Professional Documents

Culture Documents

Business Blueprint Controlling: Synokem Pharmaceuticals LTD

Business Blueprint Controlling: Synokem Pharmaceuticals LTD

Uploaded by

Gudia SharmaCopyright:

Available Formats

You might also like

- Optional Unit 1 AssignmentDocument19 pagesOptional Unit 1 AssignmentTriet NguyenNo ratings yet

- Kraft-Foods Case StudyDocument18 pagesKraft-Foods Case StudyLevi Lazareno Eugenio50% (2)

- An Ethics Role Playing Case: Stockholders Vs StakeholdersDocument2 pagesAn Ethics Role Playing Case: Stockholders Vs StakeholderssNo ratings yet

- FDS0019 GAP0080 O2C GTS Commercial InvoiceDocument22 pagesFDS0019 GAP0080 O2C GTS Commercial Invoicesomusatish100% (1)

- Document: Uses of Special Period in SAP PDFDocument9 pagesDocument: Uses of Special Period in SAP PDFswainsatyaranjanNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- International Trade - Chapt 9 Imports Tariff/ Quotas For Imperfect MarketsDocument10 pagesInternational Trade - Chapt 9 Imports Tariff/ Quotas For Imperfect MarketsglenlcyNo ratings yet

- Taller SAP Actividad 3Document67 pagesTaller SAP Actividad 3Daniel Ricardo Estupiñan Guzman100% (1)

- 1573561440-BP Conversion GuideDocument40 pages1573561440-BP Conversion GuideRuben CampoverdeNo ratings yet

- Brazil Accounting Tax Processes v1 PDFDocument163 pagesBrazil Accounting Tax Processes v1 PDFGustavo GonçalvesNo ratings yet

- 250open Text VIM For SAP SolutionsDocument2 pages250open Text VIM For SAP SolutionsTheo van BrederodeNo ratings yet

- Sap Fico Blue PrintDocument57 pagesSap Fico Blue Printuvtechdhananjay05100% (1)

- New Asset Accounting IntroductionDocument7 pagesNew Asset Accounting IntroductionCasimiro HernandezNo ratings yet

- Toaz - Info Refx Configuration Document PRDocument110 pagesToaz - Info Refx Configuration Document PRnew gstNo ratings yet

- Demo Script Planning and Consolidation (MS) Overview Demo: General InformationDocument44 pagesDemo Script Planning and Consolidation (MS) Overview Demo: General InformationbrainNo ratings yet

- Document and Reporting Compliance (5XU)Document43 pagesDocument and Reporting Compliance (5XU)Ind HashNo ratings yet

- Ifrs at Sap: Transition To IFRS: Implementation of IFRS As An Additional Set of Accounting Standards Alongside US GAAPDocument29 pagesIfrs at Sap: Transition To IFRS: Implementation of IFRS As An Additional Set of Accounting Standards Alongside US GAAPlsudhakarNo ratings yet

- IBM Review of Simple Finance 3.0 Process: Accounts ReceivableDocument9 pagesIBM Review of Simple Finance 3.0 Process: Accounts ReceivableMOORTHYNo ratings yet

- Define Functional AreaDocument1 pageDefine Functional AreaDipeshNo ratings yet

- Year End Closing Activities in Sap Fi CoDocument30 pagesYear End Closing Activities in Sap Fi Coansonyu305No ratings yet

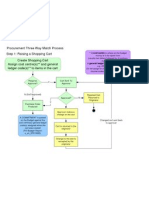

- 3 Way Match Process 1Document3 pages3 Way Match Process 1mkv428No ratings yet

- Ycoa Accdet Docu UsDocument72 pagesYcoa Accdet Docu UsSrinivas N GowdaNo ratings yet

- Accounts Payable: Global Process Management SystemDocument89 pagesAccounts Payable: Global Process Management SystemcybervistaNo ratings yet

- Funds Management Overview: © 2005 Intelligroup, IncDocument49 pagesFunds Management Overview: © 2005 Intelligroup, Incganesh gadeNo ratings yet

- SD RevRec MigrationDocument11 pagesSD RevRec MigrationAlina Cristina VranceanuNo ratings yet

- Conceptual Design of FICODocument149 pagesConceptual Design of FICOShree RamNo ratings yet

- COPADocument167 pagesCOPAAylene FloresNo ratings yet

- Project Management (PS) : Curriculum: Introduction To S/4HANA Using Global BikeDocument36 pagesProject Management (PS) : Curriculum: Introduction To S/4HANA Using Global BikeJuliusCesnakauskasNo ratings yet

- Fertilizers and Chemicals Travancore LTD: FACT ForwardDocument35 pagesFertilizers and Chemicals Travancore LTD: FACT ForwardfharooksNo ratings yet

- Sanad Wfrice Master List: SR No Object Id Object Object Purpose Tcode Object Sub CategoryDocument12 pagesSanad Wfrice Master List: SR No Object Id Object Object Purpose Tcode Object Sub CategoryAmr IsmailNo ratings yet

- BH5 S4hana1611 BPD en XXDocument23 pagesBH5 S4hana1611 BPD en XXIván Andrés Marchant NúñezNo ratings yet

- Column Fields Field: Additional Navigational AttributesDocument25 pagesColumn Fields Field: Additional Navigational AttributesSajanAndyNo ratings yet

- SAP Credit ManagementDocument6 pagesSAP Credit ManagementAvinash MalladhiNo ratings yet

- S4HANA RIG UX Lessons Learned 1909 PDFDocument42 pagesS4HANA RIG UX Lessons Learned 1909 PDFadelangel70No ratings yet

- S/4HANA Configuration Case Phase I - Handbook: Product Motivation PrerequisitesDocument75 pagesS/4HANA Configuration Case Phase I - Handbook: Product Motivation PrerequisitesDianPramana100% (2)

- Group Reporting (FIN-CS) : Public Document Version: SAP S/4HANA 2022 (October 2022) - 2022-10-03Document636 pagesGroup Reporting (FIN-CS) : Public Document Version: SAP S/4HANA 2022 (October 2022) - 2022-10-03Aymen AddouiNo ratings yet

- 2 Our HANA Capabilities PDFDocument17 pages2 Our HANA Capabilities PDFRueban manoharNo ratings yet

- Archit BBP CO V1 30.11.2010Document202 pagesArchit BBP CO V1 30.11.2010Subhash ReddyNo ratings yet

- Credit Limit On Customer Level v2Document9 pagesCredit Limit On Customer Level v2Durga SNo ratings yet

- Transition To The New Planning Solution in S/4Hana On PremiseDocument11 pagesTransition To The New Planning Solution in S/4Hana On PremiseNityaNo ratings yet

- HSPL Fi 06 House Bank v1.0Document18 pagesHSPL Fi 06 House Bank v1.0Naveen KumarNo ratings yet

- Master Data Mass MaintenanceDocument12 pagesMaster Data Mass MaintenancePaul AlcosNo ratings yet

- SAP CO PPT'sDocument5 pagesSAP CO PPT'sTapas BhattacharyaNo ratings yet

- ProjectPortfolioManagement CommercialProjectManagementDocument4 pagesProjectPortfolioManagement CommercialProjectManagementmohammad shaikNo ratings yet

- SAP FSCM Credit Management Config StepsDocument3 pagesSAP FSCM Credit Management Config StepsDamodar Naidu PaladuguNo ratings yet

- Vendor Recognition White PaperDocument9 pagesVendor Recognition White PaperAvinash MalladhiNo ratings yet

- Nota para Localização PDFDocument37 pagesNota para Localização PDFmarcosoliversilvaNo ratings yet

- SFIN - Documents Replication in CFINDocument25 pagesSFIN - Documents Replication in CFINmadhu100% (1)

- Sap (Fico) : SAP FI-Organization StructureDocument2 pagesSap (Fico) : SAP FI-Organization StructureChandrashekher EdumalaNo ratings yet

- Unity FSP MFG 06 V01R00Document83 pagesUnity FSP MFG 06 V01R00sowjanyaNo ratings yet

- Project System Module (PS) : CSU ChicoDocument38 pagesProject System Module (PS) : CSU ChicoKumar Venkat SNo ratings yet

- Design Document Co Profitabilty Analysis Author/ApproverDocument19 pagesDesign Document Co Profitabilty Analysis Author/ApproverAncuţa CatrinoiuNo ratings yet

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshNo ratings yet

- Ficobbpfinalone10022011 120815114154 Phpapp02Document146 pagesFicobbpfinalone10022011 120815114154 Phpapp02prashantaiwaleNo ratings yet

- 1qm S4hana1909 BPD en UsDocument46 pages1qm S4hana1909 BPD en UsMarceloNo ratings yet

- j62 S4hana2021 BPD en BRDocument76 pagesj62 S4hana2021 BPD en BRSandra Amadi100% (1)

- SAP BiddingDocument36 pagesSAP BiddingLakhya Pratim BaruahNo ratings yet

- Migrating Classic GL To S4 HANA Finance1Document10 pagesMigrating Classic GL To S4 HANA Finance1shaiNo ratings yet

- 1MV S4hana1909 BPD en XXDocument14 pages1MV S4hana1909 BPD en XXBiji RoyNo ratings yet

- Fica ExcelDocument171 pagesFica ExcelYash GuptaNo ratings yet

- OpenText VIM - Rollout Criteria and Event Linkages - SAP BlogsDocument9 pagesOpenText VIM - Rollout Criteria and Event Linkages - SAP BlogsDavid CoelhoNo ratings yet

- SAP GST Questionnaire-MesprosoftDocument3 pagesSAP GST Questionnaire-Mesprosoftnagesh99No ratings yet

- Sales Area: S / 4 HANA ContentDocument34 pagesSales Area: S / 4 HANA ContentEnrique Israel Flores ZúñigaNo ratings yet

- Detailed SAP Interface Design Fundamental DocumentDocument4 pagesDetailed SAP Interface Design Fundamental Documentamitava_bapiNo ratings yet

- First Nature, Second Nature and Metropolitan LocationDocument32 pagesFirst Nature, Second Nature and Metropolitan LocationCristóbal GuerraNo ratings yet

- Bechelor ThesisDocument71 pagesBechelor ThesisLê KiênNo ratings yet

- AppendixDocument4 pagesAppendixJayanga JayathungaNo ratings yet

- Multiattribute Utility FunctionsDocument25 pagesMultiattribute Utility FunctionssilentNo ratings yet

- Corporate Level Strategy Addresses The Entire Strategic Scope of The FirmDocument19 pagesCorporate Level Strategy Addresses The Entire Strategic Scope of The FirmOpshora AliNo ratings yet

- Diamond Strategy ModelDocument3 pagesDiamond Strategy ModelMERINANo ratings yet

- Economics of Strategy: The Vertical Boundaries of The FirmDocument49 pagesEconomics of Strategy: The Vertical Boundaries of The FirmVanessa HartonoNo ratings yet

- The Fundamental Freedom To Trade by Edward L. HudginsDocument9 pagesThe Fundamental Freedom To Trade by Edward L. HudginsmirunelutuNo ratings yet

- Basic Economic ProblemsDocument146 pagesBasic Economic ProblemsRichard DancelNo ratings yet

- Week 7 Practice 101Document18 pagesWeek 7 Practice 101David LimNo ratings yet

- CH - 11 - Introduction To Supply Chain ManagementDocument72 pagesCH - 11 - Introduction To Supply Chain ManagementYogesh GirgirwarNo ratings yet

- Simu GuidelinesDocument54 pagesSimu Guidelinesniket mehtaNo ratings yet

- W08 - Managerial Decisions in Competitive Markets-FJODocument41 pagesW08 - Managerial Decisions in Competitive Markets-FJOGhasan Rasendriya PutraNo ratings yet

- Retail Management Black BookDocument82 pagesRetail Management Black BookShahrukh KhanNo ratings yet

- Financial Ratio Analysis As Determinant of Profitability in African Banking IndustryDocument10 pagesFinancial Ratio Analysis As Determinant of Profitability in African Banking IndustryjaneNo ratings yet

- Analisis General CompetitivoDocument12 pagesAnalisis General CompetitivoluisNo ratings yet

- 1 Business ActivityDocument4 pages1 Business ActivityAnalía gonzalezNo ratings yet

- An Analysis and Valuation Of: Rak Ceramics (Bangladesh) LTDDocument30 pagesAn Analysis and Valuation Of: Rak Ceramics (Bangladesh) LTDFarzana Fariha LimaNo ratings yet

- Managerial Economics Sees1Document19 pagesManagerial Economics Sees1doraline0911100% (2)

- Answer Key Bank Soal Micro UAS - Tutorku - 2020Document128 pagesAnswer Key Bank Soal Micro UAS - Tutorku - 2020Vriana ZenNo ratings yet

- XA Risk Reward RatioDocument4 pagesXA Risk Reward Ratiocarlos.ernesto.aa2023No ratings yet

- Performance Based PayDocument22 pagesPerformance Based PaySonam GondlekarNo ratings yet

- Kojima, K., Ozawa, T. (1984), Micro - and Macro-Economic Models of Direct Foreign InvestmentDocument21 pagesKojima, K., Ozawa, T. (1984), Micro - and Macro-Economic Models of Direct Foreign InvestmentGabriel MerloNo ratings yet

- MANAGERIAL ECONOMICS NOTES Unit-5 MBA 1stDocument6 pagesMANAGERIAL ECONOMICS NOTES Unit-5 MBA 1stRUBA NASIMNo ratings yet

- Managerial Economics: Cheat SheetDocument110 pagesManagerial Economics: Cheat SheetSushmitha KanasaniNo ratings yet

- Potato Corner Pestle AnalysisDocument2 pagesPotato Corner Pestle AnalysisJeremia DaNo ratings yet

Business Blueprint Controlling: Synokem Pharmaceuticals LTD

Business Blueprint Controlling: Synokem Pharmaceuticals LTD

Uploaded by

Gudia SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Blueprint Controlling: Synokem Pharmaceuticals LTD

Business Blueprint Controlling: Synokem Pharmaceuticals LTD

Uploaded by

Gudia SharmaCopyright:

Available Formats

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Business Blueprint

Controlling

SAP S/4 HANA

Submitted to

Synokem Pharmaceuticals Ltd.

14/486, Sundar Vihar, Outer Ring Road

Paschim Vihar, Delhi 110087

T: 011-25271800

Email: enquiry@synokempharma.com

Submitted by

Tables of Contents

Contents

INTRODUCTION............................................................................................................4

Confidential Document Page 1 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

2. ORGANIZATION STRUCTURE........................................................................................5

3. CONTROLLING MODULE INTRODUCTIONS........................................................................5

3.1 Functional Scope of CO Module.............................................................................7

3.2 Controlling Module Integration with other Modules....................................................8

4. SAP OVERVIEW......................................................................................................10

4.1 Client............................................................................................................10

4.2 Operating Concern.............................................................................................10

4.3 Controlling Area...............................................................................................10

4.4 Company Code..................................................................................................10

4.5 Controlling Structure.........................................................................................11

4.6 Profit Center Hierarchy.......................................................................................11

4.7 Cost Center Hierarchy........................................................................................11

5. MASTER RECORD.....................................................................................................12

5.1 Cost Element Master Data....................................................................................12

5.2 Cost Center Master Data:....................................................................................13

5.3 Activity Type:..................................................................................................14

5.4 Internal Order..................................................................................................14

5.5 Profit Center:..................................................................................................15

6. BUSINESS PROCESS LIST IN CONTROLLING.....................................................................15

6.1 Cost Element Accounting:....................................................................................15

6.2 Cost Center Accounting:......................................................................................17

6.3 Internal Order..................................................................................................22

6.4 Profit Center...................................................................................................25

6.5 Product Costing................................................................................................26

6.6 Profitability Analysis..........................................................................................39

..............................................................................................................................45

7. SAP REPORTS.........................................................................................................47

INTRODUCTION

This document summarizes the findings of the CSPL consulting team and Synokem Team, with respect

to SAP processes to be implemented in Synokem.

The information contained in this blue print was gathered through above activities during different

phases of the project i.e. Reviews of business processes, Business procedures, and documentation and

Confidential Document Page 2 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Relevant reports. These project results were devised and decided on by the project team and the

department experts from Synokem during the Business Blueprint project phase.

The purpose of Business Blueprint document is to form the basis and guidelines to move

forward to the Realization Phase. The information gathered and documented in the Blueprint is

sufficient for the team to go forward into the Realization phase.

This document aims to describe the future business solution based on SAP software. Any additional

explanations that are only relevant when the project is in progress will be provided in other form of

document like User Manual, Configuration Document etc.

2. Organization Structure

Confidential Document Page 3 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

3. Controlling Module Introductions

Controlling provides you with information for management decision-making. It facilitates coordination,

monitoring and optimization of all processes in an organization. This involves recording both the

consumption of production factors and the services provided by an organization.

As well as documenting actual events, the main task of controlling is planning. You can determine

variances by comparing actual data with plan data. These variance calculations enable you to control

business flows.

Income statements such as, contribution margin accounting, are used to control the cost efficiency of

individual areas of an organization, as well as the entire organization. The following are the basic

requirements of controlling module

Cost control

Costs are tracked at the origin

Responsibility is fixed for costs incurred.

Internal orders

Transparent costing system is maintained for internal jobs or responsible areas.

Budgetary control is exercised for operating and capital expenses.

Product costing

Confidential Document Page 4 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Product cost planning at the beginning of the year/period

Accurate product / process costing during the course of production

Report of cost in summarized form

Profitability Analysis

Analysis of reports on the basis of customer, country, product, plant,

Sales organization, company code.

Sales analysis

Features in Controlling Module

Controlling (CO) module is integral components of standard SAP S4 HANA system. Controlling module

provides information to the organization for managerial decision-making and facilitates

coordination, monitoring and optimization of processes in an organization.

The data update in controlling module is on line real time with any business transaction having

financial implication and processed in any other module. SAP S4 HANA achieves this through tight

integration of CO module with rest of the modules.

For the purpose of mapping various existing business processes along with improvements, if any the

following sub-modules within CO module in SAP S4 HANA are proposed to be considered for

implementation at Synokem in Controlling area - SYPL

Cost Element Accounting

Cost elements are no longer required in SAP S/4HANA Finance because they are created as G/L

accounts using Transaction FS00 and are part of the chart of accounts. A new field for the cost

element category has been introduced in the G/L master record. The default account

assignment is maintained using Trans- action OKB9 and not in the traditional cost element

master data. Customizing settings that require cost elements such as costing sheets or

settlement profiles and the business transactions where cost elements are used will continue to

be defined by the cost element category settings from the G/L master records. Cost element

groups continue to be available in SAP S/4HANA Finance for grouping the accounts and for

reporting purposes.

cost element accounting takes care of integrating FI general ledger accounts with CO. Cost

elements are a medium to update the data in CO with respect to posting of each business

transaction having financial implication and relevant to costing. In this component an enterprise

can get complete information about costs incurred within an enterprise during a period.

Cost Center Accounting

This functionality enables an enterprise to get information about the point of cost incurrence. It

provides information with respect to all costs assigned to their source, for management decision

making. It facilitates analysis of costs incurred for individual responsibility areas (cost centre).

Cost Centre Accounting facilitates the analysis of overhead costs according to where the costs

were incurred within the organization.

Internal Order

Confidential Document Page 5 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Internal orders are used to plan, collect, and settle the costs of event specific internal jobs and

tasks. The SAP system enables you to monitor your internal orders throughout their entire life-

cycle; from initial creation, through the planning and posting of actual costs, to the final

settlement. Internal order is also a powerful tool to collate expenses posted in FI for suitable

segregation, through creation and posting to statistical internal orders.

Profit Center Accounting

This sub-module offers the responsibility accounting function within an organization. Profit

Centre is an organizational unit similar to Cost Centre. Whereas the Cost Centre are for

analyzing and controlling costs, the objective of Profit Centre is to evaluate performance of

Profit Centre based on profitability and contribution analysis.

Dummy Profit Center

The dummy profit center is the default profit center to which data is posted when the

corresponding object has not been assigned to a profit center.

Product Costing

Product costing module of SAP has eased out all hassles of costing a manufactured Product.

Product Cost Controlling calculates the costs arising from the manufacture of a product or the

provision of a service. It enables you to calculate the minimum price at which a product can be

profitably marketed.

Profitability Analysis

Profitability Analysis (CO-PA) provides a focus on the results of a company’s doing business with

the external marketplace. It provides the ability to define which aspects or segments of that

market are relevant for analyzing operating results, such as profit by customer, product,

geographic area, sales organization, etc.

The aim of the system is to provide your sales, marketing, product management and corporate

planning departments with information to support internal accounting and decision-making.

3.1 Functional Scope of CO Module

The following Controlling sub-modules will be implemented during this implementation

Cost & Revenue Element Accounting

Master Data

Actual Posting

Information System

Cost Center Accounting

Master Data

Planning

Actual Posting

Information system

Internal Orders

Master Data

Planning & Budgeting

Confidential Document Page 6 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Statistical Actual Posting

Information system

Product Cost Planning

Standard Cost Estimate

Costing Variant

Cost Component Structure

Cost sheet for overhead

Information system

Product Cost by order

Basic Settings

Manufacturing Orders

Preliminary Costing

Period End Closing

Information system

Profit center accounting

Basic Settings

Master Data

Actual Postings

Information system

Profitability accounting

Structure

Master Data

Planning

Actual Postings

Information system

3.2 Controlling Module Integration with other Modules

Other SAP modules generate data that has a direct impact on CO. For example, when consumable items

are purchased, an expense is posted to the GL. At the same time, the expense is posted as a cost to the

cost center (or other object in CO) for which the items have been purchased. That cost centre’s costs

may later be passed on as overhead to a Cost Object. In addition to financial application Module,

following module integration are required.

Integration with FI

In SAP S/4HANA Finance, accounting documents are posted using a common document number. The FI

document for profit and loss (P&L) accounts still generates CO documents. To maintain consistency and

CO compatibility views, the document type and document number Customizing settings are maintained

for the internal CO postings and to assign the actual version of CO to the ledger. With the integration of

FI and CO, there is no requirement for a reconciliation ledger going forward. In the past, any CO-

related postings were updated in both the line item table (COEP) and totals table (COSP for

primary/COSS for secondary). With SAP S/4HANA Finance, the totals tables are no longer required

because data can be aggregated from the line item table, which is also used for reporting. This avoids

data redundancy. All actuals data continue to be stored in the line item table COEP.

Confidential Document Page 7 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Two new tables—COSP_BAK and COSS_BAK—have been created to store planned data related to primary

and secondary costs, respectively.

The Universal Journal has its own currency fields in FI while CO has its own currency settings. The

currency concept used separately in FI and CO has now been combined. You can enhance the journal

entry by adding the coding block and Profitability Analysis (CO-PA) characteristics. Access to old data in

tables is still possible via the compatibility views V_<table name>_ORI.

CO-FI Reconciliation

G/L account mapping of CO real-time integration with the new G/L is now obsolete. Secondary cost

elements are now created as G/L accounts and are part of the chart of accounts. On the configuration

side, document types that you want to use for posting in CO need to be defined and require the

indicator G/L to be set. These document types need to be linked to the CO business transaction via a

variant. The fiscal year variants of all controlling areas used by an organization and their assigned

company codes must be the same.

The Financial Accounting application area of SAP is a primary source of data for Controlling. The data

flow between the two components takes place on a regular basis. The relevant accounts in Financial

Accounting are managed in Controlling as cost elements or revenue elements. This enables us to

compare and reconcile the values from Controlling and Financial Accounting. Typically, most expense

postings to the General Ledger would result in a cost posting to CO. These expense postings to the G/L

could be manual journal entries, accounts payable postings, or depreciation postings from Asset

Accounting (FI-AA).

Integration with SD

Identification of Characteristics (E.g.: Product, Customer, Product Hierarchy, Division etc.) which will

flow from Sales Order to COPA. Identification of Value fields (E.g.: Sales Revenues, Discounts etc.)

which will flow to COPA through SD conditions. The SD module calculates revenues during billing with

the help of pricing mechanism and then enters it in the billing document. The billing document

transfers revenues directly to CO-PA.

Confidential Document Page 8 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Integration with MM

Identification of Characteristics Material Group and Manufacturer Code through MM Module. The

Logistics area of SAP also has numerous integration points with Controlling e.g. At the time of goods

receipt, the RM inventory will be valuated at moving average price, At the time of goods issue to

production order, the RM cost will be valuated at moving average price, At the time of goods receipt

from production, finished goods will be valued at standard price from standard cost estimate, the profit

center for materials is maintained in the material master.

Integration with PP

The Production Planning (PP) area of Logistics also works very closely with Controlling. Direct cost

would be absorbed through activity types where labor hours, Machine hours will be picked up from PP

master (Routing) and would be multiplied with the price which we maintain in the cost center

accounting in the combination of cost center and activity type.

Integration with PM

Organization should perform cost controlled activities for maintenance personnel time and material via

maintenance work orders. Technicians should enter actual hours for work orders and record all

part/service consumption on order. Costing department should perform regular cost settlement for

orders.

Integration with HR

The Human Resource application area of SAP is a primary source of data for Controlling. The data flow

between the two components takes place on a regular basis/month end /year end basis. The relevant

G/L’s are assigned in HR module for posting Salary & other costs and the same are managed in

Controlling as cost elements. This enables us to get data from HR module to Controlling module.

Confidential Document Page 9 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

4. SAP overview

4.1 Client

User working environment,in commercial, organizational, and technical terms, a self-contained unit in

SAP System with separate master records and its own set of tables. The Client is the highest level in the

SAP System hierarchy.

4.2 Operating Concern

Profitability Analysis (CO-PA) enables you to evaluate market segments, which can be classified

according to products, customers, orders or any combination of these, or strategic business units, such

as sales organizations or business areas, with respect to your company's profit or contribution margin.

The aim of the system is to provide your sales, marketing, product management and corporate planning

departments with information to support internal accounting and decision-making.

Operating Operating Concern Name

Concern

SYPL Synokem - Operating Concern

4.3 Controlling Area

Controlling Area represents a closed system for cost accounting purposes. A controlling area includes

single or multiple company codes that may use different currencies. These company codes must use the

same operative chart of accounts.

There will be one controlling area for Synokem Pharmaceuticals Limited and DNV Overseas Impex

Private Limited.

Controlling Area Controlling Area Name

SYPL Synokem - Controlling area

4.4 Company Code

The company code is the organizational unit that allows you to structure your enterprise from a

financial accounting perspective. The company code is an independent legal entity and it is the

smallest organizational unit of Financial Accounting for which a complete self-contained set of accounts

are drawn up for purposes of external reporting. This includes recording of all relevant transactions and

generating all supporting documents required for financial statements.

Company Code Company Name

9000 Synokem Pharmaceuticals Limited

9900 DNV Overseas Impex Private Limited

4.5 Controlling Structure

Confidential Document Page 10 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

The Controlling structure of Synokem Project is summarized as below:

Description Synokem Group Structure

Company code Cross-Company code cost

accounting

Chart of accounts SYPL

Company code currency INR

Filed status variant SYPL

Posting period variant 9000 & 9900

Fiscal year April to March (12 periods + 4

Special Periods)

Fiscal year variant V3

Operating Concern SYPL

Controlling area SYPL

Controlling area currency INR

4.6 Profit Center Hierarchy

Profit Center hierarchy is a tree structure which contains all profit centers in a controlling area and

reflects the organizational structure used in Profit Center Accounting. All the Profit Centers are

assigned to the Profit Center Groups and Profit Center Groups are assigned to Profit Center Hierarchy.

4.7 Cost Center Hierarchy

Cost Center Hierarchy is a tree structure representing all cost centers belonging to a controlling area,

Combining cost centers into cost center groups, and creating cost center hierarchies from these groups

by combining the groups according to decision-making area, area of responsibility, or management

area.

A cost center hierarchy comprises all cost centers for a given period and therefore represents the

whole enterprise. This hierarchy is known as the standard hierarchy.

5. Master Record

Master data determines the structure of the given application component in the SAP System and

remains essentially unchanged in a live system, that is, in the current settlement periods. Following

Master data will be created and maintained in the system. Authorized users will be able create,

change and maintain the master data.

The following are the Controlling Master Data is:

Cost Element Master data

Primary Cost Element

Travelling Expense

Selling Expense

Secondary Cost Element

Labor

Machine Hours

Cost Center Master data

Activity Type

Internal Order

Confidential Document Page 11 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Profit Center Master data

5.1 Cost Element Master Data

Cost and Revenue Element Accounting provides with an overview of the costs and revenues. Most of the

values are moved automatically from Financial Accounting to Controlling.

Cost Elements track the type of costs or spend. They form categories of costs that are independent

from external or financial reporting requirements, but helps management to track costs according to

internal accounting policies.

The primary Cost Elements are copy of P&L expense accounts from the financial chart of accounts.

Secondary Cost Elements are no longer tied to the accounts.

As per the SAP standard, all Income & Expenses related G/L must be created in system as a Cost

Element. And in Synokem we will follow the same.

Primary Cost Elements: A primary cost or revenue element is a cost or revenue-relevant item in the

chart of accounts, for which a corresponding general ledger (G/L) account exists in Financial Accounting

(FI).

Primary cost or Revenue element is created once if you define G/L account in the chart of accounts in

Financial Accounting (FI). At the time of creation of Primary Cost and Revenue Elements, the system

checks whether a corresponding G/L account exists in Financial Accounting.

Costs that are considered as primary cost elements include:

Consumption of Material costs

Production Direct cost

Admin Cost, Marketing Cost etc.

Costs for external procurement / External Services /external processing

Cost related to different Nature of Expenses

These costs are assigned to the order, for example, via primary costs, such as material withdrawals or

the purchasing of externally processed parts.

Secondary Cost Elements: Secondary cost elements are cost elements used to allocate costs for

internal activities. Secondary cost elements do not correspond to any G/L account in Financial

Accounting. They are only used in Controlling and consequently cannot be defined in FI as an account.

Costs that are considered to be secondary cost elements include:

Activity costs / Production Cost

Material overhead costs

Production overhead costs

Distribution of Cost to various Cost

These costs are allocated to the order via internal cost allocation.

Cost Element Group

The Cost Elements (both primary and secondary cost elements) with similar characteristics are

collected in Cost Element Groups. The cost element groups are used for the information system. The

cost element groups are used to process several cost elements in one transaction, such as in Cost

Center Planning, Distribution and Assessment. These groups are also used for report viewing purposes.

Confidential Document Page 12 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

The cost element group will facilitate better planning, allocation and reporting of costs. Using Cost

element Groups similar expense codes can be viewed in one group so that it will be possible to plan,

allocate and carry out analysis for a given cost object with ease and flexibility. For Example In case all

Personnel related costs are to be planned, displayed and analyzed in a single business transaction,

processing can be carried out using the Cost Element Group ‘Personnel Costs’ instead of choosing

repeatedly each of the numerous individual cost elements comprised in this group.

Production

Administration

Marketing

Dispatch

Accounts

HR

Sales Income

Other Income

5.2 Cost Center Master Data:

Cost centers in a controlling area represent a clearly delimited location where costs occur. The cost

centers are made on the basis of functional, settlement-related, activity-related, spatial, and/or

responsibility-related standpoints.

A cost center is assigned to exactly one profit center & one Business Area to which all costs of the cost

center can be attributed. By Assigning Profit Center and Business Area to Cost Center Master, system

updates automatically the Profit Center and Business Area, when any Cost is incurred in the cost

center.

Each Plant will be classified i nt o cost center Groups and further subdivided into cost Center

based on the services provided.

The entire cost center structure will be visible in a tree form on a single screen thus giving an overview

of the entire organization from the cost controlling perspective at a glance. Generally we can divide

the cost centers into two types i.e. production cost centers and service cost centers. Production cost

centers would be tied to work centers so as to use the activity types

Cost Center Group

Cost Center Groups are used to build cost center hierarchies, which summarize the decision-making,

responsibility, and control areas according to the particular requirements of the organization. The

individual cost centers form the lowest hierarchical level.

Cost Center Hierarchy are easily adapted and modified due to changes in the organization. New Cost

Centers are also added to the Hierarchy at any later date by creating the relevant Cost Center Master

Record and linking the Cost center to the relevant hierarchy area. Synokem Cost Center Group:

Production

Administration

Marketing

Sales

Accounts

HR

Cost Center Standard Hierarchy:

Cost Center Standard Hierarchy is a tree structure representing all cost centers belonging to a

controlling area from a Controlling perspective. There must be at least one group that contains all cost

centers and represents the entire business organization. This cost center group is described as the

standard hierarchy.

Confidential Document Page 13 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

At Synokem Project there is one Controlling Area & there will be one Standard Hierarchy, each

Company Code to which all the Cost Center groups & cost centers will be assigned.

5.3 Activity Type:

Activity Type is a unit that classifies the activities performed in a cost center with in the Controlling

Area. To plan and allocate the activities, the system records quantities that are measured in activity

units. Activity quantities are valuated using an activity price (allocation price).

The Activity Types at Synokem would help in categorizing production activities provided by a cost

center. These would be used for allocating costs of internal activities to the respective production

departments. The activity types would be defined in such a way that all activity types be measured in

terms of quantity and value.

5.4 Internal Order

Internal orders are used to plan, collect, and settle the costs of internal jobs and tasks. This component

enables to monitor internal orders throughout their entire life-cycle; from initial creation, through the

planning and posting of all the actual costs, to the final settlement. Internal orders are categorized in

to the following:

Overhead Cost: Orders used only for monitoring objects in Cost Accounting (such as, Conveyance,

Travelling Expenses, Employee Salary Expenses, Vehicle Maintenance cost etc.)

Investment Order: Productive orders that are value-added, that is, orders that can be capitalized

(such as in-house construction).

An Internal Order is assigned to exactly one profit center, one Business Area & one Cost Center to which

all costs of the Internal Order can be attributed. By Assigning Profit Center, Business Area & Cost

Center to Internal Order Master, system updates automatically the Profit Center, Business Area and

Cost Center when any Cost is incurred in the Internal Order.

5.5 Profit Center:

Profit Center Accounting evaluates the profit or loss of individual, independent areas within an

organization. These areas are responsible for their costs and revenues. Profit Center Accounting is a

statistical accounting component in the SAP system. This means that it takes place on a statistical basis

at the same time as true accounting. In addition to costs and revenues, Profit Center display key

figures, such as, return on investment, working capital or cash flow on a profit center.

A profit center is a management oriented organizational unit used for internal controlling purposes.

Dividing company up into profit centers allows to analyze areas of responsibility and to delegate

responsibility to decentralized units, thus treating them as “companies within the company”.

N.B.: Profit center code would be finalized at the time of master data training & realization.

Confidential Document Page 14 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Profit Center Group

A profit center group is a hierarchical structure of profit centers. Profit center groups are used for

reporting, allocations or in various planning functions, where it does not make sense to enter or display

data at the lowest level (with a high level of detail).

Additional Balance sheet and Profit & Loss Accounts

By default, all profit-related accounts as well as selected balance sheet accounts (payables and

receivables, assets, material stocks, and work in process) are transferred to Profit Center Accounting. If

no profit center is set for a specific transaction, the system will not allow the user to posts for any kind

of transactions. It requires greater flexibility in finding the profit centers, and also defines the

derivation rules for this purpose.

6. Business Process List in Controlling

The Following are the CO Business Process List available for Synokem Project:

Cost Element Accounting

Cost Center Accounting

Internal Order Planning & Actuals

Profit Center Accounting

Product Cost Controlling

Production Order Settlement

Profitability Analysis

6.1 Cost Element Accounting:

Cost Element Accounting provides you information or overview of all the Expenses and Revenues

incurred in the organization. All most all the values flow from Financial Accounting to Controlling. In

Synokem, use of Cost Element accounting will eliminate the need to enter cost data separately. Each

Cost or Revenue account in the organization flow from FI to CO through Cost & Revenue Element.

Primary Cost Element:

By using Primary Cost Element concept, the costs that originate outside of CO will be captured. Primary

cost elements correspond to all Profit & Loss G/L accounts in Financial Accounting. Using Secondary

Cost Element concept, the costs will be allocated for internal activities. Secondary cost elements do

not correspond to any G/L account in financial accounting. They are used only in Controlling.

The link between Finance and Controlling is General Ledger Account = Primary Cost element.

Secondary Cost Element:

Secondary cost elements are like production costs, material overheads, production overheads are

created and administered in only Controlling. Secondary Cost Elements are used for Reconciling the

internal cost allocation, overhead calculation, settlement of transaction, Reposting, Distribution and

Assessments.

Secondary Cost Element does not flow from FI to CO. During Month end activities internal cost

allocations like postings from one cost center to other cost centers for the exact expenses incurred by

each department during the period or year are done. Postings to these accounts do not affect the

Financial Accounting.

Confidential Document Page 15 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Secondary cost element belongs to internal settlements / Overhead Rates / Assessments is defined in

the Secondary cost Element master record.

Examples of secondary cost elements include:

Assessment & Distribution of cost elements

Cost elements for Internal Activity Allocation

Cost elements for Order Settlement

Cost Element Category

Cost element category determines which cost elements can be used for which business transactions.

SAP distinguishes between:

Primary Cost Element Categories.

Secondary Cost Element Categories.

The Primary Cost Element Categories:

01 General Primary Cost Element - This cost element category can be debited for all primary

postings.

11 Revenue Elements - This cost element category can be used to post revenues.

12 Sales Deductions - This cost element category can be used to post deductible items.

22 External Settlement - This cost element category can be used to settle order, Project to

objects outside of controlling. Ex: Settlement to Assets.

The Secondary Cost Element Categories:

21 Internal Settlement - Used to settle internal order costs to objects such as cost centers.

31 Order/Project Result Analysis - Used to calculate WIP

41 Overhead - Used to allocate from Cost Centers to production orders

42 Assessment - Used to allocate costs center to costs center during assessment

43 Activity type allocations - Used when activities are confirmed in PP.

In SAP cost elements can be created either manually or automatically( advisable manually).

At Synokem, Primary cost element category 01 would be using for all expense accounts (other than

those coming from SD module), 11 would be for Revenues, 12 would be for expenses which are coming

from SD module and 22 would be for Settlement to Asset Accounting & for Change in inventory GL

Accounts

Secondary Cost element category 21 would be using for settlement of internal order, Plant Maintenance

Order to cost center, 31 would be for calculation of WIP, 41 would be for overhead calculation, 42

would be for Assessment (from service cost center to production cost center) & 43 would be for Activity

type.

Confidential Document Page 16 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

6.2 Cost Center Accounting:

Cost Center Accounting is used for the purpose of controlling within the organization. The costs

incurred to the organization should be transparent. This enables to check the profitability of individual

functional areas and provide decision-making data for management. This requires that all costs are

assigned according to their source. However, source-related assignment is especially difficult for

overhead costs. Cost Center Accounting analyzes the overhead costs according to where they were

incurred within the organization. Cost centers are linked to profit centers in as many to one or a one on

one relationship such to allow for profit and loss reporting at the profit center level.

Dividing an organization into cost centers allows achieving several goals, depending on the cost

accounting method.

1. Assigning costs to cost centers determines where the costs are incurred within the organization.

2. Plan costs at cost center level; can check cost efficiency at the point where costs are incurred.

3. To assign overhead costs accurately to individual products, services, or market segments, it needs

further allocate the costs to those cost centers directly involved in the creation of the products or

services. From these cost centers it gives the use different methods to assign the activities and costs

to the relevant products, services, and market segments.

Confidential Document Page 17 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Cost center Accounting can be explained by the following points:

Master Data

Cost Center Planning

Manual Actual Posting

Period End Closing

Cost Center Planning

Cost center planning involves entering plan figures for costs, activities, prices for a particular cost

center and a particular planning period. It determines the variances from these figures when it is

compared these plan values with the costs actually incurred. These variances serve as a signal to make

the necessary changes to your business processes.

Cost center planning forms a part of the overall business planning process, and it is a prerequisite for

standard costing. The main characteristic of standard costing is that values and quantities are planned

for specified timeframes, independently of the actual values from previous periods.

The plan costs and plan activity quantities to determine the (activity) prices. These prices are used to

valuate internal activities during the ongoing period, i.e., before the actual costs are known.

Cost center planning has the following objectives:

To plan the structure of the organization’s future operations for a clearly defined time period.

It defines the performance targets and target achievement grades, and it should consider the

internal and external (market) factors affecting the organization.

To control business methods within the current settlement period. It ensures to keep as closely

as possible to the plan. Iterative planning lets adapt the target performance to reflect any

changes in the organizational environment.

Cost Center Planning can be done by the following methods:

a. General Cost Center Planning

b. Manufacturing Cost Center Planning

a. General Cost Center Planning

During the Cost Center budgeting process, the managers of non-operational cost centers such as sales,

marketing, administrative, research and development etc. plan the costs for various cost

types/elements on their respective cost centers .It gives Possibility to compare planned and actual

costs, monitoring of costs on cost centers.

Confidential Document Page 18 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Based on the General Cost Center Planning at the end of the Month / Year end system displays the

variances between standard cost center planning and Actual cost incurred during the period.

b. Manufacturing Cost Center Planning

The manufacturing cost centers plan the costs for various Activity types/elements for their respective

cost centers. In addition, the quantities of activity types needed for production and their prices are

determined.

At the month end there is a Possibilities to compare planned and actual costs, by monitoring the costs

on cost centers. Allocation of production & overhead costs to products (via activity types)

Cost Center Actuals Postings

The Actual posted values enables to monitor costs on an ongoing basis. These postings enable you to

recognize variances at an early stage, and to take the necessary counter measures.

Actual cost entry involves transferring primary costs to the Controlling (CO) application component. In

the CO component, this transfer occurs real-time from the components Financial Accounting (FI), Asset

Accounting (FI-AA), Materials Management (MM), Production Planning (PP) and Payroll Accounting (PA-

PA). This is achieved by entering a cost accounting object (such as a cost center or an internal order)

during account assignment.

Posting from MM

Certain material are not stocked but is charged off at the time of purchase itself. The item is assigned

to a cost center in the purchase order. In this case consumption is booked at the time of goods receipt.

For example: Printing & Stationery is issued and cost booked to Administration Cost Centre.

Posting from Asset Accounting

Each asset is assigned to a cost centre and depreciation is debited to it during Depreciation Run at

period end.

Confidential Document Page 19 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Posting from FI

During expense booking in FI the relevant Cost Centre is assigned which enables the flow of the expense

to the relevant cost centre. Note: Integrated value flow will happen to cost center when expenses are

posted in financial accounting general ledger account of expenses. Cost center line items with date and

value of posting will automatically updated in CO.

Note: Integrated value flow will happen to cost center when expenses are posted in financial

accounting general ledger account of expenses. Cost center line items with date and value of posting

will automatically updated in CO.

Allocation:

With the introduction of the new Universal Journal in SAP S/4HANA Finance, all the CO postings are

posted directly to the Universal Journal, Secondary cost elements are now part of G/L accounts in FI

and don’t require separate assignment in CO.

Cost Allocation:

Cost allocations will be performed under controlling area. Company code can allocate their costs using

the Standard allocation tools provided by SAP. Cost allocations in SAP shall be done using the procedure

of Distribution & Assessment.

Under this procedure, the costs collected on a cost center during the accounting period are allocated to

receivers. These are indirect allocation methods for which user-defined keys such as percentage rates,

amounts, or posted amounts provide the basis for cost/quantity assignment.

These methods are easy to use as the keys and the sender/receiver relationships are usually defined

only once.

For example, Salary costs are collected on a cost center for each period & then can be allocated using

the process of reposting or distribution/ assessment cycles at the end of the period according to the

number of employees in each cost center. Methods of cost allocation include:

Distribution which moves primary costs from one object to another using the original posted

primary cost elements.

Assessments which moves primary and secondary costs from one object to another using a

secondary cost element.

Reposting which moves primary costs from one object to another using the original posted

primary cost element.

Distribution:

Distribution is a method of internal cost allocation that allocates primary costs. Main feature of this

process is that the original cost element is retained in the receiver cost center. Information about the

sender and the receiver is documented in the Controlling document.

Features of Distribution-

The original, primary, cost element is retained.

Sender and receiver information is documented with line items in the CO document.

Distribution will work only for Primary Cost Elements and it will not work for Secondary Cost

Elements.

Assessment

Confidential Document Page 20 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Assessment is a method of internal cost allocation by which the costs of a sender cost center is

allocated (transferred) to receiver CO objects (orders, other cost centers, and so on) under an

assessment cost element (category 42). The method works according to the keys defined by the user. It

is used when it is unimportant for the user to know the breakdown of costs that a cost center will

receive in an allocation. Further analysis is available through CCA reporting.

Features of Assessment-

The original cost elements are grouped together into assessment cost elements (secondary cost

elements). The original cost elements are not displayed on the receivers.

Assessment will work both primary and secondary cost elements unlike Distribution

Periodic Reposting:

Primary posting such salaries are collected on an allocation object (cost center, overhead cost order) to

restrict the number of FI posting as much as possible. Later, these costs are allocated during the period

–end closing to the corresponding controlling objects. During this process, we can only repost primary

cost and the original cost element remains the same. Items required for manual reposting of cost:

Sending Cost center

Receiving cost center

Cost element

Manual Reposting of Cost:

We use the manual reposting of the cost function mainly to adjust (correct) posting errors.

When we make an internal reposting, the primary costs are reposted (under the original cost element)

to a receiving cost center. If the initial transaction is posted using an incorrect cost element, the

transaction must be corrected in the original application component in order to ensure reconciliation

between external and internal accounting.

Note that no sender check is made, in other words the system does not check whether the costs we

repost actually exist on the sending cost center. This means that negative costs may appear on the

sending cost center.

Items required for manual reposting of cost:

Sending Cost center (From we need to remove the cost)

Receiving cost center (to which we transfer the cost)

Cost element (From where we need to repost)

Reposting of Line Items:

The function for reposting line items enables us to repost specific line items from Management

accounting documents. This function is designed to enable us to correct primary postings that we

assigned to the wrong accounts. To do this, the Management Accounting document must contain a

reference to the original FI document.

Reposing line items is the equivalent of a reversal on the sender object. We can also enter more than

one receiver object.

Confidential Document Page 21 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

If we repost a line item in Management Accounting, the original account assignment object remains

noted in the FI document. To correct the account assignment object in the FI document, we will need

to reverse the FI document. If we have already carried out a line item reposting in Management

accounting for this document, we will first need to reverse this reposting before we can reverse the

document in FI.

Items required for manual reposting of cost:

Reference document number.

Receiving cost center (to which we repost the cost).

Document types for Cost Accounting

For every posting in CO the SAP System creates a numbered document. The document numbers are

unique to each controlling area since each number is assigned only once.

Every transaction that you carry out on the controlling area level has to be assigned to a number range

group. Each group is in turn attached to certain transaction(s). The document number range in CO

independently from the fiscal year.

A separate document number ranges for each transaction type has been created as follows:

Actual primary postings will have the number ‘1’ as the first digit of the document number.

Planning transactions will have the number ‘2’ as the first digit of the document number.

Actual secondary postings will have the number ‘3’ as the first digit of the document number.

Other transactions (e.g. variance calculation, activity allocation) will have the number ‘4’ as the first

digit of the document number.

Type of Transaction From To

Actual Primary Postings 10000000 19999999

Planning Transactions 20000000 29999999

Actual Secondary Postings 30000000 39999999

Other Transactions 40000000 49999999

N.B.: Number ranges would be decided at time of realization.

Confidential Document Page 22 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

6.3 Internal Order

Internal orders are cost objects in CO. They collect actual and plan revenues and cost, statistical and

activity data. Data is collected in the order at the transaction level. Based on the order’s purpose, the

values can be settled (periodically or all at once) to a final receiver such as a cost center, general

ledger account, asset, another internal order, profitability segment, etc. The order’s inflows as well as

outflows can be reported in the Internal Orders Information System. In the delivered reports, the user

can drill down through the original documents to the line item.

Order purpose is defined in order type. Standard order types that are required for our business scenario

are provided in the system. An Internal Order master record is created on the functional side and

includes the attributes established in the order type. Use a statistical order to manage statistical detail

with value detail posted to a cost center.

An internal order type provides the following default parameters to the orders:

1. Budget Profile

2. Settlement Profile

3. Planning Profile

4. Object Class

5. Functional area to be updated

6. Release Status

7. Control indicators for revenue postings

8. Commitment item & integrated Planning data

9. Field selection

10. Number Intervals

Confidential Document Page 23 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Internal Order Accounting

Internal orders are normally used to plan, collect, and settle the costs of internal jobs and tasks.

Internal orders can be effectively utilized for Capitalization Project the SAP system enables you to

monitor your internal orders throughout their entire life-cycle; from initial creation, through the

posting of all the actual costs, to the final settlement.

An Internal Order is also known as overhead orders and is used to monitor the costs of a Cost

restricted job (Project costs) or time-restricted job , such as marketing campaign, etc. where the

costs does not directly relate to a particular source object (cost center). In such cases, actual cost for

a particular project\event are recorded on the internal order, which on completion of the event are

analyzed with respect to the total costs incurred. Internal order can be a) Statistical or b) Real. The

real orders can be settled to AUC or the responsible cost objects (cost centers).

For each capitalization project Internal Order has to be created with budget and time schedule.

Budgetary control will be activated for certain order type. Order will be created for each asset or

even at lower level according to the need. Order type created for this type of order will be real in

nature. Cost incurred for the project will be initially captured on the internal orders and subsequently

settled it to an Asset that can be also AUC.

The authorized person would create the Internal Order under respective order type. The

mandatory information is:

Order type

Order number

Settlement rule

Name and Description of the orders

The general ledger postings in FI would be assigned to respective internal orders at the time

of transaction processing.

If the material consumption were required for the order, a reservation would be created.

MM will issue the material against the reservation and consumption would be booked on the

order.

In case of direct procurement, a purchase requisition would be raised. The stores will issue

a purchase order which will contain reference of internal order against the requisition and

procure the material. At the time of GR the consumption would be booked on the order.

Preliminary cost reports would be reviewed by the responsible person. The adjustments to

actual data, if any would be identified.

The adjustments should be identified with respect to GL correction or cost object

correction.

If GL correction is required, the same should be intimated to the FI department for

rectification.

Preliminary report of actual costs taken from the system. If approvals are required the

report is sent for approval. In case of adjustments suggested by the approving authority, the

same should be executed.

Confidential Document Page 24 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Once the order is complete, the status of the order would be set to technically close.

Settlement rule would be processed and settlement transaction is executed in test run. If

the results are satisfactory on verification, the settlement is executed in update run. This

will result in transferring Project Cost to an Asset or to a CWIP for capitalization

The detailed steps involved are as under:

Activity Step Data input Data output Transaction Responsibility/ Remarks

Code in Authorization

SAP

Creation of 1 Order type, Creation of KO01

Internal Order company code, Internal Order

business area,

responsible

person, etc.

Creation of 2 Order group Internal KOH1

order group name, Orders can be

description, grouped

relevant order

numbers

Overall Planning 3 Order number, Plan data get KO12

against internal version, order generated

order type, amount

Cost Element 4 Version, period, Element wise KPF6

wise expense internal order planning at IO

planning no., cost element level

no. amount etc.

Individual 5 True Order no., IO get created KO88 For Real

Settlement of IO settlement Orders

period, only

processing type

Collective 6 True Order, IO group gets KO8G For Real

Settlement of IO Selection variant, settled Orders

period, only

processing type

Statistical Order

Statistical orders are used to collect costs to evaluate costs that cannot be itemized in detail in cost

element or cost center accounting. Costs could be booked only once to CO. When cost centers are real

cost objects, the internal orders serve as a statistical record. That means no further settlement from

the statistical order.

It is achieved by assigning the actual costs to a cost center and statistically to an internal order. The

costs will then appear under the original cost element both on the cost center (real costs) and on the

order (statistical, for information purposes only).

An example for statistical order is travelling, LTA, Conveyance, Mobile expenses incurred by each

employee can be tracked through internal Order. At the end of the month end once internal order

report is executed based on Primary Cost Element system gives the information about the person wise

details of his expenses during Travelling.

Confidential Document Page 25 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

S. No Internal Orders

1 Travelling Expenses

2 Telephone Expenses

3 Maintenance Expenses

4 Employee Salary Expenses

Investment Order

A tool used to monitor internal tasks whose costs are to be settled to a fixed asset account. It performs

preliminary costing on capital investment orders, make postings to them, and settle them to assets

under construction. On completion of the task, the order is settled to one or more assets.

An Example for Investment order is : At the time of project set up there would be some preoperative

expenses incurred, all those expenses has to be capitalized once the project is completed, For

Capitalizing the preoperative expenses SAP Provides to capitalize through Investment Order.

Internal Order Planning

Planning is the expected amount of spending during the lifetime of the internal order.Two ways of

planning are there. The first one is overall planning which does not require any detailed information

like cost elements etc. The overall amount will be broken for year-wise, if required

When it is required to have a detailed planning, the planning is carried out according to primary and

secondary cost elements.

6.4 Profit Center

A profit center is an organizational unit in accounting that reflects a management-oriented structure of

the organization for the purpose of internal control. Profit Center analyses internal profit or loss e.g.

for branch, line of business, site, etc. Profit Center Accounting is a statistical accounting component.

Confidential Document Page 26 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

Because it takes all the transaction data postings in other components and represents it in the form of

profit center oriented point of view. The postings in profit center accounting are statistical postings,

since the profit center is not an account assignment object in Controlling.

Methods of Calculating Profits in Profit Centers:

● By Time Reference (periodic Calculation or transaction Based Calculation)

● By content of period accounting

In Profit Center Accounting, the data is stored and displayed by period and account. This corresponds to

the organizational principle in Financial Accounting. As a result, the uniform report structure in these

two components makes possible to reconcile the data in cost accounting and financial accounting based

on cost elements.

Profit center Assignment

In Customizing, Profit center are assign to all account assignment objects for which contain profit-

related data (such as cost centers, Internal Orders) to profit centers. By doing this, company is split

into profit centers.

These assignments make it no longer necessary to post data explicitly to profit centers. The system

automatically transfers the data to Profit center accounting when it is posted to the original object &

can reflect both actual and plan data from the assigned objects in Profit Center Accounting.

Integration

The following data is transferred to Profit Center Accounting:

Revenues and sales input - through assignment of sales document items

Direct costs - through assignment of production orders and cost objects

Overhead costs - through assignment of account assignment objects from Overhead Cost

Controlling (cost centers, orders etc.)

Profit centres are assigned to the following:

Assigning Materials:

Assignments of materials to profit centres provide the default values for assignment of Sales Orders

With internal goods movements also (such as stock transfers or material withdrawals) the profit centre

is derived from the material master. The assignment of materials also forms the basis for the transfer of

material stocks to Profit Centre Accounting. In order to assign materials to Profit Centres, it is

important that for each Profit Centre a separate Plant is created.

Assigning Sales Orders:

It is necessary to assign Sales Orders to profit centres in order to reflect sales revenues and sales

deductions. When the goods issue is posted, the cost of goods sold is also passed on to the profit centre

of the sales order.

Assigning Manufacturing Orders

Confidential Document Page 27 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

A manufacturing order is a PP production order, when we create a production order; the system

proposes the profit center from the master record (plant segment) of the material being produced.

Consequently, we usually do not have to enter it manually.

All the costs and internal cost allocations posted to the production order are passed on to the assigned

profit center, along with the credit posted when the production order is delivered or settled. The

assignment of production orders also lets us transfer work in process for open orders to Profit Center

Accounting.

Each production order is assigned to a plant. Each plant, in turn, is assigned to a company code, which

is assigned to a controlling area. This controlling area must be the same as that to which the profit

center is assigned.

Assigning Internal Orders

We need to assign internal orders to profit centers in order to be able to observe the flow of overhead

costs from Financial Accounting and their allocation through internal accounting from a profit center

point of view. Internal activities capitalized during order settlement are also assigned to the profit

center of the internal order.

Assigning Cost Centres

It is necessary to assign cost centres to profit centres so that we can reflect all the primary costs from

Financial Accounting and all secondary allocations from Cost Centre Accounting in Profit Centre

Accounting.

By Assigning Profit Center to different objects SAP System Provides solution for generation Profitability

and select balance sheet items balances at plant level and at each branch and grouping them together.

In Synokem the Profit Centers are defined at time of realisation:

Based on the Above Profit Center System generates automatically profit center wise Profit & Loss

Account and Balance sheet account.

6.5 Product Costing

It is a tool used to estimate standard cost per unit of a product & to determine the cost of goods

manufactured & cost of goods sold. This tool contains the following areas:

1. Product Cost Planning

2. Cost Object Controlling

3. Actual Costing or Material Ledger

4. Information Systems

Cost Components

5. Material Cost

6. Process or Conversion cost

7. Overheads

Manufacturing or Production Overheads

Administrative Overheads

Selling and Distribution Overheads

Product Cost Planning (CO-PC-PCP) is an area within Product Cost Controlling (CO-PC) where you can

plan costs for materials without reference to orders, and set prices for materials and other cost

accounting objects.

Confidential Document Page 28 of 53

Synokem Pharmaceuticals Limited

Business Blueprint Document

Controlling

You can use Product Cost Planning to analyze the costs of your company’s products such as:

Manufactured materials

Services

Other intangible goods

You can analyze costs to help provide answers to questions such as:

How high are the material, production, and overhead costs?

How can production efficiency be improved?

Can the product be supplied at a competitive price?

The following graphic provides an overview of the organizational structures required for costing:

AS-IS

1 Production Process – Make to Stock

2 Costing component:-

Raw Material

Packing Material