Professional Documents

Culture Documents

Daily Equity Market Report - 08.03.2022

Daily Equity Market Report - 08.03.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 08.03.2022

Daily Equity Market Report - 08.03.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

8TH MARCH 2022

DAILY EQUITY MARKET REPORT

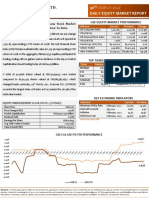

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI gains 0.19 points to Indicator Current Previous Change

GSE-Composite Index 2,730.78 2,730.59 0.19 pts

close at 2,730.78; returns -2.10% YTD.

YTD (GSE-CI) -2.10% -2.11% -0.47%

The Accra Bourse improved today as the benchmark GSE Composite GSE-Financial Stock Index 2,117.32 2,116.98 0.34 pts

YTD (GSE-FSI) -1.60% -1.62% -1.23%

Index (GSE-CI) gained 0.19 points on the day to close at 2,730.78,

Market Cap. (GHMN) 63,241.25 63,239.29 1.96

representing a YTD return of -2.10%. The GSE Financial Stock Index (GSE- Volume Traded 31,926 1,928,211 -98.34%

Value Traded (GH¢) 25,430.88 1,562,554.27 -98.37%

FSI) also improved its level as it gained 1.64 points to close trading at

2,117.32 translating into a YTD return of -1.60%. In the aggregate, ten (10) TOP TRADED EQUITIES

equities participated in trading, ending with only one gainer, namely SIC Ticker Volume Value (GH¢)

MTNGH 18,006 19,446.48

Insurance Company Ltd. (SIC) as it gained GH¢0.01 to close at GH¢0.17 SIC 10,000 1,700.00

representing a YTD gain of 112.50%. AADS 2,000 820.00

CAL 1,230 1,045.50

EGL 295 973.50 76.47%

A total of 31,926 shares valued at GH¢25,430.88 were traded compared

to 1,928,211 shares valued at GH¢1,562,554.27 which changed hands KEY ECONOMIC INDICATORS

Indicator Current Previous

Friday, 4th March, 2022. Scancom PLC. (MTNGH) traded the most, Monetary Policy Rate January 2022 14.50% 14.50%

accounting for 76.47% of the total value traded. Market Capitalization Real GDP Growth Q3 2021 6.6% 3.9%

Inflation January 2022 13.9% 12.6%

maintained its value at GH¢63.24 billion representing a YTD decline of Reference rate February 2022 14.01% 13.90%

-1.94% in 2022.

FULL YEAR 2021 FINANCIALS HIGHLIGHT

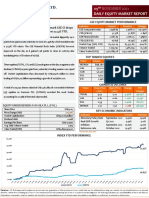

Share Price: 7 Day Return: 1 Year Return:

Scancom PLC. (MTNGH) at close of market traded the most, GH¢ 1.08 2.9% 30.1%

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH)

accounting

Share Pricefor 90.23% of the total value traded. GH¢1.08 Mobile subscribers increased by 3.9% to 25.4 million

Price Change (YtD) -2.7% Active data subscribers up by 15.3% to 12.4 million

Market Capitalization GH¢13,273.71 million Active Mobile Money (MoMo) users increased by

Dividend Yield 0.00% 3.8% to 11.0 million

Earnings Per Share GH¢0.1633 Proposed final dividend per share of GH¢0.085

Avg. Daily Volume Traded 1,612,625 bringing total dividend for 2021 to GH¢0.115 (70.6%

Value Traded (YtD) GH¢ 90,358,170

of profit after tax)

GSE-CI & GSE-FSI YTD PERFORMANCE Revenue: GH¢7.72 Billion (up 28% from FY 2020)

1.00% Data revenue grew by 56.3% YoY; contributes 36%

to service revenue

0.00%

4-Jan 11-Jan 18-Jan 25-Jan 1-Feb 8-Feb 15-Feb 22-Feb 1-Mar 8-Mar Mobile Money revenue grew by 38.2% YoY;

-1.00% -1.60% contributes 22.5% to service revenue

-2.00%

-2.10%

-3.00% Net Income: GH¢2.0 Billion (up 44% from FY 2020)

-4.00% Profit Margin: 26% (up from 23% in FY 2020)

Over the last 3 years on average, earnings per share

GSE-CI GSE-FSI has increased by 31% per year.

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Complaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDocument25 pagesComplaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDinSFLA85% (13)

- FinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDocument33 pagesFinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDaniel LópezNo ratings yet

- Chapter 5 Financial Management by CabreraDocument19 pagesChapter 5 Financial Management by CabreraLars FriasNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.02.2022Document1 pageDaily Equity Market Report - 16.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.11.2021Document1 pageDaily Equity Market Report - 11.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 29.09.2021 2021-09-29Document1 pageDaily Equity Market Report 29.09.2021 2021-09-29Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 20.08.2021Document2 pagesWeekly Capital Market Recap Week Ending 20.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 23.06.2022 2022-06-23Document1 pageDaily Equity Market Report 23.06.2022 2022-06-23Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.07.2022Document1 pageDaily Equity Market Report - 07.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.03.2022Document1 pageDaily Equity Market Report - 10.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.07.2022Document1 pageDaily Equity Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.11.2021Document1 pageDaily Equity Market Report - 24.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.07.2022Document1 pageDaily Equity Market Report - 19.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.01.2022Document1 pageDaily Equity Market Report - 24.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- SSA - Log Cases VENEZUELADocument114 pagesSSA - Log Cases VENEZUELAJuan Camilo Escobar GutierrezNo ratings yet

- AES2 Indepependent Business Valuation EngagementsDocument10 pagesAES2 Indepependent Business Valuation EngagementshnmjzhviNo ratings yet

- OpTransactionHistoryUX3 PDF28!07!2022Document14 pagesOpTransactionHistoryUX3 PDF28!07!2022Suganth SukkyNo ratings yet

- Breach of Trust Equifax ReportDocument12 pagesBreach of Trust Equifax ReportLaLa BanksNo ratings yet

- Impact of GST in Foreign Trade ProjectDocument7 pagesImpact of GST in Foreign Trade ProjectkiranNo ratings yet

- Brochure Foundation of Stock Market InvestingDocument10 pagesBrochure Foundation of Stock Market InvestingRahul SharmaNo ratings yet

- FAN Without PAN Violates Due Process - ArticleDocument3 pagesFAN Without PAN Violates Due Process - ArticleCkey ArNo ratings yet

- Module 5-Contempp World-BSA2Document12 pagesModule 5-Contempp World-BSA2Marian AntipoloNo ratings yet

- A Statement of Account Is IssuedDocument13 pagesA Statement of Account Is IssuedEliza Marie LisbeNo ratings yet

- DRP MRPDocument5 pagesDRP MRPyfdsaNo ratings yet

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Brothers Anthony and Christopher Gaber Began Operations of Their ToolDocument1 pageBrothers Anthony and Christopher Gaber Began Operations of Their Toolhassan taimourNo ratings yet

- Form PDF 240143980290722Document7 pagesForm PDF 240143980290722RebornNo ratings yet

- The Procedure of Imports & Exports in Foreign Payment: For BhelDocument72 pagesThe Procedure of Imports & Exports in Foreign Payment: For Bhelsajuthomas1987No ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument7 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- First Quiz - Basic AccountingDocument6 pagesFirst Quiz - Basic AccountingKyleZapantaNo ratings yet

- Cathay PacificDocument15 pagesCathay PacificClarisse GonzalesNo ratings yet

- SwotDocument3 pagesSwotCathelyn SaliringNo ratings yet

- Earnings StatementDocument1 pageEarnings Statementkrmita OrtizNo ratings yet

- Đinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerDocument4 pagesĐinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerPhương OanhNo ratings yet

- Income Tax RefundDocument3 pagesIncome Tax RefundAKHiiLESH BhamaNo ratings yet

- Sums On PortfolioDocument8 pagesSums On PortfolioPrantikNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Chapter2. Plant Design Revised-AASTU... 2 (Recovered)Document50 pagesChapter2. Plant Design Revised-AASTU... 2 (Recovered)Amdu BergaNo ratings yet

- Columbus Mckinnon 456923 1Document108 pagesColumbus Mckinnon 456923 1MasterrNo ratings yet

- KẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNDocument7 pagesKẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNcamnhu622003No ratings yet

- All Ratio FormulasDocument44 pagesAll Ratio FormulasNikhilNo ratings yet