Professional Documents

Culture Documents

Mid Session Reforecast 02182022

Mid Session Reforecast 02182022

Uploaded by

Fauquier NowCopyright:

Available Formats

You might also like

- Ramboll APAC Brochure - 0123 - 1-3Document21 pagesRamboll APAC Brochure - 0123 - 1-3Franky KenNo ratings yet

- Cheapassignmenthelp Co UkDocument9 pagesCheapassignmenthelp Co UkOzPaper HelpNo ratings yet

- Sales MGT, MMS Sem III 2020-2022Document4 pagesSales MGT, MMS Sem III 2020-2022Sayali PatilNo ratings yet

- 10 1108 - Dlo 01 2021 0016Document4 pages10 1108 - Dlo 01 2021 0016Malik MaulanaNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- UAW Ford Contract SummaryDocument24 pagesUAW Ford Contract SummaryCourier JournalNo ratings yet

- Hospital Indemnity Claim Form: Policy NumberDocument2 pagesHospital Indemnity Claim Form: Policy NumberMoyo Mitchell0% (1)

- SSC Admit Card 2019 PDF FreeDocument4 pagesSSC Admit Card 2019 PDF FreeRiya RaoNo ratings yet

- ERB-2023-232 CAS Golosino ProposalDocument61 pagesERB-2023-232 CAS Golosino Proposalanthonymatthew.nemenzoNo ratings yet

- Oakwood University Consolidated Financial StatementsDocument51 pagesOakwood University Consolidated Financial StatementsJavon WilliamsNo ratings yet

- Retailing in IndiaDocument64 pagesRetailing in Indiaagarwalsagar88100% (1)

- S.eng All QuestionsDocument95 pagesS.eng All Questionssheen_770No ratings yet

- Annex 11 LR Referencing Guide PDFDocument17 pagesAnnex 11 LR Referencing Guide PDFClint R OrcejolaNo ratings yet

- Jyoti Kalra: Professional SynopsisDocument5 pagesJyoti Kalra: Professional SynopsisJyoti Sanjay KalraNo ratings yet

- Letter of Intent Date: 18-Feb-2019 Mr. Ravi Mishra,: For Multiplier Brand Solutions PVT LTDDocument2 pagesLetter of Intent Date: 18-Feb-2019 Mr. Ravi Mishra,: For Multiplier Brand Solutions PVT LTDRavi MishraNo ratings yet

- Art Integrated Project Social ScienceDocument14 pagesArt Integrated Project Social Science12B42Devashish BajpaiNo ratings yet

- Test 1 Business Organisations and Their StakeholdersDocument8 pagesTest 1 Business Organisations and Their StakeholdersKiri chrisNo ratings yet

- Global Commitment 2021 Progress ReportDocument39 pagesGlobal Commitment 2021 Progress ReportPedro MentadoNo ratings yet

- Any Land Related Document Rent Agreement, Rent Receipt, Land Deed, Porcha, Lease Document As ApplicableDocument6 pagesAny Land Related Document Rent Agreement, Rent Receipt, Land Deed, Porcha, Lease Document As Applicableaparna tiwariNo ratings yet

- Exhibit A OST Approved Competitive GrantsDocument3 pagesExhibit A OST Approved Competitive GrantsWXMINo ratings yet

- Richland 2Document158 pagesRichland 2Nevin SmithNo ratings yet

- Sikkim A Gift of NatureDocument15 pagesSikkim A Gift of NatureMohit Raj SinhaNo ratings yet

- Colony Apartments NOD 1.2023Document4 pagesColony Apartments NOD 1.2023T RNo ratings yet

- Study Note 3 Preparation of Financial Statement of Profit Oriented OrganisatiosDocument27 pagesStudy Note 3 Preparation of Financial Statement of Profit Oriented Organisatiosnaga naveenNo ratings yet

- The State of Local Government and Service DeliveryDocument15 pagesThe State of Local Government and Service DeliveryAkin DolapoNo ratings yet

- Principles of MarketingDocument18 pagesPrinciples of MarketingCrismarc FariñasNo ratings yet

- FDA Background Briefing Materials Oct. 25 26 2016Document60 pagesFDA Background Briefing Materials Oct. 25 26 2016Saliba TaimehNo ratings yet

- The Hindu Review September 2022 by Ambitious BabaDocument59 pagesThe Hindu Review September 2022 by Ambitious BabaRaja SNo ratings yet

- Provincial Government Report On Prolific Offenders, Random Attacks SummaryDocument14 pagesProvincial Government Report On Prolific Offenders, Random Attacks SummaryChristopherFouldsNo ratings yet

- Investment Management Assignment 2Document8 pagesInvestment Management Assignment 2BERTHA MAJURUNo ratings yet

- Growth of Corporate FarmingDocument22 pagesGrowth of Corporate FarmingNiraj PatilNo ratings yet

- Vision India 2025Document9 pagesVision India 2025Srinivas PrabhuNo ratings yet

- Income Tax Bba 5 Sem QuestionDocument18 pagesIncome Tax Bba 5 Sem QuestionArun GuptaNo ratings yet

- VDP CatalogueDocument24 pagesVDP Cataloguemr.vj4uNo ratings yet

- Draft Scope Riverhead Logistics CenterDocument20 pagesDraft Scope Riverhead Logistics CenterRiverheadLOCALNo ratings yet

- Resilience360 Annual Risk Report 2018Document45 pagesResilience360 Annual Risk Report 2018M QasimNo ratings yet

- Red Cross, Red Crescent Magazine. No. 2, 2010Document32 pagesRed Cross, Red Crescent Magazine. No. 2, 2010International Committee of the Red Cross100% (1)

- VRS FormsDocument11 pagesVRS FormsChotu GuptaNo ratings yet

- Transition Plan - Plan A and Plan BDocument10 pagesTransition Plan - Plan A and Plan Bapi-631400099No ratings yet

- SS Linden Brochure - WebDocument28 pagesSS Linden Brochure - Websushil aroraNo ratings yet

- OHS ChecklistDocument4 pagesOHS ChecklistamalNo ratings yet

- MDA Legislative Report Elk 2021Document3 pagesMDA Legislative Report Elk 2021inforumdocsNo ratings yet

- Bank Npci FormDocument1 pageBank Npci FormRanjit Paul100% (1)

- CM20171017 08954 41228Document16 pagesCM20171017 08954 41228Azhari GunawanNo ratings yet

- Bùi Thị Thu Hường - HS170959 - MKT1813 - ECO121 - Test-01 - Individual Assignment 01Document4 pagesBùi Thị Thu Hường - HS170959 - MKT1813 - ECO121 - Test-01 - Individual Assignment 01Bui Thi Thu Huong K17 HLNo ratings yet

- Assignment#10 Global Strategy and The Multinational CorporationDocument1 pageAssignment#10 Global Strategy and The Multinational CorporationAnjaneth A. VillegasNo ratings yet

- AEI-FPD 47 - Pre-Joining Declaration For TraineesDocument2 pagesAEI-FPD 47 - Pre-Joining Declaration For TraineesKuldeep KumarNo ratings yet

- Qatar Real Estate Market Annual Report 2008Document9 pagesQatar Real Estate Market Annual Report 2008r.nair9865100% (2)

- Basic Concepts in Forest Valuation and Investment AnalysisDocument336 pagesBasic Concepts in Forest Valuation and Investment Analysisnemesis acobaNo ratings yet

- The Brazilian EconomyDocument37 pagesThe Brazilian Economyرامي أبو الفتوحNo ratings yet

- CES Scope of Work For Dallas Housing Policy Development Project HOPPE 5.12.22Document5 pagesCES Scope of Work For Dallas Housing Policy Development Project HOPPE 5.12.22April ToweryNo ratings yet

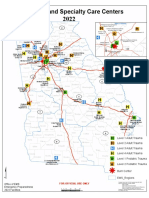

- Georgia's Designated Trauma and Specialty Care CentersDocument1 pageGeorgia's Designated Trauma and Specialty Care CentersLindsey BasyeNo ratings yet

- 2021 July Trading Post (Ver 1.1)Document3 pages2021 July Trading Post (Ver 1.1)Woods100% (1)

- Standard Bidding Document Jharkhand Procurement of Civil WorksDocument90 pagesStandard Bidding Document Jharkhand Procurement of Civil WorksKAMAC ENGINEERS PVT LTDNo ratings yet

- SLIPDocument2 pagesSLIPsaleem rasheedNo ratings yet

- BM2329I007893523Document5 pagesBM2329I007893523Divya VidyadharanNo ratings yet

- MAS 2022 Souvenir Programme BookDocument24 pagesMAS 2022 Souvenir Programme BookDrhisham MasdarNo ratings yet

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesNo ratings yet

- BiennialBudgetPresentation Monday121613Document12 pagesBiennialBudgetPresentation Monday121613normanomtNo ratings yet

- Budget Letter To Gov CooperDocument1 pageBudget Letter To Gov CooperLauren HorschNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Dar 04112022Document6 pagesDar 04112022Fauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- MP and AplDocument4 pagesMP and AplbareerahNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, Lucknow: Concept of Collective BargainingDocument13 pagesDr. Ram Manohar Lohiya National Law University, Lucknow: Concept of Collective BargainingIrul SrivastavaNo ratings yet

- Résumé - Zhiwen (Steve) Wang: CationDocument2 pagesRésumé - Zhiwen (Steve) Wang: CationJuasadf IesafNo ratings yet

- Moam - Info - A Short Course in Intermediate Microeconomics With - 5a0ec2d01723dd242ee4c613Document13 pagesMoam - Info - A Short Course in Intermediate Microeconomics With - 5a0ec2d01723dd242ee4c613Pruthvi NinganurNo ratings yet

- 34 Yale JLFeminism 22Document9 pages34 Yale JLFeminism 22Doreen AaronNo ratings yet

- Kotz, McDonough, Reich, Boyer Etc Estrutura Social de Acumulação, ConferênciaDocument538 pagesKotz, McDonough, Reich, Boyer Etc Estrutura Social de Acumulação, ConferênciaaflagsonNo ratings yet

- HO PF # 2 - Plant Design & LocationDocument32 pagesHO PF # 2 - Plant Design & LocationVinka Devi NuralindaNo ratings yet

- The Pros and Cons of MigrationDocument8 pagesThe Pros and Cons of MigrationCarlos VianaNo ratings yet

- Chapter 4 Career MGMTDocument14 pagesChapter 4 Career MGMTThuan TruongNo ratings yet

- Lesson 2 - Demand and Supply AnalysisDocument70 pagesLesson 2 - Demand and Supply AnalysisNawanithan ThanimalayNo ratings yet

- Richard Grassby - The Idea of Capitalism Before The Industrial RevolutionDocument77 pagesRichard Grassby - The Idea of Capitalism Before The Industrial RevolutionKeversson WilliamNo ratings yet

- Wonderbag Report PDFDocument48 pagesWonderbag Report PDFAlphonsius WongNo ratings yet

- Name Muhammad Talal Akhtar Roll No. 201360284 Subject Principal of Marketing Section MKT201F Company NestléDocument3 pagesName Muhammad Talal Akhtar Roll No. 201360284 Subject Principal of Marketing Section MKT201F Company NestléMuhammad Talal AzeemNo ratings yet

- Gender in World PoliticsDocument4 pagesGender in World PoliticsMaheen AliNo ratings yet

- IGCSE Economics 5.3 POPULATION AnswerDocument12 pagesIGCSE Economics 5.3 POPULATION Answeryeweiwei0925No ratings yet

- Employee Wage PolicyDocument29 pagesEmployee Wage PolicySiddhraj Singh KushwahaNo ratings yet

- Compensation TheoriesDocument34 pagesCompensation TheoriesdollyguptaNo ratings yet

- The Corporation ReviewDocument2 pagesThe Corporation ReviewMau PeñaNo ratings yet

- Business Cycles, Unemployment, and Inflation MC Connell Brue and Flynn-Chapter 26Document35 pagesBusiness Cycles, Unemployment, and Inflation MC Connell Brue and Flynn-Chapter 26Ujayer BhuiyanNo ratings yet

- Econ 5 PDFDocument3 pagesEcon 5 PDFCherrie DEE GonzalesNo ratings yet

- Supply Chain Risk Management (IBM) ManagementDocument28 pagesSupply Chain Risk Management (IBM) ManagementPredrag100% (3)

- Exam #2 Practice ProblemsDocument3 pagesExam #2 Practice Problemsbalaji0907No ratings yet

- Productivity: A Measure of The Effective Use of Resources, Usually Expressed As The Ratio of Output To InputDocument15 pagesProductivity: A Measure of The Effective Use of Resources, Usually Expressed As The Ratio of Output To InputParthi PartiNo ratings yet

- Full Ebook of Economics 14Th Global Edition Michael Parkin Online PDF All ChapterDocument69 pagesFull Ebook of Economics 14Th Global Edition Michael Parkin Online PDF All Chapterethachristi100% (4)

- Airfreight LTD Vs State of Karnataka and Ors On 4 August, 1999Document9 pagesAirfreight LTD Vs State of Karnataka and Ors On 4 August, 1999Muthu KumarNo ratings yet

- Think Mental Models PDFDocument154 pagesThink Mental Models PDFSudhanshuNo ratings yet

- Topic 4 - Government and The Macroeconomy 5Document16 pagesTopic 4 - Government and The Macroeconomy 5Faheem MahmoodNo ratings yet

- Introduction To Production ManagementDocument158 pagesIntroduction To Production ManagementAsmita ShilpiNo ratings yet

- International Business 15Th Edition Daniels Test Bank Full Chapter PDFDocument36 pagesInternational Business 15Th Edition Daniels Test Bank Full Chapter PDFlarry.farley220100% (21)

- DSME1030FG Week 1 Problem SetDocument12 pagesDSME1030FG Week 1 Problem SetKatie ChanNo ratings yet

Mid Session Reforecast 02182022

Mid Session Reforecast 02182022

Uploaded by

Fauquier NowOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mid Session Reforecast 02182022

Mid Session Reforecast 02182022

Uploaded by

Fauquier NowCopyright:

Available Formats

Glenn Youngkin

Governor

February 18, 2022

The Honorable Barry D. Knight

Chair, Appropriations Committee

Virginia House of Delegates

Pocahontas Building, Room W1312

Richmond, Virginia 23219

The Honorable Janet D. Howell

Chair, Finance and Appropriations Committee

Senate of Virginia

Pocahontas Building, Room E509

Richmond, Virginia 23219

Dear Delegate Knight and Senator Howell,

As the House and Senate prepare to release their budget proposals this weekend, I am

eager to share a revised revenue forecast and outline a constructive path toward a bipartisan

budget agreement in the coming weeks.

There is additional detail below, but the bottom line is taxes paid to the government are

soaring and the revised revenue forecast estimates the Commonwealth will collect $1.25 billion

more in the current fiscal year. That, of course, is on top of the additional $3.3 billion added to

the original forecast last December.

This is a staggering number, the largest mid-session reforecast in anyone’s memory. The

stunning amount of money being collected from taxpayers is the direct result of over taxation.

Put simply, without significant tax relief, the Commonwealth’s general fund collections will

grow by over 40% percent between 2018 and 2024.1

1

Difference in the actual spending collections in FY2018 ($20.5 billion) and the projected collections in Fiscal Year

2024 ($28.8 billion)

Patrick Henry Building • 1111 East Broad • Richmond, Virginia 23219

(804) 786-2211 • TTY (800)828-1120

www.governor.virginia.gov

In the next few weeks, as we put together a bipartisan budget agreement before the March

th

12 deadline to adjourn, it is clear that we must return money to taxpayers to relieve the

pressures of inflation and economic uncertainty felt by families and businesses.

Of the roughly $13.4 billion2 in unanticipated revenue the state will collect in this budget

cycle, I am asking the General Assembly to return $4.5 billion3 to taxpayers. That leaves nearly

$9 billion in new revenue to invest in schools and teachers, law enforcement, behavioral health,

and the other important priorities of the General Assembly. I am confident that we can provide

tax relief for Virginia families and invest in our shared priorities.

MID-SESSION REFORECAST

Looking more specifically at recent revenue figures, January 2022 was another month

where our revenues significantly exceeded the prior year and our forecast. This is the sixth

consecutive month where revenues exceeded the prior year's results by 15 percent or more versus

our forecasted year-over-year growth rate of 4.2 percent.

Based upon that strong year to date performance, I have directed my Finance staff to

perform a mid-session revenue forecast. We estimate that General Fund revenues will increase

by $1.25 billion for Fiscal Year 2022. After a required deposit into the Revenue Stabilization

Fund of $498.7 million, there is left an incremental unobligated, one-time balance of $751.4

million.

My conclusion to raise our forecast for the year to approximate the year to date surplus as

covered in the Mid-Session Revenue Review reflects a conservative view of the remainder of the

year primarily based upon uncertainty in the outlook for nonwithholding tax receipts as a result

of recent stock market volatility.

Given the surplus that these and the prior years' results have generated, the

Commonwealth is in an extraordinary position to strengthen our financial position by further

building our rainy day and other reserve funds, further reduce our long term pension plan

obligations, invest in a number of strategic one time capital projects and, most importantly,

return taxpayer money back to them, reduce our ongoing tax burden, and maintain Virginia’s

AAA bond rating.

ECONOMIC REALITY

Our ability to do these things is great news but I want to be clear on my perspective that

this positive outcome, as good as it is for Virginia, should not be considered as either an

2

Sum of the difference between the FY2022 revenue forecast assumed in the 2021 Appropriation Act and the

actual FFY2022 revenue, the projected FY2023 and FY2024 revenue.

3

Sum of the fiscal impacts of the proposed Tax Rebate, Doubling of the Standard Deduction, Veterans Retirement

Subtraction, Grocery Tax Repeal, Small Business Tax Holiday and Paycheck Protection Act tax conformity.

Patrick Henry Building • 1111 East Broad • Richmond, Virginia 23219

(804) 786-2211 • TTY (800)828-1120

www.governor.virginia.gov

indication or result of long-term economic success. Growth in our revenue receipts does not

reflect an underlying growing economy.

Our challenge remains to effectively compete with our competitor states to our south to

attract individuals, families and companies who will want to call Virginia their home and

generate real, sustainable growth.

Looking back over the past eight years, or just since the pandemic began, Virginia is not

competing at an elite level – despite our strong and unique assets and numerous accolades.

States to the south, including North Carolina, South Carolina, Georgia, Tennessee, Texas,

and Florida, are beating us in all measures of growth. Over the past 8 years, Virginia saw net out

migration of over 100,000 people.4 Over the past five years Virginia has lost 74,000 jobs. That’s

dead last among competitor states who created an average of 250,000 jobs during the same

period.5

More recently, Virginia now has 210,000 fewer jobs than prior to the pandemic, 42nd in

the country when it comes to recovery and, once again, last among competitor states.6 Our labor

participation rate, measuring eligible workers that are choosing not to take jobs that are clearly

available, has declined over that same timeframe by more than three times the national rate.7 We

have a labor shortage due to a lack of population growth and too many people continuing to sit

on the sideline while there are 300,000 job openings, nearly 100,000 more than when we entered

the pandemic.8

This shortage makes it difficult for existing companies, particularly smaller ones that

need personnel to continue to prosper, which is why we are focused on workforce development

and increasing our pipeline for talent.

CUTTING COSTS AND TAX RELIEF

While there are many contributing factors to success in winning this battle for sustainable

growth, one of the most important ingredients is the cost of living. As we all know, Virginia is a

wonderful place to live with many unique assets but, unfortunately, our cost of living is too high

and that is a factor in the decision to move here versus other states. Virginia is 30th in cost of

living overall and our competitor states are all below us.9 A number of factors go into that

4

“State-to-State Migration Flows,” U.S. Census Bureau, U.S. Department of Commerce.

5

“Total Employment.” GDP and Personal Income. Regional Data. Bureau of Economic Analysis. U.S. Department of

Commerce.

6

Ibid.

7

“Civilian Noninstitutional Population and Associated Rate and Ratio Measures for Model-Based Areas.” Local Area

Unemployment Statistics. Bureau of Labor Statistics. U.S. Department of Labor.

8

“Virginia Job Openings and Labor Turnover.” Virginia Employment Commission.

9

“Cost of Living Data Series.” Missouri Economic Research and Information Center.

Patrick Henry Building • 1111 East Broad • Richmond, Virginia 23219

(804) 786-2211 • TTY (800)828-1120

www.governor.virginia.gov

equation, overall taxes being one of them. We are above the national average and significantly

above almost all of our competitor states.10

All of that is why significant tax relief, including eliminating the grocery tax, doubling

the standard deduction, providing a tax rebate, eliminating taxes on $40,000 in veterans’

retirement income, and deferring the most recent increase in the gas tax, should be the

centerpiece of any bipartisan compromise on the budget.

I am committed to getting our economy and job creation on a track of sustainable growth

and confident that we can change that trajectory if we are all clear about what defines success

and we then work together to achieve it.

Thank you for all of your work and I look forward to continuing productive conversations

in the future. We will have a healthy and robust discussion about policy and priorities, but we are

truly united by a common goal: to make Virginia the best place in the nation to live, work, and

raise a family.

Sincerely,

Glenn Youngkin

Cc: The Honorable Stephen Cummings – Secretary of Finance

Ms. Anne Oman, Staff Director, House Appropriations Committee

Ms. April Kees, Staff Director, Senate Finance and Appropriations Committee

10

“State and Local Tax Burdens.” Tax Foundation.

Patrick Henry Building • 1111 East Broad • Richmond, Virginia 23219

(804) 786-2211 • TTY (800)828-1120

www.governor.virginia.gov

You might also like

- Ramboll APAC Brochure - 0123 - 1-3Document21 pagesRamboll APAC Brochure - 0123 - 1-3Franky KenNo ratings yet

- Cheapassignmenthelp Co UkDocument9 pagesCheapassignmenthelp Co UkOzPaper HelpNo ratings yet

- Sales MGT, MMS Sem III 2020-2022Document4 pagesSales MGT, MMS Sem III 2020-2022Sayali PatilNo ratings yet

- 10 1108 - Dlo 01 2021 0016Document4 pages10 1108 - Dlo 01 2021 0016Malik MaulanaNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- UAW Ford Contract SummaryDocument24 pagesUAW Ford Contract SummaryCourier JournalNo ratings yet

- Hospital Indemnity Claim Form: Policy NumberDocument2 pagesHospital Indemnity Claim Form: Policy NumberMoyo Mitchell0% (1)

- SSC Admit Card 2019 PDF FreeDocument4 pagesSSC Admit Card 2019 PDF FreeRiya RaoNo ratings yet

- ERB-2023-232 CAS Golosino ProposalDocument61 pagesERB-2023-232 CAS Golosino Proposalanthonymatthew.nemenzoNo ratings yet

- Oakwood University Consolidated Financial StatementsDocument51 pagesOakwood University Consolidated Financial StatementsJavon WilliamsNo ratings yet

- Retailing in IndiaDocument64 pagesRetailing in Indiaagarwalsagar88100% (1)

- S.eng All QuestionsDocument95 pagesS.eng All Questionssheen_770No ratings yet

- Annex 11 LR Referencing Guide PDFDocument17 pagesAnnex 11 LR Referencing Guide PDFClint R OrcejolaNo ratings yet

- Jyoti Kalra: Professional SynopsisDocument5 pagesJyoti Kalra: Professional SynopsisJyoti Sanjay KalraNo ratings yet

- Letter of Intent Date: 18-Feb-2019 Mr. Ravi Mishra,: For Multiplier Brand Solutions PVT LTDDocument2 pagesLetter of Intent Date: 18-Feb-2019 Mr. Ravi Mishra,: For Multiplier Brand Solutions PVT LTDRavi MishraNo ratings yet

- Art Integrated Project Social ScienceDocument14 pagesArt Integrated Project Social Science12B42Devashish BajpaiNo ratings yet

- Test 1 Business Organisations and Their StakeholdersDocument8 pagesTest 1 Business Organisations and Their StakeholdersKiri chrisNo ratings yet

- Global Commitment 2021 Progress ReportDocument39 pagesGlobal Commitment 2021 Progress ReportPedro MentadoNo ratings yet

- Any Land Related Document Rent Agreement, Rent Receipt, Land Deed, Porcha, Lease Document As ApplicableDocument6 pagesAny Land Related Document Rent Agreement, Rent Receipt, Land Deed, Porcha, Lease Document As Applicableaparna tiwariNo ratings yet

- Exhibit A OST Approved Competitive GrantsDocument3 pagesExhibit A OST Approved Competitive GrantsWXMINo ratings yet

- Richland 2Document158 pagesRichland 2Nevin SmithNo ratings yet

- Sikkim A Gift of NatureDocument15 pagesSikkim A Gift of NatureMohit Raj SinhaNo ratings yet

- Colony Apartments NOD 1.2023Document4 pagesColony Apartments NOD 1.2023T RNo ratings yet

- Study Note 3 Preparation of Financial Statement of Profit Oriented OrganisatiosDocument27 pagesStudy Note 3 Preparation of Financial Statement of Profit Oriented Organisatiosnaga naveenNo ratings yet

- The State of Local Government and Service DeliveryDocument15 pagesThe State of Local Government and Service DeliveryAkin DolapoNo ratings yet

- Principles of MarketingDocument18 pagesPrinciples of MarketingCrismarc FariñasNo ratings yet

- FDA Background Briefing Materials Oct. 25 26 2016Document60 pagesFDA Background Briefing Materials Oct. 25 26 2016Saliba TaimehNo ratings yet

- The Hindu Review September 2022 by Ambitious BabaDocument59 pagesThe Hindu Review September 2022 by Ambitious BabaRaja SNo ratings yet

- Provincial Government Report On Prolific Offenders, Random Attacks SummaryDocument14 pagesProvincial Government Report On Prolific Offenders, Random Attacks SummaryChristopherFouldsNo ratings yet

- Investment Management Assignment 2Document8 pagesInvestment Management Assignment 2BERTHA MAJURUNo ratings yet

- Growth of Corporate FarmingDocument22 pagesGrowth of Corporate FarmingNiraj PatilNo ratings yet

- Vision India 2025Document9 pagesVision India 2025Srinivas PrabhuNo ratings yet

- Income Tax Bba 5 Sem QuestionDocument18 pagesIncome Tax Bba 5 Sem QuestionArun GuptaNo ratings yet

- VDP CatalogueDocument24 pagesVDP Cataloguemr.vj4uNo ratings yet

- Draft Scope Riverhead Logistics CenterDocument20 pagesDraft Scope Riverhead Logistics CenterRiverheadLOCALNo ratings yet

- Resilience360 Annual Risk Report 2018Document45 pagesResilience360 Annual Risk Report 2018M QasimNo ratings yet

- Red Cross, Red Crescent Magazine. No. 2, 2010Document32 pagesRed Cross, Red Crescent Magazine. No. 2, 2010International Committee of the Red Cross100% (1)

- VRS FormsDocument11 pagesVRS FormsChotu GuptaNo ratings yet

- Transition Plan - Plan A and Plan BDocument10 pagesTransition Plan - Plan A and Plan Bapi-631400099No ratings yet

- SS Linden Brochure - WebDocument28 pagesSS Linden Brochure - Websushil aroraNo ratings yet

- OHS ChecklistDocument4 pagesOHS ChecklistamalNo ratings yet

- MDA Legislative Report Elk 2021Document3 pagesMDA Legislative Report Elk 2021inforumdocsNo ratings yet

- Bank Npci FormDocument1 pageBank Npci FormRanjit Paul100% (1)

- CM20171017 08954 41228Document16 pagesCM20171017 08954 41228Azhari GunawanNo ratings yet

- Bùi Thị Thu Hường - HS170959 - MKT1813 - ECO121 - Test-01 - Individual Assignment 01Document4 pagesBùi Thị Thu Hường - HS170959 - MKT1813 - ECO121 - Test-01 - Individual Assignment 01Bui Thi Thu Huong K17 HLNo ratings yet

- Assignment#10 Global Strategy and The Multinational CorporationDocument1 pageAssignment#10 Global Strategy and The Multinational CorporationAnjaneth A. VillegasNo ratings yet

- AEI-FPD 47 - Pre-Joining Declaration For TraineesDocument2 pagesAEI-FPD 47 - Pre-Joining Declaration For TraineesKuldeep KumarNo ratings yet

- Qatar Real Estate Market Annual Report 2008Document9 pagesQatar Real Estate Market Annual Report 2008r.nair9865100% (2)

- Basic Concepts in Forest Valuation and Investment AnalysisDocument336 pagesBasic Concepts in Forest Valuation and Investment Analysisnemesis acobaNo ratings yet

- The Brazilian EconomyDocument37 pagesThe Brazilian Economyرامي أبو الفتوحNo ratings yet

- CES Scope of Work For Dallas Housing Policy Development Project HOPPE 5.12.22Document5 pagesCES Scope of Work For Dallas Housing Policy Development Project HOPPE 5.12.22April ToweryNo ratings yet

- Georgia's Designated Trauma and Specialty Care CentersDocument1 pageGeorgia's Designated Trauma and Specialty Care CentersLindsey BasyeNo ratings yet

- 2021 July Trading Post (Ver 1.1)Document3 pages2021 July Trading Post (Ver 1.1)Woods100% (1)

- Standard Bidding Document Jharkhand Procurement of Civil WorksDocument90 pagesStandard Bidding Document Jharkhand Procurement of Civil WorksKAMAC ENGINEERS PVT LTDNo ratings yet

- SLIPDocument2 pagesSLIPsaleem rasheedNo ratings yet

- BM2329I007893523Document5 pagesBM2329I007893523Divya VidyadharanNo ratings yet

- MAS 2022 Souvenir Programme BookDocument24 pagesMAS 2022 Souvenir Programme BookDrhisham MasdarNo ratings yet

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesNo ratings yet

- BiennialBudgetPresentation Monday121613Document12 pagesBiennialBudgetPresentation Monday121613normanomtNo ratings yet

- Budget Letter To Gov CooperDocument1 pageBudget Letter To Gov CooperLauren HorschNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Dar 04112022Document6 pagesDar 04112022Fauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- MP and AplDocument4 pagesMP and AplbareerahNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, Lucknow: Concept of Collective BargainingDocument13 pagesDr. Ram Manohar Lohiya National Law University, Lucknow: Concept of Collective BargainingIrul SrivastavaNo ratings yet

- Résumé - Zhiwen (Steve) Wang: CationDocument2 pagesRésumé - Zhiwen (Steve) Wang: CationJuasadf IesafNo ratings yet

- Moam - Info - A Short Course in Intermediate Microeconomics With - 5a0ec2d01723dd242ee4c613Document13 pagesMoam - Info - A Short Course in Intermediate Microeconomics With - 5a0ec2d01723dd242ee4c613Pruthvi NinganurNo ratings yet

- 34 Yale JLFeminism 22Document9 pages34 Yale JLFeminism 22Doreen AaronNo ratings yet

- Kotz, McDonough, Reich, Boyer Etc Estrutura Social de Acumulação, ConferênciaDocument538 pagesKotz, McDonough, Reich, Boyer Etc Estrutura Social de Acumulação, ConferênciaaflagsonNo ratings yet

- HO PF # 2 - Plant Design & LocationDocument32 pagesHO PF # 2 - Plant Design & LocationVinka Devi NuralindaNo ratings yet

- The Pros and Cons of MigrationDocument8 pagesThe Pros and Cons of MigrationCarlos VianaNo ratings yet

- Chapter 4 Career MGMTDocument14 pagesChapter 4 Career MGMTThuan TruongNo ratings yet

- Lesson 2 - Demand and Supply AnalysisDocument70 pagesLesson 2 - Demand and Supply AnalysisNawanithan ThanimalayNo ratings yet

- Richard Grassby - The Idea of Capitalism Before The Industrial RevolutionDocument77 pagesRichard Grassby - The Idea of Capitalism Before The Industrial RevolutionKeversson WilliamNo ratings yet

- Wonderbag Report PDFDocument48 pagesWonderbag Report PDFAlphonsius WongNo ratings yet

- Name Muhammad Talal Akhtar Roll No. 201360284 Subject Principal of Marketing Section MKT201F Company NestléDocument3 pagesName Muhammad Talal Akhtar Roll No. 201360284 Subject Principal of Marketing Section MKT201F Company NestléMuhammad Talal AzeemNo ratings yet

- Gender in World PoliticsDocument4 pagesGender in World PoliticsMaheen AliNo ratings yet

- IGCSE Economics 5.3 POPULATION AnswerDocument12 pagesIGCSE Economics 5.3 POPULATION Answeryeweiwei0925No ratings yet

- Employee Wage PolicyDocument29 pagesEmployee Wage PolicySiddhraj Singh KushwahaNo ratings yet

- Compensation TheoriesDocument34 pagesCompensation TheoriesdollyguptaNo ratings yet

- The Corporation ReviewDocument2 pagesThe Corporation ReviewMau PeñaNo ratings yet

- Business Cycles, Unemployment, and Inflation MC Connell Brue and Flynn-Chapter 26Document35 pagesBusiness Cycles, Unemployment, and Inflation MC Connell Brue and Flynn-Chapter 26Ujayer BhuiyanNo ratings yet

- Econ 5 PDFDocument3 pagesEcon 5 PDFCherrie DEE GonzalesNo ratings yet

- Supply Chain Risk Management (IBM) ManagementDocument28 pagesSupply Chain Risk Management (IBM) ManagementPredrag100% (3)

- Exam #2 Practice ProblemsDocument3 pagesExam #2 Practice Problemsbalaji0907No ratings yet

- Productivity: A Measure of The Effective Use of Resources, Usually Expressed As The Ratio of Output To InputDocument15 pagesProductivity: A Measure of The Effective Use of Resources, Usually Expressed As The Ratio of Output To InputParthi PartiNo ratings yet

- Full Ebook of Economics 14Th Global Edition Michael Parkin Online PDF All ChapterDocument69 pagesFull Ebook of Economics 14Th Global Edition Michael Parkin Online PDF All Chapterethachristi100% (4)

- Airfreight LTD Vs State of Karnataka and Ors On 4 August, 1999Document9 pagesAirfreight LTD Vs State of Karnataka and Ors On 4 August, 1999Muthu KumarNo ratings yet

- Think Mental Models PDFDocument154 pagesThink Mental Models PDFSudhanshuNo ratings yet

- Topic 4 - Government and The Macroeconomy 5Document16 pagesTopic 4 - Government and The Macroeconomy 5Faheem MahmoodNo ratings yet

- Introduction To Production ManagementDocument158 pagesIntroduction To Production ManagementAsmita ShilpiNo ratings yet

- International Business 15Th Edition Daniels Test Bank Full Chapter PDFDocument36 pagesInternational Business 15Th Edition Daniels Test Bank Full Chapter PDFlarry.farley220100% (21)

- DSME1030FG Week 1 Problem SetDocument12 pagesDSME1030FG Week 1 Problem SetKatie ChanNo ratings yet