Professional Documents

Culture Documents

Tax Exemptions Section Exemption Details Allowed Max Amount

Tax Exemptions Section Exemption Details Allowed Max Amount

Uploaded by

Srinivas Etikala0 ratings0% found this document useful (0 votes)

18 views3 pagesThis document outlines various tax exemptions allowed in India under Section 80 of the Income Tax Act. It lists the exemption, details of what is covered, and the maximum amount allowed. Some of the major exemptions included are:

1) HRA exemption of up to 40% of basic salary.

2) Medical insurance and treatment deductions up to Rs. 25,000, 50,000, and 1,000,000 respectively.

3) Contributions to pension schemes like NPS and employer contributions are exempt up to Rs. 50,000 and 10,000,000 respectively.

Original Description:

tax excemptions format

Original Title

Tax Exemptions

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines various tax exemptions allowed in India under Section 80 of the Income Tax Act. It lists the exemption, details of what is covered, and the maximum amount allowed. Some of the major exemptions included are:

1) HRA exemption of up to 40% of basic salary.

2) Medical insurance and treatment deductions up to Rs. 25,000, 50,000, and 1,000,000 respectively.

3) Contributions to pension schemes like NPS and employer contributions are exempt up to Rs. 50,000 and 10,000,000 respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views3 pagesTax Exemptions Section Exemption Details Allowed Max Amount

Tax Exemptions Section Exemption Details Allowed Max Amount

Uploaded by

Srinivas EtikalaThis document outlines various tax exemptions allowed in India under Section 80 of the Income Tax Act. It lists the exemption, details of what is covered, and the maximum amount allowed. Some of the major exemptions included are:

1) HRA exemption of up to 40% of basic salary.

2) Medical insurance and treatment deductions up to Rs. 25,000, 50,000, and 1,000,000 respectively.

3) Contributions to pension schemes like NPS and employer contributions are exempt up to Rs. 50,000 and 10,000,000 respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

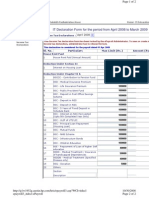

Tax Exemptions

Section Exemption Details Allowed Max Amount

U/S 10 HRA Max 40% basic salary

80D-Mediclaim (Self &Family) 25000

80D_P - Mediclaim for parents above 60 years 50000

80CCD- NPS Contribution 50000

80EE -Interest on Housing Loan ( First Home Loan) 50000

80CCD2-New Pension Scheme(Employer Contribution) 10000000

80CCF-Specified Bonds 20000

U/S 80 80DD-Treatment of handicapped dep 125000

80DDB-Treatment for specified disease 100000

80E-Int. on loan taken for higher educ 1000000

80EEA-Interest on new home loans taken in fy 2019-20 150000

80EEB-Interest on loan taken for electric vehicle 150000

80G-Donations to certain funds 500000

80G1-Donations (50%) 500000

PF_80 - Contrbn. to Provident fund

U/S 80C LICEX_80 - LIC Policies 150000

CEF-80 - Children Tution Fee

Loss on House Property 200000

Standard Dedcutions 50000

Professional Tax 2400

Donations to charitable trusts 50% of actual donation

Donations to political parties 100% of actual donation

80EE -Interest on Housing Loan ( First Home Loan) 50000 Approved

80CCD2-New Pension Scheme(Employer Contribut10000000 Approved

80CCF-Specified Bonds 20000 Approved

80DD-Treatment of handicapped dep 125000 Approved

80DDB-Treatment for specified disease 100000 Approved

80E-Int. on loan taken for higher educ 1000000 Approved

80EEA-Interest on new home loans taken in fy 20 150000 Approved

80EEB-Interest on loan taken for electric vehicle 150000 Approved

80G-Donations to certain funds 500000 Approved

80G1-Donations (50%) 500000 Approved

50000

0

0

0

0

0

150000

150000

0

0

You might also like

- Investment Appraisal Report (Individual Report)Document10 pagesInvestment Appraisal Report (Individual Report)Eric AwinoNo ratings yet

- 90 Day Workbook-Digital 14JUNv1 - Fill v2Document111 pages90 Day Workbook-Digital 14JUNv1 - Fill v2SAM100% (25)

- FDA 483 Warning Letter Response Templates Greenlight GuruDocument5 pagesFDA 483 Warning Letter Response Templates Greenlight GuruSrinivas EtikalaNo ratings yet

- Format For Tripartite Agreement - UBIDocument5 pagesFormat For Tripartite Agreement - UBInpmehendale0% (1)

- Florida Real Estate Sales Candidate BookletDocument18 pagesFlorida Real Estate Sales Candidate BookletAzul MezaNo ratings yet

- What Is A Birth CertificateDocument39 pagesWhat Is A Birth CertificateJake Morse100% (3)

- S Income Tax Declaration April 2017Document2 pagesS Income Tax Declaration April 2017HanumanthNo ratings yet

- IT Exemption Guidelines 2023-24Document7 pagesIT Exemption Guidelines 2023-24rashiramesh31No ratings yet

- IT Declaration Apr 08 - Mar 09Document2 pagesIT Declaration Apr 08 - Mar 09api-19460822No ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- GGDocument8 pagesGGlukudasNo ratings yet

- IPSFDocument7 pagesIPSFmanikandan BalasubramaniyanNo ratings yet

- Deductions at A GlanceDocument2 pagesDeductions at A Glancehitesh1601kukrejaNo ratings yet

- Deductions From IncomeDocument29 pagesDeductions From IncomeYNM AASININo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- PGBRK IPSF - 702 - 228908633 - 00702000000000031446 - W - : EPSF Confirmed On:17-12-2022 16:05:27Document3 pagesPGBRK IPSF - 702 - 228908633 - 00702000000000031446 - W - : EPSF Confirmed On:17-12-2022 16:05:27Hrithik khanna K BNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Document3 pagesSection Deduction On Allowed Limit (Maximum) FY 2018-19Praveen kumarNo ratings yet

- UntitledDocument45 pagesUntitledWS KNIGHTNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18100% (1)

- Investment Declaration Form - FY 2023-24Document2 pagesInvestment Declaration Form - FY 2023-24kunal singhNo ratings yet

- Decleration FormDocument5 pagesDecleration FormKARTHIKEYAN SELVAKUMARNo ratings yet

- Deduction From Gross Total IncomeDocument4 pagesDeduction From Gross Total Incomedevak shelarNo ratings yet

- Comparison of Old and New Tax Regime 04042023Document3 pagesComparison of Old and New Tax Regime 04042023VenkateshNo ratings yet

- I PSF 202122Document16 pagesI PSF 202122Preethi PachipulusuNo ratings yet

- Itdf PDFDocument2 pagesItdf PDFskgaddeNo ratings yet

- IpscDocument4 pagesIpscaravind madabushiNo ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- IT Saving Declaration - 2109Document2 pagesIT Saving Declaration - 2109bala govindamNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Document2 pagesSection Deduction On Allowed Limit (Maximum) FY 2018-19amarjeet mahapatraNo ratings yet

- Income Tax Primer 1658994233Document11 pagesIncome Tax Primer 1658994233Heena OsshinNo ratings yet

- Income Tax Declaration April 2017Document2 pagesIncome Tax Declaration April 2017HanumanthNo ratings yet

- Section 80 Deduction ListDocument6 pagesSection 80 Deduction ListMURALIDHARA S VNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- DeclarationDocument3 pagesDeclarationPatrick Jude Lucas PsychologyNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Idf 1025279Document3 pagesIdf 1025279tamaldNo ratings yet

- PGBRK IPSF - 1260226 - 1402697 - 00226000000000087675 - W - HDocument4 pagesPGBRK IPSF - 1260226 - 1402697 - 00226000000000087675 - W - HAshish ChauhanNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Bifurcation of Salary ArrearsDocument3 pagesBifurcation of Salary ArrearsSrikant SheelNo ratings yet

- S Income Tax Declaration April 2016Document2 pagesS Income Tax Declaration April 2016HanumanthNo ratings yet

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- 1.80C, 80Cc Details: - Amount: Empno/Pernr Cadre Pan No. Branch Position/Desig Office NameDocument3 pages1.80C, 80Cc Details: - Amount: Empno/Pernr Cadre Pan No. Branch Position/Desig Office Namesamalrani265No ratings yet

- Income Tax Actual Proof Submission Form Fy 2021 - 2022Document3 pagesIncome Tax Actual Proof Submission Form Fy 2021 - 2022muralianand92No ratings yet

- Section 80 Deduction TableDocument6 pagesSection 80 Deduction TablevineyNo ratings yet

- Unit 4 Financial Planning and Tax ManagementDocument15 pagesUnit 4 Financial Planning and Tax Managementdivy waliaNo ratings yet

- Income TaxDocument5 pagesIncome TaxAshish NarulaNo ratings yet

- DeductionsDocument2 pagesDeductionsexactincometax11No ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- Salary TaxDocument4 pagesSalary Taxapi-3810632No ratings yet

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- 1.80C, 80Cc Details: - Amount: Empno/Pernr Cadre Pan No. Branch Position/Desig Office NameDocument3 pages1.80C, 80Cc Details: - Amount: Empno/Pernr Cadre Pan No. Branch Position/Desig Office NameJeeban MishraNo ratings yet

- Investment Declaration Format FY 2022-23Document3 pagesInvestment Declaration Format FY 2022-23Divya WaghmareNo ratings yet

- Investment Declaration Form - 2021-22Document3 pagesInvestment Declaration Form - 2021-22rajamani balajiNo ratings yet

- Investment Declaration Form-2Document2 pagesInvestment Declaration Form-2Pramod KumarNo ratings yet

- Income Tax Deductions ListDocument4 pagesIncome Tax Deductions Listamitks525No ratings yet

- Income Tax DepartmentDocument4 pagesIncome Tax Departmentmansi joshiNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- Ipsf Swapnil Nage Ipsf Id-0083236968 - 2Document4 pagesIpsf Swapnil Nage Ipsf Id-0083236968 - 2Swapnil NageNo ratings yet

- Deductions Available Under Chapter VI of Income TaxDocument4 pagesDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNo ratings yet

- Ar001 291222Document1 pageAr001 291222Srinivas EtikalaNo ratings yet

- Form16 2012 AAXPE4654P 2023-24Document2 pagesForm16 2012 AAXPE4654P 2023-24Srinivas Etikala0% (1)

- AR0001Document1 pageAR0001Srinivas EtikalaNo ratings yet

- FDA Inspection Status of The SitesDocument4 pagesFDA Inspection Status of The SitesSrinivas EtikalaNo ratings yet

- Unit-III Site Presentation - NewDocument13 pagesUnit-III Site Presentation - NewSrinivas EtikalaNo ratings yet

- The Definitive Guide To Responding To Fda 483 and Warning LettersDocument18 pagesThe Definitive Guide To Responding To Fda 483 and Warning LettersSrinivas EtikalaNo ratings yet

- You Just Received A 483, Now What?Document4 pagesYou Just Received A 483, Now What?Srinivas EtikalaNo ratings yet

- Limited Purpose Bank: Public DisclosureDocument12 pagesLimited Purpose Bank: Public DisclosureanshNo ratings yet

- Ra 7835Document15 pagesRa 7835Erlyn AquinoNo ratings yet

- Global Financial Crisis and Its Impact On The Indian EconomyDocument42 pagesGlobal Financial Crisis and Its Impact On The Indian EconomyShradha Diwan95% (19)

- Rahul Retail REPORTDocument61 pagesRahul Retail REPORTmohitnonuNo ratings yet

- New Prudential Guidelines July 1 2010 (Final)Document66 pagesNew Prudential Guidelines July 1 2010 (Final)tozzy12345No ratings yet

- Bank of Commerce v. Sps. FloresDocument3 pagesBank of Commerce v. Sps. FloresBeltran KathNo ratings yet

- Test Bank For Canadian Business and The Law 4th Edition DuplessisDocument36 pagesTest Bank For Canadian Business and The Law 4th Edition Duplessisskitupend.c3mv100% (47)

- Chapter 14 The Mortgage MarketsDocument5 pagesChapter 14 The Mortgage Marketslasha Kachkachishvili100% (1)

- Opening Case Corporate GovernanceDocument2 pagesOpening Case Corporate GovernanceSandyNo ratings yet

- Too Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyDocument8 pagesToo Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyForeclosure FraudNo ratings yet

- UNIT 2 DetailDocument10 pagesUNIT 2 DetailShaifali ChauhanNo ratings yet

- Business Stats Cases For EGMP 67Document14 pagesBusiness Stats Cases For EGMP 67Nitin MishraNo ratings yet

- Legal Aid Application FormDocument16 pagesLegal Aid Application FormHsgceNo ratings yet

- Property - FINALDocument220 pagesProperty - FINALRalph Honorico100% (1)

- TWO FACES: DEMYSTIFYING THE MORTGAGE ELECTRONIC REGISTRATION SYSTEM'S LAND TITLE THEORY (MERS) SSRN-id1684729Document39 pagesTWO FACES: DEMYSTIFYING THE MORTGAGE ELECTRONIC REGISTRATION SYSTEM'S LAND TITLE THEORY (MERS) SSRN-id1684729CarrieonicNo ratings yet

- Pre Board 3 PGDocument4 pagesPre Board 3 PGzee abadillaNo ratings yet

- Michael H. Hutchison-Synergy Retainer 2 PDFDocument32 pagesMichael H. Hutchison-Synergy Retainer 2 PDFMichael HutchisonNo ratings yet

- Commercial Real Estate Valuation ModelDocument6 pagesCommercial Real Estate Valuation Modelkaran yadavNo ratings yet

- How To Buy A HouseDocument4 pagesHow To Buy A Housejosephjohnmzc4649No ratings yet

- Loan Origination Servicing DefinitionslawsDocument18 pagesLoan Origination Servicing DefinitionslawsPrivate CitizenNo ratings yet

- Example Memorandum of UnderstandingDocument10 pagesExample Memorandum of UnderstandingMonika OjhaNo ratings yet

- Rediscovering Social InnovationDocument12 pagesRediscovering Social InnovationGiselle MartinezNo ratings yet

- A Report ON "Digitalization and Acquisitions Of: HDFC Bank"Document40 pagesA Report ON "Digitalization and Acquisitions Of: HDFC Bank"Sambhavi SinghNo ratings yet

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviDocument56 pagesSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviOmnia MustafaNo ratings yet

- Financial Education Investing Retirement ResearchDocument397 pagesFinancial Education Investing Retirement ResearchCKJJ55@hotmail.cm0% (2)