Professional Documents

Culture Documents

Income Tax 2021-22 Statement - JAYAHARI G

Income Tax 2021-22 Statement - JAYAHARI G

Uploaded by

jayaharig0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

Income Tax 2021-22 Statement-- JAYAHARI G

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageIncome Tax 2021-22 Statement - JAYAHARI G

Income Tax 2021-22 Statement - JAYAHARI G

Uploaded by

jayaharigCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

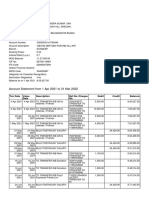

Anticipatory Income Tax Statement for the Financial Year 2021-22

(Assessment Year 2022-2023)

Name of Employee: JAYAHARI G PAN: AOQPG0368F

Designation: VOCATIONAL TEACHER Office: GVHSS CHELARI

Category: Individual (Age: below 60 years) Income Tax Slab: Slab 2020-21 (NEW)

to be furnished by the employees / officers whose income exceeds Rs. 2,50,000/-

Gross Salary / Pension for the month : (includes Salary, DA, HRA, CCA, Interim Relief, OT Allowance,

Deputation Allowance, Medical Allowance, etc.)

March - 2021 76766

April - 2021 76766

May - 2021 85692

June - 2021 85692

July - 2021 85692

a

August - 2021 85692

September - 2021 85692

1

October - 2021 85692

November - 2021 85692

December - 2021 85692

January - 2022 85692

February - 2022 85692

b Leave Surrender

c Festival Allowance / Bonus / Ex-gratia and Incentive 2750

d Pay revision Arrears, DA Arrears 219031

e Total Salary Income (a+b+c+d) 1232233

2 Deduct: a Conveyance Allowance:

3 Any other income (Business, Capital Gains or Other Sources)

4 Total Income rounded off to nearest multiple of ten rupees ( 1 - 2 + 3 ) 1232230

5 Tax on Total Income 121446

6 Less: Rebate for the Income upto 5 Lakhs u/s 87 A ( Max Rs. 12,500 )

7 Income tax after Rebate ( 5 - 6 ) 121446

8 Health and Education Cess [ @ 4% of (7) ] 4858

9 Total Tax Payable ( 7 + 8 ) 126304

10 Less: Relief for arrears of salary u/s. 89(1) 24157

11 Balance Tax Payable ( 9 - 10 ) 102147

12 Amount of Tax already deducted from salary 44400

13 Balance Income Tax to be paid 57747

14 Income Tax to be deducted monthly - 3 installments (Rounded up to 100) 19200

Place: Signature:

Date: JAYAHARI G

VOCATIONAL TEACHER

GVHSS CHELARI

You might also like

- Medicaid ApplicationDocument27 pagesMedicaid ApplicationIndiana Family to Family100% (2)

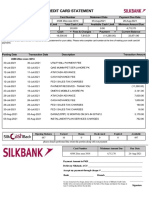

- Credit Card StatementDocument3 pagesCredit Card StatementSaifullah Saifi0% (1)

- Internship Report.Document11 pagesInternship Report.Anonymous RDMPk5UpNo ratings yet

- Audit para GGHS CHANGRANWALADocument11 pagesAudit para GGHS CHANGRANWALAGhulam DastgirNo ratings yet

- Computation 21-22Document3 pagesComputation 21-22Ruloans VaishaliNo ratings yet

- Financials 2021 2022Document4 pagesFinancials 2021 2022Divya PadigelaNo ratings yet

- Income Tax 2023-24 Statement - Mahesh R1Document2 pagesIncome Tax 2023-24 Statement - Mahesh R1akhilhed100% (1)

- Human Resource Information SystemDocument2 pagesHuman Resource Information SystempeparapowerhouseNo ratings yet

- All Paid Fee Voucher by Finance Department PF KFUIETDocument1 pageAll Paid Fee Voucher by Finance Department PF KFUIETadnanmahboob83No ratings yet

- COMPUTATION ReadingDocument4 pagesCOMPUTATION ReadingSankalp BhardwajNo ratings yet

- Duration Previous Present Consumed (KWH)Document4 pagesDuration Previous Present Consumed (KWH)Isaiah Jacob CarolinoNo ratings yet

- Fizah FebDocument2 pagesFizah FebHafizah SelamatNo ratings yet

- Arunakumar Statement of Income 24-25Document1 pageArunakumar Statement of Income 24-25duddupudipsNo ratings yet

- Comp AyushDocument2 pagesComp Ayushaca.nitinjainNo ratings yet

- Demand LetterDocument2 pagesDemand LetterJohn MaerNo ratings yet

- AnnualAccountSlip 2Document1 pageAnnualAccountSlip 2cooperativecolony02No ratings yet

- COI - FinalDocument2 pagesCOI - FinalHiren PatelNo ratings yet

- 13 CL VodafoneDocument2 pages13 CL Vodafonemohamed.saad1406No ratings yet

- FeeStatement - 5 - 7 - 2024 9 - 08 - 05 AMDocument2 pagesFeeStatement - 5 - 7 - 2024 9 - 08 - 05 AMimmanjeri39No ratings yet

- Akshay Comp. 21-22Document3 pagesAkshay Comp. 21-22avishkar guptaNo ratings yet

- Akshay Comp. 21-22Document3 pagesAkshay Comp. 21-22avishkar guptaNo ratings yet

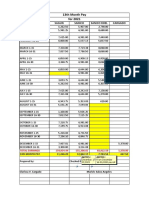

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhay RajNo ratings yet

- Withholding Tax Statement Report Run On: Thursday, September 23, 2021 11:39:25 AMDocument1 pageWithholding Tax Statement Report Run On: Thursday, September 23, 2021 11:39:25 AMYaseen BaigNo ratings yet

- Salary Certificate SRKDocument1 pageSalary Certificate SRKRAVI KUMAR SanampudiNo ratings yet

- Wa0066.Document1 pageWa0066.R.O. LESCO HujraNo ratings yet

- 20-21 Final ItrDocument9 pages20-21 Final Itrr72716026No ratings yet

- Basics of Income TaxDocument8 pagesBasics of Income Taxpajowah498No ratings yet

- Annual Account SlipDocument1 pageAnnual Account Slipcooperativecolony02No ratings yet

- Sri. v. Siva Kumar 31.03.2021Document2 pagesSri. v. Siva Kumar 31.03.2021Saravana SaruNo ratings yet

- DC3 UnlockedDocument5 pagesDC3 UnlockedRajesh Kumar SinghNo ratings yet

- Withholding Tax Statement Report Run On: Monday, September 11, 2023 11:59:15 AMDocument1 pageWithholding Tax Statement Report Run On: Monday, September 11, 2023 11:59:15 AMMuhammad SherazNo ratings yet

- Metallurgy Status 2016 To 2020Document14 pagesMetallurgy Status 2016 To 2020Srinivas MangipudiNo ratings yet

- Mhban14374600000012832 2021Document2 pagesMhban14374600000012832 2021swapnildanavale17No ratings yet

- Ry Llmo 231116142541692Document1 pageRy Llmo 231116142541692ernestine.lapurgaNo ratings yet

- Details of TDS Dedudcted During Financial Year - 2020-2021: Branch Name: JEGURUPADU Branch Code: 3651Document1 pageDetails of TDS Dedudcted During Financial Year - 2020-2021: Branch Name: JEGURUPADU Branch Code: 3651Chandramouli AtmakuriNo ratings yet

- Truly Admin Payroll 2021Document50 pagesTruly Admin Payroll 2021Truly ClarissaNo ratings yet

- Computation FY 21-22Document2 pagesComputation FY 21-22gondaliyaconsultancy0909No ratings yet

- Installation of House Water Conn.Document7 pagesInstallation of House Water Conn.Hmingsanga HauhnarNo ratings yet

- PaySlip (October)Document2 pagesPaySlip (October)karansharma690No ratings yet

- RJRAJ19545850000014181 NewDocument1 pageRJRAJ19545850000014181 NewParveen SainiNo ratings yet

- MPJBP00277110000010024 - 2023-Rajesh Patel-3Document2 pagesMPJBP00277110000010024 - 2023-Rajesh Patel-3pallav.khareNo ratings yet

- Report ViewerDocument2 pagesReport ViewerMasum SharifNo ratings yet

- R K S Infra Computation 2022Document4 pagesR K S Infra Computation 2022birpal singhNo ratings yet

- VLPK PF StatementDocument1 pageVLPK PF StatementhariveerNo ratings yet

- Bashir Ahmad SO Yar Muhammad, PPO MC, BWNDocument1 pageBashir Ahmad SO Yar Muhammad, PPO MC, BWNTao TmaNo ratings yet

- Withholding Tax Statement Report Run On: Friday, September 24, 2021 4:05:58 PMDocument1 pageWithholding Tax Statement Report Run On: Friday, September 24, 2021 4:05:58 PMMuhammad Furqaa9rsh. e0v22gn v 9No ratings yet

- GRGNT13999920000025292 NewDocument2 pagesGRGNT13999920000025292 NewSai SaiNo ratings yet

- Telephone - Bills 2022 23Document3 pagesTelephone - Bills 2022 23akhilamukka07No ratings yet

- Upkar Dhawan Fy 2016-17Document3 pagesUpkar Dhawan Fy 2016-17amit22505No ratings yet

- Withholding Tax Statement Report Run On: Thursday, September 23, 2021 11:40:31 AMDocument1 pageWithholding Tax Statement Report Run On: Thursday, September 23, 2021 11:40:31 AMYaseen BaigNo ratings yet

- LME Ferrous Monthly Report January 2022Document7 pagesLME Ferrous Monthly Report January 2022Edgar BNo ratings yet

- Ranjith Uthayalkumar PayslipDocument2 pagesRanjith Uthayalkumar PayslipRanjith 09061997No ratings yet

- Work Finacial PlaDocument21 pagesWork Finacial Plachelo F. bayaniNo ratings yet

- Chennagiri Raviteja 2023-24Document3 pagesChennagiri Raviteja 2023-24ravi.ramana64No ratings yet

- Glenwood Feestructure2022Document2 pagesGlenwood Feestructure2022Janice MkhizeNo ratings yet

- Nursing Fee Incentives - 2023Document2 pagesNursing Fee Incentives - 2023iamxai rnmanemtNo ratings yet

- LaporanHistoryPayment 075321512371Document1 pageLaporanHistoryPayment 075321512371Usaha Makassar 5No ratings yet

- Opscom AugustDocument19 pagesOpscom AugustMichelle Motin ToledoNo ratings yet

- Tnmas00313090001861778 2021Document2 pagesTnmas00313090001861778 2021Mohan RajNo ratings yet

- Government of Andhra Pradesh: Salary Slip For The Month: October 2023 (01/10/2023 - 31/10/2023)Document1 pageGovernment of Andhra Pradesh: Salary Slip For The Month: October 2023 (01/10/2023 - 31/10/2023)BB StudioNo ratings yet

- Salary CertificateDocument1 pageSalary Certificatemohin100% (1)

- PRB Parastatal Mauritius 2016 ReportDocument2 pagesPRB Parastatal Mauritius 2016 ReportSOHATEENo ratings yet

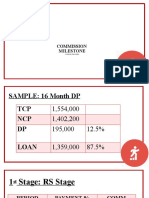

- Commission Milestone: (A Step-by-Step Guide)Document17 pagesCommission Milestone: (A Step-by-Step Guide)Froilan CaoleNo ratings yet

- Herma Shipyard, Inc. Vs Oliveros (G.R. No. 208936 April 17, 2017)Document13 pagesHerma Shipyard, Inc. Vs Oliveros (G.R. No. 208936 April 17, 2017)Ann ChanNo ratings yet

- Labor Law Cases (1-8)Document38 pagesLabor Law Cases (1-8)Samael Morningstar100% (1)

- Cfat DMT Add 202227422Document4 pagesCfat DMT Add 202227422Prabhat KumarNo ratings yet

- Employee Static InformationDocument1 pageEmployee Static Informationapi-26570979100% (30)

- Child Labour A Social Problem in IndiaDocument10 pagesChild Labour A Social Problem in Indianitesh chauhanNo ratings yet

- Dhananjay Rawat Dox1xDocument3 pagesDhananjay Rawat Dox1xDhananjayNo ratings yet

- Explore Chevron WebsiteDocument2 pagesExplore Chevron Websitejoescribd55No ratings yet

- Analysis of KFCDocument4 pagesAnalysis of KFCSubham ChakrabortyNo ratings yet

- Department of Labor: 3573Document6 pagesDepartment of Labor: 3573USA_DepartmentOfLaborNo ratings yet

- Ethics CaseDocument3 pagesEthics Casekishi8mempinNo ratings yet

- SPP Part2 ProfquizDocument30 pagesSPP Part2 ProfquizVin Yaoshua de CastroNo ratings yet

- HRM - The Analysis and Design of WorkDocument29 pagesHRM - The Analysis and Design of WorkJerome TimolaNo ratings yet

- Research Article: Former Employee of Axis BankDocument3 pagesResearch Article: Former Employee of Axis BankDhanunjayaNo ratings yet

- TR Auto Body Painting Finishing NC IIDocument83 pagesTR Auto Body Painting Finishing NC IIMichael V. MagallanoNo ratings yet

- Fong, C. J., Taylor, J., Berdyyeva, A., McClelland, A. M., Murphy, K. M. I Westbrook, J. D. (2021) - Interventions For Improving EmploymentDocument23 pagesFong, C. J., Taylor, J., Berdyyeva, A., McClelland, A. M., Murphy, K. M. I Westbrook, J. D. (2021) - Interventions For Improving EmploymentTomislav CvrtnjakNo ratings yet

- Classified Advertising: Walk-In InterviewDocument5 pagesClassified Advertising: Walk-In InterviewsasikalaNo ratings yet

- HH PDFDocument13 pagesHH PDFabdibaasidNo ratings yet

- FQF For SalariedDocument2 pagesFQF For Salariedusmankh123No ratings yet

- Performance ManagmentDocument66 pagesPerformance ManagmentBir Betal MatketingNo ratings yet

- Rada vs. NLRC GR No. 96078Document8 pagesRada vs. NLRC GR No. 96078Rochelle Othin Odsinada MarquesesNo ratings yet

- G.R. No. 164820 December 8, 2008 VICTORY LINER, INC., Petitioner, PABLO RACE, RespondentDocument3 pagesG.R. No. 164820 December 8, 2008 VICTORY LINER, INC., Petitioner, PABLO RACE, RespondentWonder WomanNo ratings yet

- Exercise On Compensation Structure - The Overpaid Bank TellersDocument2 pagesExercise On Compensation Structure - The Overpaid Bank Tellersvintosh_pNo ratings yet

- KCCMSDocument7 pagesKCCMSDisha MordaniNo ratings yet

- Vietnam PEO & Employer of RecordDocument11 pagesVietnam PEO & Employer of RecordRandloneNo ratings yet

- A Guide To Occupational ExposureDocument28 pagesA Guide To Occupational ExposureShirakawa AlmiraNo ratings yet

- New Labour Codes 2022Document2 pagesNew Labour Codes 2022Tanima Roy100% (1)