Professional Documents

Culture Documents

1.17 Whitehall: Monitoring The Markets Vol. 1 Iss. 17 (May 24, 2011)

1.17 Whitehall: Monitoring The Markets Vol. 1 Iss. 17 (May 24, 2011)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.17 Whitehall: Monitoring The Markets Vol. 1 Iss. 17 (May 24, 2011)

1.17 Whitehall: Monitoring The Markets Vol. 1 Iss. 17 (May 24, 2011)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

021,725,1*

Presented by:

Volume 1, Issue 17

May 24, 2011

0$5.(76 7+( Whitehall

. &

C o m p a n y,

L L C

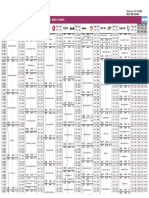

US

DEBT

MARKET*

US

Libor US

Treasury

Yield

Curve

"1

mth"

80

bps

7.00%

"3

mth"

70

bps

"6

mth"

6.00%

60

bps

5.00%

50

bps

4.00%

40

bps

Today

(5/24/11)

3.00%

30

bps

2.00% 15yr

Avg

20

bps

1.00% 30yr

Avg

10

bps

0.00% I I I I I I

Jun

Oct

Nov

Dec

Jan

Mar

Apr

Aug

May

May

Jul

Sep

Feb

2 3 5 7 10 30

Libor 1mth 3mth 6mth UST 2yr 3yr 5yr 7yr 10yr 30yr

05/24/11 19

bps 26

bps 41

bps 05/24/11 0.53% 0.94% 1.78% 2.32% 3.13% 4.27%

10

Year

US

Swap

Rates 10

Year

US

Treasury

4.00%

4.00%

5/24/11

3.22%

5/24/11

3.13%

3.50%

3.50%

5/24/11

3.22%

5/24/11

3.13% 3.00%

3.00%

2.50% 2.50%

2.00%

2.00%

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

May

May

Jun

Mar

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Feb

Apr

Jan

Mar

Apr

May

May

Average

10

Year

US

Industrial

Yield Average

10

Year

US

Industrial

Spreads

5.50%

190

bps

5/24/11

A

BBB

A

BBB

175

bps

A:

4.17%

5.00%

BBB:

4.68%

160

bps

5/24/11

145

bps

4.50%

A:

102

bps

5/24/11

A:

4.17%

BBB:

4.68% BBB:

153

bps

130

bps

5/24/11

A:

102

bps

BBB:

153

bps 4.00%

115

bps

100

bps

3.50%

85

bps

Jun

Aug

Oct

Nov

Dec

Jan

Sep

Feb

Mar

Jul

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Apr

May

May

Jun

May

May

Mar

Apr

S&P/LSTA Leveraged Loan Index Average Junk-‐Bond Yield

98 bps 9.50%

5/24/11 7.12%

5/24/11 95/24/11

6 bps 96 bps 96 bps 9.00%

5/24/11 7.12% 94 bps

8.50%

92 bps

8.00%

90 bps

88 bps 7.50%

86

bps

7.00%

Jun

Jul

Aug

Oct

Nov

Dec

Jan

Sep

Feb

Mar

Apr

Jun

Jul

Aug

Sep

Nov

Dec

Jan

Feb

May

May

Oct

May

May

Mar

Apr

*Source: Bloomberg and FINRA

Copyright © 2011 Whitehall & Company, LLC

www.whitehallandcompany.com

021,725,1*

Presented by:

Volume 1, Issue 17

May 24, 2011

0$5.(76

7+( Whitehall

. & C o m p a n y, L L C

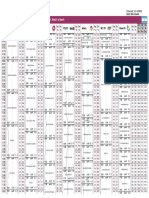

Select US Private Placements

Date Issuer Type $mm Tenor (yr) Spread Coupon Rating Sector Country

5/20 Square Butte Electric FMB $57 20/12 130bps N/A 1 Utility USA

Cooperative 31/27 145bps

5/20 PowerCo Ltd Snr Notes $245 9 120bps/10yr 4.36% 2 Utility New

12 140bps/10yr 4.56% Zealand

15 170bps/10yr 4.86%

5/20 Visy Packaging Snr Grd $250 12 220bps 5.23% 2 Industrial Australia

Properties Pty Ltd Notes 12 230bps 5.42%

5/20 Catalyst Housing Group Snr Notes £75 15 115bps 4.74% 1 Financial UK

30 5.44%

Public

and

private

market

information

is

from

sources

that

are

deemed

reliable,

but

information

has

not

been

confirmed.

Select US Public Market New Issues

Investment Grade Issuance

Date Company Type $mm Tenor (yr) Spread Coupon Yield Rating Sector Country

5/18 Alabama Power Snr Notes $450 10 82bps 3.95% 3.988% A2/A Utilities USA

30 95bps 5.20% 5.182%

5/17 Johnson & Johnson Snr Notes $3,900 2 FRN L flat N/A Aaa/ Consumer, USA

3 FRN L+9bps N/A AAA Non-Cyclical

3 33bps 1.20% 1.195%

5 43bps 2.15% 2.215%

10 55bps 3.55% 3.720%

30 68bps 4.85% 4.892%

5/17 Rio Tinto Financing Snr Notes $2,500 5 83bps 2.50% 2.588% A3/A- Basic Australia

10 103bps 4.13% 4.138% Materials

29 112.5bps 5.20% 5.322%

5/17 Total Capital Canada Ltd Snr Notes $1,000 2 FRN L+9bps N/A Aa1/AA- Energy Canada

Source: Bloomberg

Below Investment Grade Issuance

Date Company Type $mm Tenor (yr) Spread Coupon Yield Rating Sector Country

5/19 Chrysler GP/CG Snr Notes $3,200 8 524bps 8.00% N/A B2/B Consumer, USA

Co-Issuer 10 506bps 8.25% Cyclical

5/18 Alpha Natural Snr Notes $1,500 8 308.6bps 6.00% 5.861% Ba3/ Energy USA

10 325.3bps 6.25% 6.023% BB

5/16 Pertamina Snr Notes $1,500 10 235.1bps 5.25% 5.339% Ba1/ Energy Indonesia

30 231.8bps 6.50% N/A BB+

Source: Bloomberg

Select Closed Syndicated Loans

Date Issuer Type $mm Tenor (mth) Spread Class Issuer Rating Sector

5/20 Kub-Gas LLC First Lien $17 77 N/A Delay-draw Term N/A Energy

$23 77 N/A Delay-draw Term

5/19 Alpha Natural Resources First Lien $600 55 L+275bps Term Loan Ba3 Energy

$1,000 61 L+275bps Revolver

5/18 Birchcliff Energy Ltd First Lien $70 60 N/A Term Loan N/A Energy

$75 456 N/A Revolver

5/17 Trilogy Energy Unsec $35 36 N/A Revolver N/A Energy

Corporation $50 14 N/A Term Loan

$385 26 N/A Revolver

Source: Bloomberg

Source: Bloomberg

CONTACT

Jonathan Cody Timothy Page Gifford Nowland Gabrielle Sullivan

Managing Director Managing Director Analyst Analyst

(646) 450-‐9750 (646) 450-‐9751 (646) 543-‐4443 (646) 543-‐4404

jp.cody@ Lmothy.page@ gifford.nowland@ gabrielle.sullivan@

whitehallandcompany.com whitehallandcompany.com whitehallandcompany.com whitehallandcompany.com

Copyright © 2011 Whitehall & Company, LLC

www.whitehallandcompany.com

You might also like

- SRSAcquiom 2023 Deal Terms StudyDocument112 pagesSRSAcquiom 2023 Deal Terms StudyDan XiangNo ratings yet

- Annex 10 - Barrie Brown ReportDocument64 pagesAnnex 10 - Barrie Brown ReportAdhie SoekamtiNo ratings yet

- Test and Exam Qs Topic 2 - Solutions - v2 PDFDocument20 pagesTest and Exam Qs Topic 2 - Solutions - v2 PDFCindy YinNo ratings yet

- GOLKONDA RESORTS PRIVATE LIMITED - Company, Directors and Contact Details Zauba CorpDocument1 pageGOLKONDA RESORTS PRIVATE LIMITED - Company, Directors and Contact Details Zauba Corpitsmeou11No ratings yet

- Acc. No.: Boulton's Toy EmporiumDocument5 pagesAcc. No.: Boulton's Toy EmporiumMisty TranquilNo ratings yet

- 1.16 Whitehall: Monitoring The Markets Vol. 1 Iss. 16 (May 17, 2011)Document2 pages1.16 Whitehall: Monitoring The Markets Vol. 1 Iss. 16 (May 17, 2011)Whitehall & Company0% (1)

- Basics of 2 Point PerspectiveDocument1 pageBasics of 2 Point Perspectiveangelamae.reyesNo ratings yet

- Basic Information: Massivemimo 32T32R Sector 1 Objective (Crowd)Document3 pagesBasic Information: Massivemimo 32T32R Sector 1 Objective (Crowd)denny kusumaNo ratings yet

- August 2010 - Bethesda 20816 Market StatsDocument3 pagesAugust 2010 - Bethesda 20816 Market StatsJosette SkillingNo ratings yet

- Basic Information: Massivemimo 32T32R Sector 2&3 Objective (Crowd)Document3 pagesBasic Information: Massivemimo 32T32R Sector 2&3 Objective (Crowd)denny kusumaNo ratings yet

- Daily NewsletterDocument1 pageDaily NewsletterRima Parekh07No ratings yet

- PLD - GBA-230413 - 7canales VIERNESDocument8 pagesPLD - GBA-230413 - 7canales VIERNESjuan blancoNo ratings yet

- R59 - 8A Plan Cofraj Placa Cota +23.10Document1 pageR59 - 8A Plan Cofraj Placa Cota +23.10sephoraengNo ratings yet

- PLD GBA-230412 7canalesDocument8 pagesPLD GBA-230412 7canalesjuan blancoNo ratings yet

- TV Área Gran Buenos Aires - Total Hogares: Rating%, Reach% y Share%Document5 pagesTV Área Gran Buenos Aires - Total Hogares: Rating%, Reach% y Share%Hernán FerreirósNo ratings yet

- Client Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveDocument1 pageClient Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveAbhishek KumarNo ratings yet

- Paint Yard For CCTV CameraDocument1 pagePaint Yard For CCTV CameraPrem KumarNo ratings yet

- Curva S Bodegas MontolinDocument13 pagesCurva S Bodegas MontolinAndrew SanchezNo ratings yet

- Ping - Informe - INS PRTG - Wanipv6Document5 pagesPing - Informe - INS PRTG - Wanipv6cromoterveNo ratings yet

- Ganga Pipe line-L-SectionDocument1 pageGanga Pipe line-L-SectionJacob FryeNo ratings yet

- نوال معماري تعديل المكوناتDocument8 pagesنوال معماري تعديل المكوناتمحمود صقرNo ratings yet

- Redo Ps MTD 01 - 22 Juni 2024Document2 pagesRedo Ps MTD 01 - 22 Juni 2024Sandi 021 chanelNo ratings yet

- Software Pws PKM 2019Document1,136 pagesSoftware Pws PKM 2019Guntur FahzaNo ratings yet

- Dipankar Basumatary Roll No - 113, Sec A 6203 - Macroeconomics AssignmentDocument6 pagesDipankar Basumatary Roll No - 113, Sec A 6203 - Macroeconomics AssignmentDavid BassNo ratings yet

- A08 S Curve PDFDocument1 pageA08 S Curve PDFAbhishek KumarNo ratings yet

- NU ResultsDocument53 pagesNU ResultstatagalgoNo ratings yet

- Invest Update - January 2011Document8 pagesInvest Update - January 2011geetanjali04No ratings yet

- Isbl OsblDocument3 pagesIsbl OsblDina RosmaNo ratings yet

- 2020 322 Moesm4 EsmDocument2 pages2020 322 Moesm4 EsmkjhgfghjkNo ratings yet

- 4q-Oee M-Ubb WK-51 (Pop)Document31 pages4q-Oee M-Ubb WK-51 (Pop)Juan Manuel Fernandez RaudalesNo ratings yet

- CROQUISDocument1 pageCROQUISERIKANo ratings yet

- Admin 19/06/2019: Designed by Checked by Approved by Date DateDocument1 pageAdmin 19/06/2019: Designed by Checked by Approved by Date DateSinggihPrabowoNo ratings yet

- (Spanish Edition) Fred R. David-Conceptos de Administración Estratégica-Pearson (México) (2011)Document7 pages(Spanish Edition) Fred R. David-Conceptos de Administración Estratégica-Pearson (México) (2011)JuandeLa100% (1)

- Plan SarpantaDocument1 pagePlan SarpantaAlina TNo ratings yet

- ProgressDocument1 pageProgresslutfiNo ratings yet

- A B C A B C: Ground Floor Plan Second Floor PlanDocument1 pageA B C A B C: Ground Floor Plan Second Floor PlanESTRADA, DANIEL C.No ratings yet

- R55 - 8A Plan Cofraj Placa Cota +17.30Document1 pageR55 - 8A Plan Cofraj Placa Cota +17.30sephoraengNo ratings yet

- Tugas Studio 4Document1 pageTugas Studio 4thaliban hudzaifahNo ratings yet

- Yqj6 - Bahan Tayang Progres Kinerja APBN TA. 2021 KLHK S.D 27 DES 2021Document2 pagesYqj6 - Bahan Tayang Progres Kinerja APBN TA. 2021 KLHK S.D 27 DES 2021Muhammad Rifki SetiawanNo ratings yet

- Untitled 12Document20 pagesUntitled 12Jehana NaolNo ratings yet

- Padon BSDPage 6Document1 pagePadon BSDPage 6Lanie VallespinNo ratings yet

- Cricket Pitch - Outdoor DATED 12-05-2023-ModelDocument1 pageCricket Pitch - Outdoor DATED 12-05-2023-ModelShlok JoshiNo ratings yet

- DED Copra FINAL E2Document1 pageDED Copra FINAL E2Carl Lou BaclayonNo ratings yet

- الموقع العامDocument1 pageالموقع العاممحمود صقرNo ratings yet

- Proposal DrawingDocument1 pageProposal DrawingHassan AbusimNo ratings yet

- 522AE457-F90F-4195-95A4-A73D5A1E55D1_16741551691674155169HomeWork_14.01.2023Document11 pages522AE457-F90F-4195-95A4-A73D5A1E55D1_16741551691674155169HomeWork_14.01.2023magohe.bt.sqaNo ratings yet

- TAREA 1 Fin de Semana PDFDocument1 pageTAREA 1 Fin de Semana PDFAndle Solorzano AylasNo ratings yet

- TAREA 1 Fin de SemanaDocument1 pageTAREA 1 Fin de SemanaKevin Schuller PradaNo ratings yet

- R58 - 8A Plan Cofraj Placa Cota +20.20Document1 pageR58 - 8A Plan Cofraj Placa Cota +20.20sephoraengNo ratings yet

- Arrester TOV Simulator and Energy Dissipation CalculatorDocument10 pagesArrester TOV Simulator and Energy Dissipation CalculatorgilbertomjcNo ratings yet

- Suppl cclm-2019-1228 SupplDocument3 pagesSuppl cclm-2019-1228 SuppldddcvNo ratings yet

- Typikal Cross DrainDocument1 pageTypikal Cross DrainMilanoeq12No ratings yet

- SANITAREDocument1 pageSANITARETroia EdtroNo ratings yet

- 13a Fy 22 Asylum Grant Rates by CourtDocument1 page13a Fy 22 Asylum Grant Rates by CourtJdf FdcvNo ratings yet

- F1a F1BDocument1 pageF1a F1BLâm Võ ĐứcNo ratings yet

- Chart Title: 100% Total (KG) Acumulado 80-20Document3 pagesChart Title: 100% Total (KG) Acumulado 80-20RogerBalRivNo ratings yet

- Opt. 1: GDocument4 pagesOpt. 1: GŽarko LazićNo ratings yet

- Plano de Un Vivienda de Concreto Armado de Dos Pisos Con Cobertura de Teja Andina Sobre TijeralesDocument1 pagePlano de Un Vivienda de Concreto Armado de Dos Pisos Con Cobertura de Teja Andina Sobre TijeralesFrancisco IPNo ratings yet

- Zone 7Document1 pageZone 7bao phamNo ratings yet

- Print Nomor 1 PDFDocument22 pagesPrint Nomor 1 PDFSiangNo ratings yet

- PR1Document1 pagePR1EXCELLENCE ENGINEERING & CONSULTANTSNo ratings yet

- S Curve AutosavedDocument1 pageS Curve AutosavedPadmalavMahatoNo ratings yet

- WK - CFH086 - Art1 RPTDocument1 pageWK - CFH086 - Art1 RPTAbner Daniel Francisco Canel GuacamayaNo ratings yet

- A.02 Plan Compartimentari - A3Document1 pageA.02 Plan Compartimentari - A3Cezara TudosăNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- SearchFundPrimer August2010Document94 pagesSearchFundPrimer August2010Hao ShiNo ratings yet

- 2021 Vietnam Banking Opportunities and ChallengesDocument3 pages2021 Vietnam Banking Opportunities and ChallengesCường MạnhNo ratings yet

- Chapter 3 Auding and AssuranceDocument24 pagesChapter 3 Auding and AssuranceCheng Yuet JoeNo ratings yet

- The Time Value of MoneyDocument28 pagesThe Time Value of MoneyRajat ShrinetNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument3 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- Profit BandsDocument11 pagesProfit Bandszanzdude50% (2)

- Answer 1&2 CH 21Document2 pagesAnswer 1&2 CH 216Azzah Utami AnggrainiNo ratings yet

- Meta Reports Fourth Quarter and Full Year 2022 Results 2023Document12 pagesMeta Reports Fourth Quarter and Full Year 2022 Results 2023Fady EhabNo ratings yet

- Practice Sheet Session 11Document11 pagesPractice Sheet Session 11Savana AndiraNo ratings yet

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocument10 pagesChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNo ratings yet

- Demat Services by Banks PALLAVIDocument35 pagesDemat Services by Banks PALLAVIjyoti raghuvanshi100% (2)

- One Up On Wall Street: Book CondensationDocument10 pagesOne Up On Wall Street: Book CondensationAardityam SharmaNo ratings yet

- MCQS 4Document23 pagesMCQS 4humna khanNo ratings yet

- Bank of IndiaDocument49 pagesBank of IndiaJasmeet Singh50% (2)

- Financial Management Risk Analysis in Capital Budgeting Notes Finance 1 PDFDocument15 pagesFinancial Management Risk Analysis in Capital Budgeting Notes Finance 1 PDFjjNo ratings yet

- Prospectus-2019-09-03 Partners Group Direct Equity 2019 (EUR) S.C.A., SICAV-RAIFDocument161 pagesProspectus-2019-09-03 Partners Group Direct Equity 2019 (EUR) S.C.A., SICAV-RAIFGeorgio RomaniNo ratings yet

- DB Quiz-2007Document4 pagesDB Quiz-2007harlequin007No ratings yet

- Financial Accounting - 3: By: Manju Asht Lfbaa LPU, PhagwaraDocument25 pagesFinancial Accounting - 3: By: Manju Asht Lfbaa LPU, PhagwaraanmoldeepsinghNo ratings yet

- Quiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditDocument2 pagesQuiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditEzra Mikah G. CaalimNo ratings yet

- Jurnal Economica Equivalence of Islamic Financial LiteracyDocument28 pagesJurnal Economica Equivalence of Islamic Financial LiteracyMiftakhul KhasanahNo ratings yet

- Estimation of Doubtful Accounts (Chapter 5)Document12 pagesEstimation of Doubtful Accounts (Chapter 5)chingNo ratings yet

- SIC 29 - Disclosure - Service Concession ArrangementsDocument6 pagesSIC 29 - Disclosure - Service Concession ArrangementsJimmyChaoNo ratings yet

- Edited Transcript: Refinitiv StreeteventsDocument19 pagesEdited Transcript: Refinitiv StreeteventsalexisNo ratings yet

- 3182 FormulasDocument9 pages3182 FormulasAnnie HsuNo ratings yet

- Limits ChartsDocument6 pagesLimits ChartsveenamadhurimeduriNo ratings yet