Professional Documents

Culture Documents

Property, Plant and Equipment

Property, Plant and Equipment

Uploaded by

Merliza JusayanCopyright:

Available Formats

You might also like

- CBS 2021Document333 pagesCBS 2021Drew Johnson100% (1)

- 17 Property Plant and Equipment PART 1 PDFDocument25 pages17 Property Plant and Equipment PART 1 PDFJay Aubrey PinedaNo ratings yet

- Contoh InvoisDocument1 pageContoh InvoisIdea Fokus75% (4)

- ZOOMLION Indonesia Batching Plant Presentation 20211201Document48 pagesZOOMLION Indonesia Batching Plant Presentation 20211201Elkana Batti' SNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Citrus Cluster ReportDocument98 pagesCitrus Cluster ReportJasmine ZieglerNo ratings yet

- Module 7 - PAS 16 PPEDocument6 pagesModule 7 - PAS 16 PPEbladdor DG.No ratings yet

- Chapter 10 Property, Plant and EquipmentDocument11 pagesChapter 10 Property, Plant and EquipmentAngelica Joy ManaoisNo ratings yet

- Intangible Assets and LiabilitiesDocument13 pagesIntangible Assets and LiabilitiesApril ManjaresNo ratings yet

- Property, Plant and Equipment Property, Plant and EquipmentDocument5 pagesProperty, Plant and Equipment Property, Plant and EquipmentWertdie stanNo ratings yet

- Module 7 PPEDocument6 pagesModule 7 PPECha Eun WooNo ratings yet

- Assets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationDocument23 pagesAssets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationMark Angelo BustosNo ratings yet

- PSBA - Property, Plant and EquipmentDocument13 pagesPSBA - Property, Plant and EquipmentAbdulmajed Unda MimbantasNo ratings yet

- Property, Plant and Equipment: Recognition of PPEDocument6 pagesProperty, Plant and Equipment: Recognition of PPEbigbaekNo ratings yet

- DEDUCTIONSDocument13 pagesDEDUCTIONSmigueltanfelix149No ratings yet

- IntAcc1 - CHAPTER 23 and 25Document10 pagesIntAcc1 - CHAPTER 23 and 25Clyde Justine CablingNo ratings yet

- Summary PpeDocument8 pagesSummary PpeJenilyn CalaraNo ratings yet

- Government Accounting: Accounting For Non-Profit OrganizationsDocument42 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsYuvia KeithleyreNo ratings yet

- Ia 2 - Ppe SheDocument22 pagesIa 2 - Ppe SheAlisonNo ratings yet

- Govt. Acctg Chp. 10Document35 pagesGovt. Acctg Chp. 10Shane KimNo ratings yet

- Chapter 10 PpeDocument38 pagesChapter 10 PpeNoeline ParafinaNo ratings yet

- Property, Plant and Equipment (IAS 16)Document4 pagesProperty, Plant and Equipment (IAS 16)Yunus AlamgeerNo ratings yet

- Property Plant and Equipment Adacp Outline Chapter 10Document9 pagesProperty Plant and Equipment Adacp Outline Chapter 10raderpinaNo ratings yet

- Chapter 11 Intangible AssetsDocument4 pagesChapter 11 Intangible AssetsAngelica Joy ManaoisNo ratings yet

- Ias 16 Property Plant Equipment v1 080713Document7 pagesIas 16 Property Plant Equipment v1 080713Phebieon MukwenhaNo ratings yet

- Accounting For PPE - PAS 16Document39 pagesAccounting For PPE - PAS 16Marriel Fate Cullano100% (1)

- Chapter 15 - Pas 16 PpeDocument36 pagesChapter 15 - Pas 16 PpeMarriel Fate CullanoNo ratings yet

- Ia 2 Ppe She 1Document22 pagesIa 2 Ppe She 1AlisonNo ratings yet

- Chapter 10 NotesDocument22 pagesChapter 10 NotesSittie Ainna Acmed UnteNo ratings yet

- Farap 4504Document8 pagesFarap 4504Marya NvlzNo ratings yet

- Handout AP 2306 FDocument14 pagesHandout AP 2306 FDyosa MeNo ratings yet

- Property Plant and EquipmentDocument10 pagesProperty Plant and Equipmentrt2222100% (1)

- NAME: M. Azlan Rifa'i NIM: 2102113036 Subject: Financial Statement Analysis Title: Analyzing Investment Activities A) Current AssetDocument5 pagesNAME: M. Azlan Rifa'i NIM: 2102113036 Subject: Financial Statement Analysis Title: Analyzing Investment Activities A) Current AssetAzlanNo ratings yet

- Reviewer in INTACC 1.9Document4 pagesReviewer in INTACC 1.9LiaNo ratings yet

- Chapter 9Document25 pagesChapter 9Ariane CarinoNo ratings yet

- Less Tested StandardsDocument4 pagesLess Tested StandardsMD.RIDWANUR RAHMANNo ratings yet

- Ias 16Document26 pagesIas 16Niharika MishraNo ratings yet

- Theory of AccountsDocument8 pagesTheory of AccountsDariNo ratings yet

- Script Ending Pork EmpanadaDocument3 pagesScript Ending Pork EmpanadaRose MarieNo ratings yet

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument3 pagesIAS 16 Property, Plant and Equipmentamanda kNo ratings yet

- 08-MMDA2022 Part1-Notes To FSDocument74 pages08-MMDA2022 Part1-Notes To FSRonna FererNo ratings yet

- Pas34 1Document7 pagesPas34 1Elisha Mae ManzonNo ratings yet

- Basic Accounting: I. Fields of AccountingDocument11 pagesBasic Accounting: I. Fields of Accountingalliah brionesNo ratings yet

- Property, Plant and EquipmentDocument45 pagesProperty, Plant and EquipmentRiyah ParasNo ratings yet

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- Lecture Notes On PPE - Acq & RecDocument6 pagesLecture Notes On PPE - Acq & Recjudel ArielNo ratings yet

- Chapter 10 PropertyDocument10 pagesChapter 10 Propertymaria isabellaNo ratings yet

- Summary of OMB Circular A-122Document3 pagesSummary of OMB Circular A-122NewDay2013No ratings yet

- TOA 011 - Depreciation, Revaluation and Impairment With AnsDocument5 pagesTOA 011 - Depreciation, Revaluation and Impairment With AnsSyril SarientasNo ratings yet

- SIM ACC 226ACCE 411 Week 4 To 5 COPY 1Document31 pagesSIM ACC 226ACCE 411 Week 4 To 5 COPY 1Mireya Yue100% (1)

- Property, Plant and Equipment (IAS 16) : Haroon Arshad Butt IcmapDocument16 pagesProperty, Plant and Equipment (IAS 16) : Haroon Arshad Butt IcmapHaroon A ButtNo ratings yet

- IAS and IFRS Standards For F7FR ACCA ExamDocument9 pagesIAS and IFRS Standards For F7FR ACCA ExamTushar VoiceNo ratings yet

- PAS 16 Property, Plant and EquipmentDocument4 pagesPAS 16 Property, Plant and Equipmentpanda 1No ratings yet

- Ind As - 16Document11 pagesInd As - 16OopsbymistakeNo ratings yet

- 805 CC101 AFM DD 2 Valuation of Tangible F.assetsDocument32 pages805 CC101 AFM DD 2 Valuation of Tangible F.assetsArchana N VyasNo ratings yet

- PPE Presentation - 11.22.2020Document21 pagesPPE Presentation - 11.22.2020Makoy BixenmanNo ratings yet

- Property Plant and EquipmentDocument13 pagesProperty Plant and EquipmentWilsonNo ratings yet

- Reviewer in PPEDocument16 pagesReviewer in PPEDewi Leigh Ann Mangubat50% (2)

- Philippine Accounting Standards 16 & 23 (PPE and Borrowing Cost)Document32 pagesPhilippine Accounting Standards 16 & 23 (PPE and Borrowing Cost)Ecka Tubay33% (3)

- Invoices 22feb2022Document21 pagesInvoices 22feb2022Merliza JusayanNo ratings yet

- Date Received From Branch Reference Amount: Total Collections 371,905.17 Total Available Cash 527,546.92Document1 pageDate Received From Branch Reference Amount: Total Collections 371,905.17 Total Available Cash 527,546.92Merliza JusayanNo ratings yet

- This Is Not A Legal InvoiceDocument2 pagesThis Is Not A Legal InvoiceMerliza JusayanNo ratings yet

- Invoice INV-0493Document2 pagesInvoice INV-0493Merliza JusayanNo ratings yet

- Invoice INV-0208Document1 pageInvoice INV-0208Merliza JusayanNo ratings yet

- Invoice INV-0209Document2 pagesInvoice INV-0209Merliza JusayanNo ratings yet

- V2 - 2022 PNC ConsultativeDocument1 pageV2 - 2022 PNC ConsultativeMerliza JusayanNo ratings yet

- Invoice: Due Date: 27 Dec 2021Document1 pageInvoice: Due Date: 27 Dec 2021Merliza JusayanNo ratings yet

- G-Rachel Marie FelicesDocument1 pageG-Rachel Marie FelicesMerliza JusayanNo ratings yet

- Supply, Demand, and Market EquilibriumDocument69 pagesSupply, Demand, and Market EquilibriumMerliza JusayanNo ratings yet

- Supply and Demand and Market EquilibriumDocument10 pagesSupply and Demand and Market EquilibriumMerliza JusayanNo ratings yet

- Depuno, Richard Vince Marfil Compilation in Accounting For Government and Non-Profit Organizations InventoriesDocument3 pagesDepuno, Richard Vince Marfil Compilation in Accounting For Government and Non-Profit Organizations InventoriesMerliza Jusayan100% (1)

- Test Questions GovernmentDocument17 pagesTest Questions GovernmentMerliza JusayanNo ratings yet

- Presentation On Sheet Metal DesignDocument27 pagesPresentation On Sheet Metal Designniloy_67No ratings yet

- Ib-Licensing & FranchisingDocument16 pagesIb-Licensing & Franchisingsakshi agrawalNo ratings yet

- Larisseger MagForum 2017 IMFORMEDDocument18 pagesLarisseger MagForum 2017 IMFORMEDengr kazamNo ratings yet

- KE51, KE52, KE53 - Profit Center Create, Change, DisplayDocument5 pagesKE51, KE52, KE53 - Profit Center Create, Change, DisplayElboy Son DecanoNo ratings yet

- Boat 115 BillDocument1 pageBoat 115 BillVINEET TIWARINo ratings yet

- C2000-002 - Acctg Guidelines On The Use of Income of SUC Pursuant To RA8292Document3 pagesC2000-002 - Acctg Guidelines On The Use of Income of SUC Pursuant To RA8292Alquin ColladoNo ratings yet

- Perform With Style: Homogeneous VinylDocument33 pagesPerform With Style: Homogeneous Vinylniki rathodNo ratings yet

- BTW IndiaDocument5 pagesBTW IndiaZubair Alam100% (1)

- Product and Brand DecisionsDocument56 pagesProduct and Brand DecisionsSoumendra RoyNo ratings yet

- Shikora ProjectDocument8 pagesShikora ProjectSaksham GuptaNo ratings yet

- Forex MindsetDocument1 pageForex MindsetGym FitnessNo ratings yet

- This Study Resource Was: Virgen Milagrosa University FoundationDocument4 pagesThis Study Resource Was: Virgen Milagrosa University FoundationVictoria CadizNo ratings yet

- 2018 Nogiar 1Document112 pages2018 Nogiar 1Dear Lakes AyoNo ratings yet

- 94 Benito Vs Salva PDFDocument7 pages94 Benito Vs Salva PDFBeau Bautista100% (1)

- CBDT Circular 7 of 2016 - AOP Consortium TaxablilityDocument1 pageCBDT Circular 7 of 2016 - AOP Consortium TaxablilitySubramanyam SettyNo ratings yet

- GOODWILLDocument2 pagesGOODWILLFRANK IMHANFORTORNo ratings yet

- Product Life Cycle: The Evolution of A Paradigm and Literature Review From 1950-2009Document41 pagesProduct Life Cycle: The Evolution of A Paradigm and Literature Review From 1950-2009Anonymous St1j35DR05No ratings yet

- Haier Biomedical General Catalogue 2019 PDFDocument96 pagesHaier Biomedical General Catalogue 2019 PDFJean TorreblancaNo ratings yet

- Brac Bank HR PolicyDocument10 pagesBrac Bank HR PolicyManish SahaNo ratings yet

- Datasheet CPM S110Vv12010 PDFDocument3 pagesDatasheet CPM S110Vv12010 PDFMaximiliano GarciaNo ratings yet

- COMPLETE-Garver LLC Contract-ApolloParkDocument22 pagesCOMPLETE-Garver LLC Contract-ApolloParkKayode CrownNo ratings yet

- System Design Implementation and Operation - Chapter 22Document14 pagesSystem Design Implementation and Operation - Chapter 22Chantal DeLarenta100% (1)

- Kaisahan NG Manggagawang Pilipino V TrajanoDocument2 pagesKaisahan NG Manggagawang Pilipino V TrajanoTrisha OrtegaNo ratings yet

- CH 5 - DepositsDocument19 pagesCH 5 - DepositsPrashant ChandaneNo ratings yet

- Cworld - May 19Document8 pagesCworld - May 19CelestiaNo ratings yet

- InboundID - Credentials 2022 - LunDocument68 pagesInboundID - Credentials 2022 - LunLunna LazuardiNo ratings yet

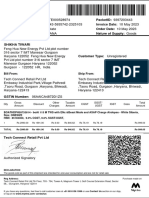

Property, Plant and Equipment

Property, Plant and Equipment

Uploaded by

Merliza JusayanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property, Plant and Equipment

Property, Plant and Equipment

Uploaded by

Merliza JusayanCopyright:

Available Formats

DEPUNO, RICHARD VINCE MARFIL March 4, 2021

BSA - 3 [45227] Ms. Leneilyn M. Poblete, CPA

Compilation in Accounting for Government and Non-profit Organizations

PROPERTY, PLANT AND EQUIPMENT

Introduction

Property, Plant and Equipment are:

a. Tangible assets;

b. Held for use in the production or supply of goods, services or program outputs, for rental

to others, or for administrative purposes, and not intended for resale in the ordinary

course of operations; and

c. Expected to be used for more than one reporting period.

recognition

For government entities, the capitalization threshold for PPE is P15,000.

measurement

PPE are initially measured at cost. Cost comprises the purchase price, including non-

refundable taxes but excluding trade and cash discounts; direct costs; and present value of

decommissioning and restoration costs.

Modes of acquisition

Promotional items:

If the same, allocate total cost to all items acquired including the promotional item.

If different, assign the promotional item its fair value; the remainder to the other items

acquired.

Acquisition by Construction:

Through Construction Contract – cost is contract price.

By Administration – cost is sum of direct materials, direct labor, and overhead.

Construction costs are initially recorded in the Construction in Progress account.

Acquisition through Exchange:

With commercial substance – (1) fair value of asset given up plus cash paid or

minus any cash received, (2) fair value of asset received plus cash paid or minus

any cash received, (3) carrying amount of asset given up plus cash paid or minus

any cash received

No commercial substance – Carrying amount of asset given up plus cash paid or

minus any cash received.

Acquisition through Non-Exchange Transactions – asset received is measured at fair value

at acquisition date.

No condition – recognized immediately as income

With condition – initially recognized as liability, subsequently recognized as income

when condition is met

Acquisition through Intra-agency or Inter-agency Transfers – measured at the carrying

amount of the asset received

Subsequent expenditures on recognized ppe

a. Repairs and Maintenance:

Minor repairs – expensed

Major repairs – capitalized

If not clear, treat as minor repairs – expensed

b. Replacement Costs – charge carrying amount of old part as loss; capitalized new part.

If carrying amount of old part is not determinable, use the cost of new part as basis.

c. Spare Pars and Servicing Equipment:

Minor – expensed

Major – capitalized

Those that can only be used in conjunction with an item of PPE are accounted for as

PPE.

d. Betterments – are capitalized (if they meet the recognition criteria for PPE) and are

subsequently depreciated: (1) over the extended useful life, if betterment extends useful life,

or (2) over remaining useful life, if betterment does not extend useful life

e. Additions – are modifications which increase the physical size or function of the PPE. If the

addition is a (an):

New unit – depreciate over its own useful life

Expansion – depreciate over useful life of original asset

Subsequent measurement

PPE are subsequently measured using the cost model. The revaluation model is not

applicable to government entities.

The straight line method of depreciation is used unless another method is more appropriate.

Residual value is generally 5% of cost.

Computation of value in use (viu)

a. Depreciated Replacement Cost Approach

VIU = Replacement cost less Accumulated depreciation based on the replacement cost

b. Restoration Cost Approach

VIU = Depreciated replacement cost minus Estimated restoration cost

c. Service Units Approach

VIU = Depreciated replacement cost x (100% less % of reduction in service potential)

Heritage asset Not depreciated but subject to impairment

Infrastructure assets Generally, no residual value

Reforestation projects Land improvement; not depreciated but subject to impairment

Idle PPE Not derecognized; continued to be depreciated

Fully depreciated Not derecognized

Unserviceable property Derecognized

Lost PPE Derecognized (if total loss)

Borrowing costs

National Government (recorded by BTr) – expensed (i.e., Benchmark Treatment)

Government Agencies – capitalized (i.e., Allowed Alternative Treatment)

REFERENCES:

Government Accounting & Accounting for Non-Profit Organization (2018). Millan, Z.V. Baguio City:

Bandolin Enterprise

You might also like

- CBS 2021Document333 pagesCBS 2021Drew Johnson100% (1)

- 17 Property Plant and Equipment PART 1 PDFDocument25 pages17 Property Plant and Equipment PART 1 PDFJay Aubrey PinedaNo ratings yet

- Contoh InvoisDocument1 pageContoh InvoisIdea Fokus75% (4)

- ZOOMLION Indonesia Batching Plant Presentation 20211201Document48 pagesZOOMLION Indonesia Batching Plant Presentation 20211201Elkana Batti' SNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Citrus Cluster ReportDocument98 pagesCitrus Cluster ReportJasmine ZieglerNo ratings yet

- Module 7 - PAS 16 PPEDocument6 pagesModule 7 - PAS 16 PPEbladdor DG.No ratings yet

- Chapter 10 Property, Plant and EquipmentDocument11 pagesChapter 10 Property, Plant and EquipmentAngelica Joy ManaoisNo ratings yet

- Intangible Assets and LiabilitiesDocument13 pagesIntangible Assets and LiabilitiesApril ManjaresNo ratings yet

- Property, Plant and Equipment Property, Plant and EquipmentDocument5 pagesProperty, Plant and Equipment Property, Plant and EquipmentWertdie stanNo ratings yet

- Module 7 PPEDocument6 pagesModule 7 PPECha Eun WooNo ratings yet

- Assets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationDocument23 pagesAssets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationMark Angelo BustosNo ratings yet

- PSBA - Property, Plant and EquipmentDocument13 pagesPSBA - Property, Plant and EquipmentAbdulmajed Unda MimbantasNo ratings yet

- Property, Plant and Equipment: Recognition of PPEDocument6 pagesProperty, Plant and Equipment: Recognition of PPEbigbaekNo ratings yet

- DEDUCTIONSDocument13 pagesDEDUCTIONSmigueltanfelix149No ratings yet

- IntAcc1 - CHAPTER 23 and 25Document10 pagesIntAcc1 - CHAPTER 23 and 25Clyde Justine CablingNo ratings yet

- Summary PpeDocument8 pagesSummary PpeJenilyn CalaraNo ratings yet

- Government Accounting: Accounting For Non-Profit OrganizationsDocument42 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsYuvia KeithleyreNo ratings yet

- Ia 2 - Ppe SheDocument22 pagesIa 2 - Ppe SheAlisonNo ratings yet

- Govt. Acctg Chp. 10Document35 pagesGovt. Acctg Chp. 10Shane KimNo ratings yet

- Chapter 10 PpeDocument38 pagesChapter 10 PpeNoeline ParafinaNo ratings yet

- Property, Plant and Equipment (IAS 16)Document4 pagesProperty, Plant and Equipment (IAS 16)Yunus AlamgeerNo ratings yet

- Property Plant and Equipment Adacp Outline Chapter 10Document9 pagesProperty Plant and Equipment Adacp Outline Chapter 10raderpinaNo ratings yet

- Chapter 11 Intangible AssetsDocument4 pagesChapter 11 Intangible AssetsAngelica Joy ManaoisNo ratings yet

- Ias 16 Property Plant Equipment v1 080713Document7 pagesIas 16 Property Plant Equipment v1 080713Phebieon MukwenhaNo ratings yet

- Accounting For PPE - PAS 16Document39 pagesAccounting For PPE - PAS 16Marriel Fate Cullano100% (1)

- Chapter 15 - Pas 16 PpeDocument36 pagesChapter 15 - Pas 16 PpeMarriel Fate CullanoNo ratings yet

- Ia 2 Ppe She 1Document22 pagesIa 2 Ppe She 1AlisonNo ratings yet

- Chapter 10 NotesDocument22 pagesChapter 10 NotesSittie Ainna Acmed UnteNo ratings yet

- Farap 4504Document8 pagesFarap 4504Marya NvlzNo ratings yet

- Handout AP 2306 FDocument14 pagesHandout AP 2306 FDyosa MeNo ratings yet

- Property Plant and EquipmentDocument10 pagesProperty Plant and Equipmentrt2222100% (1)

- NAME: M. Azlan Rifa'i NIM: 2102113036 Subject: Financial Statement Analysis Title: Analyzing Investment Activities A) Current AssetDocument5 pagesNAME: M. Azlan Rifa'i NIM: 2102113036 Subject: Financial Statement Analysis Title: Analyzing Investment Activities A) Current AssetAzlanNo ratings yet

- Reviewer in INTACC 1.9Document4 pagesReviewer in INTACC 1.9LiaNo ratings yet

- Chapter 9Document25 pagesChapter 9Ariane CarinoNo ratings yet

- Less Tested StandardsDocument4 pagesLess Tested StandardsMD.RIDWANUR RAHMANNo ratings yet

- Ias 16Document26 pagesIas 16Niharika MishraNo ratings yet

- Theory of AccountsDocument8 pagesTheory of AccountsDariNo ratings yet

- Script Ending Pork EmpanadaDocument3 pagesScript Ending Pork EmpanadaRose MarieNo ratings yet

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument3 pagesIAS 16 Property, Plant and Equipmentamanda kNo ratings yet

- 08-MMDA2022 Part1-Notes To FSDocument74 pages08-MMDA2022 Part1-Notes To FSRonna FererNo ratings yet

- Pas34 1Document7 pagesPas34 1Elisha Mae ManzonNo ratings yet

- Basic Accounting: I. Fields of AccountingDocument11 pagesBasic Accounting: I. Fields of Accountingalliah brionesNo ratings yet

- Property, Plant and EquipmentDocument45 pagesProperty, Plant and EquipmentRiyah ParasNo ratings yet

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- Lecture Notes On PPE - Acq & RecDocument6 pagesLecture Notes On PPE - Acq & Recjudel ArielNo ratings yet

- Chapter 10 PropertyDocument10 pagesChapter 10 Propertymaria isabellaNo ratings yet

- Summary of OMB Circular A-122Document3 pagesSummary of OMB Circular A-122NewDay2013No ratings yet

- TOA 011 - Depreciation, Revaluation and Impairment With AnsDocument5 pagesTOA 011 - Depreciation, Revaluation and Impairment With AnsSyril SarientasNo ratings yet

- SIM ACC 226ACCE 411 Week 4 To 5 COPY 1Document31 pagesSIM ACC 226ACCE 411 Week 4 To 5 COPY 1Mireya Yue100% (1)

- Property, Plant and Equipment (IAS 16) : Haroon Arshad Butt IcmapDocument16 pagesProperty, Plant and Equipment (IAS 16) : Haroon Arshad Butt IcmapHaroon A ButtNo ratings yet

- IAS and IFRS Standards For F7FR ACCA ExamDocument9 pagesIAS and IFRS Standards For F7FR ACCA ExamTushar VoiceNo ratings yet

- PAS 16 Property, Plant and EquipmentDocument4 pagesPAS 16 Property, Plant and Equipmentpanda 1No ratings yet

- Ind As - 16Document11 pagesInd As - 16OopsbymistakeNo ratings yet

- 805 CC101 AFM DD 2 Valuation of Tangible F.assetsDocument32 pages805 CC101 AFM DD 2 Valuation of Tangible F.assetsArchana N VyasNo ratings yet

- PPE Presentation - 11.22.2020Document21 pagesPPE Presentation - 11.22.2020Makoy BixenmanNo ratings yet

- Property Plant and EquipmentDocument13 pagesProperty Plant and EquipmentWilsonNo ratings yet

- Reviewer in PPEDocument16 pagesReviewer in PPEDewi Leigh Ann Mangubat50% (2)

- Philippine Accounting Standards 16 & 23 (PPE and Borrowing Cost)Document32 pagesPhilippine Accounting Standards 16 & 23 (PPE and Borrowing Cost)Ecka Tubay33% (3)

- Invoices 22feb2022Document21 pagesInvoices 22feb2022Merliza JusayanNo ratings yet

- Date Received From Branch Reference Amount: Total Collections 371,905.17 Total Available Cash 527,546.92Document1 pageDate Received From Branch Reference Amount: Total Collections 371,905.17 Total Available Cash 527,546.92Merliza JusayanNo ratings yet

- This Is Not A Legal InvoiceDocument2 pagesThis Is Not A Legal InvoiceMerliza JusayanNo ratings yet

- Invoice INV-0493Document2 pagesInvoice INV-0493Merliza JusayanNo ratings yet

- Invoice INV-0208Document1 pageInvoice INV-0208Merliza JusayanNo ratings yet

- Invoice INV-0209Document2 pagesInvoice INV-0209Merliza JusayanNo ratings yet

- V2 - 2022 PNC ConsultativeDocument1 pageV2 - 2022 PNC ConsultativeMerliza JusayanNo ratings yet

- Invoice: Due Date: 27 Dec 2021Document1 pageInvoice: Due Date: 27 Dec 2021Merliza JusayanNo ratings yet

- G-Rachel Marie FelicesDocument1 pageG-Rachel Marie FelicesMerliza JusayanNo ratings yet

- Supply, Demand, and Market EquilibriumDocument69 pagesSupply, Demand, and Market EquilibriumMerliza JusayanNo ratings yet

- Supply and Demand and Market EquilibriumDocument10 pagesSupply and Demand and Market EquilibriumMerliza JusayanNo ratings yet

- Depuno, Richard Vince Marfil Compilation in Accounting For Government and Non-Profit Organizations InventoriesDocument3 pagesDepuno, Richard Vince Marfil Compilation in Accounting For Government and Non-Profit Organizations InventoriesMerliza Jusayan100% (1)

- Test Questions GovernmentDocument17 pagesTest Questions GovernmentMerliza JusayanNo ratings yet

- Presentation On Sheet Metal DesignDocument27 pagesPresentation On Sheet Metal Designniloy_67No ratings yet

- Ib-Licensing & FranchisingDocument16 pagesIb-Licensing & Franchisingsakshi agrawalNo ratings yet

- Larisseger MagForum 2017 IMFORMEDDocument18 pagesLarisseger MagForum 2017 IMFORMEDengr kazamNo ratings yet

- KE51, KE52, KE53 - Profit Center Create, Change, DisplayDocument5 pagesKE51, KE52, KE53 - Profit Center Create, Change, DisplayElboy Son DecanoNo ratings yet

- Boat 115 BillDocument1 pageBoat 115 BillVINEET TIWARINo ratings yet

- C2000-002 - Acctg Guidelines On The Use of Income of SUC Pursuant To RA8292Document3 pagesC2000-002 - Acctg Guidelines On The Use of Income of SUC Pursuant To RA8292Alquin ColladoNo ratings yet

- Perform With Style: Homogeneous VinylDocument33 pagesPerform With Style: Homogeneous Vinylniki rathodNo ratings yet

- BTW IndiaDocument5 pagesBTW IndiaZubair Alam100% (1)

- Product and Brand DecisionsDocument56 pagesProduct and Brand DecisionsSoumendra RoyNo ratings yet

- Shikora ProjectDocument8 pagesShikora ProjectSaksham GuptaNo ratings yet

- Forex MindsetDocument1 pageForex MindsetGym FitnessNo ratings yet

- This Study Resource Was: Virgen Milagrosa University FoundationDocument4 pagesThis Study Resource Was: Virgen Milagrosa University FoundationVictoria CadizNo ratings yet

- 2018 Nogiar 1Document112 pages2018 Nogiar 1Dear Lakes AyoNo ratings yet

- 94 Benito Vs Salva PDFDocument7 pages94 Benito Vs Salva PDFBeau Bautista100% (1)

- CBDT Circular 7 of 2016 - AOP Consortium TaxablilityDocument1 pageCBDT Circular 7 of 2016 - AOP Consortium TaxablilitySubramanyam SettyNo ratings yet

- GOODWILLDocument2 pagesGOODWILLFRANK IMHANFORTORNo ratings yet

- Product Life Cycle: The Evolution of A Paradigm and Literature Review From 1950-2009Document41 pagesProduct Life Cycle: The Evolution of A Paradigm and Literature Review From 1950-2009Anonymous St1j35DR05No ratings yet

- Haier Biomedical General Catalogue 2019 PDFDocument96 pagesHaier Biomedical General Catalogue 2019 PDFJean TorreblancaNo ratings yet

- Brac Bank HR PolicyDocument10 pagesBrac Bank HR PolicyManish SahaNo ratings yet

- Datasheet CPM S110Vv12010 PDFDocument3 pagesDatasheet CPM S110Vv12010 PDFMaximiliano GarciaNo ratings yet

- COMPLETE-Garver LLC Contract-ApolloParkDocument22 pagesCOMPLETE-Garver LLC Contract-ApolloParkKayode CrownNo ratings yet

- System Design Implementation and Operation - Chapter 22Document14 pagesSystem Design Implementation and Operation - Chapter 22Chantal DeLarenta100% (1)

- Kaisahan NG Manggagawang Pilipino V TrajanoDocument2 pagesKaisahan NG Manggagawang Pilipino V TrajanoTrisha OrtegaNo ratings yet

- CH 5 - DepositsDocument19 pagesCH 5 - DepositsPrashant ChandaneNo ratings yet

- Cworld - May 19Document8 pagesCworld - May 19CelestiaNo ratings yet

- InboundID - Credentials 2022 - LunDocument68 pagesInboundID - Credentials 2022 - LunLunna LazuardiNo ratings yet