Professional Documents

Culture Documents

TDS 2011-12

TDS 2011-12

Uploaded by

Aditya SoniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS 2011-12

TDS 2011-12

Uploaded by

Aditya SoniCopyright:

Available Formats

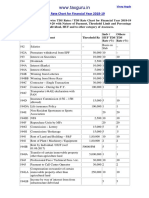

TDS RATE FOR THE ASSESSMENT YEAR 2011-2012 (in %)

(TDS rates with effect from 1st April 2010)

Threshold Threshold Individual/ Co?

limit upto limit w.e.f. HUF/ BOI/ operative

30th June, 1st July, AOP Society /

2010 2010 Local

Section Nature of Payment (in Rs.) (in Rs.) Firm Authority Company

192 N.A. N.A. N.A.

Normal Rate

Salary As per slab As per slab (incl. cess)

193 Interest on Securities

(1) Interest on Debentures or

Securities (Listed) 2500* 2500* 10 10 10 10

(2) Interest on 8% Savings (Taxable)

Bonds, 2003 10000 10000 10 10 10 10

(3) Any Other Interest on Securities 0 0 10 10 10 10

(Unlisted)

Dividend other than dividend

194 covered by Section 115-O 2500* 2500* 10 10 10 10

Interest other than Interest on

194A Securities (other than below) 5000 5000 10 10 10 10

Where the payer is

(1) Banking Company 10000 10000 10 10 10 10

(2) Co-operative Society engaged in

banking business 10000 10000 10 10 10 10

(3) Post Office (deposit scheme 10000 10000 10 10 10 10

framed by Central Government)

194B Winning from Lotteries 5000 10000 30 30 30 30

194BB Winnings from Horse Races 2500 5000 30 30 30 30

* in case of resident only

194C Payments to Contractors

(1) In case of Contract/ Sub-

Contract/ Advertising 20000 (Note 1) 30000 1 2 2 2

(2) Contractor/ Sub-Contractor in 20000 (Note 1) 30000 NIL NIL (Note 2)

NIL NIL

Transport Business

( Note 2) (Note 2) (Note 2)

194D Insurance Commission 5000 20000 10 10 10 10

Non-Resident sportsman/ sports

194E association 0 0 10 10 10 NA

Deposits under NSS to

194EE Resident/Non-Resident 2500 2500 20 20 20 NA

Repurchase of Units of Mutual

Fund/UTI from Resident / Non-

194F Resident 0 0 20 20 20 NA

Commission on Sale of lottery

tickets to Resident / Non-

194G Resident 1000 1000 10 10 10 10

194H Commission or Brokerage to 2500 5000 10 10 10 10

Resident

194I Rent to Residents

(a) Rent for Machinery/

plant/equipment 120000 180000 2 2 2 2

(b) Rent for other than in (a) 120000 180000 10 10 10 10

Note:-

1. This limit is for individual transaction. However, if aggregate payment to a contractor during the year exceed Rs. 50,000 (Rs. 75,000 w.e.f 1tst July, 2010),

then tax will be required to be deducted, even where individual transaction is less than the threshold of Rs. 20,000 (Rs. 30,000 w.e.f. 1st July, 2010).

2. The Nil rate will be applicable if the transporter quotes his PAN. If PAN is not quoted the rate will be 20%. (Transporter means persons engaged in plying,

hiring and leasing of Goods Carriages)

194J Fees for professional / technical 20000 30000 10 10 10 10

services to residents

194LA Compensation to Resident on 100000 100000 10 10 10 10

acquisition of immovable

property

Payment of other sums to a non- Rate specified under Part II of First Schedule of

195 resident 0 Finance Bill, 2010 subject to provisions of DTAA

196B Income from units (including 0 0 10 10 10 10

long term Capital Gain on

transfer of such units) to an

offshore fund

Income from foreign currency

196C bonds or GDR of Indian Company 0 0 10 10 10 10

196D Income of FII from securities not 0 0 20 20 20 20

being dividend, long term and

short term capital gain

Note:-

In order to strengthen the PAN mechanism, it is proposed to make amendments in the Income Tax Act to provide that any person whose receipts are subject to

deduction of tax at

source i.e., the deductee, shall mandatorily furnish his PAN to the deductor failing which the deductor shall deduct tax at source at higher of the following rates:

(i) the rate prescribed in the Act;

(ii) at the rate in force i.e., the rate mentioned in the Finance Act; or

(iii) at the rate of 20 percent

The above provisions will also apply in cases where the taxpayer files a declaration in form 15G or 15H (u/s 197A) but does not provide his PAN. Further, no

certificate under section

197 will be granted by the Assessing Officer unless the application contains the PAN of the applicant.

TCS RATE FOR THE ASSESSMENT YEAR 2011-2012 (in %)

(TCS rates with effect from 1st April 2010)

Threshold Individual/ Co?

Limit HUF/ BOI/ operative

(in Rs.) AOP Society /

Local

Section Nature of Payment Firm Authority Company

206CA Alcoholic liquor for human 0 1 1 1 1

consumption and Indian made

foreign liquor

206CB/ CC/ Timber obtained by any mode 0 2.5 2.5 2.5 2.5

CD and any other forest produce

206CE Scrap 0 1 1 1 1

206CF/ CG/ Parking lot / toll plaza / mining 0 2 2 2 2

CH and quarrying

206CI Tendu leaves 0 5 5 5 5

You might also like

- Car Sales AgreementDocument3 pagesCar Sales AgreementShady Kioko80% (5)

- Capital Trainers Full PPT On TDSDocument78 pagesCapital Trainers Full PPT On TDSYamuna GNo ratings yet

- Hostess Disclosure StatementDocument184 pagesHostess Disclosure StatementChapter 11 DocketsNo ratings yet

- Ortega V LeonardoDocument2 pagesOrtega V LeonardoCelest Atas0% (1)

- TDS ChartDocument3 pagesTDS ChartTiya SabharwalNo ratings yet

- TDS and TCS-rate-chart-2023 RemovedDocument4 pagesTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65No ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- TDS - and - TCS Rate Chart 2025Document5 pagesTDS - and - TCS Rate Chart 2025jsparakhNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Tds Income Tax Rates Fy 2010-11Document13 pagesTds Income Tax Rates Fy 2010-11Surender KumarNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document13 pagesTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- TDS Rate Chart 1Document1 pageTDS Rate Chart 1bulu1987No ratings yet

- Tds - and - Tcs Rate Chart Fy 2019 20 TdsmanDocument2 pagesTds - and - Tcs Rate Chart Fy 2019 20 Tdsmankumar45caNo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document2 pagesTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Ashish JainNo ratings yet

- Revised TDS Wef 14.05.20Document7 pagesRevised TDS Wef 14.05.20MANAN KOTHARINo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document1 pageTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Shwetta GogawaleNo ratings yet

- TDS and TCS Rate Chart 2023Document3 pagesTDS and TCS Rate Chart 2023praveenNo ratings yet

- TdsPac RateCard 0910Document2 pagesTdsPac RateCard 0910Ebanezer PaulrajNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- Tds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-PenaltyDocument2 pagesTds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-PenaltyNarayanakrishnan RNo ratings yet

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDocument1 pageTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINo ratings yet

- TDS and TCS Rate Chart 2022Document3 pagesTDS and TCS Rate Chart 2022Ajay ModiNo ratings yet

- Understanding TDS With Latest Judicial Judgements: CA Manish Kumar AgarwalDocument13 pagesUnderstanding TDS With Latest Judicial Judgements: CA Manish Kumar AgarwalNagaraja ShenoyNo ratings yet

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- Tds Calculator W.E.F. 1.10.09Document1 pageTds Calculator W.E.F. 1.10.09rajesh_vajjasNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Document2 pagesFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- TDS Rate Chart For AY 2009-2010: Prepared By-Himanshu MalikDocument2 pagesTDS Rate Chart For AY 2009-2010: Prepared By-Himanshu Malikysr_cool100% (6)

- TDS Ready Reckoner (1) 11Document1 pageTDS Ready Reckoner (1) 11senthilkumar_kskNo ratings yet

- TDS Rates Chart Fy 2020 21 Ay 2021 22Document6 pagesTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- TDS Rate Chart FY 2024-25Document4 pagesTDS Rate Chart FY 2024-25MOQADDARNo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDocument10 pagesTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoNo ratings yet

- A) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Document17 pagesA) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Sonika GuptaNo ratings yet

- TDS - Rates - 07 - 08Document3 pagesTDS - Rates - 07 - 08KRISHNAKUMARNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- TDS Rate Chart For Financial Year 2020 21Document1 pageTDS Rate Chart For Financial Year 2020 21Arun RajaNo ratings yet

- 57 TDS Rate Chart BOARDDocument1 page57 TDS Rate Chart BOARDSatish GoenkaNo ratings yet

- Tds Tcs Chart Fy 2023 24Document4 pagesTds Tcs Chart Fy 2023 24avinash singhNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- TDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions AreDocument1 pageTDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions ArekajalNo ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- PWC - India - Corporate - Withholding TaxesDocument11 pagesPWC - India - Corporate - Withholding Taxessanket.tatedNo ratings yet

- TDS Rate Chart For 2013-14Document1 pageTDS Rate Chart For 2013-14Bharath Kumar JNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 987951630300819 Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 987951630300819 Assessment Year: 2019-20Mikel MillerNo ratings yet

- ITR-1 Form PDFDocument3 pagesITR-1 Form PDFAravind S Narayan100% (1)

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rates For Financial Year 2009 1Document3 pagesTDS Rates For Financial Year 2009 1VISHNUNo ratings yet

- DBP vs. La CampanaDocument3 pagesDBP vs. La CampanaAaron ReyesNo ratings yet

- Frazier CV EngDocument2 pagesFrazier CV EnggringojeffNo ratings yet

- New Land Acquisition in IndiaDocument10 pagesNew Land Acquisition in IndiaAarya ThhakkareNo ratings yet

- EASA Reporting DocumentDocument26 pagesEASA Reporting DocumentDavid OwenNo ratings yet

- Crim Law Arts 6-10Document10 pagesCrim Law Arts 6-10cattaczNo ratings yet

- ICCPR Article 25Document9 pagesICCPR Article 25hilarytevesNo ratings yet

- Order 31 2nd Training of Polling Personnel of PC-05 Scheduled On 16-17 May, 2024 at DTUDocument10 pagesOrder 31 2nd Training of Polling Personnel of PC-05 Scheduled On 16-17 May, 2024 at DTUarhabanothNo ratings yet

- Lawphil - net-GR No 117188Document9 pagesLawphil - net-GR No 117188jericglennNo ratings yet

- AL Ang Network Vs MondejarDocument2 pagesAL Ang Network Vs MondejarGillian Caye Geniza BrionesNo ratings yet

- Letter To Gov. Tom WolfDocument3 pagesLetter To Gov. Tom WolfPennCapitalStarNo ratings yet

- Bid Document PDFDocument125 pagesBid Document PDFAzharudin ZoechnyNo ratings yet

- Land Titles Cases - Rovancy To Dream VillagaDocument54 pagesLand Titles Cases - Rovancy To Dream VillagaAlvin NiñoNo ratings yet

- 10 Common Forms of GovernmentDocument6 pages10 Common Forms of GovernmentariestgNo ratings yet

- Human Rights in PakistanDocument20 pagesHuman Rights in PakistanKamran ShafiqNo ratings yet

- Labor Law OutlineDocument61 pagesLabor Law OutlineJane SmithNo ratings yet

- Dumayas vs. COMELECDocument17 pagesDumayas vs. COMELECKirsten Denise B. Habawel-VegaNo ratings yet

- LAbor LawDocument4 pagesLAbor LawJohny Tumaliuan100% (1)

- Deviation PDFDocument11 pagesDeviation PDFFatihah YusofNo ratings yet

- Gerandoy, Jingle Merry G. Legal Forms Midterm Exam JD3: AdditionDocument11 pagesGerandoy, Jingle Merry G. Legal Forms Midterm Exam JD3: AdditionJing Goal MeritNo ratings yet

- Cambodian Legal SystemDocument17 pagesCambodian Legal SystemBORINHYNo ratings yet

- 19-10-08 Continental Motion For TRO Against Avanci Et Al.Document6 pages19-10-08 Continental Motion For TRO Against Avanci Et Al.Florian MuellerNo ratings yet

- Brondial Notes - EvidenceDocument12 pagesBrondial Notes - EvidenceArvi GerongaNo ratings yet

- Code of EthicsDocument5 pagesCode of EthicsMarjonNo ratings yet

- Adidas America v. Payless ShoesourceDocument26 pagesAdidas America v. Payless ShoesourcesunilNo ratings yet

- (Pretest) : Directions: Choose The Letter of The Correct Answer, and Write The CAPITAL LETTER ofDocument13 pages(Pretest) : Directions: Choose The Letter of The Correct Answer, and Write The CAPITAL LETTER ofJhunella Mae Collera SapinosoNo ratings yet

- Homestead PatentDocument2 pagesHomestead PatentJP PalamNo ratings yet

- Disini Vs Sandiganbayan GR No. 180564, June 22, 2010Document5 pagesDisini Vs Sandiganbayan GR No. 180564, June 22, 2010Marianne Shen PetillaNo ratings yet