Professional Documents

Culture Documents

E21 16

E21 16

Uploaded by

WarmthxCopyright:

Available Formats

You might also like

- DocDocument13 pagesDocIbnu Bang BangNo ratings yet

- CH 10Document9 pagesCH 10Antonios FahedNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Working 3Document6 pagesWorking 3Hà Lê DuyNo ratings yet

- P2 41 2 42 SolutionsDocument3 pagesP2 41 2 42 SolutionsMarjorie PalmaNo ratings yet

- Problem 21.3Document3 pagesProblem 21.3Fayed Rahman MahendraNo ratings yet

- Chapter 17 HWDocument40 pagesChapter 17 HWEejay MagatNo ratings yet

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- Kunci Jawaban Semua BabDocument46 pagesKunci Jawaban Semua BabMuhammad RifqiNo ratings yet

- CH 08Document10 pagesCH 08Antonios FahedNo ratings yet

- 2010-09-27 104244 AdvancedDocument11 pages2010-09-27 104244 Advancedhetalcar100% (1)

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- What Is Happening To World MarketsDocument2 pagesWhat Is Happening To World MarketsJohana ApriliaNo ratings yet

- October Mobile Bill PDFDocument2 pagesOctober Mobile Bill PDFRajasekaran SubramaniNo ratings yet

- List of Nbfcs Holding Cor For Accepting Public Deposits (As On February 29, 2020) Sno Name of The Company Address 1 Address 2 Address 3 City State Pincode Regional OfficeDocument8 pagesList of Nbfcs Holding Cor For Accepting Public Deposits (As On February 29, 2020) Sno Name of The Company Address 1 Address 2 Address 3 City State Pincode Regional Officepranav mbaNo ratings yet

- Exercise 21Document3 pagesExercise 21Ruth UtamiNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Latihan Soal Akuntansi Untuk PensionDocument4 pagesLatihan Soal Akuntansi Untuk PensionRini SusantyNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- E18-16 (LO3) Sales With Returns: InstructionsDocument15 pagesE18-16 (LO3) Sales With Returns: InstructionsHappy MichaelNo ratings yet

- Wahyudi Syaputra - Assignment Week 13Document11 pagesWahyudi Syaputra - Assignment Week 13Wahyudi SyaputraNo ratings yet

- Acct 301 Ex Textbook SP 2022Document15 pagesAcct 301 Ex Textbook SP 2022semsem ahmedNo ratings yet

- Jawaban TugasDocument7 pagesJawaban TugasRani AdhirasariNo ratings yet

- Module 9 Problems - MrnakDocument9 pagesModule 9 Problems - MrnakJenny MrnakNo ratings yet

- 17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoDocument6 pages17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoMajd MustafaNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- Tugas Akuntansi Keuangan II E10.1, E 10.25Document2 pagesTugas Akuntansi Keuangan II E10.1, E 10.25Dea Gheby YolandaNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Tugas AKM II Minggu 9Document2 pagesTugas AKM II Minggu 9Clarissa NastaniaNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- E14-8 (Entries and Questions For Bond Transactions) On June 30, 2010, Mackers CompanyDocument3 pagesE14-8 (Entries and Questions For Bond Transactions) On June 30, 2010, Mackers CompanySandra SholehahNo ratings yet

- Forum 6Document1 pageForum 6cecillia lissawatiNo ratings yet

- Accounting For LeasesDocument112 pagesAccounting For LeasesPoomza TaramarukNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Kieso IFRS4 TB ch17Document68 pagesKieso IFRS4 TB ch17Scarlet WitchNo ratings yet

- BAB 16 v2Document10 pagesBAB 16 v2rahmat lubisNo ratings yet

- Soal Bab 15Document5 pagesSoal Bab 15suci monalia putriNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- Exercises Chapter1Document4 pagesExercises Chapter1Huyen Siu NhưnNo ratings yet

- Chapter 13Document8 pagesChapter 13kimberlyann ongNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- Revenue Recognition: Assignment Classification Table (By Topic)Document32 pagesRevenue Recognition: Assignment Classification Table (By Topic)BryanaNo ratings yet

- Kelompok 4-SOAL STANDAR COSTINGDocument3 pagesKelompok 4-SOAL STANDAR COSTINGAndriana Butera0% (1)

- Condensed Income Statement, Periodic Inventory MethodDocument2 pagesCondensed Income Statement, Periodic Inventory MethodAsma HatamNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Akuntansi Biaya - Tugas E4-23Document3 pagesAkuntansi Biaya - Tugas E4-23Rizkya Ajrin ArtameviaNo ratings yet

- Problem 5-2, 5-5Document5 pagesProblem 5-2, 5-5Indra Budi SetiyawanNo ratings yet

- CH 18Document130 pagesCH 18Indah PNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- Tugas Ke 6Document6 pagesTugas Ke 6Yunda Kintan SinatriyaNo ratings yet

- Aldino Ega Liandra - Kelas O - Tugas Minggu 2Document9 pagesAldino Ega Liandra - Kelas O - Tugas Minggu 2RafiNo ratings yet

- E21.17 (LO 3, 4) (Lessor Accounting) Use The Information For Rauch AG and Donahue SADocument2 pagesE21.17 (LO 3, 4) (Lessor Accounting) Use The Information For Rauch AG and Donahue SAWarmthxNo ratings yet

- Eazy V2Document76 pagesEazy V2saidnouriNo ratings yet

- Ass 2 - PASS - Dinh Khanh HuyenDocument23 pagesAss 2 - PASS - Dinh Khanh HuyenNguyen Minh Thanh (FGW HCM)No ratings yet

- Jesus Reigns Christian College Foundation, Inc.: Iv - Ab PsychologyDocument2 pagesJesus Reigns Christian College Foundation, Inc.: Iv - Ab PsychologyJedidiah SartorioNo ratings yet

- Statement of Account: Mr. Aryan JaiswalDocument2 pagesStatement of Account: Mr. Aryan Jaiswalvivogroup7570No ratings yet

- FQ1Document4 pagesFQ1Maviel Suaverdez100% (1)

- Post Graduate Diploma in IR & HRD SYllabus Kutch UniversityDocument25 pagesPost Graduate Diploma in IR & HRD SYllabus Kutch Universityamanbharadiya2626No ratings yet

- Marketing-Strategies-of-Berger-Paints-Bangladesh-Limited - Final Draft 2Document43 pagesMarketing-Strategies-of-Berger-Paints-Bangladesh-Limited - Final Draft 2Toabur RahmanNo ratings yet

- Operationalization in Dynamic Capabilities Research Review and Recommendations For Future ResearchDocument28 pagesOperationalization in Dynamic Capabilities Research Review and Recommendations For Future ResearchanaskashafNo ratings yet

- 001 July 21 DQ LHR EOBI VoucherDocument1 page001 July 21 DQ LHR EOBI VoucherSajid AliNo ratings yet

- Cement Infobank 2016Document49 pagesCement Infobank 2016Priya SinghNo ratings yet

- Bovee bct12 tb15Document30 pagesBovee bct12 tb15MahmoudTahboubNo ratings yet

- Washington State Employee 11/2015Document8 pagesWashington State Employee 11/2015WFSEc28No ratings yet

- मध्यप्रदेश MADHYA PRADESH D 005833Document6 pagesमध्यप्रदेश MADHYA PRADESH D 005833Bhagwan Singh KeerNo ratings yet

- A Conceptual Model of Operational Risk Events in The Banking SectorDocument20 pagesA Conceptual Model of Operational Risk Events in The Banking SectorAmjad RafiqueNo ratings yet

- RedMart FYE2021 FinancialsDocument48 pagesRedMart FYE2021 FinancialsTIANo ratings yet

- Course Name 9Document6 pagesCourse Name 9Revise PastralisNo ratings yet

- Sample OTsDocument5 pagesSample OTsVishnu ArvindNo ratings yet

- Water Scarcity ProblemDocument33 pagesWater Scarcity ProblemSurjanarayan GoraiNo ratings yet

- Final Requirement - Org DevtDocument46 pagesFinal Requirement - Org Devtjocelyn delgadoNo ratings yet

- Greenfir - 2021Document47 pagesGreenfir - 2021Jian LeiNo ratings yet

- Name-Sohan Sarkar Regno-20Bec0767Document11 pagesName-Sohan Sarkar Regno-20Bec0767Binode SarkarNo ratings yet

- Multiplier and IS-LM ModelDocument49 pagesMultiplier and IS-LM ModelPRATIKSHA KARNo ratings yet

- 408 CSR MCQ PaperDocument6 pages408 CSR MCQ Paperkunal mittalNo ratings yet

- Practical Framework For Process Safety ManagementDocument13 pagesPractical Framework For Process Safety ManagementSubhi El Haj SalehNo ratings yet

- Application Form For Mses: Name of The BankDocument5 pagesApplication Form For Mses: Name of The BankdhivyaNo ratings yet

- FM - Assignment #1Document2 pagesFM - Assignment #1SERNADA, SHENA M.No ratings yet

- NLRB Amazon SettlementDocument5 pagesNLRB Amazon SettlementGeekWireNo ratings yet

- Net Present Value and Other Investment RulesDocument34 pagesNet Present Value and Other Investment Ruleskristina niaNo ratings yet

E21 16

E21 16

Uploaded by

WarmthxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E21 16

E21 16

Uploaded by

WarmthxCopyright:

Available Formats

E21.

16 (LO 2, 4) (Lessee Accounting, Initial Direct Costs) Rauch AG leases a piece of

equipment to Donahue SA on January 1, 2022. The lease agreement called for annual rental

payments of €4,892 at the beginning of each year of the 4- year lease. The equipment has an

economic useful life of 6 years, a fair value of €25,000, and a book value of €20,000. Both

parties expect a residual value of €8,250 at the end of the lease term, though this amount is not

guaranteed. Rauch set the lease payments with the intent of earning a 5% return, and Donahue

is aware of this rate. There is no bargain purchase option, ownership of the lease does not

transfer at the end of the lease term, and the asset is not of a specialized nature.

Instructions

a. Prepare the lease amortization schedule(s) for Donahue for all 4 years of the lease.

b. Prepare the journal entries for Donahue for 2022 and 2023.

c. Suppose Donahue incurs initial direct costs of €750 related to the lease. Prepare the

journal entries for 2022.

d. Explain how a fully guaranteed residual value by Donahue would change the

accounting for the company. The expected residual value is €8,250.

e. Explain how a bargain renewal option for one extra year at the end of the lease term

would change the accounting of the lease for Donahue.

JAWAB :

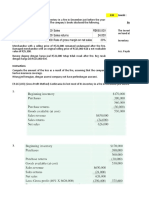

a. Annual rental payment €4,892

PV 3.72325 x

€18,214

DONAHUE SA

Jadwal Amortisasi Sewa

Dasar utang tahunan

Pembayaran Pengurangan Kewajiban

Tanggal Bunga (8%)

Tahunan kewajiban sewa sewa

1/1/2022 - - - 18,214

1/1/2022 4,892 0 4,892 13,322

1/1/2023 4,892 666 4,226 9,096

1/1/2024 4,892 455 4,437 4,659

1/1/2025 4,892 233 4,659 -

b. 1/1/2022

Right of use asset €18,214

Kewajiban Sewa €18,214

Kewajiban sewa €4,892

Kas €4,892

12/31/2022

Beban bunga €666

Kewajiban Sewa €666

Beban penyusutan €4,554

Right of use asset (18,214 : 4) €4,554

1/1/2023

Kewajiban sewa €4,892

Kas €4,892

12/31/2023

Beban bunga €455

Kewajiban sewa €455

You might also like

- DocDocument13 pagesDocIbnu Bang BangNo ratings yet

- CH 10Document9 pagesCH 10Antonios FahedNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Working 3Document6 pagesWorking 3Hà Lê DuyNo ratings yet

- P2 41 2 42 SolutionsDocument3 pagesP2 41 2 42 SolutionsMarjorie PalmaNo ratings yet

- Problem 21.3Document3 pagesProblem 21.3Fayed Rahman MahendraNo ratings yet

- Chapter 17 HWDocument40 pagesChapter 17 HWEejay MagatNo ratings yet

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- Kunci Jawaban Semua BabDocument46 pagesKunci Jawaban Semua BabMuhammad RifqiNo ratings yet

- CH 08Document10 pagesCH 08Antonios FahedNo ratings yet

- 2010-09-27 104244 AdvancedDocument11 pages2010-09-27 104244 Advancedhetalcar100% (1)

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- What Is Happening To World MarketsDocument2 pagesWhat Is Happening To World MarketsJohana ApriliaNo ratings yet

- October Mobile Bill PDFDocument2 pagesOctober Mobile Bill PDFRajasekaran SubramaniNo ratings yet

- List of Nbfcs Holding Cor For Accepting Public Deposits (As On February 29, 2020) Sno Name of The Company Address 1 Address 2 Address 3 City State Pincode Regional OfficeDocument8 pagesList of Nbfcs Holding Cor For Accepting Public Deposits (As On February 29, 2020) Sno Name of The Company Address 1 Address 2 Address 3 City State Pincode Regional Officepranav mbaNo ratings yet

- Exercise 21Document3 pagesExercise 21Ruth UtamiNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Latihan Soal Akuntansi Untuk PensionDocument4 pagesLatihan Soal Akuntansi Untuk PensionRini SusantyNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- E18-16 (LO3) Sales With Returns: InstructionsDocument15 pagesE18-16 (LO3) Sales With Returns: InstructionsHappy MichaelNo ratings yet

- Wahyudi Syaputra - Assignment Week 13Document11 pagesWahyudi Syaputra - Assignment Week 13Wahyudi SyaputraNo ratings yet

- Acct 301 Ex Textbook SP 2022Document15 pagesAcct 301 Ex Textbook SP 2022semsem ahmedNo ratings yet

- Jawaban TugasDocument7 pagesJawaban TugasRani AdhirasariNo ratings yet

- Module 9 Problems - MrnakDocument9 pagesModule 9 Problems - MrnakJenny MrnakNo ratings yet

- 17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoDocument6 pages17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoMajd MustafaNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- Tugas Akuntansi Keuangan II E10.1, E 10.25Document2 pagesTugas Akuntansi Keuangan II E10.1, E 10.25Dea Gheby YolandaNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Tugas AKM II Minggu 9Document2 pagesTugas AKM II Minggu 9Clarissa NastaniaNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- E14-8 (Entries and Questions For Bond Transactions) On June 30, 2010, Mackers CompanyDocument3 pagesE14-8 (Entries and Questions For Bond Transactions) On June 30, 2010, Mackers CompanySandra SholehahNo ratings yet

- Forum 6Document1 pageForum 6cecillia lissawatiNo ratings yet

- Accounting For LeasesDocument112 pagesAccounting For LeasesPoomza TaramarukNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Kieso IFRS4 TB ch17Document68 pagesKieso IFRS4 TB ch17Scarlet WitchNo ratings yet

- BAB 16 v2Document10 pagesBAB 16 v2rahmat lubisNo ratings yet

- Soal Bab 15Document5 pagesSoal Bab 15suci monalia putriNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- Exercises Chapter1Document4 pagesExercises Chapter1Huyen Siu NhưnNo ratings yet

- Chapter 13Document8 pagesChapter 13kimberlyann ongNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- Revenue Recognition: Assignment Classification Table (By Topic)Document32 pagesRevenue Recognition: Assignment Classification Table (By Topic)BryanaNo ratings yet

- Kelompok 4-SOAL STANDAR COSTINGDocument3 pagesKelompok 4-SOAL STANDAR COSTINGAndriana Butera0% (1)

- Condensed Income Statement, Periodic Inventory MethodDocument2 pagesCondensed Income Statement, Periodic Inventory MethodAsma HatamNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Akuntansi Biaya - Tugas E4-23Document3 pagesAkuntansi Biaya - Tugas E4-23Rizkya Ajrin ArtameviaNo ratings yet

- Problem 5-2, 5-5Document5 pagesProblem 5-2, 5-5Indra Budi SetiyawanNo ratings yet

- CH 18Document130 pagesCH 18Indah PNo ratings yet

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- Tugas Ke 6Document6 pagesTugas Ke 6Yunda Kintan SinatriyaNo ratings yet

- Aldino Ega Liandra - Kelas O - Tugas Minggu 2Document9 pagesAldino Ega Liandra - Kelas O - Tugas Minggu 2RafiNo ratings yet

- E21.17 (LO 3, 4) (Lessor Accounting) Use The Information For Rauch AG and Donahue SADocument2 pagesE21.17 (LO 3, 4) (Lessor Accounting) Use The Information For Rauch AG and Donahue SAWarmthxNo ratings yet

- Eazy V2Document76 pagesEazy V2saidnouriNo ratings yet

- Ass 2 - PASS - Dinh Khanh HuyenDocument23 pagesAss 2 - PASS - Dinh Khanh HuyenNguyen Minh Thanh (FGW HCM)No ratings yet

- Jesus Reigns Christian College Foundation, Inc.: Iv - Ab PsychologyDocument2 pagesJesus Reigns Christian College Foundation, Inc.: Iv - Ab PsychologyJedidiah SartorioNo ratings yet

- Statement of Account: Mr. Aryan JaiswalDocument2 pagesStatement of Account: Mr. Aryan Jaiswalvivogroup7570No ratings yet

- FQ1Document4 pagesFQ1Maviel Suaverdez100% (1)

- Post Graduate Diploma in IR & HRD SYllabus Kutch UniversityDocument25 pagesPost Graduate Diploma in IR & HRD SYllabus Kutch Universityamanbharadiya2626No ratings yet

- Marketing-Strategies-of-Berger-Paints-Bangladesh-Limited - Final Draft 2Document43 pagesMarketing-Strategies-of-Berger-Paints-Bangladesh-Limited - Final Draft 2Toabur RahmanNo ratings yet

- Operationalization in Dynamic Capabilities Research Review and Recommendations For Future ResearchDocument28 pagesOperationalization in Dynamic Capabilities Research Review and Recommendations For Future ResearchanaskashafNo ratings yet

- 001 July 21 DQ LHR EOBI VoucherDocument1 page001 July 21 DQ LHR EOBI VoucherSajid AliNo ratings yet

- Cement Infobank 2016Document49 pagesCement Infobank 2016Priya SinghNo ratings yet

- Bovee bct12 tb15Document30 pagesBovee bct12 tb15MahmoudTahboubNo ratings yet

- Washington State Employee 11/2015Document8 pagesWashington State Employee 11/2015WFSEc28No ratings yet

- मध्यप्रदेश MADHYA PRADESH D 005833Document6 pagesमध्यप्रदेश MADHYA PRADESH D 005833Bhagwan Singh KeerNo ratings yet

- A Conceptual Model of Operational Risk Events in The Banking SectorDocument20 pagesA Conceptual Model of Operational Risk Events in The Banking SectorAmjad RafiqueNo ratings yet

- RedMart FYE2021 FinancialsDocument48 pagesRedMart FYE2021 FinancialsTIANo ratings yet

- Course Name 9Document6 pagesCourse Name 9Revise PastralisNo ratings yet

- Sample OTsDocument5 pagesSample OTsVishnu ArvindNo ratings yet

- Water Scarcity ProblemDocument33 pagesWater Scarcity ProblemSurjanarayan GoraiNo ratings yet

- Final Requirement - Org DevtDocument46 pagesFinal Requirement - Org Devtjocelyn delgadoNo ratings yet

- Greenfir - 2021Document47 pagesGreenfir - 2021Jian LeiNo ratings yet

- Name-Sohan Sarkar Regno-20Bec0767Document11 pagesName-Sohan Sarkar Regno-20Bec0767Binode SarkarNo ratings yet

- Multiplier and IS-LM ModelDocument49 pagesMultiplier and IS-LM ModelPRATIKSHA KARNo ratings yet

- 408 CSR MCQ PaperDocument6 pages408 CSR MCQ Paperkunal mittalNo ratings yet

- Practical Framework For Process Safety ManagementDocument13 pagesPractical Framework For Process Safety ManagementSubhi El Haj SalehNo ratings yet

- Application Form For Mses: Name of The BankDocument5 pagesApplication Form For Mses: Name of The BankdhivyaNo ratings yet

- FM - Assignment #1Document2 pagesFM - Assignment #1SERNADA, SHENA M.No ratings yet

- NLRB Amazon SettlementDocument5 pagesNLRB Amazon SettlementGeekWireNo ratings yet

- Net Present Value and Other Investment RulesDocument34 pagesNet Present Value and Other Investment Ruleskristina niaNo ratings yet