Professional Documents

Culture Documents

Research Methods Student Activity 3

Research Methods Student Activity 3

Uploaded by

Xuan Quynh Phan0 ratings0% found this document useful (0 votes)

38 views2 pagesOriginal Title

RESEARCH METHODS STUDENT ACTIVITY 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

38 views2 pagesResearch Methods Student Activity 3

Research Methods Student Activity 3

Uploaded by

Xuan Quynh PhanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

20211104 Class Activity 3

Name: 潘氏春瓊 (Quinn)

Student ID: 11096020

Exercise 7/ P.104:

a. The dependent variable is: PRICE

The independent variable is: BIDRS

The dummy variables are: NEW and SCRATCH

b. An equation representing the relationship between the price and the condition of

the iPod is expected to be:

(+) (-) (+)

PRICEi = β0 + β1NEWi + β2SCRATCHi + β3BIDRSi + ɛi

where: PRICEi = the price at which the ith iPod sold on eBay

NEWi = a dummy variable equal to 1 if the ith iPod was new, 0 otherwise

SCARTCHi = a dummy variable equal to 1 if the ith iPod had a minor

cosmetic defect, 0 otherwise

BIDRSi = the number of bidders on the ith iPod

Explain:

The coefficient β1 indicates that the price can be increased if the iPod is new, the

slopes (SCRATCH and BIDRS) remain constant. The coefficient β 3 illustrates

that the higher number of bidders lead to the higher the iPod’s price. Since the

condition of the iPod is new and the bidders of the iPod is high can be expected to

increase the price of the iPod. So that I expected positive coefficients for both

variables.

The coefficient β 2 shows that if the iPod have a scratch or other defect, the price

of the iPod can be decreased, the slopes remain constant. Hence, I predicted the

relationship between this variable and the dependent variable is negative.

c. Yes. Because whether the iPod’s condition is still the same, we can not control the

number of bidders within 3 weeks which can still be able to influence the price of

the iPod. So I am concerned that the observations are not comparable during the

time change, however it may be able to use because the time period is short.

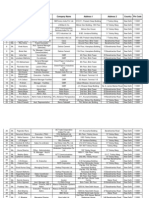

d. ^

PRICE = 109.24 + 54.99NEWi – 20.44SCRATCHi + 0.73BIDRSi

(5.43) (5.11) (0.59)

t= 10.28 - 4.00 1.23

N = 215

Explain: The data set contains 215 observations. The number in parentheses is

the estimated standard error of the estimated coefficient, which means the

standard error of β1 is estimated 5.43, for β2 is 5.11 and for β3 is 0.59. The t-value

is used to test the hypothesis that the true value of the coefficient β 1; β2 and β3 are

different from zero.

The equation using Rezende’s data shows that: if the bidders increase by 1, the

price of the iPod is increase 0.73 unit.

β1 = 54.99 means that the price of the new iPod is 54.99 higher than for the used

iPods, holding SCRATCH and BIDRS constant.

β2 = - 20.44 means that the price of the scratched iPod is 20.44 lower than for

other defect, holding NEW and BIDRS contant.

e. There are some missing items should be included in the data output in part d. such

as the degree of freedom R2; adjusted R2 and other items.

f.

The R2 of the model accounted for 0.439229 which means 43,9229% observations

can be explained by the model’s inputs and 56,0771% can be explained by other

variables outside the model and random errors. The value of the R2 is under half

which could be considered the relationship between a dependent and independent

variables can be explained quite fair by a linear regression equation.

You might also like

- Econ 466 Fall 2010 Homework 6 Answer Key: roe + β ros + uDocument4 pagesEcon 466 Fall 2010 Homework 6 Answer Key: roe + β ros + uMtwalo Msoni100% (1)

- Econ 466 Fall 2010 Homework 5 Answer Key: β / (2 - ˆ β -), or .0003/ (.000000014) ≈ 21, 428.57; reDocument4 pagesEcon 466 Fall 2010 Homework 5 Answer Key: β / (2 - ˆ β -), or .0003/ (.000000014) ≈ 21, 428.57; reJaime Andres Chica PNo ratings yet

- How To Download Scribd Documents For Free OnlineDocument7 pagesHow To Download Scribd Documents For Free Onlineameet kumar0% (1)

- Homework #08 (Phy 112) SolutionsDocument18 pagesHomework #08 (Phy 112) SolutionsKvn4N6100% (1)

- Econ 466 HW 7Document5 pagesEcon 466 HW 7Patrick AndrewNo ratings yet

- MSC 1st Physics Mathaematical PhysicsDocument51 pagesMSC 1st Physics Mathaematical PhysicsNaresh GulatiNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Problem CH 3Document3 pagesProblem CH 3upb553118No ratings yet

- Econometrics Sample PaperDocument5 pagesEconometrics Sample PaperGiri PrasadNo ratings yet

- ECON 601 - Module 4 PS - Solutions - FA 19 PDFDocument11 pagesECON 601 - Module 4 PS - Solutions - FA 19 PDFTamzid IslamNo ratings yet

- Name: . ID No: .. BITS-Pilani Dubai Campus Econ F241 Econometric Methods Semester I, 2018test-1 (Closed Book)Document6 pagesName: . ID No: .. BITS-Pilani Dubai Campus Econ F241 Econometric Methods Semester I, 2018test-1 (Closed Book)Giri PrasadNo ratings yet

- ECON 11 Activity 3Document2 pagesECON 11 Activity 3Kenzie AlmajedaNo ratings yet

- Mehak Fatima QRM ExamDocument4 pagesMehak Fatima QRM ExamMEHAK FATIMANo ratings yet

- Homework 03 Answers PDFDocument12 pagesHomework 03 Answers PDFNoahIssaNo ratings yet

- Final Exam 2015 Version 1 CombinedDocument9 pagesFinal Exam 2015 Version 1 CombinedMichael AyadNo ratings yet

- Chapter 12 - Chi-Squared Test - SendDocument24 pagesChapter 12 - Chi-Squared Test - SendHa Uyen NguyenNo ratings yet

- 2205Document3 pages2205milience chartlesNo ratings yet

- Problem Set 3Document3 pagesProblem Set 3brittni07No ratings yet

- Appendix CDocument6 pagesAppendix CjyothiswaroopgaNo ratings yet

- hw4 SoDocument18 pageshw4 SoAbdu Abdoulaye100% (2)

- CW ReportDocument15 pagesCW ReportJoseph PalinNo ratings yet

- Part 1: Test of CAPM: by Beibei WangDocument8 pagesPart 1: Test of CAPM: by Beibei WangBeibei WangNo ratings yet

- Basic Econometrics 5Th Edition Gujarati Solutions Manual Full Chapter PDFDocument40 pagesBasic Econometrics 5Th Edition Gujarati Solutions Manual Full Chapter PDFJoshuaJohnsonwxog100% (16)

- MS 02 More ExercisesDocument5 pagesMS 02 More Exercisesgabprems11No ratings yet

- Econometrics For ECO 2022 Tutorial 6Document7 pagesEconometrics For ECO 2022 Tutorial 6HenkNo ratings yet

- Addis Ababa University Addis Ababa Institute of TechnologyDocument3 pagesAddis Ababa University Addis Ababa Institute of TechnologyBukti NegalNo ratings yet

- Econ 113 Probset3 SolDocument7 pagesEcon 113 Probset3 SolPrebble Q RamswellNo ratings yet

- Econ 222 W2012 Assignment 3 Answers PostedDocument9 pagesEcon 222 W2012 Assignment 3 Answers PostedakNo ratings yet

- mt1 2017 SolnDocument8 pagesmt1 2017 Solncdh367No ratings yet

- Introduction To Econometrics, TutorialDocument19 pagesIntroduction To Econometrics, Tutorialagonza70No ratings yet

- Tutorial 9Document19 pagesTutorial 9Trang Nguyễn Ngọc ThiênNo ratings yet

- Minimum Variance Efficient PortfolioDocument7 pagesMinimum Variance Efficient PortfoliohatemNo ratings yet

- Dummy Variable Regression Models 9.1:, Gujarati and PorterDocument18 pagesDummy Variable Regression Models 9.1:, Gujarati and PorterTân DươngNo ratings yet

- MidtermII Preparation QuestionsDocument5 pagesMidtermII Preparation Questionsjoud.eljazzaziNo ratings yet

- Midterm Solutions 2018Document13 pagesMidterm Solutions 2018Manan ShahNo ratings yet

- Exam-Empirical Methods For FinanceDocument7 pagesExam-Empirical Methods For FinanceVilhelm CarlssonNo ratings yet

- Problem Set 6: riots income, income) = 0, ∀ (i, j), i, j, but E (ε income) = σDocument3 pagesProblem Set 6: riots income, income) = 0, ∀ (i, j), i, j, but E (ε income) = σKen Ling KokNo ratings yet

- Chapter 2, Exercise 2Document9 pagesChapter 2, Exercise 2jia meng baiNo ratings yet

- Exercise No. 3Document2 pagesExercise No. 3Quenny RasNo ratings yet

- Chapter 6 MulticollinerityDocument4 pagesChapter 6 MulticollinerityKanan DhamijaNo ratings yet

- 2022 FinalDocument10 pages2022 FinalFarah. SmidaNo ratings yet

- MGMT 670 Assignment 1Document6 pagesMGMT 670 Assignment 1deviarchanadasNo ratings yet

- Introductory Economics: Trinity Term 2000Document10 pagesIntroductory Economics: Trinity Term 2000Edward NickellNo ratings yet

- Chapter 4 (Hypothesis Testing)Document20 pagesChapter 4 (Hypothesis Testing)Dyg Nademah Pengiran MustaphaNo ratings yet

- Chapter 17Document62 pagesChapter 17liupenzi06No ratings yet

- Econometrics Assignment Week 1-806979Document6 pagesEconometrics Assignment Week 1-806979jantien De GrootNo ratings yet

- HW1 (Practice Problem Set) - 1Document6 pagesHW1 (Practice Problem Set) - 1Beta WaysNo ratings yet

- EE282 Lab 02Document5 pagesEE282 Lab 02Ravi TejaNo ratings yet

- Ps6sol Fa13 PDFDocument15 pagesPs6sol Fa13 PDFchan chadoNo ratings yet

- hw2 2024spring SolutionDocument11 pageshw2 2024spring Solutionbellance xavierNo ratings yet

- Logic Design and Digital CircuitsDocument3 pagesLogic Design and Digital CircuitsShawn Michael SalazarNo ratings yet

- EY D EY D Ey D Ey D Ey y D Ey D Ey D: Solution I Lecture 2 Exercise 2Document6 pagesEY D EY D Ey D Ey D Ey y D Ey D Ey D: Solution I Lecture 2 Exercise 2amrendra kumarNo ratings yet

- 2012+ +STA2020F+Test+2+SolutionsDocument2 pages2012+ +STA2020F+Test+2+SolutionsYea Eun KimNo ratings yet

- Hypothesis Testing & ANOVADocument23 pagesHypothesis Testing & ANOVAShaugat AshrafNo ratings yet

- SUM: To Find The Sum of Values in Range of Cell (ALT+ )Document11 pagesSUM: To Find The Sum of Values in Range of Cell (ALT+ )AnkithaNo ratings yet

- Final - Econ3005 - 2022spring - Combined 2Document11 pagesFinal - Econ3005 - 2022spring - Combined 2Swae LeeNo ratings yet

- 5 Elasticities IiDocument9 pages5 Elasticities Iialeema anjumNo ratings yet

- Chapter 2Document28 pagesChapter 2Messi AbNo ratings yet

- Gretl Empirical Exercise 2 - KEY PDFDocument3 pagesGretl Empirical Exercise 2 - KEY PDFDaniel Lee Eisenberg JacobsNo ratings yet

- ECE 102 Lab 15Document10 pagesECE 102 Lab 15Marven YusonNo ratings yet

- Solution 897614Document8 pagesSolution 897614hansikav327No ratings yet

- Next Generation Low Light Underwater Navigation CameraDocument2 pagesNext Generation Low Light Underwater Navigation CameraRich ManNo ratings yet

- Smr-Mep Method Statement 20072020Document10 pagesSmr-Mep Method Statement 20072020Im Chinith67% (3)

- Impact of Video Games On Youth in Our Society: A Survey Among Young People in DhakaDocument34 pagesImpact of Video Games On Youth in Our Society: A Survey Among Young People in DhakaMa LeonNo ratings yet

- 5024 - Wire Rope Sling Inspection Form PDFDocument1 page5024 - Wire Rope Sling Inspection Form PDFAgung NugrohoNo ratings yet

- Simple JeopardyDocument55 pagesSimple JeopardyD DurbNo ratings yet

- Roland Berger Report On Key Enablers For Hydrogen in MENA 1673535736Document16 pagesRoland Berger Report On Key Enablers For Hydrogen in MENA 1673535736MohamedNo ratings yet

- Faq For The Mastercard Identity Check "-ProcedureDocument2 pagesFaq For The Mastercard Identity Check "-ProcedureКалоян АспаруховNo ratings yet

- A Study of Communication Barriers in Open Distance Learning System of EducationDocument15 pagesA Study of Communication Barriers in Open Distance Learning System of EducationRyn EscañoNo ratings yet

- Z97 Extreme6 Quick Installation GuideDocument201 pagesZ97 Extreme6 Quick Installation Guideshinto kushiNo ratings yet

- Module 7 - Course Culminating Task - Susanna WalthamDocument4 pagesModule 7 - Course Culminating Task - Susanna Walthamapi-531717646No ratings yet

- S270 S271 User Manual V3.0 PDFDocument46 pagesS270 S271 User Manual V3.0 PDFAsad van LeonNo ratings yet

- Destoner MachineDocument6 pagesDestoner MachinekunalkakkadNo ratings yet

- Rabindra Bharati University: 56A, B.T. Road, Kolkata - 700050Document13 pagesRabindra Bharati University: 56A, B.T. Road, Kolkata - 700050Salman NoorNo ratings yet

- Adaptation DatabaseDocument6 pagesAdaptation DatabaseMed Zakaria HamidNo ratings yet

- TURCK Programmable Pressure SensorsDocument2 pagesTURCK Programmable Pressure SensorsRonaldNo ratings yet

- Power CapacitorDocument2 pagesPower Capacitorkunsridhar8901No ratings yet

- ICT Lesson (Starting Graphs)Document49 pagesICT Lesson (Starting Graphs)Kyi Sin AyeNo ratings yet

- CNT-300 Product SpecificationDocument3 pagesCNT-300 Product SpecificationCharlesNo ratings yet

- Saubhagaya Email & LL NumberDocument40 pagesSaubhagaya Email & LL NumberAjai DakshNo ratings yet

- It Optimize IT Change Management Phases 1 4 R4Document138 pagesIt Optimize IT Change Management Phases 1 4 R4Mohammad YasirNo ratings yet

- IntesisBox HI-AW-KNX-1 Manual EngDocument21 pagesIntesisBox HI-AW-KNX-1 Manual EngnajibNo ratings yet

- Hardik Patel - Iciame2013 "RESEARCH PAPER-37"Document31 pagesHardik Patel - Iciame2013 "RESEARCH PAPER-37"hardik10888No ratings yet

- FMEA TemplateDocument8 pagesFMEA TemplateRohit LakhotiaNo ratings yet

- Arctic Hotel: 12 APR 2021 14 JUL 2021Document16 pagesArctic Hotel: 12 APR 2021 14 JUL 2021Tsuki Ko100% (1)

- Wifirobin ManualDocument25 pagesWifirobin ManualfilfrNo ratings yet

- Automation of The Multi-Option Fuze For Artillery (MOFA) Post-Launch BatteryDocument13 pagesAutomation of The Multi-Option Fuze For Artillery (MOFA) Post-Launch BatteryC S Kumar0% (1)

- Idm Assignment Cover PageDocument29 pagesIdm Assignment Cover PageRainbows StudioNo ratings yet

- H27UBG8T2A HynixDocument67 pagesH27UBG8T2A HynixivandevelNo ratings yet

- 1 MVA New UPS Load ChartDocument1 page1 MVA New UPS Load ChartSOURAVNo ratings yet