Professional Documents

Culture Documents

Ratios - Financial Analysis

Ratios - Financial Analysis

Uploaded by

Mohamed EzzatOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios - Financial Analysis

Ratios - Financial Analysis

Uploaded by

Mohamed EzzatCopyright:

Available Formats

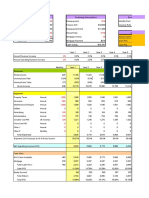

Value Value Ratio

Main input 2008 2007 Name

1- Profitability Ratios

Gross Profit GPM (Gross Profit Margin)

Operating Incom OR OPM (Operating Profit

EBIT Margin)

Net Profit NPM or ROS (net profit

OR Net Income marginor return on sales)

Sales ROE (Return on Equity)

ROA & ROI (Return on

Total Equity

Assets)

Total Assets

interest Expenses

2- Liquidity Ratios

Current Assets Working Capital

Current Liabilities Current Ratio

Inventory Quick Ratio

Cash + Cash Equivalent Cash Ratio

3- Solvency OR Leverage

Total Liabilities D2TA OR Debt Ratio

Total Assets 103601 D/E Ratio (Debt to Equity)

Total Equity OR

Financial Leverage

Stockholders' Equity

interset paid Times Interest Earned Ratio

Cash Flow from

Cash Coverage

operating activitie

4- Efficiency OR Assets Manage

TATO (Total Assets Turn

Over)

FATO (Fixed Assets Turn

Fixed Assets

Over)

Account Receivables RTO (Receivable Turn Over)

ACP (Average Collection

Period)

inventory Turn Over

DOH (inventory Days on

Hand)

5- Market Test OR Market

Average No. of Shares Earnings Per Share (EPS)

Current MKT Price per

Price / Earning Ratio (P/E)

Share

Dividend per Share Dividend Yield Ratio

Equation OR Result how Result

Formula 2008 Express 2007

1- Profitability Ratios

(Gross Profit / Sales) * 100 #DIV/0! % #DIV/0!

(Operating Income or EBIT/ Sales) * 100 #DIV/0! % #DIV/0!

(net profit or net income / Sales) * 100 #DIV/0! % #DIV/0!

(Net income / Total Equity) * 100 #DIV/0! % #DIV/0!

Net incom + interest expense (net of

#DIV/0! Decimal #DIV/0!

tax) / Total Assets

2- Liquidity Ratios

Current Assets - Current Liabilities 0 value 0

Current Assets / Current liabilities #DIV/0! Decimal #DIV/0!

(Current Assets - Inventory) / Current

#DIV/0! Decimal #DIV/0!

Liabilities

(Cash + Cash Equivalent) / Current Liabilities #DIV/0! Decimal #DIV/0!

Solvency OR Leverage Ratios

(Total Liabilities / Total Assets) * 100 0 % #DIV/0!

Total Liabilities / Total Equity #DIV/0! Decimal #DIV/0!

Total Assets / Stockholders' Equity #DIV/0! Times #DIV/0!

Operating Income or EBIT / Interest Expenses #DIV/0! Times #DIV/0!

Cash flow from Operating activities / interest

#DIV/0! #DIV/0!

paid

ncy OR Assets Management Ratios

Sales / Total Assets #DIV/0! Decimal #DIV/0!

Sales / Fixed Assets #DIV/0! Decimal #DIV/0!

Sales / Account Receivables #DIV/0! Times #DIV/0!

365 / RTO #DIV/0! Days #DIV/0!

Sales / Inventory #DIV/0! Times #DIV/0!

365 / inventory Turn Over #DIV/0! Days #DIV/0!

Market Test OR Market Ratios

Net income / Average no. of shares of

#DIV/0! #DIV/0!

common stock outstanding

Current Market price per share / Earning per

#DIV/0! Decimal #DIV/0!

Share

Dividend Per Share / Current Market Price Per

#DIV/0! % #DIV/0!

Share

Interpretation

Profitability is a primary measure of the overall success of a company

For each one $ of sales the company generate XX $ of Gross Profit (before

subtact operation expenses)

For each one $ of sales the company generate XX $ of Operating Profit

(before subtact operation expenses)

For each one $ of sales the company achieves XX $ of Net Profit (before

subtact operation expenses)

For each one $ invesed by the owner's the Company achieves XX $ of net

profit (if raised means the Stakeholders are better-off)

Each one $ invested on Assets results in XX $ of net income (it considered

as the best overall measure of copmany profitability)

Liquidity measure the company ability to pay its short term libailities

using its short term assets

The excess of current assets over than current liabilities equals X $ or the

oppisit if current liabilities is greater

For each one $ of current liabilities the company has XX $ of current assets

For each one $ of current liabilities the company has XX $ of Quick assets

The company immediate ability to pay its debts by cash is XXX $

Tests of solvency measure a company’s capability to meet its long-

term obligations.

it means that XX % of Assets are financed through liabilities or Debts (more

Risky OR less Risky)

For each one $ in Equity there are XXX of liabilities

For each one $ invested by the owners the company levered up the assets

to XXX $ OR ( Assets are XXX Times Equity)

The firm can pay its total interest expense XX Times out of its EBIT

For every one $ invested in Total Assets the company generates XX $ of

Sales

For every one $ invested in Fixed Assets the company generates XX $ of

Sales

The company could Collect the money XXX Times per year

The company takes XXX days to collect Mony from Customers

The company could sell inventory XXX Times per year

The Good Sold every XXX Days OR Inventory lasts for XXX days

Indicates the dividend rate of return to common shareholders at the current

market price.

You might also like

- Joe Hall - CROCI A Real Value Investment Process - April 2015Document29 pagesJoe Hall - CROCI A Real Value Investment Process - April 2015npapadokostasNo ratings yet

- Corporate Finance NPV and IRR SolutionsDocument3 pagesCorporate Finance NPV and IRR SolutionsMark HarveyNo ratings yet

- StockDelver CalculatorDocument11 pagesStockDelver CalculatorAhtsham AhmadNo ratings yet

- A Note On Valuation in Entrepreneurial SettingsDocument4 pagesA Note On Valuation in Entrepreneurial SettingsUsmanNo ratings yet

- Deed of Sale With MortgageDocument4 pagesDeed of Sale With Mortgagecess_rmtNo ratings yet

- Where Many Advisors Get It WrongDocument15 pagesWhere Many Advisors Get It WrongFinancial SenseNo ratings yet

- Five Steps To Valuing A Business: 1. Collect The Relevant InformationDocument7 pagesFive Steps To Valuing A Business: 1. Collect The Relevant InformationArthavruddhiAVNo ratings yet

- Stock Portfolio Tracking SpreadsheetDocument37 pagesStock Portfolio Tracking SpreadsheetalgerNo ratings yet

- Ratio InterpretationDocument15 pagesRatio InterpretationAsad ZainNo ratings yet

- IRR Approach - To Assess Which One Is Better Investment AlternativeDocument5 pagesIRR Approach - To Assess Which One Is Better Investment Alternativew_fibNo ratings yet

- Model 2 Feb 05 V7.0 BlankDocument19 pagesModel 2 Feb 05 V7.0 BlanknicoweissNo ratings yet

- Capital Raising PresentationDocument24 pagesCapital Raising PresentationMaryJane WermuthNo ratings yet

- Discount Factor TemplateDocument5 pagesDiscount Factor TemplateRashan Jida Reshan100% (1)

- Bond ValuationDocument17 pagesBond ValuationMatthew RyanNo ratings yet

- MezzanineDocument14 pagesMezzaninevirtualatallNo ratings yet

- Fundamentals of FinancemangementDocument103 pagesFundamentals of FinancemangementjajoriavkNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Financial CalculatorDocument58 pagesFinancial CalculatorAngela HarringtonNo ratings yet

- Distribution Waterfall - Four ExamplesDocument14 pagesDistribution Waterfall - Four ExamplesShashankNo ratings yet

- Starboard Darden Sept 2014 294 Slide Deck PPT PDF PresentationDocument294 pagesStarboard Darden Sept 2014 294 Slide Deck PPT PDF PresentationAla BasterNo ratings yet

- CH - 4 - Time Value of MoneyDocument49 pagesCH - 4 - Time Value of Moneyak sNo ratings yet

- WST Cash Flow MetricsDocument2 pagesWST Cash Flow MetricsGabriel La MottaNo ratings yet

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- Basic Business Valuation PrinciplesDocument128 pagesBasic Business Valuation Principlesfan_511No ratings yet

- Valuation TechniquesDocument22 pagesValuation Techniquespoisonbox100% (1)

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- Valuation of Stressed Assets: The Institute of Cost Accountants of IndiaDocument43 pagesValuation of Stressed Assets: The Institute of Cost Accountants of IndiaAny YnaNo ratings yet

- 2012 Analyst Position For KKR Capstone IndiaDocument1 page2012 Analyst Position For KKR Capstone IndiasuhrutNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Investment Banking ExcelDocument28 pagesInvestment Banking ExcelJohn ChiwaiNo ratings yet

- Capital Raising ProcessDocument22 pagesCapital Raising ProcessAli Gokhan KocanNo ratings yet

- Beta Value - Levered & UnleveredDocument2 pagesBeta Value - Levered & UnleveredVijayBhasker VeluryNo ratings yet

- Understand Earnings QualityDocument175 pagesUnderstand Earnings QualityVu LichNo ratings yet

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaNo ratings yet

- Eva Mva Study Pack 40Document2 pagesEva Mva Study Pack 40vishalbansal6675No ratings yet

- COH Valuation ModelDocument123 pagesCOH Valuation ModeleamonnsmithNo ratings yet

- Equity ValuationDocument42 pagesEquity ValuationSrinivas NuluNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Trian PepsicoDocument59 pagesTrian PepsicoSaurabh SharmaNo ratings yet

- Valuation Corporate Valuations - inDocument55 pagesValuation Corporate Valuations - insonamkhanchandaniNo ratings yet

- MergedDocument634 pagesMergedRishabh DabasNo ratings yet

- Managing Personal Finance NotesDocument32 pagesManaging Personal Finance NotesMonashreeNo ratings yet

- Business Anaytics Unit 1Document37 pagesBusiness Anaytics Unit 1K.V.T SNo ratings yet

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Capital StructureDocument25 pagesCapital StructureMihael Od SklavinijeNo ratings yet

- Capital Budgeting Financial ManagementDocument18 pagesCapital Budgeting Financial ManagementAmoghavarsha BMNo ratings yet

- FCFEDocument7 pagesFCFEbang bebetNo ratings yet

- Anti-Dilution CalculationsDocument1 pageAnti-Dilution CalculationsHugo PereiraNo ratings yet

- Valuing Private Companies:: Factors and Approaches To ConsiderDocument35 pagesValuing Private Companies:: Factors and Approaches To ConsiderAvinash DasNo ratings yet

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- One Page M&A Simple Model Improved BlankDocument21 pagesOne Page M&A Simple Model Improved BlankAllen FengNo ratings yet

- Behavioural Finance and Financial BiasesDocument16 pagesBehavioural Finance and Financial Biasessadaf hashmiNo ratings yet

- Portfolio SelectionDocument6 pagesPortfolio SelectionAssfaw KebedeNo ratings yet

- 1) Template Detailed ModelDocument20 pages1) Template Detailed Modelabdul5721No ratings yet

- Startup Valuation - Applying The Discoun... D in Six Easy Steps - EY - NetherlandsDocument14 pagesStartup Valuation - Applying The Discoun... D in Six Easy Steps - EY - NetherlandsRodrigo Langenhin Vásquez VarelaNo ratings yet

- Valuation of Early Stage StartupsDocument2 pagesValuation of Early Stage StartupsPaulo Timothy AguilaNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Ratios PDFDocument1 pageRatios PDFSayan AcharyaNo ratings yet

- Analysis of MoneyDocument13 pagesAnalysis of MoneyMohamed EzzatNo ratings yet

- 1 Financial MGTDocument33 pages1 Financial MGTMohamed EzzatNo ratings yet

- 3 Financial RatiosDocument9 pages3 Financial RatiosMohamed EzzatNo ratings yet

- Chapter Three Decision Making, Learning, Crea5vity, and EntrepreneurshipDocument11 pagesChapter Three Decision Making, Learning, Crea5vity, and EntrepreneurshipMohamed EzzatNo ratings yet

- Chapter Four Stragy Formulation and ImplementationDocument13 pagesChapter Four Stragy Formulation and ImplementationMohamed EzzatNo ratings yet

- Chapter Two Environment and Corporate CultureDocument17 pagesChapter Two Environment and Corporate CultureMohamed EzzatNo ratings yet

- Contemporary Management - Chapter1Document41 pagesContemporary Management - Chapter1Mohamed EzzatNo ratings yet

- Wise and OtherwiseDocument3 pagesWise and OtherwiseMamata Hebbar100% (1)

- Senior High School: Rules of Debit and CreditDocument19 pagesSenior High School: Rules of Debit and CreditIva Milli Ayson50% (2)

- Siprotec 5 IEC61850 Pixit, Pics, Tics: Preface Applications IEC 61850 Conformance StatementsDocument40 pagesSiprotec 5 IEC61850 Pixit, Pics, Tics: Preface Applications IEC 61850 Conformance Statementsdaniel ortizNo ratings yet

- Kwik Tek v. WOW Sports - ComplaintDocument17 pagesKwik Tek v. WOW Sports - ComplaintSarah BursteinNo ratings yet

- (36-Way Distributor Drawing)Document1 page(36-Way Distributor Drawing)Celso De Jesus XavierNo ratings yet

- Education Importance EssayDocument5 pagesEducation Importance Essayxsfazwwhd100% (1)

- Course Outline Forensic 5 MIDYEAR CLASS AY 2021-2022Document7 pagesCourse Outline Forensic 5 MIDYEAR CLASS AY 2021-2022Sean Misola GacuyaNo ratings yet

- Bca 121 Financial Accounting II NotesDocument27 pagesBca 121 Financial Accounting II NotesIsaac KiprotichNo ratings yet

- Conjunction: (A) The Period / (B) Between 1980 To 1990 / (C) Was Very Significant in My Life. / (D) No ErrorDocument3 pagesConjunction: (A) The Period / (B) Between 1980 To 1990 / (C) Was Very Significant in My Life. / (D) No ErrorChandni 1996No ratings yet

- GeM Bidding 3462207Document6 pagesGeM Bidding 3462207Sudheer Singh chauhanNo ratings yet

- Structuring Politics: Historical Institutionalism in Comparative AnalysisDocument272 pagesStructuring Politics: Historical Institutionalism in Comparative AnalysisMaría Fernandall100% (3)

- Avn 34Document3 pagesAvn 34Himanshu PatidarNo ratings yet

- C:i RD@DL 2 ) 5ut F:D: DR Shamanur Shivashankarappa Janakalyana Trust (RDocument2 pagesC:i RD@DL 2 ) 5ut F:D: DR Shamanur Shivashankarappa Janakalyana Trust (RTúshâr GüptåNo ratings yet

- Commuter Crossword Puzzles UpdatedDocument3 pagesCommuter Crossword Puzzles UpdatedChidinma UwadiaeNo ratings yet

- Nursing Ethics 2018Document43 pagesNursing Ethics 2018mustafaNo ratings yet

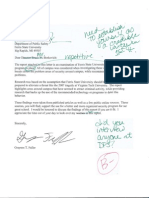

- Unsolicted Recommendation OriginalDocument12 pagesUnsolicted Recommendation Originalapi-273204627No ratings yet

- Almira Vs Court of Appeals GR No. 115966 March 20, 2003 Topic: Article 1191 Rescission of Contract FactDocument8 pagesAlmira Vs Court of Appeals GR No. 115966 March 20, 2003 Topic: Article 1191 Rescission of Contract FactJani MisterioNo ratings yet

- Accounting TerminologyDocument10 pagesAccounting TerminologySamarth100% (1)

- HSE Procedure For Planning & AuditingDocument4 pagesHSE Procedure For Planning & AuditingKhuda Buksh100% (2)

- Milwaukee Health Department Lead Investigation 3-24-2022Document2 pagesMilwaukee Health Department Lead Investigation 3-24-2022TMJ4 NewsNo ratings yet

- 12 Task Performance 1Document2 pages12 Task Performance 1Maricar EgnpNo ratings yet

- Albina - Final OutputDocument5 pagesAlbina - Final OutputJohn Kenneth BoholNo ratings yet

- RT Why Human Rights Matter enDocument100 pagesRT Why Human Rights Matter enJohn KalvinNo ratings yet

- DA Suggests O.J. Was Acting - UPI Archives Drug Debt Christian Faye ResnickDocument7 pagesDA Suggests O.J. Was Acting - UPI Archives Drug Debt Christian Faye ResnickShaka ZuluNo ratings yet

- Beige Scrapbook Art and History Museum Presentation - 20240303 - 204235 - 0000Document7 pagesBeige Scrapbook Art and History Museum Presentation - 20240303 - 204235 - 0000JARYL PILLAZARNo ratings yet

- R30120G2Document6 pagesR30120G2Israel Osornio LeonNo ratings yet

- TDCAA DWI Caselaw Update 120621Document206 pagesTDCAA DWI Caselaw Update 120621Charles SullivanNo ratings yet

- 4 History of The Muslim - Study of Aqidah and FirqahDocument15 pages4 History of The Muslim - Study of Aqidah and FirqahLaila KhalidNo ratings yet