Professional Documents

Culture Documents

Problem 1

Problem 1

Uploaded by

Anton0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

Problem 1 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageProblem 1

Problem 1

Uploaded by

AntonCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

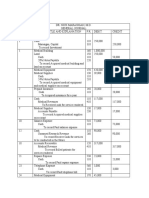

During January, 2021, the first month of operations, the following transactions took place.

Jan 1 Mr. A started his new business by depositing 350,000 in a bank account.

Jan 2.Bought computer equipment costing 145,000 is acquired on cash basis.

Jan 3.Computer supplies in the amount of 25,000 are purchase on account.

Jan 8.Mr. A collected 880,000 in cash for services rendered.

Jan 10.Mr.A. paid 18,000 utility bills for the month of Jan.

Jan 13.Mr. A. billed several clients amounting to 35,000 for service already rendered during the month.

Jan 15.Mr.A made a partial payment of 17,000 for Jan 3 purchase on account.

Jan 18.Checks totalling 25,000 were received from clients for billing dated Jan.13.

Jan 20.Mr. A withdrew 2,000 from the business for personal use.

Jan 25 Received utility bills amounting to 8,000 for the month of Jan.

Jan 31.Mr A. paid his assistant salary for January amounting to 15,000.

Required:

1. Prepare journal entries of the above transactions

2. Prepare Analysis on the effect of the accounting equation

3. Prepare T account

4. Prepare Financial Statements.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Topic 2:: The Nature of The Human PersonDocument5 pagesTopic 2:: The Nature of The Human PersonAntonNo ratings yet

- Simple InterestDocument5 pagesSimple InterestAntonNo ratings yet

- Cost Accounting and Control: Cagayan State UniversityDocument74 pagesCost Accounting and Control: Cagayan State UniversityAntonNo ratings yet

- Unit 1: Mathematics in Our World (5 Hours)Document5 pagesUnit 1: Mathematics in Our World (5 Hours)AntonNo ratings yet

- Unit 1.1 Accounting DefinedDocument9 pagesUnit 1.1 Accounting DefinedAntonNo ratings yet

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingAntonNo ratings yet

- Filipino ValuesDocument30 pagesFilipino ValuesAntonNo ratings yet

- Journal Entries: Edgar DetoyaDocument17 pagesJournal Entries: Edgar DetoyaAntonNo ratings yet

- Unit 1: College of Human KineticsDocument5 pagesUnit 1: College of Human KineticsAntonNo ratings yet

- Table Manners and EtiquetteDocument19 pagesTable Manners and EtiquetteAntonNo ratings yet

- Module 8. FARDocument9 pagesModule 8. FARAntonNo ratings yet

- Unit 2 Aerobic and Anaerobic ExerciseDocument17 pagesUnit 2 Aerobic and Anaerobic ExerciseAntonNo ratings yet

- Unit 2 Mathematical Language and SymbolsDocument4 pagesUnit 2 Mathematical Language and SymbolsAntonNo ratings yet

- Cfas ActivitiesDocument10 pagesCfas ActivitiesAntonNo ratings yet

- As The Subject of A Sentence, They Are:: Pronouns and Their AntecedentDocument6 pagesAs The Subject of A Sentence, They Are:: Pronouns and Their AntecedentAntonNo ratings yet