Professional Documents

Culture Documents

2021 Hawaii WS SBO Summary Report - FINAL

2021 Hawaii WS SBO Summary Report - FINAL

Uploaded by

AARP HawaiiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 Hawaii WS SBO Summary Report - FINAL

2021 Hawaii WS SBO Summary Report - FINAL

Uploaded by

AARP HawaiiCopyright:

Available Formats

SURVEY OF SMALL

www.aarp.org/austin BUSINESS OWNERS IN HAWAI`I

Hawai`i Small Business Owners Want More Residents to Save for Retirement

Data from this survey show that almost three-

More Should be Done to Encourage

quarters (73%) of Hawai`i small business owners

Hawai`i Residents to Save

(and decision makers of small businesses with 5- for Retirement

100 employees) responding to this survey think (n=300 Hawai`i Small Business Owners)

more should be done to encourage Hawai`i

residents to save for retirement. In fact, nearly half 6%

6% Don’t

say a lot more should be done. Furthermore, over Nothing

know

More

three in five (63%) express concern about their

employees not having enough money to cover 15%

health care or living expenses when they retire, A Little More 49%

with almost one quarter (23%) saying they are very A Lot

concerned. Three in four (75%) small business

24%

More

owners in this survey also express concern as

taxpayers that some Hawai`i residents have not

Some

saved enough money for retirement and could end

More

up being reliant on public assistance programs

(Very concerned: 29%; Somewhat concerned:

46%).

Hawai`i Small Business Owners Support A Public-Private Retirement Savings Option

Over four in five Hawai`i small business owners support a privately managed, ready-to-go retirement

savings option that would help small businesses offer employees a way to save for retirement.

Furthermore, over four in five (85%) agree it is vital for themselves and their employees to have access to

the proposed program when thinking about the COVID-19 pandemic’s impact on small business owners

and workers. Additionally, most small business owners agree that state lawmakers should support a bill

to make it easier for small business owners to access a retirement savings option for their employees and

themselves.

Support/Oppose Hawai`i Agree/Disagree Lawmakers Should Support

Retirement Savings Option Hawai`i Retirement Savings Option

(n=300 Hawai`i Small Business Owners)

(n=300 Hawai`i Small Business Owners)

Strongly or somewhat agree 47% 36%

Strongly or somewhat support 38% 44%

Neither agree nor disagree 3%

Neither support nor oppose 4%

Somewhat oppose Somewhat disagree 4%

6%

82% 83%

Strongly oppose 6% Support Strongly disagree 9% Agree

Don't know 2% Don't know 1%

AARP Research © 2021 ALL RIGHTS RESERVED http://doi.org/10.26419/res.00495.001 1

Hawai`i Small Business Owners Are Likely to Offer Public-Private Retirement Savings Option

About two in five small business owners in Hawai`i responding to this survey say they do not participate in

or offer a retirement savings plan, and many say they would face challenges providing a workplace savings

plan for their employees. Over seven in ten (72%) of these business owners say retirement savings plans

are too costly and two in five (40%) say they are concerned about how complicated they are to operate.

Nearly a third (32%) of these small business owners say the retirement savings plans would be too time

consuming to operate. But when asked how likely they would be to participate in or offer their employees

access to the retirement savings program being proposed in Hawai`i, well over four in five say they would

be likely to offer it (Very: 41%; Somewhat: 44%).

Currently Offer/Participates in Likelihood of Offer/Participates in

Retirement Savings Plan Retirement Savings Option

(n=300 Hawai`i Small Business Owners) (n= 123 Hawai`i Small Business Owners - who

do not offer employees a savings plan)

5%

Don’t

Know

58% 41%

No

85%

Yes 3% Likely

Not Likely

At All

6%

Not too

Likely

Staying Competitive is Among Top Reasons to Offer a Retirement Savings Option

The majority of all small business owners in Agree/Disagree Retirement Savings Option

Hawai`i agree that being able to offer a voluntary, Can Help Small Businesses Attract

portable, retirement savings program helps local Employees/Stay Competitive

small businesses attract and retain quality (n= 300 Hawai`i Small Business Owners)

employees and stay competitive. Among the fifty-

Strongly or somewhat agree 38% 37%

eight percent of small business owners in Hawai`i

who do offer a retirement savings plan to their Neither agree nor disagree 4%

employees, a quarter (25%) indicate that the main Somewhat disagree 11%

reason they offer a retirement savings plan is 75%

Strongly disagree 8%

because it is the right thing to do. In addition, Agree

Don't know 2%

nearly one in four (24%) offer an employee savings

plan to attract and/or retain quality employees.

DEMOGRAPHICS: n=300 small business owners or company decision makers with 5-100 additional employees within the state of Hawai’i; Business Size: 5-9

additional employees (41%), 10-49 additional employees (52%), 50-100 additional employees (8%); Years in Business: 0-10 years (17%), 11-25 years (33%), 26 or

more years (48%); 2020 Business Revenue: Less than $100K (12%), $100K – less than $500K (24%), $500K or more (51%); Employer/Respondent age: 18-39 (19%),

40-49 (22%), 50 and older (51%); Political ideology: Conservative (23%), Liberal (21%), Moderate (30%), None (17%).

METHODOLOGY: The 2021 Hawai’i Small Business Owner Survey was a telephone study among 300 small business owners or decision makers about employee

benefits at companies with 5-100 additional employees. Interviews were conducted August 31, 2021 – October 3, 2021. The margin of error for this sample is ± 5.7

percent. The sample, including owner names and companies, came from a Data Axle USA list and is weighted to using the 2017 Economic Census from the U.S.

Census Bureau (based on industry and number of employees) in Hawai’i with 5-100 additional employees. For more information about the methodology, visit

www.aarp.org/hawaiisaves.

AARP Research © 2021 ALL RIGHTS RESERVED www.aarp.org/research 2

You might also like

- Consumer Briefing - Evolving Behaviors During COVID Crisis (Week 6)Document60 pagesConsumer Briefing - Evolving Behaviors During COVID Crisis (Week 6)Daniel PiquêNo ratings yet

- Hollywood Reporter Morning Consult Poll TV RebootsDocument31 pagesHollywood Reporter Morning Consult Poll TV RebootsTHRNo ratings yet

- 1000 Calorie Challenge Workout Log SheetsDocument33 pages1000 Calorie Challenge Workout Log SheetsJavi Marin100% (1)

- Psychiatric Evaluation Comprehensive SkeletonDocument4 pagesPsychiatric Evaluation Comprehensive SkeletonThomasean BrittenNo ratings yet

- 2020 Workplace Wellness Short ReportDocument28 pages2020 Workplace Wellness Short ReportMeeraNo ratings yet

- Deloitte COVID-19 Survey Findings 2020Document12 pagesDeloitte COVID-19 Survey Findings 2020CincinnatiEnquirerNo ratings yet

- Member Retention in The Fitness Industry: Thesis Ii Presentation By: Alec DebenedictisDocument12 pagesMember Retention in The Fitness Industry: Thesis Ii Presentation By: Alec DebenedictisAlec DeBenedictisNo ratings yet

- Buncombe County Resident Survey Report FinalDocument42 pagesBuncombe County Resident Survey Report FinalDillon DavisNo ratings yet

- "The Research, Risks and Rewards": Multilevel MarketingDocument8 pages"The Research, Risks and Rewards": Multilevel MarketingLindy Lou YamiloNo ratings yet

- Rethinking Target Date Fund DesignDocument16 pagesRethinking Target Date Fund DesignChrabąszczWacławNo ratings yet

- Health InsuranceDocument7 pagesHealth Insurancerohan.goyal1211No ratings yet

- Deloitte Millennials GenZ Survey 2022 INDIADocument19 pagesDeloitte Millennials GenZ Survey 2022 INDIADrishtiNo ratings yet

- Ipsos-Global Happiness 2023 - MALAYSIANDocument7 pagesIpsos-Global Happiness 2023 - MALAYSIANQueenie HubertNo ratings yet

- EngageMB Parks Reservation Service FeedbackDocument25 pagesEngageMB Parks Reservation Service FeedbackChrisDcaNo ratings yet

- Deloitte-Millennials Gen Z Survey-2022 BRAZILDocument19 pagesDeloitte-Millennials Gen Z Survey-2022 BRAZILKassielle HaicalNo ratings yet

- 5 Reasons You MUST Measure Employee Loyalty During A RecessionDocument35 pages5 Reasons You MUST Measure Employee Loyalty During A Recessionhien-nguyenNo ratings yet

- 2021 Millennial and Gen Z Survey: A Call For Accountability and Action - IndiaDocument24 pages2021 Millennial and Gen Z Survey: A Call For Accountability and Action - IndiaSupraja BattulaNo ratings yet

- LRN Employee EngagementDocument13 pagesLRN Employee EngagementSillyBee1205No ratings yet

- Running Head: OBAMACARE 1Document7 pagesRunning Head: OBAMACARE 1Stephen OndiekNo ratings yet

- FACETS Issue2 July 2022Document17 pagesFACETS Issue2 July 2022GUPTA SAGAR SURESH 1980174No ratings yet

- AIDS Impact PPT - Major Challenges To PS Programmes - TBDocument21 pagesAIDS Impact PPT - Major Challenges To PS Programmes - TBChengetai DziwaNo ratings yet

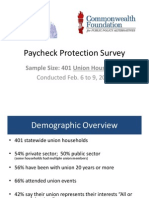

- Paycheck Protection Survey: Sample Size: 401 Union HouseholdsDocument7 pagesPaycheck Protection Survey: Sample Size: 401 Union HouseholdsCommonwealth FoundationNo ratings yet

- Caribbean Studies IADocument22 pagesCaribbean Studies IAalisha khanNo ratings yet

- ASHP-SPPL-PSF-Leadership-Workshop 2021 Revised 1hr NewDocument50 pagesASHP-SPPL-PSF-Leadership-Workshop 2021 Revised 1hr NewFlorinda PllanaNo ratings yet

- Presentation 1Document19 pagesPresentation 1Mohd SajidNo ratings yet

- Farmers' Sustenance On Their Families' Basic NeedDocument27 pagesFarmers' Sustenance On Their Families' Basic NeedRhobin Paul RespicioNo ratings yet

- Enabling Women To Breastfeed Through Better Policies and ProgrammesDocument4 pagesEnabling Women To Breastfeed Through Better Policies and ProgrammesIrsani BerlianaNo ratings yet

- Canadian Women's Foundation SurveyDocument21 pagesCanadian Women's Foundation SurveyToronto StarNo ratings yet

- 2014 Sep Survey of Bangladesh Public Opinion August 21-September 7 2014Document53 pages2014 Sep Survey of Bangladesh Public Opinion August 21-September 7 2014Rokon UddinNo ratings yet

- Innovations For The Future: Building Globally Responsible LeadersDocument8 pagesInnovations For The Future: Building Globally Responsible LeadersgilbertociroNo ratings yet

- The Guide To Employee Experience Listen A5-08-23Document13 pagesThe Guide To Employee Experience Listen A5-08-23Mehul TamakuwalaNo ratings yet

- An Investigation of Innovative Finance To Support Business Development and Sustainability in SMEs in Chemical Logistics IndustryDocument16 pagesAn Investigation of Innovative Finance To Support Business Development and Sustainability in SMEs in Chemical Logistics IndustrySyeda IrumNo ratings yet

- White Paper 3 Ways Recognition Combats Economic UncertaintyDocument14 pagesWhite Paper 3 Ways Recognition Combats Economic UncertaintySushil RautNo ratings yet

- Where Are The Workers ReportDocument37 pagesWhere Are The Workers Reportemills11No ratings yet

- Group-5-Assigned-Part-Graphs. FinalDocument8 pagesGroup-5-Assigned-Part-Graphs. FinalAngel Lynn YlayaNo ratings yet

- Spending Guide For A Family of SixDocument1 pageSpending Guide For A Family of Sixapi-3711938100% (1)

- EAP121 - WCW - First Draft Daoyuan LiDocument10 pagesEAP121 - WCW - First Draft Daoyuan LiAlbert LiNo ratings yet

- Lusardi 2020 - Building Up Fnancial Literacy and Fnancial ResilienceDocument7 pagesLusardi 2020 - Building Up Fnancial Literacy and Fnancial ResilienceNadia Cenat CenutNo ratings yet

- P Homemortgageloans StudentDocument6 pagesP Homemortgageloans Studentapi-708555321No ratings yet

- Empowering Circular Economy Engaging Stakeholders For Effective Waste ManagementDocument23 pagesEmpowering Circular Economy Engaging Stakeholders For Effective Waste ManagementAnandaVickryPratamaNo ratings yet

- Millennials Gen Z Survey 2022 deDocument19 pagesMillennials Gen Z Survey 2022 derachel.liuNo ratings yet

- 2014 Long-Term Caregiving StudyDocument10 pages2014 Long-Term Caregiving StudyFaidah PANGANDAMANNo ratings yet

- Greenville County EMS Employee Engagement Survey Results-2020Document15 pagesGreenville County EMS Employee Engagement Survey Results-2020Sarah NelsonNo ratings yet

- Essentials of Business Statistics Communicating With Numbers 1st Edition Jaggia Solutions ManualDocument36 pagesEssentials of Business Statistics Communicating With Numbers 1st Edition Jaggia Solutions Manualjanicepriceoziyktpndf100% (33)

- Product Placement in Reality Shows and Its Influence On Audience in Brand Recalls and Purchase Decision in Pune City"Document31 pagesProduct Placement in Reality Shows and Its Influence On Audience in Brand Recalls and Purchase Decision in Pune City"Vinay PandeyNo ratings yet

- Spending Guide For A Family of FourDocument1 pageSpending Guide For A Family of Fourapi-3711938No ratings yet

- Final Chapter 4Document11 pagesFinal Chapter 4Quarl SanjuanNo ratings yet

- An A 2022 Sods Report 11663092456592Document52 pagesAn A 2022 Sods Report 11663092456592khaled azzamNo ratings yet

- A Study On Mutual Fund and Awareness of Mutual Fund Among Insurance AdvisorDocument6 pagesA Study On Mutual Fund and Awareness of Mutual Fund Among Insurance AdvisorRichard SinghNo ratings yet

- Water Conservation Survey 2011Document14 pagesWater Conservation Survey 2011Md Mamunur RashidNo ratings yet

- Global Entrepreneur Indicator Business Environment Report Aug2012Document5 pagesGlobal Entrepreneur Indicator Business Environment Report Aug2012manusm651No ratings yet

- HRC Web Financial WellnessDocument33 pagesHRC Web Financial WellnessSandeep K BiswalNo ratings yet

- GfobenchmarkingreportDocument20 pagesGfobenchmarkingreportAshok LahotyNo ratings yet

- Cook County HOPE Adult Redeploy Illinois Team and Partner Survey IIDocument79 pagesCook County HOPE Adult Redeploy Illinois Team and Partner Survey IIInjustice WatchNo ratings yet

- HalalDocument16 pagesHalalfranciscodenroseNo ratings yet

- TEA Statewide Voucher Poll CrosstabsDocument9 pagesTEA Statewide Voucher Poll CrosstabsUSA TODAY NetworkNo ratings yet

- 2021 US Salary SurveyDocument16 pages2021 US Salary SurveysnvijaysaiNo ratings yet

- 4P's Final Na GDDocument18 pages4P's Final Na GDmizpah mae jolitoNo ratings yet

- Service Recovery: Mcgraw-Hill/IrwinDocument168 pagesService Recovery: Mcgraw-Hill/IrwinCarlosNo ratings yet

- Employees Love Perks - AflacDocument1 pageEmployees Love Perks - AflacScottNo ratings yet

- Opportunities in Physician Assistant Careers, Revised EditionFrom EverandOpportunities in Physician Assistant Careers, Revised EditionNo ratings yet

- Unemployment to Self-Employment and Beyond: The Journey of a Reluctant EntrepreneurFrom EverandUnemployment to Self-Employment and Beyond: The Journey of a Reluctant EntrepreneurNo ratings yet

- Frontal Bone& Frontal Sinus FractureDocument51 pagesFrontal Bone& Frontal Sinus Fracturetegegnegenet2No ratings yet

- Test Bank For Phlebotomy 4th Edition by WarekoisDocument2 pagesTest Bank For Phlebotomy 4th Edition by Warekoissilasham3h8f0% (1)

- Amphetamine Use DisordersDocument22 pagesAmphetamine Use DisordersZaid WaniNo ratings yet

- Current Concepts in Preventive Dentistry: Connie Myers Kracher, PHD (C), MSD, CdaDocument28 pagesCurrent Concepts in Preventive Dentistry: Connie Myers Kracher, PHD (C), MSD, CdalaykblakNo ratings yet

- HIV and AIDS at Work PlaceDocument30 pagesHIV and AIDS at Work PlaceRajab Saidi KufikiriNo ratings yet

- Bio ProjectDocument29 pagesBio ProjectbazilNo ratings yet

- Seinfeld Syncope'': To The EditorDocument1 pageSeinfeld Syncope'': To The EditorJason ChambersNo ratings yet

- Gender and Human Sexuality1Document3 pagesGender and Human Sexuality1Jhon Paul C. ApostolNo ratings yet

- Urinary CatheterDocument21 pagesUrinary CatheterGiFt Wimolratanachaisiri0% (1)

- DLL - Mapeh 6 - Q1 - W1Document6 pagesDLL - Mapeh 6 - Q1 - W1ruth danielle dela cruzNo ratings yet

- What Are H2 Blockers?Document3 pagesWhat Are H2 Blockers?Alexandra FeherNo ratings yet

- Fdar Charting and Discharge PlanningDocument2 pagesFdar Charting and Discharge PlanningFaine Angela Caones100% (1)

- A Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityDocument6 pagesA Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityAnirudh Singh ChawdaNo ratings yet

- Farmer Type Ion Chambers, NE2571 and NE2581Document2 pagesFarmer Type Ion Chambers, NE2571 and NE2581Russell ClarkNo ratings yet

- Internal Combustion Engine: Factories & Machinery Act 1967. & RegulationsDocument43 pagesInternal Combustion Engine: Factories & Machinery Act 1967. & RegulationsMuhammad Fahmi MahmudNo ratings yet

- Vaccine TextDocument2,739 pagesVaccine TextMark Mast0% (2)

- Performance Appraisal Methods: Past Oriented Methods Consists ofDocument7 pagesPerformance Appraisal Methods: Past Oriented Methods Consists ofNang NangNo ratings yet

- Antibacterial Activity of Thuja OrientalisDocument9 pagesAntibacterial Activity of Thuja OrientalisMădălina FrunzeteNo ratings yet

- Theory Middle RangeDocument24 pagesTheory Middle RangeHervia agshaNo ratings yet

- Noise Pollution and Our HealthDocument9 pagesNoise Pollution and Our HealthlouloubebeNo ratings yet

- Cognitive Defusion Versus Thought DistractionDocument20 pagesCognitive Defusion Versus Thought DistractionPaula StroianNo ratings yet

- Nbme Step 1 ImmunologyDocument8 pagesNbme Step 1 ImmunologyNatasha Waji0% (1)

- Module 1 KAMALAYAN Understanding Autism Spectrum Disorder by Bismar and Guanzon I2ADocument10 pagesModule 1 KAMALAYAN Understanding Autism Spectrum Disorder by Bismar and Guanzon I2ATricia Mae RuizNo ratings yet

- Risk Evaluation (Refer To Evaluation Form)Document3 pagesRisk Evaluation (Refer To Evaluation Form)Parvez Taslim OfficialNo ratings yet

- OET Nursing - Official OET Practice Part 4Document46 pagesOET Nursing - Official OET Practice Part 4jonam7102No ratings yet

- Course Syllabus in Guidance and Counseling For Children With Special Needs 1Document6 pagesCourse Syllabus in Guidance and Counseling For Children With Special Needs 1Jansel S ArongNo ratings yet

- Result-7th Batch FinalDocument3 pagesResult-7th Batch FinalBalaMuruganNo ratings yet

- A Handbook of Rice Seedborne FungiDocument91 pagesA Handbook of Rice Seedborne FungiIsroi.comNo ratings yet