Professional Documents

Culture Documents

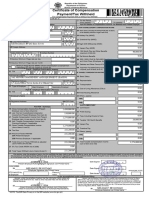

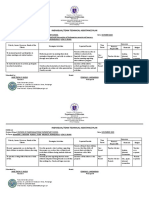

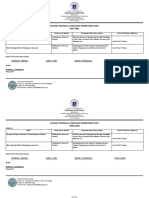

Certificate of Compensation Payment/Tax Withheld

Certificate of Compensation Payment/Tax Withheld

Uploaded by

Jane Tricia Dela penaCopyright:

Available Formats

You might also like

- Ss Case Study FinalDocument42 pagesSs Case Study Finalapi-25365638690% (20)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- Banasthali Vidyapeeth Hrds Assignment 2 Submitted By: Muskan Saxena 2045167 (WBMBA2000 7) Batch A1, Mba Semester 2Document4 pagesBanasthali Vidyapeeth Hrds Assignment 2 Submitted By: Muskan Saxena 2045167 (WBMBA2000 7) Batch A1, Mba Semester 2muskanNo ratings yet

- Water Falls in PampangaDocument5 pagesWater Falls in PampangaJane Tricia Dela penaNo ratings yet

- Kapampangan Placenames and Their Origin StoriesDocument23 pagesKapampangan Placenames and Their Origin StoriesJane Tricia Dela penaNo ratings yet

- Kapampangan PoemsDocument16 pagesKapampangan PoemsJane Tricia Dela pena100% (1)

- SAP - Audit FindingsDocument22 pagesSAP - Audit FindingsCristina BancuNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument1 page2316 Jan 2018 ENCS FinalCaina LeyvaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- 28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Document4 pages28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Kenneth Vallejos CesarNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- New 2316 Annex ADocument1 pageNew 2316 Annex AGeram ConcepcionNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- 2316 For Eb Ss Deso Ss PDL SsDocument1 page2316 For Eb Ss Deso Ss PDL SsJesi Ray Almacen ZamoraNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- BIR GovernmentDocument15 pagesBIR GovernmentEdgar Miralles Inales ManriquezNo ratings yet

- 2316Document1 page2316FedsNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Bir Form 2316 BlankDocument296 pagesBir Form 2316 BlankRomeda ValeraNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldSafferon SaffronNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- Bir Form 2316Document1 pageBir Form 2316edenestoleros27No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Commission On ElectionsDocument9 pagesCertificate of Compensation Payment/Tax Withheld: Commission On ElectionsMARLON TABACULDENo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldTrish CalumaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Microsoft Word - Basics Lesson PlanDocument8 pagesMicrosoft Word - Basics Lesson PlanJane Tricia Dela penaNo ratings yet

- Microsoft Word - Images Lesson PlanDocument6 pagesMicrosoft Word - Images Lesson PlanJane Tricia Dela penaNo ratings yet

- INSET ResearchDocument10 pagesINSET ResearchJane Tricia Dela penaNo ratings yet

- Sample Chapter 1Document16 pagesSample Chapter 1Jane Tricia Dela penaNo ratings yet

- Sample Qualitative Research ProposalDocument15 pagesSample Qualitative Research ProposalJane Tricia Dela penaNo ratings yet

- T.A - Form B Jane Tricia NuquiDocument2 pagesT.A - Form B Jane Tricia NuquiJane Tricia Dela penaNo ratings yet

- Porac Es, Porac East, CPR 20-21Document6 pagesPorac Es, Porac East, CPR 20-21Jane Tricia Dela penaNo ratings yet

- Old Names of Pampanga TownsDocument9 pagesOld Names of Pampanga TownsJane Tricia Dela penaNo ratings yet

- Form A.2 Jane Tricia NuquiDocument9 pagesForm A.2 Jane Tricia NuquiJane Tricia Dela penaNo ratings yet

- Ta-Form A-1-Jane Tricia D. NuquiDocument8 pagesTa-Form A-1-Jane Tricia D. NuquiJane Tricia Dela penaNo ratings yet

- Laman Labuad (Earth Creatures) of PampangaDocument6 pagesLaman Labuad (Earth Creatures) of PampangaJane Tricia Dela penaNo ratings yet

- Kapampangan DietiesDocument17 pagesKapampangan DietiesJane Tricia Dela penaNo ratings yet

- Kapampangan Folk SongsDocument7 pagesKapampangan Folk SongsJane Tricia Dela penaNo ratings yet

- Curriculum and Instruction: Department of Education Division of Pampanga Porac East District Poblacion, Porac, PampangaDocument32 pagesCurriculum and Instruction: Department of Education Division of Pampanga Porac East District Poblacion, Porac, PampangaJane Tricia Dela penaNo ratings yet

- Garden Plants and Flowers and Their Kapampangan NamesDocument7 pagesGarden Plants and Flowers and Their Kapampangan NamesJane Tricia Dela penaNo ratings yet

- Kapampangan Dieties)Document16 pagesKapampangan Dieties)Jane Tricia Dela penaNo ratings yet

- Notable Features: KulitanDocument2 pagesNotable Features: KulitanJane Tricia Dela penaNo ratings yet

- Kapampangan Folk SongsDocument7 pagesKapampangan Folk SongsJane Tricia Dela penaNo ratings yet

- Kapampangan Folk SongsDocument7 pagesKapampangan Folk SongsJane Tricia Dela penaNo ratings yet

- Total Experience Your Guide To Delivering A Unified Customer and Employee Experience.Document21 pagesTotal Experience Your Guide To Delivering A Unified Customer and Employee Experience.mdheman10No ratings yet

- Cust Roles in Serv Delivery-Lect # 11Document32 pagesCust Roles in Serv Delivery-Lect # 11Subhani KhanNo ratings yet

- Breheny 1995 Compat CityDocument22 pagesBreheny 1995 Compat CityDaniel KozakNo ratings yet

- Shamel Business Advanced Level Business Studies-1Document183 pagesShamel Business Advanced Level Business Studies-1tadiwamahiuNo ratings yet

- Director Training Development in Salt Lake City UT Resume Todd TritschDocument3 pagesDirector Training Development in Salt Lake City UT Resume Todd TritschToddTritschNo ratings yet

- Payroll FraudDocument3 pagesPayroll FraudEBY TradersNo ratings yet

- Contemporary Issues in Work AND Business EthicsDocument28 pagesContemporary Issues in Work AND Business EthicsAhmad Saifuddin Che AbdullahNo ratings yet

- Exercises-Sql1 1Document8 pagesExercises-Sql1 1swajag2599No ratings yet

- Rafia Ehsan: EducationDocument3 pagesRafia Ehsan: EducationSheikh Muhammad UsamaNo ratings yet

- SLS (Period 36 - Draft)Document5 pagesSLS (Period 36 - Draft)M.KazimSadiqNo ratings yet

- 2022-Grade 12-BS-Preliminary Examination - Paper 2Document10 pages2022-Grade 12-BS-Preliminary Examination - Paper 2Leo WinterNo ratings yet

- Human Resource Management QuestionnaireDocument4 pagesHuman Resource Management QuestionnairerishiNo ratings yet

- Joseph NewPublication IJDSDocument23 pagesJoseph NewPublication IJDSEva SangaNo ratings yet

- Development EconomicsDocument11 pagesDevelopment EconomicsRahmathullah BaluchNo ratings yet

- Television and Production Exponents, Inc. Vs Roberto ServañaDocument2 pagesTelevision and Production Exponents, Inc. Vs Roberto ServañaAbdulateef Sahibuddin100% (1)

- Corp Law Reviewer FinalsDocument13 pagesCorp Law Reviewer FinalsRen A EleponioNo ratings yet

- Talon Sports - The Ultimate Sports CompanyDocument1 pageTalon Sports - The Ultimate Sports CompanyAmina IqbalNo ratings yet

- San Juan de Dios Hospital V NLRC (1997)Document15 pagesSan Juan de Dios Hospital V NLRC (1997)J.N.No ratings yet

- Accounting For ManagersDocument287 pagesAccounting For ManagersmenakaNo ratings yet

- Job DesignDocument45 pagesJob Designzamani77100% (1)

- Travel and Tourism Competitiveness Report Part 2/3Document111 pagesTravel and Tourism Competitiveness Report Part 2/3World Economic Forum100% (31)

- Triple Eight v. NLRC, G.R. No. 129584, 3 December 1998Document10 pagesTriple Eight v. NLRC, G.R. No. 129584, 3 December 1998Andrei Jose V. LayeseNo ratings yet

- Commerce PresentationDocument90 pagesCommerce PresentationHansika NathNo ratings yet

- MSC in Management Employment Report (Class of 2022)Document12 pagesMSC in Management Employment Report (Class of 2022)Makhi AkiyamaNo ratings yet

- CH-1 Overiview of HRMDocument7 pagesCH-1 Overiview of HRMborena extensionNo ratings yet

- A Practical Guide To FTE Reporting 2015Document6 pagesA Practical Guide To FTE Reporting 2015dremad1974No ratings yet

- 2022 Fall Agents Manual R & HDocument383 pages2022 Fall Agents Manual R & HBruce henschelNo ratings yet

Certificate of Compensation Payment/Tax Withheld

Certificate of Compensation Payment/Tax Withheld

Uploaded by

Jane Tricia Dela penaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Compensation Payment/Tax Withheld

Certificate of Compensation Payment/Tax Withheld

Uploaded by

Jane Tricia Dela penaCopyright:

Available Formats

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Compensation

2316

January 2018 (ENCS)

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld 2316 01/18ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

01

1 For the Year

(YYYY) 2022 2 For the Period

From (MM/DD) 0 1To (MM/DD) 12 31

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN

4 3 -6 0 7 1- 3 5 6- 000 A.NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

NUQUI, JANE

4 Employee's Name TRICIA,

(Last Name,DELA PEÑA

First Name, Middle Name) 21B

5 RDO Code

27 Basic Salary (including the exempt P250,000 & below) or

the Statutory Minimum Wage of the MWE

PUROK Address

6 Registered 4, BABO PANGULO, PORAC, PAMPANGA 2 0 Code

6A ZIP 0 8 28 Holiday Pay (MWE)

29 Overtime Pay (MWE)

6B Local Home Address 6C ZIP Code

30 Night Shift Differential (MWE)

6D Foreign Address

31 Hazard Pay (MWE)

0 5of Birth

1 4(MM/DD/YYYY)

1992 0 9 Number

5 6 8 4 5 4 3 5 9 32 13th Month Pay and Other Benefits

7 Date 8 Contact

(maximum of P90,000)

33 De Minimis Benefits

9 Statutory Minimum Wage rate per day

34 SSS, GSIS, PHIC & PAG-IBIG Contributions

and Union Dues (Employee share only)

10 Statutory Minimum Wage rate per month

35 Salaries and Other Forms of Compensation

11 Minimum Wage Earner (MWE) whose compensation is exempt from

withholding tax and not subject to income tax 36 Total Non-Taxable/Exempt Compensation Income

Part II - Employer Information (Present) (Sum of Items 27 to 35)

12 TIN

-

COMMISSION ON ELECTIONS - - B.TAXABLE COMPENSATION INCOME REGULAR

13 Employer's Name

37 Basic Salary

14 Registered Address 14A ZIP Code 38 Representation

39 Transportation

15 Type of Employer Main Employer Secondary Employer

40 Cost of Living Allowance (COLA)

Part III - Employer Information (Previous)

16 TIN

- - - 41 Fixed Housing Allowance

17 Employer's Name 42 Others (specify)

42A

18 Registered Address

18A ZIP Code

42B

SUPPLEMENTARY

Part IVA - Summary 43 Commission

19 Gross Compensation Income from Present

Employer (Sum of Items 36 and 50)

44 Profit Sharing

20 Less: Total Non-Taxable/Exempt Compensation

Income from Present Employer (From Item 36)

45 Fees Including Director's Fees

21 Taxable Compensation Income from Present

Employer (Item 19 Less Item 20) (From Item 50)

46 Taxable 13th Month Benefits

22 Add: Taxable Compensation Income from

Previous Employer, if applicable

47 Hazard Pay

23 Gross Taxable Compensation Income

(Sum of Items 21 and 22)

48 Overtime Pay

24 Tax Due

49 Others (specify)

25 Amount of Taxes Withheld

49A

25A Present Employer

25B Previous Employer, if applicable 49B

26 Total Amount of Taxes Withheld as adjusted 50 Total Taxable Compensation Income

(Sum of Items 25A and 25B) (Sum of Items 37 to 49B)

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to the provisions of the

National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy

Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

51 Date Signed

Present Employer/Authorized Agent Signature over Printed Name

CONFORME: JANE TRICIA D. NUQUI

52

Date Signed

Employee Signature over Printed Name

Amount paid, if CTC

CTC/Valid ID No. Place of

MANILA, PHILIPPINES 11 07 20 1 4

of Employee PRC 1311150 Issue

Date Issued

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are reported

under BIR Form No. 1604-C which has been filed with the Bureau of Internal

Revenue. 53

Present Employer/Authorized Agent Signature over Printed Name (Head of I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return (BIR Form

Accounting/Human Resource or Authorized Representative) No. 1700), since I received purely compensation income from only one employer in the Philippines for the calendar year;

that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph) the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR Form No.

2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions of Revenue

Regulations (RR) No. 3-2002, as amended.

54

Employee Signature over Printed Name

You might also like

- Ss Case Study FinalDocument42 pagesSs Case Study Finalapi-25365638690% (20)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- Banasthali Vidyapeeth Hrds Assignment 2 Submitted By: Muskan Saxena 2045167 (WBMBA2000 7) Batch A1, Mba Semester 2Document4 pagesBanasthali Vidyapeeth Hrds Assignment 2 Submitted By: Muskan Saxena 2045167 (WBMBA2000 7) Batch A1, Mba Semester 2muskanNo ratings yet

- Water Falls in PampangaDocument5 pagesWater Falls in PampangaJane Tricia Dela penaNo ratings yet

- Kapampangan Placenames and Their Origin StoriesDocument23 pagesKapampangan Placenames and Their Origin StoriesJane Tricia Dela penaNo ratings yet

- Kapampangan PoemsDocument16 pagesKapampangan PoemsJane Tricia Dela pena100% (1)

- SAP - Audit FindingsDocument22 pagesSAP - Audit FindingsCristina BancuNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument1 page2316 Jan 2018 ENCS FinalCaina LeyvaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- 28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Document4 pages28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Kenneth Vallejos CesarNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- New 2316 Annex ADocument1 pageNew 2316 Annex AGeram ConcepcionNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- 2316 For Eb Ss Deso Ss PDL SsDocument1 page2316 For Eb Ss Deso Ss PDL SsJesi Ray Almacen ZamoraNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- BIR GovernmentDocument15 pagesBIR GovernmentEdgar Miralles Inales ManriquezNo ratings yet

- 2316Document1 page2316FedsNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Bir Form 2316 BlankDocument296 pagesBir Form 2316 BlankRomeda ValeraNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldSafferon SaffronNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- Bir Form 2316Document1 pageBir Form 2316edenestoleros27No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Commission On ElectionsDocument9 pagesCertificate of Compensation Payment/Tax Withheld: Commission On ElectionsMARLON TABACULDENo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldTrish CalumaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Microsoft Word - Basics Lesson PlanDocument8 pagesMicrosoft Word - Basics Lesson PlanJane Tricia Dela penaNo ratings yet

- Microsoft Word - Images Lesson PlanDocument6 pagesMicrosoft Word - Images Lesson PlanJane Tricia Dela penaNo ratings yet

- INSET ResearchDocument10 pagesINSET ResearchJane Tricia Dela penaNo ratings yet

- Sample Chapter 1Document16 pagesSample Chapter 1Jane Tricia Dela penaNo ratings yet

- Sample Qualitative Research ProposalDocument15 pagesSample Qualitative Research ProposalJane Tricia Dela penaNo ratings yet

- T.A - Form B Jane Tricia NuquiDocument2 pagesT.A - Form B Jane Tricia NuquiJane Tricia Dela penaNo ratings yet

- Porac Es, Porac East, CPR 20-21Document6 pagesPorac Es, Porac East, CPR 20-21Jane Tricia Dela penaNo ratings yet

- Old Names of Pampanga TownsDocument9 pagesOld Names of Pampanga TownsJane Tricia Dela penaNo ratings yet

- Form A.2 Jane Tricia NuquiDocument9 pagesForm A.2 Jane Tricia NuquiJane Tricia Dela penaNo ratings yet

- Ta-Form A-1-Jane Tricia D. NuquiDocument8 pagesTa-Form A-1-Jane Tricia D. NuquiJane Tricia Dela penaNo ratings yet

- Laman Labuad (Earth Creatures) of PampangaDocument6 pagesLaman Labuad (Earth Creatures) of PampangaJane Tricia Dela penaNo ratings yet

- Kapampangan DietiesDocument17 pagesKapampangan DietiesJane Tricia Dela penaNo ratings yet

- Kapampangan Folk SongsDocument7 pagesKapampangan Folk SongsJane Tricia Dela penaNo ratings yet

- Curriculum and Instruction: Department of Education Division of Pampanga Porac East District Poblacion, Porac, PampangaDocument32 pagesCurriculum and Instruction: Department of Education Division of Pampanga Porac East District Poblacion, Porac, PampangaJane Tricia Dela penaNo ratings yet

- Garden Plants and Flowers and Their Kapampangan NamesDocument7 pagesGarden Plants and Flowers and Their Kapampangan NamesJane Tricia Dela penaNo ratings yet

- Kapampangan Dieties)Document16 pagesKapampangan Dieties)Jane Tricia Dela penaNo ratings yet

- Notable Features: KulitanDocument2 pagesNotable Features: KulitanJane Tricia Dela penaNo ratings yet

- Kapampangan Folk SongsDocument7 pagesKapampangan Folk SongsJane Tricia Dela penaNo ratings yet

- Kapampangan Folk SongsDocument7 pagesKapampangan Folk SongsJane Tricia Dela penaNo ratings yet

- Total Experience Your Guide To Delivering A Unified Customer and Employee Experience.Document21 pagesTotal Experience Your Guide To Delivering A Unified Customer and Employee Experience.mdheman10No ratings yet

- Cust Roles in Serv Delivery-Lect # 11Document32 pagesCust Roles in Serv Delivery-Lect # 11Subhani KhanNo ratings yet

- Breheny 1995 Compat CityDocument22 pagesBreheny 1995 Compat CityDaniel KozakNo ratings yet

- Shamel Business Advanced Level Business Studies-1Document183 pagesShamel Business Advanced Level Business Studies-1tadiwamahiuNo ratings yet

- Director Training Development in Salt Lake City UT Resume Todd TritschDocument3 pagesDirector Training Development in Salt Lake City UT Resume Todd TritschToddTritschNo ratings yet

- Payroll FraudDocument3 pagesPayroll FraudEBY TradersNo ratings yet

- Contemporary Issues in Work AND Business EthicsDocument28 pagesContemporary Issues in Work AND Business EthicsAhmad Saifuddin Che AbdullahNo ratings yet

- Exercises-Sql1 1Document8 pagesExercises-Sql1 1swajag2599No ratings yet

- Rafia Ehsan: EducationDocument3 pagesRafia Ehsan: EducationSheikh Muhammad UsamaNo ratings yet

- SLS (Period 36 - Draft)Document5 pagesSLS (Period 36 - Draft)M.KazimSadiqNo ratings yet

- 2022-Grade 12-BS-Preliminary Examination - Paper 2Document10 pages2022-Grade 12-BS-Preliminary Examination - Paper 2Leo WinterNo ratings yet

- Human Resource Management QuestionnaireDocument4 pagesHuman Resource Management QuestionnairerishiNo ratings yet

- Joseph NewPublication IJDSDocument23 pagesJoseph NewPublication IJDSEva SangaNo ratings yet

- Development EconomicsDocument11 pagesDevelopment EconomicsRahmathullah BaluchNo ratings yet

- Television and Production Exponents, Inc. Vs Roberto ServañaDocument2 pagesTelevision and Production Exponents, Inc. Vs Roberto ServañaAbdulateef Sahibuddin100% (1)

- Corp Law Reviewer FinalsDocument13 pagesCorp Law Reviewer FinalsRen A EleponioNo ratings yet

- Talon Sports - The Ultimate Sports CompanyDocument1 pageTalon Sports - The Ultimate Sports CompanyAmina IqbalNo ratings yet

- San Juan de Dios Hospital V NLRC (1997)Document15 pagesSan Juan de Dios Hospital V NLRC (1997)J.N.No ratings yet

- Accounting For ManagersDocument287 pagesAccounting For ManagersmenakaNo ratings yet

- Job DesignDocument45 pagesJob Designzamani77100% (1)

- Travel and Tourism Competitiveness Report Part 2/3Document111 pagesTravel and Tourism Competitiveness Report Part 2/3World Economic Forum100% (31)

- Triple Eight v. NLRC, G.R. No. 129584, 3 December 1998Document10 pagesTriple Eight v. NLRC, G.R. No. 129584, 3 December 1998Andrei Jose V. LayeseNo ratings yet

- Commerce PresentationDocument90 pagesCommerce PresentationHansika NathNo ratings yet

- MSC in Management Employment Report (Class of 2022)Document12 pagesMSC in Management Employment Report (Class of 2022)Makhi AkiyamaNo ratings yet

- CH-1 Overiview of HRMDocument7 pagesCH-1 Overiview of HRMborena extensionNo ratings yet

- A Practical Guide To FTE Reporting 2015Document6 pagesA Practical Guide To FTE Reporting 2015dremad1974No ratings yet

- 2022 Fall Agents Manual R & HDocument383 pages2022 Fall Agents Manual R & HBruce henschelNo ratings yet