestionsDan Andrei BongoNo ratings yet

- Presentation of Accounts by Holding Companies (As-21)Document44 pagesPresentation of Accounts by Holding Companies (As-21)Maanik Julka100% (3)

- Act 3122 Intermediate Financial Accounting Ii: Lecturer: Dr. Mazrah Malek Room: A302Document10 pagesAct 3122 Intermediate Financial Accounting Ii: Lecturer: Dr. Mazrah Malek Room: A302Shahrul FadreenNo ratings yet

- PWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021Document6 pagesPWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021arifansari2299No ratings yet

- Details of The Unclaimed Dividends (Upto FY Ended 31.03.2018) For The AGM Held On August 02 2018Document345 pagesDetails of The Unclaimed Dividends (Upto FY Ended 31.03.2018) For The AGM Held On August 02 2018Md. Mehedi HasanNo ratings yet

- Blaine Kitchenware Inc: Capital Structure Case StudyDocument23 pagesBlaine Kitchenware Inc: Capital Structure Case StudyMai PhamNo ratings yet

- Cazeñas-Debit Credit MemoDocument35 pagesCazeñas-Debit Credit MemoMicah Hanna Mae CazenasNo ratings yet

- Final RevisionDocument9 pagesFinal RevisionVo Phuc An (K17 HCM)No ratings yet

- Quiz 2 Answers BUSICOMBIDocument9 pagesQuiz 2 Answers BUSICOMBIfoxtrotNo ratings yet

- 01 Long QuizDocument6 pages01 Long Quizgiana riveraNo ratings yet

- ECON2103 L1 & 2 - Fall 2013 (Practice) MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument5 pagesECON2103 L1 & 2 - Fall 2013 (Practice) MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The Questioneric3765No ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 6 PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 6 PDF Scribdlauryn.corbett387100% (49)

- HUYA 2Q20 Earnings Release 08.11 4pm-FinalDocument12 pagesHUYA 2Q20 Earnings Release 08.11 4pm-FinalFaris RahmanNo ratings yet

- HBS Case MicrosoftDocument28 pagesHBS Case MicrosoftYitchell ChowNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial Statementsmaria isabella100% (2)

- TYBCom Sem VI Cost Accounting MCQsDocument35 pagesTYBCom Sem VI Cost Accounting MCQsAdi100% (1)

- Cfpacket 2 SPR 22Document266 pagesCfpacket 2 SPR 22EXII iNo ratings yet

- Singer BangladeshDocument16 pagesSinger BangladeshMahbubur RahmanNo ratings yet

- Abm 005 2Q Week 12 PDFDocument10 pagesAbm 005 2Q Week 12 PDFJoel Vasquez MalunesNo ratings yet