Professional Documents

Culture Documents

Non - Negotiable: Notification of Deposit

Non - Negotiable: Notification of Deposit

Uploaded by

ေျပာမယ္ လက္တို႔ၿပီးေတာ့Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non - Negotiable: Notification of Deposit

Non - Negotiable: Notification of Deposit

Uploaded by

ေျပာမယ္ လက္တို႔ၿပီးေတာ့Copyright:

Available Formats

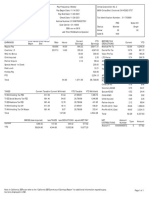

11/11/2021 Ihub - Paycheck

Southern California Permanente Medical Group Pay Group: PRT-Biweekly Partners Medical Center: RI

393 East Walnut Street Pay Begin Date: 10/18/2021 Advice #: 4272248

Pasadena, CA 91188 Pay End Date: 10/31/2021 Advice Date: 11/05/2021

Myo Min M.D. Emplid: 22102816 TAX DATA Federal CA State

5549 Meadowbrook Ct. Department: 1591-Internal Medicine-Inpatient

Marital Status:

Rancho Cucamonga, CA 91739 Location: 81351-Riverside Med Center Allowances:

Sub-Specialty: Hospital Medicine Addl. Pct.:

Addl. Amt.:

PayRate: $25,500.00 Monthly

SESSIONS/HOURS AND EARNINGS TAXES

---------- Current ---------- ---------- YTD ----------

Description Rate Sessions/Hours Earnings Sessions/Hours Earnings Description Current YTD

Work Weekend 706.1520 4.00 2,824.61 94.00 66,075.43

Work Evening 706.1520 2.25 1,588.84 36.50 25,609.81

Work Day 588.4600 11.00 6,473.06 239.75 140,386.78

Vacation 588.4600 0.75 441.35 32.00 18,717.68

Education 1/2 Day 588.4600 2.00 1,176.92 28.00 16,404.17

Work Overnight 0.00 7.50 6,602.02

Work Holiday 0.00 2.00 2,589.22

Patient Educational Time 0.00 12.00 7,021.12

Indirect Worked 0.00 1.00 580.38

Holiday 0.00 6.00 3,514.61 Total: 0.00 0.00

Education Leave 0.00 10.25 5,948.93 DEDUCTIONS

Clinical Quality of Care 0.00 2,444.00

Banked Education Time 0.00 8.00 4,707.68 Description Current YTD

Adjust Work Weekend 0.00 1.00 696.46

**Partner EAP 1.33 14.63

Unum Physician Voluntary LTD 108.92 2,318.04

*Keogh Cont-Incl Lump Sum 0.00 36,437.68

*Keogh Catch Up 0.00 2,062.32

*TSR for Age 50 and Over 0.00 19,862.13

TSR for Age 50 and Over 0.00 6,137.87

AD&D 100% 0.00 40.00

Optional Life 100% 0.00 834.95

*Before Tax **Taxable ***Non-Taxable

Total: 20.00 12,504.78 301,298.29 Total: 108.92

TOTAL GROSS FED TAXABLE GROSS TOTAL TAXES TOTAL DEDUCTIONS NET PAY

Current: 12,504.78 0.00 0.00 108.92 12,395.86

YTD: 301,298.29 0.00 0.00

LEAVE ACCRUALS DAYS LEAVE ACCRUALS DAYS NET PAY DISTRIBUTION

Vacation 80.35 Jury Duty 10.00 Advice #4272248 12,395.86

Education Leave 11.88 Negative Balance 0.00

Acute Sick 22.00 Total: 12,395.86

MESSAGE:Brought to you by the patients and members you serve.

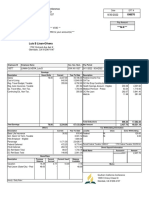

Southern California Permanente Medical Group

Advice Date Advice No.

393 East Walnut Street

11/05/2021 4272248

Pasadena, CA 91188

* * * N O T I F I C A T I O N O F D E P O S I T * * *

DIRECT DEPOSIT DISTRIBUTION

Account Type Account Number Deposit Amount

Deposit Amount: $12,395.86

Checking 4411132551 12,395.86

To The

Account Of

MYO MIN M.D.

5549 Meadowbrook Ct.

Rancho Cucamonga, CA 91739

Location: Riverside Med Center Total: $12,395.86

NON - NEGOTIABLE

https://scpmghcm.kp.org/psc/mdhrprd/EMPLOYEE/HRMS/c/MD_ADMINISTER_IHUB.MD_IH_PYCHK_PDF.GBL?Page=MD_IH_PYCHK_PDF&Action=C&C… 1/1

You might also like

- E-Statement 20131018 00027Document1 pageE-Statement 20131018 00027Renee0430100% (1)

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- USOnline PayslipDocument2 pagesUSOnline PayslipTami SariNo ratings yet

- Screenshot 2019-12-04 at 17.37.04Document1 pageScreenshot 2019-12-04 at 17.37.04Arthur LottieNo ratings yet

- Document 2Document2 pagesDocument 2Trenika SwainNo ratings yet

- Ronald 1Document1 pageRonald 1kevin kuhnNo ratings yet

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadNo ratings yet

- 201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Document1 page201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Tera's TarotNo ratings yet

- Keon MillerDocument4 pagesKeon MillerKeon MillerNo ratings yet

- Sspusadv PDFDocument1 pageSspusadv PDFKIMNo ratings yet

- 02475792798Document1 page02475792798Edwin Zamora PastorNo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNo ratings yet

- Payroll 08142020Document2 pagesPayroll 08142020Shana RushNo ratings yet

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVJamesNo ratings yet

- MZTooo 009416240000 R 0719 E2 DF39 B1621Document1 pageMZTooo 009416240000 R 0719 E2 DF39 B1621to become oneNo ratings yet

- PayStatement-Apr 21 2023Document1 pagePayStatement-Apr 21 2023alejandro avila barbaNo ratings yet

- Attachment 1 4Document1 pageAttachment 1 4Tabbitha CampfieldNo ratings yet

- Earnings: Hourly Ot Sick Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Sick Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- Pay003 2296Document1 pagePay003 2296selvam.kandasamy3297No ratings yet

- Sep 15-Pay StatementDocument1 pageSep 15-Pay Statementmahak.gupta1902No ratings yet

- Document 3Document1 pageDocument 3Chris AcostaNo ratings yet

- Hersey K Delynn PayStubDocument1 pageHersey K Delynn PayStubSharon JonesNo ratings yet

- Statement of Earnings: NON NegotiableDocument1 pageStatement of Earnings: NON NegotiableireneNo ratings yet

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNo ratings yet

- Earnings: Our Lady of Peace Ruth MbaDocument1 pageEarnings: Our Lady of Peace Ruth MbaNanga wolosoNo ratings yet

- Paystub 202303Document1 pagePaystub 202303carinaNo ratings yet

- Paystub Golden Limousine, Inc 20210906 20210919Document2 pagesPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- Nieves 1Document1 pageNieves 1carterNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableLuis Alexander Soriano SanchezNo ratings yet

- Pay Stub 2Document2 pagesPay Stub 2Antionette JewelNo ratings yet

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnNo ratings yet

- Check Ais-3Document1 pageCheck Ais-3JOHNNo ratings yet

- Compruebe El Talón para Angelo Hernandez Clemente - 27052022Document1 pageCompruebe El Talón para Angelo Hernandez Clemente - 27052022Angelo HernandezNo ratings yet

- Non-Negotiable This Is Not A Check: Hours and Earnings TaxesDocument1 pageNon-Negotiable This Is Not A Check: Hours and Earnings TaxesSkyler GageNo ratings yet

- Full Payroll Summary: Net PayDocument2 pagesFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Paystub 2022 04 17Document1 pagePaystub 2022 04 17Vivian TorresNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- Earnings: Hourly OT Hol Emsick RetroDocument1 pageEarnings: Hourly OT Hol Emsick RetroAlbie Madrid100% (1)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableKarma HoranNo ratings yet

- 5419 N Sheridan RD Chicago, IL 60640-1917 773-878-7340 Restaurant Personnel IncDocument2 pages5419 N Sheridan RD Chicago, IL 60640-1917 773-878-7340 Restaurant Personnel IncLizbhet Paz100% (1)

- Sukhvinder Singh - ES LoblawsDocument1 pageSukhvinder Singh - ES LoblawsLily NguyenNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- JF PaycheckDocument1 pageJF Paycheckapi-285511542No ratings yet

- Check Stubs 3.0Document3 pagesCheck Stubs 3.0maliktaimoorsurahNo ratings yet

- 7258a013 9ad0 496f 8340 2b6368 PDFDocument1 page7258a013 9ad0 496f 8340 2b6368 PDFLadis andradeNo ratings yet

- 08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFDocument1 page08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFVictoria ChevalierNo ratings yet

- Earnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Document1 pageEarnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Muhammad AdeelNo ratings yet

- Earnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Document1 pageEarnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Alfredo MurrugarraNo ratings yet

- Earnings: Hourly Ot Bonus Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Bonus Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- Jadin 1:27 PDFDocument1 pageJadin 1:27 PDFChris LeeNo ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- E Book3Document95 pagesE Book3ေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Nov-2021 ChaseDocument6 pagesNov-2021 Chaseေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Sten Gwak YaDocument1 pageSten Gwak Yaေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- E Book2Document29 pagesE Book2ေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Ibbi I. Emmanuel - Curriculum VitaeDocument12 pagesIbbi I. Emmanuel - Curriculum VitaeWakaye AbbaNo ratings yet

- Aizawl Taxi FareDocument6 pagesAizawl Taxi FareWilliam LgguiteNo ratings yet

- Toilet & Bath at Bedroom: Medicine Cabinet Counter Top Lavatory Installation Siphon Jet Water ClosetDocument1 pageToilet & Bath at Bedroom: Medicine Cabinet Counter Top Lavatory Installation Siphon Jet Water ClosetStephen Mark Garcellano DalisayNo ratings yet

- Dear Sir or Madam, Greetings For The Day!Document2 pagesDear Sir or Madam, Greetings For The Day!Eminence SOP WritersNo ratings yet

- JCIDocument54 pagesJCIanaskamel82No ratings yet

- Jennifer Holloway Nurse Practitioner Resume 1Document1 pageJennifer Holloway Nurse Practitioner Resume 1api-576546248No ratings yet

- BB TariffDocument21 pagesBB TariffKarthikeyanNo ratings yet

- Notice of Intent To Sue Kroger PharmacyDocument3 pagesNotice of Intent To Sue Kroger PharmacyJames Alan BushNo ratings yet

- Citizen CharterDocument16 pagesCitizen CharterAYYANAR RAJANo ratings yet

- Child Care Emergency Contact Information and Consent Form Template-79400Document1 pageChild Care Emergency Contact Information and Consent Form Template-79400Thriftyshop StoreNo ratings yet

- Test Bank For Introduction To Clinical Psychology 8 e 8th Edition Geoffrey P Kramer Douglas A Bernstein Vicky PharesDocument11 pagesTest Bank For Introduction To Clinical Psychology 8 e 8th Edition Geoffrey P Kramer Douglas A Bernstein Vicky PharesMarlyn Islam100% (41)

- 2021 Delegation Opportunities For Malnutrition Care Activities To Dietitian Assistants-Findings of A Multi-Site SurveyDocument13 pages2021 Delegation Opportunities For Malnutrition Care Activities To Dietitian Assistants-Findings of A Multi-Site SurveySaceci24No ratings yet

- Quick Reference Guide Pharmacists Dispensing Purchasing Controlled SubstancesDocument2 pagesQuick Reference Guide Pharmacists Dispensing Purchasing Controlled Substancesritchelle abigail mataNo ratings yet

- 2015 Patient-Satisfaction-From-Medical-Service-Provided-By-University-Outpatient-Clinic-Taif-University-Saudi-ArabiaDocument8 pages2015 Patient-Satisfaction-From-Medical-Service-Provided-By-University-Outpatient-Clinic-Taif-University-Saudi-Arabiaapouakone apouakoneNo ratings yet

- Hospital Profile:: ApplicantDocument2 pagesHospital Profile:: Applicantdeepshikha singhNo ratings yet

- MapehDocument26 pagesMapehAmor Elleso FelicianoNo ratings yet

- Organizational Chart For HospitalDocument6 pagesOrganizational Chart For HospitalKHILE KID CANTILANG100% (1)

- Service Quality Gap Model - Singpore Post Case - Group15Document3 pagesService Quality Gap Model - Singpore Post Case - Group15FuckYou TradingNo ratings yet

- 6 - Postal Glossary Part IIDocument55 pages6 - Postal Glossary Part IIUma MaheswararaoNo ratings yet

- LMR Quiz 1Document5 pagesLMR Quiz 1Je KirsteneNo ratings yet

- C07 - Abu Hail Metro Station To Wafi Residences Dubai Bus Service TimetableDocument32 pagesC07 - Abu Hail Metro Station To Wafi Residences Dubai Bus Service TimetableDubai Q&ANo ratings yet

- EDN-Core Competencies of Nurses Responding To MCI-1Document5 pagesEDN-Core Competencies of Nurses Responding To MCI-1Chan SorianoNo ratings yet

- Disaster TriageDocument31 pagesDisaster Triagekurnia ciptaNo ratings yet

- Resume 2024-2Document1 pageResume 2024-2Samson Oroma OnginjoNo ratings yet

- Schedule Fees 2021 2022Document2 pagesSchedule Fees 2021 2022Marneil Daevid ArevaloNo ratings yet

- 24 PDFDocument14 pages24 PDFBBNo ratings yet

- Clinical RotationDocument2 pagesClinical RotationDarwin QuirimitNo ratings yet

- Hta - BiaDocument17 pagesHta - Bialaxman kavitkarNo ratings yet

- My Visa Cover Letter 1Document5 pagesMy Visa Cover Letter 1Tehami JawedNo ratings yet

- HEALTH INFINITY Plan ONE PagerDocument3 pagesHEALTH INFINITY Plan ONE PagerVikas SharmaNo ratings yet