Professional Documents

Culture Documents

UTI Mastershare Unit Scheme-Growth: Objective of The Scheme

UTI Mastershare Unit Scheme-Growth: Objective of The Scheme

Uploaded by

Gurvansh Singh0 ratings0% found this document useful (0 votes)

15 views1 pageThe UTI Mastershare Unit Scheme- Growth fund aims to generate long-term capital appreciation by investing predominantly in large cap companies. As of February 28, 2022, the fund had a NAV of Rs. 187.21 with an expense ratio of 1.82% and minimum investment of Rs. 100. The fund carries high risk and is best suited for long-term wealth creation through equity market investment.

Original Description:

Original Title

UTI PPT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe UTI Mastershare Unit Scheme- Growth fund aims to generate long-term capital appreciation by investing predominantly in large cap companies. As of February 28, 2022, the fund had a NAV of Rs. 187.21 with an expense ratio of 1.82% and minimum investment of Rs. 100. The fund carries high risk and is best suited for long-term wealth creation through equity market investment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageUTI Mastershare Unit Scheme-Growth: Objective of The Scheme

UTI Mastershare Unit Scheme-Growth: Objective of The Scheme

Uploaded by

Gurvansh SinghThe UTI Mastershare Unit Scheme- Growth fund aims to generate long-term capital appreciation by investing predominantly in large cap companies. As of February 28, 2022, the fund had a NAV of Rs. 187.21 with an expense ratio of 1.82% and minimum investment of Rs. 100. The fund carries high risk and is best suited for long-term wealth creation through equity market investment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

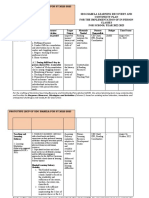

UTI Mastershare Unit Scheme- Growth

NAV ₹187.21 Inception CRISIL RANK

as of Feb 28, 2022 October 15, 1986

Objective of the Scheme:

The objective of the scheme is to generate long term capital Fund Manager- Swati Kulkarni

The funds in this category have their principle at high risk, therefore investors

appreciation by investing predominantly in equity and equity Fund Size - 9659.33 Cr. seeking to creating wealth over a long period of time should invest in this fund.

related securities of large cap companies.

Fund Key Highlights: Benchmark Index - S&P BSE 100 Index

Month End AuM- ₹9,659.33 Cr

1. The Current Net Asset Value of the UTI Mastershare Fund - Regular Plan Monthly Avg. AuM- ₹9,865.44 Cr

as of 28 Feb 2022 is Rs 187.2109 for Growth option of its Regular plan. No. of Folio Accounts6,52,160

2. The expense ratio of the fund is 1.82% for Regular plan as on Jan 31, 2022. Minimum Investment Amount₹100

3. UTI Mastershare Fund - Regular Plan shall attract an Exit Load, "For Exit Load

more than 10% of investments 1% will be charged if redeemed within 1 year" (a) Redemption/Switch out within 12 months from date of allotment -

4. Minimum investment required is Rs 100 and minimum additional i. upto 10% of allotted units - NIL

investment is Rs 100. Minimum SIP investment is Rs 100. ii. beyond 10% of allotted units - 1.00%

(b) After 12 months from date of allotment – NIL

Sector-wise Allocation RISK RATIOS

PARTICULARS FUND

Financial 28.70%

Technology 15.94%

Automobile 8.72%

Healthcare 7.49%

Services 7.23%

Communication 5.08%

Energy 4.95%

Consumer Staples 4.43%

Construction 4.23%

TOP 10 STOCKS HOLDING IN PORTFOLIO (as on 31st Jan,2022) Moving Average Graph

Current Assest Allocation

No. of Stocks - 51

ASSEST Allocation

Equity 98.41%

Debt 0.07%

Others 1.49%

You might also like

- Manolo Fortich Christian AcademyDocument10 pagesManolo Fortich Christian AcademyYan YanNo ratings yet

- KOGAS 2020 Sustainability Bond Annual ReportDocument4 pagesKOGAS 2020 Sustainability Bond Annual ReportVinaya NaralasettyNo ratings yet

- Fitment - Ugc 6th Pay CommissionDocument10 pagesFitment - Ugc 6th Pay CommissionJoseph Anbarasu100% (3)

- Financial Derivatives and Risk Management Interim ReportDocument5 pagesFinancial Derivatives and Risk Management Interim ReportPriyanka MajumdarNo ratings yet

- Mirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Document2 pagesMirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Sudheer GangisettyNo ratings yet

- Blackrock US Index FundDocument2 pagesBlackrock US Index FundAlex MoidlNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- Invest in Long Term Equity Fund - ELSS Mutual Fund - Edelweiss MFDocument1 pageInvest in Long Term Equity Fund - ELSS Mutual Fund - Edelweiss MFJune RobertNo ratings yet

- FSISectoralFund MonthlyDocument1 pageFSISectoralFund MonthlyVNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDeepak Singh PundirNo ratings yet

- Interest On FD 1Document8 pagesInterest On FD 1Padma mohanNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- Edelweiss Balanced Advantage Fund: Investment ObjectiveDocument1 pageEdelweiss Balanced Advantage Fund: Investment ObjectivePavankopNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Fund Facts - HDFC Tax Saver - August 22.1422969Document3 pagesFund Facts - HDFC Tax Saver - August 22.1422969Jignesh Jagjivanbhai PatelNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNo ratings yet

- Nippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Document29 pagesNippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Saif MansooriNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- WWW - Starhealth.in.: Jayashree SethuramanDocument18 pagesWWW - Starhealth.in.: Jayashree Sethuramankrutika.blueoceaninvestmentsNo ratings yet

- Beware of Spurious Fraud Phone CallsDocument2 pagesBeware of Spurious Fraud Phone Callsrajish2014No ratings yet

- Edelweiss Factsheet Large Cap Fund August MF 2023 10082023 042056 PMDocument1 pageEdelweiss Factsheet Large Cap Fund August MF 2023 10082023 042056 PMall in one videosNo ratings yet

- Fund Facts - HDFC TaxSaver - February 2022Document2 pagesFund Facts - HDFC TaxSaver - February 2022Tarun TiwariNo ratings yet

- Managed Fund January 2021Document3 pagesManaged Fund January 2021CHEONG WEI HAONo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- Utilities 2Q 2022Document3 pagesUtilities 2Q 2022ag rNo ratings yet

- Conservative Mutual Funds AssessmentDocument24 pagesConservative Mutual Funds AssessmentRula Abu NuwarNo ratings yet

- DTI2019 Part2-Observations and RecommDocument42 pagesDTI2019 Part2-Observations and RecommDonaldDeLeonNo ratings yet

- Fs PDFDocument1 pageFs PDFJuhaizan Mohd YusofNo ratings yet

- Cambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsJexNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- En Principal DALI Equity Fund IRDocument52 pagesEn Principal DALI Equity Fund IRSrf SaharinNo ratings yet

- Kim - Canara Robeco Equity Tax Saver Fund - Regular Plan - 2021Document25 pagesKim - Canara Robeco Equity Tax Saver Fund - Regular Plan - 2021mayankNo ratings yet

- Home First Finance Company India Limited: Issue HighlightsDocument16 pagesHome First Finance Company India Limited: Issue HighlightstempvjNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- YYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Document4 pagesYYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Calvin YeohNo ratings yet

- Fund Facts - HDFC Focused 30 Fund - July 2021Document2 pagesFund Facts - HDFC Focused 30 Fund - July 2021Tarun TiwariNo ratings yet

- ABSL Equity Hybrid '95 Fund Factsheet PDFDocument1 pageABSL Equity Hybrid '95 Fund Factsheet PDFKiranmayi UppalaNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- HDFC MF Monthly Income Plan LTP December 2012Document18 pagesHDFC MF Monthly Income Plan LTP December 2012khadenileshNo ratings yet

- Global Opportunities (Loomis Sayles) : Net Assets: 29.3 MillionDocument2 pagesGlobal Opportunities (Loomis Sayles) : Net Assets: 29.3 MillionAlex MoidlNo ratings yet

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNo ratings yet

- Aggressive Mutual Funds AssessmentDocument40 pagesAggressive Mutual Funds AssessmentRula Abu NuwarNo ratings yet

- UTI Nifty Fund - Growth31052017Document2 pagesUTI Nifty Fund - Growth31052017Pruthvi KumarNo ratings yet

- Icici Prudential Mutual Fund - 100655Document27 pagesIcici Prudential Mutual Fund - 100655Gauresh BandhalNo ratings yet

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocument2 pagesAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNo ratings yet

- A Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Document19 pagesA Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Shaun WooNo ratings yet

- Nepal Budget Highlights FY 78-79Document33 pagesNepal Budget Highlights FY 78-79Shraddha NepalNo ratings yet

- Home First Finance Company India LTD.: SubscribeDocument7 pagesHome First Finance Company India LTD.: SubscribeVanshajNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Fidelity Global InnovatorsDocument2 pagesFidelity Global InnovatorsjituniNo ratings yet

- SyngeneDocument12 pagesSyngeneIndraneel MahantiNo ratings yet

- Energy Opportunities 1Q 2022Document3 pagesEnergy Opportunities 1Q 2022ag rNo ratings yet

- Adequity TrustDocument2 pagesAdequity TrustedenrealtyNo ratings yet

- Bajaj Allianz Fund FactsheetDocument2 pagesBajaj Allianz Fund FactsheetgirlsbioNo ratings yet

- Balanced Mutual Funds AssessmentDocument23 pagesBalanced Mutual Funds AssessmentRula Abu NuwarNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Perbandingan Harga BhinekaDocument4 pagesPerbandingan Harga BhinekaJulio MariscalNo ratings yet

- Kao LC - Portafolio de ProductosDocument2 pagesKao LC - Portafolio de ProductosBadri Rached100% (1)

- 3.horor (1970-2012)Document21 pages3.horor (1970-2012)vexa123No ratings yet

- Extended Readings: Chapter 4 Discourse and GenreDocument3 pagesExtended Readings: Chapter 4 Discourse and GenreMPTScribidNo ratings yet

- v2 SDO ISABELA LEARNING RECOVERY PLANDocument16 pagesv2 SDO ISABELA LEARNING RECOVERY PLANRoland Mark DumaliangNo ratings yet

- ARTI Refrigerant Database - Volume Two PDFDocument578 pagesARTI Refrigerant Database - Volume Two PDFAymanNo ratings yet

- Circle The Correct Answers.: Objective QuestionsDocument8 pagesCircle The Correct Answers.: Objective QuestionsHishanuddin RamliNo ratings yet

- Wizard S AideDocument58 pagesWizard S AideKnightsbridge~No ratings yet

- HR Score CardDocument16 pagesHR Score Cardvijay77777No ratings yet

- 3544 Im 21455-30Document58 pages3544 Im 21455-30grosselloNo ratings yet

- FCS195 - Essay 2 GuidelinesDocument2 pagesFCS195 - Essay 2 GuidelinesaaaaanksNo ratings yet

- List of IP Reference Substances Available at IPC, Ghaziabad List of ImpuritiesDocument4 pagesList of IP Reference Substances Available at IPC, Ghaziabad List of ImpuritiesUrva VasavadaNo ratings yet

- Matrix CitateDocument1 pageMatrix CitateluizetteNo ratings yet

- Christian Leadership Who Is A Christian?Document10 pagesChristian Leadership Who Is A Christian?Kunle AkingbadeNo ratings yet

- 6CH04 01 Que 20130612Document24 pages6CH04 01 Que 20130612nathaaaaNo ratings yet

- Social MediaDocument4 pagesSocial MediaJeff_Yu_5215No ratings yet

- Account Name BSB Account Number Account Type Date OpenedDocument6 pagesAccount Name BSB Account Number Account Type Date OpenedAbdul HaseebNo ratings yet

- Current Status, Research Trends, and ChallengesDocument23 pagesCurrent Status, Research Trends, and Challengesqgi-tanyaNo ratings yet

- Almonte HistoryDocument3 pagesAlmonte HistoryAngelo ErispeNo ratings yet

- Engineers Syndicate Company ProfileDocument17 pagesEngineers Syndicate Company ProfileSakshi NandaNo ratings yet

- Experiment 2 Conservation of Angular Momentum: I. ObjectivesDocument9 pagesExperiment 2 Conservation of Angular Momentum: I. ObjectivesFelixNo ratings yet

- Ics Lab Manual PDFDocument46 pagesIcs Lab Manual PDFEyes FlikerNo ratings yet

- Methodology in The New MillenniumDocument15 pagesMethodology in The New Millenniumerzsebetkacso67% (3)

- Pain Neuroscience Education in Older Adults With Chronic Back and or Lower Extremity PainDocument12 pagesPain Neuroscience Education in Older Adults With Chronic Back and or Lower Extremity PainAriadna BarretoNo ratings yet

- Study of Characteristics of Fire Damp ExplosionDocument9 pagesStudy of Characteristics of Fire Damp ExplosionsamratNo ratings yet

- The Inner World in The Outer World 565089838Document266 pagesThe Inner World in The Outer World 565089838ramonaNo ratings yet

- BC KMBN107 Unit 3Document26 pagesBC KMBN107 Unit 3Rizwan SaifiNo ratings yet

- MINI2-2 Ravens Under The Midday SunDocument40 pagesMINI2-2 Ravens Under The Midday SunKen JacobsenNo ratings yet