Professional Documents

Culture Documents

Apple's Financial Report

Apple's Financial Report

Uploaded by

mav2Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apple's Financial Report

Apple's Financial Report

Uploaded by

mav2Copyright:

Available Formats

Item 8.

Financial Statements and Supplementary Data

Index to Consolidated Financial Statements Page

Consolidated Statements of Operations for the years ended September 28, 2019, September 29, 2018 and

September 30, 2017 29

Consolidated Statements of Comprehensive Income for the years ended September 28, 2019, September 29, 2018

and September 30, 2017 30

Consolidated Balance Sheets as of September 28, 2019 and September 29, 2018 31

Consolidated Statements of Shareholders’ Equity for the years ended September 28, 2019, September 29, 2018

and September 30, 2017 32

Consolidated Statements of Cash Flows for the years ended September 28, 2019, September 29, 2018 and

September 30, 2017 33

Notes to Consolidated Financial Statements 34

Selected Quarterly Financial Information (Unaudited) 55

Reports of Independent Registered Public Accounting Firm 56

All financial statement schedules have been omitted, since the required information is not applicable or is not present in amounts

sufficient to require submission of the schedule, or because the information required is included in the consolidated financial

statements and accompanying notes.

Apple Inc. | 2019 Form 10-K | 28

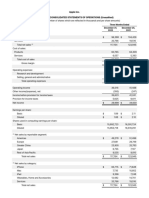

Apple Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except number of shares which are reflected in thousands and per share amounts)

Years ended

September 28, September 29, September 30,

2019 2018 2017

Net sales:

Products $ 213,883 $ 225,847 $ 196,534

Services 46,291 39,748 32,700

Total net sales 260,174 265,595 229,234

Cost of sales:

Products 144,996 148,164 126,337

Services 16,786 15,592 14,711

Total cost of sales 161,782 163,756 141,048

Gross margin 98,392 101,839 88,186

Operating expenses:

Research and development 16,217 14,236 11,581

Selling, general and administrative 18,245 16,705 15,261

Total operating expenses 34,462 30,941 26,842

Operating income 63,930 70,898 61,344

Other income/(expense), net 1,807 2,005 2,745

Income before provision for income taxes 65,737 72,903 64,089

Provision for income taxes 10,481 13,372 15,738

Net income $ 55,256 $ 59,531 $ 48,351

Earnings per share:

Basic $ 11.97 $ 12.01 $ 9.27

Diluted $ 11.89 $ 11.91 $ 9.21

Shares used in computing earnings per share:

Basic 4,617,834 4,955,377 5,217,242

Diluted 4,648,913 5,000,109 5,251,692

See accompanying Notes to Consolidated Financial Statements.

Apple Inc. | 2019 Form 10-K | 29

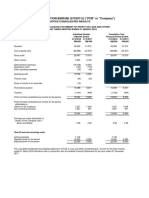

Apple Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In millions)

Years ended

September 28, September 29, September 30,

2019 2018 2017

Net income $ 55,256 $ 59,531 $ 48,351

Other comprehensive income/(loss):

Change in foreign currency translation, net of tax (408) (525) 224

Change in unrealized gains/losses on derivative instruments, net of tax:

Change in fair value of derivatives (661) 523 1,315

Adjustment for net (gains)/losses realized and included in net

income 23 382 (1,477)

Total change in unrealized gains/losses on derivative

instruments (638) 905 (162)

Change in unrealized gains/losses on marketable securities, net of tax:

Change in fair value of marketable securities 3,802 (3,407) (782)

Adjustment for net (gains)/losses realized and included in net

income 25 1 (64)

Total change in unrealized gains/losses on marketable

securities 3,827 (3,406) (846)

Total other comprehensive income/(loss) 2,781 (3,026) (784)

Total comprehensive income $ 58,037 $ 56,505 $ 47,567

See accompanying Notes to Consolidated Financial Statements.

Apple Inc. | 2019 Form 10-K | 30

Apple Inc.

CONSOLIDATED BALANCE SHEETS

(In millions, except number of shares which are reflected in thousands and par value)

September 28, September 29,

2019 2018

ASSETS:

Current assets:

Cash and cash equivalents $ 48,844 $ 25,913

Marketable securities 51,713 40,388

Accounts receivable, net 22,926 23,186

Inventories 4,106 3,956

Vendor non-trade receivables 22,878 25,809

Other current assets 12,352 12,087

Total current assets 162,819 131,339

Non-current assets:

Marketable securities 105,341 170,799

Property, plant and equipment, net 37,378 41,304

Other non-current assets 32,978 22,283

Total non-current assets 175,697 234,386

Total assets $ 338,516 $ 365,725

LIABILITIES AND SHAREHOLDERS’ EQUITY:

Current liabilities:

Accounts payable $ 46,236 $ 55,888

Other current liabilities 37,720 33,327

Deferred revenue 5,522 5,966

Commercial paper 5,980 11,964

Term debt 10,260 8,784

Total current liabilities 105,718 115,929

Non-current liabilities:

Term debt 91,807 93,735

Other non-current liabilities 50,503 48,914

Total non-current liabilities 142,310 142,649

Total liabilities 248,028 258,578

Commitments and contingencies

Shareholders’ equity:

Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares

authorized; 4,443,236 and 4,754,986 shares issued and outstanding, respectively 45,174 40,201

Retained earnings 45,898 70,400

Accumulated other comprehensive income/(loss) (584) (3,454)

Total shareholders’ equity 90,488 107,147

Total liabilities and shareholders’ equity $ 338,516 $ 365,725

See accompanying Notes to Consolidated Financial Statements.

Apple Inc. | 2019 Form 10-K | 31

Apple Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In millions, except per share amounts)

Years ended

September 28, September 29, September 30,

2019 2018 2017

Total shareholders’ equity, beginning balances $ 107,147 $ 134,047 $ 128,249

Common stock and additional paid-in capital:

Beginning balances 40,201 35,867 31,251

Common stock issued 781 669 555

Common stock withheld related to net share settlement of equity

awards (2,002) (1,778) (1,468)

Share-based compensation 6,194 5,443 4,909

Tax benefit from equity awards, including transfer pricing

adjustments — — 620

Ending balances 45,174 40,201 35,867

Retained earnings:

Beginning balances 70,400 98,330 96,364

Net income 55,256 59,531 48,351

Dividends and dividend equivalents declared (14,129) (13,735) (12,803)

Common stock withheld related to net share settlement of equity

awards (1,029) (948) (581)

Common stock repurchased (67,101) (73,056) (33,001)

Cumulative effects of changes in accounting principles 2,501 278 —

Ending balances 45,898 70,400 98,330

Accumulated other comprehensive income/(loss):

Beginning balances (3,454) (150) 634

Other comprehensive income/(loss) 2,781 (3,026) (784)

Cumulative effects of changes in accounting principles 89 (278) —

Ending balances (584) (3,454) (150)

Total shareholders’ equity, ending balances $ 90,488 $ 107,147 $ 134,047

Dividends and dividend equivalents declared per share or RSU $ 3.00 $ 2.72 $ 2.40

See accompanying Notes to Consolidated Financial Statements.

Apple Inc. | 2019 Form 10-K | 32

Apple Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

Years ended

September 28, September 29, September 30,

2019 2018 2017

Cash, cash equivalents and restricted cash, beginning balances $ 25,913 $ 20,289 $ 20,484

Operating activities:

Net income 55,256 59,531 48,351

Adjustments to reconcile net income to cash generated by operating activities:

Depreciation and amortization 12,547 10,903 10,157

Share-based compensation expense 6,068 5,340 4,840

Deferred income tax expense/(benefit) (340) (32,590) 5,966

Other (652) (444) (166)

Changes in operating assets and liabilities:

Accounts receivable, net 245 (5,322) (2,093)

Inventories (289) 828 (2,723)

Vendor non-trade receivables 2,931 (8,010) (4,254)

Other current and non-current assets 873 (423) (5,318)

Accounts payable (1,923) 9,175 8,966

Deferred revenue (625) (3) (593)

Other current and non-current liabilities (4,700) 38,449 1,092

Cash generated by operating activities 69,391 77,434 64,225

Investing activities:

Purchases of marketable securities (39,630) (71,356) (159,486)

Proceeds from maturities of marketable securities 40,102 55,881 31,775

Proceeds from sales of marketable securities 56,988 47,838 94,564

Payments for acquisition of property, plant and equipment (10,495) (13,313) (12,451)

Payments made in connection with business acquisitions, net (624) (721) (329)

Purchases of non-marketable securities (1,001) (1,871) (521)

Proceeds from non-marketable securities 1,634 353 126

Other (1,078) (745) (124)

Cash generated by/(used in) investing activities 45,896 16,066 (46,446)

Financing activities:

Proceeds from issuance of common stock 781 669 555

Payments for taxes related to net share settlement of equity awards (2,817) (2,527) (1,874)

Payments for dividends and dividend equivalents (14,119) (13,712) (12,769)

Repurchases of common stock (66,897) (72,738) (32,900)

Proceeds from issuance of term debt, net 6,963 6,969 28,662

Repayments of term debt (8,805) (6,500) (3,500)

Proceeds from/(Repayments of) commercial paper, net (5,977) (37) 3,852

Other (105) — —

Cash used in financing activities (90,976) (87,876) (17,974)

Increase/(Decrease) in cash, cash equivalents and restricted cash 24,311 5,624 (195)

Cash, cash equivalents and restricted cash, ending balances $ 50,224 $ 25,913 $ 20,289

Supplemental cash flow disclosure:

Cash paid for income taxes, net $ 15,263 $ 10,417 $ 11,591

Cash paid for interest $ 3,423 $ 3,022 $ 2,092

See accompanying Notes to Consolidated Financial Statements.

Apple Inc. | 2019 Form 10-K | 33

You might also like

- Wilson Lumber Q&ADocument3 pagesWilson Lumber Q&AShubham KumarNo ratings yet

- CHAPTER 1-Semester 2-Capital Market. Investment & ConsumptionDocument49 pagesCHAPTER 1-Semester 2-Capital Market. Investment & ConsumptionYohana Ray100% (10)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Basel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskDocument19 pagesBasel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskAnghel StefanNo ratings yet

- 2015-2014 June 30 The Florida Bar Financial StatementsDocument35 pages2015-2014 June 30 The Florida Bar Financial StatementsNeil GillespieNo ratings yet

- Apple - Annual ReportDocument5 pagesApple - Annual ReportVeni GuptaNo ratings yet

- Statement of OperationsDocument1 pageStatement of Operations227230No ratings yet

- Chapter 5. Income Statement, Balance Sheet - AppleDocument2 pagesChapter 5. Income Statement, Balance Sheet - AppleJodie NguyễnNo ratings yet

- Apple Financial StatementsDocument3 pagesApple Financial StatementsNadine Felicia MugliaNo ratings yet

- 2021Q3 Alphabet Earnings ReleaseDocument10 pages2021Q3 Alphabet Earnings ReleasegigokiNo ratings yet

- Fa2 Final Final ReportDocument15 pagesFa2 Final Final ReportMohammadNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Apple Q3 FY19 Consolidated Financial StatementsDocument3 pagesApple Q3 FY19 Consolidated Financial StatementsJack PurcherNo ratings yet

- Condensed Consolidated Statements of Operations (Unaudited)Document1 pageCondensed Consolidated Statements of Operations (Unaudited)Heng SokhaNo ratings yet

- Alliance Aviation 2020Document80 pagesAlliance Aviation 2020Hoàng Minh ChuNo ratings yet

- Pvatepla q3 2023 enDocument14 pagesPvatepla q3 2023 enrogercabreNo ratings yet

- Consolidated Statements of Operations (In Millions, Except Per Share Data)Document2 pagesConsolidated Statements of Operations (In Millions, Except Per Share Data)Asa GellerNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- Directors ReportDocument51 pagesDirectors ReportEllis ElliseusNo ratings yet

- Microsoft Financial Data - FY19Q1Document26 pagesMicrosoft Financial Data - FY19Q1trisanka banikNo ratings yet

- PPBInt RPT 2003Document15 pagesPPBInt RPT 2003Gan ZhiHanNo ratings yet

- Consolidated Statements of Operations: Years Ended September 26, 2015 September 27, 2014 September 28, 2013Document5 pagesConsolidated Statements of Operations: Years Ended September 26, 2015 September 27, 2014 September 28, 2013Anna Mae Corpuz PrioloNo ratings yet

- 2022Q1 Alphabet Earnings ReleaseDocument9 pages2022Q1 Alphabet Earnings ReleaseArthur SzNo ratings yet

- Audited Consolidated-Statements - PAL 2022Document10 pagesAudited Consolidated-Statements - PAL 2022P patelNo ratings yet

- Asl Marine Holdings Ltd.Document30 pagesAsl Marine Holdings Ltd.citybizlist11No ratings yet

- CHB Jun19 PDFDocument14 pagesCHB Jun19 PDFSajeetha MadhavanNo ratings yet

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- Trend AnalysisDocument10 pagesTrend AnalysisGhritachi PaulNo ratings yet

- Disney Q1-Fy20-EarningsDocument15 pagesDisney Q1-Fy20-EarningsImnevada AcidNo ratings yet

- Session 5 Financial Statement Analysis Part 1-2Document17 pagesSession 5 Financial Statement Analysis Part 1-2Prakriti ChaturvediNo ratings yet

- 2022Q3 Alphabet Earnings ReleaseDocument9 pages2022Q3 Alphabet Earnings ReleaseAdam BookerNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- Microsoft Financial Data - FY19Q3Document29 pagesMicrosoft Financial Data - FY19Q3trisanka banikNo ratings yet

- Chapter 8 - Financial AnalysisDocument4 pagesChapter 8 - Financial AnalysisLưu Ngọc Tường ViNo ratings yet

- 2021Q2 Alphabet Earnings ReleaseDocument10 pages2021Q2 Alphabet Earnings ReleasextrangeNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- Greg Davis 501 Mod 2Document28 pagesGreg Davis 501 Mod 2Anonymous 9xPCckpn0pNo ratings yet

- Alphabet ResultadosDocument10 pagesAlphabet ResultadosBruno EnriqueNo ratings yet

- FY23 Q1 Consolidated Financial StatementsDocument3 pagesFY23 Q1 Consolidated Financial StatementsJack PurcherNo ratings yet

- Case StudyDocument14 pagesCase StudyViren DeshpandeNo ratings yet

- Documento para SubirDocument3 pagesDocumento para SubirVictoriaNo ratings yet

- Horizontal Analysis-AssignmentDocument1 pageHorizontal Analysis-AssignmentvalNo ratings yet

- WSP OpModelPrepDocument22 pagesWSP OpModelPreplewisbjunkNo ratings yet

- Financial Statement of Analysis Horizontal and VerticalDocument7 pagesFinancial Statement of Analysis Horizontal and VerticalALYSSA MARIE NAVARRANo ratings yet

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanNo ratings yet

- 2018 GrubHub 10-K ExtractsDocument4 pages2018 GrubHub 10-K ExtractsShuting QinNo ratings yet

- Current Assets: (See Accompanying Notes To Financial Statements)Document7 pagesCurrent Assets: (See Accompanying Notes To Financial Statements)Alicia NhsNo ratings yet

- Week 2 (3chapter3financeDocument9 pagesWeek 2 (3chapter3financeEllen Joy PenieroNo ratings yet

- Quarterly Report 20180331Document15 pagesQuarterly Report 20180331Ang SHNo ratings yet

- Far 202324 t2 Normal LVMH 2019 Eng FinancialstatementsDocument88 pagesFar 202324 t2 Normal LVMH 2019 Eng Financialstatementslingling9905No ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- MBA 640 - Week 4 - Final Project Milestone OneDocument3 pagesMBA 640 - Week 4 - Final Project Milestone Onewilhelmina baxterNo ratings yet

- 22 001269Document176 pages22 001269Marcos AlvarezNo ratings yet

- Apple 10k 2023-1 ClassworkDocument132 pagesApple 10k 2023-1 ClassworkmarioNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Perpetual Inventory System Journal EntriesDocument1 pagePerpetual Inventory System Journal EntriesJasmeen KhanNo ratings yet

- FIN202 - Individual AssignmentDocument9 pagesFIN202 - Individual AssignmentleuhuuhoiNo ratings yet

- Illustrative LBO AnalysisDocument21 pagesIllustrative LBO AnalysisBrian DongNo ratings yet

- Full Chapter The International Loan Documentation Handbook 3Rd Edition Wright PDFDocument53 pagesFull Chapter The International Loan Documentation Handbook 3Rd Edition Wright PDFfelicita.mattern522100% (5)

- An Analysis of Finanacial Performance of Sunrise Bank LimitedDocument6 pagesAn Analysis of Finanacial Performance of Sunrise Bank LimitedrahulNo ratings yet

- Competitor Analysis On Banks CBE's Case Study - FinalsDocument25 pagesCompetitor Analysis On Banks CBE's Case Study - FinalsAbel JacobNo ratings yet

- Recent Trends in BankingDocument7 pagesRecent Trends in BankingArun KCNo ratings yet

- Auditing ProblemsDocument17 pagesAuditing ProblemsMakiri Sajili II50% (2)

- List of Banks EtcDocument3 pagesList of Banks EtcMehmood Ul HassanNo ratings yet

- X SF STD InvDocument1 pageX SF STD InvABDUL GHAFARNo ratings yet

- Ratio - Basics: Liquidity Ratios (Short Term Solvency Ratios)Document5 pagesRatio - Basics: Liquidity Ratios (Short Term Solvency Ratios)Aditya SharmaNo ratings yet

- Tia Dobi Publisher Bio Kcourtney SmithDocument1 pageTia Dobi Publisher Bio Kcourtney Smithf2662961No ratings yet

- ACC 680 Module Three HomeworkDocument2 pagesACC 680 Module Three HomeworkJeirel RuizNo ratings yet

- Chapter 24 Test BankDocument61 pagesChapter 24 Test BankBrandon LeeNo ratings yet

- mPassBook 161022 150423 2918Document4 pagesmPassBook 161022 150423 2918Ashish kumarNo ratings yet

- Accounting AssignmentsDocument4 pagesAccounting AssignmentsIshan Kumar100% (1)

- BANK ASIA LIMITED AT A GLANCE FinalDocument19 pagesBANK ASIA LIMITED AT A GLANCE FinalRubayet HasanNo ratings yet

- CA Final Eco - Law 6D Amendments May 2023Document33 pagesCA Final Eco - Law 6D Amendments May 2023Bhat AbhiNo ratings yet

- Reserve Bank of India's Tightening Monetary PolicyDocument8 pagesReserve Bank of India's Tightening Monetary PolicyGautam Ladha100% (1)

- 25404Document29 pages25404alicewilliams83nNo ratings yet

- MiCA RegulationDocument4 pagesMiCA RegulationSocial Media Digital MarketingNo ratings yet

- of Icici BankDocument32 pagesof Icici BankSandesh Kamble50% (2)

- The New Color of Money:: Safer. Smar Ter. More SecureDocument1 pageThe New Color of Money:: Safer. Smar Ter. More SecureLuis FernadndoNo ratings yet

- BN101 Foundation Course in Banking IDocument134 pagesBN101 Foundation Course in Banking IDevashish NigamNo ratings yet

- FCP Barclays 1Document3 pagesFCP Barclays 1PadilaNo ratings yet

- Banking Principles and PracticesDocument68 pagesBanking Principles and Practicesmolla fentayeNo ratings yet