Professional Documents

Culture Documents

Inventory Estimation - Gross Profit Method (Lecture and Exercises)

Inventory Estimation - Gross Profit Method (Lecture and Exercises)

Uploaded by

xvii entertainmentOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Estimation - Gross Profit Method (Lecture and Exercises)

Inventory Estimation - Gross Profit Method (Lecture and Exercises)

Uploaded by

xvii entertainmentCopyright:

Available Formats

Inventory Estimation Methods

Inventories have high inherent risk. It may be lost due to embezzlement or catastrophic events.

Estimation method- used to give a reliable measurement to inventory.

1. Gross Profit Method – usually used when there are catastrophies.

Example: To know the number of goods damaged, the amount of loss or even how

much is embezzled.

2. Cost-to-Retail Method – usually used to estimate amount of inventory of retail businesses.

Example: Used in malls or stores. Instead of physically counting the goods, they estimate

the amount of inventory.

*Estimation happens when physical count alone is not enough to give a reliable measurement of the

inventory. *

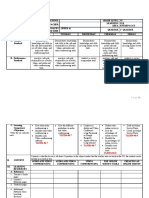

GROSS PROFIT METHOD

Remember: When estimating inventories, you do not consider sales discount and sales allowances.

Exception: If sales returns and allowances are together. (If not, sales allowances are ignored).

Gross Profit Method uses the COGS Method of accounting for ending inventory and Cost of

Goods Sold:

Note: Net Purchases = Purchases

Beginning Inventory – Returns – Allowances -

Discounts

Net Purchases +Freight In

-

Goods Available for Sale

(Estimated COGS)

Estimated Ending Inventory

How to estimate the COGS?

By getting the relationship between the Sales

and COGS. Example:

SALES 100 SALES 125%

(COGS) 75% (COGS) 100%

GROSS PROFIT 25% GROSS PROFIT 25%

(GP based on sales) (GP based on cost)

*Sales discounts and allowances are IGNORED because they DO NOT have physical transfer of

goods. This helps preserve the Gross Profit ratio and Cost ratio.*

If there is a Shortage due to Theft / Embezzlement

Estimated Ending Inventory Example: You have an estimated inventory of 100.

-Inventory Per Count During the inventory count, you only have 90.

-Goods not in Possession You purchased goods from a supplier with

Inventory Shortage terms FOB shipping point worth 5.

Estimated Ending Inventory 100

-Inventory Per Count 90

-Goods not in Possession 5

Inventory Shortage 5

Note: Goods not in possession can either be Goods in transit or Goods in Consignment.

If there is a Loss due to Catastrophe on hand goods

Estimated Ending Inventory

-Undamaged goods @cost including in transit goods in transit

- Partially damaged goods @LCNRV

Inventory Loss goods on consignment

Exercises:

Computation:

How to get the Ending Inventory:

Beginning Inventory P550,000

Total purchases 3,000,000

Freight In 60,000

Credit Memo (200,000)

Purchase Discount (80,000)

Goods In Transit (FOB shipping) 120,000

Cost of Goods Available for Sale 3,450,000

COGS (2,618,000)

Ending Inventory P832,000

How to get the estimated Cost of Goods Sold:

Total sales delivered and recorded P3,600,000

Unrecorded sales 300,000

Sales returns (160,000)

Net Sales P3,740,000 (100%)

COGS (2,618,000) (70%)

Gross Profit P1,122,000 (30%)

How to get the Inventory loss:

Ending Inventory P832,000

Undamaged Goods – goods in transit (120,000)

Partially damaged goods (50,000)

Inventory Loss P662,000

Answer : B

Computation:

How to get the Ending Inventory:

Jan 1, inventory P1,000,000

Purchases 800,000

Freight In 20,000

Cost of Goods Available for Sale 1,820,000

Cost of Goods Sold 1,477,000

Ending Inventory P 343,000

How to get the estimated Cost of Goods Sold:

Sales P2,200,000

Sales return (50,000)

Sales return (in transit) (40,000)

Net Sales 2,110,000 (100%)

COGS (1,477,000) (70%)

Gross Profit P633,000 (30%)

How to get the Inventory Shortage:

Ending Inventory P343,000

Inventory Per Count (160,000)

Goods not in Possesion @ cost (28,000) - 70% of 40,000

Inventory shortage P155,000

Answer: C

You might also like

- FIN1161 - Introduction To Finance For Business - Report 2Document6 pagesFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128No ratings yet

- Emperor Rise of The Middle Kingdom - ManualDocument151 pagesEmperor Rise of The Middle Kingdom - ManualAnonymous YLI2wF100% (1)

- Mallet Percussion ApproachDocument3 pagesMallet Percussion Approachjohap7100% (2)

- Mulukanoor Women's Mutually Aided Milk Producers' CooperativeDocument21 pagesMulukanoor Women's Mutually Aided Milk Producers' CooperativeSri HimajaNo ratings yet

- Traidos Bank Case Study - Marsha StevensDocument4 pagesTraidos Bank Case Study - Marsha StevensGilang Ramadhan0% (2)

- CH 05Document9 pagesCH 05Tien Thanh DangNo ratings yet

- P7Document2 pagesP7Andreas Brown0% (1)

- Unit 2: Accounting Concepts and Trial BalanceDocument12 pagesUnit 2: Accounting Concepts and Trial Balanceyaivna gopeeNo ratings yet

- CH 06Document4 pagesCH 06vivien100% (1)

- Studi Kasus 12 1 Dan 12 2Document4 pagesStudi Kasus 12 1 Dan 12 2Adhi PramuditaNo ratings yet

- Weygandt Accounting Principles 10e PowerPoint Ch09Document66 pagesWeygandt Accounting Principles 10e PowerPoint Ch09billy93No ratings yet

- BA5103-Accounting For ManagementDocument23 pagesBA5103-Accounting For Managementanon_183527117No ratings yet

- Contingencies Presented Below Are Three Independent Situations PDFDocument1 pageContingencies Presented Below Are Three Independent Situations PDFAnbu jaromiaNo ratings yet

- Russia-Ukraine Crisis and Its Impact On Global Supply Chain - 13 - 07Document4 pagesRussia-Ukraine Crisis and Its Impact On Global Supply Chain - 13 - 07Diva SharmaNo ratings yet

- SCM 1Document15 pagesSCM 1klumba2027No ratings yet

- Inflation Accounting New CourseDocument11 pagesInflation Accounting New CourseAkshay Mhatre100% (1)

- Chap 17Document34 pagesChap 17ridaNo ratings yet

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDocument69 pagesIntermediate Accounting: Prepared by University of California, Santa BarbaraHenry BarlowNo ratings yet

- Written Assignment Unit 4 Creating Your Own Five Paragraph Essay University of The PeopleDocument5 pagesWritten Assignment Unit 4 Creating Your Own Five Paragraph Essay University of The PeopleMack SpencerNo ratings yet

- The Promise of Constructivism in IRDocument31 pagesThe Promise of Constructivism in IRVivian YingNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- NFta and The United States Textileindustry Case StudyDocument1 pageNFta and The United States Textileindustry Case StudyMohamedNo ratings yet

- Chapter01Sol 6e2005fDocument42 pagesChapter01Sol 6e2005fThu HươngNo ratings yet

- Practice 2 Passage 1 (Question 1) : A Solution For Better HumanDocument4 pagesPractice 2 Passage 1 (Question 1) : A Solution For Better Humanweldy kurniawanNo ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- Financial Reporting Analysis 10e Manual by Charles H GibbsonDocument467 pagesFinancial Reporting Analysis 10e Manual by Charles H GibbsonRan CoatNo ratings yet

- Xacc280 Chapter 2Document46 pagesXacc280 Chapter 2jdcirbo100% (1)

- MSOP Project ReportDocument3 pagesMSOP Project Reportcsankitkhandal0% (2)

- Americas Trade PolicyDocument18 pagesAmericas Trade PolicyAnkit KhetanNo ratings yet

- C Law T2Document5 pagesC Law T2hudaNo ratings yet

- Assignment Financial ManagementDocument6 pagesAssignment Financial ManagementMinh Hằng TrịnhNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- All HOMEWORK ANSWER KEYDocument6 pagesAll HOMEWORK ANSWER KEYhy_saingheng_7602609No ratings yet

- Profile of OrganizationDocument5 pagesProfile of OrganizationSilver Stones PharmaNo ratings yet

- Jones Earnings Management During Import Relief InvestigationsDocument16 pagesJones Earnings Management During Import Relief InvestigationsarfankafNo ratings yet

- يوــــيــــــلعلا Note 1 Acc451 Accounting Information Systems AIS: An OverviewDocument8 pagesيوــــيــــــلعلا Note 1 Acc451 Accounting Information Systems AIS: An OverviewsararabeeaNo ratings yet

- Assignment 4Document2 pagesAssignment 4Samira AlhashimiNo ratings yet

- CH 03 Financial Statements ExercisesDocument39 pagesCH 03 Financial Statements ExercisesJocelyneKarolinaArriagaRangel100% (1)

- Mini Research Report Economic Growth in IndonesiaDocument13 pagesMini Research Report Economic Growth in IndonesialilyNo ratings yet

- Full DisclosureDocument22 pagesFull DisclosurepanjiNo ratings yet

- ALMI - Annual Report - 2016 (Rugi) PDFDocument115 pagesALMI - Annual Report - 2016 (Rugi) PDFbuwat donlotNo ratings yet

- Big Data and Changes in Audit Technology - Contemplating A Research AgendaDocument26 pagesBig Data and Changes in Audit Technology - Contemplating A Research AgendaMuh.shahib100% (1)

- Quiz On BudgetDocument2 pagesQuiz On BudgetShamittaaNo ratings yet

- Balance of Payment of India For StudentsDocument4 pagesBalance of Payment of India For StudentskhushiYNo ratings yet

- PartnershipDocument41 pagesPartnershipBinex67% (3)

- SEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Document5 pagesSEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Aaysha AgrawalNo ratings yet

- Article - Int Control 1Document25 pagesArticle - Int Control 1ColdBlooded CharmaineNo ratings yet

- Tugas Cost AccountingDocument7 pagesTugas Cost AccountingRudy Setiawan KamadjajaNo ratings yet

- Uts Asistensi Pengantar Akuntansi 2Document5 pagesUts Asistensi Pengantar Akuntansi 2Falhan AuliaNo ratings yet

- Value Stream Mapping As A Versatile Tool For Lean Implementation: An Indian Case Study of A Manufacturing FirmDocument11 pagesValue Stream Mapping As A Versatile Tool For Lean Implementation: An Indian Case Study of A Manufacturing FirmAditya Dimas IswandharuNo ratings yet

- Chapter 5Document6 pagesChapter 5Kajek FirstNo ratings yet

- UNIT 9 - LogisticsDocument7 pagesUNIT 9 - LogisticsTran AnhNo ratings yet

- Giachetti, Ronald E. - Design of Enterprise Systems - Theory, Architecture, and Methods (2010, CRC Press) - Páginas-229-261Document33 pagesGiachetti, Ronald E. - Design of Enterprise Systems - Theory, Architecture, and Methods (2010, CRC Press) - Páginas-229-261Loraynne Beatriz Amaya MarmolNo ratings yet

- MCS Case 1-2Document2 pagesMCS Case 1-2Shella FadelaNo ratings yet

- CH 06Document58 pagesCH 06Fathih Nawar FikriNo ratings yet

- CH 7Document9 pagesCH 7Karina AcostaNo ratings yet

- ADC 401 Financial ReportingDocument4 pagesADC 401 Financial ReportingM Ahmad M Ahmad100% (2)

- Journal of Accounting and Economics 7Document35 pagesJournal of Accounting and Economics 7Ovilia Intan DoniarNo ratings yet

- Module 8 - Inventory EstimationDocument10 pagesModule 8 - Inventory Estimationmarvy AndayaNo ratings yet

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Document7 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Lorraine Joy AbanillaNo ratings yet

- Inventories (Part 2)Document4 pagesInventories (Part 2)20220276No ratings yet

- Disaster Management: Floods, Earthquakes, Cyclones and Land SlidesDocument59 pagesDisaster Management: Floods, Earthquakes, Cyclones and Land SlidesAnand gowdaNo ratings yet

- BadmintonDocument11 pagesBadmintonIsabel Sanchez80% (5)

- Michael King - PresentationDocument14 pagesMichael King - PresentationArk GroupNo ratings yet

- Consumer Perception: A Conceptual FrameworkDocument12 pagesConsumer Perception: A Conceptual FrameworkRustyRamNo ratings yet

- Wholesale Fba Brands Sheet 12345Document18 pagesWholesale Fba Brands Sheet 12345you forNo ratings yet

- List of Red-Light Districts: Jump To Navigation Jump To SearchDocument32 pagesList of Red-Light Districts: Jump To Navigation Jump To SearchsudeepomNo ratings yet

- 83 - SUDO - Root Programme Unter User Laufen: SpecificationsDocument3 pages83 - SUDO - Root Programme Unter User Laufen: SpecificationssaeeddeepNo ratings yet

- Bhishek Atta: Junior Associate - TraineeDocument1 pageBhishek Atta: Junior Associate - TraineeMegha MattaNo ratings yet

- Detailed Experimental Principle or TheoryDocument2 pagesDetailed Experimental Principle or TheoryKrisha Mae Balazon RubioNo ratings yet

- Noise Pollution and Its Control at Construction SiteDocument14 pagesNoise Pollution and Its Control at Construction SiteAbhishek KadianNo ratings yet

- Pension Papers UAPDocument14 pagesPension Papers UAPgms313No ratings yet

- TERM 1 Half SYLLABUS PDFDocument5 pagesTERM 1 Half SYLLABUS PDFranjanjhallbNo ratings yet

- Atlantic BlueDocument70 pagesAtlantic BlueLyubomir IvanovNo ratings yet

- 1ºano Comparative Superlative FormDocument3 pages1ºano Comparative Superlative FormAna Carolina Gonçalves e SilvaNo ratings yet

- The Importance of Early Childhood EducationDocument4 pagesThe Importance of Early Childhood EducationImam Dwi MaryantoNo ratings yet

- Nstp1 Group 4Document31 pagesNstp1 Group 4Renato Dongito Jr.No ratings yet

- Karma by Khushwant SinghDocument13 pagesKarma by Khushwant SinghHazelClaveNo ratings yet

- Business Intelligence Solutions Buyers GuideDocument22 pagesBusiness Intelligence Solutions Buyers GuideJulio BazanNo ratings yet

- OIC Use Case V0 Import Journal Entries - Amazon S3 - Oracle Financials CloudDocument9 pagesOIC Use Case V0 Import Journal Entries - Amazon S3 - Oracle Financials Cloudsiva_lordNo ratings yet

- Critical Vices of PostmodernismDocument276 pagesCritical Vices of PostmodernismmytitaniciraqNo ratings yet

- TLE-ICT-WEEK-4-DLL Done Page 23-38Document15 pagesTLE-ICT-WEEK-4-DLL Done Page 23-38Sta. Rita Elementary School100% (2)

- EDUCATIONDocument14 pagesEDUCATIONVƯỢNG ĐỨCNo ratings yet

- FprEN 1998-1-1 (2024)Document123 pagesFprEN 1998-1-1 (2024)MarcoNo ratings yet

- Amrita NeurologyDocument2 pagesAmrita NeurologyGautham rajuNo ratings yet

- Presentación Argentina NegociaciónDocument33 pagesPresentación Argentina NegociaciónLeandro Bustamante TrujilloNo ratings yet

- About Datanet2Document1 pageAbout Datanet2ferdaus_rahimNo ratings yet

- Progressive Revelation: The Unfolding of God's RevelationDocument2 pagesProgressive Revelation: The Unfolding of God's Revelationgrace10000No ratings yet