Professional Documents

Culture Documents

Tax Table No. 07 Rates For The Deduction of Tax From The Second Employment

Tax Table No. 07 Rates For The Deduction of Tax From The Second Employment

Uploaded by

ThamilaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nallur by Jean ArasanayagamDocument3 pagesNallur by Jean ArasanayagamThamilaNo ratings yet

- Uqo, A Ixirkh Iy Uy Nexl J: Institution MangementDocument12 pagesUqo, A Ixirkh Iy Uy Nexl J: Institution MangementThamilaNo ratings yet

- 2) Financial IntermediationDocument14 pages2) Financial IntermediationThamilaNo ratings yet

- Survey of Financial System: Uq, H Moao S IólaikhDocument24 pagesSurvey of Financial System: Uq, H Moao S IólaikhThamilaNo ratings yet

- 1) Introduction To Survey of Financial SystemDocument11 pages1) Introduction To Survey of Financial SystemThamilaNo ratings yet

- l02 S 16 MDocument19 pagesl02 S 16 MThamilaNo ratings yet

- Code of Criminal ProcedureDocument160 pagesCode of Criminal ProcedureThamilaNo ratings yet

- Legislative Drafting & Statutory InterpretationDocument25 pagesLegislative Drafting & Statutory InterpretationThamila100% (1)

- Dec 16 BillDocument1 pageDec 16 BillanandNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rintu DasNo ratings yet

- Aviva - Family Income BuilderDocument3 pagesAviva - Family Income BuilderSahil KumarNo ratings yet

- Tax Rates and Allowances (FA23)Document6 pagesTax Rates and Allowances (FA23)nancybao0316No ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Deliveroo Order Receipt 1467474759Document3 pagesDeliveroo Order Receipt 1467474759Basma MohammedNo ratings yet

- Consolidated Income Statement: 12 Months Ended: Dec 31, 2020Document2 pagesConsolidated Income Statement: 12 Months Ended: Dec 31, 2020Sefinas KabeerNo ratings yet

- Estate Planning 101 - For Website 2014Document10 pagesEstate Planning 101 - For Website 2014Varun Singh ChandelNo ratings yet

- Quotation: Shanthi Gears - No.1 in High Quality Gears / Gear Boxes Customer Name & AddressDocument2 pagesQuotation: Shanthi Gears - No.1 in High Quality Gears / Gear Boxes Customer Name & Addressgullipalli srinivasa raoNo ratings yet

- E-Invoicing For Certificate Course On GSTDocument16 pagesE-Invoicing For Certificate Course On GSTShweta Prathamesh BadgujarNo ratings yet

- 2019 Tax LMTDocument26 pages2019 Tax LMTchristineNo ratings yet

- US Master Dep Guide 2016 Product-BrochureDocument1,217 pagesUS Master Dep Guide 2016 Product-BrochureAdinaOanaPrihorNo ratings yet

- CIR Vs ST LukesDocument1 pageCIR Vs ST LukesMeAnn TumbagaNo ratings yet

- Payslip 2019 2020 4 2380 SVATANTRADocument1 pagePayslip 2019 2020 4 2380 SVATANTRAsunil.srfcNo ratings yet

- Checklist of Documents To Be Submitted by Applicant Organization Available IncompleteDocument2 pagesChecklist of Documents To Be Submitted by Applicant Organization Available IncompleteMae HapalNo ratings yet

- Raytheon Vs CommissionerDocument2 pagesRaytheon Vs CommissionerSuiNo ratings yet

- 444 PDFDocument1 page444 PDFRELIABLE ORGANIC CERTIFICATION ORGANIZATIONNo ratings yet

- Tax Penalty and SurchargeDocument2 pagesTax Penalty and SurchargeRaymond Phillip Maria DatuonNo ratings yet

- Declaration of Exemption - Employment at A Special Work SiteDocument2 pagesDeclaration of Exemption - Employment at A Special Work SiteMatt WoodNo ratings yet

- 5% and 1% Stamp Duty ExemptionDocument2 pages5% and 1% Stamp Duty ExemptionAbhinand S VijayNo ratings yet

- OUTPUTPDFDocument2 pagesOUTPUTPDFMukund RanjanNo ratings yet

- TaxDocument11 pagesTaxFreak'n HellNo ratings yet

- La Suerte Cigar v. CADocument4 pagesLa Suerte Cigar v. CAKhian Jamer100% (1)

- CIR vs. CADocument4 pagesCIR vs. CARobNo ratings yet

- How To Be The Breakaway Company in The Upturn - Dermot ReillyDocument13 pagesHow To Be The Breakaway Company in The Upturn - Dermot ReillyDublinChamber100% (1)

- TMC Vs CIRDocument3 pagesTMC Vs CIREllaine BernardinoNo ratings yet

- Tts NDocument20 pagesTts NShubham AgarwalNo ratings yet

- Grand Total: M/s S.P Singla Construction PVT LTD Engineers & ContractorsDocument4 pagesGrand Total: M/s S.P Singla Construction PVT LTD Engineers & Contractorsnawazkhan23No ratings yet

- IcmlDocument1 pageIcmlCwsNo ratings yet

- Non-Negotiable: Agantic Group LLCDocument4 pagesNon-Negotiable: Agantic Group LLCmarcosiniesta10No ratings yet

Tax Table No. 07 Rates For The Deduction of Tax From The Second Employment

Tax Table No. 07 Rates For The Deduction of Tax From The Second Employment

Uploaded by

ThamilaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Table No. 07 Rates For The Deduction of Tax From The Second Employment

Tax Table No. 07 Rates For The Deduction of Tax From The Second Employment

Uploaded by

ThamilaCopyright:

Available Formats

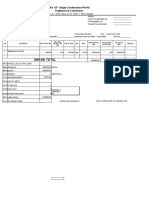

Tax Table No.

07

Rates for the deduction of Tax from the Second Employment

Rates for the deduction of tax from the gains and profits from employment of any employee who has not

furnished the primary employment declaration, or in respect of gains and profits from employment of any

employee employed under more than one employer.

01. Resident Employee

If the employee is a resident in terms of the provisions of the Inland Revenue Act, and consent is

granted to the employer by a declaration to deduct tax on such profits, the tax should be deducted at

appropriate rate given in Table 7.1 which depends on the income from primary employment. Please

apply the rate to corresponding income of primary employment as the employee stated in his

declaration.

Table 7.1- Rates for Deduction of Tax from Second Employment - Residents

Monthly Remunerations Tax Rate on

from Primary Employment Amount on which Monthly Tax is Deductible Remunerations from

(Rs.) Second Employment

up to - 250,000 On the total remunerations from second employment 6%

250,001 - 500,000 On the total remunerations from second employment 12%

500,001 - And above On the total remunerations from second employment 18%

Example:

Mr. Perera is a resident employee of a private Company X, and his regular monthly profits

(remuneration) from employment (including non-cash benefits) is Rs 500,000. Further, He gets a

monthly fixed payment of Rs. 100,000 from Company Y as his second employment.

Tax liability on the second employment should be computed as follows:

As his Income from Primary employment Rs. 500,000 falls under income range of Rs. 250,000 –

500,000, the applicable tax rate on second employment is 12%.

Then, the tax deductible is, Rs. 100,000 X 12% = 12,000

02. Non-Resident Employee

If the employee is a non-resident in terms of the provisions of the Inland Revenue Act (whether he is

a citizen in Sri Lanka or not), regardless of the consent of the employee, the tax should be deducted,

compulsorily by the employer at the rate given in table 7.2, unless otherwise a direction has been

issued by the Commissioner General or any officer authorized by him (The Secretariat).

Table 7.2 - Rate for Deduction of Tax from Second Employment – Non-residents

Monthly Remunerations from Second Employment

Tax Rate

(Rs.)

On the total remunerations from second employment 18%

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nallur by Jean ArasanayagamDocument3 pagesNallur by Jean ArasanayagamThamilaNo ratings yet

- Uqo, A Ixirkh Iy Uy Nexl J: Institution MangementDocument12 pagesUqo, A Ixirkh Iy Uy Nexl J: Institution MangementThamilaNo ratings yet

- 2) Financial IntermediationDocument14 pages2) Financial IntermediationThamilaNo ratings yet

- Survey of Financial System: Uq, H Moao S IólaikhDocument24 pagesSurvey of Financial System: Uq, H Moao S IólaikhThamilaNo ratings yet

- 1) Introduction To Survey of Financial SystemDocument11 pages1) Introduction To Survey of Financial SystemThamilaNo ratings yet

- l02 S 16 MDocument19 pagesl02 S 16 MThamilaNo ratings yet

- Code of Criminal ProcedureDocument160 pagesCode of Criminal ProcedureThamilaNo ratings yet

- Legislative Drafting & Statutory InterpretationDocument25 pagesLegislative Drafting & Statutory InterpretationThamila100% (1)

- Dec 16 BillDocument1 pageDec 16 BillanandNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rintu DasNo ratings yet

- Aviva - Family Income BuilderDocument3 pagesAviva - Family Income BuilderSahil KumarNo ratings yet

- Tax Rates and Allowances (FA23)Document6 pagesTax Rates and Allowances (FA23)nancybao0316No ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Deliveroo Order Receipt 1467474759Document3 pagesDeliveroo Order Receipt 1467474759Basma MohammedNo ratings yet

- Consolidated Income Statement: 12 Months Ended: Dec 31, 2020Document2 pagesConsolidated Income Statement: 12 Months Ended: Dec 31, 2020Sefinas KabeerNo ratings yet

- Estate Planning 101 - For Website 2014Document10 pagesEstate Planning 101 - For Website 2014Varun Singh ChandelNo ratings yet

- Quotation: Shanthi Gears - No.1 in High Quality Gears / Gear Boxes Customer Name & AddressDocument2 pagesQuotation: Shanthi Gears - No.1 in High Quality Gears / Gear Boxes Customer Name & Addressgullipalli srinivasa raoNo ratings yet

- E-Invoicing For Certificate Course On GSTDocument16 pagesE-Invoicing For Certificate Course On GSTShweta Prathamesh BadgujarNo ratings yet

- 2019 Tax LMTDocument26 pages2019 Tax LMTchristineNo ratings yet

- US Master Dep Guide 2016 Product-BrochureDocument1,217 pagesUS Master Dep Guide 2016 Product-BrochureAdinaOanaPrihorNo ratings yet

- CIR Vs ST LukesDocument1 pageCIR Vs ST LukesMeAnn TumbagaNo ratings yet

- Payslip 2019 2020 4 2380 SVATANTRADocument1 pagePayslip 2019 2020 4 2380 SVATANTRAsunil.srfcNo ratings yet

- Checklist of Documents To Be Submitted by Applicant Organization Available IncompleteDocument2 pagesChecklist of Documents To Be Submitted by Applicant Organization Available IncompleteMae HapalNo ratings yet

- Raytheon Vs CommissionerDocument2 pagesRaytheon Vs CommissionerSuiNo ratings yet

- 444 PDFDocument1 page444 PDFRELIABLE ORGANIC CERTIFICATION ORGANIZATIONNo ratings yet

- Tax Penalty and SurchargeDocument2 pagesTax Penalty and SurchargeRaymond Phillip Maria DatuonNo ratings yet

- Declaration of Exemption - Employment at A Special Work SiteDocument2 pagesDeclaration of Exemption - Employment at A Special Work SiteMatt WoodNo ratings yet

- 5% and 1% Stamp Duty ExemptionDocument2 pages5% and 1% Stamp Duty ExemptionAbhinand S VijayNo ratings yet

- OUTPUTPDFDocument2 pagesOUTPUTPDFMukund RanjanNo ratings yet

- TaxDocument11 pagesTaxFreak'n HellNo ratings yet

- La Suerte Cigar v. CADocument4 pagesLa Suerte Cigar v. CAKhian Jamer100% (1)

- CIR vs. CADocument4 pagesCIR vs. CARobNo ratings yet

- How To Be The Breakaway Company in The Upturn - Dermot ReillyDocument13 pagesHow To Be The Breakaway Company in The Upturn - Dermot ReillyDublinChamber100% (1)

- TMC Vs CIRDocument3 pagesTMC Vs CIREllaine BernardinoNo ratings yet

- Tts NDocument20 pagesTts NShubham AgarwalNo ratings yet

- Grand Total: M/s S.P Singla Construction PVT LTD Engineers & ContractorsDocument4 pagesGrand Total: M/s S.P Singla Construction PVT LTD Engineers & Contractorsnawazkhan23No ratings yet

- IcmlDocument1 pageIcmlCwsNo ratings yet

- Non-Negotiable: Agantic Group LLCDocument4 pagesNon-Negotiable: Agantic Group LLCmarcosiniesta10No ratings yet