Professional Documents

Culture Documents

Balance of Payments of The Republic of Moldova For 2010 (Preliminary Data)

Balance of Payments of The Republic of Moldova For 2010 (Preliminary Data)

Uploaded by

kkjnnk jihOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance of Payments of The Republic of Moldova For 2010 (Preliminary Data)

Balance of Payments of The Republic of Moldova For 2010 (Preliminary Data)

Uploaded by

kkjnnk jihCopyright:

Available Formats

National Bank of Moldova

March 31, 2011

Page 1 of 19

Balance of Payments of the Republic of Moldova

for 2010 (preliminary data)

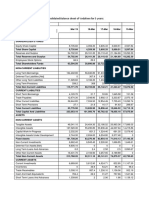

Table 1. Balance of Payments of Moldova (main aggregates) (US$ million)

2006 2007 2008 2009 2010

CURRENT ACCOUNT -387.86 -674.05 -987.13 -464.61 -482.27

Goods and services -1604.68 -2322.74 -3224.53 -1988.17 -2259.19

Goods -1582.70 -2298.07 -3223.17 -1944.19 -2178.88

Exports (FOB) 1060.81 1373.34 1645.97 1331.57 1631.08

Imports (FOB), of which: -2643.51 -3671.41 -4869.14 -3275.76 -3809.96

imports of energy resources (except electricity) -544.89 -644.70 -903.24 -652.99 -732.77

Services -21.98 -24.67 -1.36 -43.98 -80.31

Exports 465.66 625.46 837.28 668.88 689.79

Imports -487.64 -650.13 -838.64 -712.86 -770.10

Income 402.53 416.41 598.60 302.93 471.17

inflow, of which: 605.91 710.07 905.01 590.00 741.25

compensation of employees working abroad 573.00 649.00 842.00 563.42 722.82

outflow, of which: -203.38 -293.66 -306.41 -287.07 -270.08

dividends and distributed branch profits -55.08 -52.77 -37.84 -136.85 -124.47

reinvested earnings and undistributed branch profits -41.59 -112.81 -98.70 11.56 -22.05

interest payable on loans -50.50 -64.03 -73.22 -83.80 -57.96

Current transfers 814.29 1232.28 1638.80 1220.63 1305.75

inflow, of which: 864.28 1297.34 1750.29 1323.99 1391.15

workers' remittances from abroad 602.82 842.26 1046.02 635.21 635.03

outflow -49.99 -65.06 -111.49 -103.36 -85.40

CAPITAL AND FINANCIAL ACCOUNT 310.62 556.80 900.97 406.84 411.40

Capital transfers -22.78 -7.96 -14.61 -17.54 -28.36

Direct investment 240.65 516.26 696.69 121.08 195.40

of which: in domestic economy 239.72 533.62 712.77 127.84 198.90

equity capital and reivested earnings 160.61 340.19 540.40 150.00 175.72

other capital 79.11 193.43 172.37 -22.16 23.18

Portfolio investment -4.79 -4.51 6.38 -5.82 5.64

Assets * -0.21 -0.07 -0.04 -0.25 -0.20

equity securities -0.21 -0.07 -0.03 -0.25 -0.20

debt securities -0.01

Liabilities** -4.58 -4.44 6.42 -5.57 5.84

equity securities 1.78 1.72 11.36 2.39 5.84

debt securities -6.36 -6.16 -4.94 -7.96

Financial derivatives, net 0.19 -0.47 0.94 0.34 -0.63

Other investment 238.11 582.34 663.58 108.23 533.72

Assets* -49.36 35.32 52.14 -210.56 75.46

trade credits 17.42 -7.61 76.30 44.86 21.24

currency and deposits abroad -66.78 48.93 -25.96 -259.62 61.61

loans -6.00 1.80 4.20 -7.39

Liabilities** 287.47 547.02 611.44 318.79 458.26

trade credits 44.89 107.08 131.16 90.70 128.62

long-term loans 203.40 292.59 364.72 -9.88 253.33

disbursed 393.94 533.75 702.23 308.87 607.29

reimbursed -190.54 -241.16 -337.51 -318.75 -353.96

short-term loans 0.09 39.96 32.79 -48.90 29.73

non-residents' deposits in the national banking system 53.32 60.56 53.12 -46.64 -69.59

other liabilities -14.23 46.83 29.65 149.31 116.17

SDR allocation 184.20

Reserve assets* -140.76 -528.86 -452.01 200.55 -294.37

Errors and omissions 77.24 117.25 86.16 57.77 70.87

Informative:

Money transfers from abroad in favor of individuals

854.55 1218.23 1660.09 1182.02 1244.14

(migrant workers and other) via authorized banks

* (-) increase, (+) decrease

** (+) increase, (-) decrease

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 2 of 19

During 2010, the economic recovery of the partner countries determined an increase in external

demand for products exported by the Republic of Moldova.

The current account of the balance of payments recorded a deficit amounting to US$ 482.27 million

in 2010, which increased by 3.8% as compared to the previous year. It should be mentioned, the growth

rate of exports of goods (22.5%) was higher than that of imports (16.3%).

The evolution of imports of energy resources shows growing values, driven by price increases.

Also the receipts for communications services, information, business, and governmental services

have increased, while the balance of services was determined by travel and transportation, which have

significant shares and recorded deficits.

The deficit in the external trade in goods and services totaled US$ 2259.19 million.

The income balance recorded a surplus of US$ 471.17 million. Total income inflow amounted to

US$ 741.25 million, of which residents’ compensation for working abroad was evaluated at US$ 722.82

million. Income in the form of dividends received by foreign direct investors totaled US$ 124.47 million.

Curent transfers recorded a surplus of US$ 1305.75 million. The inflow of current transfers equaled

US$ 1391.15 million, of which workers’ remittances were estimated at US$ 635.03 million.

The net inflows of foreign direct investment in domestic economy in January-December 2010

amounted to US$ 198.90 million, which is by 55.6% higher as against the previous year, nevertheless, the

pre-crisis level was not reached. Foreign direct investment in equity capital of banks increased by US$

34.03, while other sectors’ net FDI inflow was much lower than before the crisis.

During 2010, the public sector – the National Bank of Moldova (NBM) and the Government –

made new drawings on external loans in the amount of US$ 273.39 million, of which US$ 183.08 million

– from the International Monetary Fund (IMF) and US$ 40.42 million – lent to the government by the

International Development Agency and the Government of Poland. The repayments according to

agreements amounted to US$ 54.32 million.

The banks made drawings on new long-term loans in the amount of US$ 146.21 million and repaid

US$ 120.35 million. Other sectors’ long-term loan drawings totaled US$ 187.69 million, scheduled

repayments – US$ 179.29 million, but actually have been repaid US$ 138.72 million, the difference being

counted as arrears.

The official reserve assets constituted US$ 1717.69 million as of December 31, 2010, which is

enough to cover 4.5 months of imports of goods and services. Their net increase as a result of balance of

payments transactions was US$ 294.37 million.

The international investment position, which reflects foreign assets and liabilities, remained net

debit and recorded US$ 4546.43 million at the end of 2010. Net foreign assets have increased by US$

587.03 million over the year, and the liabilities – by US$ 132.96 million.

The gross external debt of the Republic of Moldova amounted to US$ 4778.72 million as of

December 31, 2010, of which: US$ 1348.77 million - public and publicly guaranteed debt, and US$

3429.95 million – private non-guaranteed debt. It should be noted that long-term liabilities accounted for

64.0% of the total gross external debt of the Republic of Moldova.

Main macroeconomic indicators characterizing the developments in the external sector of the

national economy over the last years are summarized in table 2.

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 3 of 19

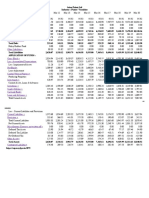

Table 2. Main Macroeconomic Indicators

UM 2006 2007 2008 2009 2010

Gross domestic product in current prices MDL million 44754 53430 62922 60430 71849

Gross domestic product in US$ US$ million 3408.1 4402.5 6056.3 5437.6 5810.1

Real GDP as against the previous year % 104.8 103.0 107.8 94.0 106.9

Agricultural output as against the previous year % 98.9 76.9 132.1 90.4 107.9

Industrial output as against the previous year % 95.2 98.7 101.5 78.9 107.0

Capital investment as against the previous year % 124.0 121.9 102.3 65.0 116.7

Broad money (M2) MDL million 12485.2 18396.7 21774.1 20942.0 24770.7

Consumer price index (annual average) % 112.7 112.3 112.7 100.0 107.4

Annual average exchange rate MDL/US$ 13.1319 12.1362 10.3895 11.1134 12.3663

Current account / GDP % -11.4 -15.3 -16.3 -8.5 -8.3

Current account less current transfers / GDP % -35.3 -43.3 -43.4 -31.0 -30.8

Compensation of employees and workers’ remittances / GDP % 34.5 33.9 31.2 22.0 23.4

Balance of goods and services / GDP % -47.1 -52.8 -53.2 -36.6 -38.9

Exports of goods and services / Imports of goods and services % 48.8 46.3 43.5 50.2 50.7

Exports of goods and services / GDP % 44.8 45.4 41.0 36.8 39.9

Imports of goods and services / GDP % 91.9 98.2 94.2 73.4 78.8

Reserve assets / Imports of goods and services months 2.97 3.70 3.52 4.45 4.50

Foreign direct investment in domestic economy, net flow, per

US$ 67 149 200 36 56

capita

Foreign direct investment in domestic economy, stock, per

US$ 351 516 719 743 797

capita

Net international investment position (at year-end) US$ million -1699.89 -2079.42 -2717.40 -3726.59 -4092.40

External debt (at year-end) US$ million 2078.05 2522.67 3345.46 4093.81 4364.10

External debt / GDP % 69.5 74.0 76.0 67.6 80.8

Sources: NBS, NBM

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 4 of 19

CURRENT ACCOUNT

Chart 1. Current Account Balance

US$ million Current account Balance / GDP %

0 0

-200 -8.5 -8.3

-400 -8

-600 -16.3 -464.61 -482.27

-800 -16

-1000

-987.13

-1200 -24

2008 2009 2010

Chart 2. Current Account – Main Components (US$ million)

2000 1638.80

1220.63 1305.75

1500

1000 598.60 471.17

302.93

500 -1.36

0

-43.98 -80.31

-500

-1000 -464.61 -482.27

-1500 -987.13

-2000

-2500 -1944.19

-2178.88

-3000

-3500 -3223.17

2008 2009 2010

Goods Services Income Current transfers Current account

Chart 3. Deficit of the External Trade in Goods and Services (US$ million)

6000

5000 Imports

4000

3000

2000

Exports

1000

0

2006 2007 2008 2009 2010

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 5 of 19

Chart 4. External Trade in Goods Balance

mil. USD %

1645.97 1331.57 1631.08

2000 25

1000

0 0

-1000

-2000 -25

-3000

-4000 -3275.76 -50

-3809.96

-5000

-4869.14

-6000 -75

2008 2009 2010

Exports (left axis) Imports (left axis) Balance (left axis) Balance / GDP (right axis)

Table 3. External Trade in Goods, Dynamics

U.M. 2008 2009 2010

US$ million 1645.97 1331.57 1631.08

Exports, f.o.b. prices (EX)

%* 119.9 80.9 122.5

US$ million -4869.14 -3275.76 -3809.96

Imports, f.o.b. prices (IM)

%* 132.6 67.3 116.3

US$ million -3223.17 -1944.19 -2178.88

Trade balance (EX-IM)

%* 140.3 60.3 112.1

US$ million 6515.11 4607.33 5441.04

External trade turnover (EX+IM)

%* 129.1 70.7 118.1

Exports / GDP % 27.2 24.5 28.1

Imports / GDP % 80.4 60.2 65.6

Trade balance / GDP % -53.2 -35.8 -37.5

Exports to imports ratio % 33.8 40.6 42.8

External trade turnover (EX+IM) / GDP % 107.6 84.7 93.6

* annual dynamics

Chart 5. Trade Balance (f.o.b.- f.o.b.) in Goods by Geographical Region (US$ million)

0

-500

-1000 -622.41 -602.60

-1090.32

-1500 -1321.78

-1576.28

-2000

-2500 -2132.85

-1944.19

-2178.88

-3000

-3500 -3223.17

2008 2009 2010

Trade balance - CIS Trade balance - RW Trade balance - TOTAL

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 6 of 19

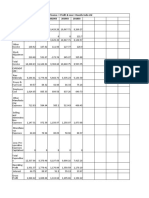

Table 4. Trade Balance (f.o.b.-c.i.f.) in Goods by Groups of Countries

Degree of

2008 2009 2010 2010 / 2009

influence*

US$ million % p.p. **

European Union, of which: -1,531.04 -946.13 -1,204.54 127.3 13.0

Romania -534.64 -299.87 -369.56 123.2 3.5

Germany -303.11 -156.12 -203.48 130.3 2.4

Poland -83.02 -68.43 -83.64 122.2 0.8

Hungary -67.84 -52.13 -77.80 149.2 1.3

Italy -81.71 -50.25 -69.35 138.0 1.0

Greece -19.31 -31.30 -60.36 192.8 1.5

Bulgaria -37.44 -39.95 -55.74 139.5 0.8

Austria -48.79 -37.96 -42.80 112.8 0.2

Netherlands -43.79 -30.51 -37.63 123.3 0.4

Lithuania -38.10 -29.54 -34.31 116.1 0.2

Belgium -37.99 -23.28 -32.27 138.6 0.5

Czechia -49.50 -27.39 -31.89 116.4 0.2

France -52.10 -18.75 -20.46 109.1 0.1

Spain -21.87 -20.29 -18.95 93.4 -0.1

Slovakia -26.15 -14.73 -18.57 126.1 0.2

Slovenia -30.19 -19.46 -18.53 95.2 0.0

United Kingdom 10.62 12.78 21.67 169.6 -0.4

Balkan states, of which: -180.78 -121.87 -106.81 87.6 -0.8

Turkey -185.56 -121.85 -106.48 87.4 -0.8

Albania 0.78 1.18 6.56 5.6 times -0.3

CIS, of which: -1,197.31 -709.69 -686.00 96.7 -1.2

Ukraine -780.67 -441.31 -517.12 117.2 3.8

Russia -347.12 -251.57 -157.80 62.7 -4.7

Belarus -108.91 -53.38 -36.30 68.0 -0.9

Uzbekistan -1.01 5.42 0.71 13.1 0.2

Kyrgyzstan 2.97 2.10 2.03 96.7 0.0

Azerbaidjan 6.78 3.45 7.02 2.0 times -0.2

Kazakhstan 27.67 24.09 14.85 61.6 0.5

Other countries, of which: -398.45 -213.05 -275.81 129.5 3.2

China -200.19 -155.49 -198.62 127.7 2.2

Brazil -10.85 -4.16 -36.65 8.8 times 1.6

India -13.33 -11.22 -11.73 104.5 0.0

Switzerland 6.05 -2.23 -5.76 2.6 times 0.2

USA -43.77 -5.28 -1.33 25.2 -0.2

Egypt -2.27 -0.08 1.86 - -0.1

Syria 1.28 4.30 9.85 2.3 times -0.3

Iraq 3.63 5.43 10.17 187.3 -0.2

Georgia 4.80 7.07 11.01 155.7 -0.2

Total -3,307.58 -1,990.74 -2,273.16 114.2 14.2

Source: NBS, selections on imports (c.i.f.) by country of shipment, shuttle trade not included

* Influence of the country on growth (+) / decrease (-) of trade balance in goods; ** Percentage points

Note: NBS data do not include adjustments to the foreign trade in goods operated by the Balance of Payments Division of the National Bank

of Moldova, such as exports / imports carried out by individuals, repairs on goods, goods purchased in ports by carriers, etc. Imports are

evaluated in c.i.f. prices and are analysed by country of shipment.

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 7 of 19

Chart 6. Main trading partners of the Republic of Moldova in 2010 (US$ million)

Exports from the Republic of Imports to the Republic

Moldova of Moldova

Russia 404.17 561.97

Romania 257.33 626.89

Ukaine 91.59 608.71

Italy 148.09 217.44

Germany 75.43 278.91

Turkey 82.49 188.97

China 2.30 200.92

Belarus 80.28 116.58

Poland 46.73 130.37

United Kingdom 82.11 60.44

500 400 300 200 100 0 100 200 300 400 500 600 700

Source: NBS (shuttle trade not included); selections on imports by country of shipment

Table 5. Exports of Goods by Groups of Countries

Share in total Degree of

2008 2009 2010 2010 / 2009

2009 2010 influence*

US$ million % p.p. **

European Union, of which: 820.13 668.09 746.51 51.9 47.2 111.7 6.1

Romania 335.82 239.64 257.33 18.6 16.3 107.4 1.4

Italy 167.05 135.71 148.09 10.5 9.4 109.1 1.0

United Kingdom 52.27 60.30 82.11 4.7 5.2 136.2 1.7

Germany 63.77 75.46 75.43 5.9 4.8 100.0 0.0

Poland 56.14 33.69 46.73 2.6 3.0 138.7 1.0

Greece 9.01 17.06 23.45 1.3 1.5 137.5 0.5

France 21.37 22.23 23.31 1.7 1.5 104.9 0.1

Bulgaria 22.34 13.91 18.83 1.1 1.2 135.4 0.4

Lithuania 8.06 10.45 11.74 0.8 0.7 112.3 0.1

Netherlands 13.15 10.94 10.88 0.8 0.7 99.5 0.0

Austria 12.47 7.81 10.78 0.6 0.7 138.0 0.2

Hungary 18.48 13.20 8.14 1.0 0.5 61.7 -0.4

Czechia 5.34 5.21 7.78 0.4 0.5 149.3 0.2

Belgium 9.65 5.55 7.49 0.4 0.5 135.0 0.2

Slovakia 7.62 6.68 5.33 0.5 0.3 79.8 -0.1

Balkan states, of which: 48.12 40.73 92.40 3.2 5.8 2.3 times 4.0

Turkey 33.44 33.10 82.49 2.6 5.2 2.5 times 3.8

Albania 0.83 1.20 6.56 0.1 0.4 5.5 times 0.4

CIS, of which: 616.71 491.39 624.20 38.2 39.5 127.0 10.3

Russia 313.68 286.60 404.17 22.3 25.5 141.0 9.1

Ukraine 142.82 81.41 91.59 6.3 5.8 112.5 0.8

Belarus 92.66 80.79 80.28 6.3 5.1 99.4 0.0

Kazakhstan 44.51 26.55 30.55 2.1 1.9 115.1 0.3

Azerbaidjan 7.12 3.86 7.48 0.3 0.5 193.8 0.3

Uzbekistan 8.09 6.69 4.44 0.5 0.3 66.4 -0.2

Other countries, of which: 106.22 87.33 119.02 6.8 7.5 136.3 2.5

USA 15.10 12.21 22.01 0.9 1.4 180.3 0.8

Switzerland 39.69 21.69 17.45 1.7 1.1 80.5 -0.3

Georgia 6.34 8.57 12.36 0.7 0.8 144.2 0.3

Syria 3.90 6.68 11.36 0.5 0.7 170.1 0.4

Iraq 3.85 5.49 10.17 0.4 0.6 185.2 0.4

Egypt 0.19 2.12 4.97 0.2 0.3 2.3 times 0.2

Total 1,591.18 1,287.54 1,582.13 100.0 100.0 122.9 22.9

Source: NBS; shuttle trade not included

* Influence of the country on growth (+) / decrease (-) of exports of goods; ** Percentage points

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 8 of 19

Table 6. Exports by Main Groups of Goods

Share in

2008 2009 2010 2010 / 2009

total 2010

US$ million %

I. Livestock; animal products 10.14 9.15 26.97 1.7 2.9 times

II. Vegetable products 210.08 268.38 381.09 24.1 142.0

III. Animal or vegetable fats and oils 62.89 50.71 47.59 3.0 93.8

IV. Prepared foodstuffs; beverages, spirits; tobacco 311.93 281.00 316.95 20.0 112.8

V. Mineral products 63.46 14.38 17.15 1.1 119.3

VI. Products of the chemical industry 32.97 57.57 74.13 4.7 128.8

VII. Plastics, rubber and articles thereof 38.19 26.86 26.22 1.7 97.6

VIII. Raw hides and skins, leather, furs, and articles thereof 33.29 23.94 24.72 1.6 103.3

IX. Wood and articles thereof (furniture not included) 5.39 3.91 5.73 0.4 146.5

X. Wood pulp, paper, paperboard and articles thereof 16.71 7.82 11.81 0.7 151.0

XI. Textiles and textile articles 313.94 257.80 267.69 16.9 103.8

XII. Footwear, headgear, umbrellas and the like 48.00 26.38 30.65 1.9 116.2

XIII. Articles of stone, plaster, cement; ceramic products; glass 52.51 25.82 35.33 2.2 136.8

and glassware

XIV. Pearls, precious or semi-precious stones, precious metals,

metals clad with precious metal and articles thereof; imitation 0.22 0.37 0.30 0.0 81.1

jewellery; coins

XV. Base metals and articles thereof 119.12 29.42 58.26 3.7 198.0

XVI. Machinery and mechanical appliances; electrical

167.50 139.28 171.76 10.9 123.3

equipment; image and sound recorders and reproducers

XVII. Vehicles, aircraft and associated transport equipment 16.07 14.99 21.17 1.3 141.2

XVIII. Optical, photographic, cinematographic, medical or

surgical instruments and apparatuses; clocks and watches; 28.88 10.94 12.87 0.8 117.6

musical instruments, parts and accessories thereof

Other 59.89 38.82 51.74 3.3 133.3

TOTAL 1,591.18 1,287.54 1,582.13 100.0 122.9

Source: NBS; shuttle trade not included

Table 7. Exports of Alcoholic Beverages

Share in total 2010 / Degree of

2005 2008 2009 2010

2009 influence*

2005 2008 2009 2010

US$ million % % p.p.**

TOTAL 314.24 193.15 157.26 175.84 100.0 100.0 100.0 100.0 111.8 11.8

Russia 234.92 58.90 52.15 62.20 74.8 30.5 33.2 35.4 119.3 6.4

Belarus 36.56 46.65 44.02 41.33 11.6 24.2 28.0 23.5 93.9 -1.7

Ukraine 18.40 43.84 13.56 23.98 5.9 22.7 8.6 13.6 176.8 6.6

Kazakhstan 7.47 9.18 14.37 13.44 2.4 4.8 9.1 7.6 93.5 -0.6

Poland 2.39 9.53 9.39 7.97 0.8 4.9 6.0 4.5 84.9 -0.9

Georgia 1.76 2.24 3.67 4.90 0.6 1.2 2.3 2.8 133.5 0.8

Czechia 1.27 3.02 3.50 4.13 0.4 1.6 2.2 2.3 118.0 0.4

USA 0.79 1.56 1.81 2.56 0.3 0.8 1.2 1.5 141.4 0.5

Germany 1.37 1.78 4.22 2.52 0.4 0.9 2.7 1.4 59.7 -1.1

Romania 1.59 5.56 3.23 2.41 0.5 2.9 2.1 1.4 74.6 -0.5

China 0.00 0.61 0.37 2.10 0.0 0.3 0.2 1.2 5.7 times 1.1

Kyrgyzstan 1.21 1.39 1.99 1.41 0.4 0.7 1.3 0.8 70.9 -0.4

Lithuania 0.71 0.59 0.72 1.02 0.2 0.3 0.5 0.6 141.7 0.2

Azerbaidjan 1.02 2.54 0.17 0.89 0.3 1.3 0.1 0.5 5.2 times 0.5

Latvia 1.20 1.48 0.63 0.58 0.4 0.8 0.4 0.3 92.1

Other countries 3.58 4.28 3.46 4.40 1.1 2.2 2.2 2.5 127.2 0.6

Source: NBS

* Influence of the country on growth (+) / decrease (-) of exports of alcoholic beverages; ** Percentage points

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 9 of 19

Table 8. Exports of Goods after Processing

2009 2010

Exports of goods Exports of goods Change 2010 / Degree of

after share in after share in in share 2009 influence**

total processing total* total processing total*

US$ million % US$ million % p.p.*** % p.p.***

Romania 239.64 138.38 57.7 257.33 134.75 52.4 -5.4 97.4 -0.9

Italy 135.71 118.20 87.1 148.09 124.36 84.0 -3.1 105.2 1.6

United Kingdom 60.30 44.42 73.7 82.11 56.67 69.0 -4.6 127.6 3.1

Germany 75.46 30.74 40.7 75.43 27.06 35.9 -4.9 88.0 -0.9

Turkey 33.10 22.66 68.5 82.49 22.89 27.7 -40.7 101.0 0.1

Poland 33.69 14.53 43.1 46.73 15.03 32.2 -11.0 103.4 0.1

France 22.23 6.74 30.3 23.31 6.96 29.9 -0.5 103.3 0.1

Belgium 5.55 3.79 68.3 7.49 5.08 67.8 -0.5 134.0 0.3

Netherlands 10.94 3.53 32.3 10.88 3.73 34.3 2.0 105.7 0.1

Slovakia 6.68 3.79 56.7 5.33 3.34 62.7 5.9 88.1 -0.1

San Marino 2.90 2.90 100.0 3.34 3.31 99.1 -0.9 114.1 0.1

Bulgaria 13.91 0.11 0.8 18.83 1.53 8.1 7.3 13.9 times 0.4

Switzerland 21.69 1.87 8.6 17.45 1.45 8.3 -0.3 77.5 -0.1

USA 12.21 1.15 9.4 22.01 1.29 5.9 -3.6 112.2 0.0

Other countries 613.53 2.97 0.5 366.36 1.34 0.4 -0.1 45.1 -0.4

TOTAL 1,287.54 395.78 30.7 1,582.13 410.57 26.0 -4.8 103.7 3.7

* Share of exports of goods after processing in total exports of goods of the respective country

** Influence of the country on the growth (+) / decrease (-) of exports of goods after processing; *** Percentage points

Table 9. Imports of Goods by Groups of Countries (c.i.f. prices)

Degree of

2008 2009 2010 Share in total 2010 2010 / 2009

influence*

US$ million % p.p.**

European Union, of which: 2351.17 1614.22 1951.05 50.6 120.9 10.3

Romania 870.46 539.51 626.89 16.3 116.2 2.7

Germany 366.88 231.58 278.91 7.2 120.4 1.4

Italy 248.76 185.96 217.44 5.6 116.9 1.0

Poland 139.16 102.12 130.37 3.4 127.7 0.9

Hungary 86.32 65.33 85.94 2.2 131.5 0.6

Greece 28.32 48.36 83.81 2.2 173.3 1.1

Bulgaria 59.78 53.86 74.57 1.9 138.5 0.6

United Kingdom 41.65 47.52 60.44 1.6 127.2 0.4

Austria 61.26 45.77 53.58 1.4 117.1 0.2

Netherlands 56.94 41.45 48.51 1.3 117.0 0.2

Lithuania 46.16 39.99 46.05 1.2 115.2 0.2

France 73.47 40.98 43.77 1.1 106.8 0.1

Belgium 47.64 28.83 39.76 1.0 137.9 0.3

Czechia 54.84 32.60 39.67 1.0 121.7 0.2

Slovakia 33.77 21.41 23.90 0.6 111.6 0.1

Spain 23.13 21.48 19.65 0.5 91.5 -0.1

Slovenia 31.66 20.07 19.30 0.5 96.2

Balkan states. of which: 228.90 162.60 199.21 5.2 122.5 1.1

Turkey 219.00 154.95 188.97 4.9 122.0 1.0

CIS. of which: 1814.02 1201.08 1310.20 34.0 109.1 3.3

Ukraine 923.49 522.72 608.71 15.8 116.5 2.6

Russia 660.80 538.17 561.97 14.6 104.4 0.7

Belarus 201.57 134.17 116.58 3.0 86.9 -0.5

Kazakhstan 16.84 2.46 15.70 0.4 6.4 times 0.4

Other countries. of which: 504.67 300.38 394.83 10.2 131.4 2.9

China 202.45 156.40 200.92 5.2 128.5 1.4

Brazil 16.77 4.41 36.77 1.0 8.3 times 1.0

USA 58.87 17.49 23.34 0.6 133.4 0.2

Switzerland 33.64 23.92 23.21 0.6 97.0

India 14.39 11.76 15.14 0.4 128.7 0.1

TOTAL 4898.76 3278.28 3855.29 100.0 117.6 17.6

Source: NBS (shuttle trade not included); selections on imports by country of shipment

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 10 of 19

Table 10. Imports of Goods by Groups of Countries (c.i.f. prices)

Share in

2008 2009 2010 2010 / 2009

total 2010

US$ million %

I. Livestock; animal products 100.32 75.28 94.74 2.5 125.9

II. Vegetable products 166.76 132.57 168.88 4.4 127.4

III. Animal or vegetable fats and oils 20.88 16.07 19.30 0.5 120.1

IV. Prepared foodstuffs; beverages, spirits; tobacco 343.42 289.69 308.62 8.0 106.5

V. Mineral products 1,126.00 718.18 807.10 20.9 112.4

VI. Products of the chemical industry 416.76 365.95 404.33 10.5 110.5

VII. Plastics, rubber and articles thereof 276.80 186.54 227.67 5.9 122.0

VIII. Raw hides and skins, leather, furs, and articles thereof 33.18 26.29 27.43 0.7 104.3

IX. Wood and articles thereof (furniture not included) 89.30 64.83 73.00 1.9 112.6

X. Wood pulp, paper, paperboard and articles thereof 117.21 87.94 102.71 2.7 116.8

XI. Textiles and textile articles 285.43 244.38 282.33 7.3 115.5

XII. Footwear, headgear, umbrellas and the like 30.89 22.20 22.17 0.6 99.9

XIII. Articles of stone, plaster, cement; ceramic products; glass and

138.70 86.57 98.71 2.6 114.0

glassware

XIV. Pearls, precious or semi-precious stones, precious metals, metals clad

10.87 8.02 6.07 0.2 75.7

with precious metal and articles thereof; imitation jewellery; coins

XV. Base metals and articles thereof 372.51 183.75 242.39 6.3 131.9

XVI. Machinery and mechanical appliances; electrical equipment; image

765.52 467.49 576.47 15.0 123.3

and sound recorders and reproducers

XVII. Vehicles, aircraft and associated transport equipment 390.59 157.33 237.94 6.2 151.2

XVIII. Optical, photographic, cinematographic, medical or surgical

instruments and apparatuses; clocks and watches; musical instruments, 74.63 56.07 53.92 1.4 96.2

parts and accessories thereof

Other 138.99 89.13 101.51 2.6 113.9

TOTAL 4,898.76 3,278.28 3,855.29 100.2 117.6

Source: NBS (shuttle trade not included); selections on imports by country of shipment

Table 11. Imports of Energy Resources (f.o.b. prices)

Share in

Unit of 2010 / 2009

2008 2009 2010 total 2010

measure

%

Energy products – total (US$ million) 903.24 652.99 732.77 100.0 112.2

From CIS (US$ million) 546.79 435.87 467.96 63.9 107.4

Coal (US$ million) 19.28 10.48 19.53 2.7 186.4

(thou. tons) 148.50 132.88 179.61 135.2

Natural gas (US$ million) 256.50 267.45 267.39 36.5 100.0

(m3 mil.) 1,226.90 1,126.27 1,187.85 105.5

Fuel oil (US$ million) 271.01 157.94 181.04 24.7 114.6

Fuel oil (US$ million) 6.35 14.25 8.90 1.2 62.5

(thou. tons) 14.00 45.83 18.01 39.3

Diesel (US$ million) 178.85 92.71 107.59 14.7 116.1

(thou. tons) 188.04 176.47 153.47 87.0

Gasoline (US$ million) 18.69 11.52 7.12 1.0 61.8

(thou. tons) 21.70 21.30 10.35 48.6

Other (US$ million) 67.12 39.46 57.43 7.8 145.5

From the rest of the world (US$ million) 356.45 217.12 264.81 36.1 122.0

Coal (US$ million) 13.12 0.20 0.24 - 120.0

(thou. tons) 57.32 1.35 1.87 138.5

Fuel oil (US$ million) 343.33 216.92 264.57 36.1 122.0

Fuel oil (US$ million) 0.60 0.22 0.15 - 68.2

(thou. tons) 0.77 0.42 0.24 57.1

Diesel (US$ million) 160.70 82.98 121.06 16.5 145.9

(thou. tons) 163.27 142.72 166.92 117.0

Gasoline (US$ million) 167.06 123.81 133.22 18.2 107.6

(thou. tons) 189.75 196.53 174.19 88.6

Other (US$ million) 14.97 9.91 10.14 1.4 102.3

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 11 of 19

Chart 7. Imports of Energy Resources in Physical Volume by Country

Fuel oil Other Diesel

Kazakhstan countries Other

Greece countries

9.4% 3.5% Belarus 10.9% 3.2%

14.2%

Romania

Belarus Ukraine 40.6%

87.1% 31.0%

Gasoline Other Coal Other

Bulgaria Belarus countries countries

Lithuania 2.7%

6.4% 5.5% 0.2%

7.9%

Greece

12.8%

Romania

Ukraine

67.2%

97.3%

Table 12. Imports and Exports of Electricity (f.o.b. prices)

2008 2009 2010 2010 / 2009 (%)

Quantity, kw/h mil. 2,958.06 6.90 24.88 3.6 times

Value, US$ mil. 137.96 0.36 2.11 5.9 times

Chart 8. Balance of Services

US$ million Exports (left axis) %

Imports (left axis)

1500 Balance / GDP (right axis) 3

1200 Balance (left axis)

837.28 2

900 668.88 689.79

600 1

300

0

0

-300 -1

-600

-2

-900 -712.86 -770.10

-838.64

-1200 -3

2008 2009 2010

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 12 of 19

Table 13. Services in Dynamics

2008 2009 2010 2010 / 2009

US$ million %

Balance of services -1.36 -43.98 -80.31 182.6

Exports 837.28 668.88 689.79 103.1

Imports -838.64 -712.86 -770.10 108.0

Transportation 32.12 -3.29 -40.68 12.4 times

Exports 357.04 253.48 244.45 96.4

Imports -324.92 -256.77 -285.13 111.0

Travel -75.73 -74.75 -103.83 138.9

Exports 211.96 168.29 162.10 96.3

Imports -287.69 -243.04 -265.93 109.4

Communications 67.19 66.06 87.92 133.1

Exports 114.56 105.21 126.05 119.8

Imports -47.37 -39.15 -38.13 97.4

Other services -24.94 -32.00 -23.72 74.1

Exports 153.72 141.90 157.19 110.8

Imports -178.66 -173.90 -180.91 104.0

Chart 9. External Trade in Services Balance by Geographic Region (US$ million)

40 27.23 Balance of services - CIS

Balance of services - RW

20

Balance of services - TOTAL

0 -1.36

-20

-15.64 -20.44

-40 -28.59 -28.34

-60 -43.98

-59.87

-80 -80.31

-100

2008 2009 2010

Chart 10. Income Balance

mil. USD Inflow (left axis)

%

Outflow (left axis)

1000 905.01 Balance (left axis) 20

741.25 18

800 Balance / GDP (right axis) 16

590.00 14

600 12

10

400 8

6

200 4

2

0 0

-2

-200 -4

-6

-400 -306.41 -287.07 -270.08 -8

2008 2009 2010

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 13 of 19

Table 14. Income Balance, Dynamics

2008 2009 2010 2010 / 2009

US$ million %

Income balance 598.60 302.93 471.17 155.5

Credit 905.01 590.00 741.25 125.6

Debit -306.41 -287.07 -270.08 94.1

Compensation of employees 763.00 497.12 663.47 133.5

Credit 842.00 563.42 722.82 128.3

Debit -79.00 -66.30 -59.35 89.5

Income on direct and portfolio investment -140.25 -138.02 -142.23 103.1

Credit 16.47 19.50 15.22 78.1

Debit -156.72 -157.52 -157.45 100.0

Dividends and distributed profits -41.50 -137.90 -126.41 91.7

Credit 0.04 0.14 0.70 5.0 times

Debit -41.54 -138.04 -127.11 92.1

Reinvested earnings and non-distributed profits (-) /

-98.70 11.56 -22.05 -

losses (+)

Debit -98.70 11.56 -22.05 -

Interest -0.05 -11.68 6.23 -

Credit 16.43 19.36 14.52 75.0

Debit -16.48 -31.04 -8.29 26.7

Income on other investment -24.15 -56.17 -50.07 89.1

Credit 46.54 7.08 3.21 45.3

Debit -70.69 -63.25 -53.28 84.2

Chart 11. Current Transfers Balance

US$ mil. %

2000 1750.29 50

1600 1323.99 1391.15 40

1200 30

800 20

400 10

0 0

-400 -111.49 -103.36 -85.40 -10

2008 2009 2010

Credit (left axis) Debit (left axis) Balance (left axis) Balance / GDP (right axis)

Table 15. Current Transfers in Dynamics

2008 2009 2010 2010 / 2009

US$ million %

Current transfers balance 1638.80 1220.63 1305.75 107.0

Credit 1750.29 1323.99 1391.15 105.1

Debit -111.49 -103.36 -85.4 82.6

Grants and technical assistance 276.44 246.62 275.50 111.7

Credit 277.71 247.56 276.98 111.9

Debit -1.27 -0.94 -1.48 157.4

Education and staff training 35.40 28.47 42.02 147.6

Credit 35.68 28.96 42.72 147.5

Debit -0.28 -0.49 -0.70 142.9

Humanitarian aid 59.37 21.42 40.97 191.3

Credit 59.41 21.43 40.99 191.3

Debit -0.04 -0.01 -0.02 2.0 times

Fees to international organizations -5.82 -5.00 -4.94 98.8

Credit 0.09 0.02 0.04 2.0 times

Debit -5.91 -5.02 -4.98 99.2

Workers' remittances 1032.77 627.24 618.88 98.7

Credit 1046.02 635.21 635.03 100.0

Debit -13.25 -7.97 -16.15 2.0 times

Other current transfers 240.64 301.88 333.32 110.4

Credit 331.38 390.81 395.39 101.2

Debit -90.74 -88.93 -62.07 69.8

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 14 of 19

CAPITAL AND FINANCIAL ACCOUNT

Chart 12. Capital and Financial Account – Main Components (US$ million)

1100 900.97 Capital transfers Direct investment

1000 Portfolio investment* Other investment

900 Reserve assets Capital and financial account

800 696.69

700 663.58

600 406.84 411.40 533.72

500

400

300 200.55 195.40

200 121.08 108.23

100 7.32 5.01

0

-100 -14.61 -17.54 -5.48 -28.36

-200

-300

-400 -294.37

-500

-452.01

2008 2009 2010

* including financial derivatives

Table 16. External Assets and Liabilities, Net Flows

2008 2009 2010

US$ million

Financial account 915.58 424.38 439.76

External assets -416.05 -17.10 -223.24

Direct investment -16.08 -6.76 -3.50

Portfolio investment -0.04 -0.25 -0.20

Financial derivatives -0.06 -0.08 -0.63

Other investment 52.14 -210.56 75.46

trade credits 76.30 44.86 21.24

loans 1.80 4.20 -7.39

currency and deposits -25.96 -259.62 61.61

Reserve assets -452.01 200.55 -294.37

External liabilities 1331.63 441.48 663.00

Direct investment 712.77 127.84 198.90

Portfolio investment 6.42 -5.57 5.84

Financial derivatives 1.00 0.42

Other investment 611.44 318.79 458.26

trade credits 131.16 90.70 128.62

loans 397.51 -58.78 283.06

currency and deposits 53.12 -46.64 -69.59

other liabilities 29.65 149.31 116.17

SDR allocation 184.20

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 15 of 19

Table 17. Direct Investment (US$ million)

2008 2009 2010

inflow outflow net inflow outflow net inflow outflow net

Direct investment 870.86 174.17 696.69 363.40 242.32 121.08 360.57 165.17 195.40

abroad 7.10 23.18 -16.08 3.39 10.15 -6.76 0.09 3.59 -3.50

in domestic economy 863.76 150.99 712.77 360.01 232.17 127.84 360.48 161.58 198.90

equity capital 481.21 39.51 441.70 209.53 47.97 161.56 183.05 29.38 153.67

banks 30.06 30.06 25.45 25.45 34.03 34.03

other sectors 451.15 39.51 411.64 184.08 47.97 136.11 149.02 29.38 119.64

reinvested earnings and undistributed profit

98.70 98.70 -11.56 -11.56 22.05 22.05

(+) / losses (-)

banks 22.68 22.68 -21.48 -21.48 -24.66 -24.66

other sectors 76.02 76.02 9.92 9.92 46.71 46.71

other capital (other sectors) 283.85 111.48 172.37 162.04 184.20 -22.16 155.38 132.20 23.18

claims on direct investors 7.69 22.84 -15.15 10.28 0.10 10.18 2.71 6.80 -4.09

liabilities to direct investors 276.16 88.64 187.52 151.76 184.10 -32.34 152.67 125.40 27.27

Structure of direct investment flows in

100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

domestic economy (%)

banks 6.1 7.4 1.1 3.1 2.6 4.7

other sectors 93.9 100.0 92.6 98.9 100.0 96.9 97.4 100.0 95.3

Chart 13. FDI in Domestic Economy, Annual Dynamics (US$ million)

3000 2649.59 2837.48

2566.56

2500

2000

1500

1000 712.77

500 198.90

127.84

0

2008 2009 2010

Stock, at the year-end Net flow

Chart 14. FDI – Equity Capital Accumulated at Year-end, by Region (US$ million)

EU CIS Other countries

1000

900

800

700

600

500

400

300

200

100

0

|December 31, 2008 December 31, 2009 December 31, 2010

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 16 of 19

Chart 15. FDI Stock – Equity Capital, Main Countries (US$ million)

Banks Other sectors

Romania Russia

Italy Cyprus

France USA

Austria Germany

Germany Netherlands

Russia Italy

USA Romania

UK France

End of 2010 End of 2010

Greece End of 2009 Switzerland End of 2009

End of 2008 End of 2008

Virgin Is. (Br.) Turkey

0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 0 15 30 45 60 75 90 105 120 135 150 165

Table 18. Portfolio Investment (US$ million)

2008 2009 2010

Portfolio investment 6.38 -5.82 5.64

Assets -0.04 -0.25 -0.20

Equity securities -0.03 -0.25 -0.20

Other sectors -0.03 -0.25 -0.20

Debt securities -0.01

Banks -0.01

Liabilities 6.42 -5.57 5.84

Equity securities 11.36 2.39 5.84

Banks 10.98 -0.52 5.75

equity securities sold to nonresidents 12.38 0.01 5.81

equity securities repurchased from nonresidents -1.40 -0.53 -0.06

Other sectors 0.38 2.91 0.09

equity securities sold to nonresidents 0.66 3.07 0.13

equity securities repurchased from nonresidents -0.28 -0.16 -0.04

Debt securities – bonds and notes -6.36 -6.35

General government -6.36 -6.35

Money market instruments 1.42 -1.61

General government 1.42 -1.61

treasury bills sold to nonresidents 4.56

treasury bills repurchased from nonresidents -3.14 -1.61

Note: Nonresident to nonresident transactions are not reflected in the balance of payments.

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 17 of 19

Chart 16. Other Investment – Assets (US$ million)

160

120 75.46

76.30 61.61

80 52.14 44.86

40 1.80 21.24

4.20

0

-40 -7.39

-25.96

-80

-120

-160 Currency and deposits

-200 Trade credits

Loans

-240 Total assets

-210.56

-280 -259.62

2008 2009 2010

Note: (-) growth

Chart 17. Other Investment – Liabilities (US$ million)

700 Trade credits

611.44 Government and NBM loans, SDR allocations

Banks' and other sectors' loans

600 Currency and deposits

Change in arrears on energy resources

Other

500 Total liabilities 458.26

400 365.29 318.79

300

219.07

200 165.93

131.16 128.62

115.82

90.70

100 63.99 69.14

53.12 47.03

32.22 17.23 12.42 33.49

-40.51 -46.64

-100 -69.59

2008 2009 2010

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 18 of 19

Table 19. External Loans (US$ million)

2008 2009 2010

drawings repayments drawings repayments drawings repayments

Monetary authorities loans

37.56 25.43 14.86 61.34 8.41

(NBM from IMF)

Government loans 74.82 54.73 41.19 44.60 212.05 45.91

including: rescheduled 31.52 21.74

Banking loans 226.10 62.16 100.04 155.65 156.98 123.12

long-term 171.51 54.21 98.04 107.47 146.21 120.35

short-term 54.59 7.95 2.00 48.18 10.77 2.77

Other sectors’ loans 476.22 274.87 184.72 169.62 217.75 187.62

long-term 418.34 203.14 169.64 151.82 187.69 179.29

short-term 57.88 71.73 15.08 17.80 30.06 8.33

TOTAL 814.70 417.19 325.95 384.73 648.12 365.06

TOTAL except rescheduled 783.18 395.45 325.95 384.73 648.12 365.06

Table 20. Other Liabilities (US$ million)

2008 2009 2010

Other liabilities 29.65 149.31 116.17

General government

accumulation of principal arrears 21.74

accumulation of interest arrears 9.78

rescheduling of arrears -31.52

Other sectors 39.95 149.31 115.56

accumulation of principal arrears 60.60 159.01 126.78

including: arrears on energy resources imports 17.23 33.49 47.03

accumulation of interest arrears 4.77 19.79 13.66

repayment of principal arrears -25.42 -29.49 -24.88

Banks -10.30 0.61

Chart 18. Official Reserve Assets of the Republic of Moldova at Year-end

US$ mil. months

4.5 4.5

2400 5

2100 3.5

1800

1500 3

1717.69

1200 1672.41 1480.26

900 2

600

300

0 0

2008 2009 2010

Reserve assets stock (left axis)

Reserve assets / Average monthly imports of goods and services (right axis)

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

National Bank of Moldova

March 31, 2011

Page 19 of 19

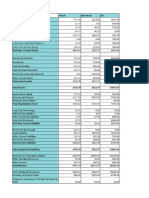

ANALYTICAL PRESENTATION OF THE BALANCE OF PAYMENTS

Table 21. Balance of Payments of Moldova in Analytical Presentation (US$ million)

2006 2007 2008 2009 2010

CURRENT ACCOUNT -392.55 -726.27 -1049.05 -533.96 -590.32

Goods -1582.70 -2298.07 -3223.17 -1944.19 -2178.88

Services -21.98 -24.67 -1.36 -43.98 -80.31

Income 402.53 416.41 598.60 302.93 471.17

Current transfers 809.60 1180.06 1576.88 1151.28 1197.70

CAPITAL AND FINANCIAL ACCOUNT 337.30 995.69 1259.55 71.84 375.12

Capital transfers -22.78 -7.96 -14.61 -17.54 -28.36

Direct investment, of which: 240.65 516.26 696.69 121.08 190.82

in domestic economy 239.72 533.62 712.77 127.84 194.32

Portfolio investment -4.79 -4.51 6.38 -5.82 5.64

Assets -0.21 -0.07 -0.04 -0.25 -0.20

Liabilities -4.58 -4.44 6.42 -5.57 5.84

Financial derivatives 0.19 -0.47 0.94 0.34 -0.63

Other investment 124.03 492.37 570.15 -26.22 207.65

Assets -49.36 35.32 52.14 -210.56 75.46

Liabilities 173.39 457.05 518.01 184.34 132.19

loans* 75.18 279.11 344.03 -43.92 72.55

general government -29.90 -14.62 -21.26 -3.41 3.98

banks 7.00 121.91 163.94 -55.61 38.44

other sectors 98.08 171.82 201.35 15.10 30.13

other investment flows 98.21 177.94 173.98 44.06 59.64

SDR allocation 184.20

Errors and omissions 77.24 117.25 86.16 57.77 70.87

OVERALL BALANCE 21.99 386.67 296.66 -404.35 -144.33

Financing -21.99 -386.67 -296.66 404.35 144.33

IMF loans, net 41.05 11.22 12.13 -14.86 174.67

Change in reserve assets** -140.76 -528.86 -452.01 200.55 -294.37

Exceptional financing 77.72 130.97 143.22 218.66 264.03

Intergovernmental grants 4.69 52.22 61.92 69.35 108.05

Direct investment associated with reduction in debt 4.58

Other investment - liabilities 73.48 78.75 81.30 149.31 155.98

- governmental loans for BOP sustaining 10.28 9.83 40.42

- loans rescheduling 87.71 31.94 31.52

- arrears (net), including rescheduled -14.23 36.53 39.95 149.31 115.56

Advance payments, subsequent rescheduled payments -0.45 -4.58

* except rescheduled

**(-) increase, (+) decrease

• 1 Grigore Vieru Avenue, MD-2005, Chişinău • www.bnm.md • E-mail: official@bnm.md •

ş

• Telephone (373 22) 409 006 • Fax (373 22) 220 591 •

You might also like

- Dancing in The Flames Dark Goddess Transformation of Consciousness Buddhism Marion Woodman, Elinor DicksonDocument244 pagesDancing in The Flames Dark Goddess Transformation of Consciousness Buddhism Marion Woodman, Elinor DicksonAna Terazu100% (2)

- Oracle Brazilian Integrated ReceivingDocument507 pagesOracle Brazilian Integrated ReceivingRicardoNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- History of Prostitution in India 11111Document2 pagesHistory of Prostitution in India 11111Ankit AnandNo ratings yet

- People vs. Balgos Case DigestDocument2 pagesPeople vs. Balgos Case DigestKatherine AplacadorNo ratings yet

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaNo ratings yet

- Analysis by CompanyDocument12 pagesAnalysis by CompanyNadia ZahraNo ratings yet

- PCBL - Valuation 2Document6 pagesPCBL - Valuation 2Sagar SahaNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Table 141: India'S Overall Balance of Payments - RupeesDocument2 pagesTable 141: India'S Overall Balance of Payments - Rupeesmahbobullah rahmaniNo ratings yet

- Consolidated Balance Sheet Equity and Liabilities Shareholders' FundsDocument17 pagesConsolidated Balance Sheet Equity and Liabilities Shareholders' FundsGaurav SharmaNo ratings yet

- ITC ReportDocument13 pagesITC ReportFaizan SiddiquiNo ratings yet

- Indigo FSADocument8 pagesIndigo FSAKarthik AnanthNo ratings yet

- Cost of Project & Means of Finance Annexure-1Document12 pagesCost of Project & Means of Finance Annexure-1Siddharth RanaNo ratings yet

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraNo ratings yet

- Company Analysis KRBL Mayank GargDocument27 pagesCompany Analysis KRBL Mayank GargGaneshTatiNo ratings yet

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDocument5 pagesVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNo ratings yet

- Financial Analysis (HAL) FinalDocument22 pagesFinancial Analysis (HAL) FinalAbhishek SoniNo ratings yet

- Hindustan Unilever LTD Industry:Personal Care - MultinationalDocument17 pagesHindustan Unilever LTD Industry:Personal Care - MultinationalZia AhmadNo ratings yet

- VedantaDocument19 pagesVedantaSaurabh NeveNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Asian PaintsDocument230 pagesAsian PaintsKapil JainNo ratings yet

- UTV Software Communications LTDDocument4 pagesUTV Software Communications LTDNeesha PrabhuNo ratings yet

- Eveready Industries India Balance Sheet - in Rs. Cr.Document5 pagesEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- AFSA - Group 7 - Havells Vs BajajDocument103 pagesAFSA - Group 7 - Havells Vs BajajArnnava SharmaNo ratings yet

- Ten Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Document2 pagesTen Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Undefined OrghoNo ratings yet

- Spice JetDocument4 pagesSpice Jetpulkit sharmaNo ratings yet

- MKT Ca1Document96 pagesMKT Ca1Nainpreet KaurNo ratings yet

- UPLODE Mini ProjrctDocument7 pagesUPLODE Mini ProjrctSONA MBANo ratings yet

- Bombay DyeingDocument3 pagesBombay DyeingJinal_Punjani_5573No ratings yet

- Consolidated Balance Sheet of Cipla - in Rs. Cr.Document7 pagesConsolidated Balance Sheet of Cipla - in Rs. Cr.Neha LalNo ratings yet

- Income Statement 2018-2019 %: Sources of FundsDocument8 pagesIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNo ratings yet

- Arvind LTD: Balance Sheet Consolidated (Rs in CRS.)Document8 pagesArvind LTD: Balance Sheet Consolidated (Rs in CRS.)Sumit GuptaNo ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet

- Icici Bank CMP: Rs. 956.05: Result UpdateDocument6 pagesIcici Bank CMP: Rs. 956.05: Result UpdatemahasagarNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of FundsAbhisek SarkarNo ratings yet

- Apollo Tyres: PrintDocument2 pagesApollo Tyres: PrintTiaNo ratings yet

- T V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreDocument4 pagesT V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreRahul DesaiNo ratings yet

- DCF ValuationV!Document80 pagesDCF ValuationV!Sohini DeyNo ratings yet

- COMPANY/FINANCE/BALANCE SHEET/175/Nestle IndiaDocument1 pageCOMPANY/FINANCE/BALANCE SHEET/175/Nestle IndiabhuvaneshkmrsNo ratings yet

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033No ratings yet

- Ten Years Performance at A GlanceDocument1 pageTen Years Performance at A GlancerahulNo ratings yet

- Acc LTD Balance Sheet: Sources of FundsDocument75 pagesAcc LTD Balance Sheet: Sources of FundsSaad YousufNo ratings yet

- Sagar CementsDocument33 pagesSagar Cementssarbjeetk21No ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDocument4 pages58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNo ratings yet

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Document128 pagesGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahNo ratings yet

- Sec A - Group 5 - GCPL - Final ProjectDocument36 pagesSec A - Group 5 - GCPL - Final ProjectDhruv GandhiNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- Berger Paints India Ltd.Document19 pagesBerger Paints India Ltd.Abhisek MohantyNo ratings yet

- Dalmia Cement (Bharat) LTDDocument8 pagesDalmia Cement (Bharat) LTDRemonNo ratings yet

- AFM Group ProjectDocument13 pagesAFM Group ProjectMehak GargNo ratings yet

- Balance Sheet For Mahindra & Mahindra Pvt. LTD.: Assets Amount (In Crores) Non-Current AssetsDocument32 pagesBalance Sheet For Mahindra & Mahindra Pvt. LTD.: Assets Amount (In Crores) Non-Current AssetsAniketNo ratings yet

- Kalyan JewellersDocument8 pagesKalyan Jewellersaarushikhunger12No ratings yet

- Balance Sheet of Iifl Securities LimitedDocument6 pagesBalance Sheet of Iifl Securities Limitedshubham ghodkeNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- Opm With TQM Module by Prof. NovedaDocument74 pagesOpm With TQM Module by Prof. NovedaMaria CamachoNo ratings yet

- Sesi 7 - Skyview Manor CaseDocument3 pagesSesi 7 - Skyview Manor CasestevenNo ratings yet

- History of KarateDocument5 pagesHistory of KaratekyleNo ratings yet

- Rank PG 2015Document133 pagesRank PG 2015Gangatharan NarayananNo ratings yet

- Donoghue V. Stevenson: Case Study AnalysisDocument6 pagesDonoghue V. Stevenson: Case Study AnalysisSarah jamalNo ratings yet

- chiến lược marketing cho panasonicDocument19 pageschiến lược marketing cho panasonicVu Tien ThanhNo ratings yet

- Intelligence and IQ: Landmark Issues and Great DebatesDocument7 pagesIntelligence and IQ: Landmark Issues and Great DebatesRaduNo ratings yet

- Vcrreport AP102 Dec2022 002586Document2 pagesVcrreport AP102 Dec2022 002586penukonda checkpostNo ratings yet

- Loadmaster v. Glodel BrokerageDocument2 pagesLoadmaster v. Glodel Brokeragequi_micaelNo ratings yet

- C3h - 3 People v. PalanasDocument2 pagesC3h - 3 People v. PalanasAaron AristonNo ratings yet

- Modern Electroplating PDFDocument193 pagesModern Electroplating PDFMartin Ong100% (2)

- Complaint in Walls, Et Al. v. Sanders, Et Al., 4:24-CV-270-KGB.Document56 pagesComplaint in Walls, Et Al. v. Sanders, Et Al., 4:24-CV-270-KGB.egodinezfr100% (1)

- Jesse Owens Oneonone Activities ReadingDocument3 pagesJesse Owens Oneonone Activities Readingririn everynNo ratings yet

- Mhra - GLPDocument24 pagesMhra - GLPRambabu komati - QANo ratings yet

- HDFC - Ergo Insurance Grievance Redressal ProcedureDocument2 pagesHDFC - Ergo Insurance Grievance Redressal ProcedureReshma GuptaNo ratings yet

- Shadow of God ShortDocument64 pagesShadow of God ShortVA_nihilist100% (1)

- Akash Agarwal: San Francisco Bay Area GVP @SAP Mobile, General MGR, CEODocument4 pagesAkash Agarwal: San Francisco Bay Area GVP @SAP Mobile, General MGR, CEOOm Prakash DubeyNo ratings yet

- Cognizant Company FAQDocument4 pagesCognizant Company FAQManojChowdary100% (1)

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- Panasonic Compact Solar PV 300w Panels. HIT SeriesDocument13 pagesPanasonic Compact Solar PV 300w Panels. HIT SeriesMichaelPurcellNo ratings yet

- E-F-H-, AXXX XXX 818 (BIA Dec. 22, 2016)Document5 pagesE-F-H-, AXXX XXX 818 (BIA Dec. 22, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Seat Wise Analysis AE 2022 - 403 SeatsDocument24 pagesSeat Wise Analysis AE 2022 - 403 SeatsRavi KumarNo ratings yet

- Rivera vs. PeopleDocument1 pageRivera vs. PeopleGraziella AndayaNo ratings yet

- Social Studies Chapter 8Document2 pagesSocial Studies Chapter 8Arooj BaigNo ratings yet

- Mock Cpa Board Exams Rfjpia R 12 W AnsDocument17 pagesMock Cpa Board Exams Rfjpia R 12 W AnsRheneir MoraNo ratings yet

- G.R. No. 180356: February 16, 2010Document18 pagesG.R. No. 180356: February 16, 2010Alyssa Clarizze MalaluanNo ratings yet