Professional Documents

Culture Documents

NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI Notes

NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI Notes

Uploaded by

Sano Manjiro0 ratings0% found this document useful (0 votes)

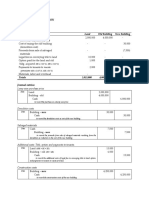

12 views1 pageThe document lists various costs associated with acquiring and developing property. It includes costs such as unpaid property taxes, option costs, excavation, legal and agent fees, permits, construction of a new building, fixtures, and demolition of the old building. The total costs are broken down into amounts allocated to land, old building, new building, and liability.

Original Description:

Original Title

Document (1) 10

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists various costs associated with acquiring and developing property. It includes costs such as unpaid property taxes, option costs, excavation, legal and agent fees, permits, construction of a new building, fixtures, and demolition of the old building. The total costs are broken down into amounts allocated to land, old building, new building, and liability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI Notes

NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI Notes

Uploaded by

Sano ManjiroThe document lists various costs associated with acquiring and developing property. It includes costs such as unpaid property taxes, option costs, excavation, legal and agent fees, permits, construction of a new building, fixtures, and demolition of the old building. The total costs are broken down into amounts allocated to land, old building, new building, and liability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

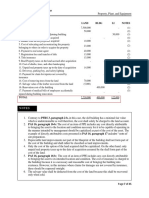

NFCPAR- Auditing Problems

Solution Guide Property, Plant, and Equipment

CASE NO.1 LAND OLD NEW LI NOTES

BLDG BLDG

8,750,000 1,250,000 - - (1)

1. Unpaid real property taxes up to the (2)

date of acquisition 12,250 1,750

2. Cost of option of the acquired property 17,500 2,500 (2)

3. Excavation cost 12,000 (3)

4. Escrow fees on the properties acquired 9,625 1,375 (2)

5. Cost of relocating and reconstructing 2,875 (2)

the property belonging to others in order 20,125

to acquire the property

6. Payment to real estate agent 35,000 5,000 (2)

7. Payments to tenants of the building to 2,625 375 (2)

induce them to vacate the premises

8. Legal fees for contract to purchase 11,000 (3)

land

9. Cost of removing trees from the land 70,000 (3)

10. Building permit and licenses 60,000 (3)

11. Architect fee 50,000 (3)

12. Materials used in all construction 600,000 (3)

13. Driveway and walk to building (part 30,000 (3)

of the building plan)

14. Payment for claim for injuries not (4)

covered by insurance - - - -

15. Broker’s fee on the properties 8,750 1,250 (2)

acquired

16. Rental fees generated on the portion (5)

of the building being used as a parking

site - - - -

17. Cost of paving parking lot adjoining 50,000 (6)

building

18. Other overhead cost incurred as a 220,000 (3)

result of construction

19. Service equipment and fixture made a 11,000 (3)

PERMANENT part of the structure

20. Safety fence around construction site 35,000 (3)

21. Removal of safety fence 9,800 (3)

22. Demolition cost of the old building 33,000 (3)

23. Proceeds from salvage of the (4,000) (3)

demolition

TOTAL 8,926,875 1,265,125 1.056,800 50,000

Cost allocated to Land:

Cost allocated to Bldg:

Page 10 of 45

You might also like

- PrepAgent ExamPrep EbookDocument83 pagesPrepAgent ExamPrep EbookAvgvstine100% (1)

- Solution Guide For PpeDocument45 pagesSolution Guide For PpeTrek Apostol57% (7)

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- CH 10Document9 pagesCH 10Antonios FahedNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Eviction Notice To Quit Template FormDocument2 pagesEviction Notice To Quit Template FormImtsal KhalidNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Transfer Certificate of TitleDocument3 pagesTransfer Certificate of TitleSyzian ExonyryNo ratings yet

- Transfer Taxes Who Owes What and How Much NLIDocument161 pagesTransfer Taxes Who Owes What and How Much NLImpoxNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing ProblemsDocument1 pageSolution Guide Property, Plant, and Equipment: NFCPAR-Auditing ProblemsSano ManjiroNo ratings yet

- NAMA1Document2 pagesNAMA1Iwel NetriNo ratings yet

- CH 10Document9 pagesCH 10Saleh RaoufNo ratings yet

- 5-1 (Uy Company) : Property, Plant and Equipment ProblemsDocument13 pages5-1 (Uy Company) : Property, Plant and Equipment ProblemsExequielCamisaCrusperoNo ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BDocument5 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BMahasia MANDIGANNo ratings yet

- Akm IwelDocument7 pagesAkm IwelIwel NetriNo ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Document9 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Rezzan Joy Camara Mejia100% (1)

- Audit of PPE 2 - AssignmentDocument2 pagesAudit of PPE 2 - AssignmentNychi SitchonNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- PPE - Part - 1. CHAPTER 15Document22 pagesPPE - Part - 1. CHAPTER 15Ms VampireNo ratings yet

- SOL MAN CHAPTER 15 PPE PART 1 IA PART 1B 2020ed1 DocxDocument21 pagesSOL MAN CHAPTER 15 PPE PART 1 IA PART 1B 2020ed1 DocxVkyla BataoelNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-1 - Problem 26-5Document5 pagesIA 1 Valix 2020 Ver. Problem 26-1 - Problem 26-5Ariean Joy DequiñaNo ratings yet

- Comprehensive Problem Land & BuildingDocument2 pagesComprehensive Problem Land & BuildingGlaizel LarragaNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Document5 pagesIA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Ariean Joy DequiñaNo ratings yet

- PPE Initial Recognition. Part 2Document6 pagesPPE Initial Recognition. Part 2sheenacgacitaNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- Valdez Blessed Nizelle - Midterm Assignemnt - Aud ProbDocument9 pagesValdez Blessed Nizelle - Midterm Assignemnt - Aud ProbEsse ValdezNo ratings yet

- Tugas Akuntansi Keuangan II E10.1, E 10.25Document2 pagesTugas Akuntansi Keuangan II E10.1, E 10.25Dea Gheby YolandaNo ratings yet

- A231 - MC 3 PPE-StudentsDocument4 pagesA231 - MC 3 PPE-StudentsHafiza ZahidNo ratings yet

- Problem 2-1Document18 pagesProblem 2-1ILIG, Pauline Joy E.No ratings yet

- Activity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEDocument2 pagesActivity - 01&02 - Capitalizable Costs and Modes of Acquisition of PPEFrankie AsidoNo ratings yet

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- A311Chapter 10 ProblemsDocument43 pagesA311Chapter 10 ProblemsVibria Rezki Ananda50% (2)

- Answer KeysDocument35 pagesAnswer Keyspayos manuelNo ratings yet

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- PPE - Initial Measurement - Assignment - No AnswersDocument2 pagesPPE - Initial Measurement - Assignment - No Answersemman neriNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Expenditures: V-Audit of Property, Plant and EquipmentDocument24 pagesExpenditures: V-Audit of Property, Plant and EquipmentKirstine DelegenciaNo ratings yet

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Practical Accounting 1 (Ppe)Document9 pagesPractical Accounting 1 (Ppe)Ivan Landaos100% (1)

- ACTIVITIESDocument13 pagesACTIVITIESJanine TupasiNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- SEATWORK-LBM 1st2324 STUDENTSDocument3 pagesSEATWORK-LBM 1st2324 STUDENTSpadayonmhieNo ratings yet

- Tutorial 1 Topic 1 AnswerDocument1 pageTutorial 1 Topic 1 AnswerSiti NadhiraNo ratings yet

- Mini Case 3 Ppe-1Document5 pagesMini Case 3 Ppe-1ying huiNo ratings yet

- Ppe Test BankDocument10 pagesPpe Test BankAna Mae HernandezNo ratings yet

- ACCT105 Quiz 02 and 03 Prelim SolutionDocument3 pagesACCT105 Quiz 02 and 03 Prelim SolutionAway To PonderNo ratings yet

- PPE ExcelDocument4 pagesPPE ExcelKeana Cassandra TobiasNo ratings yet

- The Following Payments and Receipts Are Related To Land Land 115625Document1 pageThe Following Payments and Receipts Are Related To Land Land 115625M Bilal SaleemNo ratings yet

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- Quiz #1 PracticeDocument7 pagesQuiz #1 PracticeSano ManjiroNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- Production Departments Direct Labor Rate Manufacturing Overhead Application RatesDocument10 pagesProduction Departments Direct Labor Rate Manufacturing Overhead Application RatesSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-119Document1 page1000 Solved Problem in Modern Physics-119Sano ManjiroNo ratings yet

- 2.2.1 de Broglie Waves: 2.2 ProblemsDocument1 page2.2.1 de Broglie Waves: 2.2 ProblemsSano ManjiroNo ratings yet

- Econs 101 - Quiz #2 Answer KeyDocument1 pageEcons 101 - Quiz #2 Answer KeySano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-118Document1 page1000 Solved Problem in Modern Physics-118Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-105Document1 page1000 Solved Problem in Modern Physics-105Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-116Document1 page1000 Solved Problem in Modern Physics-116Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-120Document1 page1000 Solved Problem in Modern Physics-120Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-107Document1 page1000 Solved Problem in Modern Physics-107Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-101Document1 page1000 Solved Problem in Modern Physics-101Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-106Document1 page1000 Solved Problem in Modern Physics-106Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-108Document1 page1000 Solved Problem in Modern Physics-108Sano ManjiroNo ratings yet

- Two Limiting Cases Ne: 1.3 Solutions 83Document1 pageTwo Limiting Cases Ne: 1.3 Solutions 83Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-104Document1 page1000 Solved Problem in Modern Physics-104Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-103Document1 page1000 Solved Problem in Modern Physics-103Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-102Document1 page1000 Solved Problem in Modern Physics-102Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Capitalizable Cost of MachineryDocument1 pageNFCPAR-Auditing Problems: Capitalizable Cost of MachinerySano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing ProblemsDocument1 pageSolution Guide Property, Plant, and Equipment: NFCPAR-Auditing ProblemsSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Description Machinery Others NotesDocument1 pageNFCPAR-Auditing Problems: Description Machinery Others NotesSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- The Law of Trusts: Kenya Law Resource CenterDocument18 pagesThe Law of Trusts: Kenya Law Resource CenterDickson Tk Chuma Jr.No ratings yet

- Condominium LeaseDocument10 pagesCondominium LeaseRocketLawyer100% (1)

- Residential Free Patent ApplicationDocument3 pagesResidential Free Patent ApplicationCharlene GalenzogaNo ratings yet

- SCC Trade Licence Application FormDocument2 pagesSCC Trade Licence Application Formmunna ahmedNo ratings yet

- Estate of Cabacungan Vs LaigoDocument5 pagesEstate of Cabacungan Vs LaigoMarilou GaralNo ratings yet

- Acquisition of Easement by PrescriptionDocument2 pagesAcquisition of Easement by PrescriptionTejasri LNo ratings yet

- 07 Constitution & Formalities IDocument65 pages07 Constitution & Formalities IHannah LINo ratings yet

- TEMA VII - Marketing InternacionalDocument15 pagesTEMA VII - Marketing InternacionalFlippas RDNo ratings yet

- Affidavit of Undertaking With Good Standing - TEDocument1 pageAffidavit of Undertaking With Good Standing - TEGrace TargaNo ratings yet

- Release or Relinquishment of An Interest in Immovable PropertyDocument1 pageRelease or Relinquishment of An Interest in Immovable PropertyMi MmNo ratings yet

- Answering To Question 1: Transfer of PropertyDocument5 pagesAnswering To Question 1: Transfer of PropertyNaman GuptaNo ratings yet

- Victoria The Trustee's Right of SurvivorshipDocument184 pagesVictoria The Trustee's Right of SurvivorshiprunspeedhypeNo ratings yet

- Affidavit of Co-OwnershipDocument2 pagesAffidavit of Co-OwnershipFERRER FERRER and DELOS REYES LAW FIRM Co.No ratings yet

- Asdfasdfasdfasdfasdfa Wwerwersasfasdfd As Fdas Dfa SDF AsdfDocument5 pagesAsdfasdfasdfasdfasdfa Wwerwersasfasdfd As Fdas Dfa SDF AsdfbalajithrillerNo ratings yet

- Possession of The Litigated Parcel of Land Since They Bought The Same in 1934 and SinceDocument4 pagesPossession of The Litigated Parcel of Land Since They Bought The Same in 1934 and SinceLynne SanchezNo ratings yet

- ACT26 - Ch01 Introduction To Business TaxesDocument8 pagesACT26 - Ch01 Introduction To Business TaxesMark BajacanNo ratings yet

- Civil Law Bar Exam Answers Land Transfer and DeedsDocument38 pagesCivil Law Bar Exam Answers Land Transfer and DeedsKhiel YumulNo ratings yet

- Ecea109 A12 Activity1b PadillaDocument2 pagesEcea109 A12 Activity1b PadillaGabby PadillaNo ratings yet

- Usufruct and EasementsDocument21 pagesUsufruct and EasementsSZNo ratings yet

- Configurations of Desire in THDocument188 pagesConfigurations of Desire in THlpNo ratings yet

- TET01-A Introduction To Trusts - Part A PDFDocument12 pagesTET01-A Introduction To Trusts - Part A PDFAlellie Khay JordanNo ratings yet

- UCPB Properties For Sale 201801Document10 pagesUCPB Properties For Sale 201801Mary Mheng OjoNo ratings yet

- ASHRAE Standard 55-2010 - ASHRAE-55-2010Document44 pagesASHRAE Standard 55-2010 - ASHRAE-55-2010AlejandroNo ratings yet

- Land Law PDFDocument272 pagesLand Law PDFTrading Yu100% (3)

- Republic of The Philippines City of Lipa, BatangasDocument3 pagesRepublic of The Philippines City of Lipa, BatangasMerlo Sebasthian SilvaNo ratings yet