Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

21 viewsSolution Guide Property, Plant, and Equipment: NFCPAR-Auditing Problems

Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing Problems

Uploaded by

Sano ManjiroThe document discusses an old building that will not be demolished by Levy Co. after acquiring land and an existing building for $9 million plus assuming a $1 million mortgage on March 1, 2018. It provides a list of 23 costs incurred relating to the acquisition, construction plans, and demolition of the old building. However, the old building will now not be demolished as stated in the problem description.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- FULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF EbookDocument41 pagesFULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF Ebookkathy.galayda516100% (40)

- Solution Guide For PpeDocument45 pagesSolution Guide For PpeTrek Apostol57% (7)

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- CH 10Document9 pagesCH 10Antonios FahedNo ratings yet

- Assessment 2 - Module 2 Quiz - CourseraDocument1 pageAssessment 2 - Module 2 Quiz - CourseraCarla MissionaNo ratings yet

- Durian Crepe BMC REPORT (MUHD HANAFI BIN SAMSUDDIN 2019689276)Document18 pagesDurian Crepe BMC REPORT (MUHD HANAFI BIN SAMSUDDIN 2019689276)muhd fadhliNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Property, Plant and Equipement: Prior To Expense AfterDocument8 pagesProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNo ratings yet

- IMFPADocument3 pagesIMFPAAngel Acuña71% (7)

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesSano ManjiroNo ratings yet

- Ufrs ActivityDocument4 pagesUfrs ActivityErika TeradoNo ratings yet

- PPE - Initial Measurement - Assignment - No AnswersDocument2 pagesPPE - Initial Measurement - Assignment - No Answersemman neriNo ratings yet

- Activity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEDocument2 pagesActivity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEFrankie AsidoNo ratings yet

- NAMA1Document2 pagesNAMA1Iwel NetriNo ratings yet

- PPE ExcelDocument4 pagesPPE ExcelKeana Cassandra TobiasNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- Problem Set PpeDocument11 pagesProblem Set PpeHdhsiaihagatataNo ratings yet

- Ppe Test BankDocument10 pagesPpe Test BankAna Mae HernandezNo ratings yet

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Mini Case 3 Ppe-1Document5 pagesMini Case 3 Ppe-1ying huiNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Gen010 Act1Document5 pagesGen010 Act1Zia DumalagueNo ratings yet

- Intermediate Accounting I PpeDocument2 pagesIntermediate Accounting I PpeJoovs JoovhoNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Intermediate Accounting I - Ppe AnswersDocument3 pagesIntermediate Accounting I - Ppe AnswersJoovs Joovho50% (2)

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- Plants, Property and EquipmentDocument21 pagesPlants, Property and EquipmentAna Mae HernandezNo ratings yet

- Module6 Property2CPlant2CandEquipmentDocument10 pagesModule6 Property2CPlant2CandEquipmentGabrielle OlaesNo ratings yet

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- Ap Ppe Quizzer Q Accounting ReviewerDocument19 pagesAp Ppe Quizzer Q Accounting Reviewercynthia reyesNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- 3 HW On PPEDocument3 pages3 HW On PPENikko Bowie PascualNo ratings yet

- Intermediate Accounting 2Document5 pagesIntermediate Accounting 2Kristine Lara100% (3)

- CH 10Document9 pagesCH 10Saleh RaoufNo ratings yet

- RP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationDocument5 pagesRP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationViky Rose EballeNo ratings yet

- Ppe 2Document13 pagesPpe 2Jerome BaluseroNo ratings yet

- A231 - MC 3 PPE-StudentsDocument4 pagesA231 - MC 3 PPE-StudentsHafiza ZahidNo ratings yet

- PPE Initial Recognition. Part 2Document6 pagesPPE Initial Recognition. Part 2sheenacgacitaNo ratings yet

- Assignment PPE PArt 1Document7 pagesAssignment PPE PArt 1JP Mirafuentes100% (1)

- ACTIVITIESDocument13 pagesACTIVITIESJanine TupasiNo ratings yet

- Chapter 15Document10 pagesChapter 15Jess SiazonNo ratings yet

- Land Building MachineryDocument11 pagesLand Building MachineryJomerNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- Land Building Machinery ProblemsDocument13 pagesLand Building Machinery ProblemsJomerNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- Audit of PPE AssignmentDocument1 pageAudit of PPE AssignmentAlexis BagongonNo ratings yet

- Solution - PPE Nad IntangiblesDocument1 pageSolution - PPE Nad IntangiblesROB101512No ratings yet

- Problem No. 1: QuestionsDocument4 pagesProblem No. 1: QuestionsAnna Mae NebresNo ratings yet

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Audit of PPE Initial MeasurementDocument2 pagesAudit of PPE Initial MeasurementGwyneth TorrefloresNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- Quiz #1 PracticeDocument7 pagesQuiz #1 PracticeSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-105Document1 page1000 Solved Problem in Modern Physics-105Sano ManjiroNo ratings yet

- Production Departments Direct Labor Rate Manufacturing Overhead Application RatesDocument10 pagesProduction Departments Direct Labor Rate Manufacturing Overhead Application RatesSano ManjiroNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- Econs 101 - Quiz #2 Answer KeyDocument1 pageEcons 101 - Quiz #2 Answer KeySano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-120Document1 page1000 Solved Problem in Modern Physics-120Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-103Document1 page1000 Solved Problem in Modern Physics-103Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-101Document1 page1000 Solved Problem in Modern Physics-101Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-119Document1 page1000 Solved Problem in Modern Physics-119Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-108Document1 page1000 Solved Problem in Modern Physics-108Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-118Document1 page1000 Solved Problem in Modern Physics-118Sano ManjiroNo ratings yet

- 2.2.1 de Broglie Waves: 2.2 ProblemsDocument1 page2.2.1 de Broglie Waves: 2.2 ProblemsSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-116Document1 page1000 Solved Problem in Modern Physics-116Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-102Document1 page1000 Solved Problem in Modern Physics-102Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-107Document1 page1000 Solved Problem in Modern Physics-107Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Description Machinery Others NotesDocument1 pageNFCPAR-Auditing Problems: Description Machinery Others NotesSano ManjiroNo ratings yet

- Two Limiting Cases Ne: 1.3 Solutions 83Document1 pageTwo Limiting Cases Ne: 1.3 Solutions 83Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-106Document1 page1000 Solved Problem in Modern Physics-106Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-104Document1 page1000 Solved Problem in Modern Physics-104Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Capitalizable Cost of MachineryDocument1 pageNFCPAR-Auditing Problems: Capitalizable Cost of MachinerySano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Oracle EBS R12 Legal Entity Operating Unit Structure DesignDocument6 pagesOracle EBS R12 Legal Entity Operating Unit Structure Designqkhan2000No ratings yet

- Cash Flow Forecasting Global 1st Edition PGguidance 2013 PDFDocument28 pagesCash Flow Forecasting Global 1st Edition PGguidance 2013 PDFboris maric100% (1)

- Assignment Week 2 - Maya Wulansari - 09111840000040Document4 pagesAssignment Week 2 - Maya Wulansari - 09111840000040mayasari50% (2)

- The Forum: Our New Comment SectionDocument36 pagesThe Forum: Our New Comment SectionCity A.M.No ratings yet

- Beps PPT Atad 3 1704896464Document30 pagesBeps PPT Atad 3 1704896464avnidikaNo ratings yet

- Retail BankingDocument15 pagesRetail BankingjazzrulzNo ratings yet

- The Champion Legal Ads: 11-17-22Document64 pagesThe Champion Legal Ads: 11-17-22Donna S. SeayNo ratings yet

- Econ 2Document11 pagesEcon 2Marcos PittmanNo ratings yet

- Rithanya-Consumer Awareness-ProjectDocument19 pagesRithanya-Consumer Awareness-ProjecthfjnffefeNo ratings yet

- Internship Report PELDocument60 pagesInternship Report PELsara-bashir-8426No ratings yet

- Online Q 12014Document2 pagesOnline Q 12014Anonymous Feglbx5No ratings yet

- Salary and Wages AdministrationDocument52 pagesSalary and Wages Administrationjajurupesh88% (16)

- Conquistadors On The Beach SPANISH COMPANIESDocument6 pagesConquistadors On The Beach SPANISH COMPANIESMazana ÁngelNo ratings yet

- Human Resource Management: Ms. Sumina Susan KochittyDocument40 pagesHuman Resource Management: Ms. Sumina Susan KochittyFebin.Simon1820 MBANo ratings yet

- RomerDocument20 pagesRomerAkistaaNo ratings yet

- India Prepares - December 2011 (Vol.1 Issue 3)Document92 pagesIndia Prepares - December 2011 (Vol.1 Issue 3)India PreparesNo ratings yet

- BPE-60312 Sept 2020 - MARKET ANALYSISDocument26 pagesBPE-60312 Sept 2020 - MARKET ANALYSISAntonio MoncayoNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalJohn Marthin ReformaNo ratings yet

- Howard Marks Memo - The Seven Worst Words in The WorldDocument12 pagesHoward Marks Memo - The Seven Worst Words in The Worldmarketfolly.comNo ratings yet

- B-Law311 - Midterm Examination Bold: 3 Wrong Answers (Excluding Essay)Document7 pagesB-Law311 - Midterm Examination Bold: 3 Wrong Answers (Excluding Essay)Joana TrinidadNo ratings yet

- Chapter 8 - Economic DevelopmentDocument17 pagesChapter 8 - Economic DevelopmentJaycel Yam-Yam VerancesNo ratings yet

- Financial Management in MSMEs in IndiaDocument15 pagesFinancial Management in MSMEs in IndiaSürÿã PrakashNo ratings yet

- Resilient ChicagoDocument162 pagesResilient Chicagoshveta jainNo ratings yet

- ACCT551 Week 7 Quiz AnswersDocument3 pagesACCT551 Week 7 Quiz AnswersDominickdad100% (2)

- Financial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business EntrepreneursDocument7 pagesFinancial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business EntrepreneursqueenfaustineeNo ratings yet

- Argania CosmeticsDocument7 pagesArgania CosmeticsEma SousouNo ratings yet

Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing Problems

Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing Problems

Uploaded by

Sano Manjiro0 ratings0% found this document useful (0 votes)

21 views1 pageThe document discusses an old building that will not be demolished by Levy Co. after acquiring land and an existing building for $9 million plus assuming a $1 million mortgage on March 1, 2018. It provides a list of 23 costs incurred relating to the acquisition, construction plans, and demolition of the old building. However, the old building will now not be demolished as stated in the problem description.

Original Description:

Original Title

Document (1) 8

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses an old building that will not be demolished by Levy Co. after acquiring land and an existing building for $9 million plus assuming a $1 million mortgage on March 1, 2018. It provides a list of 23 costs incurred relating to the acquisition, construction plans, and demolition of the old building. However, the old building will now not be demolished as stated in the problem description.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views1 pageSolution Guide Property, Plant, and Equipment: NFCPAR-Auditing Problems

Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing Problems

Uploaded by

Sano ManjiroThe document discusses an old building that will not be demolished by Levy Co. after acquiring land and an existing building for $9 million plus assuming a $1 million mortgage on March 1, 2018. It provides a list of 23 costs incurred relating to the acquisition, construction plans, and demolition of the old building. However, the old building will now not be demolished as stated in the problem description.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

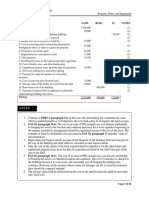

NFCPAR- Auditing Problems

Solution Guide Property, Plant, and Equipment

PROBLEM NO. 3

Old building will not be demolished

On March 1, 2018, Levy Co. acquired land and building by paying ₱ 9,000,000 and assuming

a mortgage of ₱ 1,000,000. The old building will be demolished for the construction of a new

building.

1. Unpaid real property taxes up to the date of acquisition 14,000

2. Cost of option of the acquired property 20,000

3. Excavation cost 12,000

4. Escrow fees on the properties acquired 11,000

5. Cost of relocating and reconstructing the property belonging to others in order to

acquire the property 23,000

6. Payment to real estate agent 40,000

7. Payments to tenants of the building to induce them to vacate the premises 3,000

8. Legal fees for contract to purchase land 11,000

9. Cost of removing trees from the land 70,000

10. Building permit and licenses 60,000

11. Architect fee 50,000

12. Materials used in all construction 600,000

13. Driveway and walk to building (part of the building plan) 30,000

14. Payment for claim for injuries not covered by insurance 40,000

15. Broker’s fee on the properties acquired 10,000

16. Rental fees generated on the portion of the building being used as a parking site 23,500

17. Cost of paving parking lot adjoining building 50,000

18. Other overhead cost incurred as a result of construction 220,000

19. Service equipment and fixture made a PERMANENT part of the structure 11,000

20. Safety fence around construction site 35,000

21. Removal of safety fence 9,800

22. Demolition cost of the old building 33,000

23. Proceeds from salvage of the demolition 4,000

Page 8 of 45

You might also like

- FULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF EbookDocument41 pagesFULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF Ebookkathy.galayda516100% (40)

- Solution Guide For PpeDocument45 pagesSolution Guide For PpeTrek Apostol57% (7)

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- CH 10Document9 pagesCH 10Antonios FahedNo ratings yet

- Assessment 2 - Module 2 Quiz - CourseraDocument1 pageAssessment 2 - Module 2 Quiz - CourseraCarla MissionaNo ratings yet

- Durian Crepe BMC REPORT (MUHD HANAFI BIN SAMSUDDIN 2019689276)Document18 pagesDurian Crepe BMC REPORT (MUHD HANAFI BIN SAMSUDDIN 2019689276)muhd fadhliNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Property, Plant and Equipement: Prior To Expense AfterDocument8 pagesProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNo ratings yet

- IMFPADocument3 pagesIMFPAAngel Acuña71% (7)

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesSano ManjiroNo ratings yet

- Ufrs ActivityDocument4 pagesUfrs ActivityErika TeradoNo ratings yet

- PPE - Initial Measurement - Assignment - No AnswersDocument2 pagesPPE - Initial Measurement - Assignment - No Answersemman neriNo ratings yet

- Activity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEDocument2 pagesActivity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEFrankie AsidoNo ratings yet

- NAMA1Document2 pagesNAMA1Iwel NetriNo ratings yet

- PPE ExcelDocument4 pagesPPE ExcelKeana Cassandra TobiasNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- Problem Set PpeDocument11 pagesProblem Set PpeHdhsiaihagatataNo ratings yet

- Ppe Test BankDocument10 pagesPpe Test BankAna Mae HernandezNo ratings yet

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Mini Case 3 Ppe-1Document5 pagesMini Case 3 Ppe-1ying huiNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Gen010 Act1Document5 pagesGen010 Act1Zia DumalagueNo ratings yet

- Intermediate Accounting I PpeDocument2 pagesIntermediate Accounting I PpeJoovs JoovhoNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Intermediate Accounting I - Ppe AnswersDocument3 pagesIntermediate Accounting I - Ppe AnswersJoovs Joovho50% (2)

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- Plants, Property and EquipmentDocument21 pagesPlants, Property and EquipmentAna Mae HernandezNo ratings yet

- Module6 Property2CPlant2CandEquipmentDocument10 pagesModule6 Property2CPlant2CandEquipmentGabrielle OlaesNo ratings yet

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- Ap Ppe Quizzer Q Accounting ReviewerDocument19 pagesAp Ppe Quizzer Q Accounting Reviewercynthia reyesNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- 3 HW On PPEDocument3 pages3 HW On PPENikko Bowie PascualNo ratings yet

- Intermediate Accounting 2Document5 pagesIntermediate Accounting 2Kristine Lara100% (3)

- CH 10Document9 pagesCH 10Saleh RaoufNo ratings yet

- RP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationDocument5 pagesRP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationViky Rose EballeNo ratings yet

- Ppe 2Document13 pagesPpe 2Jerome BaluseroNo ratings yet

- A231 - MC 3 PPE-StudentsDocument4 pagesA231 - MC 3 PPE-StudentsHafiza ZahidNo ratings yet

- PPE Initial Recognition. Part 2Document6 pagesPPE Initial Recognition. Part 2sheenacgacitaNo ratings yet

- Assignment PPE PArt 1Document7 pagesAssignment PPE PArt 1JP Mirafuentes100% (1)

- ACTIVITIESDocument13 pagesACTIVITIESJanine TupasiNo ratings yet

- Chapter 15Document10 pagesChapter 15Jess SiazonNo ratings yet

- Land Building MachineryDocument11 pagesLand Building MachineryJomerNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- Land Building Machinery ProblemsDocument13 pagesLand Building Machinery ProblemsJomerNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- Audit of PPE AssignmentDocument1 pageAudit of PPE AssignmentAlexis BagongonNo ratings yet

- Solution - PPE Nad IntangiblesDocument1 pageSolution - PPE Nad IntangiblesROB101512No ratings yet

- Problem No. 1: QuestionsDocument4 pagesProblem No. 1: QuestionsAnna Mae NebresNo ratings yet

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Audit of PPE Initial MeasurementDocument2 pagesAudit of PPE Initial MeasurementGwyneth TorrefloresNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- Quiz #1 PracticeDocument7 pagesQuiz #1 PracticeSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-105Document1 page1000 Solved Problem in Modern Physics-105Sano ManjiroNo ratings yet

- Production Departments Direct Labor Rate Manufacturing Overhead Application RatesDocument10 pagesProduction Departments Direct Labor Rate Manufacturing Overhead Application RatesSano ManjiroNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- Econs 101 - Quiz #2 Answer KeyDocument1 pageEcons 101 - Quiz #2 Answer KeySano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-120Document1 page1000 Solved Problem in Modern Physics-120Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-103Document1 page1000 Solved Problem in Modern Physics-103Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-101Document1 page1000 Solved Problem in Modern Physics-101Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-119Document1 page1000 Solved Problem in Modern Physics-119Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-108Document1 page1000 Solved Problem in Modern Physics-108Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-118Document1 page1000 Solved Problem in Modern Physics-118Sano ManjiroNo ratings yet

- 2.2.1 de Broglie Waves: 2.2 ProblemsDocument1 page2.2.1 de Broglie Waves: 2.2 ProblemsSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-116Document1 page1000 Solved Problem in Modern Physics-116Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-102Document1 page1000 Solved Problem in Modern Physics-102Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-107Document1 page1000 Solved Problem in Modern Physics-107Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Description Machinery Others NotesDocument1 pageNFCPAR-Auditing Problems: Description Machinery Others NotesSano ManjiroNo ratings yet

- Two Limiting Cases Ne: 1.3 Solutions 83Document1 pageTwo Limiting Cases Ne: 1.3 Solutions 83Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-106Document1 page1000 Solved Problem in Modern Physics-106Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-104Document1 page1000 Solved Problem in Modern Physics-104Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Capitalizable Cost of MachineryDocument1 pageNFCPAR-Auditing Problems: Capitalizable Cost of MachinerySano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Oracle EBS R12 Legal Entity Operating Unit Structure DesignDocument6 pagesOracle EBS R12 Legal Entity Operating Unit Structure Designqkhan2000No ratings yet

- Cash Flow Forecasting Global 1st Edition PGguidance 2013 PDFDocument28 pagesCash Flow Forecasting Global 1st Edition PGguidance 2013 PDFboris maric100% (1)

- Assignment Week 2 - Maya Wulansari - 09111840000040Document4 pagesAssignment Week 2 - Maya Wulansari - 09111840000040mayasari50% (2)

- The Forum: Our New Comment SectionDocument36 pagesThe Forum: Our New Comment SectionCity A.M.No ratings yet

- Beps PPT Atad 3 1704896464Document30 pagesBeps PPT Atad 3 1704896464avnidikaNo ratings yet

- Retail BankingDocument15 pagesRetail BankingjazzrulzNo ratings yet

- The Champion Legal Ads: 11-17-22Document64 pagesThe Champion Legal Ads: 11-17-22Donna S. SeayNo ratings yet

- Econ 2Document11 pagesEcon 2Marcos PittmanNo ratings yet

- Rithanya-Consumer Awareness-ProjectDocument19 pagesRithanya-Consumer Awareness-ProjecthfjnffefeNo ratings yet

- Internship Report PELDocument60 pagesInternship Report PELsara-bashir-8426No ratings yet

- Online Q 12014Document2 pagesOnline Q 12014Anonymous Feglbx5No ratings yet

- Salary and Wages AdministrationDocument52 pagesSalary and Wages Administrationjajurupesh88% (16)

- Conquistadors On The Beach SPANISH COMPANIESDocument6 pagesConquistadors On The Beach SPANISH COMPANIESMazana ÁngelNo ratings yet

- Human Resource Management: Ms. Sumina Susan KochittyDocument40 pagesHuman Resource Management: Ms. Sumina Susan KochittyFebin.Simon1820 MBANo ratings yet

- RomerDocument20 pagesRomerAkistaaNo ratings yet

- India Prepares - December 2011 (Vol.1 Issue 3)Document92 pagesIndia Prepares - December 2011 (Vol.1 Issue 3)India PreparesNo ratings yet

- BPE-60312 Sept 2020 - MARKET ANALYSISDocument26 pagesBPE-60312 Sept 2020 - MARKET ANALYSISAntonio MoncayoNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalJohn Marthin ReformaNo ratings yet

- Howard Marks Memo - The Seven Worst Words in The WorldDocument12 pagesHoward Marks Memo - The Seven Worst Words in The Worldmarketfolly.comNo ratings yet

- B-Law311 - Midterm Examination Bold: 3 Wrong Answers (Excluding Essay)Document7 pagesB-Law311 - Midterm Examination Bold: 3 Wrong Answers (Excluding Essay)Joana TrinidadNo ratings yet

- Chapter 8 - Economic DevelopmentDocument17 pagesChapter 8 - Economic DevelopmentJaycel Yam-Yam VerancesNo ratings yet

- Financial Management in MSMEs in IndiaDocument15 pagesFinancial Management in MSMEs in IndiaSürÿã PrakashNo ratings yet

- Resilient ChicagoDocument162 pagesResilient Chicagoshveta jainNo ratings yet

- ACCT551 Week 7 Quiz AnswersDocument3 pagesACCT551 Week 7 Quiz AnswersDominickdad100% (2)

- Financial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business EntrepreneursDocument7 pagesFinancial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business EntrepreneursqueenfaustineeNo ratings yet

- Argania CosmeticsDocument7 pagesArgania CosmeticsEma SousouNo ratings yet