Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

35 viewsKiddie Tax 2021

Kiddie Tax 2021

Uploaded by

Finn Kevin“Kiddie Tax” is the term used for the tax on certain unearned income of children taxed at the parent’s rate instead of the child’s rate. Children typically are in a lower

tax bracket than their parents and the Kiddie Tax was developed to prevent parents from lowering their tax liability by shifting investment income assets to their children.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Trustee HandbookDocument47 pagesTrustee HandbookAlberto88% (16)

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNo ratings yet

- 3-1-Notice of Correction For FraudDocument2 pages3-1-Notice of Correction For FraudJohn DownsNo ratings yet

- CDMB Presentation Re Discretionary Distributions A Trustees GuidelineDocument16 pagesCDMB Presentation Re Discretionary Distributions A Trustees Guidelineodovacar1No ratings yet

- Assignment - LLC Membership Interests in - (1 Person)Document2 pagesAssignment - LLC Membership Interests in - (1 Person)crystalNo ratings yet

- Instructions For Form 8615: Future DevelopmentsDocument11 pagesInstructions For Form 8615: Future DevelopmentsAmanda SareNo ratings yet

- Building Your Child's Education FundDocument32 pagesBuilding Your Child's Education FundLNP MEDIA GROUP, Inc.No ratings yet

- Direct Deposit Authorization Form Krystal McbeeDocument15 pagesDirect Deposit Authorization Form Krystal McbeeKrystal McbeeNo ratings yet

- Children Employed by Owners PDFDocument2 pagesChildren Employed by Owners PDFceostoriesNo ratings yet

- Families With Children 2021Document2 pagesFamilies With Children 2021Finn KevinNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- Onboarding Package - AB - Hourly - NewDocument6 pagesOnboarding Package - AB - Hourly - Newyumie canivelNo ratings yet

- 2019-2020 Tax GuideDocument2 pages2019-2020 Tax Guidecherry LiNo ratings yet

- Taxation of Individuals: Individual Income Tax Computation and Tax CreditsDocument53 pagesTaxation of Individuals: Individual Income Tax Computation and Tax CreditsKarina NoellNo ratings yet

- US Internal Revenue Service: I8615Document4 pagesUS Internal Revenue Service: I8615IRSNo ratings yet

- How To Save ITDocument14 pagesHow To Save ITVanessa PereiraNo ratings yet

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- US Internal Revenue Service: F1040es - 2000Document7 pagesUS Internal Revenue Service: F1040es - 2000IRSNo ratings yet

- Regulation MyNotesDocument50 pagesRegulation MyNotesaudalogy100% (1)

- DineroDocument4 pagesDineroValeria Amaya Burgos0% (1)

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Becker REG - Chapter 1 OutlineDocument5 pagesBecker REG - Chapter 1 OutlineCassandra TangNo ratings yet

- US Internal Revenue Service: F1040esn - 1998Document5 pagesUS Internal Revenue Service: F1040esn - 1998IRSNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- US Internal Revenue Service: F1040es - 2001Document7 pagesUS Internal Revenue Service: F1040es - 2001IRSNo ratings yet

- Economic Impact Payments For Social Security and Ssi RecipientsDocument7 pagesEconomic Impact Payments For Social Security and Ssi RecipientsLeanne Joy RumbaoaNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument38 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualihlemadonna100% (14)

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument33 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualngocalmai0236h100% (32)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Child Tax Credit and ACTCDocument1 pageChild Tax Credit and ACTCNelwin ThomasNo ratings yet

- BT 211 Module 05 1Document12 pagesBT 211 Module 05 1Franz PampolinaNo ratings yet

- 2020 Yukon Personal Tax Credits Return: Td1YtDocument2 pages2020 Yukon Personal Tax Credits Return: Td1YtBryan WilleyNo ratings yet

- "Child Tax Credits and Economic Impact Payments" May Have Considerable Implications For Your Tax FilingDocument2 pages"Child Tax Credits and Economic Impact Payments" May Have Considerable Implications For Your Tax FilingNewzjunky0% (1)

- CH 04Document65 pagesCH 04engarbangarNo ratings yet

- Summary Notes - Week 7Document4 pagesSummary Notes - Week 7Aayushi NaikNo ratings yet

- Tax-Efficient Investment For Your Grandchildren: Junior IsasDocument1 pageTax-Efficient Investment For Your Grandchildren: Junior Isasapi-125732404No ratings yet

- EA LectureNotesDocument84 pagesEA LectureNotesKim Nguyen100% (1)

- Frequently Asked Questions: Immigrants and Tax Credits: 2. Can Immigrants Claim The Child Tax Credit (CTC) ?Document2 pagesFrequently Asked Questions: Immigrants and Tax Credits: 2. Can Immigrants Claim The Child Tax Credit (CTC) ?JamesNo ratings yet

- US Internal Revenue Service: fw5 - 1998Document2 pagesUS Internal Revenue Service: fw5 - 1998IRSNo ratings yet

- Chapter 3 - Investment IncomeDocument26 pagesChapter 3 - Investment IncomeRyan YangNo ratings yet

- Regulation 1: Individual TaxationDocument14 pagesRegulation 1: Individual TaxationFaten AlraiiNo ratings yet

- US Internal Revenue Service: F1040esn - 2002Document5 pagesUS Internal Revenue Service: F1040esn - 2002IRSNo ratings yet

- Ea Ea1 Su1 CCDocument2 pagesEa Ea1 Su1 CCAnkit chouhanNo ratings yet

- TaxationDocument5 pagesTaxationHyuga NejiNo ratings yet

- Parents FormDocument11 pagesParents Formrico saundersNo ratings yet

- 2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsDocument12 pages2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsCrystal KleistNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (37)

- Module 2 Slides - Income and Income ExclusionsDocument48 pagesModule 2 Slides - Income and Income Exclusionsjciy4No ratings yet

- Overlooked Tax DeductionsDocument4 pagesOverlooked Tax Deductionsskumar1965No ratings yet

- ACC 330 Final Project Formal Letter To Client TemplateDocument4 pagesACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Child Tax Credit: Future DevelopmentsDocument14 pagesChild Tax Credit: Future DevelopmentsKimNo ratings yet

- Tax Credit Return PDFDocument2 pagesTax Credit Return PDFserbisyongtotooNo ratings yet

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- 04 - Taxes (Key)Document5 pages04 - Taxes (Key)j leeNo ratings yet

- Tax Update 2009Document2 pagesTax Update 2009calebwoodsNo ratings yet

- Ontario TD1Document2 pagesOntario TD1Diego Gallo MacínNo ratings yet

- Loopholes of The RichDocument17 pagesLoopholes of The RichcarolinegodwinNo ratings yet

- Interest, Dividends and Social Security BenefitsDocument32 pagesInterest, Dividends and Social Security BenefitskhayceepadillaNo ratings yet

- Dynasty TrustsDocument5 pagesDynasty TrustsMarcus Lenton100% (2)

- Business Use of Home 2021Document2 pagesBusiness Use of Home 2021Finn KevinNo ratings yet

- Itemized Deductions - Homeowners 2021Document2 pagesItemized Deductions - Homeowners 2021Finn KevinNo ratings yet

- Individual Retirement Accounts - Roth IRAs 2021Document2 pagesIndividual Retirement Accounts - Roth IRAs 2021Finn KevinNo ratings yet

- Individual Retirement Accounts - Required Minimum Distributions RMDs 2021Document2 pagesIndividual Retirement Accounts - Required Minimum Distributions RMDs 2021Finn KevinNo ratings yet

- Household Employees 2021Document2 pagesHousehold Employees 2021Finn KevinNo ratings yet

- Identity Theft and Your Taxes 2021Document2 pagesIdentity Theft and Your Taxes 2021Finn KevinNo ratings yet

- Health Savings Accounts HSAs 2021Document2 pagesHealth Savings Accounts HSAs 2021Finn KevinNo ratings yet

- Individual Retirement Accounts - Backdoor Roth IRA 2021Document2 pagesIndividual Retirement Accounts - Backdoor Roth IRA 2021Finn KevinNo ratings yet

- Self-Employment Tax 2021Document2 pagesSelf-Employment Tax 2021Finn KevinNo ratings yet

- High-Income Taxpayers 2021Document2 pagesHigh-Income Taxpayers 2021Finn KevinNo ratings yet

- Short-Term Rentals 2021Document2 pagesShort-Term Rentals 2021Finn KevinNo ratings yet

- Expense Reimbursements For Employees 2021Document2 pagesExpense Reimbursements For Employees 2021Finn KevinNo ratings yet

- Taxpayers Who Receive An IRS Notice 2021Document2 pagesTaxpayers Who Receive An IRS Notice 2021Finn KevinNo ratings yet

- Recordkeeping For Tax Purposes 2021Document2 pagesRecordkeeping For Tax Purposes 2021Finn KevinNo ratings yet

- Form 1099-MISC and Form 1099-NEC Reporting 2021Document2 pagesForm 1099-MISC and Form 1099-NEC Reporting 2021Finn KevinNo ratings yet

- Small Business Health Care Tax Credit 2021Document2 pagesSmall Business Health Care Tax Credit 2021Finn KevinNo ratings yet

- Partnerships: Save $ and Experience The DifferenceDocument2 pagesPartnerships: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- Referrals Appreciated 2021Document2 pagesReferrals Appreciated 2021Finn KevinNo ratings yet

- Rental Income and Expenses 2021Document2 pagesRental Income and Expenses 2021Finn KevinNo ratings yet

- Filing Status 2021Document2 pagesFiling Status 2021Finn KevinNo ratings yet

- Estimated Taxes: Save $ and Experience The DifferenceDocument2 pagesEstimated Taxes: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- Farm Expenses Worksheet 2021Document2 pagesFarm Expenses Worksheet 2021Finn KevinNo ratings yet

- Farm Vehicles and Fuels 2021Document2 pagesFarm Vehicles and Fuels 2021Finn KevinNo ratings yet

- Multi-State Taxation 2021Document2 pagesMulti-State Taxation 2021Finn KevinNo ratings yet

- Farm Income Worksheet 2021Document2 pagesFarm Income Worksheet 2021Finn KevinNo ratings yet

- Employee or Independent Contractor 2021Document2 pagesEmployee or Independent Contractor 2021Finn KevinNo ratings yet

- Dependent Support Worksheet 2021Document2 pagesDependent Support Worksheet 2021Finn KevinNo ratings yet

- Pandemic Relief: Save $ and Experience The DifferenceDocument2 pagesPandemic Relief: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- What Should You Do If You Cant Pay Your Taxes 2021Document2 pagesWhat Should You Do If You Cant Pay Your Taxes 2021Finn KevinNo ratings yet

- Education Tax Benefits 2021Document2 pagesEducation Tax Benefits 2021Finn KevinNo ratings yet

- Case List - TrustDocument5 pagesCase List - TrustRdn DiamanteNo ratings yet

- Online Trading ProposalDocument14 pagesOnline Trading ProposalAlex CurtoisNo ratings yet

- Designation of Beneficiary: ImportantDocument3 pagesDesignation of Beneficiary: ImportantJeremy KissellNo ratings yet

- Unlversltl Teknologi Mara Final Examination:: Equity: LAW5011233: 23 MARCH 2005: 3 HOURS (9.00 A.MDocument4 pagesUnlversltl Teknologi Mara Final Examination:: Equity: LAW5011233: 23 MARCH 2005: 3 HOURS (9.00 A.Mspecies09No ratings yet

- Trust Fund Doctrine, Ong Yong v. Tiu, RonaldDocument2 pagesTrust Fund Doctrine, Ong Yong v. Tiu, RonaldJoshua Pielago100% (4)

- Case Laws For ReferenceDocument8 pagesCase Laws For ReferenceSrijan MishraNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition Copley Solutions Manual Full Chapter PDFDocument49 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition Copley Solutions Manual Full Chapter PDFJessicaTorresxokc100% (18)

- Mutual FundsDocument8 pagesMutual FundsHarmanSinghNo ratings yet

- Introduction To Estate Planning CFPDocument5 pagesIntroduction To Estate Planning CFPbitterhoney4871No ratings yet

- Article 1440Document2 pagesArticle 1440Brandon BaxterNo ratings yet

- IRS Publication Form 706Document4 pagesIRS Publication Form 706Francis Wolfgang UrbanNo ratings yet

- Company Law LAW2450 - Topic Notes - Topic 1Document7 pagesCompany Law LAW2450 - Topic Notes - Topic 1KimNo ratings yet

- Security Bank Corporation, V. Great Wall Commercial Press Company, Inc., G.R. No. 219345, January 30, 2017 Mendoza, J. FactsDocument8 pagesSecurity Bank Corporation, V. Great Wall Commercial Press Company, Inc., G.R. No. 219345, January 30, 2017 Mendoza, J. FactsClint Joseph CatacutanNo ratings yet

- Consumer Perception Uti Mutual FundDocument80 pagesConsumer Perception Uti Mutual FundMazhar Zaman100% (1)

- Module 2 CasesDocument87 pagesModule 2 CasesMCDNo ratings yet

- Establishing A Business in TanzaniaDocument54 pagesEstablishing A Business in Tanzaniaimran hameerNo ratings yet

- The Bookkeepers Guide To Internal ControlsDocument10 pagesThe Bookkeepers Guide To Internal ControlsDemitrius GreenNo ratings yet

- NERI V HEIRS OF HADJI YUSOP UYDocument2 pagesNERI V HEIRS OF HADJI YUSOP UYChilzia RojasNo ratings yet

- Marcos Ii vs. Ca 273 SCRA 47, GR No. 120880, June 5, 1997Document3 pagesMarcos Ii vs. Ca 273 SCRA 47, GR No. 120880, June 5, 1997Ralph Christian UsonNo ratings yet

- Reynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodeDocument35 pagesReynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodesaverjaneNo ratings yet

- On-Line Expression of Interest (EOI) For Empanelment and Strategic TIE-UP With Indian Startup CompaniesDocument40 pagesOn-Line Expression of Interest (EOI) For Empanelment and Strategic TIE-UP With Indian Startup CompaniesMounik PaniNo ratings yet

- Heirs of Timoteo Moreno vs. Mactan CebuDocument5 pagesHeirs of Timoteo Moreno vs. Mactan Cebushirlyn cuyongNo ratings yet

- WillsDocument2 pagesWillsPepa JuarezNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument8 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionnatashaNo ratings yet

- Privatization and Management OfficeDocument27 pagesPrivatization and Management Officesabrina gayoNo ratings yet

- First Nat'l Bank of St. Paul v. Ramier, 311 N.W.2d 502 (Minn. 1981)Document4 pagesFirst Nat'l Bank of St. Paul v. Ramier, 311 N.W.2d 502 (Minn. 1981)richdebtNo ratings yet

Kiddie Tax 2021

Kiddie Tax 2021

Uploaded by

Finn Kevin0 ratings0% found this document useful (0 votes)

35 views2 pages“Kiddie Tax” is the term used for the tax on certain unearned income of children taxed at the parent’s rate instead of the child’s rate. Children typically are in a lower

tax bracket than their parents and the Kiddie Tax was developed to prevent parents from lowering their tax liability by shifting investment income assets to their children.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document“Kiddie Tax” is the term used for the tax on certain unearned income of children taxed at the parent’s rate instead of the child’s rate. Children typically are in a lower

tax bracket than their parents and the Kiddie Tax was developed to prevent parents from lowering their tax liability by shifting investment income assets to their children.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

35 views2 pagesKiddie Tax 2021

Kiddie Tax 2021

Uploaded by

Finn Kevin“Kiddie Tax” is the term used for the tax on certain unearned income of children taxed at the parent’s rate instead of the child’s rate. Children typically are in a lower

tax bracket than their parents and the Kiddie Tax was developed to prevent parents from lowering their tax liability by shifting investment income assets to their children.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

TAX YEAR

2021

Kiddie Tax

Save $

And Experience

The Difference

+1-516-464-7444

info@cpaclinics.com

www.cpaclinics.com

Kiddie Tax Unearned income. Unearned income is generally all

income other than earned income. It includes invest-

“Kiddie Tax” is the term used for the tax on certain un- ment-type income such as taxable interest, dividends, cap-

earned income of children taxed at the parent’s rate in- ital gains (including capital gain distributions), rents, royal-

stead of the child’s rate. Children typically are in a lower ties, taxable Social Security benefits, pension and annuity

tax bracket than their parents and the Kiddie Tax was de- income, taxable scholarship and fellowship grants not re-

veloped to prevent parents from lowering their tax liability ported on Form W-2, unemployment compensation, alimo-

by shifting investment income assets to their children. ny, and unearned income received as the beneficiary of a

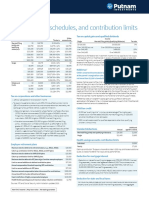

Tax Treatment of Child’s Unearned Income* trust. Unearned income includes amounts produced by as-

Income Amount On Child’s Return On Parent’s Return sets the child obtained with earned income (such as interest

First $1,100 Not taxed. Not taxed. on a savings account into which the child deposited wages).

Second $1,100 Taxed at 10% (0% for Taxed at 10%. Nontaxable income. Unearned income includes only

capital gains and qualified

dividends). amounts the child must include in gross income. Nontax-

Amounts over Taxed at parent’s rate for Added to parent’s income as able unearned income, such as tax-exempt interest and the

$2,200 ordinary income and/or ordinary income, qualified nontaxable part of Social Security and pension payments,

capital gains. dividends, or capital gain is not included in gross income.

distributions.

* For dependents with no earned income. Capital loss. A child’s capital losses are taken into account

in figuring the child’s unearned income. Capital losses are

Kiddie Tax General Rules first applied against capital gains. If the capital losses are

more than the capital gains, the difference (up to $3,000) is

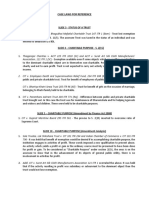

Children Subject to Kiddie Tax

subtracted from the child’s interest, dividends, and other

• Child’s unearned income (investment-type • The child is required to file a tax return

income) was more than $2,200. for the year. unearned income. Any difference over $3,000 is carried to

• At least one of the child’s parents was • The child does not file a joint tax return the next year.

alive at the end of the tax year. for the year.

• The child meets one of the following age requirements:

Income from property received as a gift. A child’s un-

Under Age 18 Kiddie Tax applies

earned income includes all income produced by property

Age 18 Kiddie Tax applies unless the child provided more than half of belonging to the child. This is true even if the property was

his or her own support with earned income. transferred to the child, regardless of when the property was

Full-Time Students Kiddie Tax applies unless the child provided more than half of transferred or purchased or who transferred it. A child’s un-

Ages 19 – 23 his or her own support with earned income. earned income includes income produced by property giv-

Age is determined on January 1.* en as a gift to the child. This includes gifts to the child from

* January 1 birthdays. Under Kiddie Tax rules, a child born on January 1 reaches that

age at the end of the previous year. For example, a child born on January 1, 2004, grandparents or any other person and gifts made under the

reaches age 18 on December 31, 2021. Uniform Gift to Minors Act.

Parent Includes Child’s Income/Tax on Parent

Return

Kiddie Tax The election to include a child’s income/tax on a parent’s

tax return is still available. In order to make this election,

the child’s unearned income must be less than $11,000 for

the year among other qualifications.

Example: Amanda, age 13, received the following income.

Dividends—$1,000 Tax-exempt interest—$100 The parent’s election to include the child’s income/tax on

Wages—$2,100 Capital gains—$300 the parent return is figured on a separate form which must

Taxable interest—$1,200 Capital losses—($200) be attached to the parent’s tax return.

The dividends were qualified dividends on stock given to her by Reasons to file a separate return for your child:

her grandparents. • Your child’s investment income could reduce your

Amanda’s unearned income is $2,300. This is the total of the div- Earned Income Credit.

idends ($1,000), taxable interest ($1,200), and capital gains re- • Deductions and credits limited or phased out by AGI

duced by capital losses ($300 − $200 = $100). Her wages are (Child Tax Credit, Credit for Other Dependents, educa-

earned income because they are received for work actually per- tion credits, medical deductions, etc.) could be affected.

formed. Her tax-exempt interest is not included because it is • The taxable portion of any Social Security Benefits you

nontaxable. receive may increase.

• Some deductions can only be taken on your child’s

Trust income. If a child is the beneficiary of a trust, distri-

return.

butions of taxable interest, dividends, capital gains, and

– Higher standard deduction if the child is blind.

other unearned income from the trust are unearned in-

– His or her own itemized deductions.

come to the child. However, taxable distributions from a

– Penalty on early withdrawal of the child’s savings.

qualified disability trust are considered earned income.

– His or her capital loss carryover.

Earned income. Earned income includes wages, salaries, • If your child has qualified dividends or capital gain distri-

tips, and other payments for personal services performed. butions, tax is up to $110 lower on his or her own return.

For purposes of determining a dependent’s standard de- • Your child’s tax-exempt interest from certain private

duction, earned income also includes any part of a scholar- activity bonds would not be included in your AMT

ship or fellowship grant that the dependent must include in calculation.

his or her gross income. Earned income also includes tax- • The additional tax on your child’s income would not

able distributions from a qualified disability trust. increase your estimated tax requirements.

Support. A child’s support includes all amounts spent to pro- Reasons to report your child’s income on your return:

vide the child with food, lodging, clothing, education, med- • No additional return is required for your child.

ical and dental care, recreation, transportation, and similar • No estimated taxes payments are required for your child.

necessities. • Your child’s tax can be paid from your withholding.

• Your child’s income is treated as your income for purpos-

Child Files a Tax Return es of the investment interest expense deduction.

For a child who must file a tax return, Form 8615, Tax for Cer-

tain Children Who Have Unearned Income, is used to calcu-

late the child’s tax and must be attached to the child’s tax

return.

A child whose tax is figured on Form 8615 may be subject Contact Us

to the net investment income tax (NIIT). The NIIT is a 3.8% There are many events that occur during the year that can affect

your tax situation. Preparation of your tax return involves sum-

additional tax on the lesser of net investment income or marizing transactions and events that occurred during the prior

the excess of the child’s modified adjusted gross income year. In most situations, treatment is firmly established at the

(MAGI) over a threshold amount. time the transaction occurs. However, negative tax effects can

be avoided by proper planning. Please contact us in advance

if you have questions about the tax effects of a transaction or

event, including the following:

• Pension or IRA distributions. • Retirement.

• Significant change in income or • Notice from IRS or other

deductions. revenue department.

• Job change. • Divorce or separation.

This brochure contains general information for taxpayers and • Marriage. • Self-employment.

should not be relied upon as the only source of authority. • Attainment of age 59½ or 72. • Charitable contributions

Taxpayers should seek professional tax advice for more information. • Sale or purchase of a business. of property in excess of

• Sale or purchase of a residence $5,000.

Copyright © 2021 Tax Materials, Inc.

or other real estate.

All Rights Reserved

Powered by TCPDF (www.tcpdf.org)

You might also like

- Trustee HandbookDocument47 pagesTrustee HandbookAlberto88% (16)

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNo ratings yet

- 3-1-Notice of Correction For FraudDocument2 pages3-1-Notice of Correction For FraudJohn DownsNo ratings yet

- CDMB Presentation Re Discretionary Distributions A Trustees GuidelineDocument16 pagesCDMB Presentation Re Discretionary Distributions A Trustees Guidelineodovacar1No ratings yet

- Assignment - LLC Membership Interests in - (1 Person)Document2 pagesAssignment - LLC Membership Interests in - (1 Person)crystalNo ratings yet

- Instructions For Form 8615: Future DevelopmentsDocument11 pagesInstructions For Form 8615: Future DevelopmentsAmanda SareNo ratings yet

- Building Your Child's Education FundDocument32 pagesBuilding Your Child's Education FundLNP MEDIA GROUP, Inc.No ratings yet

- Direct Deposit Authorization Form Krystal McbeeDocument15 pagesDirect Deposit Authorization Form Krystal McbeeKrystal McbeeNo ratings yet

- Children Employed by Owners PDFDocument2 pagesChildren Employed by Owners PDFceostoriesNo ratings yet

- Families With Children 2021Document2 pagesFamilies With Children 2021Finn KevinNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- Onboarding Package - AB - Hourly - NewDocument6 pagesOnboarding Package - AB - Hourly - Newyumie canivelNo ratings yet

- 2019-2020 Tax GuideDocument2 pages2019-2020 Tax Guidecherry LiNo ratings yet

- Taxation of Individuals: Individual Income Tax Computation and Tax CreditsDocument53 pagesTaxation of Individuals: Individual Income Tax Computation and Tax CreditsKarina NoellNo ratings yet

- US Internal Revenue Service: I8615Document4 pagesUS Internal Revenue Service: I8615IRSNo ratings yet

- How To Save ITDocument14 pagesHow To Save ITVanessa PereiraNo ratings yet

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- US Internal Revenue Service: F1040es - 2000Document7 pagesUS Internal Revenue Service: F1040es - 2000IRSNo ratings yet

- Regulation MyNotesDocument50 pagesRegulation MyNotesaudalogy100% (1)

- DineroDocument4 pagesDineroValeria Amaya Burgos0% (1)

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Becker REG - Chapter 1 OutlineDocument5 pagesBecker REG - Chapter 1 OutlineCassandra TangNo ratings yet

- US Internal Revenue Service: F1040esn - 1998Document5 pagesUS Internal Revenue Service: F1040esn - 1998IRSNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- US Internal Revenue Service: F1040es - 2001Document7 pagesUS Internal Revenue Service: F1040es - 2001IRSNo ratings yet

- Economic Impact Payments For Social Security and Ssi RecipientsDocument7 pagesEconomic Impact Payments For Social Security and Ssi RecipientsLeanne Joy RumbaoaNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument38 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualihlemadonna100% (14)

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument33 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualngocalmai0236h100% (32)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Child Tax Credit and ACTCDocument1 pageChild Tax Credit and ACTCNelwin ThomasNo ratings yet

- BT 211 Module 05 1Document12 pagesBT 211 Module 05 1Franz PampolinaNo ratings yet

- 2020 Yukon Personal Tax Credits Return: Td1YtDocument2 pages2020 Yukon Personal Tax Credits Return: Td1YtBryan WilleyNo ratings yet

- "Child Tax Credits and Economic Impact Payments" May Have Considerable Implications For Your Tax FilingDocument2 pages"Child Tax Credits and Economic Impact Payments" May Have Considerable Implications For Your Tax FilingNewzjunky0% (1)

- CH 04Document65 pagesCH 04engarbangarNo ratings yet

- Summary Notes - Week 7Document4 pagesSummary Notes - Week 7Aayushi NaikNo ratings yet

- Tax-Efficient Investment For Your Grandchildren: Junior IsasDocument1 pageTax-Efficient Investment For Your Grandchildren: Junior Isasapi-125732404No ratings yet

- EA LectureNotesDocument84 pagesEA LectureNotesKim Nguyen100% (1)

- Frequently Asked Questions: Immigrants and Tax Credits: 2. Can Immigrants Claim The Child Tax Credit (CTC) ?Document2 pagesFrequently Asked Questions: Immigrants and Tax Credits: 2. Can Immigrants Claim The Child Tax Credit (CTC) ?JamesNo ratings yet

- US Internal Revenue Service: fw5 - 1998Document2 pagesUS Internal Revenue Service: fw5 - 1998IRSNo ratings yet

- Chapter 3 - Investment IncomeDocument26 pagesChapter 3 - Investment IncomeRyan YangNo ratings yet

- Regulation 1: Individual TaxationDocument14 pagesRegulation 1: Individual TaxationFaten AlraiiNo ratings yet

- US Internal Revenue Service: F1040esn - 2002Document5 pagesUS Internal Revenue Service: F1040esn - 2002IRSNo ratings yet

- Ea Ea1 Su1 CCDocument2 pagesEa Ea1 Su1 CCAnkit chouhanNo ratings yet

- TaxationDocument5 pagesTaxationHyuga NejiNo ratings yet

- Parents FormDocument11 pagesParents Formrico saundersNo ratings yet

- 2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsDocument12 pages2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsCrystal KleistNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (37)

- Module 2 Slides - Income and Income ExclusionsDocument48 pagesModule 2 Slides - Income and Income Exclusionsjciy4No ratings yet

- Overlooked Tax DeductionsDocument4 pagesOverlooked Tax Deductionsskumar1965No ratings yet

- ACC 330 Final Project Formal Letter To Client TemplateDocument4 pagesACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Child Tax Credit: Future DevelopmentsDocument14 pagesChild Tax Credit: Future DevelopmentsKimNo ratings yet

- Tax Credit Return PDFDocument2 pagesTax Credit Return PDFserbisyongtotooNo ratings yet

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- 04 - Taxes (Key)Document5 pages04 - Taxes (Key)j leeNo ratings yet

- Tax Update 2009Document2 pagesTax Update 2009calebwoodsNo ratings yet

- Ontario TD1Document2 pagesOntario TD1Diego Gallo MacínNo ratings yet

- Loopholes of The RichDocument17 pagesLoopholes of The RichcarolinegodwinNo ratings yet

- Interest, Dividends and Social Security BenefitsDocument32 pagesInterest, Dividends and Social Security BenefitskhayceepadillaNo ratings yet

- Dynasty TrustsDocument5 pagesDynasty TrustsMarcus Lenton100% (2)

- Business Use of Home 2021Document2 pagesBusiness Use of Home 2021Finn KevinNo ratings yet

- Itemized Deductions - Homeowners 2021Document2 pagesItemized Deductions - Homeowners 2021Finn KevinNo ratings yet

- Individual Retirement Accounts - Roth IRAs 2021Document2 pagesIndividual Retirement Accounts - Roth IRAs 2021Finn KevinNo ratings yet

- Individual Retirement Accounts - Required Minimum Distributions RMDs 2021Document2 pagesIndividual Retirement Accounts - Required Minimum Distributions RMDs 2021Finn KevinNo ratings yet

- Household Employees 2021Document2 pagesHousehold Employees 2021Finn KevinNo ratings yet

- Identity Theft and Your Taxes 2021Document2 pagesIdentity Theft and Your Taxes 2021Finn KevinNo ratings yet

- Health Savings Accounts HSAs 2021Document2 pagesHealth Savings Accounts HSAs 2021Finn KevinNo ratings yet

- Individual Retirement Accounts - Backdoor Roth IRA 2021Document2 pagesIndividual Retirement Accounts - Backdoor Roth IRA 2021Finn KevinNo ratings yet

- Self-Employment Tax 2021Document2 pagesSelf-Employment Tax 2021Finn KevinNo ratings yet

- High-Income Taxpayers 2021Document2 pagesHigh-Income Taxpayers 2021Finn KevinNo ratings yet

- Short-Term Rentals 2021Document2 pagesShort-Term Rentals 2021Finn KevinNo ratings yet

- Expense Reimbursements For Employees 2021Document2 pagesExpense Reimbursements For Employees 2021Finn KevinNo ratings yet

- Taxpayers Who Receive An IRS Notice 2021Document2 pagesTaxpayers Who Receive An IRS Notice 2021Finn KevinNo ratings yet

- Recordkeeping For Tax Purposes 2021Document2 pagesRecordkeeping For Tax Purposes 2021Finn KevinNo ratings yet

- Form 1099-MISC and Form 1099-NEC Reporting 2021Document2 pagesForm 1099-MISC and Form 1099-NEC Reporting 2021Finn KevinNo ratings yet

- Small Business Health Care Tax Credit 2021Document2 pagesSmall Business Health Care Tax Credit 2021Finn KevinNo ratings yet

- Partnerships: Save $ and Experience The DifferenceDocument2 pagesPartnerships: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- Referrals Appreciated 2021Document2 pagesReferrals Appreciated 2021Finn KevinNo ratings yet

- Rental Income and Expenses 2021Document2 pagesRental Income and Expenses 2021Finn KevinNo ratings yet

- Filing Status 2021Document2 pagesFiling Status 2021Finn KevinNo ratings yet

- Estimated Taxes: Save $ and Experience The DifferenceDocument2 pagesEstimated Taxes: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- Farm Expenses Worksheet 2021Document2 pagesFarm Expenses Worksheet 2021Finn KevinNo ratings yet

- Farm Vehicles and Fuels 2021Document2 pagesFarm Vehicles and Fuels 2021Finn KevinNo ratings yet

- Multi-State Taxation 2021Document2 pagesMulti-State Taxation 2021Finn KevinNo ratings yet

- Farm Income Worksheet 2021Document2 pagesFarm Income Worksheet 2021Finn KevinNo ratings yet

- Employee or Independent Contractor 2021Document2 pagesEmployee or Independent Contractor 2021Finn KevinNo ratings yet

- Dependent Support Worksheet 2021Document2 pagesDependent Support Worksheet 2021Finn KevinNo ratings yet

- Pandemic Relief: Save $ and Experience The DifferenceDocument2 pagesPandemic Relief: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- What Should You Do If You Cant Pay Your Taxes 2021Document2 pagesWhat Should You Do If You Cant Pay Your Taxes 2021Finn KevinNo ratings yet

- Education Tax Benefits 2021Document2 pagesEducation Tax Benefits 2021Finn KevinNo ratings yet

- Case List - TrustDocument5 pagesCase List - TrustRdn DiamanteNo ratings yet

- Online Trading ProposalDocument14 pagesOnline Trading ProposalAlex CurtoisNo ratings yet

- Designation of Beneficiary: ImportantDocument3 pagesDesignation of Beneficiary: ImportantJeremy KissellNo ratings yet

- Unlversltl Teknologi Mara Final Examination:: Equity: LAW5011233: 23 MARCH 2005: 3 HOURS (9.00 A.MDocument4 pagesUnlversltl Teknologi Mara Final Examination:: Equity: LAW5011233: 23 MARCH 2005: 3 HOURS (9.00 A.Mspecies09No ratings yet

- Trust Fund Doctrine, Ong Yong v. Tiu, RonaldDocument2 pagesTrust Fund Doctrine, Ong Yong v. Tiu, RonaldJoshua Pielago100% (4)

- Case Laws For ReferenceDocument8 pagesCase Laws For ReferenceSrijan MishraNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition Copley Solutions Manual Full Chapter PDFDocument49 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition Copley Solutions Manual Full Chapter PDFJessicaTorresxokc100% (18)

- Mutual FundsDocument8 pagesMutual FundsHarmanSinghNo ratings yet

- Introduction To Estate Planning CFPDocument5 pagesIntroduction To Estate Planning CFPbitterhoney4871No ratings yet

- Article 1440Document2 pagesArticle 1440Brandon BaxterNo ratings yet

- IRS Publication Form 706Document4 pagesIRS Publication Form 706Francis Wolfgang UrbanNo ratings yet

- Company Law LAW2450 - Topic Notes - Topic 1Document7 pagesCompany Law LAW2450 - Topic Notes - Topic 1KimNo ratings yet

- Security Bank Corporation, V. Great Wall Commercial Press Company, Inc., G.R. No. 219345, January 30, 2017 Mendoza, J. FactsDocument8 pagesSecurity Bank Corporation, V. Great Wall Commercial Press Company, Inc., G.R. No. 219345, January 30, 2017 Mendoza, J. FactsClint Joseph CatacutanNo ratings yet

- Consumer Perception Uti Mutual FundDocument80 pagesConsumer Perception Uti Mutual FundMazhar Zaman100% (1)

- Module 2 CasesDocument87 pagesModule 2 CasesMCDNo ratings yet

- Establishing A Business in TanzaniaDocument54 pagesEstablishing A Business in Tanzaniaimran hameerNo ratings yet

- The Bookkeepers Guide To Internal ControlsDocument10 pagesThe Bookkeepers Guide To Internal ControlsDemitrius GreenNo ratings yet

- NERI V HEIRS OF HADJI YUSOP UYDocument2 pagesNERI V HEIRS OF HADJI YUSOP UYChilzia RojasNo ratings yet

- Marcos Ii vs. Ca 273 SCRA 47, GR No. 120880, June 5, 1997Document3 pagesMarcos Ii vs. Ca 273 SCRA 47, GR No. 120880, June 5, 1997Ralph Christian UsonNo ratings yet

- Reynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodeDocument35 pagesReynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodesaverjaneNo ratings yet

- On-Line Expression of Interest (EOI) For Empanelment and Strategic TIE-UP With Indian Startup CompaniesDocument40 pagesOn-Line Expression of Interest (EOI) For Empanelment and Strategic TIE-UP With Indian Startup CompaniesMounik PaniNo ratings yet

- Heirs of Timoteo Moreno vs. Mactan CebuDocument5 pagesHeirs of Timoteo Moreno vs. Mactan Cebushirlyn cuyongNo ratings yet

- WillsDocument2 pagesWillsPepa JuarezNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument8 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionnatashaNo ratings yet

- Privatization and Management OfficeDocument27 pagesPrivatization and Management Officesabrina gayoNo ratings yet

- First Nat'l Bank of St. Paul v. Ramier, 311 N.W.2d 502 (Minn. 1981)Document4 pagesFirst Nat'l Bank of St. Paul v. Ramier, 311 N.W.2d 502 (Minn. 1981)richdebtNo ratings yet