Professional Documents

Culture Documents

Encore Receivable Management, Inc. Philippine Branch

Encore Receivable Management, Inc. Philippine Branch

Uploaded by

Samantha Joyce Valera TaezaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Encore Receivable Management, Inc. Philippine Branch

Encore Receivable Management, Inc. Philippine Branch

Uploaded by

Samantha Joyce Valera TaezaCopyright:

Available Formats

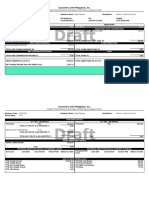

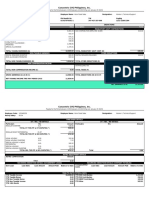

Encore Receivable Management, Inc.

Philippine Branch

Payslip for the Period January 30 2022-February 12 2022 (Pay-out: February 18 2022)

Employee Code: 101329740 Employee Name: Samantha Joyce Taeza Designation: Advisor I, Collections

Hourly Salary: 78.46

Tax Code: SSS No. Phil Health No. TIN Pagibig

01-2801285-7 02-250609366-3 000-348-408-859 1212-2970-5169

EARNINGS DEDUCTIONS

Description Hrs Total Description Total

TAXABLE EARNINGS MANDATORY GOVT CONTRIBUTIONS

BASIC PAY 81.00 6,355.24 SSS CONTRIBUTION EMPLOYEE SHARE 517.50

Total Holiday 8.00 188.30

TOTAL TAXABLE EARNINGS (A) 6,543.54 TOTAL MANDATORY GOVT CONT (D) 517.50

NON-TAXABLE EARNINGS OTHER DEDUCTIONS

PERFORMANCE BONUS 4,000.00

Transportation Allowance 689.66

Meal Allowance 459.77

Rice Allowance 459.77

TOTAL NON-TAXABLE EARNINGS (B) 5,609.20 TOTAL OTHER DEDUCTIONS (E) 0.00

NON COMPENSATION INCOME TAXES

TOTAL NON COMPENSATION INCOME (C) 0.00 TOTAL TAXES (F) 0.00

GROSS EARNINGS (G) (A+B+C) 12,152.74 TOTAL DEDUCTIONS (H) (D+E+F) 517.50

NET TAXABLE INCOME THIS PAY PERIOD (A-D) 6,026.04

NET EARNINGS (G-H) 11,635.24

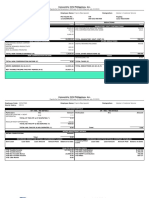

Encore Receivable Management, Inc. Philippine Branch

Payslip for the Period January 30 2022-February 12 2022 (Pay-out: February 18 2022)

Employee Code: 101329740 Employee Name: Samantha Joyce Taeza Designation: Advisor I, Collections

Hourly Salary: 78.46

TIME BASED DETAILS

OT / HOL / ND DETAILS OT / HOL / ND DETAILS

Particulars Hrs Amount Particulars Hrs Amount

TOTAL OT THIS PP & OT DISPUTES (*) 0.00

TOTAL ND THIS PP & ND DISPUTES (*) 0.00

SPECIAL HOLIDAY 7.9999 188.30

TOTAL HOL THIS PP & HOL DISPUTES (*) 188.30 Total 0.00

RETRO ADJUSTMENT DETAILS

RETRO COMPUTATION Amount

Total 0.00

RECURRING DEDUCTION DETAILS (GOVERNMENT LOANS) RECURRING DEDUCTION DETAILS (COMPANY PAYABLES)

Company/Other

Govt Loan Loan Date Loan Amount Amount Paid Balance to Date Loan Date Loan Amount Amount Paid Balance to Date

Loans

YEAR-TO-DATE PAYROLL DATA

YTD Taxable Income 24,101.55 YTD SSS Contribution 1,912.50

YTD Taxable Bonus 0.00 YTD PHI Contribution 409.56

YTD Non Taxable Bonus 14,000.00 YTD HDMF Contribution 200.00

YTD Non Taxable Income 2,689.66 YTD Wtax 0.00

YTD 13th Month 0.00

You might also like

- Ebook Ebook PDF Personal Finance 2nd Edition by Vickie L Bajtelsmit PDFDocument34 pagesEbook Ebook PDF Personal Finance 2nd Edition by Vickie L Bajtelsmit PDFwarren.beltran184100% (43)

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionszayn malikNo ratings yet

- Payroll Tables ListDocument6 pagesPayroll Tables ListsshelkeNo ratings yet

- Management Accounting - HCA16ge - Ch6Document76 pagesManagement Accounting - HCA16ge - Ch6Corliss Ko100% (3)

- Fabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueDocument21 pagesFabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueFlordilyn DichonNo ratings yet

- BSBFIM601 Final AssessmentDocument17 pagesBSBFIM601 Final Assessmenthemant100% (2)

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsArmina Aguilar BaisNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDj HandsomeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsEstephen EncenzoNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionskeen yumangNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionspaacostanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZeth Nathaniel TominesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKaye ApostolNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationMike Gonzales JulianNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZarah BernabeNo ratings yet

- Payslip YemplateDocument2 pagesPayslip YemplateCristine GonzalesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsMeleisa joy BeslyNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- Payslip July 7Document2 pagesPayslip July 7Clarke BlakeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Oct 15Document2 pagesOct 15Jane CruzNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsAngela AradaNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- 3483571f b300 4c77 b086 fb15ff8fccDocument2 pages3483571f b300 4c77 b086 fb15ff8fcckim JuabanNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- Concentrix Daksh Services Philippines CorporationDocument3 pagesConcentrix Daksh Services Philippines CorporationThea HeterozygoesNo ratings yet

- PAYSLIP Feb-2023Document1 pagePAYSLIP Feb-2023prasunaNo ratings yet

- 1.roshan Kumar-Payslip - May-2022Document1 page1.roshan Kumar-Payslip - May-2022Burning to ShineNo ratings yet

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- PaySlip December2022 3Document1 pagePaySlip December2022 3pankaj kumarNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Salary Slip NOVDocument1 pageSalary Slip NOVdefinetrading2022.coNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchAngelo Mark Ordoña PorgatorioNo ratings yet

- Payslip IR 129147 Suneel+Kumar MAY 2024Document1 pagePayslip IR 129147 Suneel+Kumar MAY 2024ayanbhargav3No ratings yet

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- Bharat Heavy Electricals Limited: 06290981 Shivam GuptaDocument1 pageBharat Heavy Electricals Limited: 06290981 Shivam GuptaMr. Shivam GuptaNo ratings yet

- DR Siddhartha Majumdar-payslip-Mar-2024Document1 pageDR Siddhartha Majumdar-payslip-Mar-2024humanresourcesphoenixassuranceNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument2 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- Abhishek Singh 3690Document1 pageAbhishek Singh 3690Abhishek SinghNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Payslip Nov 2023Document1 pagePayslip Nov 2023VarshaNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Salary StructureDocument6 pagesSalary StructureValluru SrinivasNo ratings yet

- Cca 1990-91Document314 pagesCca 1990-91Samples Ames PLLCNo ratings yet

- QB Online Payroll Answer Key Sec 2Document4 pagesQB Online Payroll Answer Key Sec 2khotiakovaarinaNo ratings yet

- Mayank Mehta EYDocument10 pagesMayank Mehta EYyasmeenfatimak52No ratings yet

- A Small Briefing On CSI PayrollDocument6 pagesA Small Briefing On CSI PayrollAjay PandeyNo ratings yet

- IRS Criminal Investigation Annual ReportDocument28 pagesIRS Criminal Investigation Annual ReportJames CampbellNo ratings yet

- Homework 5 - Current Liabilities - RevisedDocument3 pagesHomework 5 - Current Liabilities - RevisedalvarezxpatriciaNo ratings yet

- Cost Flow ProductionDocument1 pageCost Flow ProductionHuzaifa WaseemNo ratings yet

- Payroll Audit Checklist 1683964116Document16 pagesPayroll Audit Checklist 1683964116CA Shuaib AnsariNo ratings yet

- Tally Prime Notes 2023 ...Document22 pagesTally Prime Notes 2023 ...sarveshgautam2005No ratings yet

- A Proposed Computerized Payroll System of GEMPHIL Technologies Inc 1Document52 pagesA Proposed Computerized Payroll System of GEMPHIL Technologies Inc 1Vanessa59% (17)

- Applied Module - PrelimDocument37 pagesApplied Module - PrelimManilyn G. ZubietaNo ratings yet

- Project Background Background of The StudyDocument24 pagesProject Background Background of The StudyjordanNo ratings yet

- Spesifikasi Kaedah Pengiraan Berkomputer PCB 2019Document44 pagesSpesifikasi Kaedah Pengiraan Berkomputer PCB 2019fjNo ratings yet

- Syed Wajeeh Hasan Zaidi-CVDocument4 pagesSyed Wajeeh Hasan Zaidi-CVmba2135156No ratings yet

- AP - Comprehensive ExamDocument10 pagesAP - Comprehensive ExamCharlesNo ratings yet

- Acct II Chapter 4Document12 pagesAcct II Chapter 4Gizaw Belay100% (1)

- Exhibit 56 November 28 2023 Tax LetterDocument8 pagesExhibit 56 November 28 2023 Tax LetterAnthony TalcottNo ratings yet

- DENR CC 2021 5th EdDocument228 pagesDENR CC 2021 5th EdMelitus NaciusNo ratings yet

- Manual Payroll System: Production Cost AccountingDocument17 pagesManual Payroll System: Production Cost AccountingStephanie Diane SabadoNo ratings yet

- Current Liabilities and Contingencies Current Liabilities and ContingenciesDocument60 pagesCurrent Liabilities and Contingencies Current Liabilities and Contingenciesasep_efendhiNo ratings yet

- EH - UK - Employers - Basics of UK Payroll GuideDocument10 pagesEH - UK - Employers - Basics of UK Payroll GuidexiibzzxNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungDocument24 pagesSolution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungJohnValenciaajgq100% (40)

- Chapter9-Accounting For LaborDocument46 pagesChapter9-Accounting For LaborNashaNo ratings yet

- ch13 SolDocument17 pagesch13 SolJohn Nigz PayeeNo ratings yet